Delves into the evolving dynamics of EUR, GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

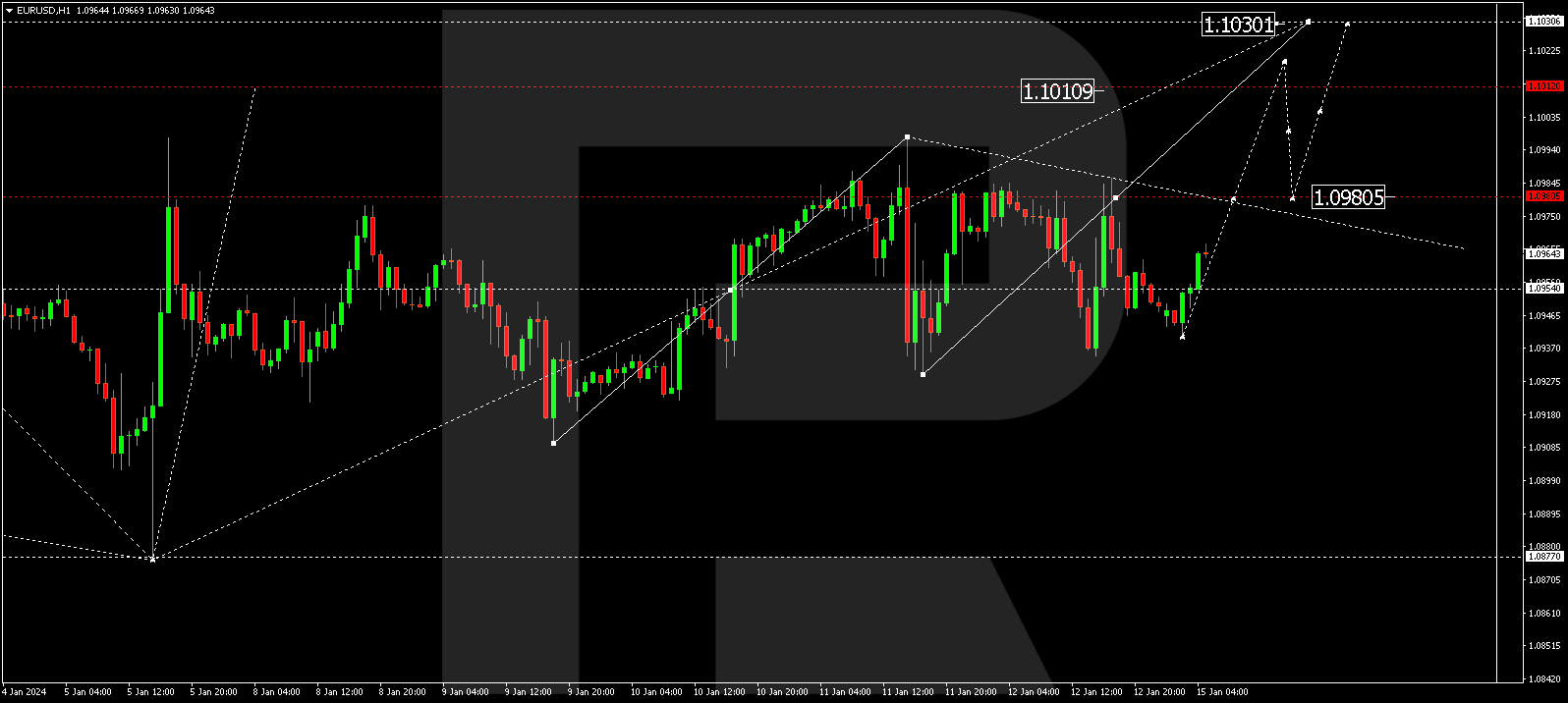

EUR/USD (Euro vs US Dollar)

EUR/USD is in the midst of a consolidation range around 1.0955. An anticipated upward movement to 1.0980 is expected today. If this level is breached, the potential for an ascent to 1.1010 becomes viable, marking a local target.

