Gold Initiates a Correction. This overview also delves into the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

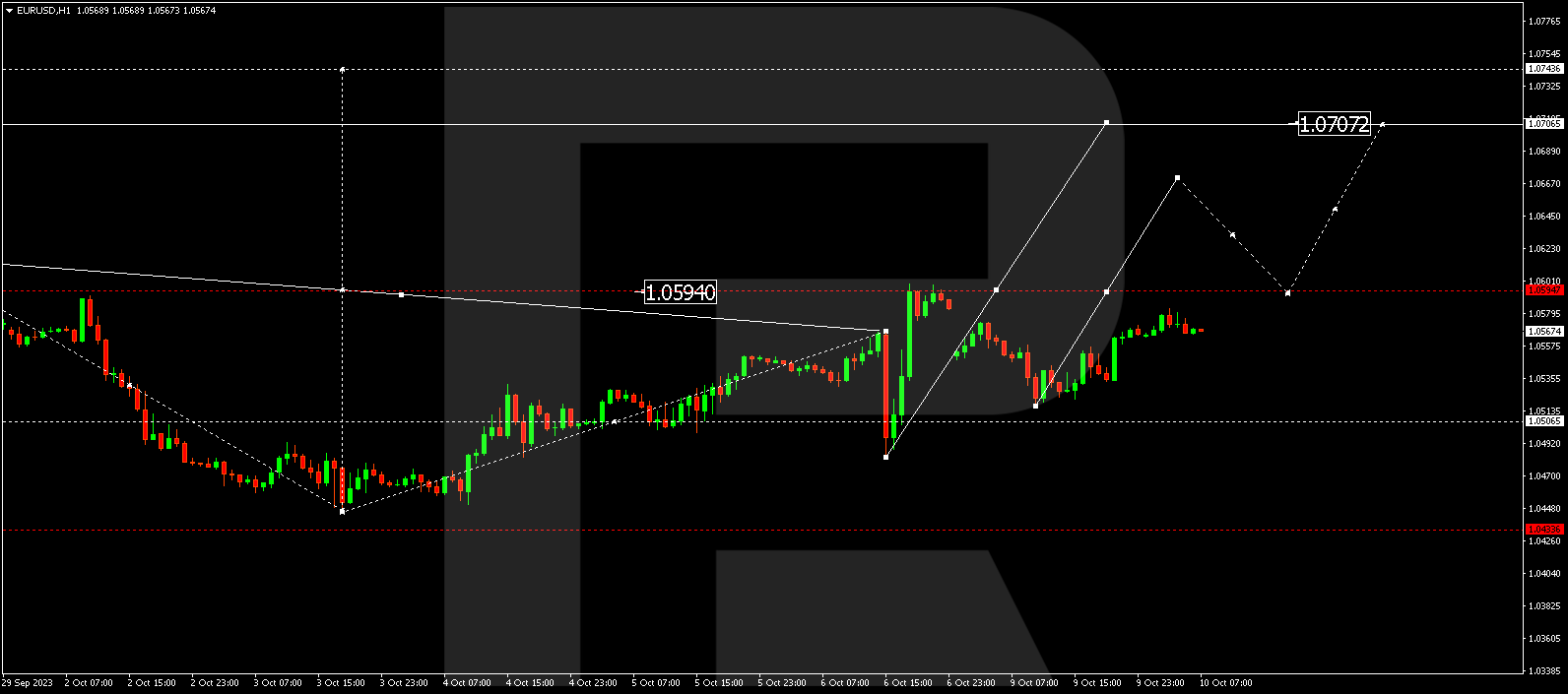

EUR/USD (Euro vs US Dollar)

EUR/USD has engaged in a corrective motion, reaching 1.0519. Today, the market continues its upward movement towards 1.0595. Following this, a consolidation range may establish around this level. If an upward breakout occurs, it could trigger a surge to 1.0670. Additionally, a corrective retrace to 1.0595 is possible (with a test from above). Upon completion of this correction, a growth wave to 1.0707 might initiate. This is a local target.

