Brent Continues Its Upward Momentum: This overview also encompasses the dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

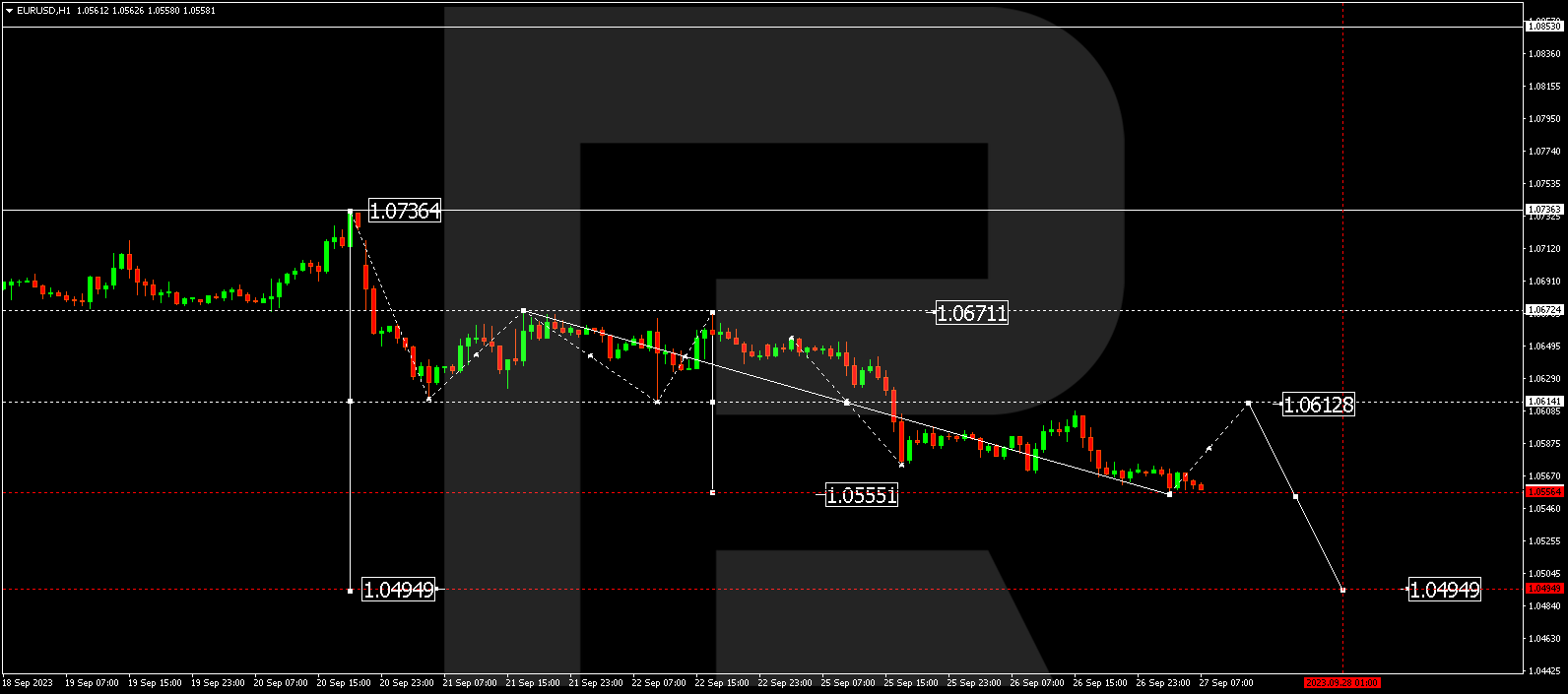

EUR/USD (Euro vs US Dollar)

EUR/USD has completed a downward wave, reaching 1.0555. Today, a consolidation range may develop above this level. A potential rise to 1.0612 (a test from below) cannot be ruled out, followed by a decline to 1.0494, possibly extending to 1.0450. This marks a local target.