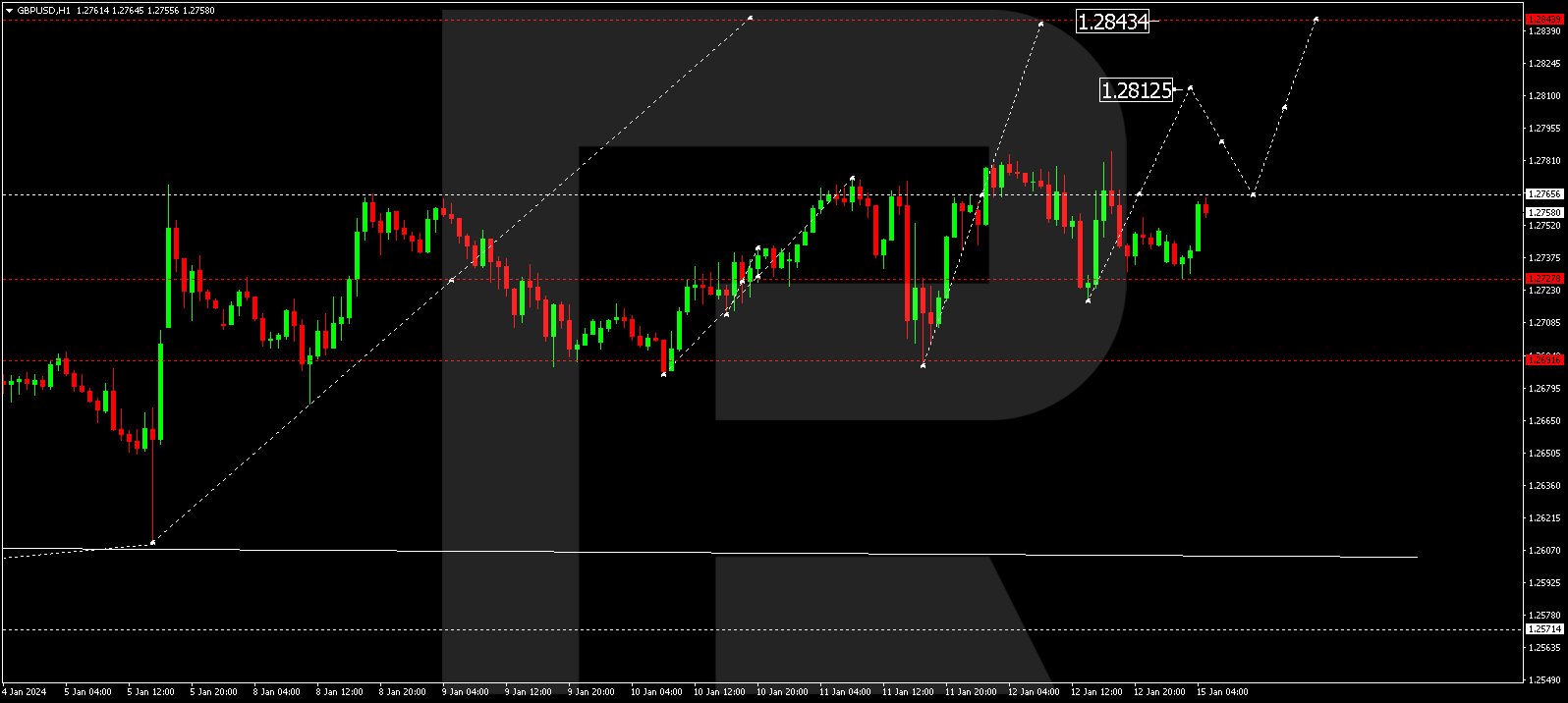

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is navigating a consolidation range near 1.2727. A projected upward movement to 1.2784 is anticipated today. If this level is surpassed, the potential for an extension to 1.2812 arises, followed by a possible decline to 1.2690.