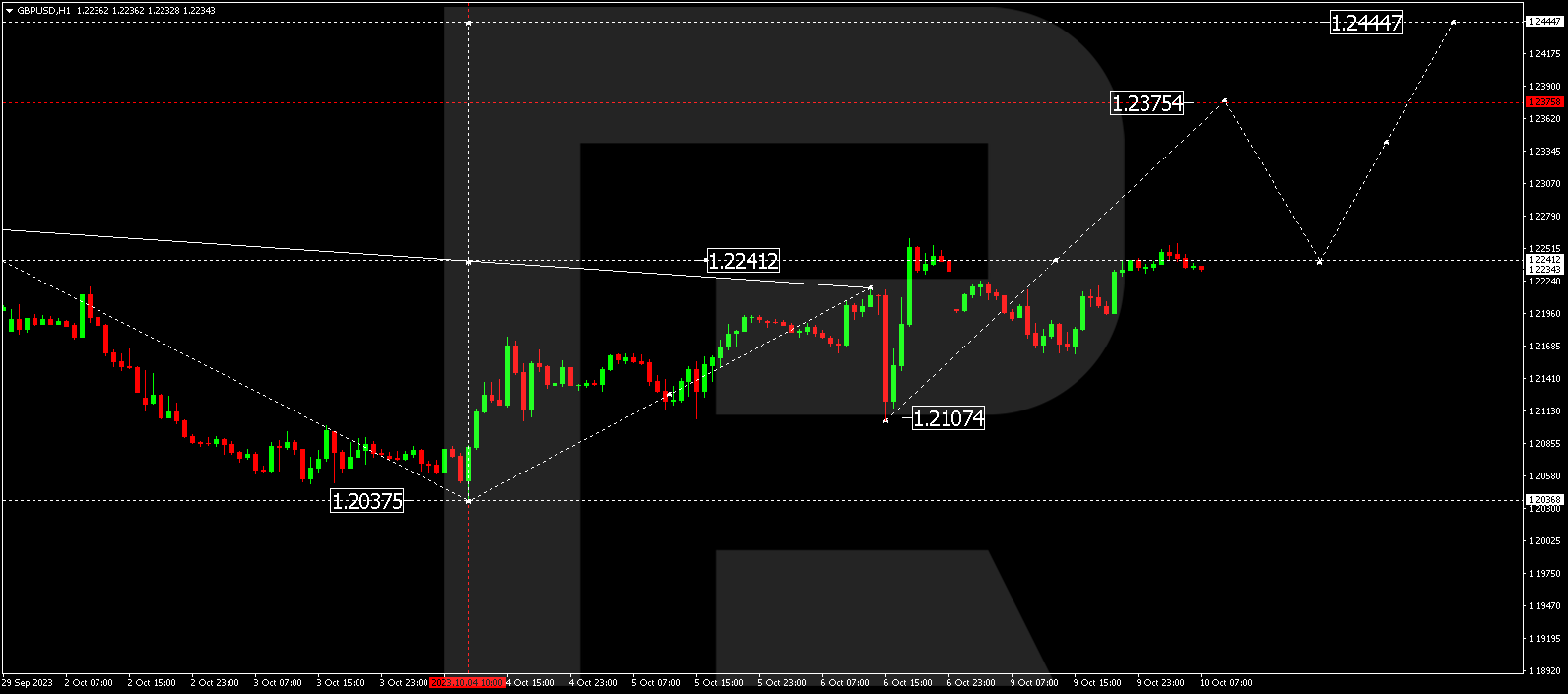

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD underwent a downward move to 1.2163. Today, the market surged to 1.2242. Currently, a consolidation range is forming around this level, with potential for an upward breakout reaching 1.2375. This stands as a local target. Subsequently, a correction to 1.2242 (with a test from above) might precede a rise to the 1.2444 level.

