AUD may prolong its downward momentum. In addition, this overview outlines the progression of EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500 index.

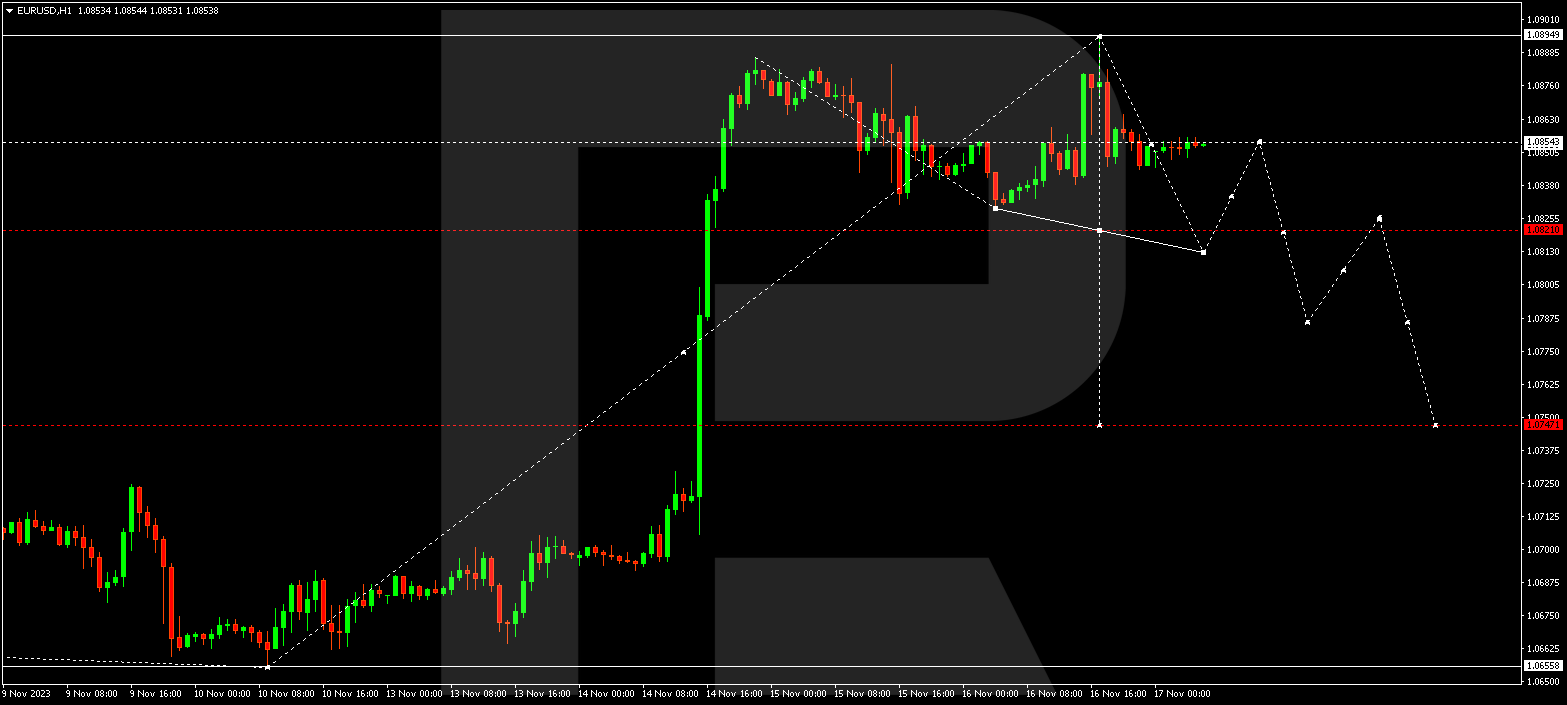

EUR/USD (Euro vs US Dollar)

EUR/USD is continuing its consolidation phase around 1.0855. The market has recently expanded the range to 1.0894. There is a possibility that today the range might retract to 1.0813. Subsequently, there could be an upward movement to 1.0855 (with a test from below), followed by a decline to 1.0787. This is considered a local target.