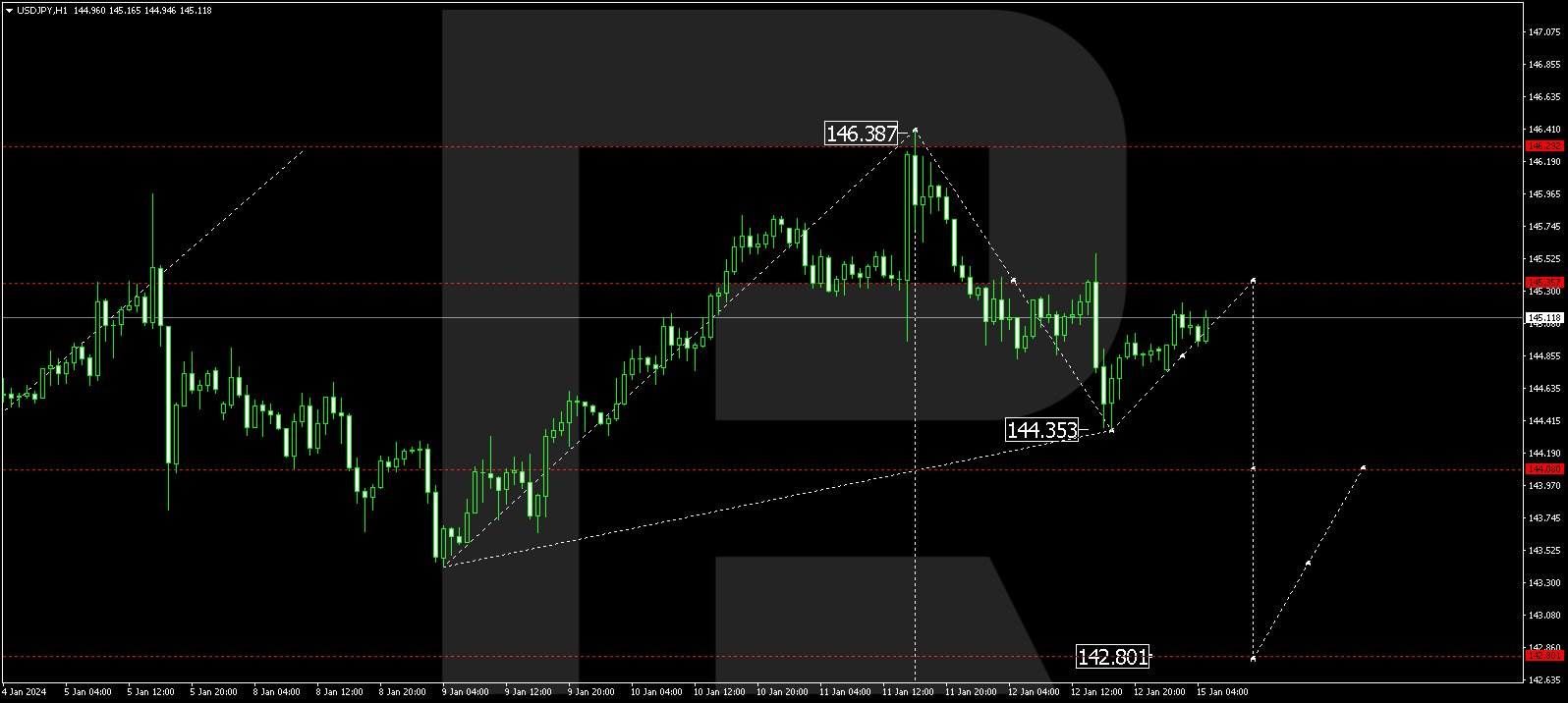

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is currently developing an upward wave targeting 145.35. Subsequently, a downward correction to 144.00 is anticipated. A breakout below this level could trigger a descent to 142.80, serving as a local target.

