What influences share prices? Why and how can a share rise for several months or even years?

The answer is very simple: share prices are affected by the demand and the supply. However, this raises another question – who creates the demand for shares?

And again, the answer is quite simple – the demand is created by market players. ”But I’m also a market player!” – says an investor – “Today, I bought a share, thus creating demand. But tomorrow, the day after tomorrow, or in a month, I’ll be waiting for the price to rise, hence no more buying for me. As a result, I created demand just once but the price continues rising”.

To dig deeper, let’s take a look at, for example, Alphabet Inc. (NASDAQ: GOOG) share, which costs $2,800, with an average daily trading volume of over 1 million shares, which give us $2.8 billion.

Let’s assume that $1.2 billion of this money is the sale of shares, i. e. the supply. In this case, $1.6 billion is the purchase of shares. Who creates such a demand for Alphabet shares every day? One thing is certain here – not retail investors.

A clear-cut answer to this question can be given by a stock exchange that trades these shares. This is the place where one can see who buys or sells securities, and in what volume. All that is left for us is to settle for standard conclusions, such as market makers, institutional investors, the companies themselves, and retail investors. It’s not always possible to find out who a heavy buyer is (it might even be a simulation or an artificial intelligence game).

While trying to find the market player, who is ready to create the demand for shares of some particular company every day and is interested in their growth without making a profit, I encountered one quite well-known procedure performed by issuers called a buyback.

Today. I’ll tell you more details about buyback, more specifically – why companies spend billions of dollars to buy their shares back and who capitalizes on this. I’ll also provide you with examples of several companies that have recently announced their buyback programs.

Buyback

A buyback is a repurchase of shares by a company. Typically, it happens on the open market but sometimes companies repurchase their shares from shareholders off-board at the stipulated price.

As a rule, companies use their available cash assets to carry out buybacks – invest in the expansion of production, company mergers, dividend payouts, and so on. In other words, if a company carries out a buyback, in most cases, it means that it has plenty of money, hence it’s financially stable.

What influence do buybacks have on a company and its shareholders?

A buyback reduces the number of outstanding shares on the open market. It helps to avoid unfriendly takeovers because the number of shares becomes smaller.

Repurchased shares belong to a company – they won’t require payout of dividends, do not take part in the voting, and are usually cancelled. However, sometimes, companies manage them more wisely.

Repurchased shares can be used as payment while merging with other companies or distributed among employees to increase their productivity and efficiency. They can also be used for hiring highly qualified personnel, who receive the company’s shares as a reward.

The reduction of the number of shares on the market leads to the increase of existing shareholders’ share of the company (provided repurchased shares were cancelled). For example, a company issued 1,000 shares, 800 of which were distributed among major shareholders and 200 went to the market via IPO. As a result, major shareholders got an 80% share, while the other 20% were sold on the open market to retail investors.

After that, a company announces a buyback, repurchases 100 shares (10%), and cancels them. As a result, the number of outstanding shares is 900 – 800 owned by major shareholders and 100 by those who acquired them via IPO. In the buyback process, the major shareholders’ share increases up to 88%, while the number of shares available on the market goes from 20% to 12%.

What’s the point for shareholders if their share in a company increases?

When the number of outstanding shares goes down, a return per share goes up, as well as a dividend payout (in a company pays dividends, of course). In the case of liquidation of a company, a shareholder can claim a bigger share in it. Also, one shareholder’s share may increase to such an amount that they will have deciding voting right in a company.

As you can see, a buyback doesn’t imply a single negative consequence for a company and its shareholders. As a matter of fact, the procedure is pretty positive.

When do companies carry out buybacks?

First of all, a buyback is a signal to investors that a company is stable and the management believes in further growth potential. It also shows that the management considers shares of a company underestimated. It might often happen due to negative news flow, which is sometimes quite far from reality.

That’s why when investors start selling off shares on the market, issuers often interfere (if regulating authorities and finances allow) and increase the demand for shares, which later prevents them from falling.

