Brent continues its upward trajectory. This overview also encompasses the movements of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

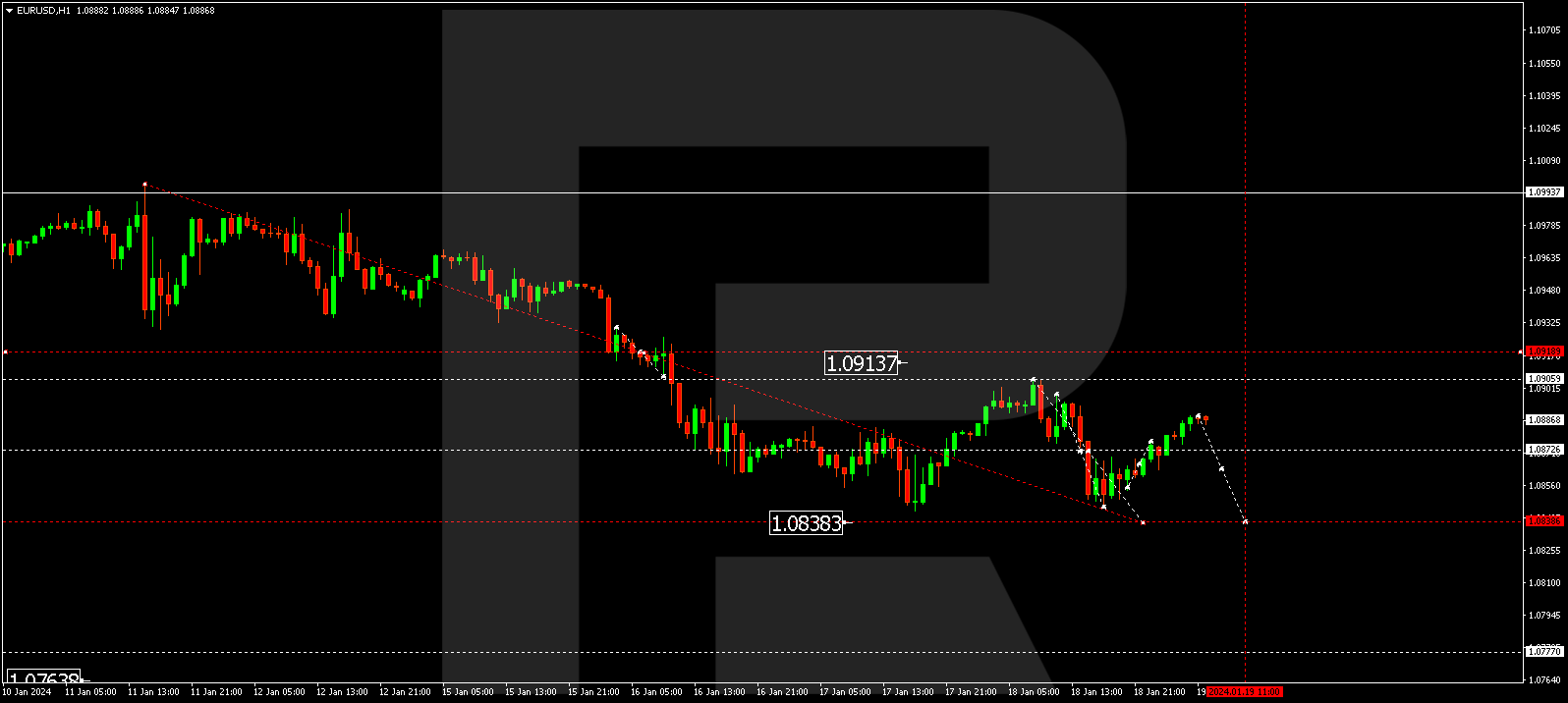

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a downward structure reaching 1.0845. The market has subsequently corrected to 1.0888 (testing from below). Anticipate a renewed downward wave to 1.0838, potentially forming a consolidation range afterward. A breakout downward could pave the way for a decline to 1.0733.