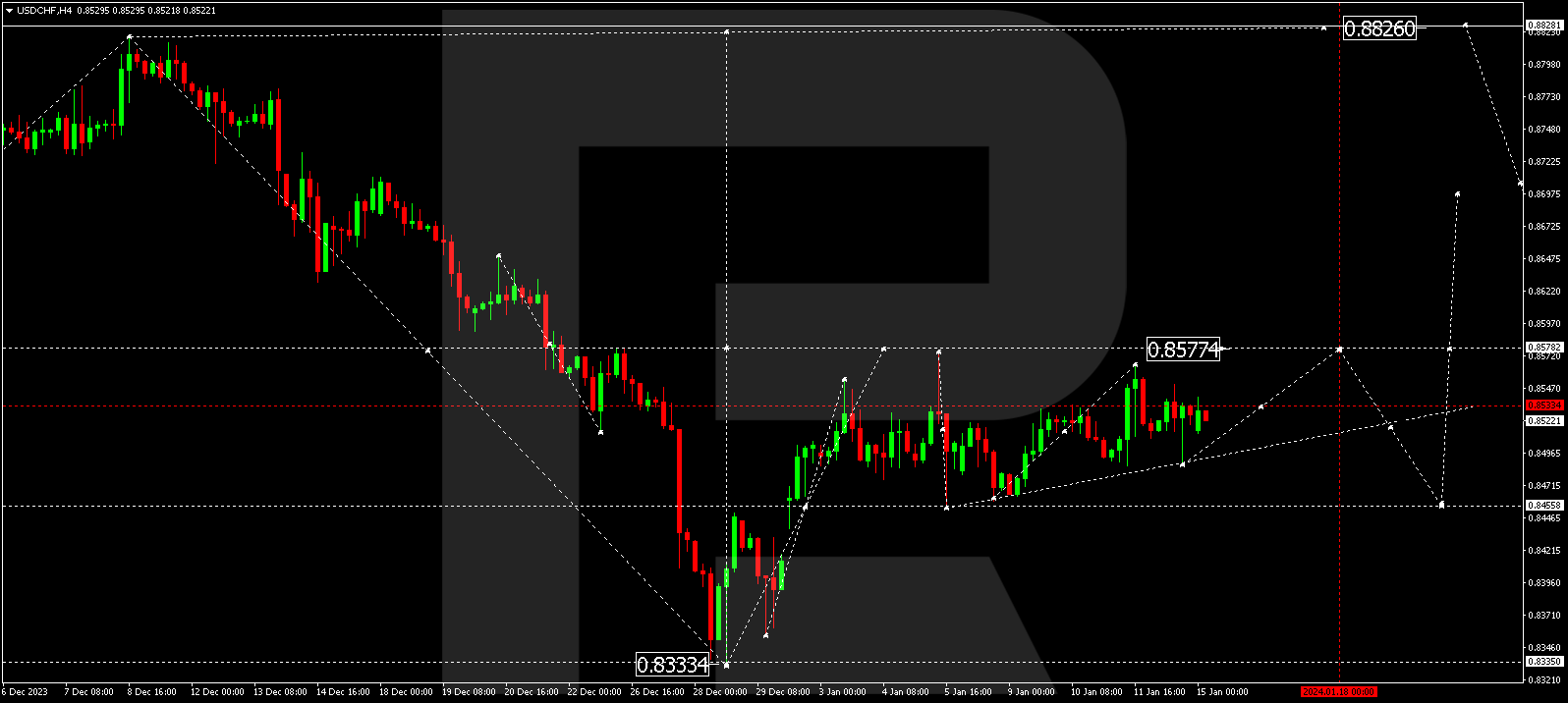

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is engaged in a consolidation range around 0.8530, with expectations for an upward extension to 0.8577 today as the initial target. Following this, a correction to 0.8458 might commence.