There is another reason for a buyback. In the USA, a dividend tax is higher than a capital gains tax. In this situation, shareholders tend to vote in favour of applying funds towards a buyback rather than dividend payouts, because its positive effect is higher.

For example, a company has 1 billion outstanding shares. After a quarterly report, $1 billion was paid in dividends. As a result, a dividend on each share is $1. Let’s assume that a share costs $10 – in this case, a dividend yield is 10%.

Here’s another situation: money is applied towards a buyback instead of dividends. $1 billion means 100 million outstanding shares, which is almost 10% of their total number.

For starters, the news about an upcoming buyback will result in a rise in the price due to the interest shown by investors. Then the number of outstanding shares will reduce by 10% but the price of a share will add the same 10% (considering the ongoing demand). The buyback procedure will continue for a particular period of time and one of its purposes is to increase the price of a share. As a result, the procedure profitability (news flow, increased demand for shares) may be much higher than dividend payouts.

Now I’ll give you an example of a real company, which doesn’t pay dividends.

Alphabet has been carrying out a buyback since 2015

In the first two quarters of 2021, Alphabet spent $23 billion on the buyback procedure. The total number of the company’s outstanding shares is 660 million. If the above-mentioned $23 billion is spent on paying dividends, a dividend yield would be $35 per share. The average share price in the first half of 2021 was $2,300. As a result, a dividend yield would be 1.5%. Just saying – Alphabet shares added 70% over this period of time.

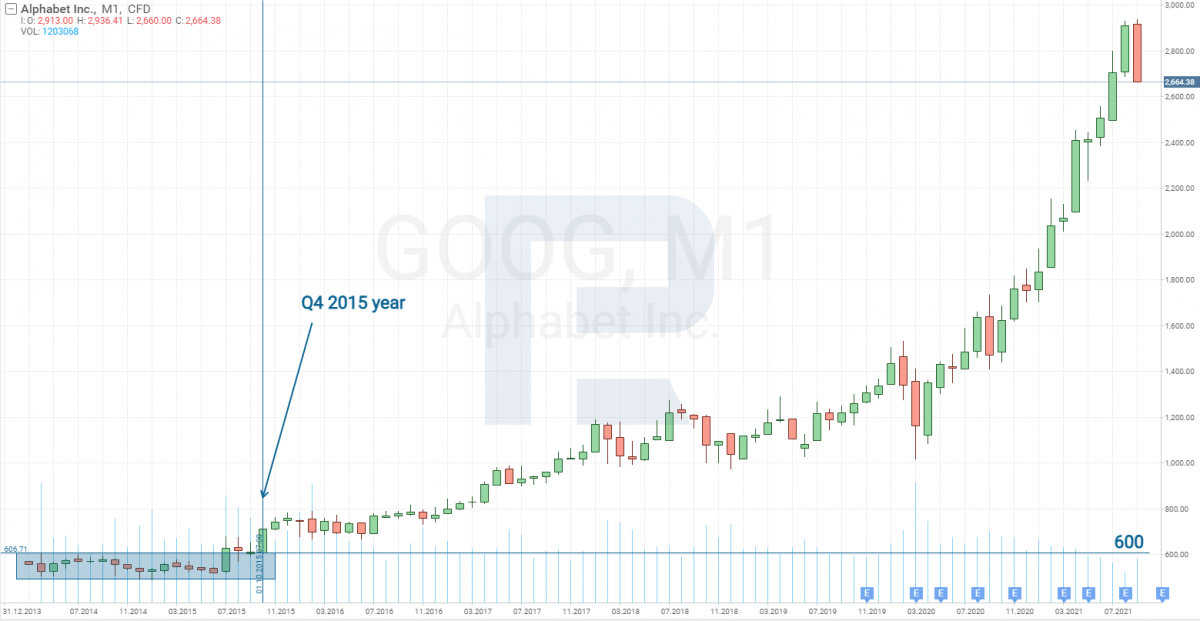

One may think that they would rise onу way or another, without any buybacks, but here is the fact: Google started repurchasing its shares in 2015. Take a look at the chart and you’ll see that from the IPO date and to 2015, shares had been trading between $500 and $600.