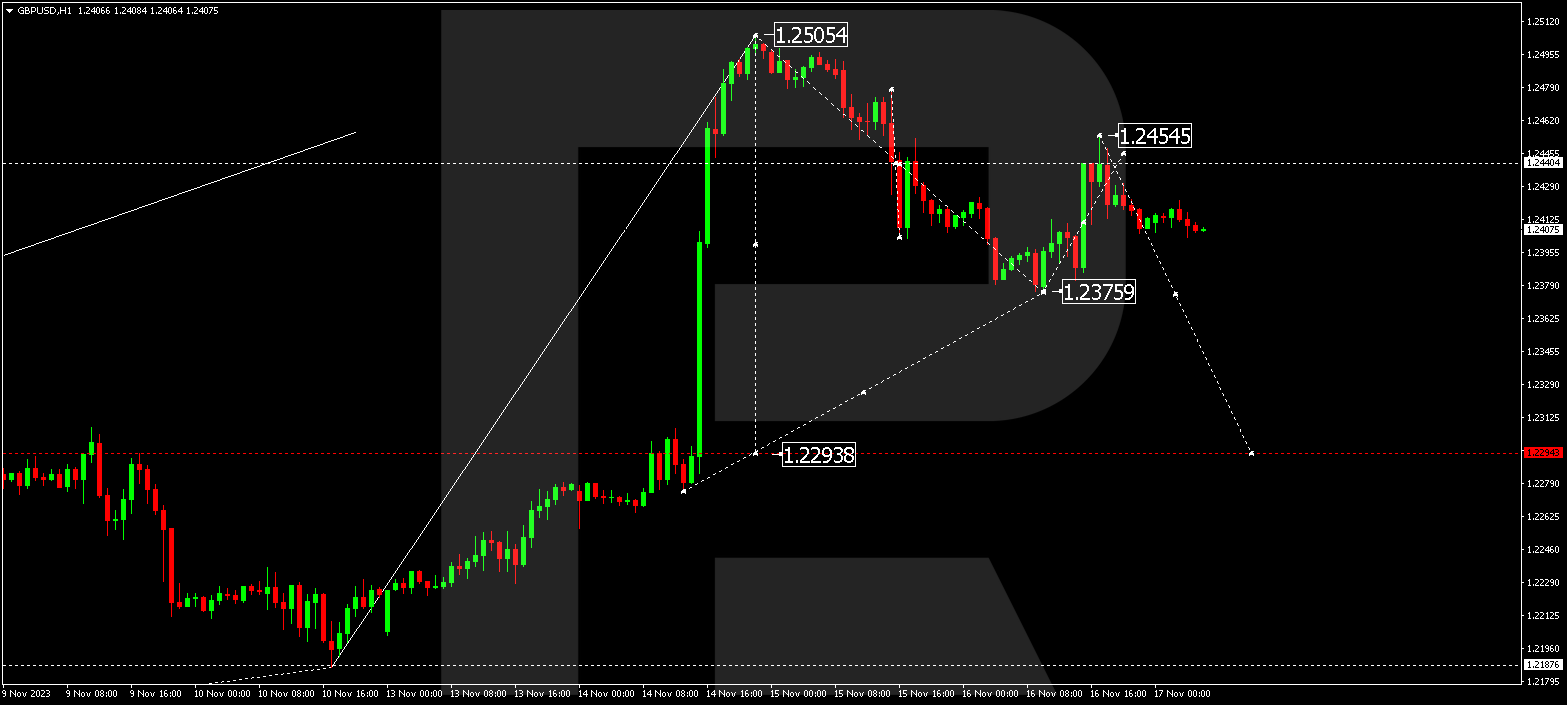

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has executed a corrective wave to 1.2454. A decline to 1.2376 may ensue. In the case of a downward breakout from this level, the potential for a decline wave to 1.2294 might manifest. This is identified as a local target.