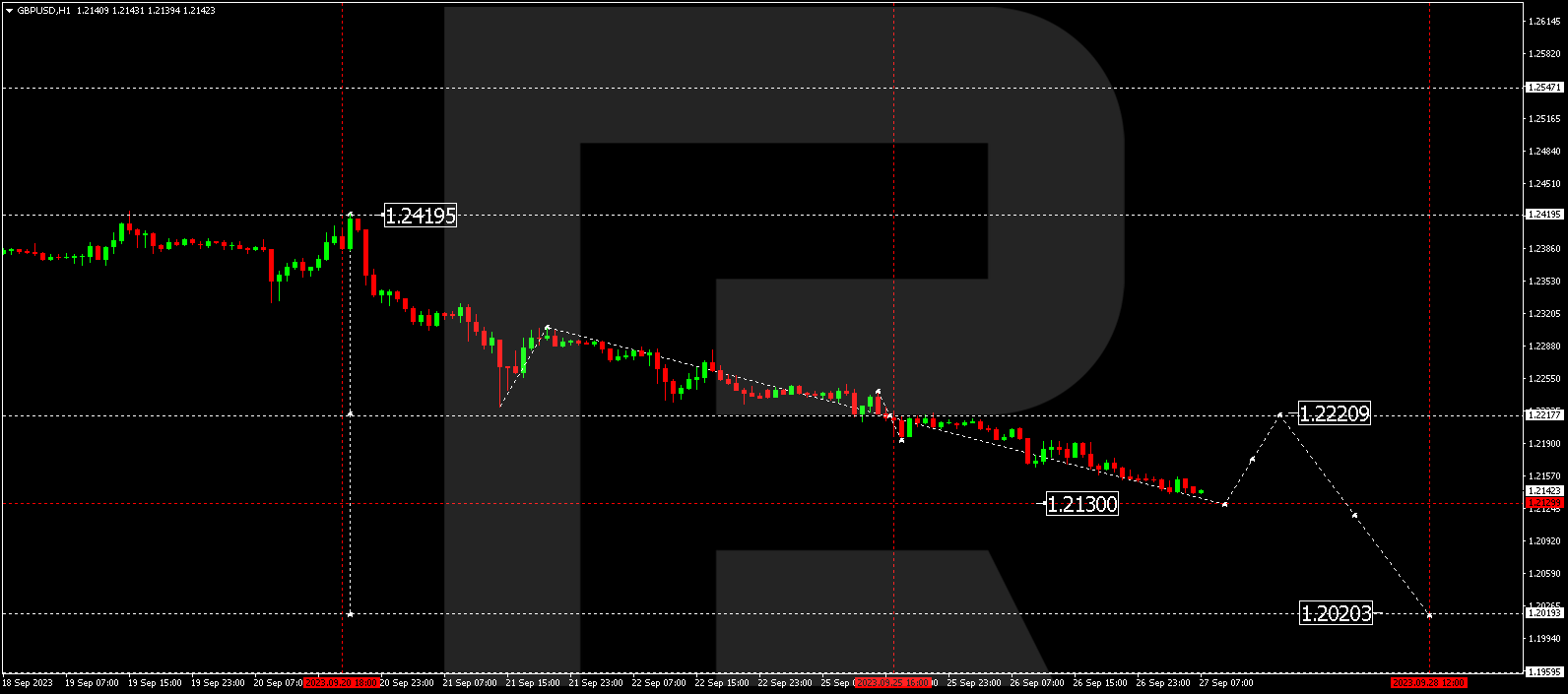

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is maintaining its downward trajectory towards 1.2130. After reaching this level, a correction to 1.2220 (a test from below) might initiate, followed by a decline to 1.2020.

