This article describes a plain short-term trading strategy based on the signals of the popular Bollinger Bands trend indicator. The article deals with the peculiarities of the strategy, its use in trading, and examples of buying and selling.

What one needs to know about One-Two

One-Two is a type of reversal trading systems based on Bollinger Bands signals. The strategy is easy to master and uses just one tech indicator with altered parameters. Note that it is a default indicator in almost all trading terminals, including MT4 and MT5.

The trading approach is based on using bounces of the quotes off the outer borders of the Bollinger Bands channel that act as dynamic support and resistance levels. After a bounce, the price is expected to return to the middle line of the channel.

Which instruments, time frames, and indicators can be used

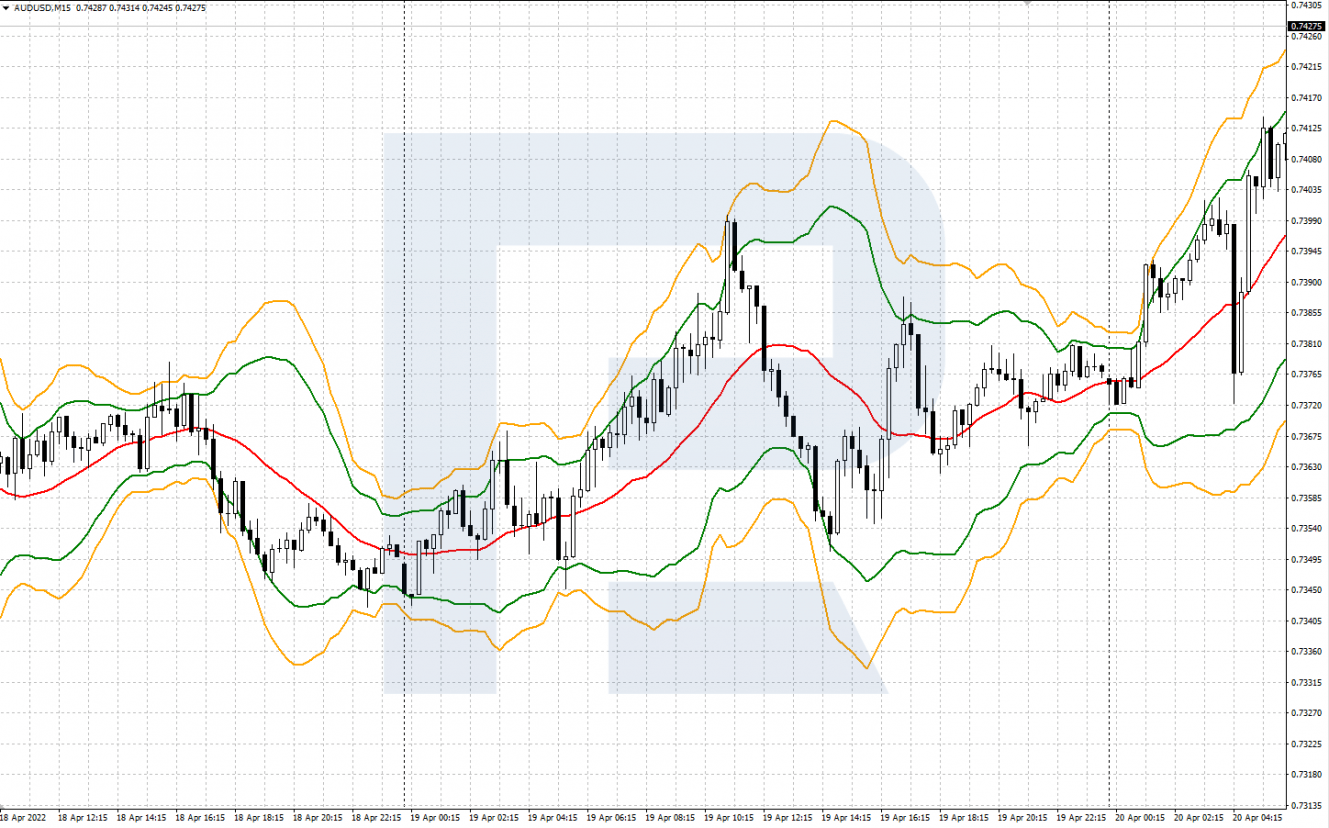

For trading by the strategy, you can use currency pairs, oil, gold, and other commodities. Recommended TFs are M15, M30, H1, H4, and D1.

Indicators:

- Bollinger Bands (Period 20, Shift 0, Deviation 2) — green lines on the chart.

- Bollinger Bands (Period 20, Shift 0, Deviation 3) — orange lines on the chart.