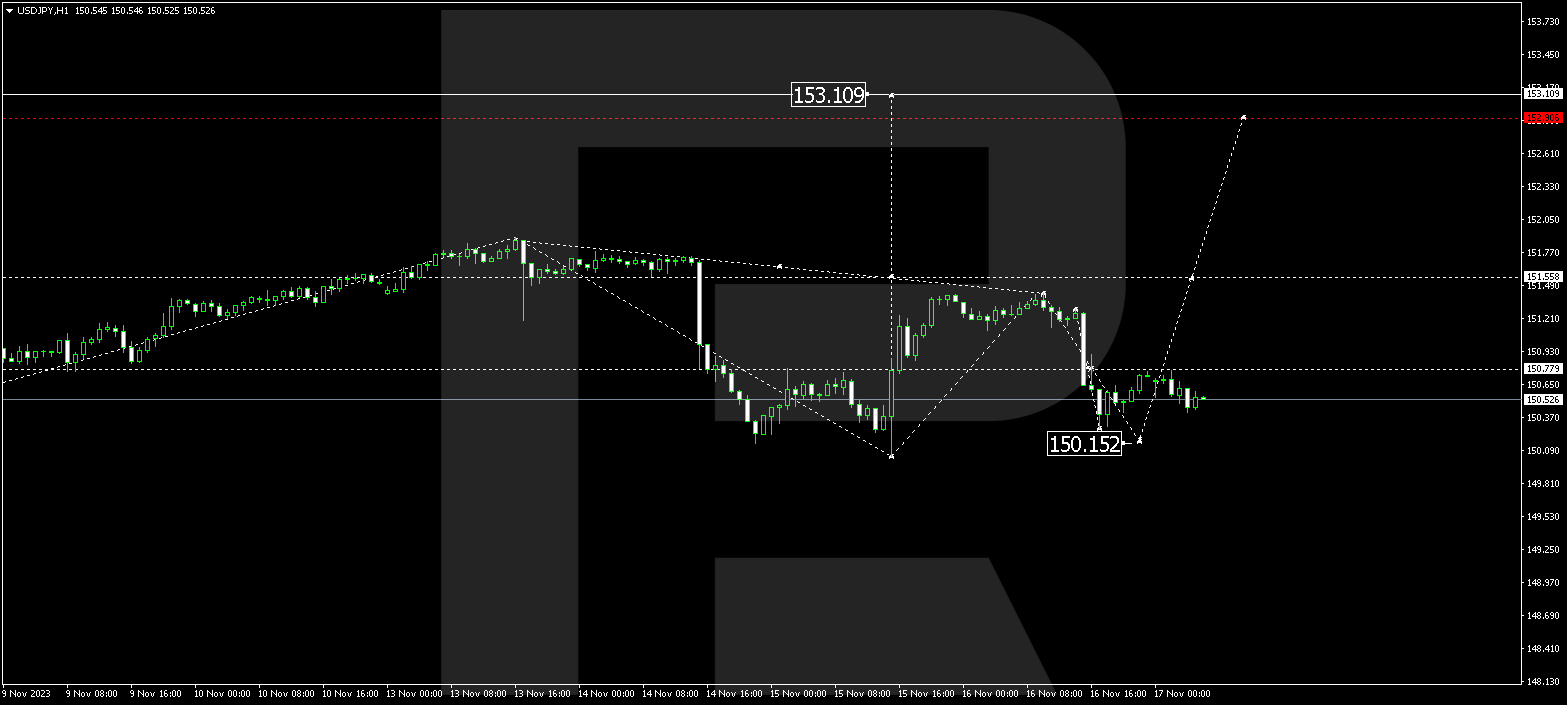

USD/JPY (US Dollar vs Japanese Yen)

The USD/JPY pair is persisting in the development of a consolidation range around 150.77. A decline to 150.15 is within the realm of possibility. Following this, a rise to 152.90 could initiate. This is considered a local target.