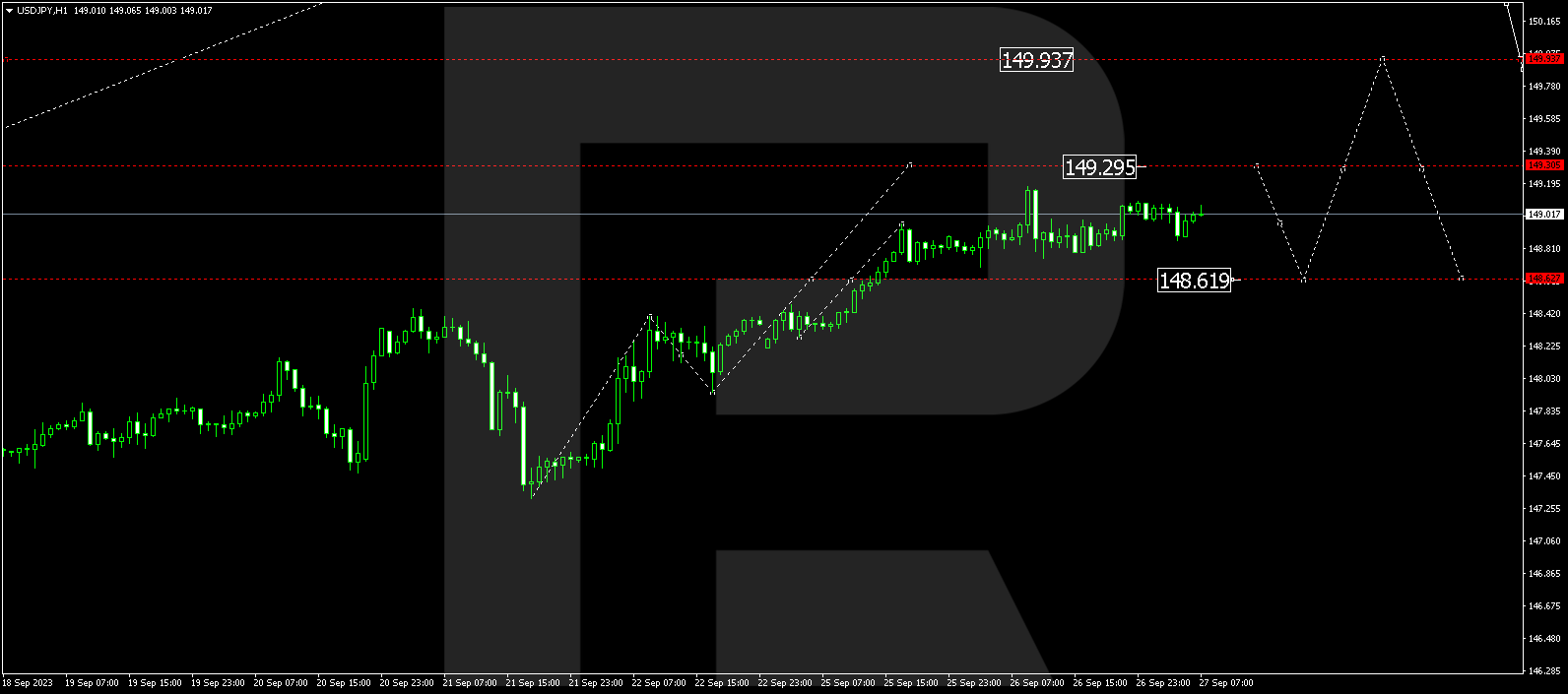

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY continues its upward trajectory to 149.29. Following this achievement, a correction to 148.62 could follow, eventually leading to a rise to 149.94.