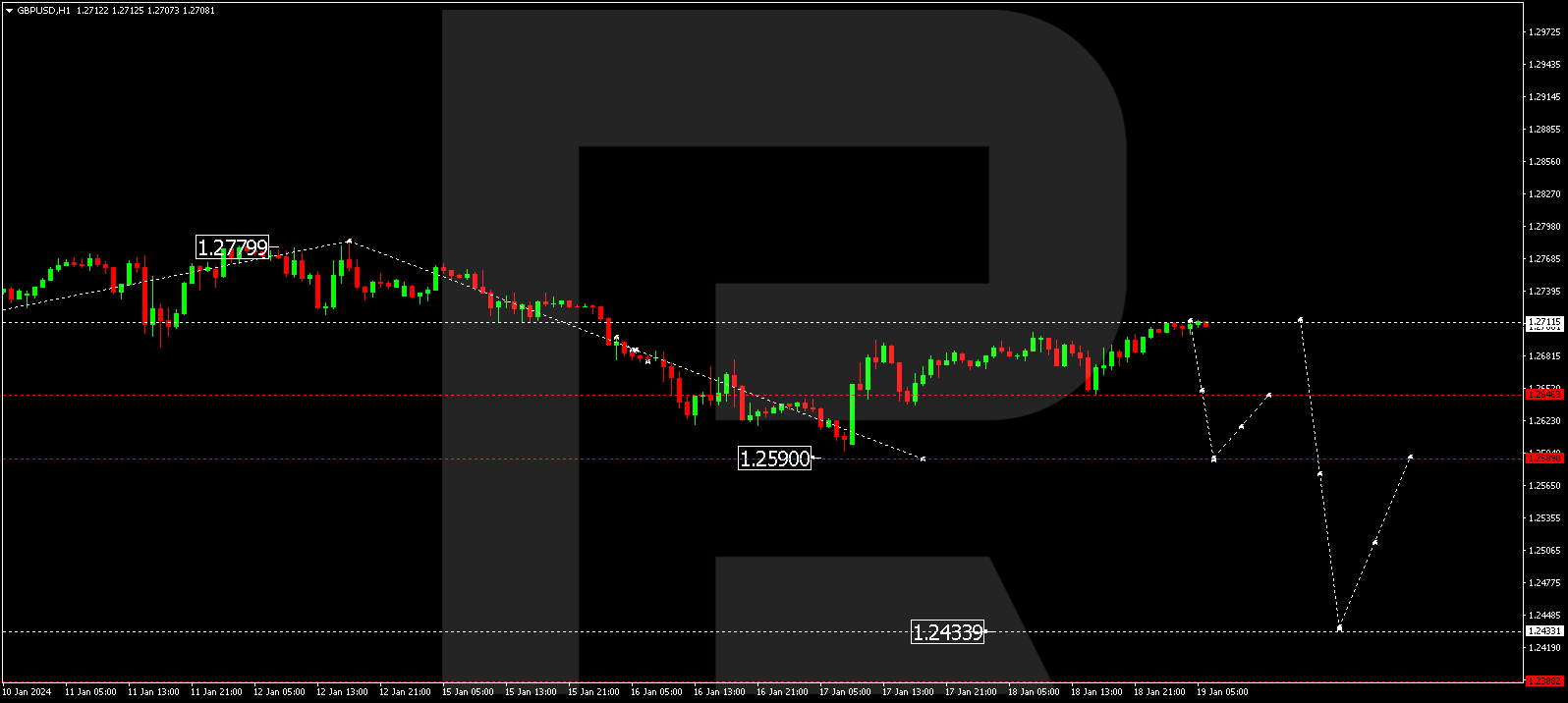

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a corrective wave to 1.2711. Currently, the market is establishing a consolidation range below this level. A downward breakout might trigger a new decline wave to 1.2646, and if this level is breached, the trend may persist towards 1.2433. This serves as a local target.

