Market participants expect that the US Federal Reserve (Fed) monetary policy tightening cycle is coming to an end. The US inflation rate eased to 7.7% in October, further strengthening the belief that the regulator’s head, Jerome Powell, will soften his rhetoric. Against this background, the S&P 500 index (US500) is up 15% in two months.

Is there really any reason for optimism? In this article, we will try to analyse what is happening to the US economy now, what parameters Mr. Powell is focusing on, why the inflation rate fell in October, and whether there is a chance that this dynamic will continue in the future.

What parameters does Jerome Powell monitor?

After the COVID-19 pandemic crisis, we saw a sharp rise in inflation. At the time, many investors were saying that it was time to raise the interest rate, otherwise, it would not be possible to control inflation with monetary means.

In his speeches, Jerome Powell said that inflation is temporary, there is no need to rush to tighten the monetary policy, and the interest rate hike will start after unemployment has fallen to 2019 levels.

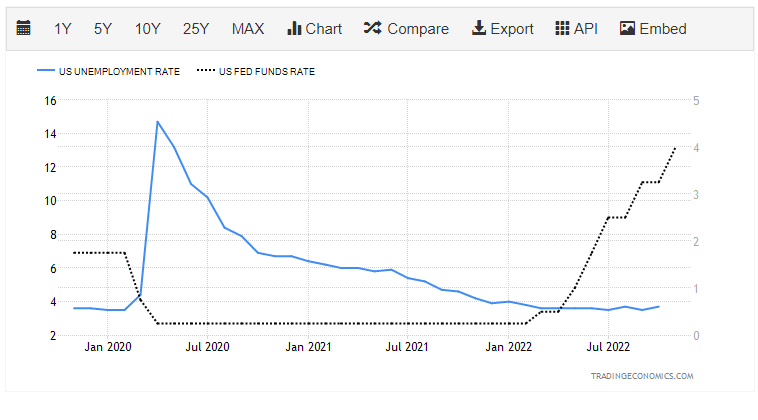

In March 2022, the unemployment rate fell to 3.8% in line with pre-crisis levels, and the Fed started a cycle of interest rate hikes already in April.

Many market participants are now wondering when the Fed will bring its monetary policy tightening cycle to an end. On 3 November, Jerome Powell said: “Before rates peak, we need to see a sustained decline in inflation and a series of declining monthly figures will be good evidence of that. Continued rate hikes will be needed to have a sufficiently restrictive effect on the economy and bring inflation back to the Fed’s 2% target.”

This means that one month’s data would not change anything, while all the attention of the head of the regulatory body is currently not on the labour market, but on the inflation rate.

Has the US economy suffered from the Fed’s actions?

A further interest rate hike could bring down the US economy – this is the view increasingly being relayed by the media. If we look at the rate increase, it has risen from 0.25% to 4% in 7 months. Such an increase was only seen in the 1970s during the economic crisis, which was accompanied by high inflation.

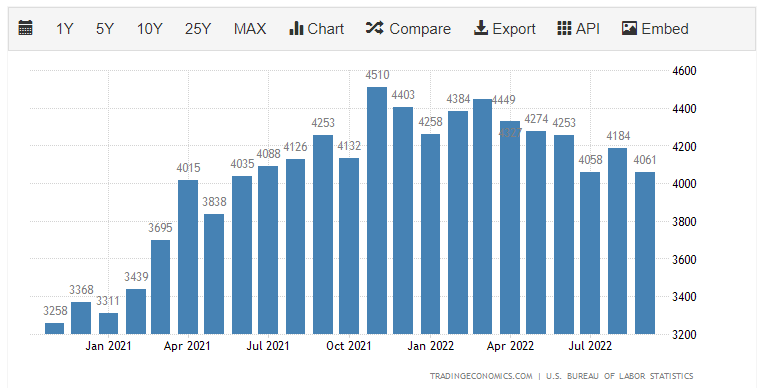

The first thing we will look at when seeking to find out whether the US economy has been hurt by the Fed’s actions is the labour market. Yes, large companies – like Meta Platforms Inc. (NASDAQ: META), Tesla Inc. (NASDAQ: TSLA), and Snap Inc. (NYSE: SNAP) – have reported layoffs, but if we take a look at the number of layoffs in the country, we can see that the figure has been declining since 2021.

At the same time, the number of vacancies is at its highest level in 10 years.