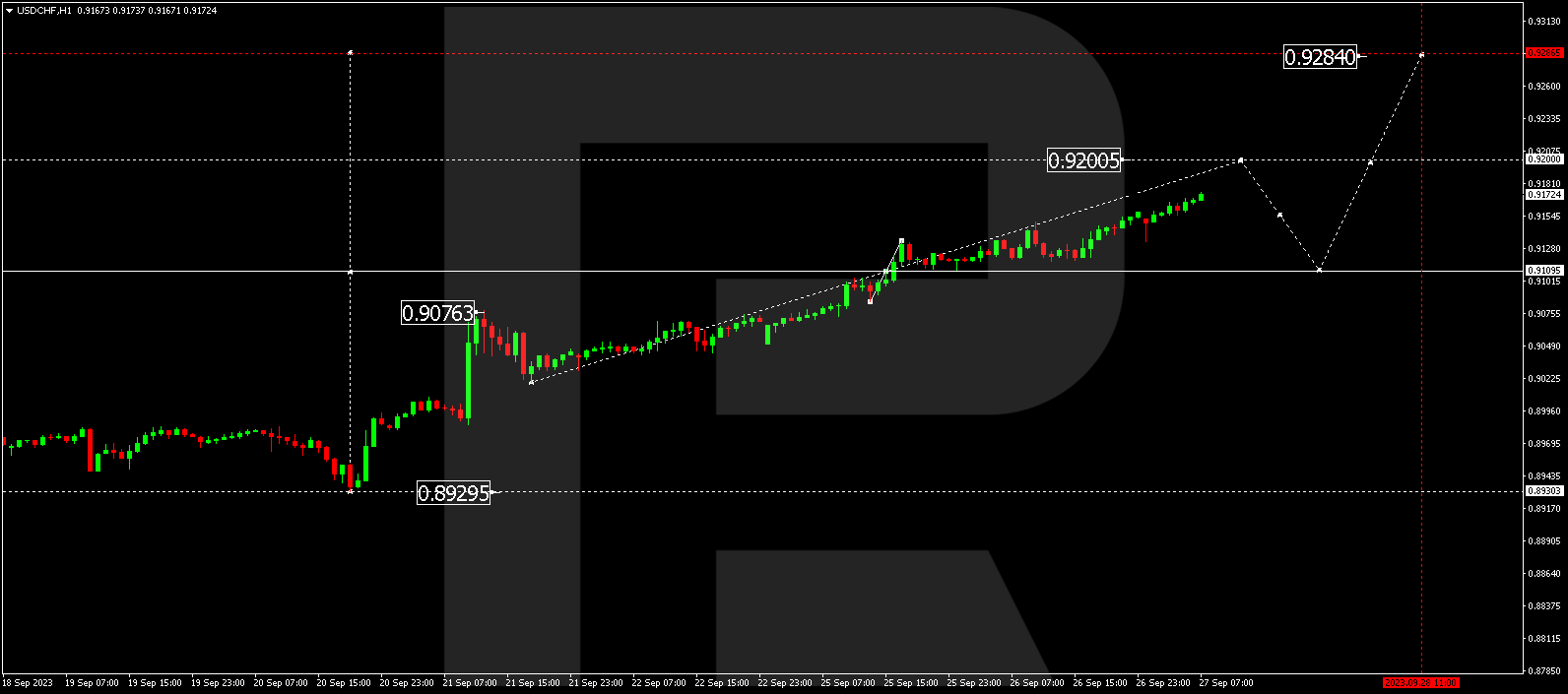

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is experiencing a growth wave towards 0.9200. Once this level is attained, a correction to 0.9109 may develop, followed by an ascent to 0.9284. This represents a local target.