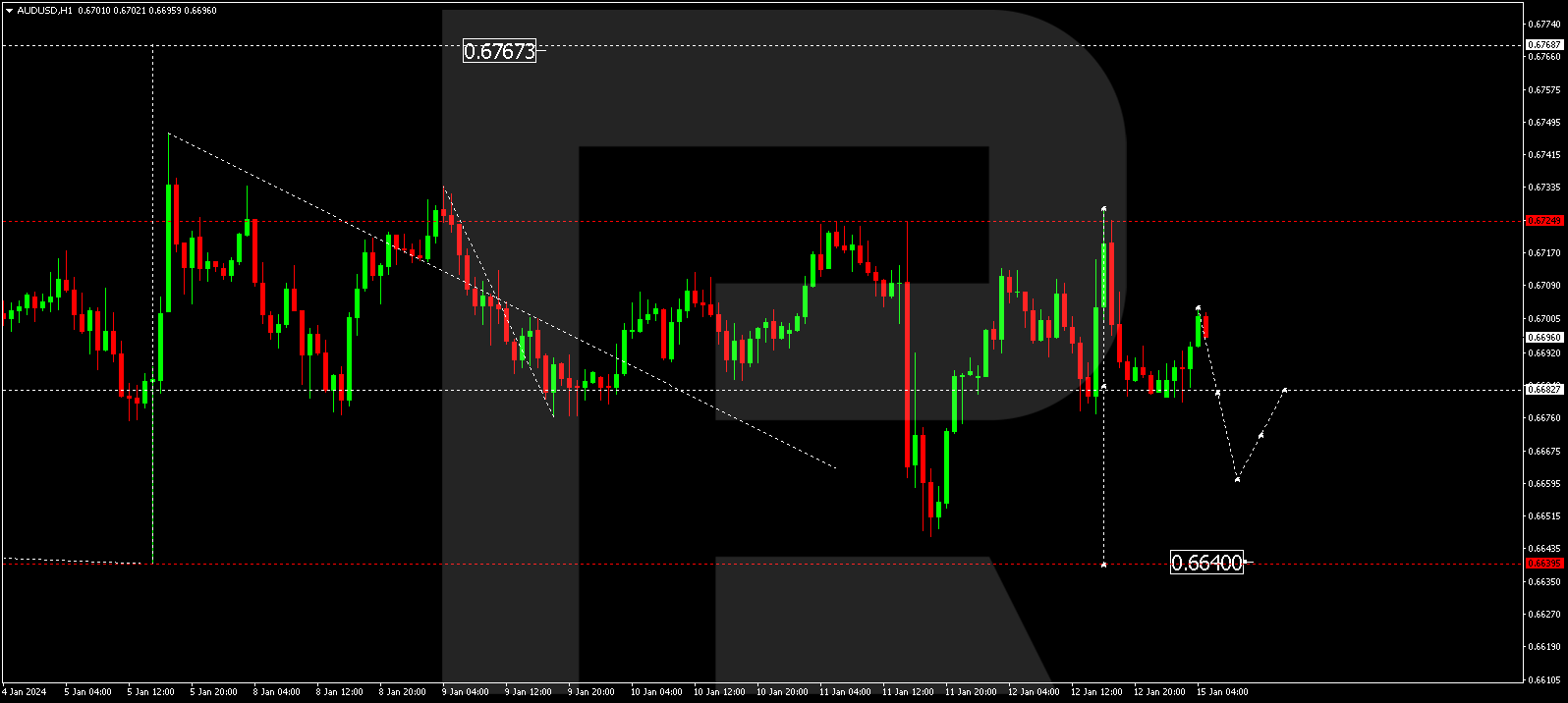

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is navigating a consolidation range near 0.6682. A potential decline to 0.6640 might unfold today, constituting a local target.