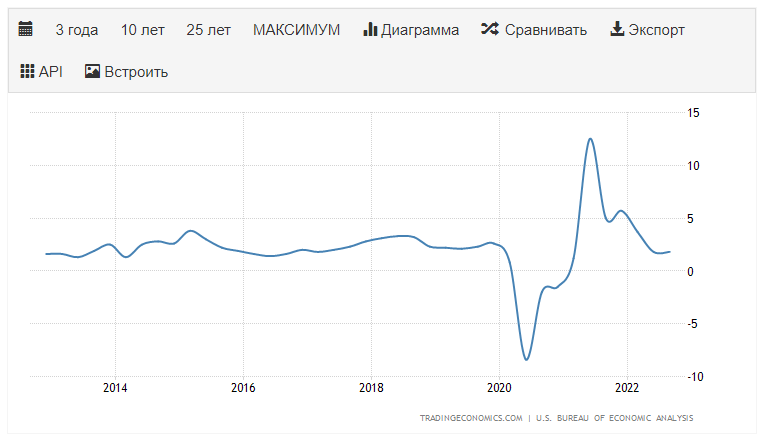

GDP is not giving negative signals: its annual growth rate has dropped to the average of the last 10 years and currently stands at 1.8%.

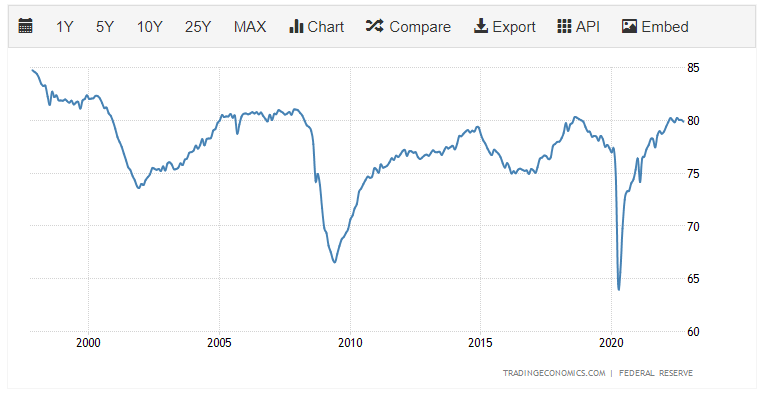

Production capacity is utilised at 80%, which is in line with pre-crisis levels.

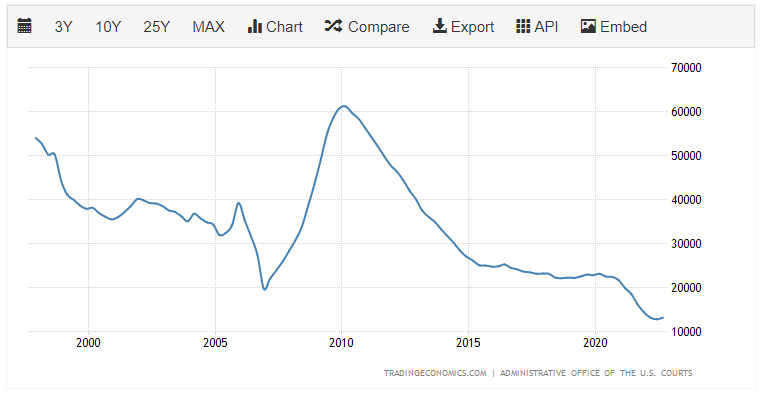

The number of bankruptcy filings in the country is at its lowest in 25 years.

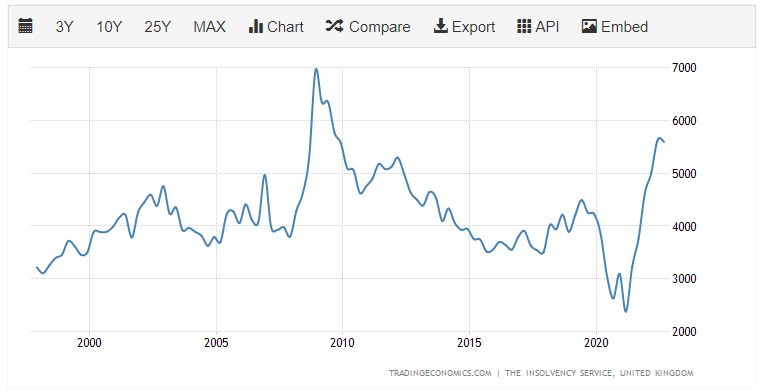

In comparison, in the UK, the figure is approaching the highs of the last 25 years.

Perhaps the full effect of the interest rate hike will be felt by the economy later, but for now, things are good in the US. To understand whether there is a risk of a renewed rise in inflation, let’s look at other important financial indicators.

Why is inflation rising?