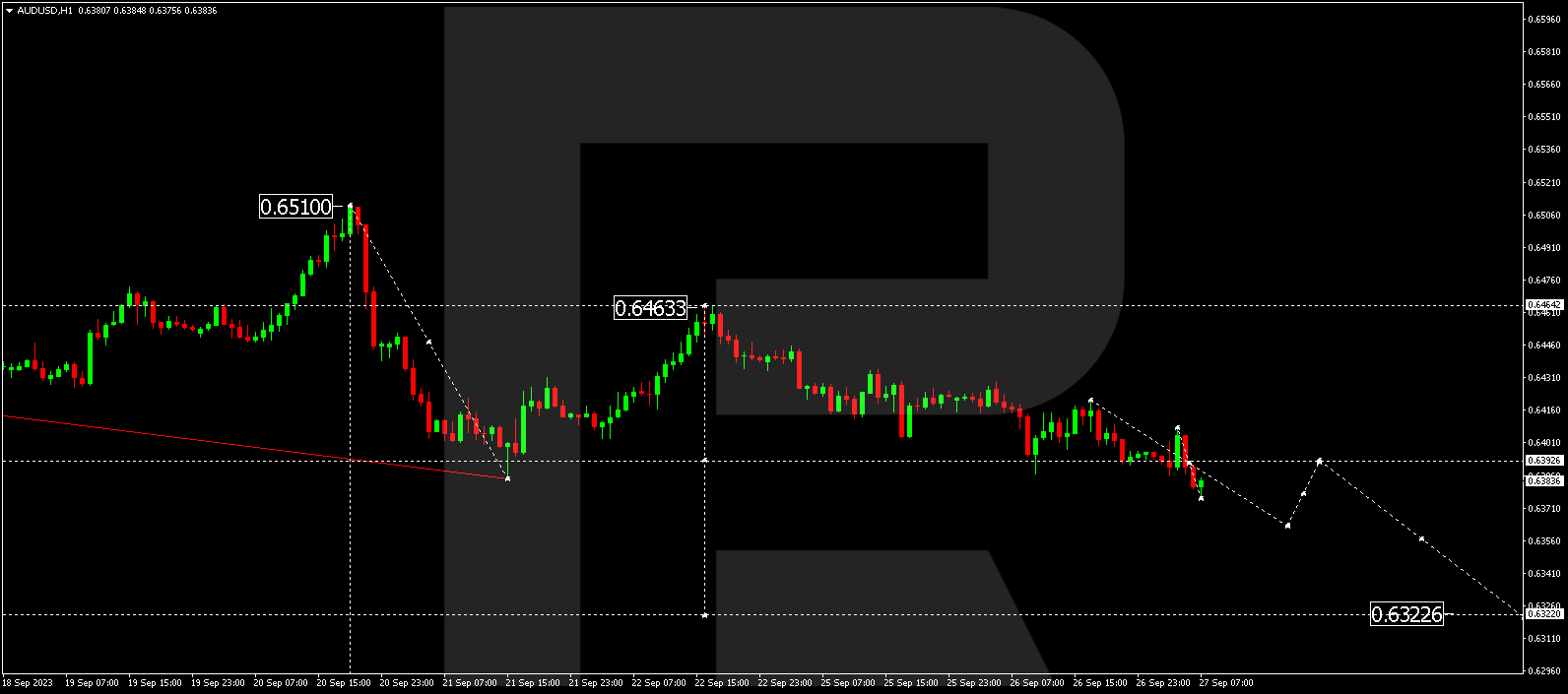

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is maintaining its downward movement towards 0.6323. After hitting this level, a corrective rise to 0.6393 (a test from below) might occur. Subsequently, a drop to 0.6276 could take place, from where the trend may extend to 0.6200.

