The EUR could potentially extend its downward trajectory. Additionally, this overview encompasses the movements of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

EUR/USD (Euro vs US Dollar)

EUR/USD has completed a corrective phase, reaching 1.0875, and is now entering a renewed descending wave. During the current trading session, the market has demonstrated a downward structure towards 1.0777. While a potential corrective move to 1.0810 is not out of the question (with possible testing from below), the subsequent phase could entail a decline to 1.0750, followed by a potential continuation towards 1.0700. This level serves as a nearby target.

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD experienced a correction to 1.2732, heralding the commencement of a new downward wave. In the current market activity, the pair has completed a pattern that suggests movement towards 1.2558. A potential upward correction to 1.2628 remains plausible (potentially tested from below). However, expectations point towards a decline to 1.2520, possibly extending further to 1.2450.

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY’s upward trend continues, aiming for 146.25. As the price approaches this level, a downward correction to 145.45 is conceivable, followed by a resurgence towards 146.30, representing a local target.

Do you want to trade on favourable terms? Click on the banner below to access some of the most cost-effective trading conditions in the market!

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF’s uptrend is persisting, with a target at 0.8888. Once this mark is attained, a downward correction to 0.8850 (potentially with a testing from above) is foreseeable, preceding an ascent towards 0.8935. This figure serves as a nearby target.

