JPY Initiates an Uptrend. Also in Focus: EUR, GBP, CHF, AUD, Brent, Gold, and the S&P 500 Index.

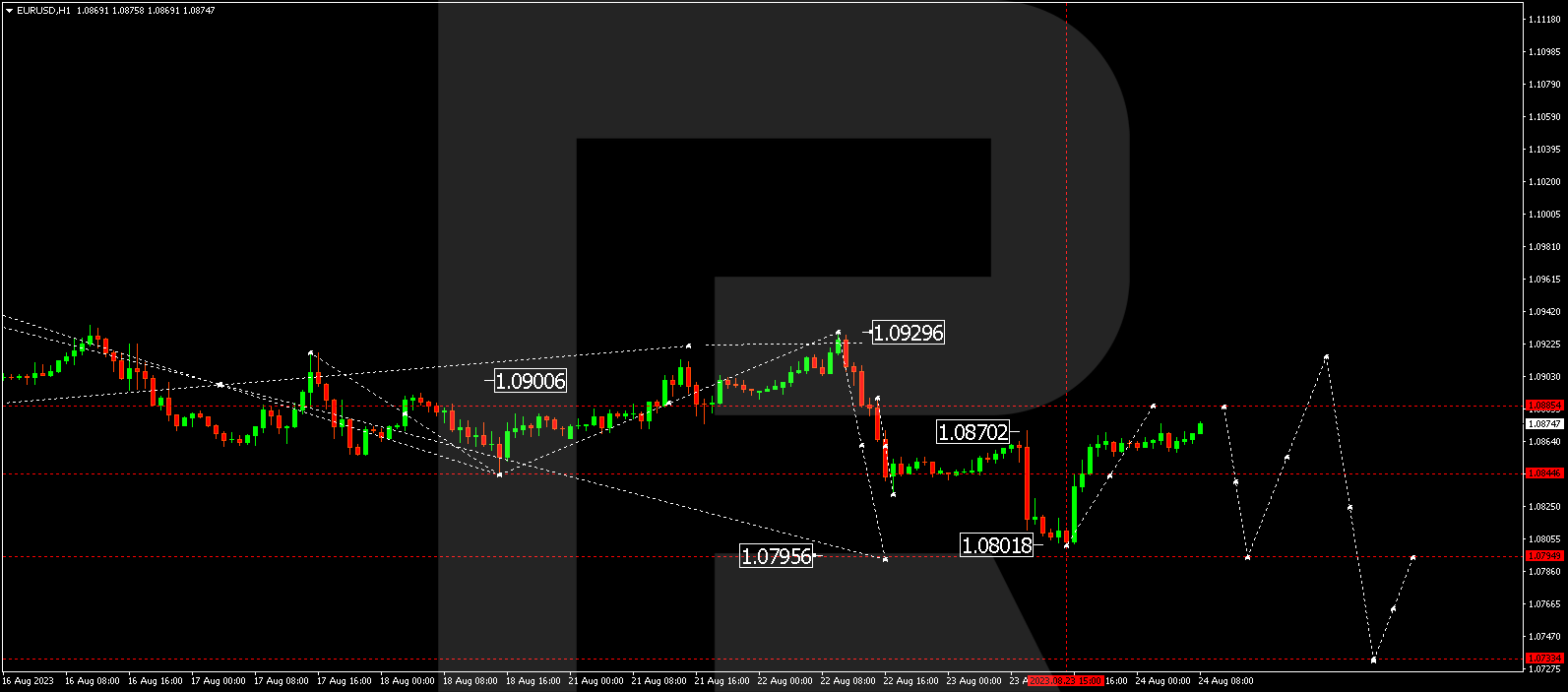

EUR/USD (Euro vs US Dollar)

EUR/USD completed a downtrend wave at 1.0818. Today, the market is correcting this decline with a potential upward movement to 1.0885, followed by a drop to 1.0795. The trend might extend to 1.0750, which is a local target.