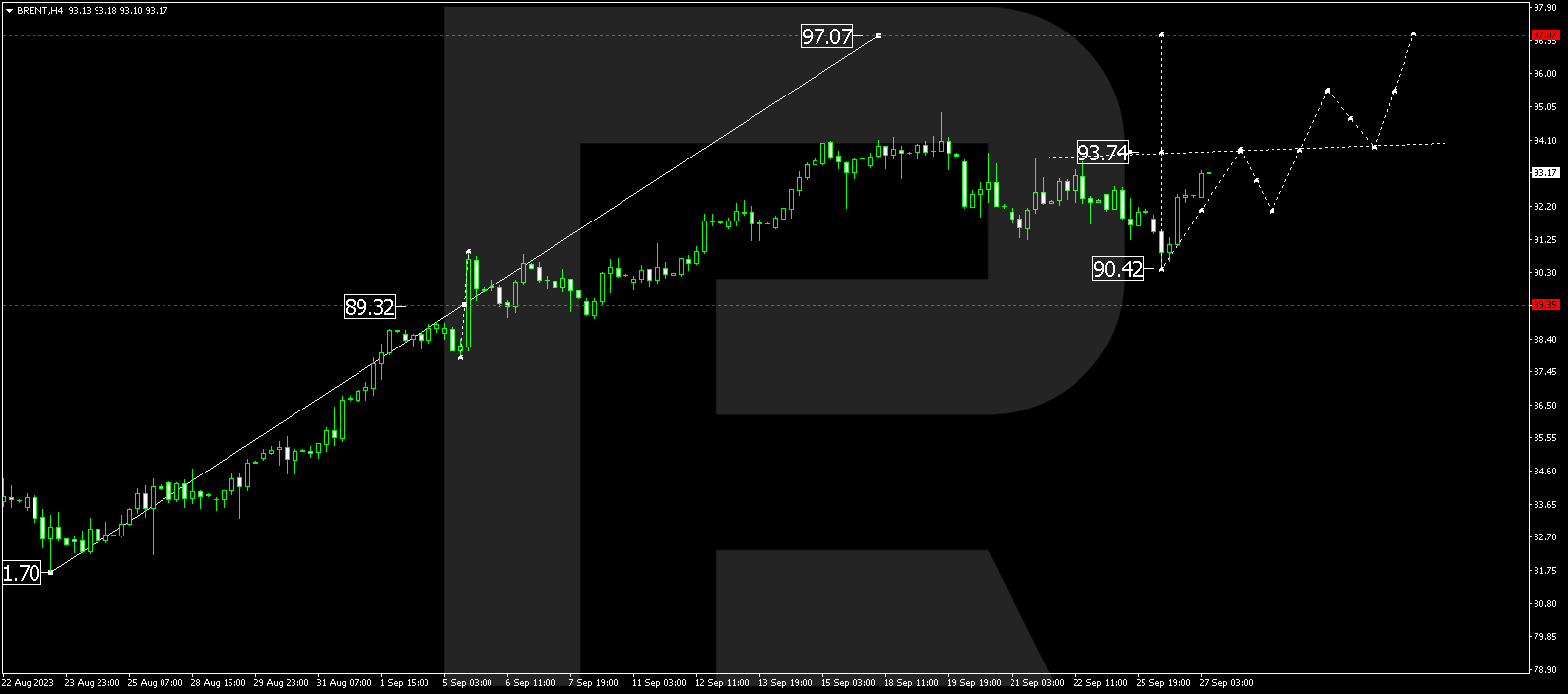

Brent

Brent has corrected to 90.42. Today, the market is extending an upward wave to 93.73. A breakthrough of this level could pave the way for a movement towards 97.07. After reaching this level, a corrective phase to 93.75 may form, followed by a rise to 104.40.

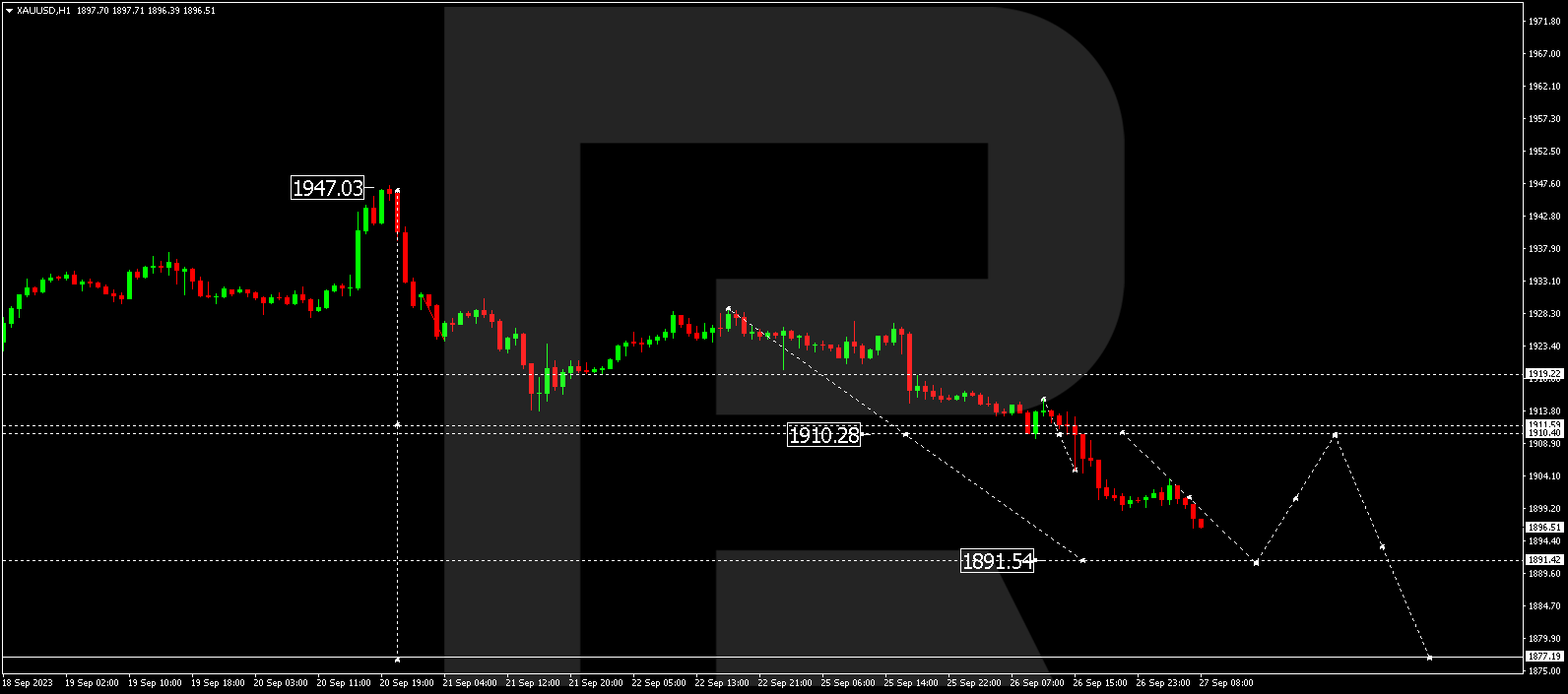

XAU/USD (Gold vs US Dollar)

Gold is maintaining its downward trajectory towards 1891.44. Following this, the price may rise to 1910.40 (a test from below) and then decline to 1877.20. From there, the trend might continue towards 1864.00.

