Gold Continues Decline: In-Depth Overview of EUR, GBP, JPY, CHF, AUD, Brent, and S&P 500 Index.

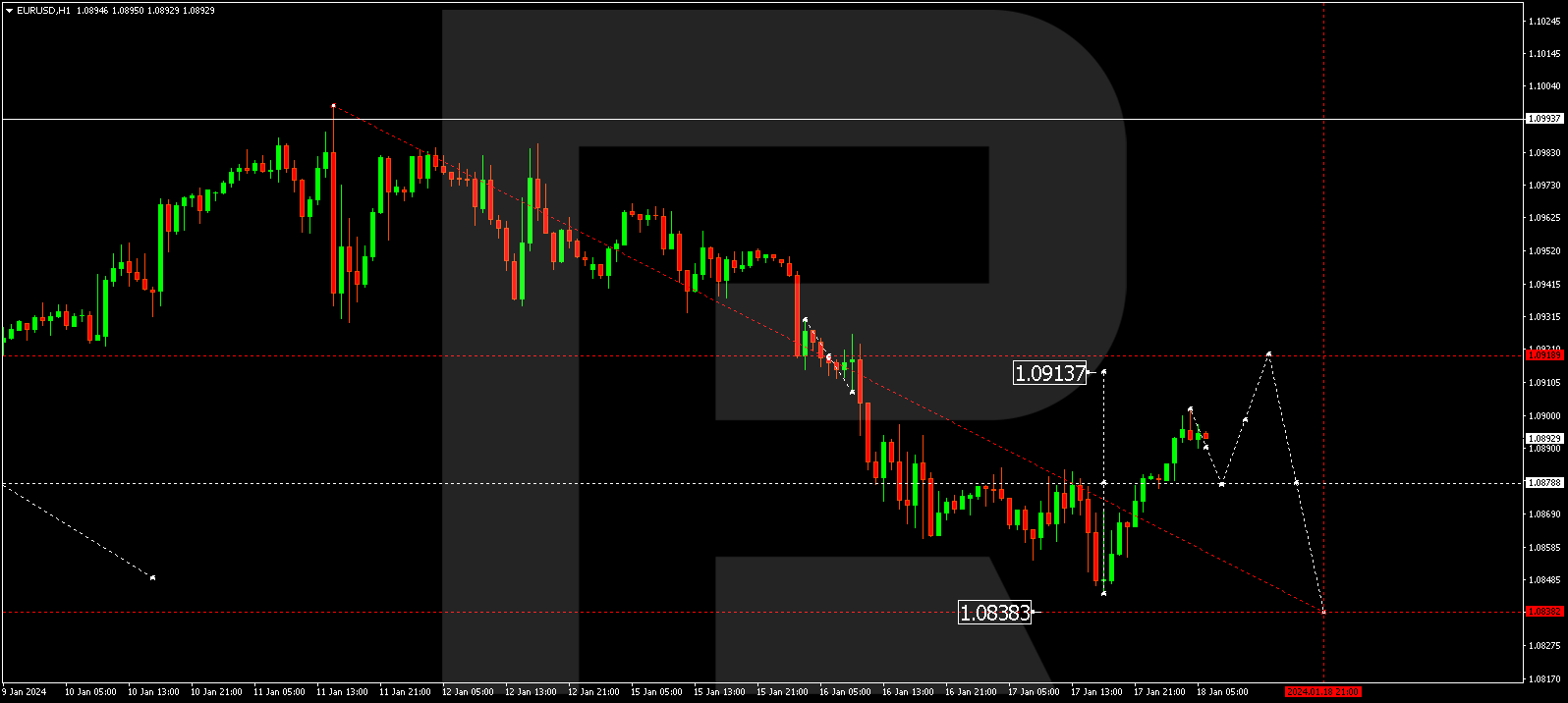

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a decline wave, reaching 1.0845. The market is currently undergoing a correction to the 1.0910 level (a test from below). Following the correction, a potential new decline wave to the 1.0838 level may initiate. Subsequently, a consolidation range could form, with a downward breakout from the range opening the potential for a decline wave to 1.0733.