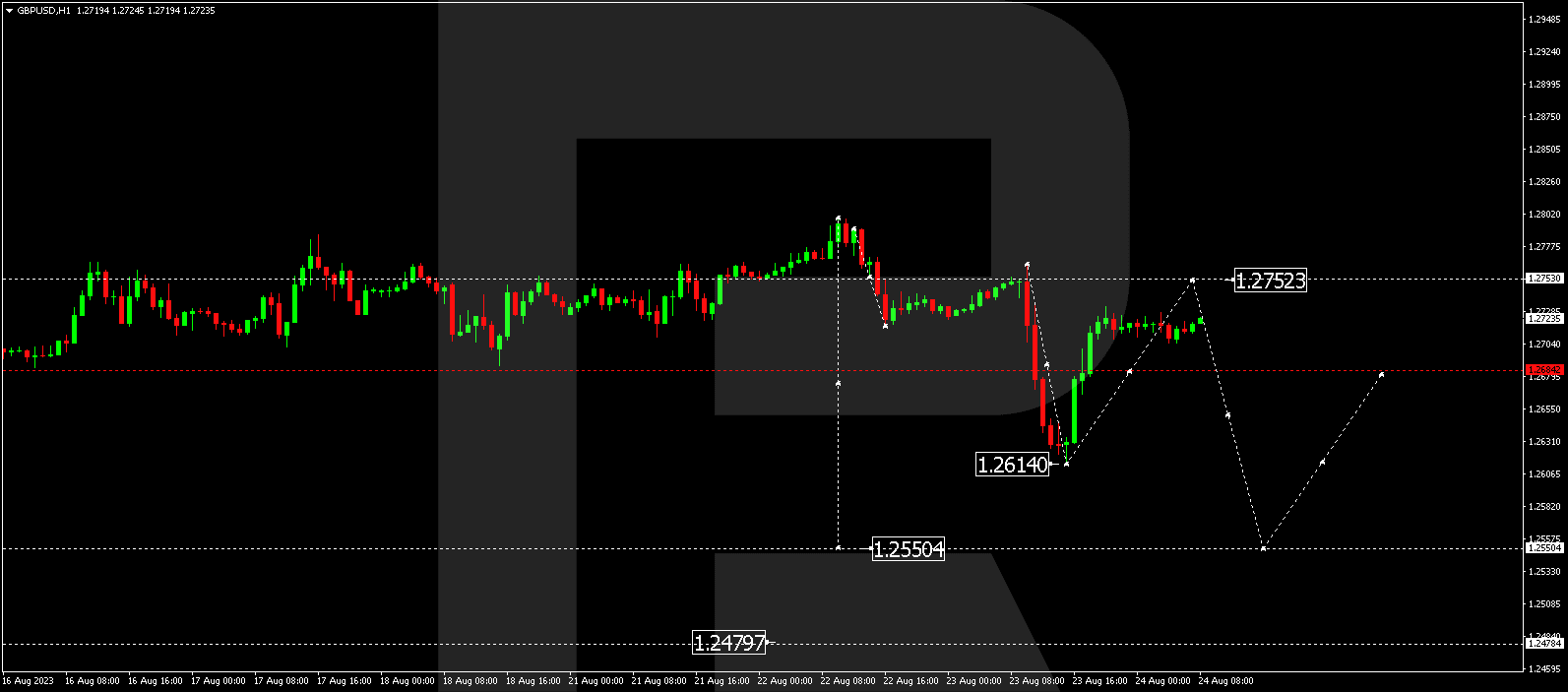

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD wrapped up a bearish impulse at 1.2614. We anticipate a correction to 1.2750 today. Once this correction is done, a new bearish wave to 1.2550 might develop, potentially leading to a continuation down to 1.2480.