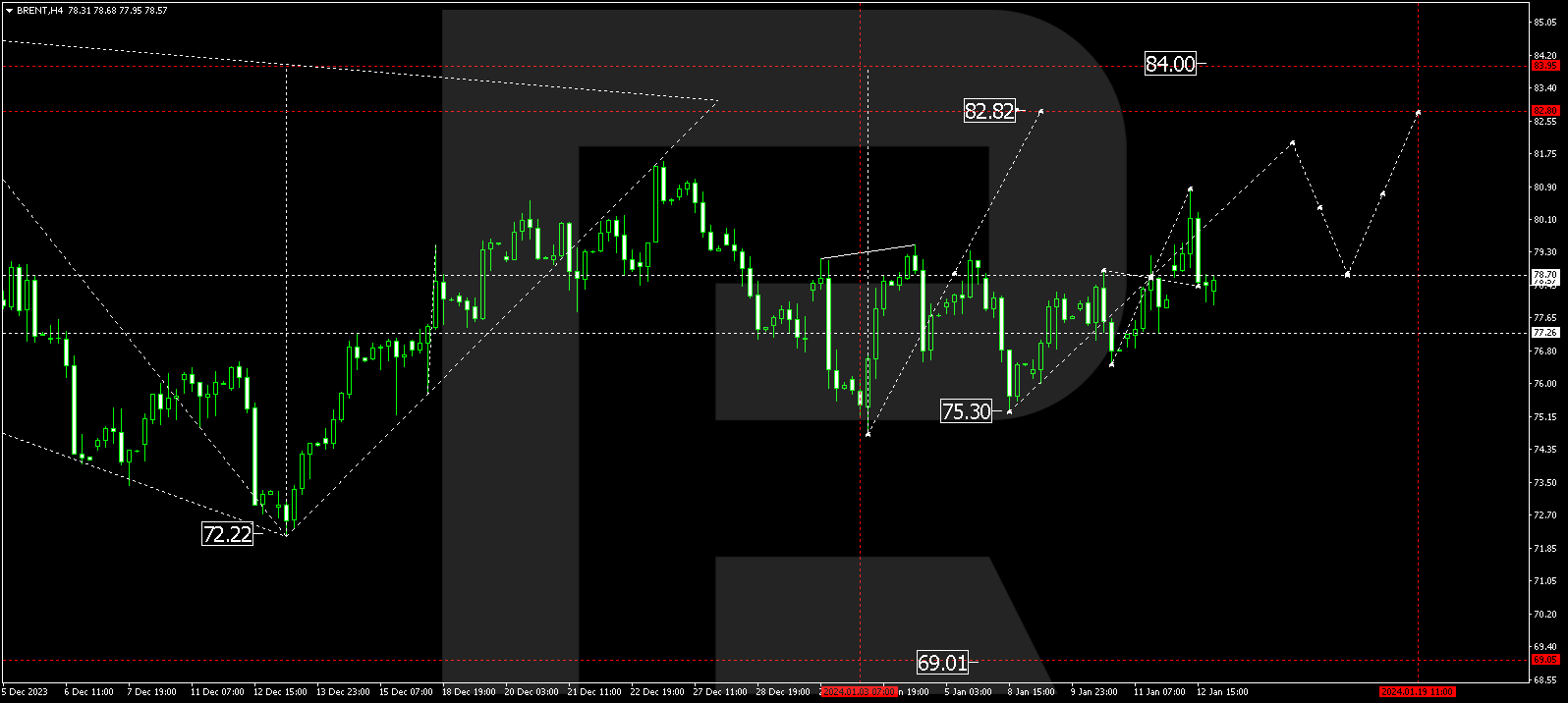

BRENT

Having completed a corrective phase to 78.03, Brent is poised for a growth wave to 81.70 today. From there, the trend might extend to 82.82, representing a local target. Subsequently, a decline to 79.10 (a test from above) is anticipated, followed by a potential rise to 84.00.