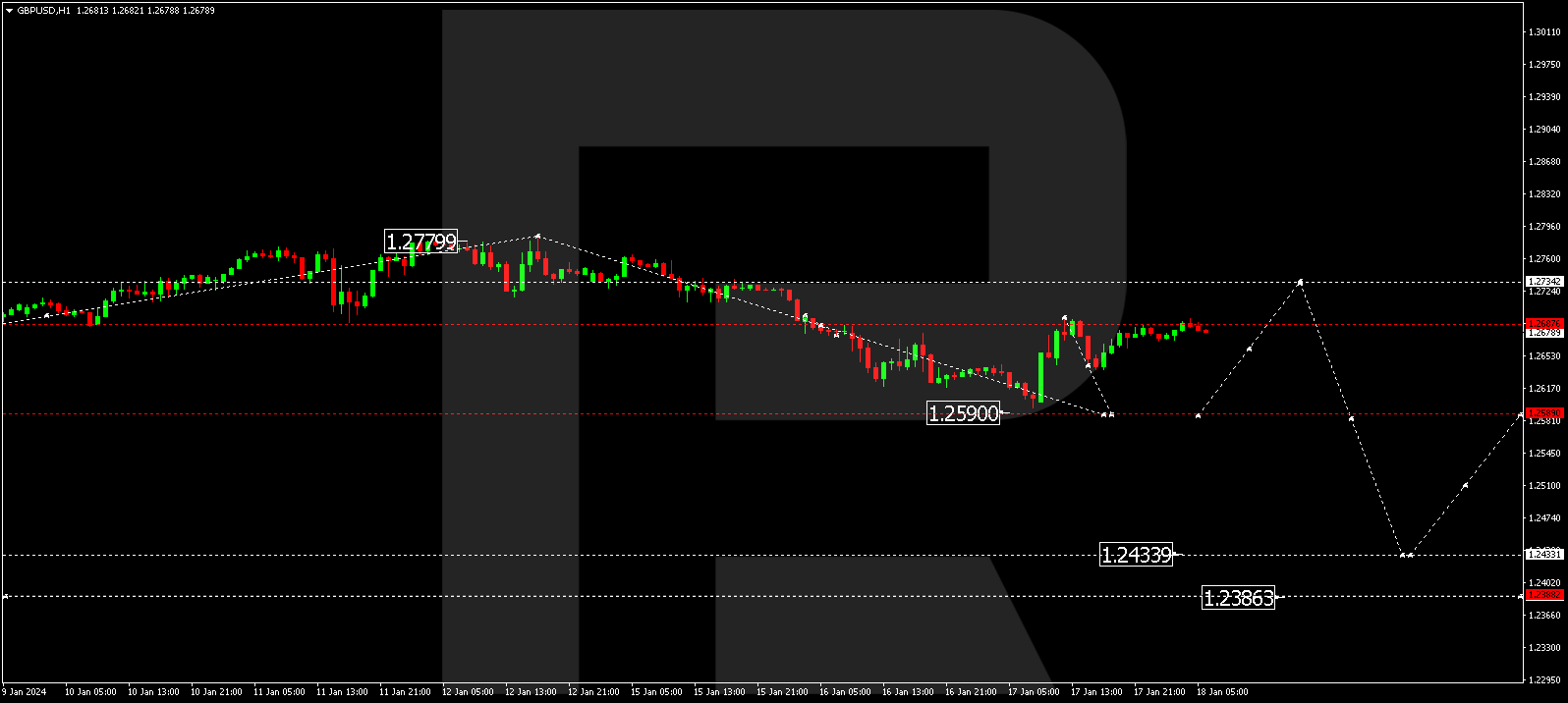

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a decline wave to 1.2596. A correction to 1.2677 has been completed, with expectations of a consolidation range around this level. An escape from the range downward could signal a new decline wave to 1.2590, marking a local target.