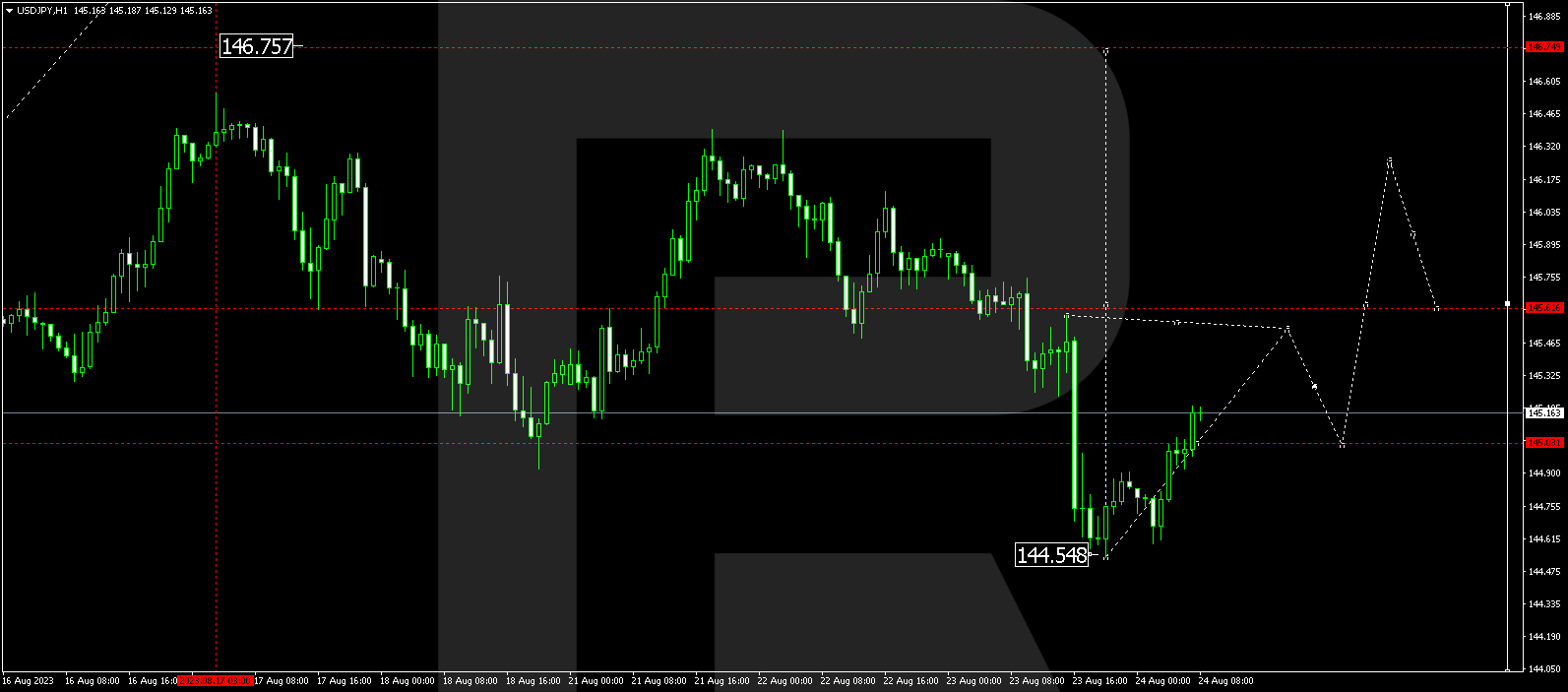

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed a correction wave at 144.55. Today, the market has initiated a new uptrend with an initial target at 145.55. Following this, a decline to 145.05 is possible, followed by a rise to 146.30. From there, the trend could persist to 146.77.

Do you want to trade on favourable terms? Click on the banner below to access some of the most cost-effective trading conditions in the market!

