The S&P 500 index initiates a descent. Additionally, delve into the overview covering the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and Gold.

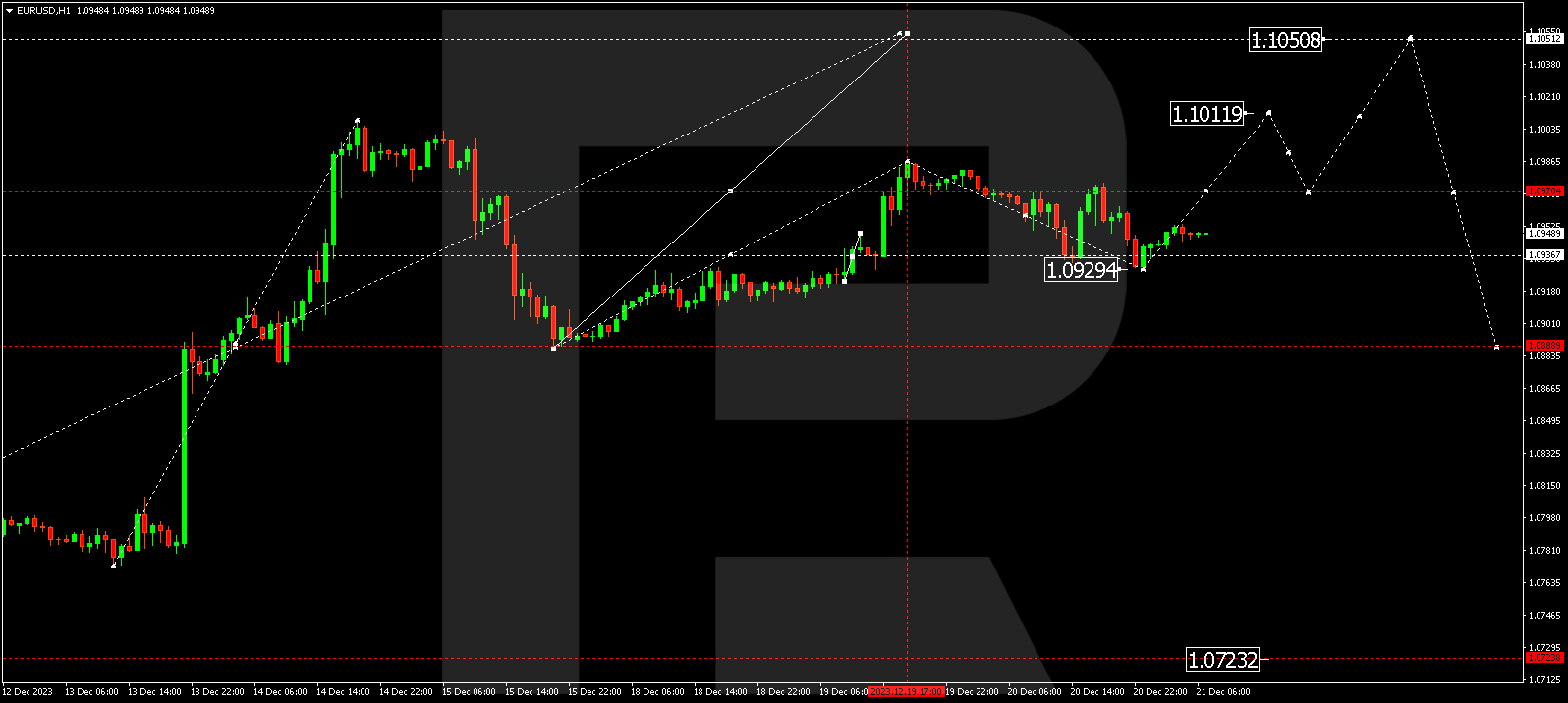

EUR/USD (Euro vs US Dollar)

EUR/USD concluded a corrective phase at 1.0929. Anticipate the establishment of a consolidation range above this level today. A breakout to the upside may signal a growth phase to 1.0972, extending the wave to 1.1012. Conversely, a downward escape could lead to a decline to 1.0888.

