AUD/USD is one of the key currency pairs in the international foreign exchange market. In this article, we will examine the primary factors affecting the pair’s exchange rate, analyse the AUD/USD performance in 2023, and explore the short-term and medium-term forecasts provided by experts.

Overview of the AUD/USD currency pair

AUD/USD shows the ratio of the US dollar (USD) to the Australian dollar (AUD). Its quotes indicate the value of one Australian dollar denominated in US dollars. When the pair’s exchange rate rises, the Australian dollar strengthens against the US currency. When the exchange rate drops, this signals that the AUD is on the decline against the USD.

Trading characteristics of the AUD/USD pair

- Trading hours: The pair is traded round the clock except for the weekends, with the highest activity observed during the Pacific, Asian, and American trading sessions

- Volatility: AUD/USD is characterised by moderate volatility, showing average daily fluctuations ranging from 500 to 700 pips. However, during times of crises and stock market swings, volatility may increase to 1,000-2,000 pips per day for a short time

- Spread: thanks to high liquidity and moderate volatility, the spread for AUD/USD is minimal, with often less than 10 pips in popular ECN accounts

Fundamental factors influencing the AUD/USD quotes

The Australian central bank’s monetary policy

The Reserve Bank of Australia (RBA) has been implementing a series of tightening measures in its monetary policy since May 2022 to combat inflation. During this tightening cycle, the central bank raised the key rate from 0.1% in April 2022 to 4.1% in June 2023. Subsequently, in its meetings held in July, August, September, and October, the RBA maintained the interest rate at 4.1%.

Following its fourth consecutive meeting, the RBA decided to keep the interest rate unchanged. According to the central bank’s projections, the pace of consumer price increases will continue decelerating, eventually returning to the target range of 2-3% by the end of 2025. Following the meeting, Michele Bullock, the governor of the RBA, stated that further tightening of monetary policy might be necessary to ensure a prompt return of inflation to the target range. However, this decision will depend on forthcoming economic data and the evolving assessment of associated risks.

The Federal Reserve’s monetary policy

The US Federal Reserve intensified its efforts to combat inflation by tightening monetary policies. From the beginning of 2022, the key rate has gradually risen from 0.25% to 5.5%, significantly affecting the exchange rate of the US dollar and strengthening its position against many world currencies.

On 20 September 2023, the Fed kept the interest rate at 5.5%. The central bank noted that economic activity continues to grow steadily, and although job gains have slowed, the dynamics still are impressive. The Fed’s leadership emphasised that inflation rates remain high, with inflation risks being the focus of attention. Analysts predict that the US will see a further interest rate increase by the end of 2023.

The impact of natural resource prices

Despite being relatively young, Australia’s economy holds a prominent position in the global rankings. The country is rich in diverse natural resources, including gold, iron ore, diamonds, minerals, uranium, and coal deposits. The export of these resources plays a pivotal role in bolstering government revenue. Therefore, an upswing in the global prices of commodities like iron ore, industrial metals, gold, silver, and coal contributes to strengthening the Australian dollar exchange rate and fuels the growth of the AUD/USD currency pair.

Conversely, a decline in the prices of natural resources, often triggered by a global economic crisis, results in a decrease in the Australian dollar exchange rate and the AUD/USD quotes. It is worth noting that the AUD/USD currency pair is correlated with the price of gold. Rising gold prices usually contribute to strengthening the Australian dollar and driving up the pair’s exchange rate. In contrast, a decline in gold quotes is commonly followed by a drop in the Australian currency exchange rate and the pair’s quotes.

Indicators for economic development for the US and Australia

- Unemployment Rate

- Nonfarm Payrolls

- GDP Growth Rates (GDP)

- Inflation Indices (CPI, PPI)

- Industrial Production (Industrial Production Index)