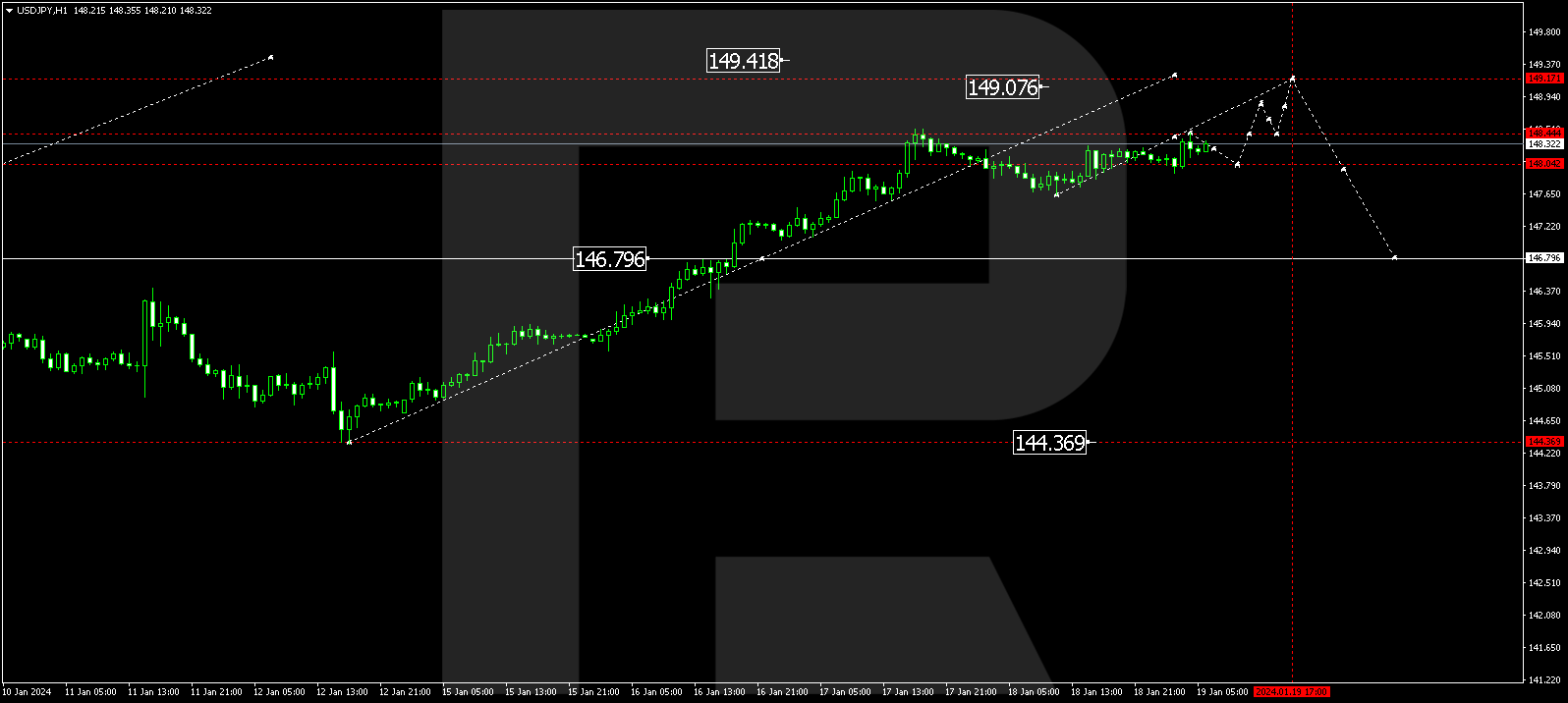

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has finished a growth wave reaching 148.44. A correction to 148.08 is plausible today. Following the correction, a new growth wave to 149.19 could unfold, representing a local target.