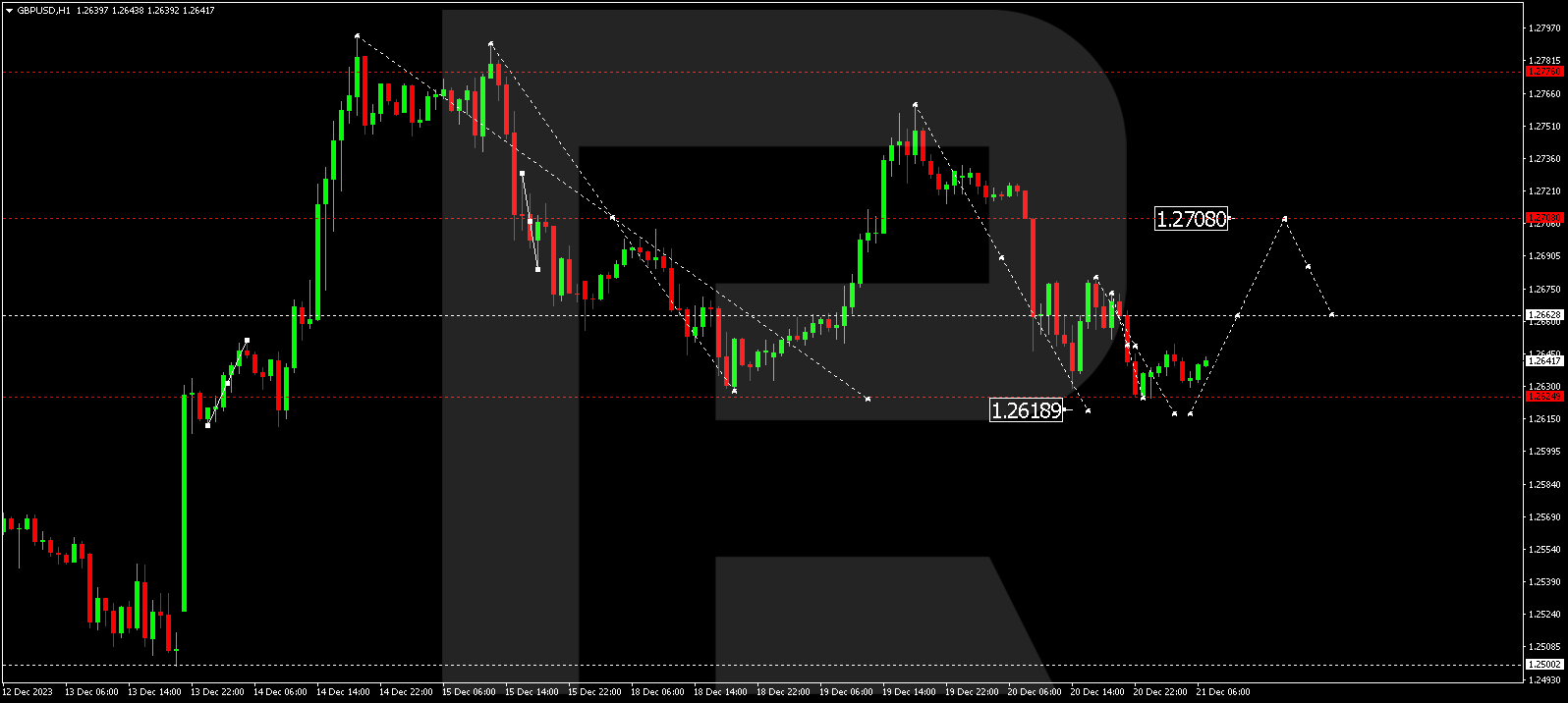

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD completed a decline wave reaching 1.2625. Foresee the formation of a consolidation range above this level today. An upward breakout could pave the way for a growth structure to 1.2708. Conversely, a downward escape may open the potential for a decline wave to 1.2500.