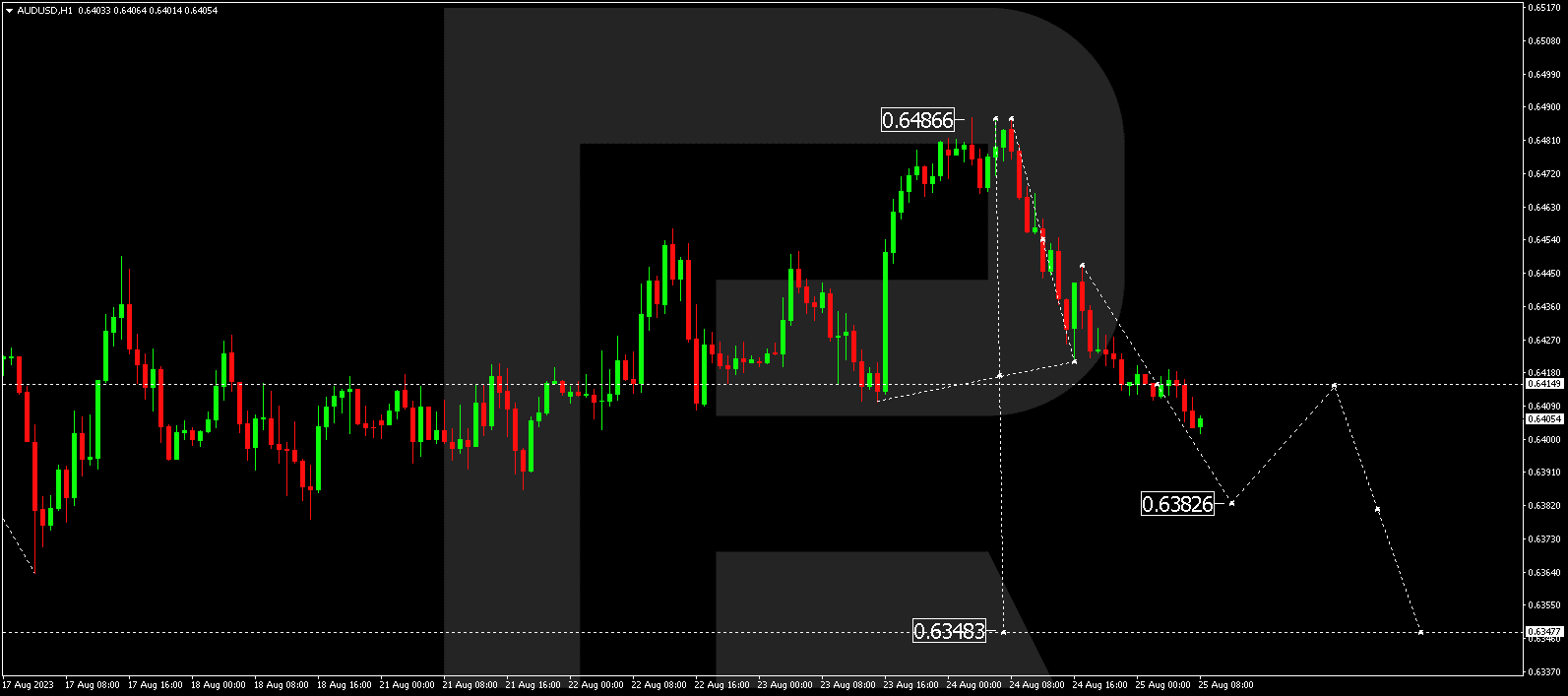

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD’s corrective phase concluded at 0.6486, signifying the onset of a new descending wave. During the present trading session, the market pattern suggests a trajectory towards 0.6401. While the potential for an upward correction to 0.6415 exists (possibly with a test from below), a subsequent decline to 0.6383 is anticipated, with the potential to extend further to 0.6348.

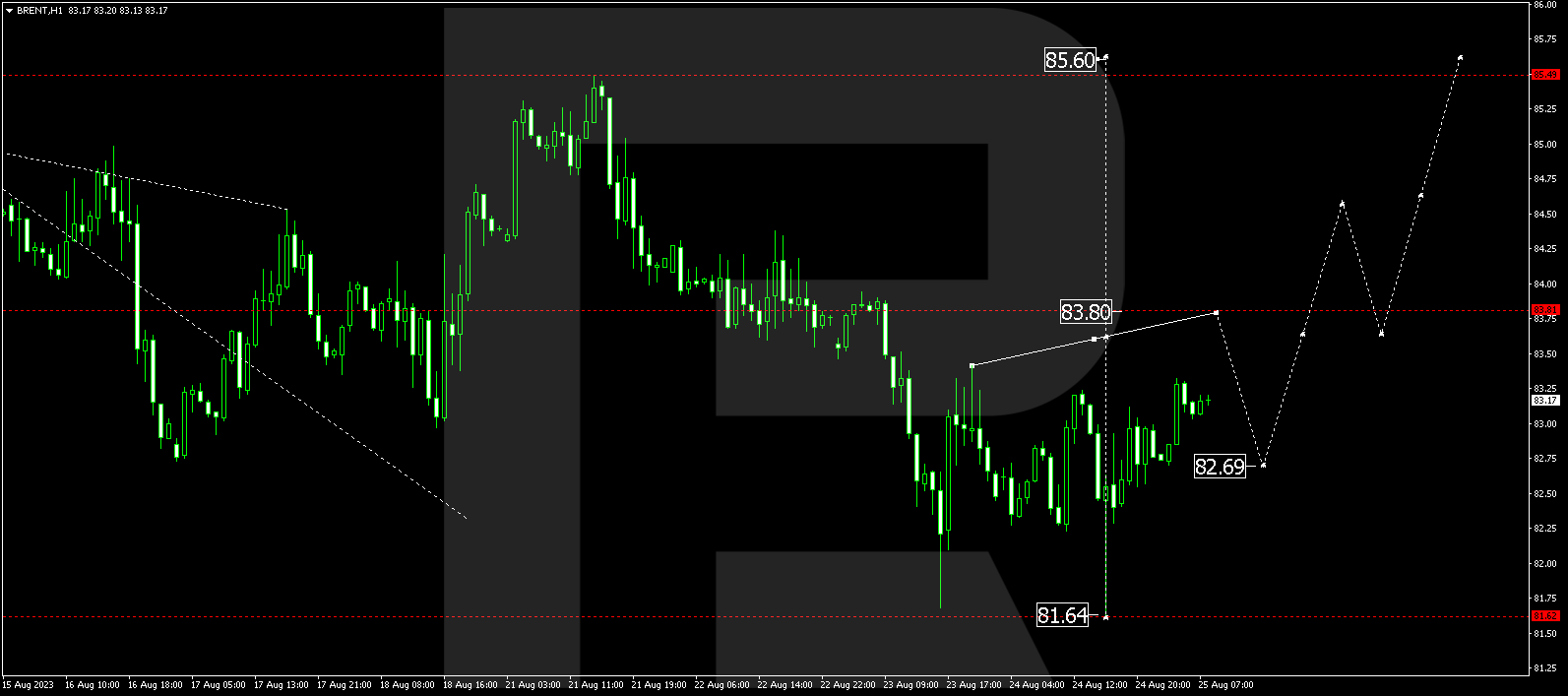

BRENT

The Brent crude oil market continues to experience a consolidation phase around 82.70. Today’s analysis indicates the possibility of a climb towards 83.80. Subsequently, an upturn to 84.55 is plausible, with potential continuation towards 85.60, serving as a local target.

