Regardless of the sphere, provision of goods and services is normally subdivided into small stages. The sphere of finance is no exception.

An ordinary person quite often struggles to find optimum crediting conditions, mortgage, investment options, or other financial products. Nowadays not only bank employees can help but also mobile financial advisors are useful.

NerdWallet Inc., the company owning a website and app with the same name that consult people on financial issues, is planning an IPO at NASDAQ on November 4th, 2021. Trades will start on November 5th under the ticker NRDS.

This article is devoted to the details of the business model of the issuer and why it is attractive for investors.

Business of NerdWallet Inc.

The company was founded in 2009 by Tim Chen and Jake Gibson (former trader from JPMorgan Chase). Authorized capital of the company at that time was just 800 USD.

NerdWallet is based in San Francisco, USA. They carried out the first round of financing in 2011, attracting 64 million USD. The main investors were the Silicon Valley Bank, RRE Ventures, and IVP.

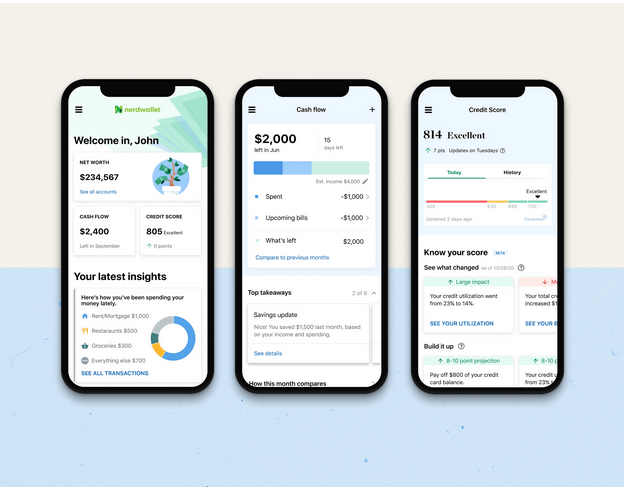

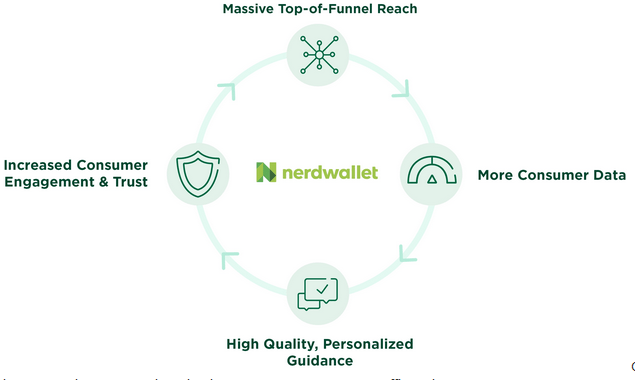

The issuer claims to be an independent and unbiased expert. The company has developed an application based on the marketplace model. The main goal is to connect the provider of financial services and the customer.

NerdWallet provides interactive educational content. Via machine learning, the app analyzes reactions of users and recommends financial instruments to them. Thus the client gets over 500 offers of services on the best conditions.

At the start, the company only helped compare credit cards conditions. However, by 2014 the number of active users of its app had reached 30 million people (now it amounts to 160 million people). In 2016, NerdWallet carried out the first merger with AboutLife, a company specializing in personal retirement plans.

In 2017, the company survived a crisis, firing 10% of its employees. In 2020, it expanded outside the US, appearing in the UK and Canada. Simultaneously, the company bought the Know Your Money start-up, which was its rival. Next thing, it merged with the British Fundera. In autumn the same year, the company entered the market of loans for small and medium businesses. In 2021, it signed a partnership agreement with Inclusiv.

All in all, the issuer entered new markets and lived through a growth crisis. The company is planning to enter other UK and EU markets. According to CB Insights, the company is one of the top-250 leaders of fintech.

Market and rivals of NerdWallet

The issuer works in the market of personal money management that in 2020 in the USA amounted to 1 trillion USD. The global volume of this market is 1.5 trillion USD. According to Statista, it will be growing by more than 19% annually over the next 5 years.

The limitations of the COVID-19 pandemic gave a momentum to fintech services. Commercial banks could interact with clients online only. Hence, information hubs for private investors and entrepreneurs became extremely popular. Note that these trends are yet to develop intensity. The generation of millenials prefers managing their finance on their own.