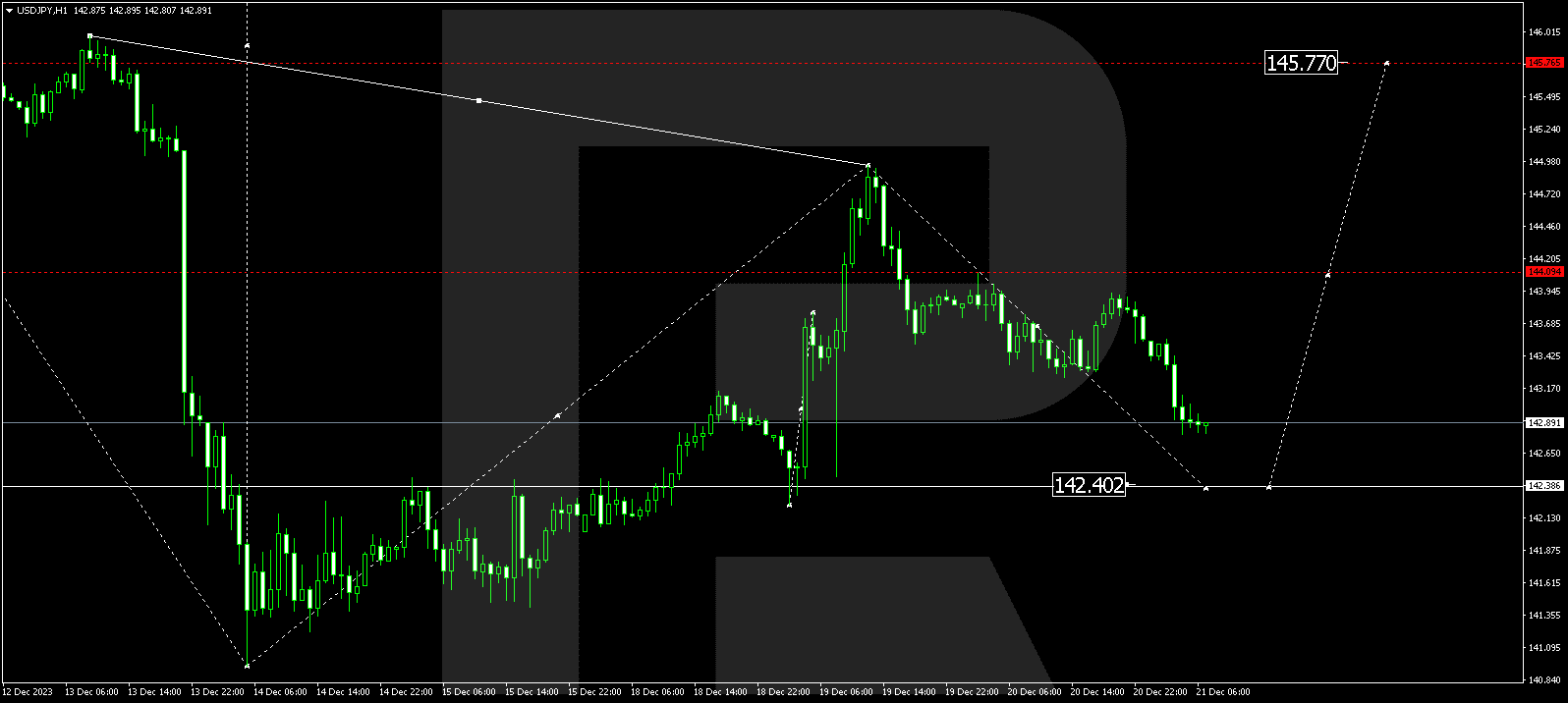

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY established a consolidation range around 143.66. A downward escape might prolong the correction to 142.39. Upon reaching this level, a growth wave to 144.10 could commence, potentially continuing to 145.77.