How to install indicators

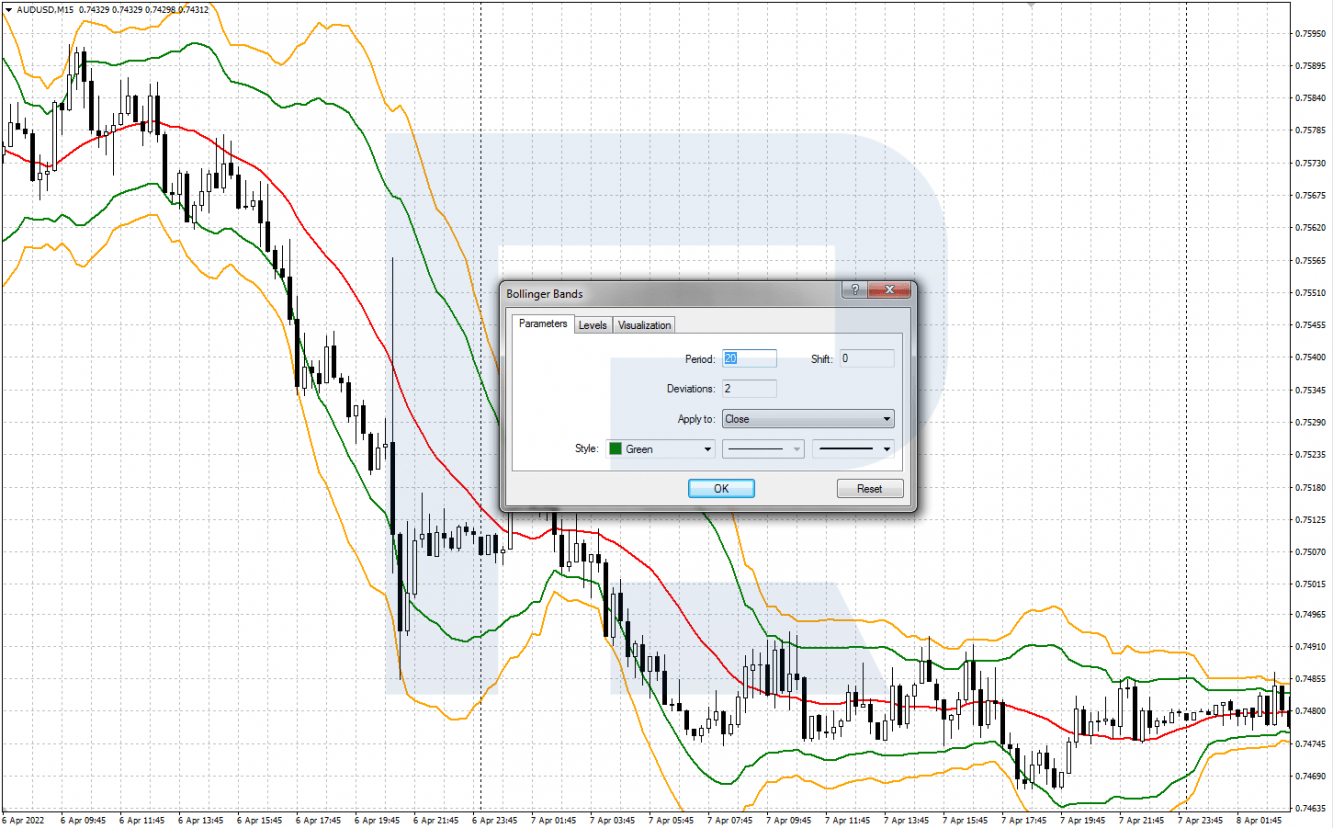

To search for trading signals by One-Two, you need to install two Bollinger Bands indicators with slightly different parameters on the price chart. On the popular MT4 and MT5 platforms, the indicators are installed via the Main Menu/Insert/Indicators/Bollinger Bands.

In the setting window, choose the following parameters:

- Period 20, Shift 0, Deviation 2, style green is the first indicator

- Period 20, Shift 0, Deviation 3, style orange is the second indicator.

Upon installing the indicators, you may start searching for One-Two trading signals.

How to buy by One-Two

Conditions of opening a buying position are as follows:

- Wait for the price to get between the lower green and orange indicator lines. Mark this candlestick as 0

- Wait for two more candlesticks to form. If they show a reversal upwards with close prices no lower than those of candlestick 0 — open a buying trade after candlestick 2 closes. Candlesticks 1 and 2 have white bodies, or the first one is a Doji and the second one has a white body.

- Place a Stop Loss 5 points below the lows of candlesticks 1 and 2.