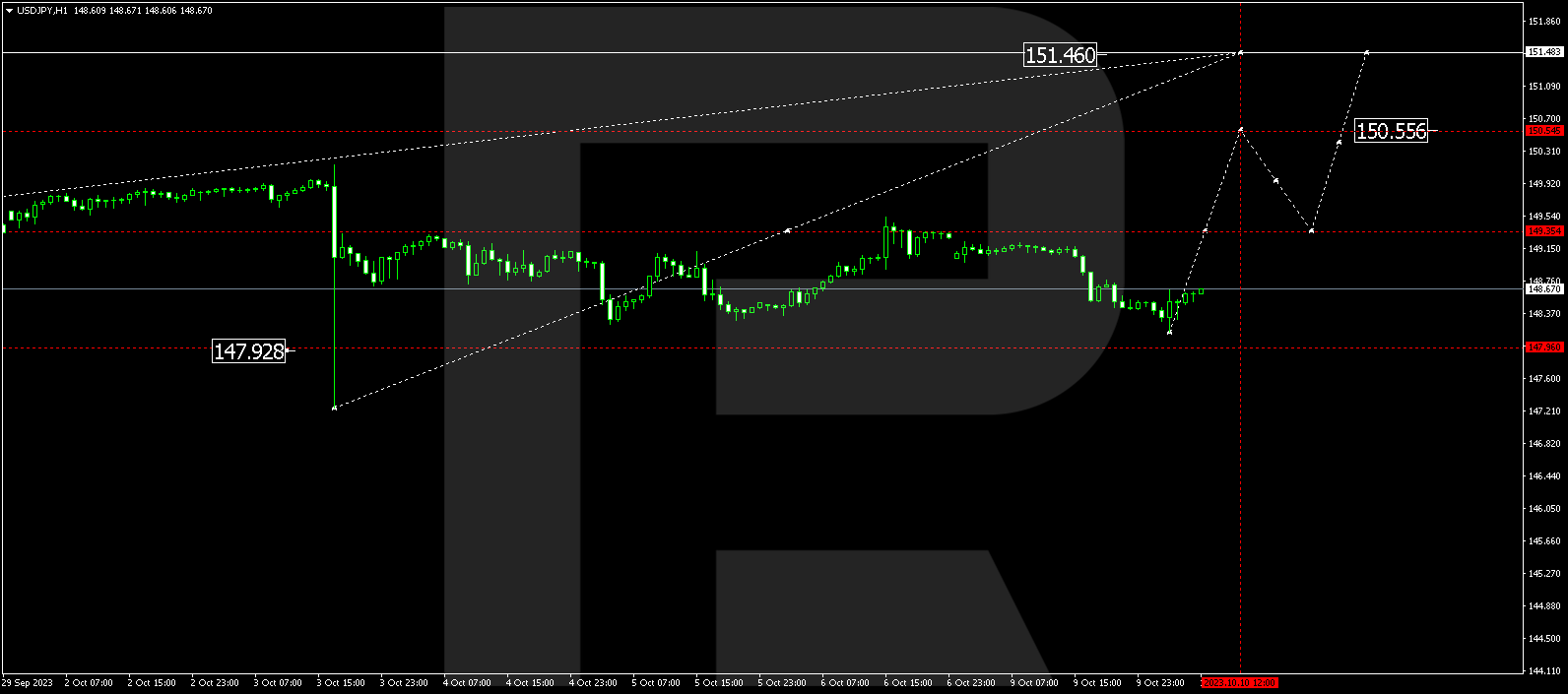

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY completed a growth wave to 149.52 followed by a correction to 148.16. Today, the market commenced another rising wave towards 149.40. A breakout at this level could trigger a wave up to 150.55. This is a local target.