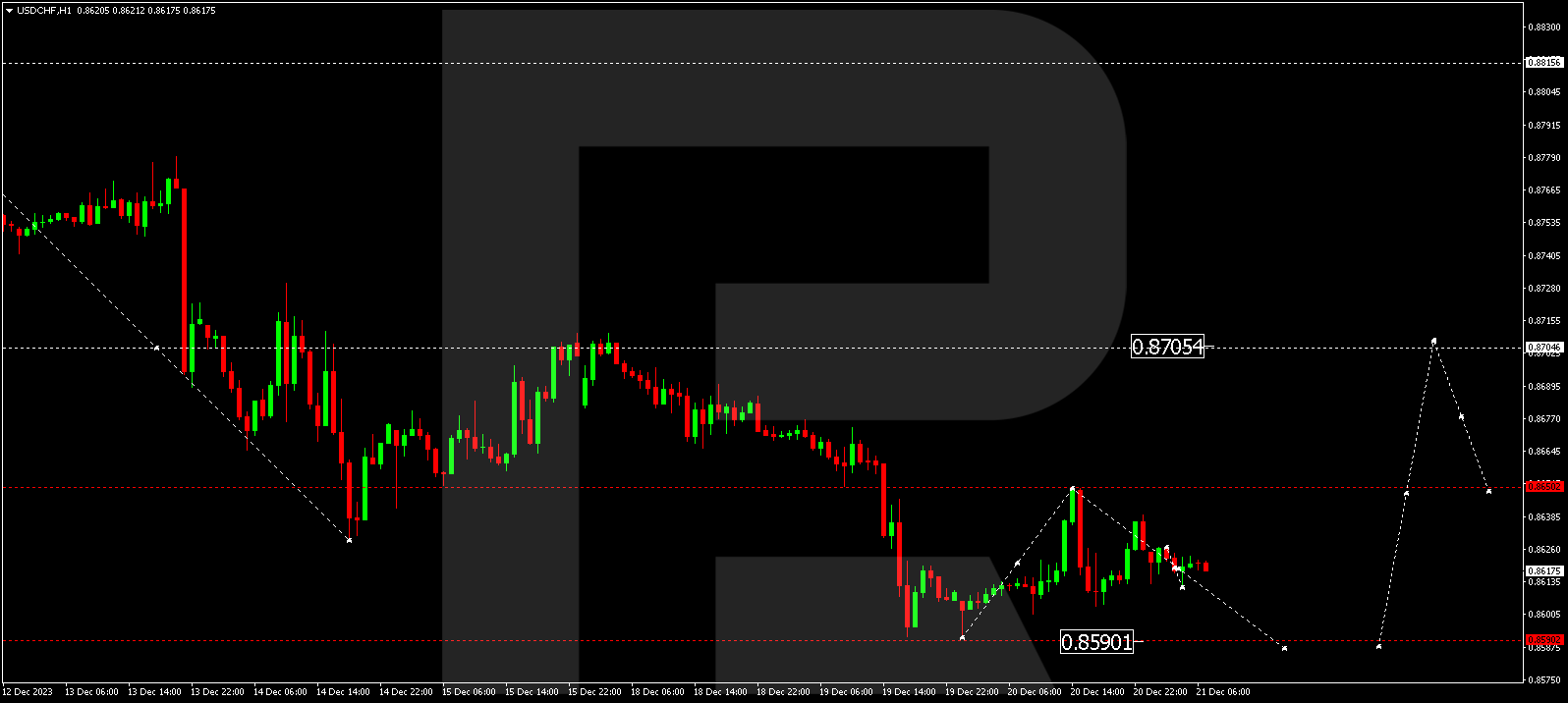

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF corrected to 0.6650. A decline to 0.8590 could manifest today. After reaching this level, a growth phase to 0.8705 might initiate, constituting the first target.