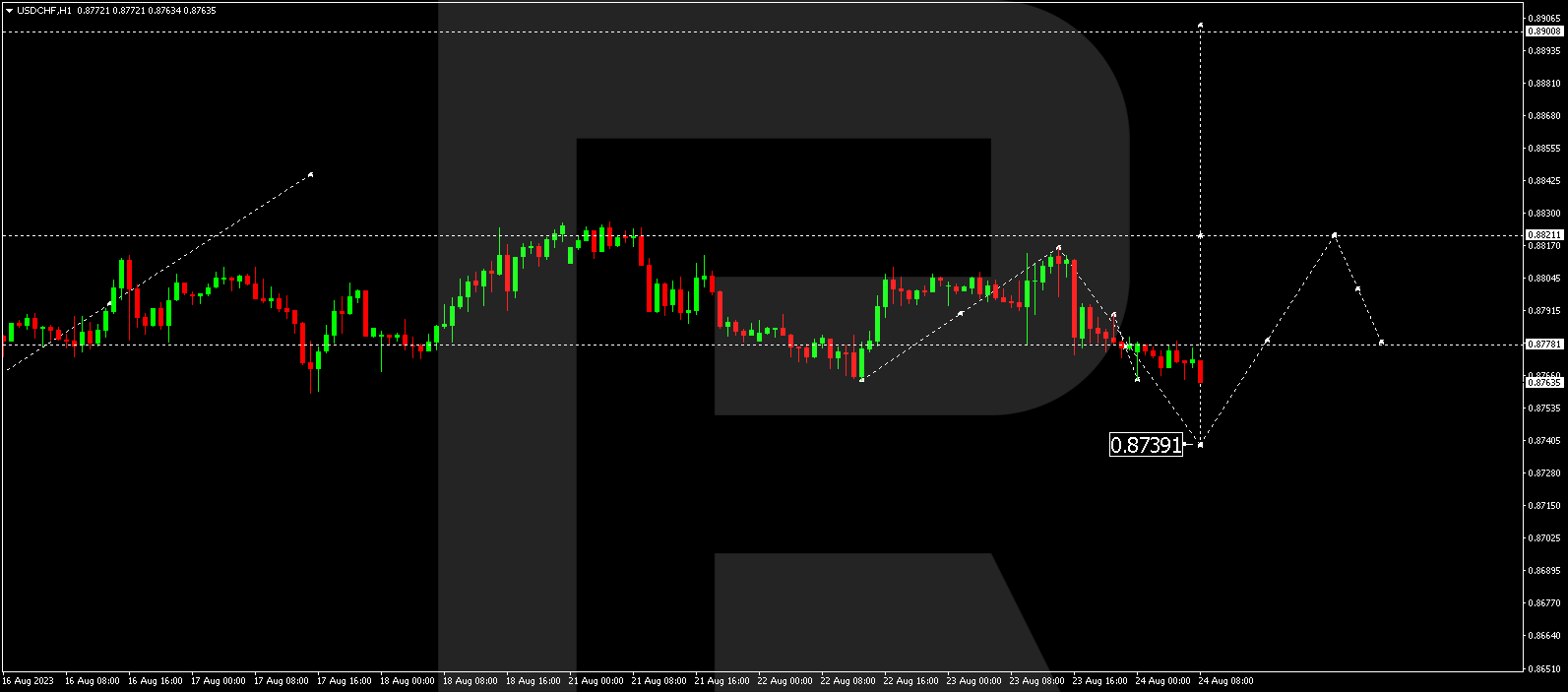

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is currently undergoing a correction to 0.8740. After this correction wraps up, a fresh uptrend to 0.8822 may commence, potentially breaking out to 0.8888.