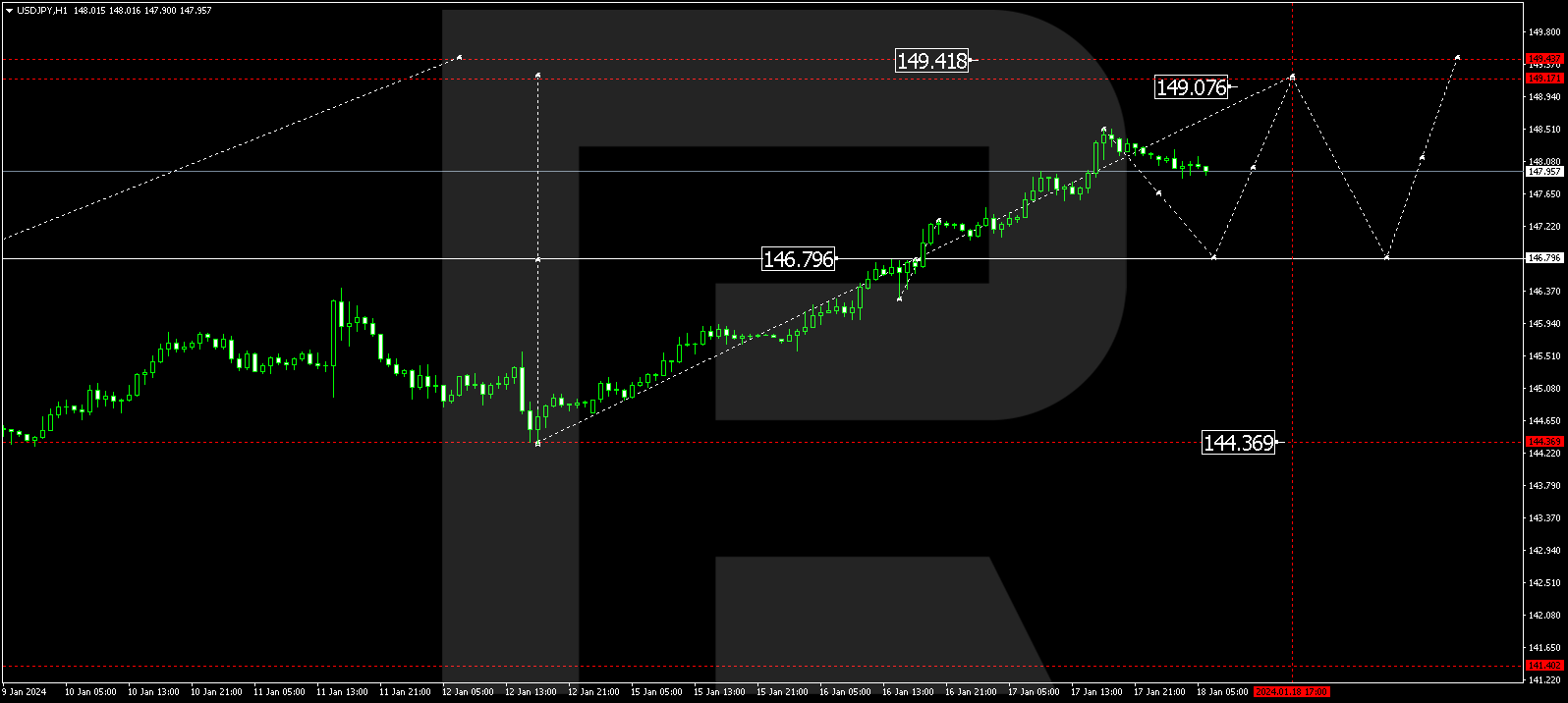

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has concluded a growth wave to 148.50. A correction to 146.77 is anticipated today. Following the correction, a growth wave to 149.17 might form, representing a local target.