The first buyback worth $1.7 billion was carried out in the fourth quarter of 2015. At that time, the price went from $600 to $800. After that, Google carried out buybacks on a regular basis. Since 2015, shares have added 380%. Coincidence? I don’t think so.

In total, Google has spent $90 billion on repurchases since 2015. This is the buyer we talked about, who is ready to spend billions of dollars to support share value. The goal is not to secure profits. In this situation, profits go to investors whose portfolios include shares of a company that is carrying out a buyback.

Intermediate conclusion

First of all, a buyback demonstrates that a company has sufficient cash set aside for emergencies and a low probability of economic troubles. A continuous buyback has a positive influence on the price of shares – it is rising due to the presence of a heavy buyer. A buyback is good for all market players and the information about it makes investors buy shares.

Consequently, if we want to find a stock for short or long-term investments, we should pay attention to the companies that announced buybacks.

What companies announced buybacks?

In the last two weeks, buybacks were announced by such companies as Dollar Tree (NASDAQ: DLTR), Thermo Fisher Scientific Inc. (NYSE: TMO), Lockheed Martin Corporation (NYSE: LMT), and McDonald’s Corporation (NYSE: MCD). However, it doesn’t necessarily mean that you should hurry to buy their shares.

On the day of the announcement, these companies’ shares rose but started falling the day after. You might as well say that retail investors had enough money for one day only.

A buyback announcement doesn’t mean that a company will start repurchasing its shares on the very same day, that’s why there weren’t enough market players to support shares on their levels.

When to buy shares?

It’s not enough just to find a company that announced a buyback, you need to choose the right moment to buy its shares. After all, shares may drop, so a company will buy them back trying to prevent them from falling deeper. The market can experience all kinds of situations.

A Facebook buyback

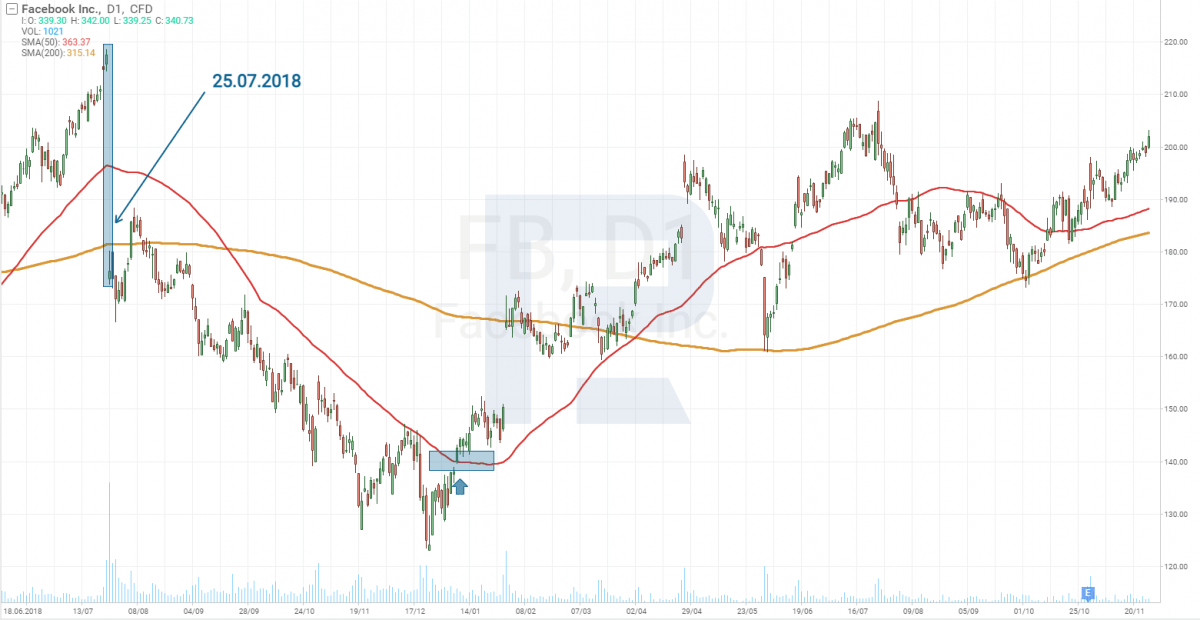

For example, in July 2018, Facebook (NASDAQ: FB) said that its revenue growth rate might slow down because the company had to increase expenses by 50% in order to find and remove fake news quickly. On that day, the company’s shares lost 19% and had been moving within the downtrend until 2019.