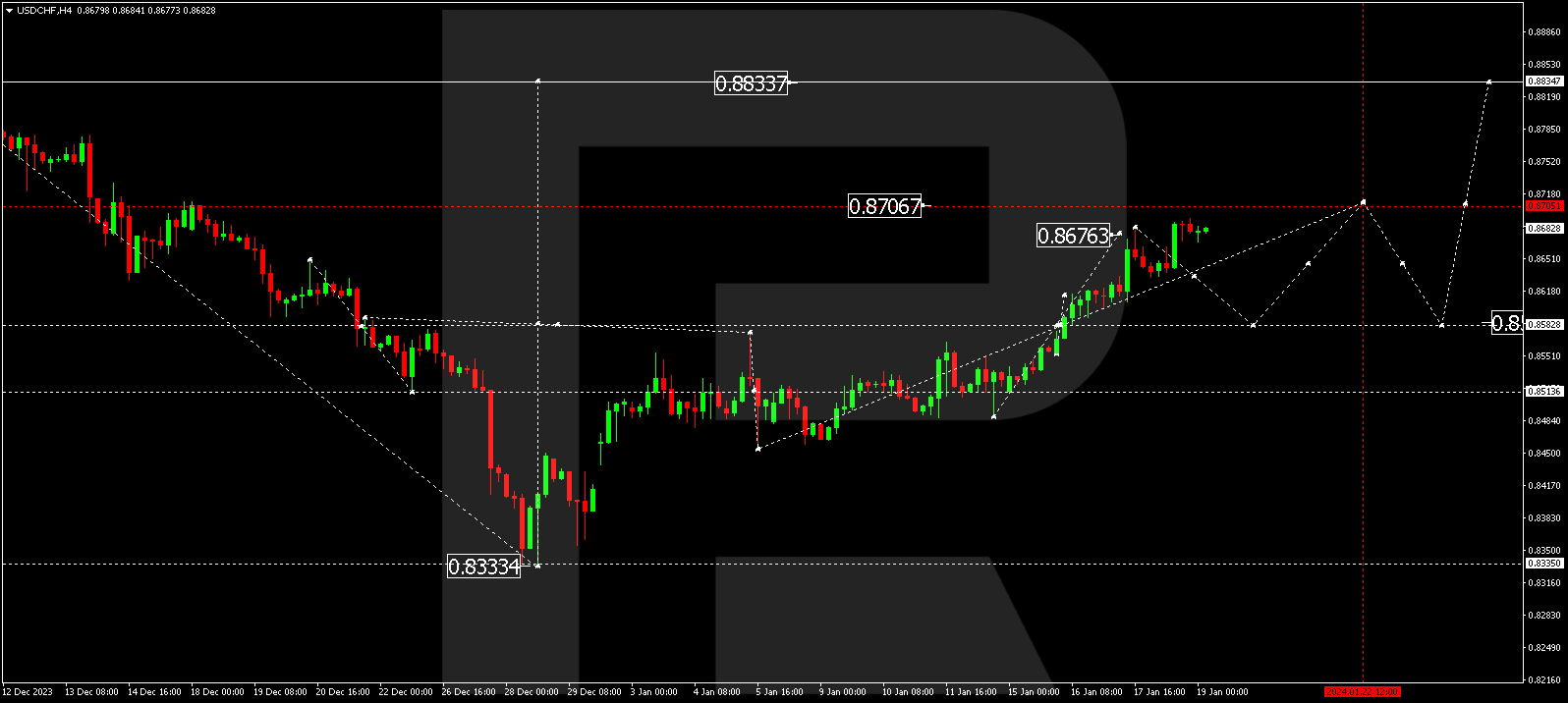

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed a growth wave reaching 0.8693. Presently, the market is forming a consolidation range around this level. A potential correction to 0.8633 might occur, followed by an ascent to 0.8705 as a local target.