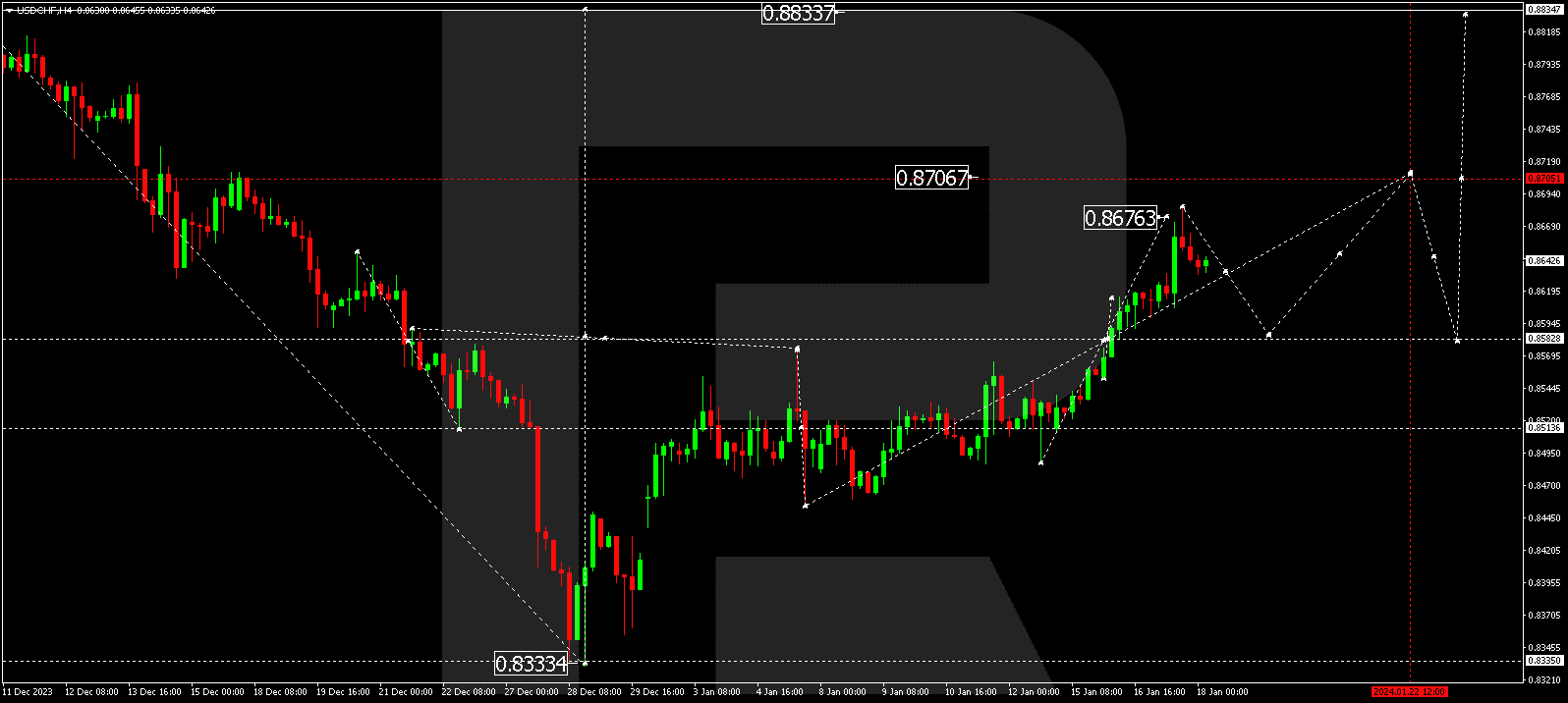

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed a growth wave to 0.8684. Currently correcting to 0.8585 (a test from above), a subsequent rise to 0.8705 is expected, constituting a local target.