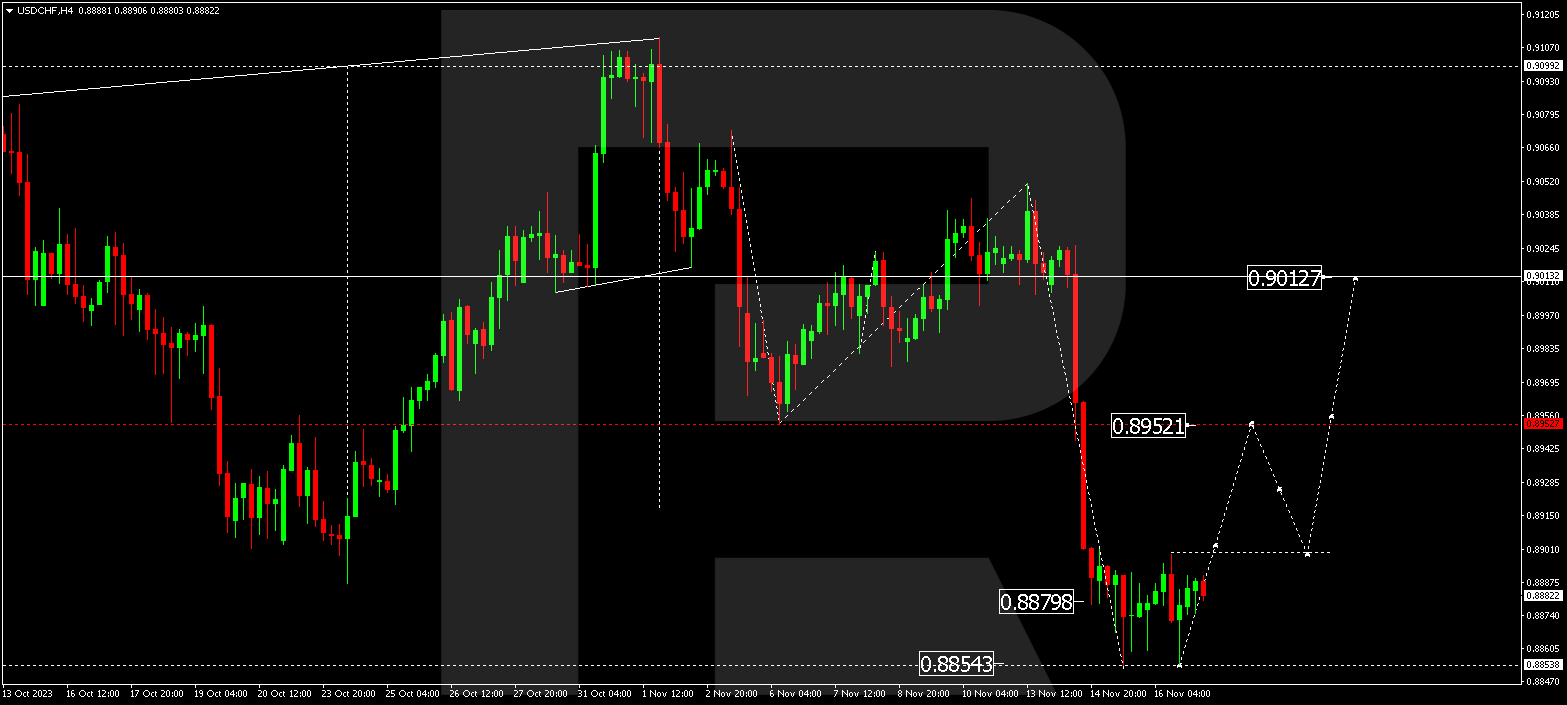

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is in the process of forming a consolidation range around 0.8880. A movement of growth to 0.8952 could materialize today, from where the trend might extend to 0.9012.