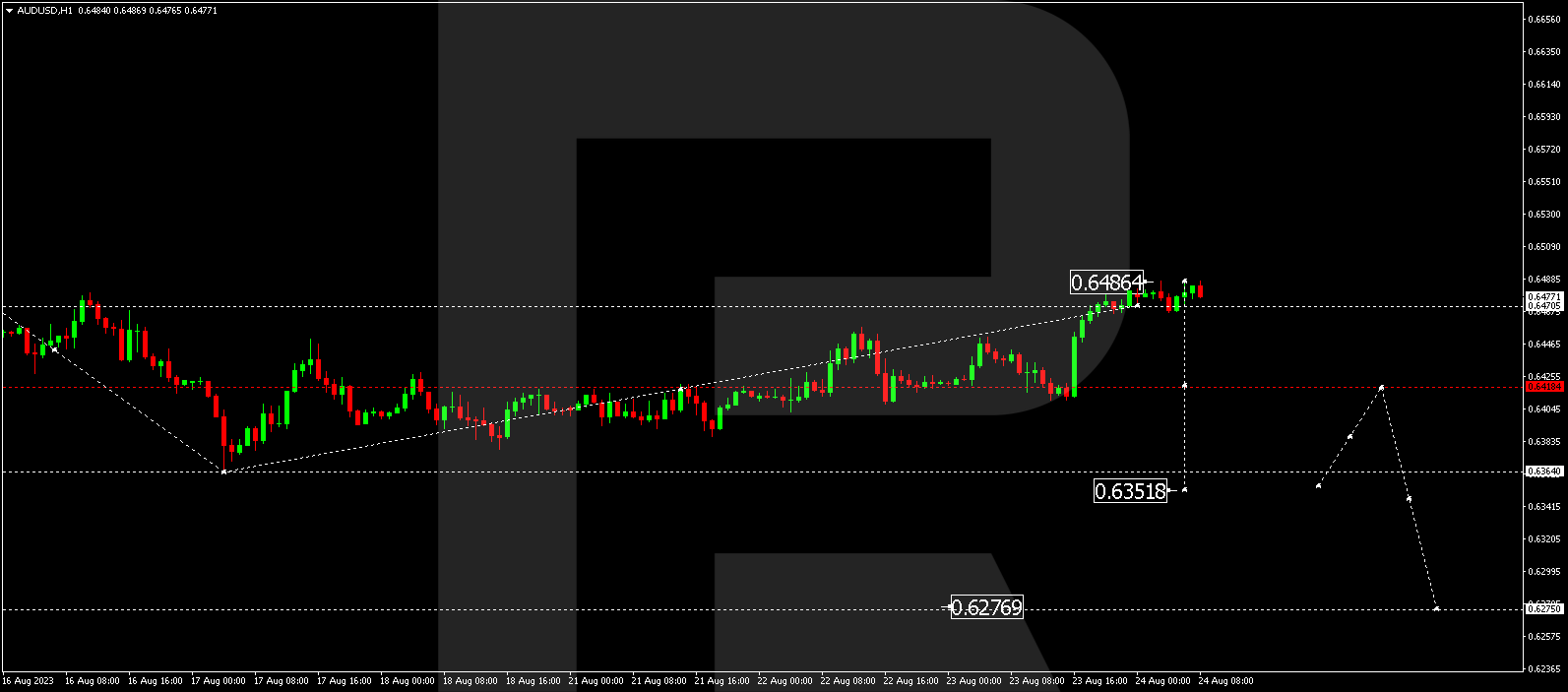

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a correction wave at 0.6486. Today, the market is establishing a consolidation range beneath this level. If it breaks out below the range, the price could initiate a bearish wave to 0.6418. A further breakout might extend the trend down to 0.6352, which is a local target.