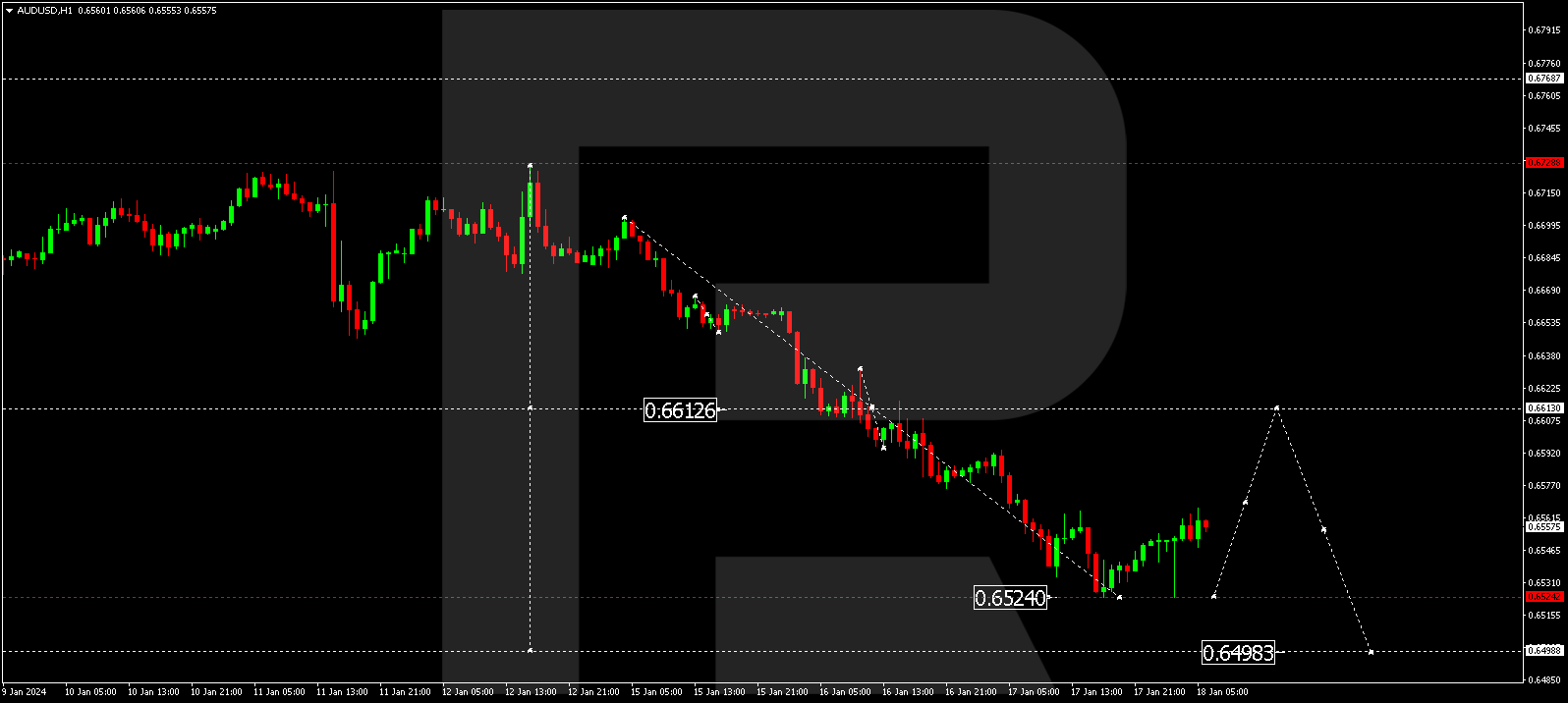

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has completed a decline wave to 0.6625. A consolidation range has formed above this level. A corrective escape upward to 0.6610 is possible (a test from below). Subsequently, a decline to 0.6498 might follow, marking a local target.