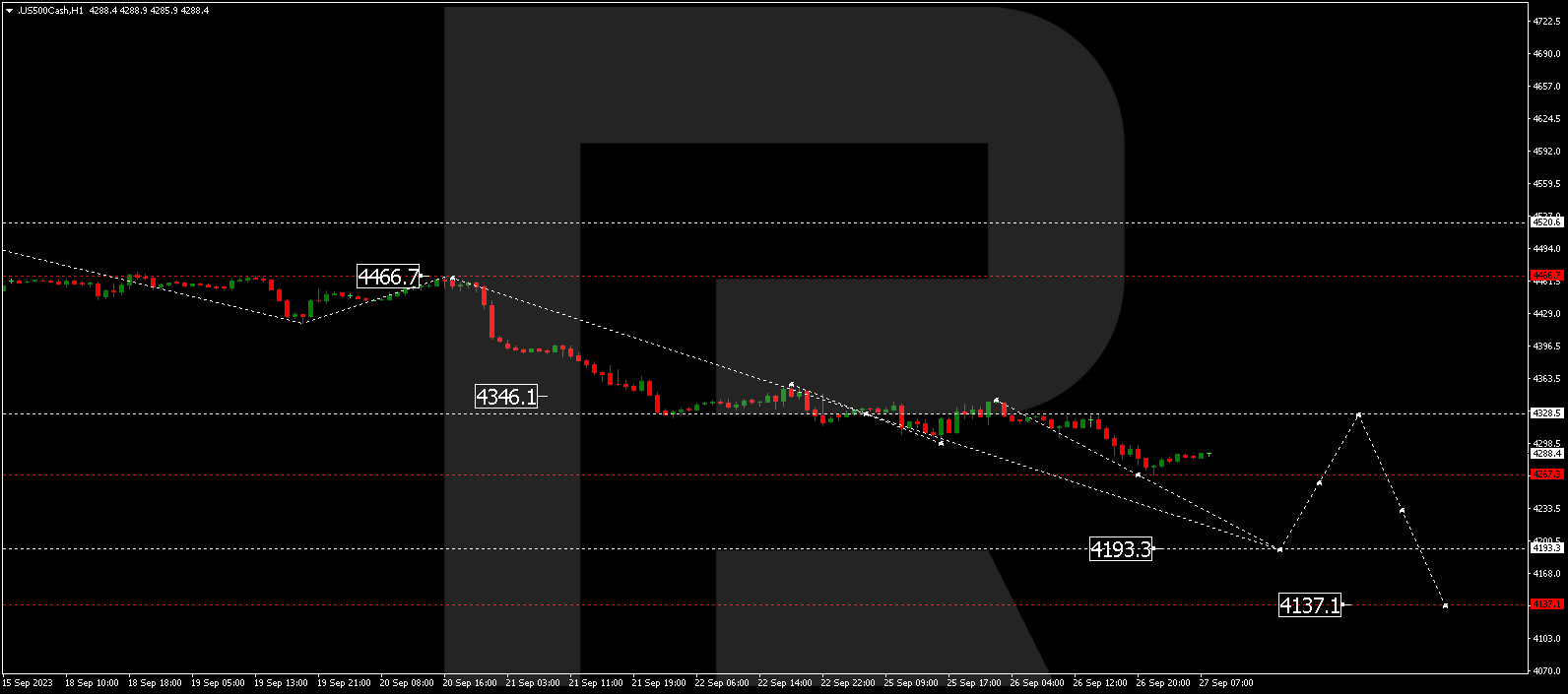

S&P 500

The stock index has formed a consolidation range around 4328.5 and, breaking below it, reached 4267.3. Today, a corrective link to 4300.0 might develop, followed by a decline to 4193.3. The trend could potentially expand towards 4137.0. This signifies a local target.

The post Technical Analysis & Forecast September 27, 2023 appeared first at R Blog – RoboForex.