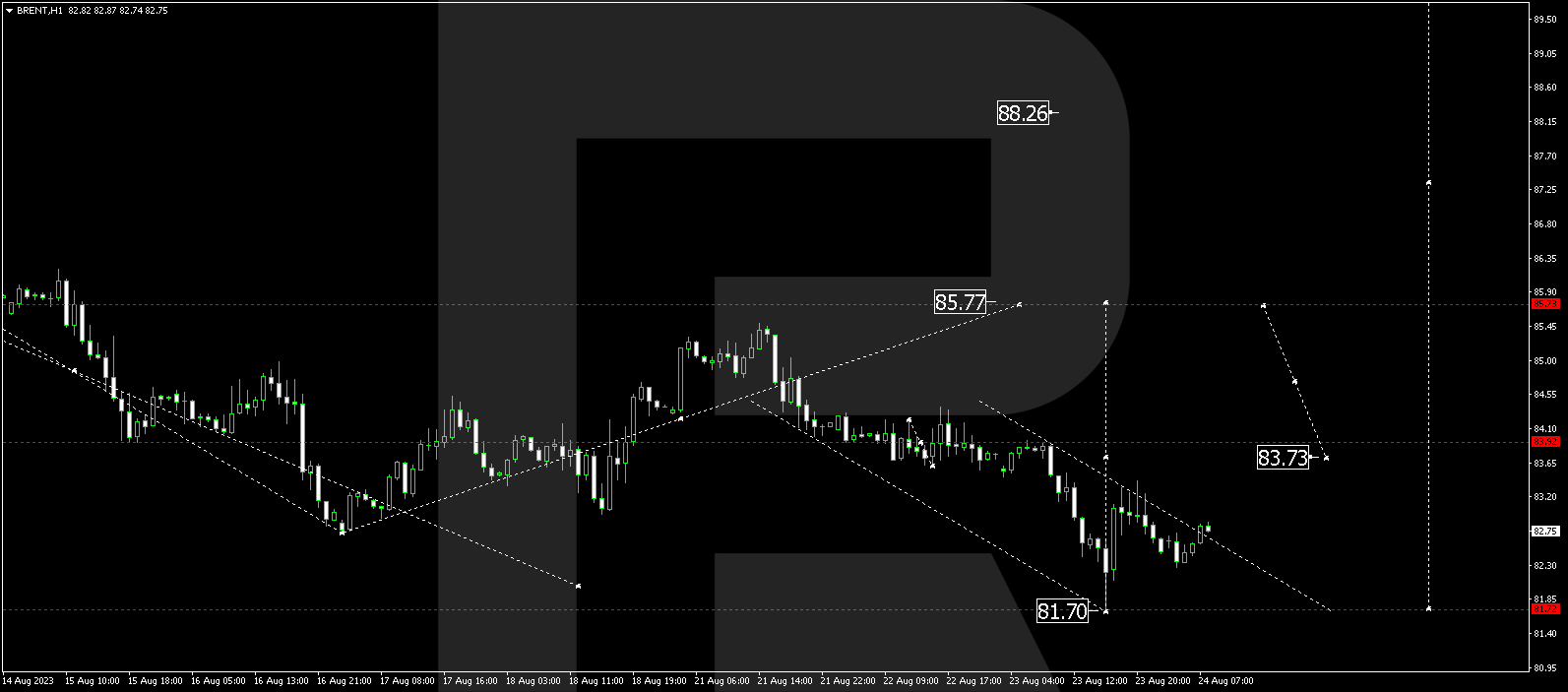

BRENT

Brent completed a correction wave at 81.70. Today, the market is forming the first wave of an uptrend, targeting 83.73. After reaching this level, a drop to 82.70 is possible, followed by a rise to 86.77. From there, the trend could continue to 88.30.

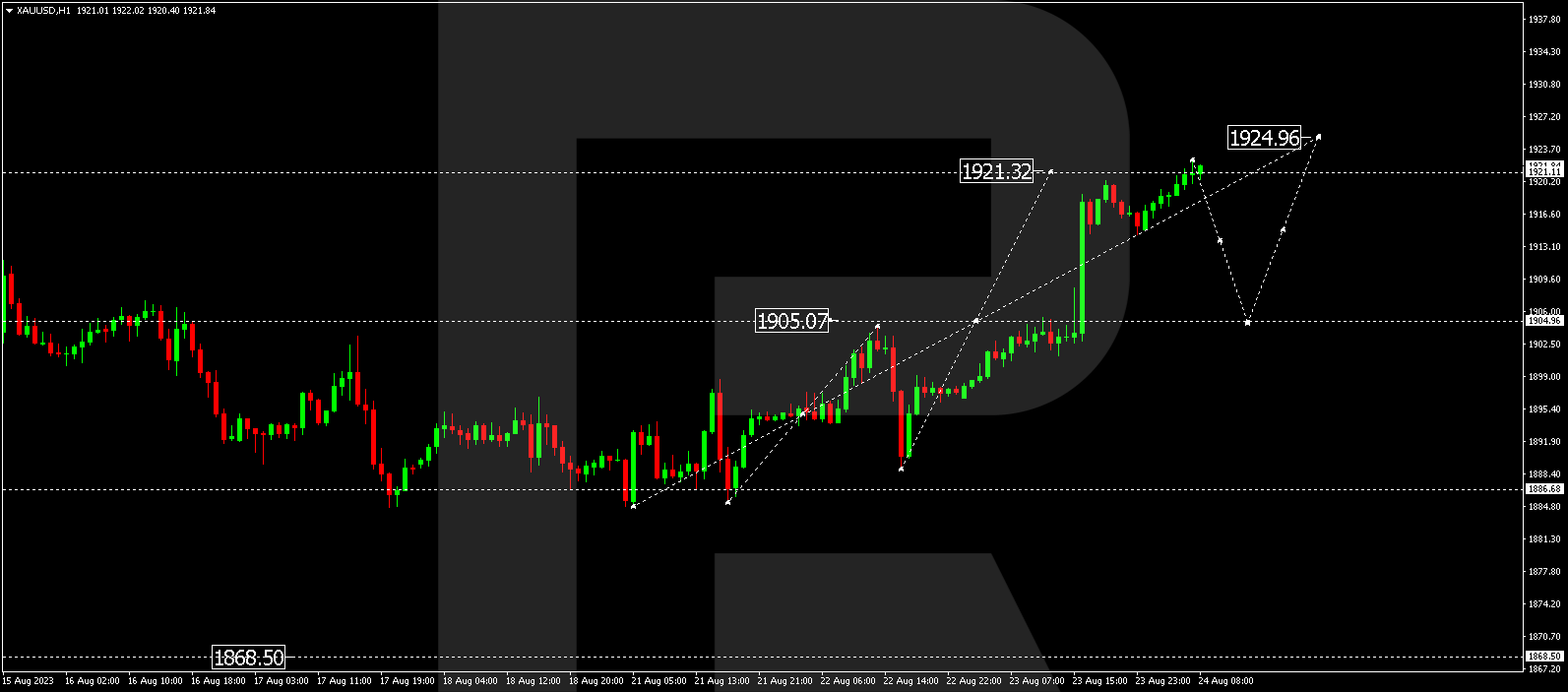

XAU/USD (Gold vs US Dollar)

Gold has established a consolidation range around 1905.00. A breakout upward may provoke a correction to 1923.00. Subsequently, a drop to 1905.00 (with a test from above) and a rise to 1925.00 might occur. After completing this correction, the trend could continue down to 1868.50, which is a local target.