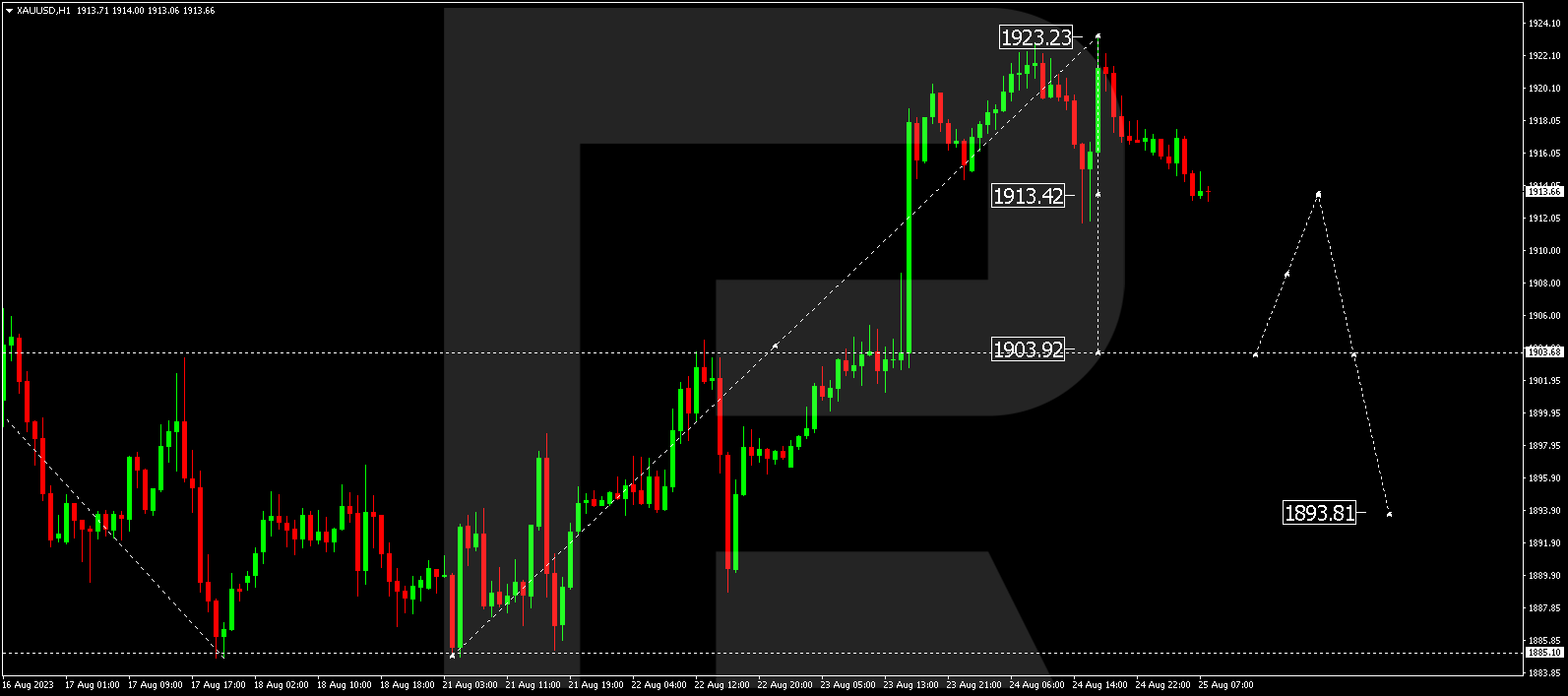

XAU/USD (Gold vs US Dollar)

Gold’s correction led it to 1923.23. In ongoing market activity, the trend is downward, with an expected dip to 1904.00. Subsequently, a corrective increase to 1913.00 is plausible. Anticipated further is a decline to 1893.80, potentially extending to 1885.00 as an initial target.