- Take the Profit as soon as the quotes reach the middle line (red colour) of Bollinger Bands. Or, if the movement is strong, you can take the SL to the breakeven when the price reaches the middle line and wait for the quotes to grow to the upper green line of the indicator channel.

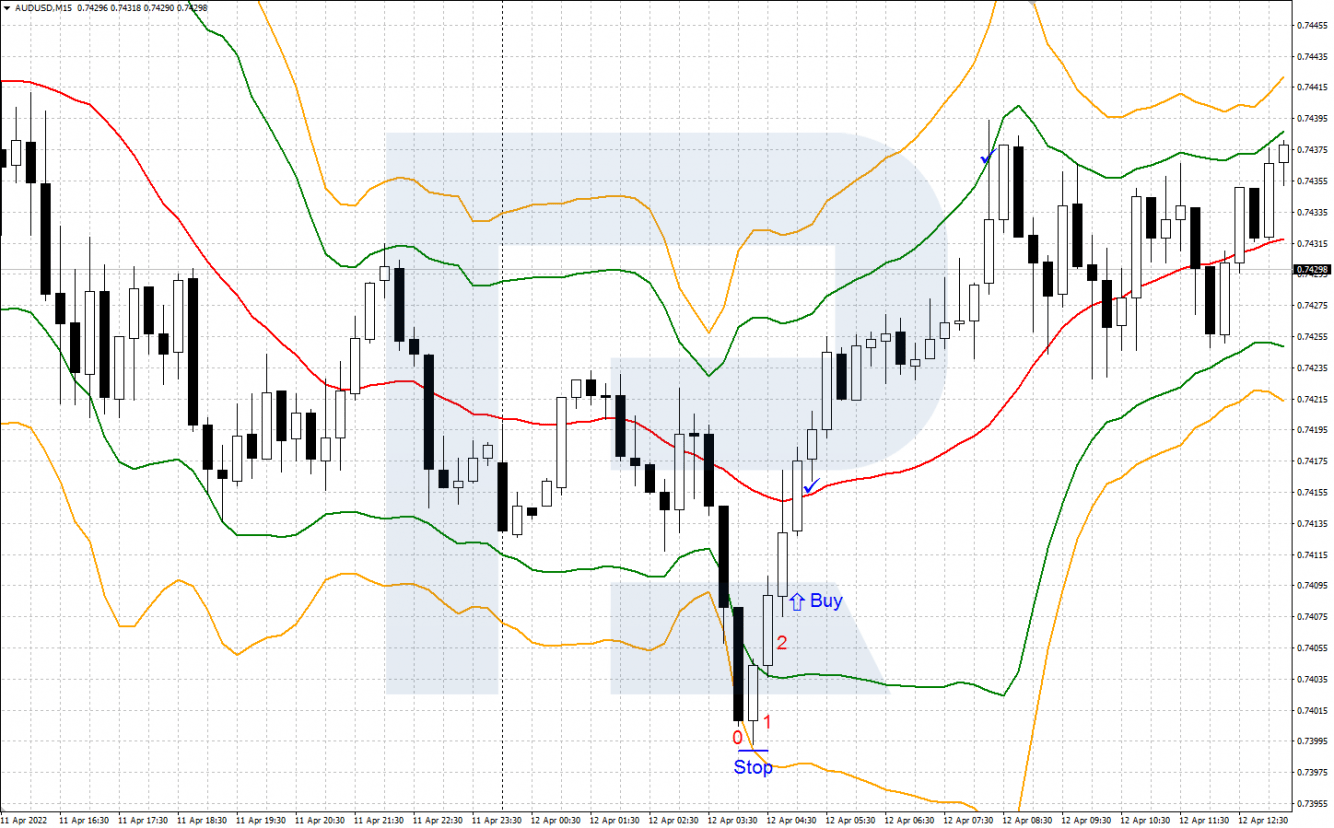

Example of buying by One-Two

- The quotes of the AUD/USD currency pair on M15 dropped between the green and orange lines of Bollinger Bands. The black candlestick becomes number 0.

- The price shows an upward reversal, two white candlesticks 1 and 2 appear on the chart.

- After candlestick 2 closes, open a buying position, placing an SL behind the lows of candlesticks 1 and 2.

- The first goal for the TP is the middle line of Bollinger Bands, the second one is the upper green line of the channel.

How to sell by One-Two

Conditions of opening a selling position are like those:

- Wait for the price to get between the upper green and orange lines of Bollinger Bands. This is candlestick 0.

- Wait for two more candlesticks to form. If they show a reversal downwards with close prices no higher than those of candlestick 0, open a selling position after candlestick 2 closes. Candlesticks 1 and 2 have black bodies, or the first one can be a Doji and the second one must have a black body.

- Place an SL 5 points above the highs of candlesticks 1 and 2.