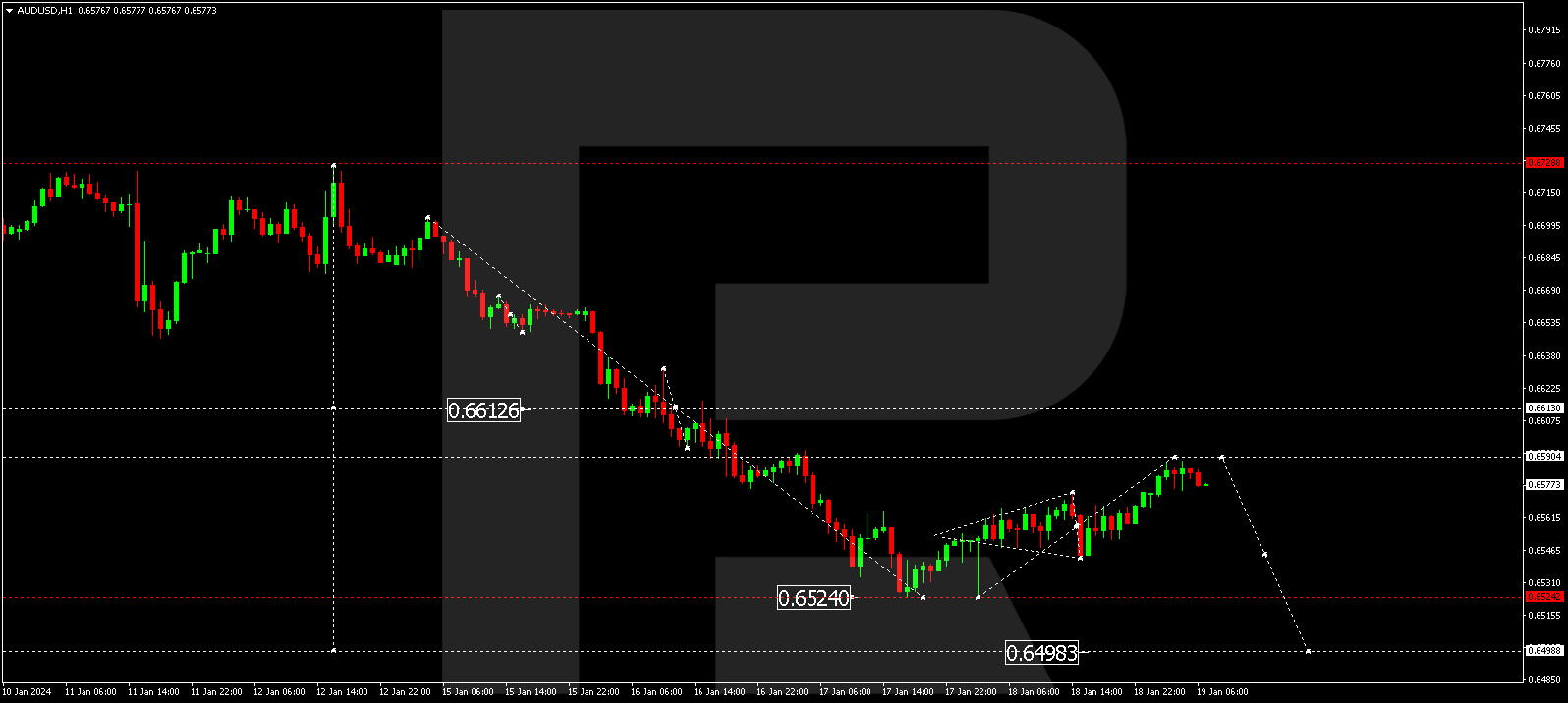

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has concluded a corrective wave to 0.6588. The market is currently shaping a consolidation range below this level. An extension of the range to 0.6590 is feasible, followed by an ascent to 0.6545. A downward breakout may lead to a potential wave to 0.6498.