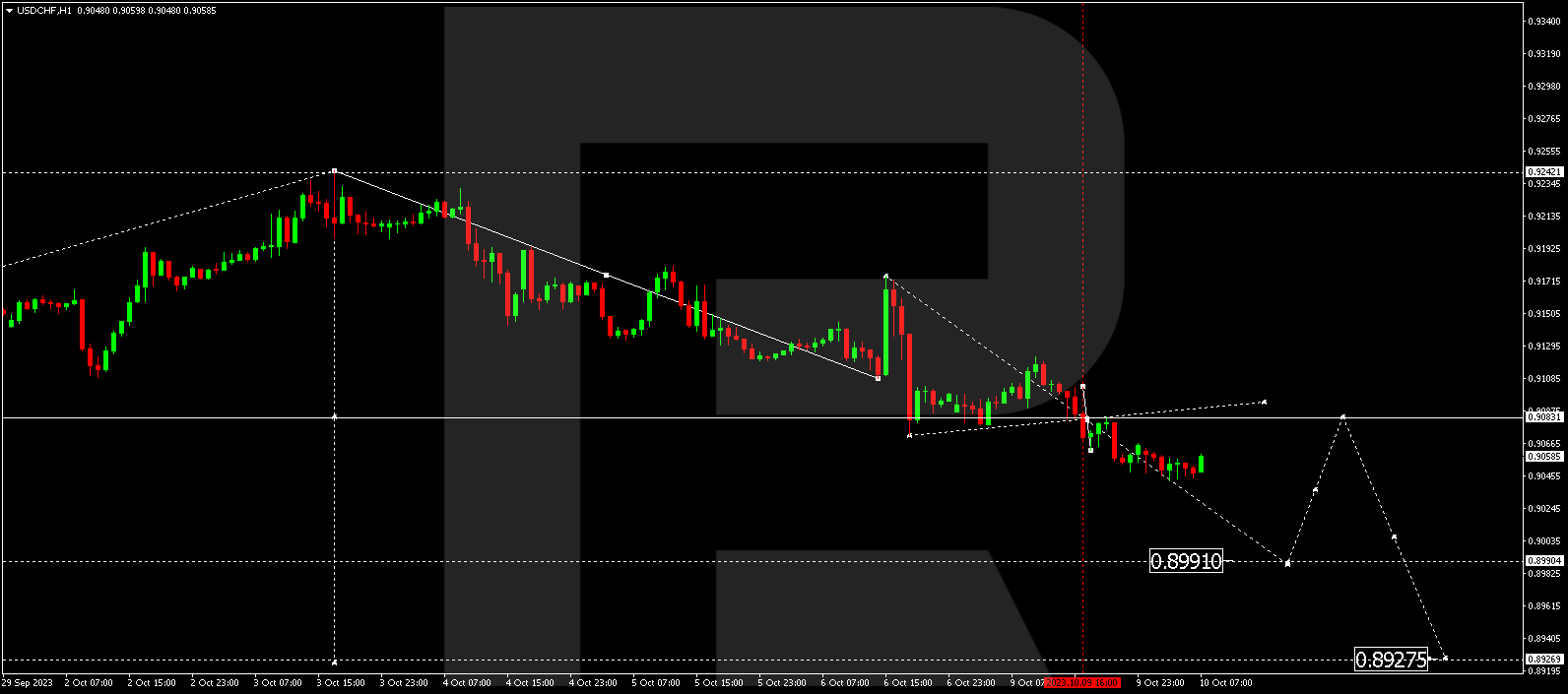

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF formed a consolidation range around 0.9083. Today, the market broke out of this range in a downward direction. There is potential for a decline to 0.8991, constituting a local target. After reaching this level, a price correction to 0.9083 (with a test from below) may precede a decline to 0.8928.