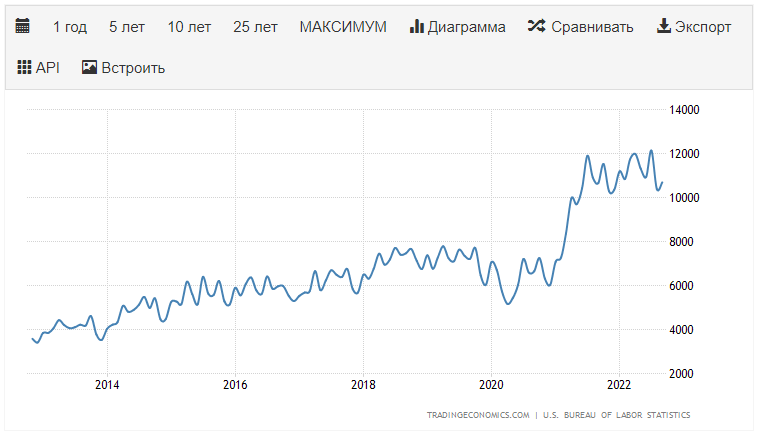

Inflation in the US and around the world began to rise sharply due to the disruption of supply chains caused by the COVID-19 pandemic. Freight costs rose, which had an impact on the final cost of goods. Logistics problems were resolved over time, and while there was a shortage of shipping containers, there is now a surplus of them sitting idle in ports.

However, once the logistics situation improved, inflation continued, supported by high commodity prices. For example, oil is still traded at almost USD 100/barrel. But to better understand the situation, let’s look at the behaviour of the price of black gold after the 2008 and 2020 crises.

Oil prices went from a low in 2009 to a high in two years. Later on, the situation followed a similar pattern, with a low in 2020 and a high in 2022. After 2011, the price of black gold started to fall. Given this, it can be assumed that this course of events could also be repeated.

How do oil prices affect inflation?

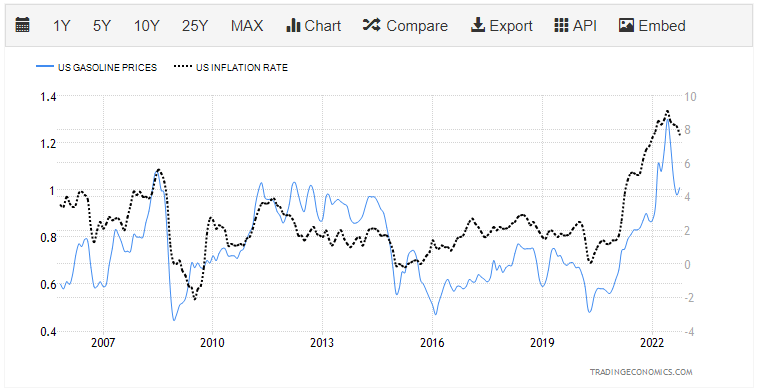

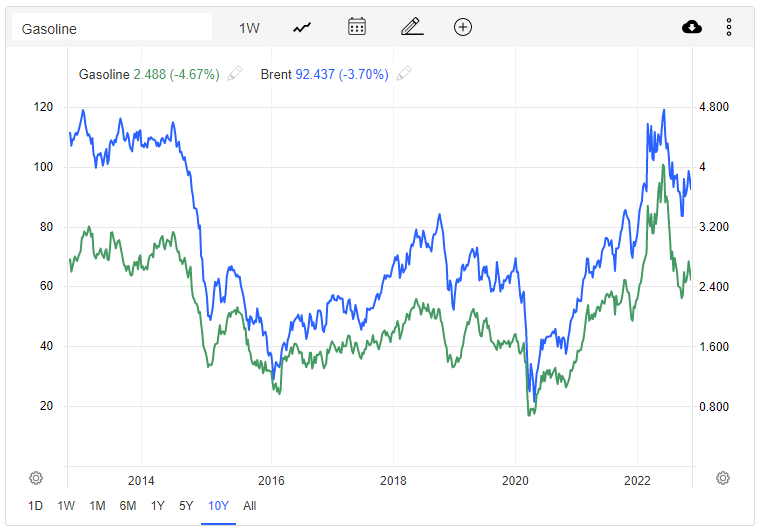

For a better understanding of the relationship between the price of black gold and inflation, let’s take a look at a graph of US gasoline prices and inflation data.

Since 2005, there has been a correlation between these values: when the price of fuel falls, inflation goes down, and vice versa. In 2022, this correlation has intensified.

The cost of fuel in the US is directly related to oil prices – look at the graph.

Given the data presented above, it can be assumed that if oil prices fall, inflation will follow suit. This decline would soften the Fed’s rhetoric, which would have a positive effect on stock indices. But will oil prices decrease?

What could prevent oil prices from falling?