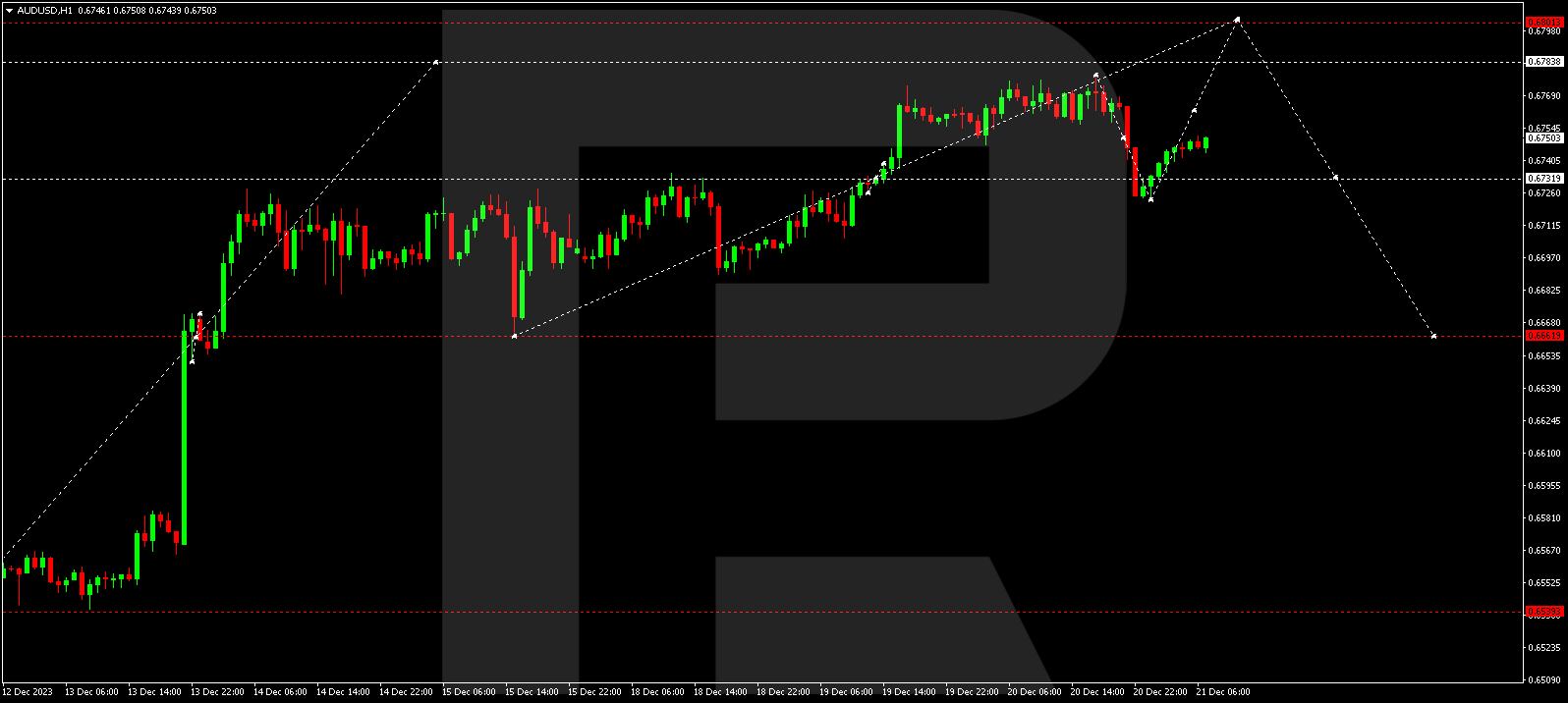

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD corrected to 0.6730, with a consolidation range forming around this level today, potentially extending to 0.6713. Subsequently, a growth structure to 0.6800 could unfold, followed by a decline to 0.6660.