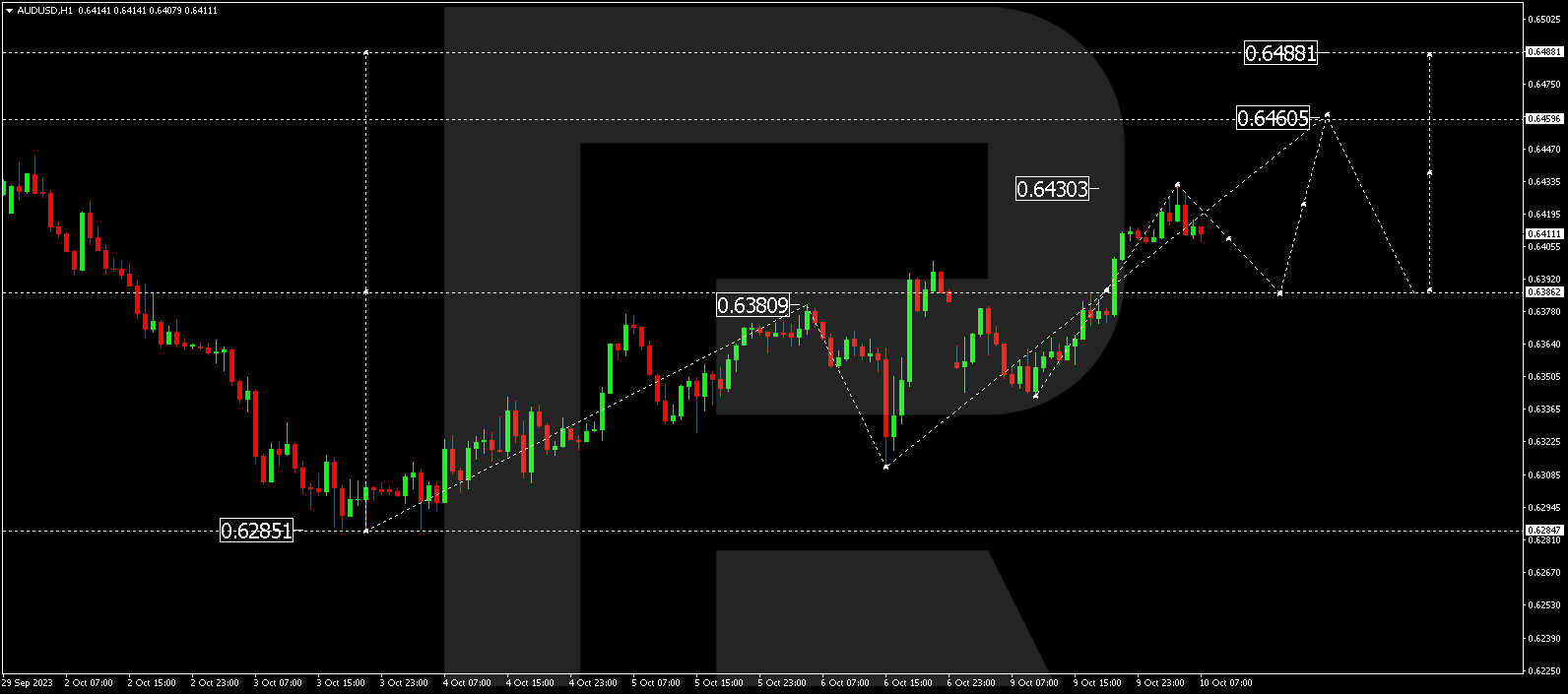

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD established an upward link to 0.6430. Today, a corrective link to 0.6386 could form, subsequently leading to a rise to 0.6460, marking a local target. An extension of this upward wave to 0.6488 is also possible.