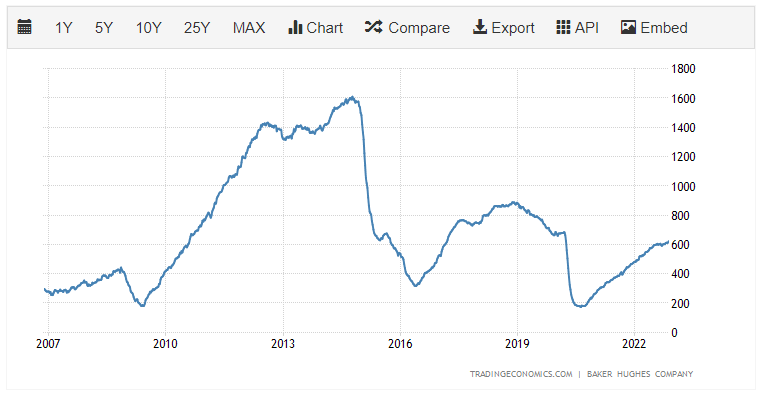

The main difference between the developments after the 2008 crisis and what is happening now is the level of black gold production. In 2011 and later, oil prices were under considerable pressure from a sharp rise in this indicator.

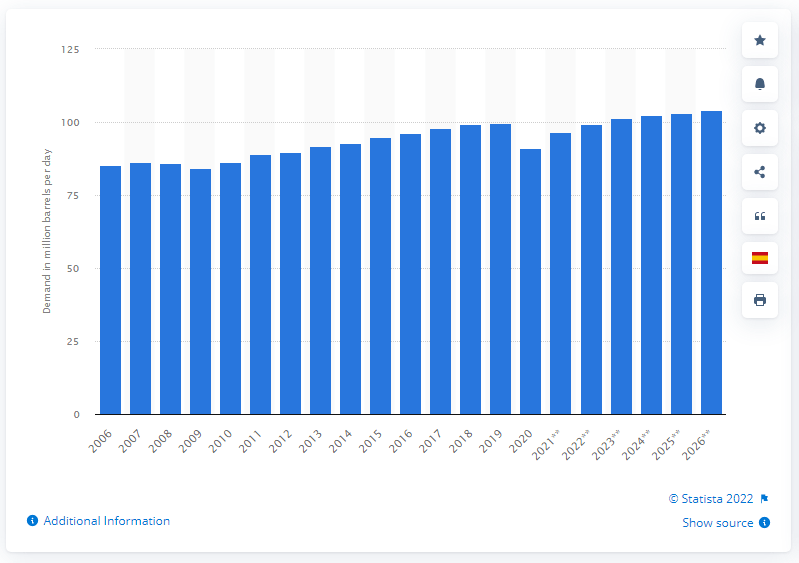

The number of oil rigs currently is not higher than in 2019. This suggests that supply in the market is growing at a slow pace. And daily demand, according to the statistics below, has already reached pre-crisis levels and is only expected to increase further.

Demand for oil is likely to increase further in the near future.

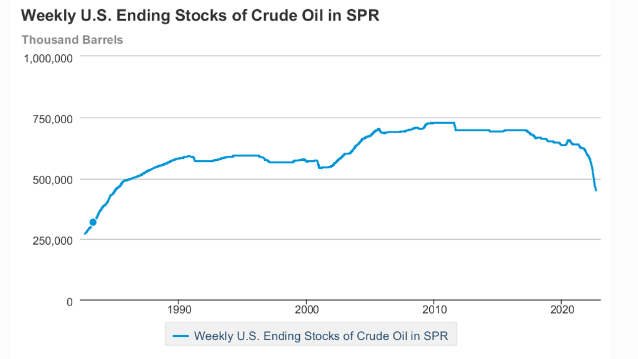

In order to contain inflation, the Joseph Biden administration decided to sell oil from strategic reserves. As a result, the reserves have fallen to 450 million barrels, which is the lowest level since 1984.

The US congressional elections are over and there was no information about new sales from strategic stocks. However, it was reported that the US now intends to replenish reserves, which would create additional demand in the oil market and could push the price of black gold up.

In order to curb oil prices, it is now necessary to slow down the country’s economy significantly, and this can be done through Quantitative tightening (QT) and changes in the monetary policy.

What do investors expect?

The US interest rate is currently at 4%. Market participants are working ahead of the curve and are setting expectations for a maximum rate of around 5%. This can be seen in the one-year treasury bonds: The yield is now 4.78%, and the maximum was at 4.84%.

In other words, the market has already factored in a rate hike of 0.75-1%. The surprise will be a further tightening of the monetary policy, which could result in a rate hike above 5%. And this event is quite possible if oil prices continue to rise.

Conclusion

If next month’s inflation data is below the previous statistics or on the same level, then this will reinforce investors’ belief that rates will not rise above 5%. A rally in the stock market would then be inevitable, with the current movement in the stock indices just the start of another uptrend.

However, if the value is higher next month, then the Fed will have to raise interest rates even further. Market participants would not take this lightly, and stock indices might once again test the October lows.

Separately, it is important to keep an eye on oil prices as they currently play a key role in what will happen with inflation.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post Is the Interest Rate growth Cycle coming to an End? appeared first at R Blog – RoboForex.