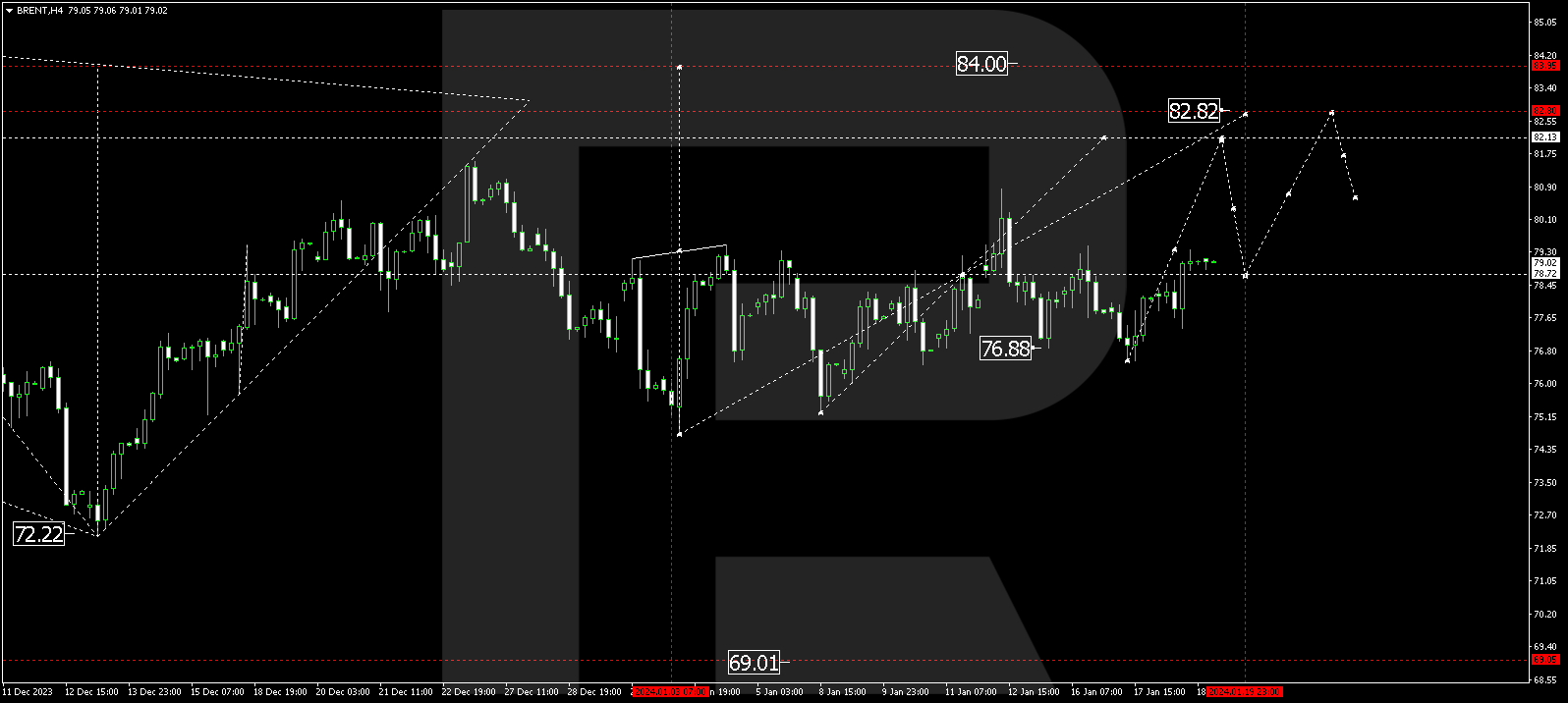

BRENT

Brent has completed an upward structure to 79.34. Currently, the market is establishing a consolidation range below this level. A correction link to 78.70 is plausible. Subsequently, a new upward structure to 82.12 might form, with the potential for the trend to continue towards 82.82, representing a local target.