Facebook’s management decided that the market was too negative in its response to the news about a possible drop in income and increased the amount of money applied to buybacks. Before that, Facebook spent about $800 million a quarter but after the news, this sum increased up to $4.2 billion. In the fourth quarter same year, the company spent an additional $3.5 billion and its shares stopped falling. As a matter of fact, they started rising slowly and the quarterly buyback amount dropped to $1.1 billion.

Now, let’s take a look at the chart. The gap that you see is the day when investors found out about a possible revenue growth rate slowdown. The gap was followed by sales, which continued until the end of 2018.

Yes, the company was carrying out a buyback. However, if you had bought its shares in, for example, August, you would have lost money. To avoid such an unpleasant situation, it was necessary to turn to tech analysis – it might have given a clue when the downtrend was over so that investors could safely add Facebook shares to their portfolios.

Indicators in favour of the purchase of shares

To find an entry point, you can use one of the most famous indicators on the market, the Moving Average. Typically, people use the 50-day Moving Average or the 200-day Moving Average. The first one is used to define the moment of the trend reversal as early as possible.

In the shares chart, the price broke the 50-day Moving Average at $140. This event could be interpreted as a signal in favour of buying shares. After the breakout, shares had been rising until 2019 before the COVID-19 pandemic crisis occurred.

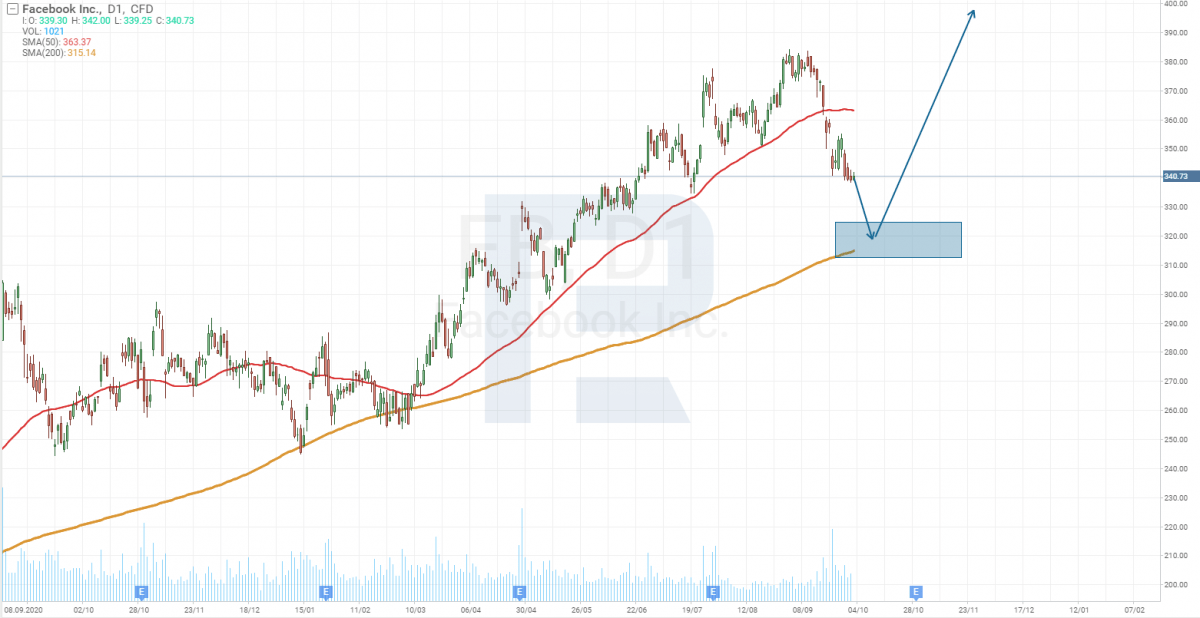

At the moment, Facebook shares are falling again influenced by the same news as in 2018. The company’s management is concerned about the possibility that its advertising profit may reduce because of the Apple (NASDAQ: AAPL) policy, which allows users not to provide any third parties with the data on their application activities. Shares are falling, the buyback sum is increasing again.