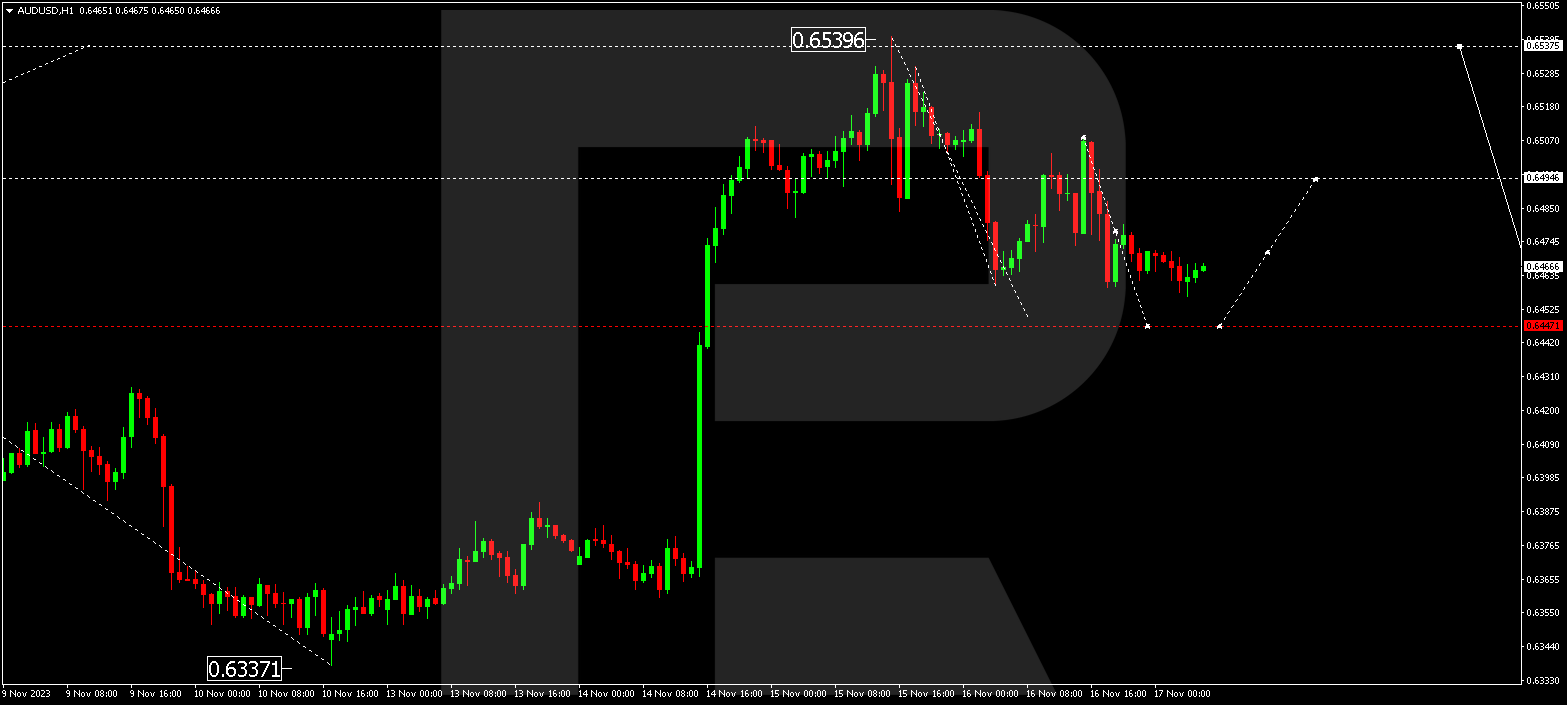

AUD/USD (Australian Dollar vs US Dollar)

The AUD/USD pair is still undergoing a declining wave to 0.6444. This marks the initial target. After reaching this level, a correction to 0.6494 is plausible, followed by a decline to 0.6340.