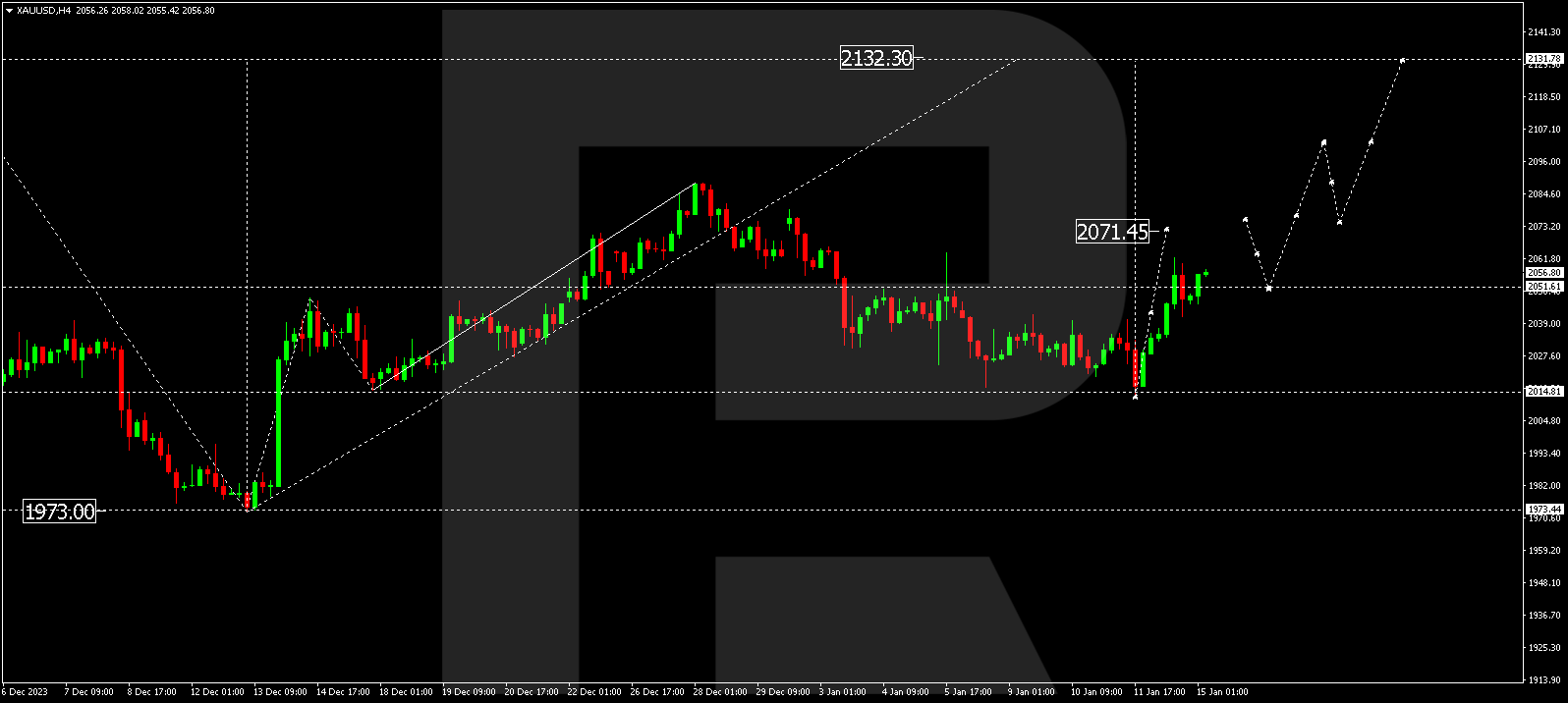

XAU/USD (Gold vs US Dollar)

Gold is continuing its upward wave to 2071.45. Upon reaching this level, a correction to 2050.00 is conceivable, followed by an anticipated rise to 2131.78.