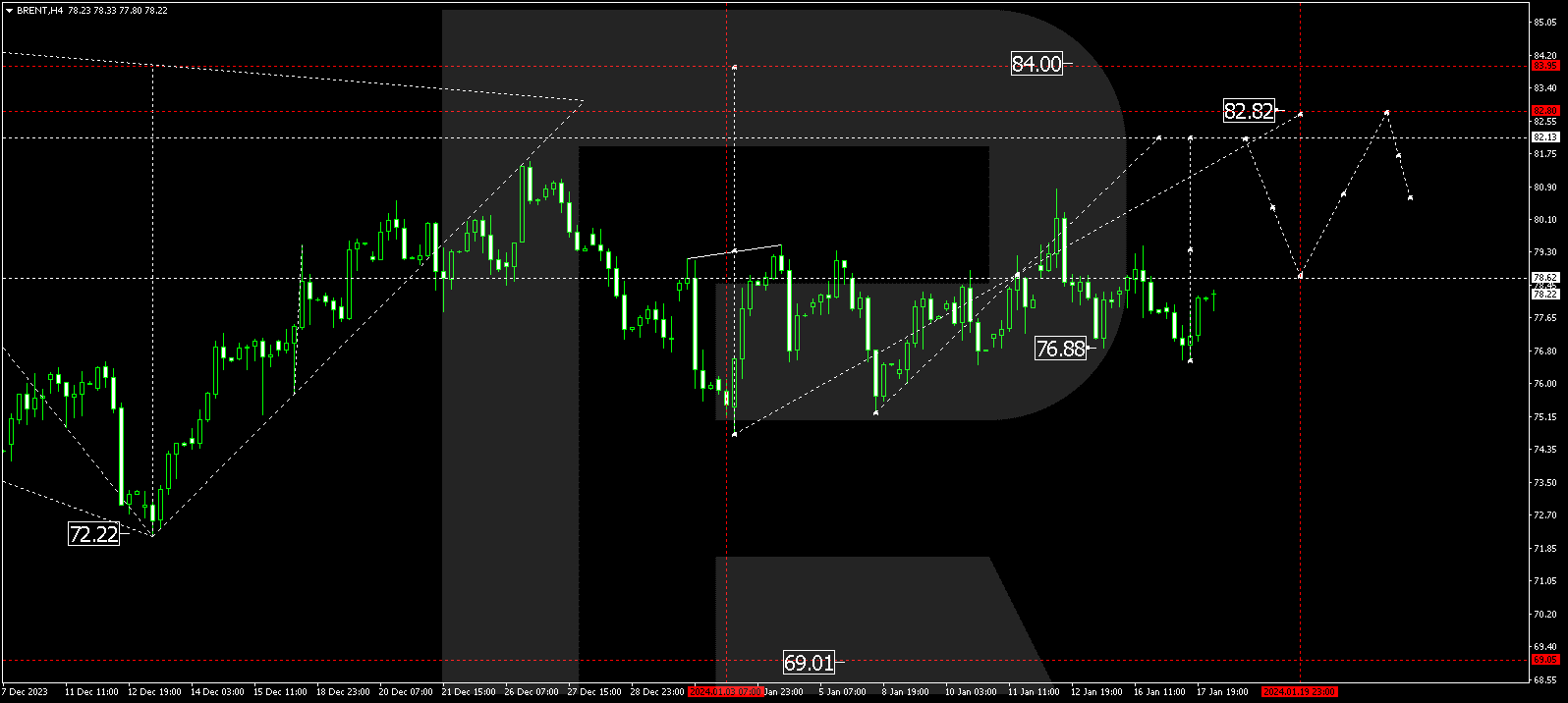

BRENT

Brent has completed a new correction wave to 76.55. The market is currently forming a growth structure to 79.30. An upward breakout from this level could open the potential for a wave to 82.82, marking a local target.

