Today I’m telling you about the performance of Walmart in Q3, financial 2022. Does the world’s largest wholesale and retail chain have anything to boast? What are the forecasts? How did the shares of the corporation react? I’m eager to share with you not only the answers but also a fresh tech analysis of Walmart shares by Maksim Artyomov.

Walmart report for Q2, financial 2022: profit drops by almost 40%

On October 16th, before the trading session opened, Walmart Inc published its financial performance for August-October, 2021. As I have said above, the corporation is the world’s largest wholesaler and retailer: it includes over 10,500 stores in 24 countries and employs 2.2 million people.

Compared to the same reporting period last year, sales volume in the USA grew by 9.3% to $96.6 billion, while in other countries it dropped by 20.1% to $23.6 billion. This decline in the global market happened due to selling the assets of the corporation, it is reported.

Sales volume of Walmart outside the USA declined by 20.1%

In Q3, financial 2022, electronic commerce in Walmart leaped up by 8%, and over 2 years, this parameter increased by 87%. However, positive dynamics on many sides didn’t help quarterly report to avoid falling by almost 40%. The reasons were supply chain issues due to quarantine measures and an increase in purchase prices.

Important report details

- Revenue — $140.5 billion, +4.3%, forecast — $135.2 billion.

- Return on stock — $1.11, -38. 7%, forecast — $1.39.

- Net profit — $3.1 billion, -39.8%.

Walmart forecasts

In the corporation, they claim that over the holiday season, demand for toys, clothes, and shoes will increase, so they’ve improved their forecasts for the financial 2022. Revised return on stock amounts to $6.4 against $6.2-6.35 forecast previously.

As for the capital expenses, they are to reach $13 billion. Sales volume will grow by over 6% while previously, growth was forecast under 6%.

Walmart is getting prepared for the holiday agitation and has already increased its goods in US stocks by 11.5%. The corporation ordered seasonal products in advance, engaging its own ships in transporting them across the country.

Walmart shares reaction to the quarterly report

Yesterday, on November 16th, the trading session closed with a decline in Walmart shares (NYSE: EMT) by 2.55%. The decline stopped at $143.17.

Note that the share price has been falling for three trading days in a row, by 3.6% total. Since the beginning of calendar 2021, the share price has grown by less than 1%.

Tech analysis of Walmart shares by Maksim Artyomov

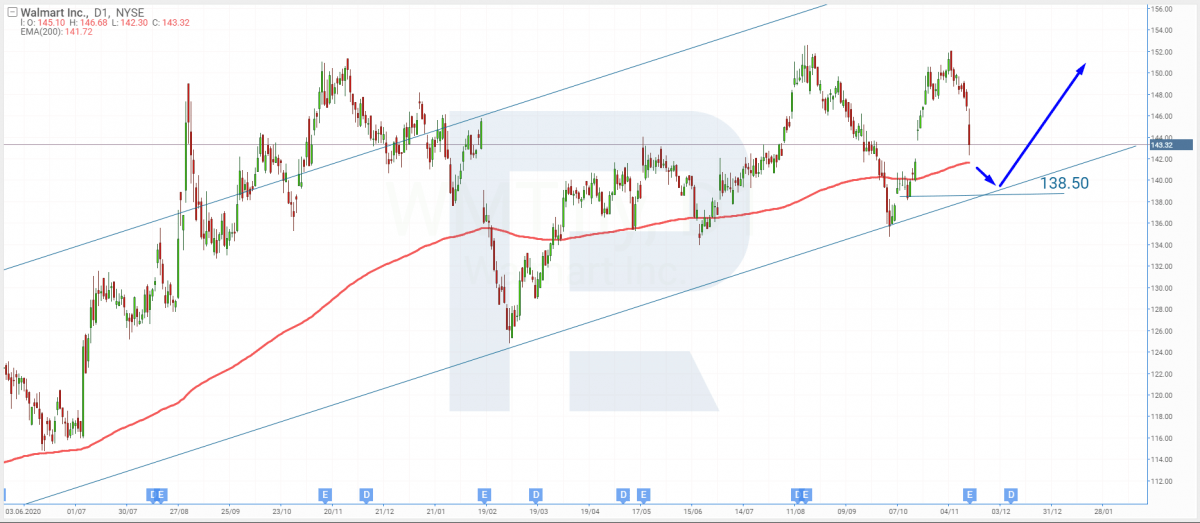

The shares of the company keep falling rapidly, regardless of the revenue exceeding all expectations and forecasts. As long as on D1 there is a clear uptrend, this decline can be regarded as a correction. In the way of the quotations, there is a 200-days Moving Average that can be broken through in the nearest future.

After the MA is broken away, the aim for further decline will be the lower border of the channel and the horizontal support level of $138.5. After correcting, Walmart quotations can bounce off and continue the uptrend, then test the highs.

Summing up

The world’s largest retailer and wholesaler reported its performance for Q3, financiap 2022. It revealed an increase in sales and revenue alongside a sharp drop in the net profit. The quotations of the corporation reacted to the statistics by a decline by 2.5%. In the company, they expect a significant increase in sales during holiday season, so the forecast for the current financial year was increased.

More quarterly reports on R Blog

- Number of Walt Disney Paid Subscriptions Grows Slower while Shares Also Fall

- PayPal Shares Are Falling due to Q3 Report and Q4, 2021 Forecast

- Airbnb and Uber Shares Are Growing After Reports for Q3, 2021

- Weak Forecast Dropped Moderna Shares

The post Decline in Quarterly Profit Drag Walmart Shares Down appeared first at R Blog – RoboForex.