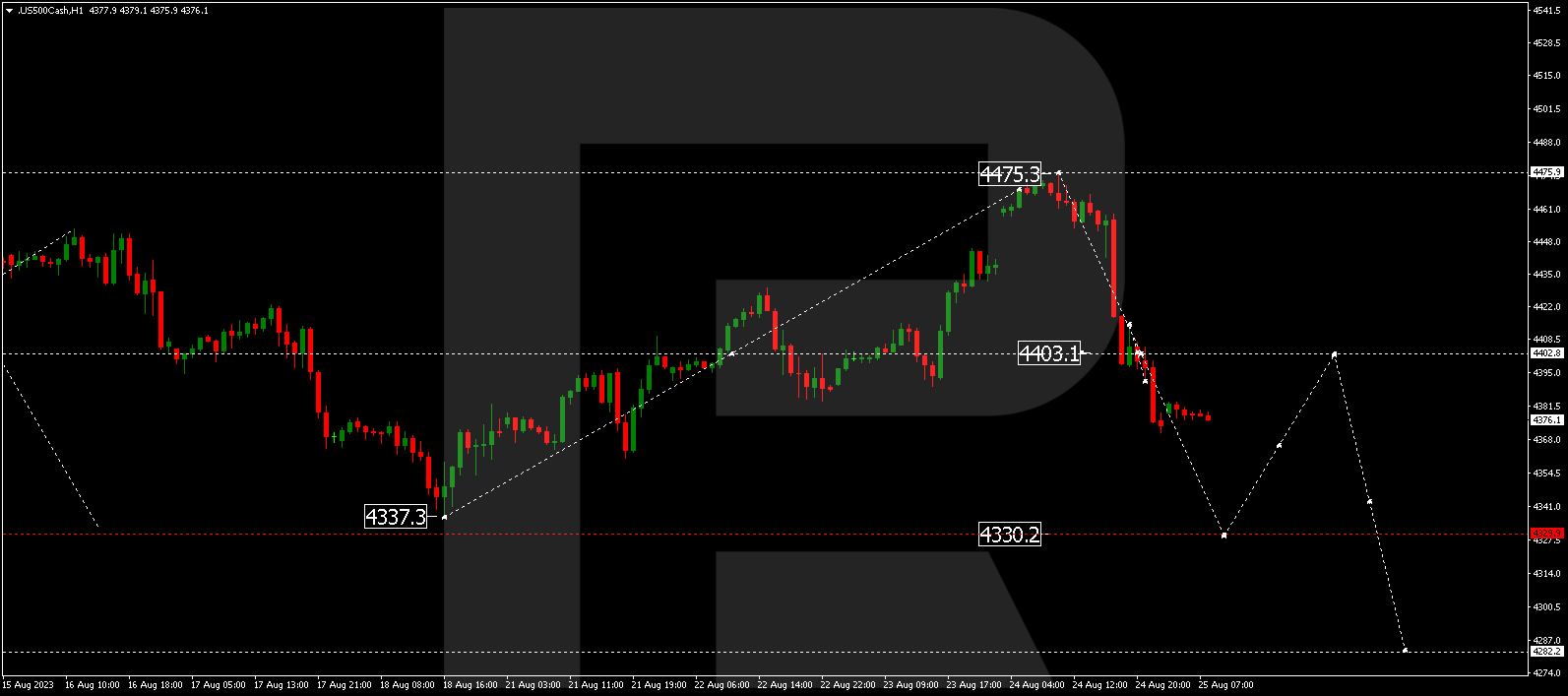

S&P 500

The S&P 500 stock index has completed a corrective phase, reaching 4475.3. In the current market scenario, the trend indicates a continued decline towards 4330.0. Once this level is achieved, an upward correction towards 4404.0 is conceivable (with potential testing from below). Thereafter, an anticipated decline to 4282.0 stands as a local target in this scenario.

The post Technical Analysis & Forecast August 25, 2023 appeared first at R Blog – RoboForex.