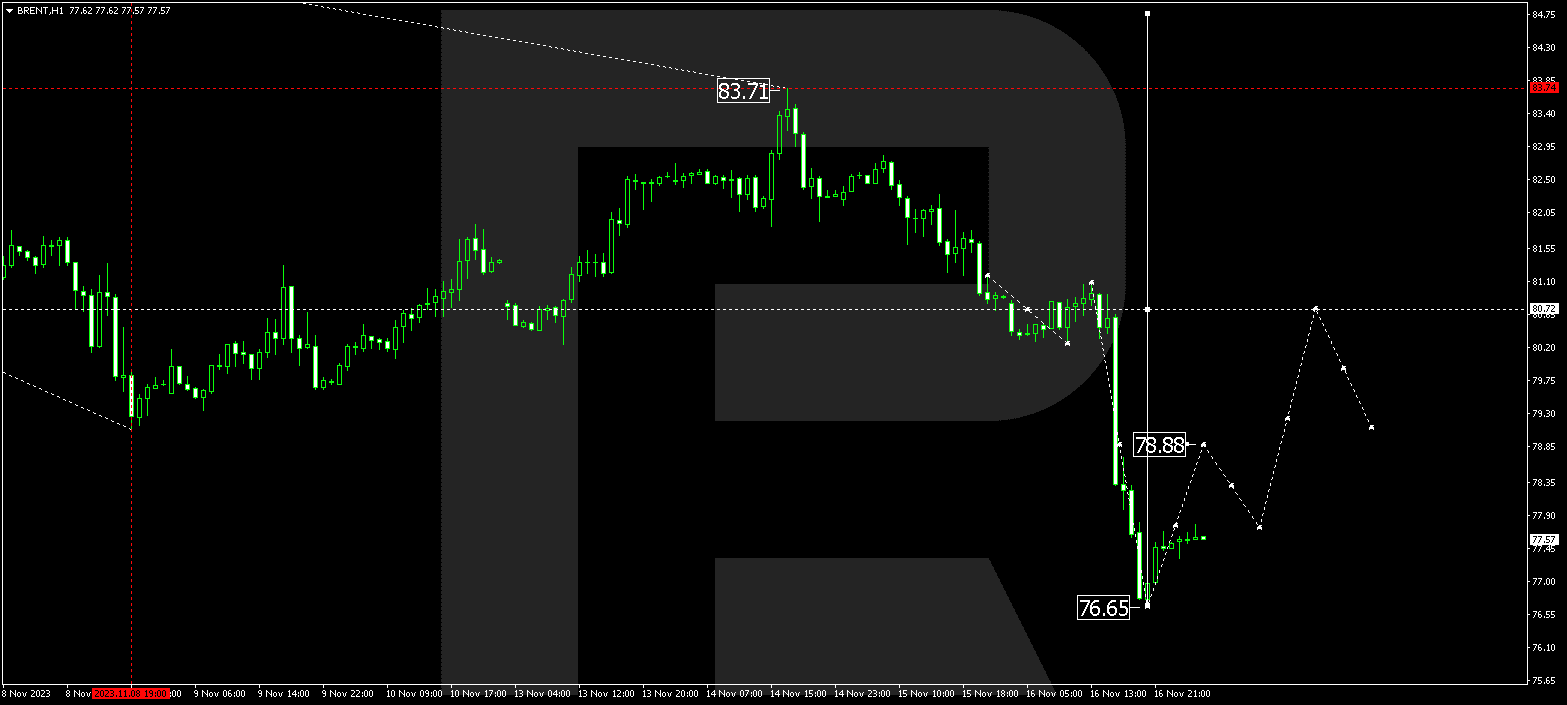

BRENT

Brent is advancing in its correction phase. It has recently concluded a downward structure at 76.66. A consolidation range might establish itself around this level today. A breakout from the range towards the upside could set in motion a new growth wave to 84.10. This is considered the primary target.