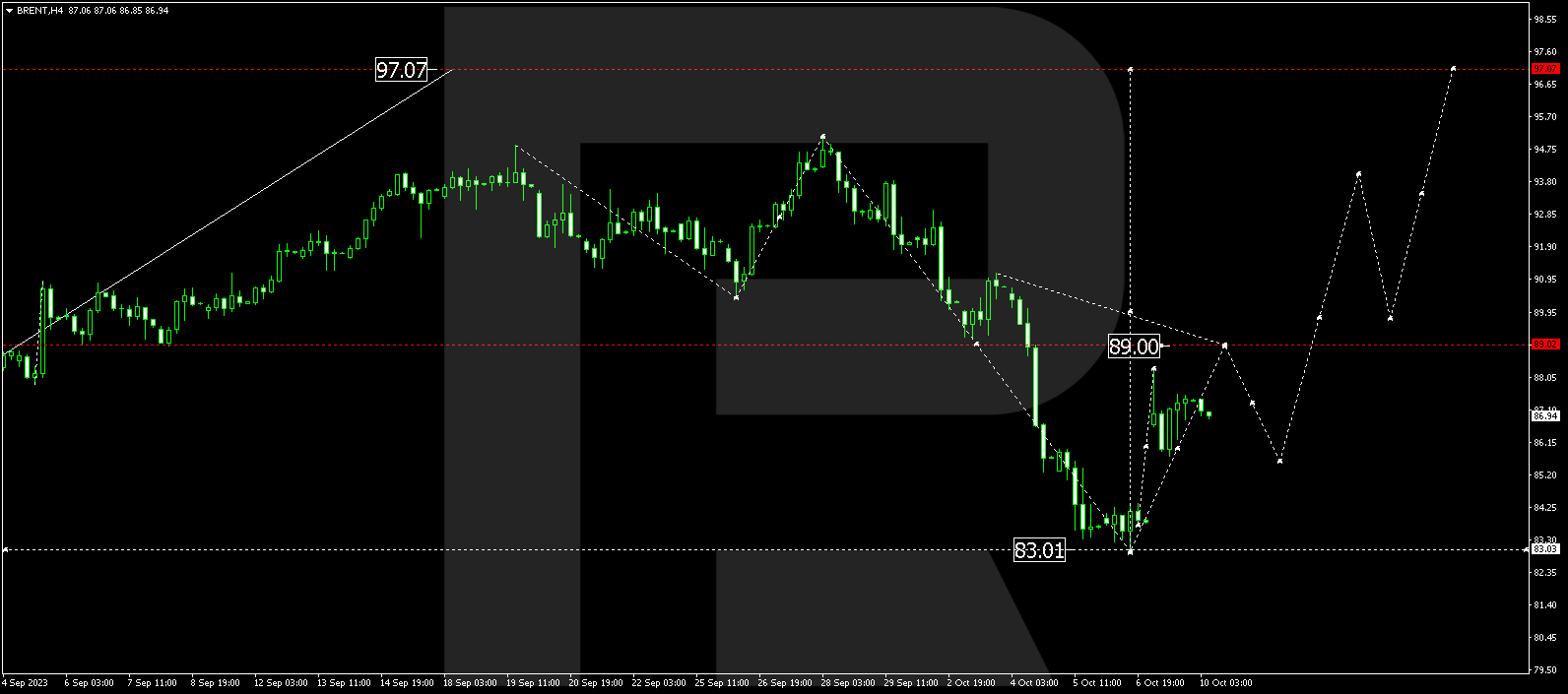

BRENT

Brent is currently forming a consolidation range above 86.00. An upward breakout to 89.00 is anticipated as the first target. Following this, a correction to 86.00 may follow (with a test from above). Post-correction, a new growth wave to 94.00 might initiate, paving the way for the trend to reach 97.07.

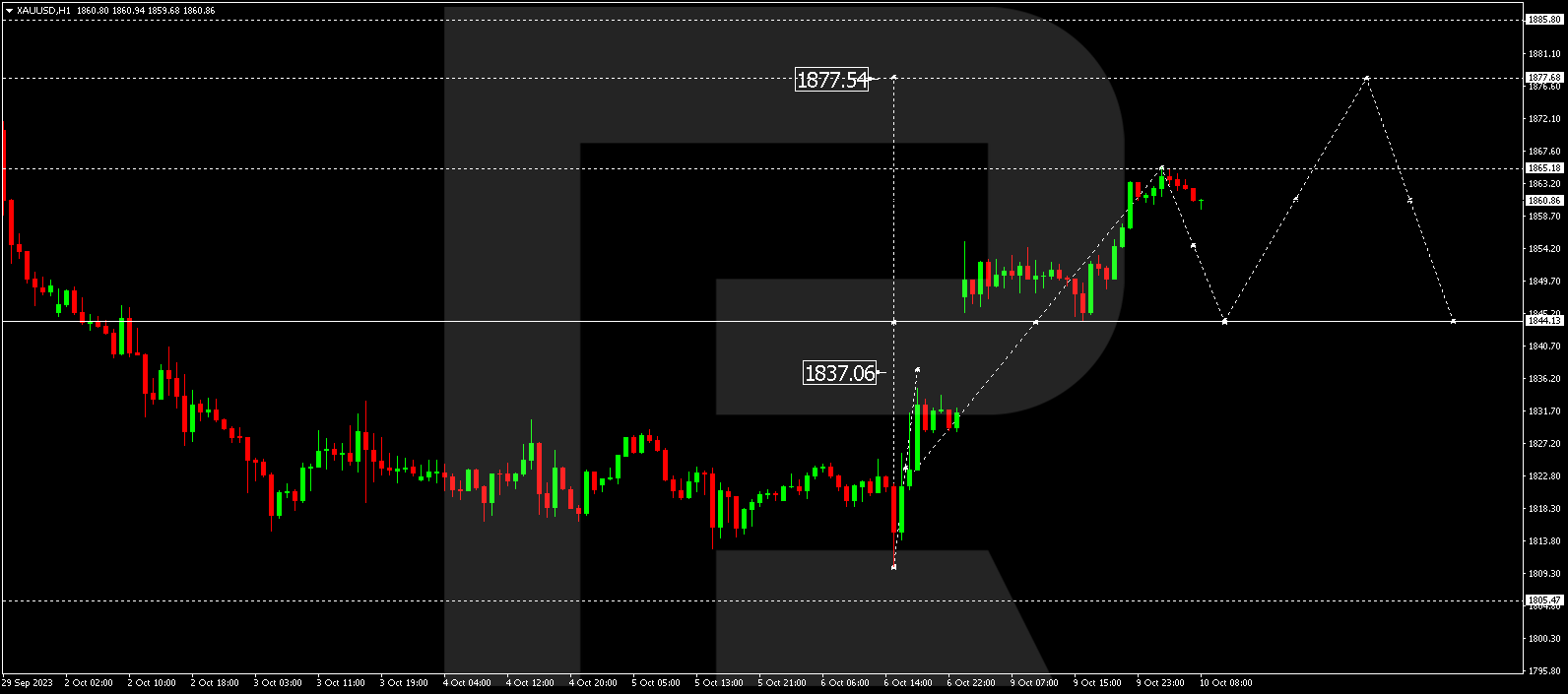

XAU/USD (Gold vs US Dollar)

Gold completed an upward wave to 1865.18. Today, the market is forming a corrective structure to 1844.20 (with a test from above). After reaching this level, the quotes could rise to 1877.70 and then drop to 1844.10.