In the second quarter of 2021, Facebook spent a record-breaking amount of money on a buyback, $7 billion. In total, the social network is planning to spend $25 billion on repurchasing its own shares. The situation is pretty similar to what happened in 2018 when the company allocated huge amounts of money to repurchase its shares while they were falling. However, there is a small difference in tch analysis.

Right now, the price is trading below the 50-day Moving Average but above the 200-day one, which currently acts as the support, consequently, the first entry point will be a rebound from it. If the price fails to reach it, the second choice will be a breakout of the 50-day Moving Average to the upside.

Tech analysis of Thermo Fisher and McDonald’s

Now let’s get back to the companies that have announced buybacks recently. Their charts show different situations, which means that there is no single approach to all companies but there are common rules we can use to make decisions.

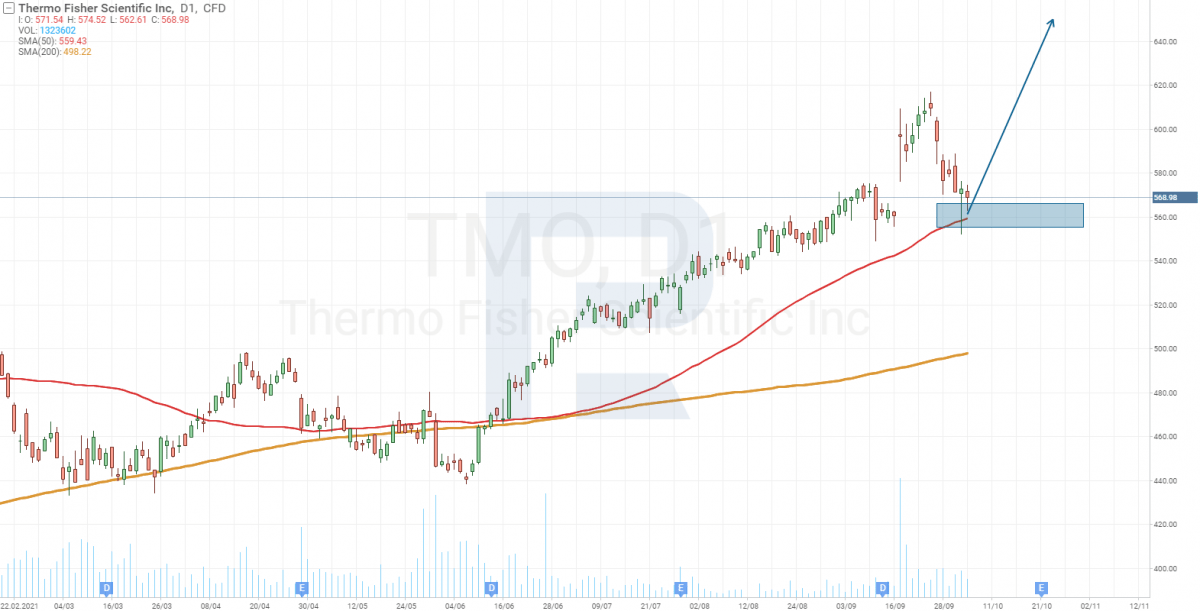

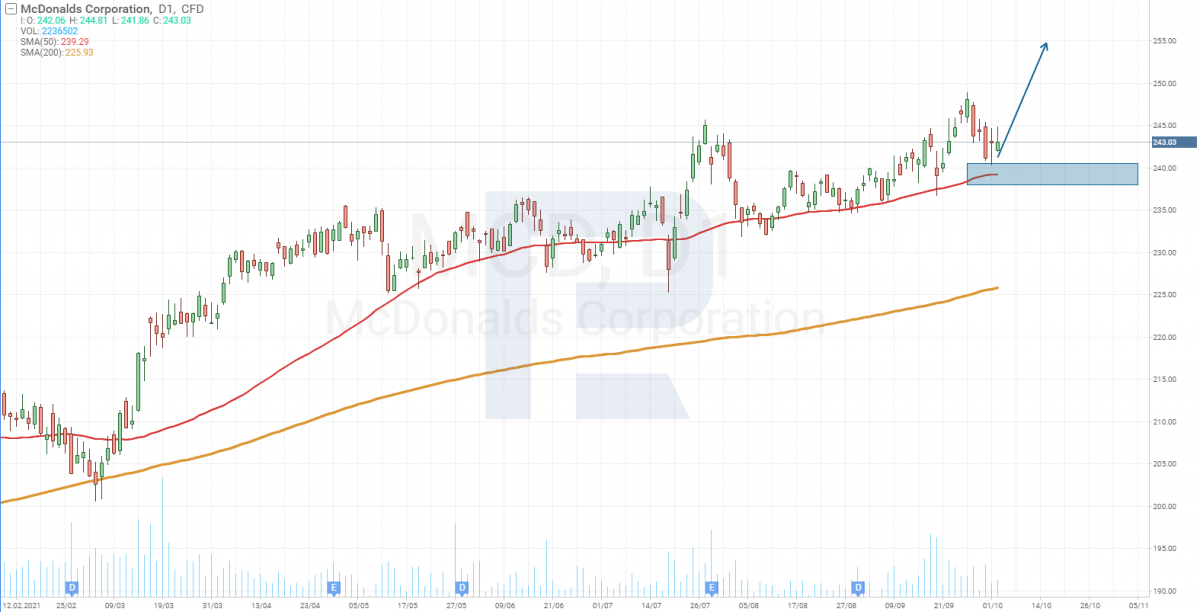

Moving Averages are used as support or resistance levels. If the price is moving above the indicator’s line, a Moving Average is used as the support. Consequently, when the pride is approaching a Moving Average, we expect a rebound, which will be a signal in favour of new growth. A rebound from a Moving Average can be used for shares of Thermo Fisher and McDonald’s.

Thermo Fisher shares are already trading at the 50-day Moving Average, so we should wait a bit. If the price rebounds, it might be considered as a signal to buy. Otherwise, we should wait for a test of the 200-day Moving Average.

McDonald’s shares have already rebounded from the 50-day Moving Average and that’s a signal in favour of further growth. However, we shouldn’t exclude a possibility of another descending wave towards the 200-day Moving Average, where may add shares to our portfolio.