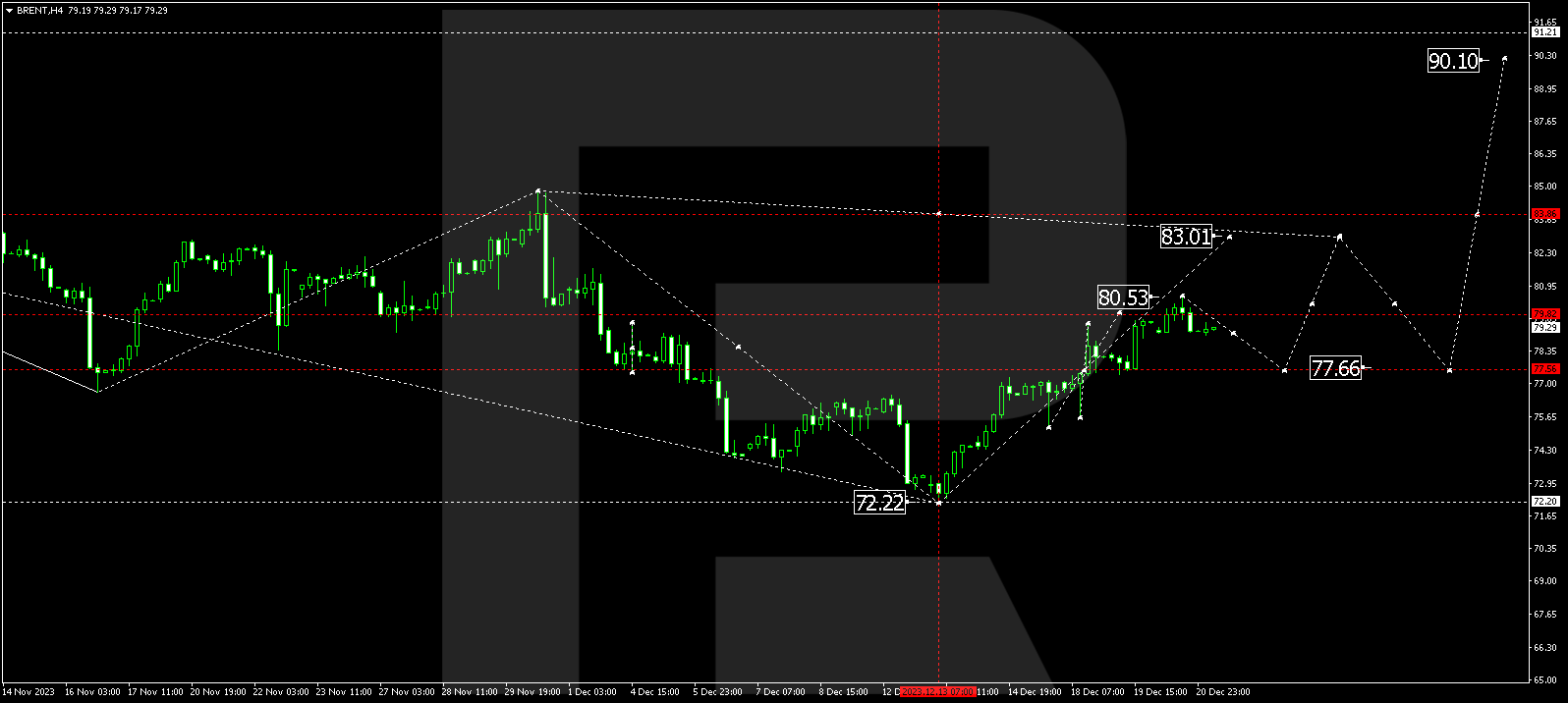

BRENT

Brent completed a growth wave to 83.00. Today, a correction to 77.66 might ensue, followed by a growth wave to 83.83. From this point, the trend could progress to 90.10. This is considered a local target.

