Let me tell you the Story

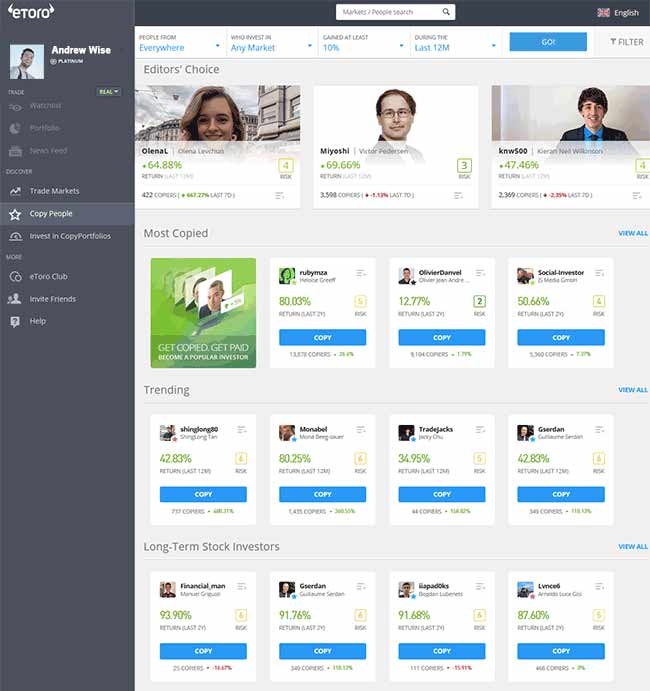

The Israeli brokerage firm eToro offers social trading services and multi-asset brokerages, specializing in financial and copy trading services. The company has registered offices in Cyprus, the United Kingdom, the United States, and Australia. As of 2018, the company’s value was $800 million, which tripled to $2.5 billion in 2020.