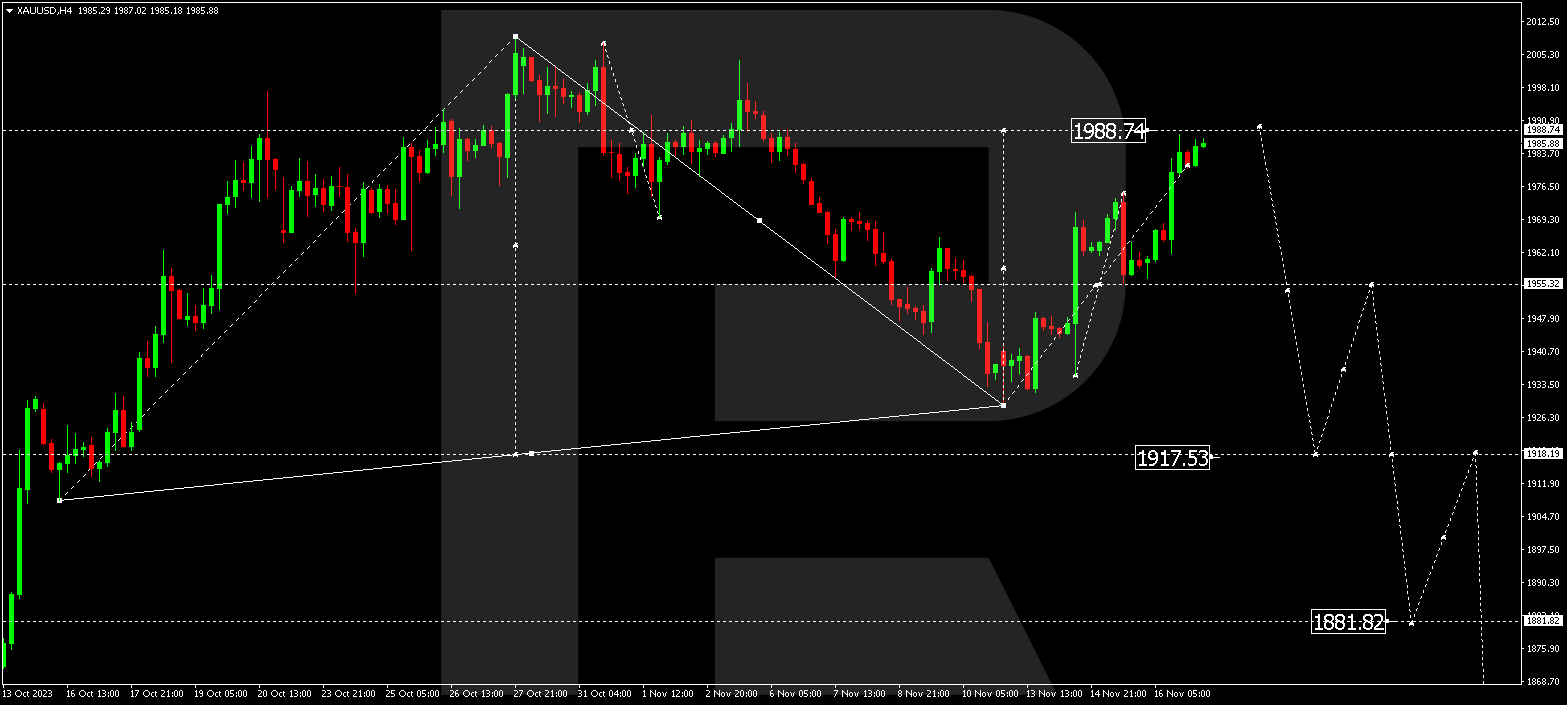

XAU/USD (Gold vs US Dollar)

Gold has established a consolidation range around 1955.30. A breakout from the range towards the upside could prolong the correction to 1988.74. Upon completion of the correction, a new decline wave to 1918.20 could initiate. This is identified as a local target.