- Take the Profit when the quotes drop to the middle line (red) of the price channel. Alternatively, if the decline is strong enough, transfer the SL to the breakeven and wait for the price to fall to the lower green line of Bollinger Bands.

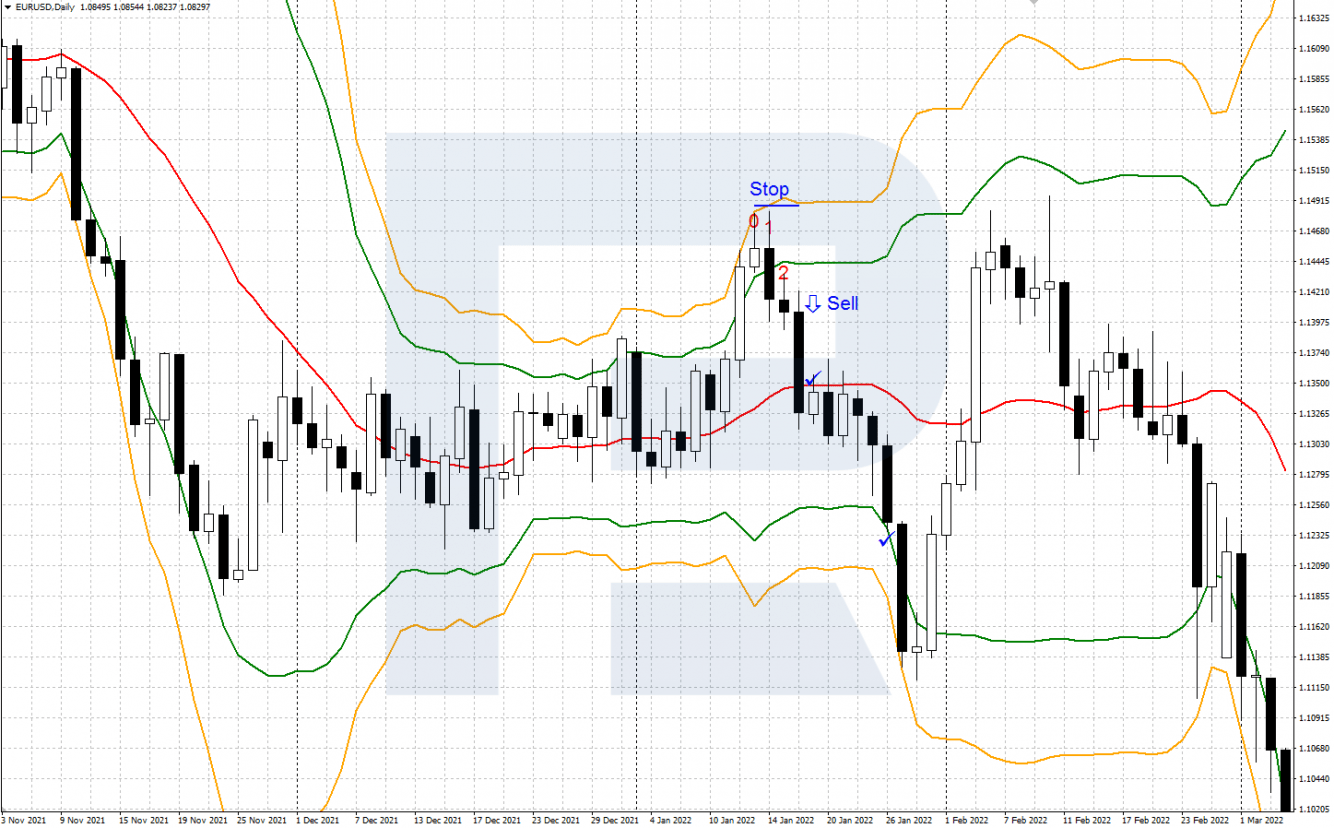

Example of selling by One-Two

- The quotes of EUR/USD on D1 got between the upper green and orange lines of Bollinger Bands, going by an ascending movement. The white candlestick becomes number 0.

- The price demonstrates a reversal downwards, and two black candlesticks — 1 and 2 — appear on the chart.

- After candlestick 2 closes, open a selling position with an SL behind the highs of candlesticks 1 and 2.

- The first goal of the TP is a decline to the middle line of Bollinger Bands, and the second one is the lower green line of the price channel.

Closing thoughts

The One-Two trading strategy is based on the signals of a popular trend indicator Bollinger Bands with different parameters. The strategy is based on reversals of the quotes from the borders of the price channel that are used as dynamic support/resistance levels.

This strategy is rather universal and can be used for various instruments and on various TFs. Before trading for real, practising on a demo account is strongly recommended.