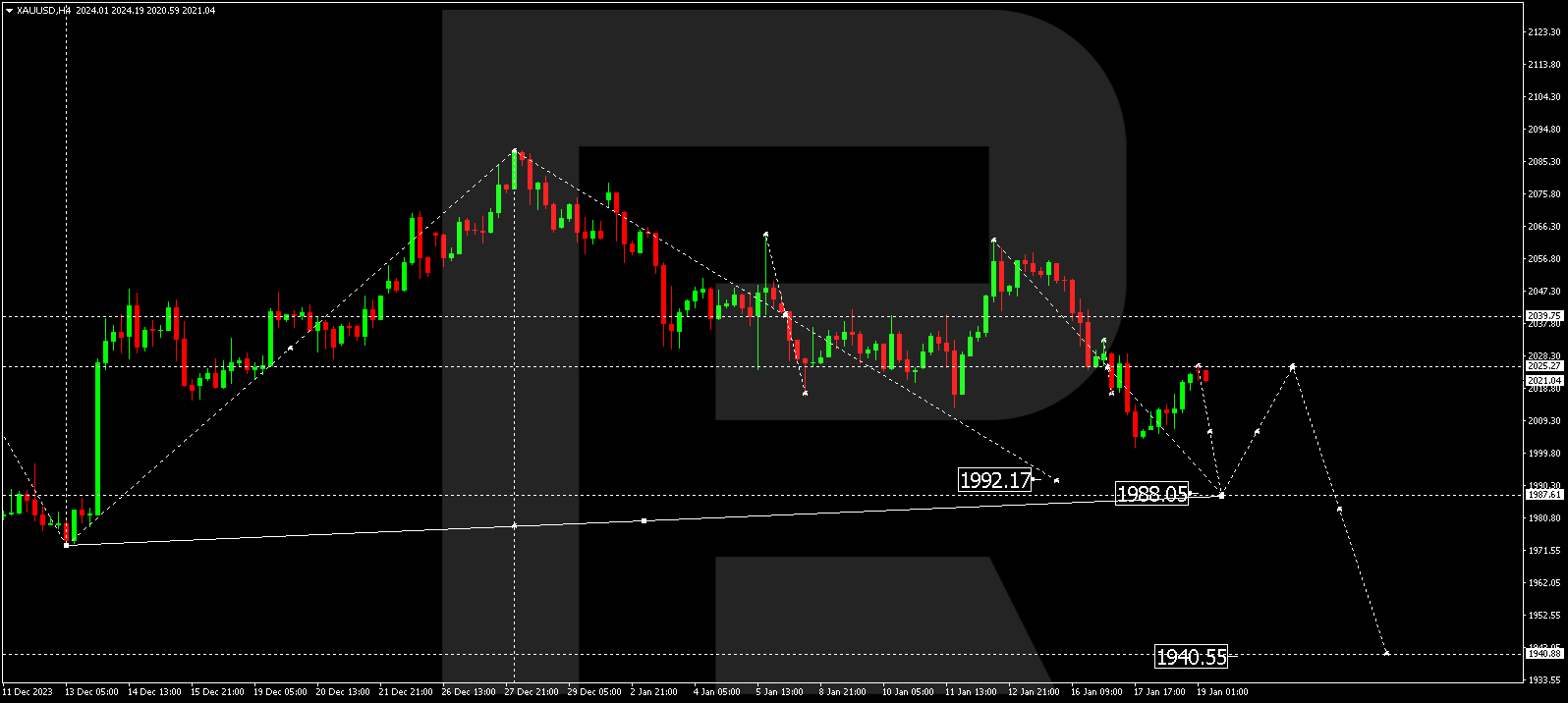

XAU/USD (Gold vs US Dollar)

Gold has formed a downward structure to 2001.75. Upon reaching this level, a correction to 2025.25 might follow (testing from below). Today, a new downward structure to 1988.05 could develop, serving as a local target.