- Retail Sales

- Trade Balance

- Consumer Confidence Index

- ISM Manufacturing Purchasing Managers Index

AUD/USD performance in 2023

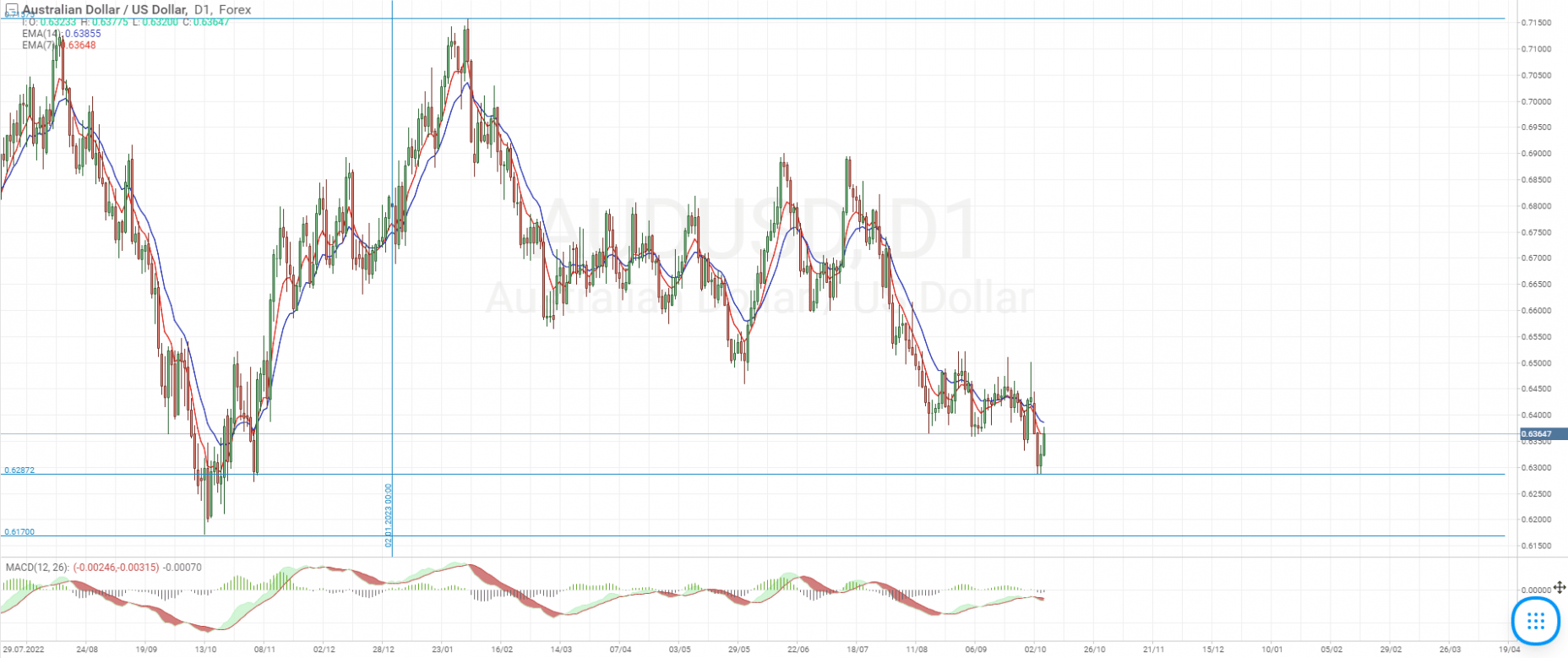

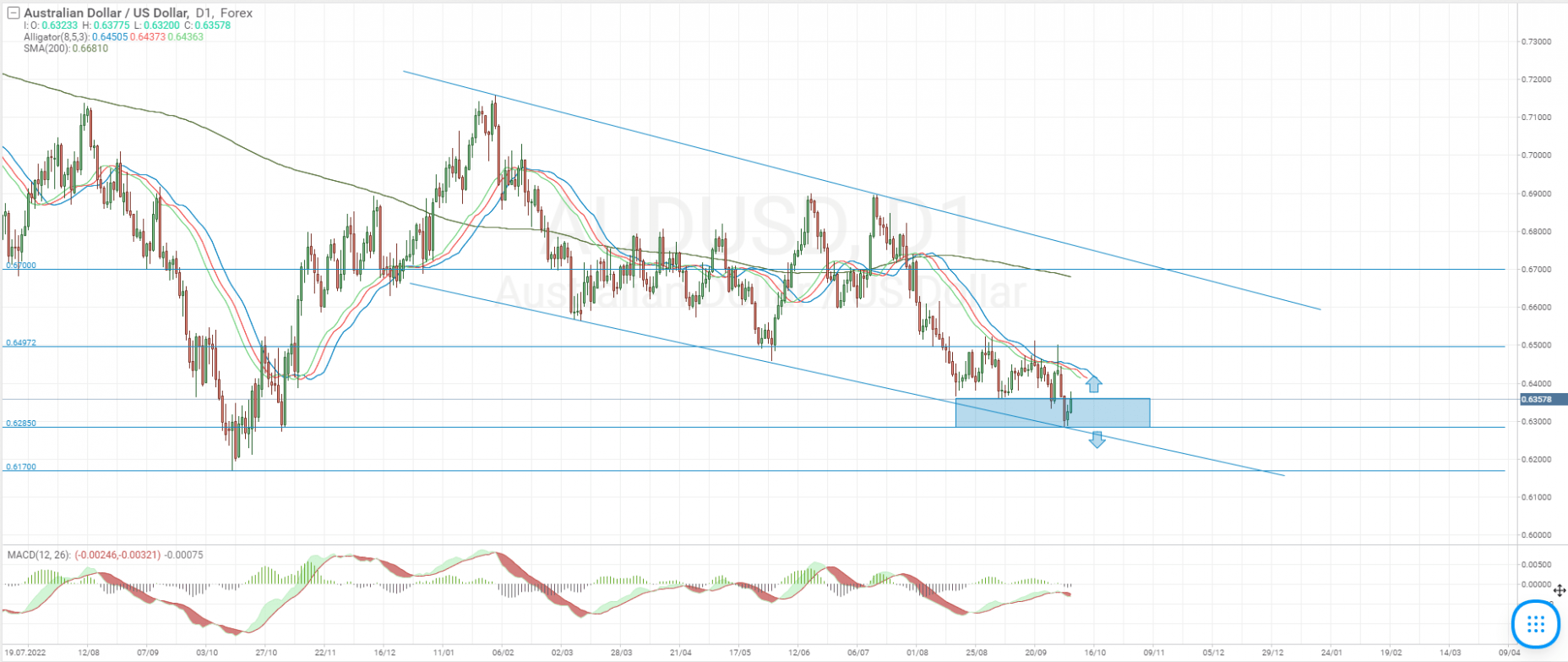

The AUD/USD currency pair has experienced a moderate decline in 2023. Although it demonstrated upward momentum at the beginning of the year, reaching an annual high of 0.7157 in February, the pair later entered a downtrend phase. At the time of writing, the AUD/USD quotes are approaching the 0.6300 mark and continue to reach new annual lows steadily.

AUD/USD live chart

Technical analysis of AUD/USD

After reaching an annual high of 0.7157 in February, the AUD/USD currency pair reversed downwards, demonstrating a consistent downtrend. A descending price channel has formed on the daily chart, with the exchange rate gradually falling and regularly reaching new annual lows. The quotes are currently hovering near 0.6300, with the Alligator indicator and the 200-day Moving Average above the price chart confirming the downtrend.

On the daily chart, the price has rebounded from the lower boundary of the price channel, which serves as local support. Following a considerable decline, an upward correction could develop towards the resistance level at 0.6500. If this level breaks, the next target will be 0.6700, where the 200-day SMA and the upper boundary of the price channel are located. Should the price continue to decline, the nearest support level is at the 0.6285 mark. With a breakout of this level, the price could target the support level at 0.6170, the lowest value of 2022.

AUD/USD forecasts for 2023

- Analysts at J.P. Morgan Research forecast that the AUD/USD quotes will hover near 0.7000 by the end of 2023

- Citibank’s specialists suggest that the pair will trade near 0.6300 by the end of 2023 and the beginning of 2024

- ING Group’s economists expect the Australian dollar to end the year near 0.6600

Long-term AUD/USD forecasts

- HSBC experts believe the US dollar is currently overvalued and will revert to fair value within five years as US yields decline and equity markets gain. They see the AUD/USD exchange rate standing at 0.7200 by the end of 2024 and rising further to 0.7400 by 2026