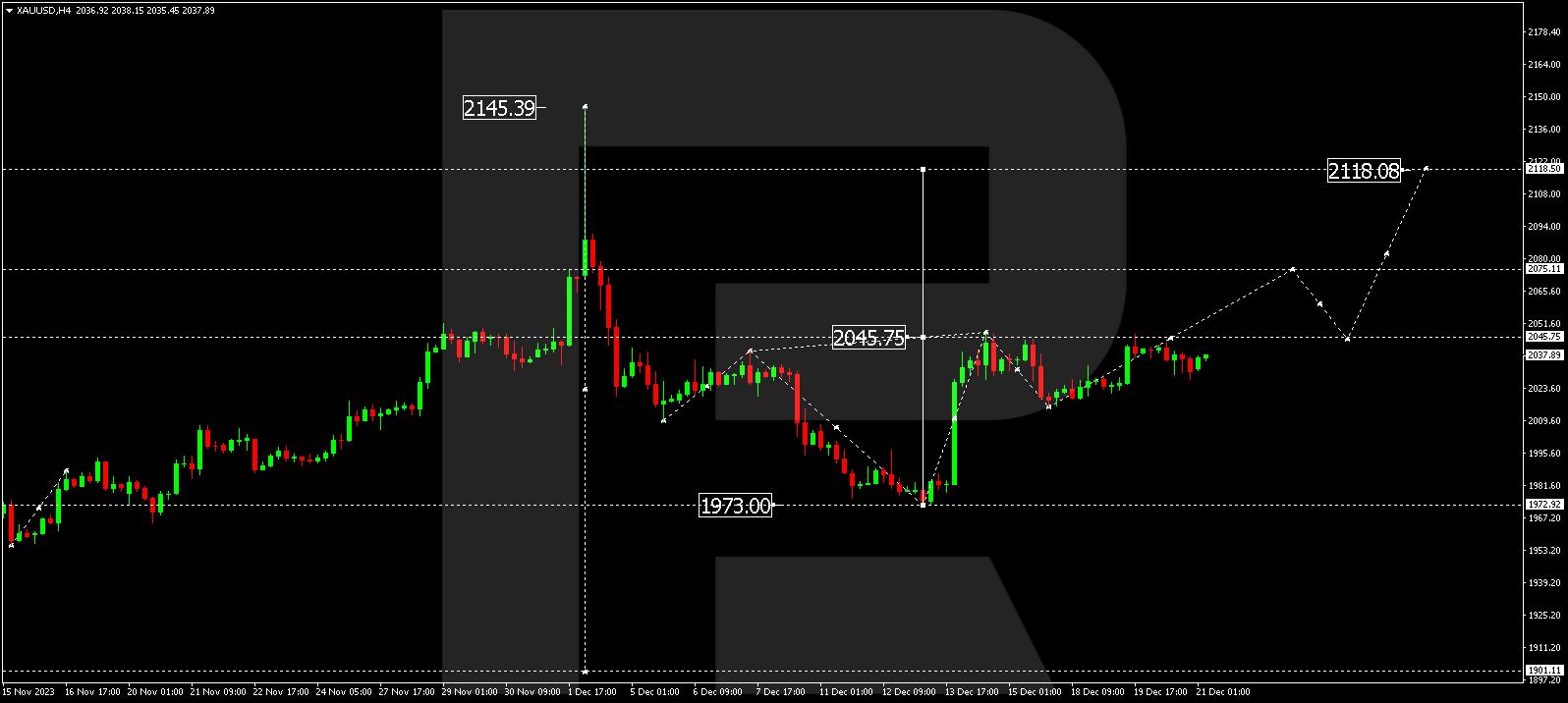

XAU/USD (Gold vs US Dollar)

Gold continues within a consolidation range below 2045.75. A downward escape could lead to a decline to 1990.00. Conversely, an upward breakout may open the potential for a growth wave to 2075.11, potentially extending the trend to 2118.00.