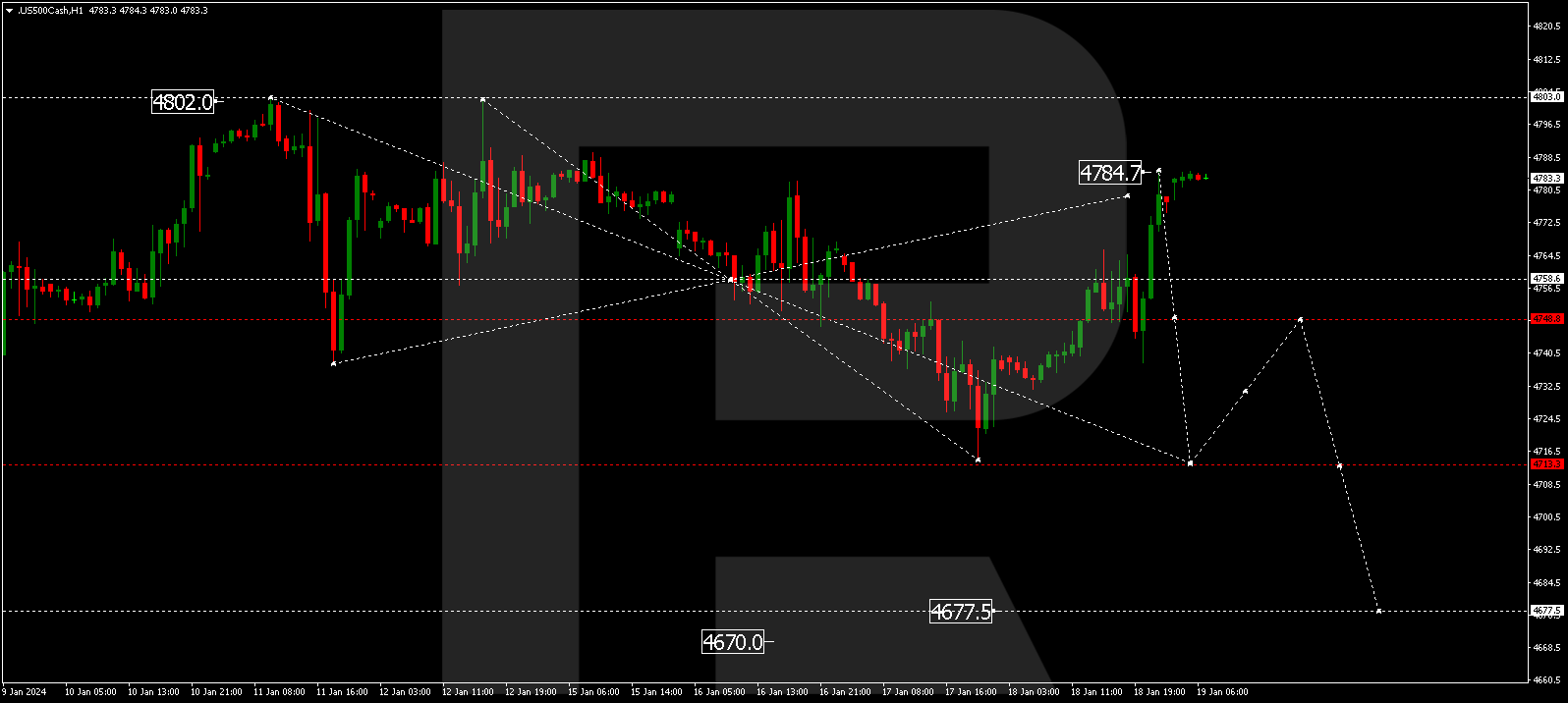

S&P 500

The stock index has formed a correction to 4784.7. The initiation of a new downward wave to 4713.3 might occur today, representing the first target. Upon reaching this level, a potential correction to 4748.8 is plausible, followed by a decline to 4677.5, serving as a local target.

The post Technical Analysis & Forecast January 19, 2024 appeared first at R Blog – RoboForex.