- Analysts at the Economy Forecast Agency (EFA) predict that the pair’s exchange rate will drop, reaching 0.5880 by the end of 2024, 0.5770 by the end of 2025, and 0.5540 by the end of 2026

- According to the Wallet Investor portal, AUD/USD will reach 0.6220 by the end of 2024 and 0.6050 by the end of 2025

Summary

The AUD/USD pair has been demonstrating a downtrend since February 2023, attributed to Australia’s central bank’s prolonged pause in interest rate hikes. According to analysts’ forecasts, the US Federal Reserve may raise the interest rate within a year. There are currently no obvious signs that the downtrend is over, and following a potential correction, the pair’s quotes may continue to decline. The 2022 low of 0.6170 serves as a significant decline mark.

FAQ

1. Why is AUD/USD forecasting important?

Forecasting is crucial for strategic planning and risk management, helping investors predict the movements of the currency pair.

2. What methods are used to forecast AUD/USD?

Commonly employed methods include fundamental analysis, technical analysis, and sentiment analysis.

3. How accurate are AUD/USD forecasts?

While forecasting methods have their advantages, they are not entirely reliable. Various factors can affect AUD/USD and trigger unexpected price movements.

4. What are the risks in AUD/USD forecasting?

The primary risk lies in the unpredictability of global political and economic events that can significantly affect the AUD/USD rate.

5. What potential future events could trigger AUD/USD exchange rate changes?

The list of potential events is extensive, including shifts in the monetary policies of US and Australian regulators, considerable fluctuations in resource prices, geopolitical changes, natural and human-caused disasters, and crisis developments in national and global economies.

6. Will the AUD/USD exchange rate continue to remain volatile?

Influenced by various factors, the AUD/USD rate may maintain its volatility.

7. How does the difference in interest rates affect the AUD/USD rate?

An increasing interest rate in the US contributes to the pair’s downward movement, whereas an interest rate hike in Australia drives up the AUD/USD quotes.

The post AUD/USD Forecast: Will the Australian Dollar Continue to Decline in 2023? appeared first at R Blog – RoboForex.