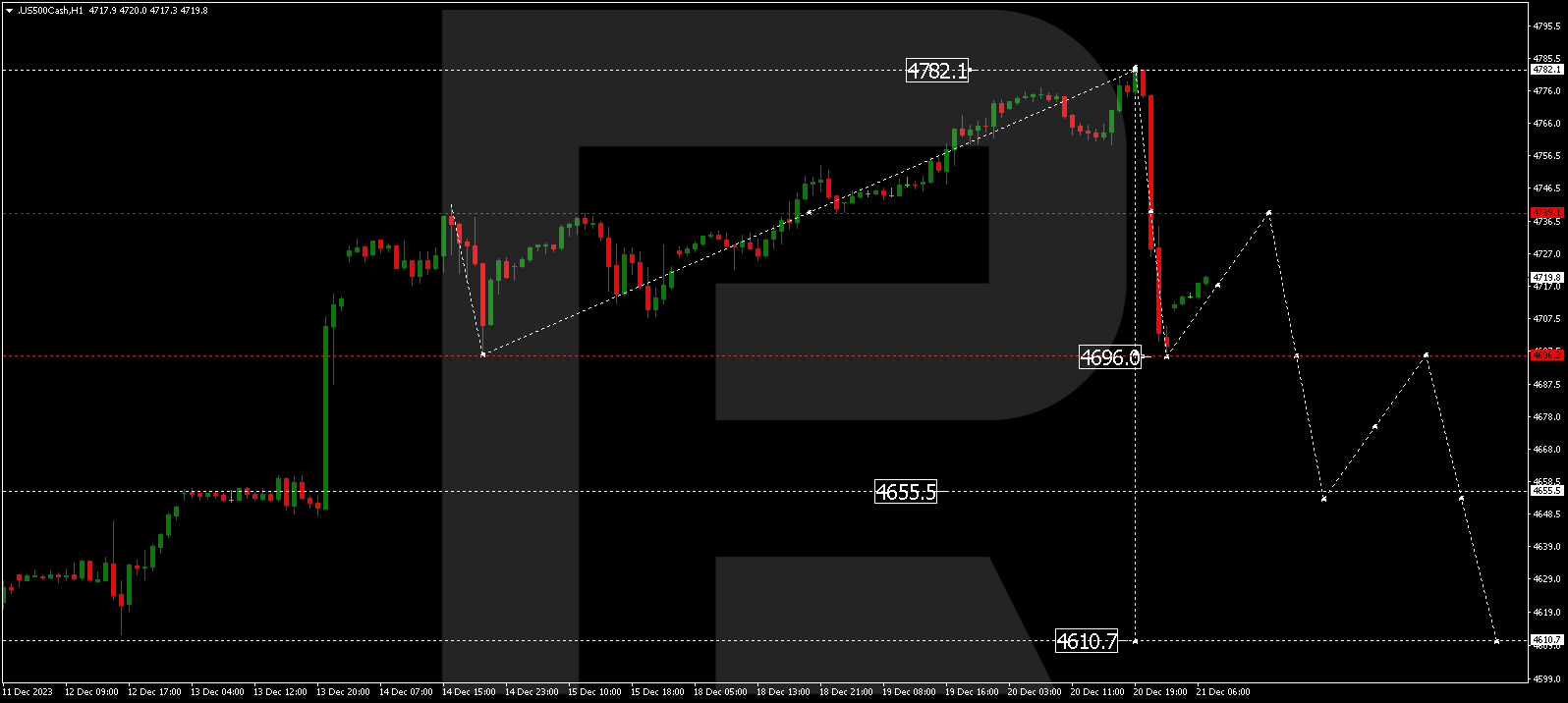

S&P 500

The stock index achieved the target of a growth wave at 4782.0. Today, a decline impulse formed to 4696.0, with a consolidation range above this level. An upward breakout might indicate a correction to 4739.0 (a test from below), followed by a decline to 4695.0. If this level is breached, the potential for a decline wave to 4655.5 could unfold. This marks a local target.

The post Technical Analysis & Forecast December 21, 2023 appeared first at R Blog – RoboForex.