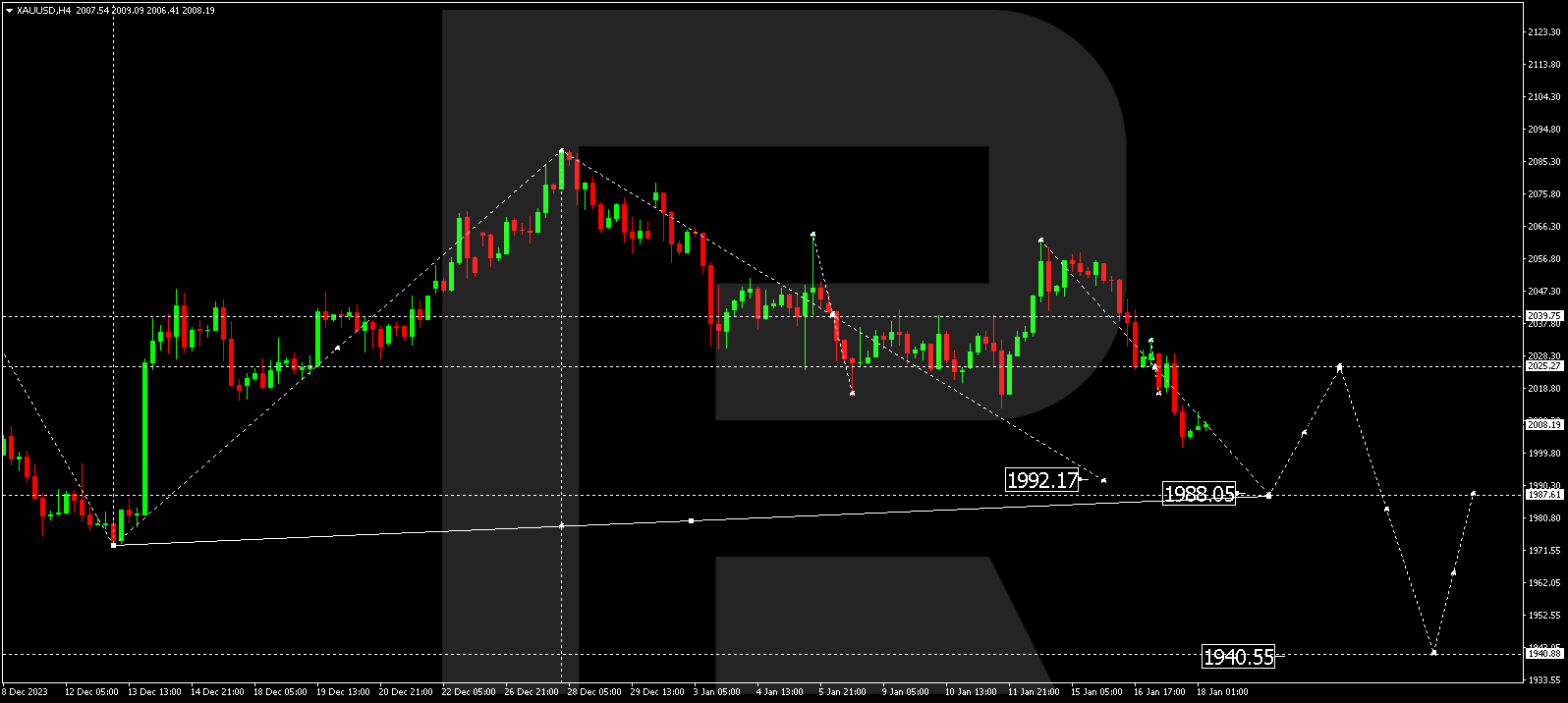

XAU/USD (Gold vs US Dollar)

Gold has formed a consolidation range around 2025.25 and, breaking out of the range downwards, continues the decline wave to 1988.00. Following this level, a correction to 2025.25 might follow (a test from below).

