The quarterly report of Walt Disney performance in Q4, 2021 was one of the major events last week. I can’t miss the chance to treat you on the details of the quarterly performance of one of the largest global companies in the sphere of entertainment. Enjoy a fresh tech analysis by Maksim Artyomov on the side of your plate.

Walt Disney report for Q4, financial 2021

On November 10th, financial performance for the quarter that ended on October 2nd, 2021 was reported by an American media conglomerate from the entertainment industry — Walt Disney. Important statistics of the company was inferior to the expectations of Wall Street analysts.

However, note that over July-September this year, the company managed to increase its profit: in 2020, the net loss over the same period was $710 million.

Important report details

- Revenue — $18.5 billion, +26%, forecast — $18.8 billion.

- Return on stock — $0.37, +85%, forecast — $0.51.

- Net profit — $160 million, +122.5%.

Disney+ audience starts growing slower

Out of all key characteristics, the surplus of paid subscriptions of the Disney+ streaming service made investors nervous. Many analysts openly say that this business and audience don’t demonstrate the expected growth.

In Q4, financial 2021 the number of paid subscriptions of the streaming service reached 118.1 million, which means 60% more than last year. However, experts had forecast an increase by 70%, up to 125.3 million users.

Moreover, if you compare this with the results of Q3, financial 2021, the increase is just 2.1 million users. For comparison, according to Reuters, the number of paid subscriptions at Netflix over the same time increased by over 4 million users.

Entertainment parks bring revenue

Last quarter, some quarantine measures were abolished, and at last Walt Disney entertainment parks opened their gates for visitors. The quarterly revenue of the segment reached $5.5 billion, growing by 99%.

Note that this sector stopped being losing: operational profit in Q4, financial 2021 reached $640 million. A year ago, the corporation reported an operational loss of $945 million.

How Walt Disney shares reacted to the quarterly report

On November 11th, the shares of Walt Disney (NYSE: DIS) closed the trading session with a decline by 7.07% to $162.11. Also remember, that the quotations of the media conglomerate have been falling for four trading days in a row and have lost almost 10%. Since the beginning of the calendar year, the shares have lost 2.3%.

Tech analysis of Walt Disney shares by Maksim Artyomov

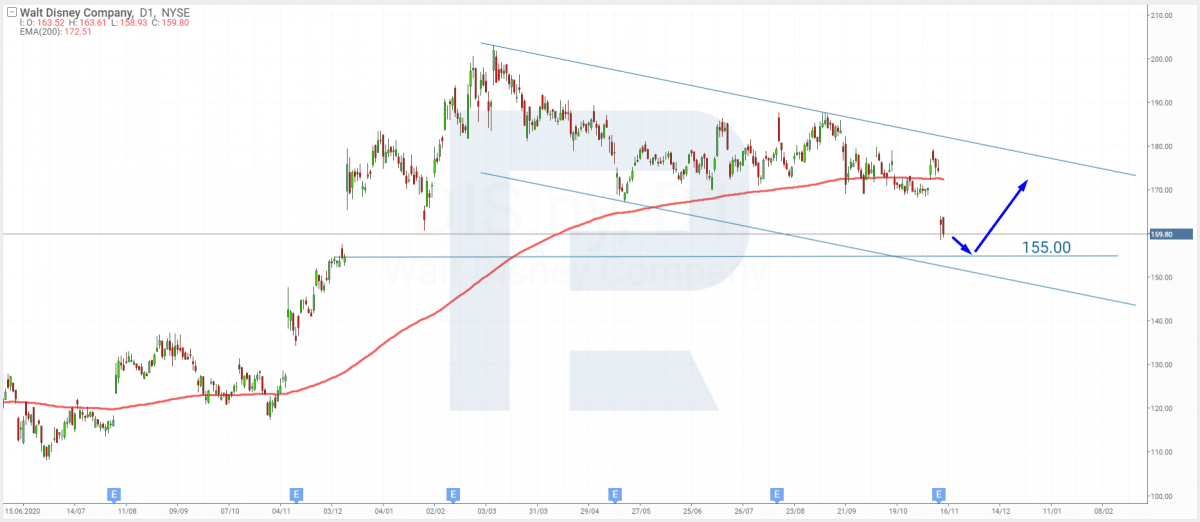

After opening the trading session with a gap, the quotations of the company kept declining. The clue to the decline was the financial report for Q4. Breaking through the 200-days Moving Average, the price is moving inside a descending channel, which might indicate further decline in the future.

Now the goal is the horizontal support level of $155. Testing the support line, the price might bounce off it. If the financial results get better eventually, Walt Disney shares have all chances for recovery with the aim of growth at $200.

Walt Disney forecasts

Director-general of the company Bob Chapek announced that by 2024 the number of Disney+ paid subscribers would have grown to 260 million people. This should be thanks to the creation of new content and international expansion. Bob Chapek highlighted that the service will stop being losing thanks to such growth of the audience.

Enhanced production of new content for the streaming service will lead to increased spending. By the forecasts of Christine McCarthy, losses at the end of the next financial year will reach the peak.

Summing up

Walt Disney report for Q4, financial 2021 made the stocks fall by 7%. Trust of investors was deteriorated by the lame increase in the number of paid subscribers. Analysts expected this to grow to 125.3 million users, while the actual result was 118.1 million.

In the nearest future, the company plans to increase production of new content for the platform noticeably. On the one hand, this will let increase the speed of surplus of new users; on the other hand, net loss will also increase.

More quarterly reports on R Blog

- PayPal Shares Are Falling due to Q3 Report and Q4, 2021 Forecast

- Airbnb and Uber Shares Are Growing After Reports for Q3, 2021

- Weak Forecast Dropped Moderna Shares

- How Did Pfizer Shares React to Q3 Report?

The post Number of Walt Disney Paid Subscriptions Grows Slower while Shares Also Fall appeared first at R Blog – RoboForex.