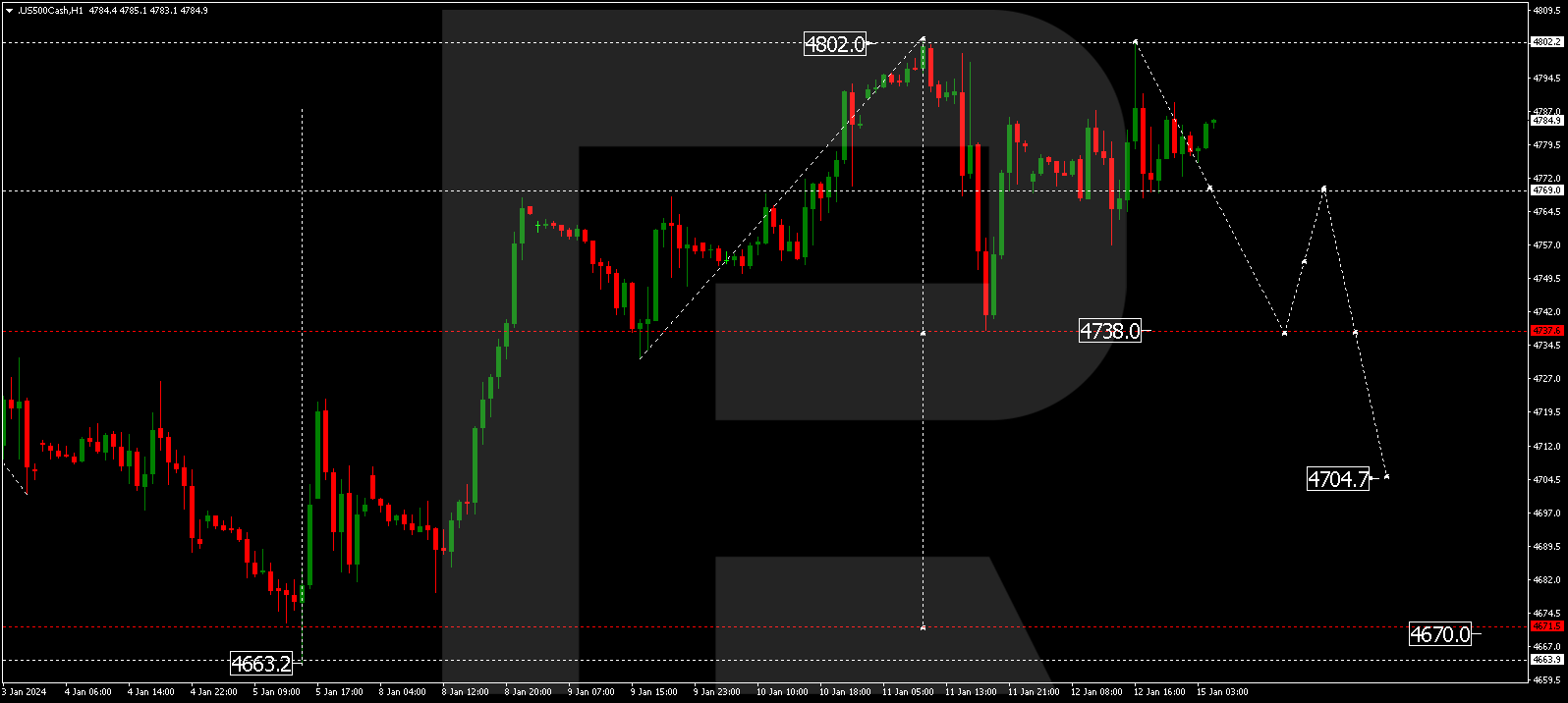

S&P 500

The stock index is currently forming a consolidation range around 4770.0. Today, the price might dip to 4738.0, succeeded by an upward movement to 4770.0 (a test from below). Subsequently, quotes could decline to 4704.0, serving as a local target.

The post Technical Analysis & Forecast January 15, 2024 appeared first at R Blog – RoboForex.