The issuer has no real rivals in the market. This is one of the main advantages of NerdWallet.

Financial performance of the company

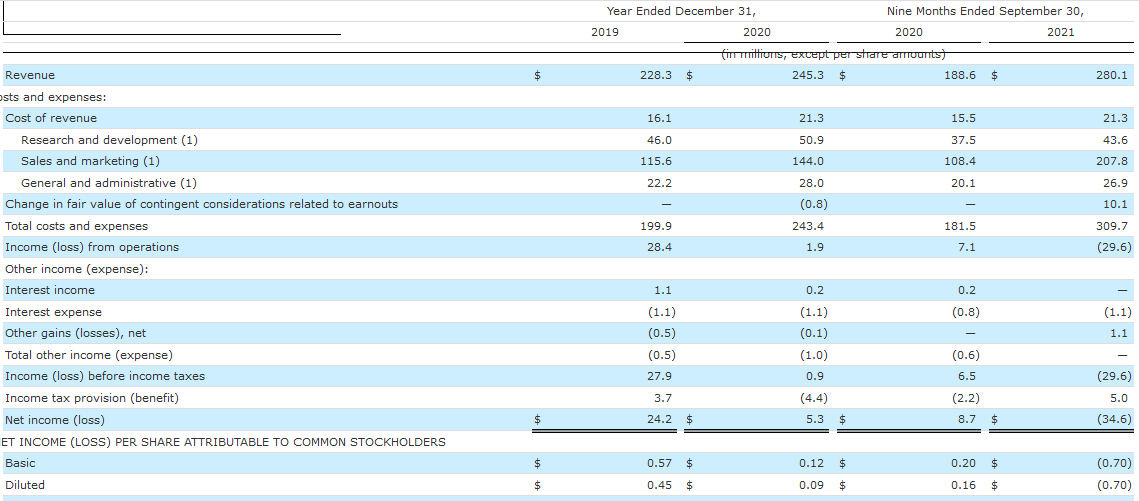

The issuer had long generated a net profit, yet lately due to entering new markets its expenses have increased substantially. Hence, let us start the analysis from the revenue. In 2020, sales of NerdWallet amounted to 245.3 million USD, which is 7.45% more than in 2019.

According to the S-1 report, over the 9 months of 2021, the revenue of the company reached 280.1 million USD; growth against 2020 – 48.52%. I the same speed of growth preserves, by the end of the year the revenue will have reached 364.3 million USD. Over the last 12 months, the revenue was 336.8 million USD.

In 2020, the company made 5.3 million USD of net profit, which is 78.1% less than in 2019. The reason for the decline was growth of expenses by 21.76%. Over 3 quarters of 2021, the issuer suffered a loss of 34.6 million USD. The reason was the growth of expenses by 70.63% relative to the same part of 2020.

The company has 41.1 million USD of cash and 30.1 million USD of debts. This creates a cash position of 11.0 million USD.

Strong and weak sides of NerdWallet

Let us move on to the risks and advantages of investments in NerdWallet. The strong sides of the company would be:

- Its revenue growth by over 40%.

- It has professional management.

- Its target market amounts to 1 trillion USD.

- It is entering new markets: the UK and Canada.

- It has no real rivals in the industry.

However, the main risks of investments in the company are:

- If a better app appears, financial companies will leave for the rival.

- A decrease in the market of personal finance might lead to a decrease in the income of the issuer.

- Expansion to new markets has generated losses.

IPO details and NerdWallet capitalization assessment

The underwriters of the company are William Blair & Company, L.L.C., Truist Securities, Inc., Citigroup Global Markets Inc., Oppenheimer & Co. Inc., Barclays Capital Inc., BofA Securities, Inc., KeyBanc Capital Markets Inc. и Morgan Stanley & Co. LLC.

They plan to sell 7.3 million of ordinary stocks for 17-19 USD each. If the placement occurs at the upper border of the price range, capitalization will amount to 1.23 billion USD.

To assess losing companies, we use the P/S multiplier. For tech companies with a target market growing so fast, the P/S value might be 5.0 during the lock-up period. In this case, the capitalization of NerdWallet can reach 1.68 billion USD (336.8 million USD * 5) and the upside of its shares – 36.58%.

All the above-mentioned taken into account, I recommend the shares of NerdWallet for long-term investments.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex.com and open a trading account.

The post NerdWallet Inc. IPO: Financial Advisor in Your Smartphone appeared first at R Blog – RoboForex.