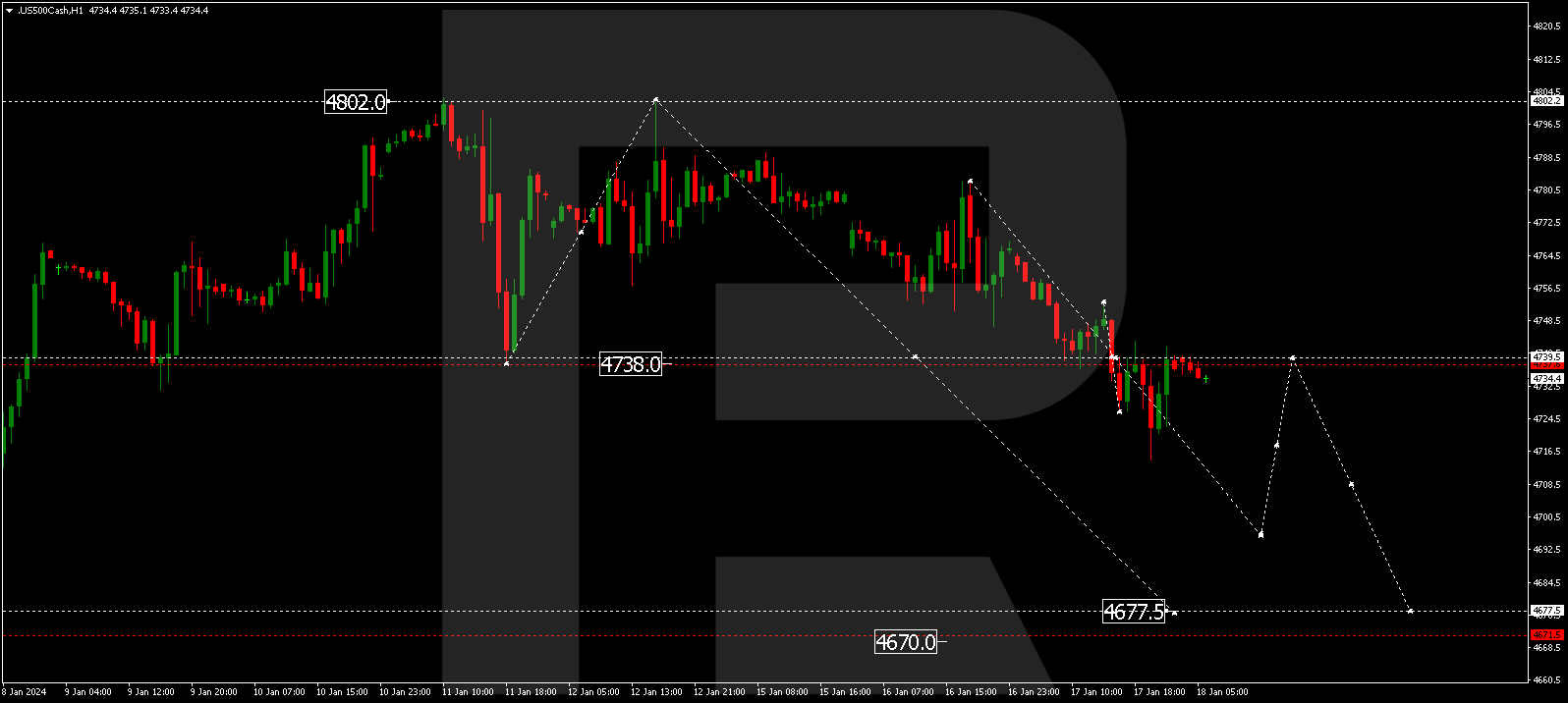

S&P 500

The stock index has formed a consolidation range around 4739.0. The market has extended the range downwards to 4714.4, technically returning to 4739.0 (a test from below). A decline wave to 4696.0 is expected, marking a local target. Subsequently, a correction to 4720.0 and a decline to 4677.5 could follow, constituting the first target.

The post Technical Analysis & Forecast January 18, 2024 appeared first at R Blog – RoboForex.