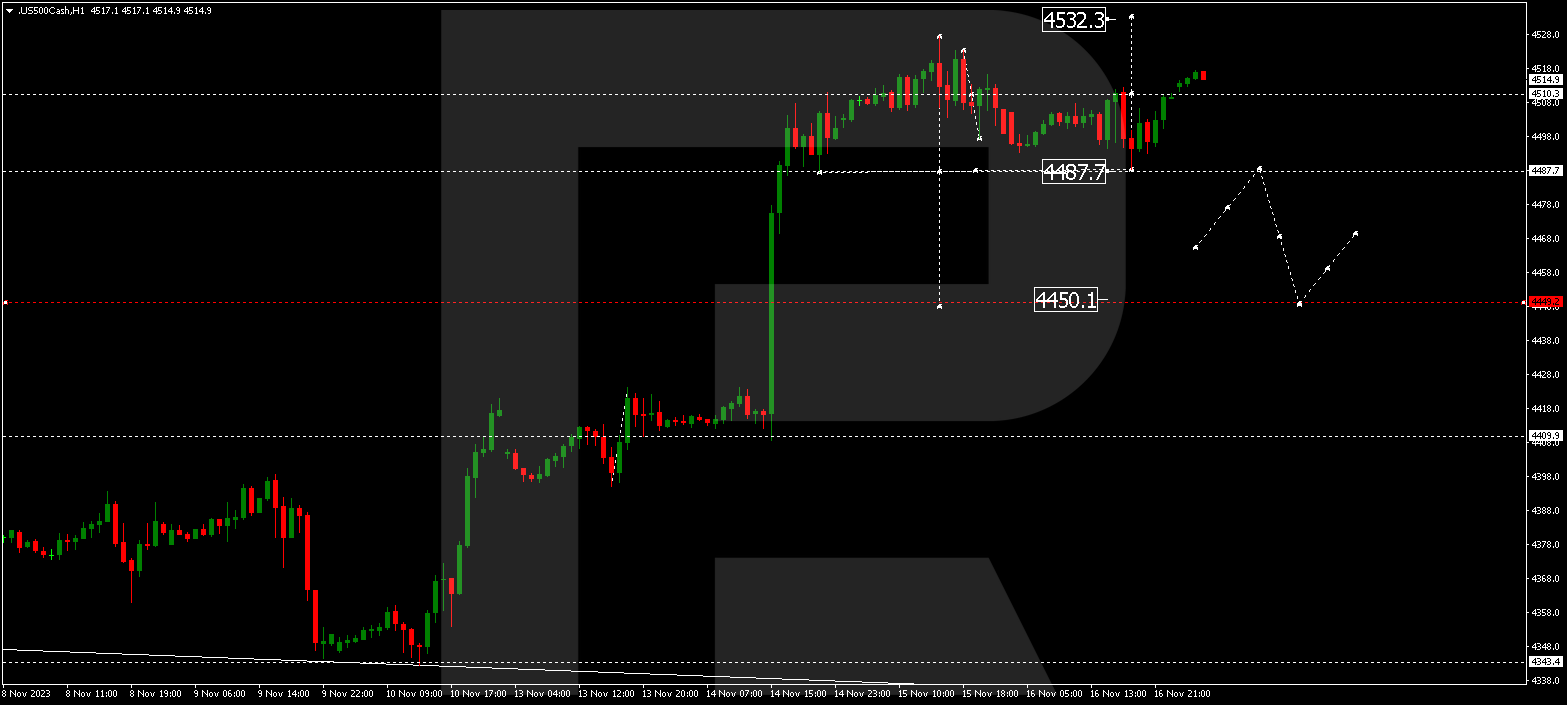

S&P 500

The stock index continues to configure a consolidation range around 4510.0. The range might then expand to 4532.3, after which the quotes might decline to 4532.3. With a downward breakout from this level, the potential for a wave to 4450.0 might be unveiled. This is recognized as a local target.

The post Technical Analysis & Forecast November 17, 2023 appeared first at R Blog – RoboForex.