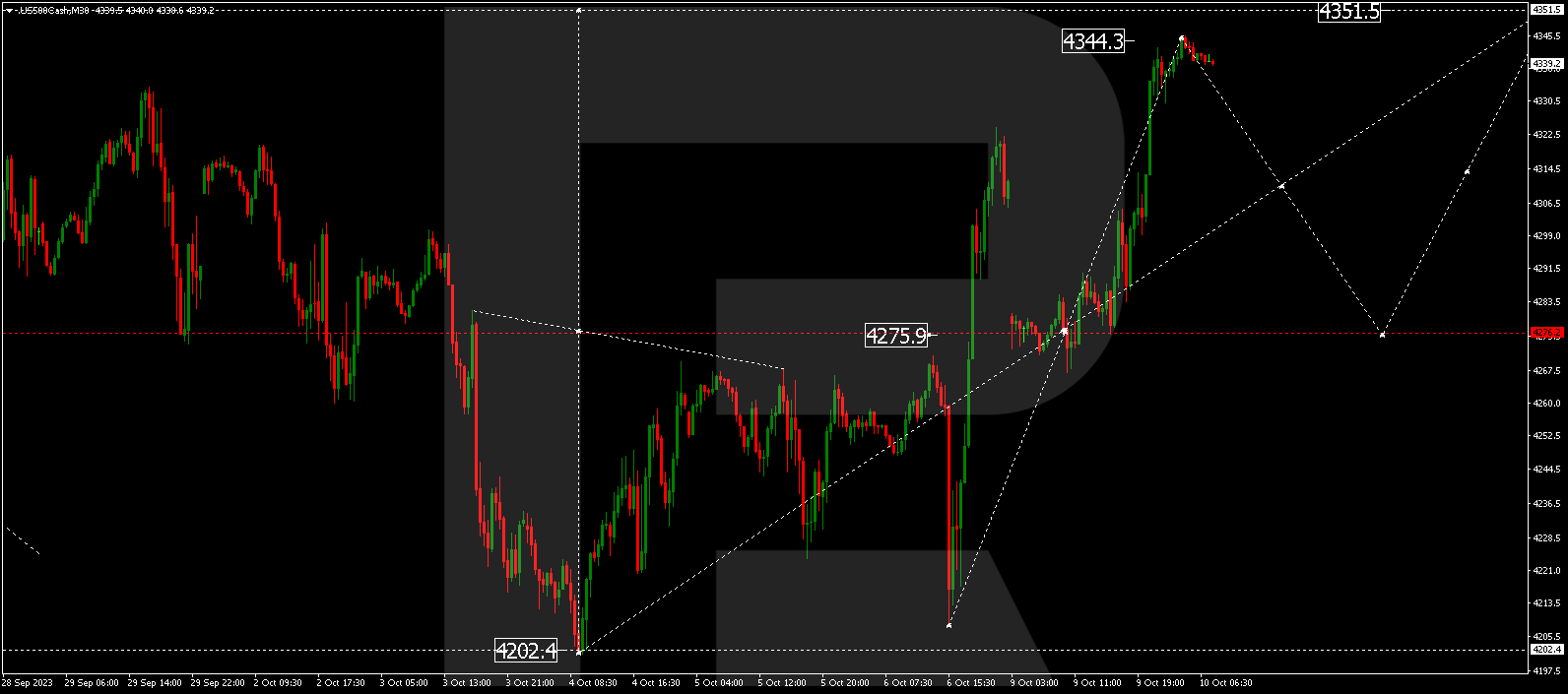

S&P 500

The stock index formed a consolidation range around 4276.0. Today, the market broke out of this range upward, initiating a growth wave to 4344.3. This stands as a local target. A correction to 4276.0 might begin (with a test from above). Following this, the quotes could rise to 4351.5.

The post Technical Analysis & Forecast October 10, 2023 appeared first at R Blog – RoboForex.