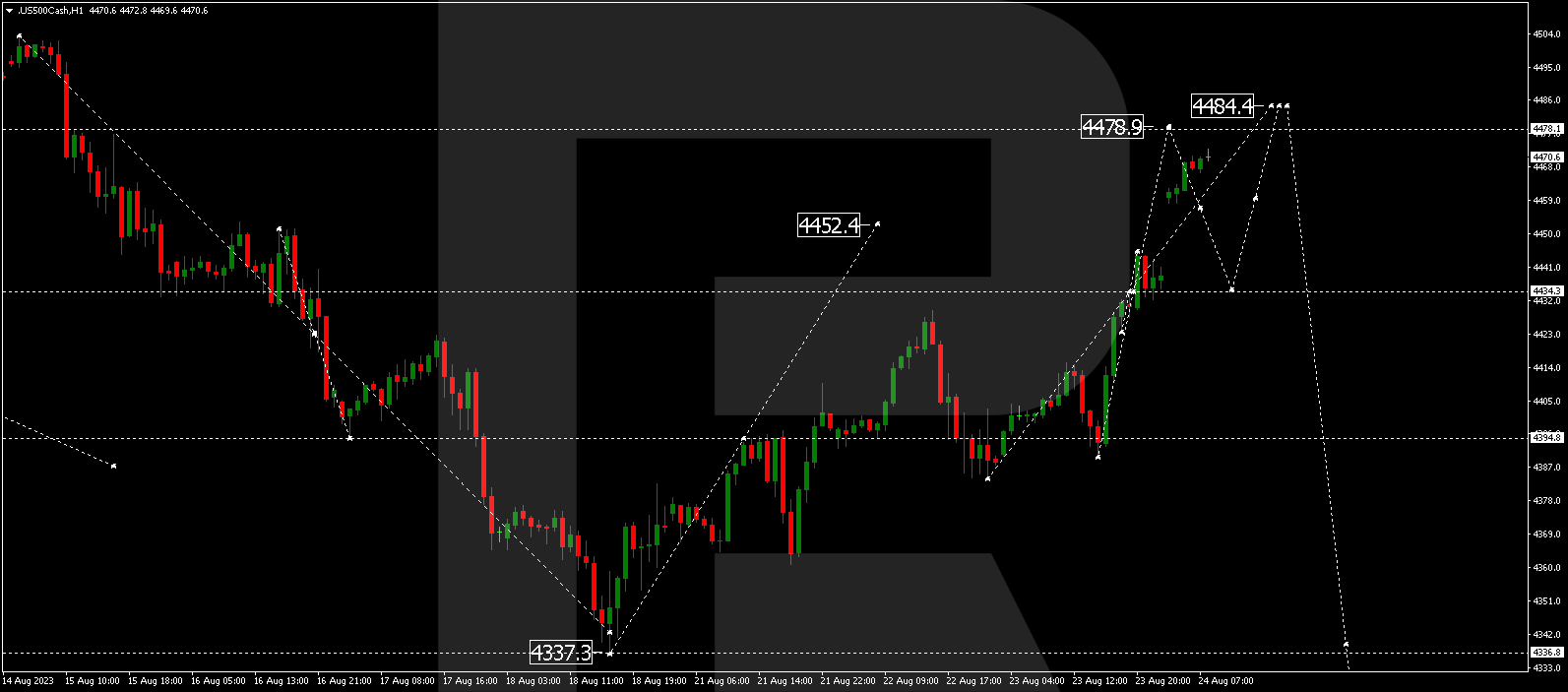

S&P 500

The stock index concluded a correction wave at 4434.0, forming a consolidation range around this level. If it breaks out upward, the price may continue the correction to 4479.0. Following that, a drop to 4434.0 (with a test from above) and a rise to 4484.0 could ensue. After completing this correction, a new downward wave to 4333.0 might initiate.

The post Technical Analysis & Forecast for August 24, 2023 appeared first at R Blog – RoboForex.