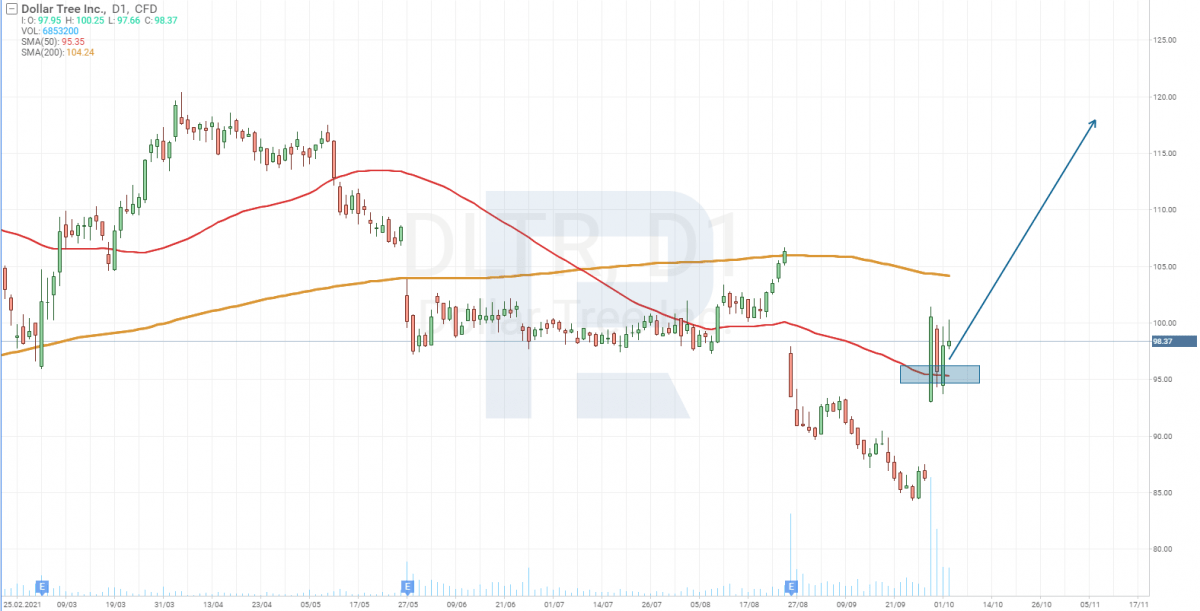

Tech analysis of Dollar Tree

In the case of Dollar Tree, the price has broken the 50-day Moving Average. In other words, the situation is similar to Facebook in 2018. This event may be considered as a signal to buy shares.

It is interesting to note that along with the news about a buyback, Dollar Tree also announced that it was going to test sales of 1-, 3-, and 5-dollar goods in its retail chain of 7,880 shops (at the moment, the company is selling goods at the fixed price of $1). If these prices go well in Dollar Tree shops, the company’s revenue may increase and it may raise a buyback amount in the future.

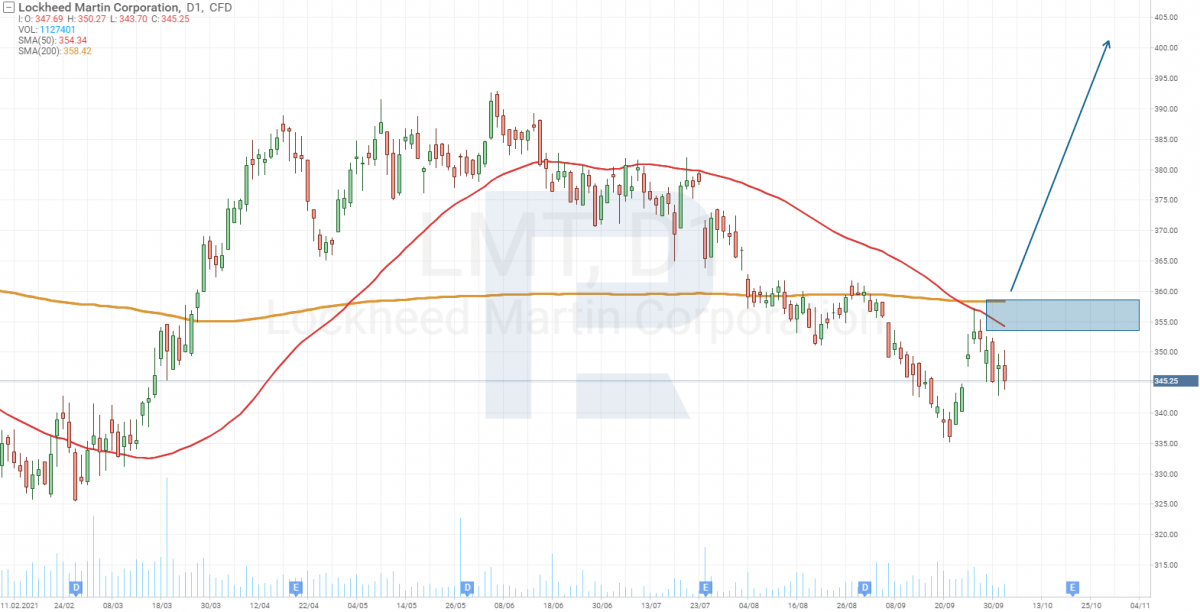

Tech analysis of Lockheed Martin

Judging by the chart, Lockheed Martin is the weakest of them all, although its revenue is higher than other companies mentioned above. Lockheed Martin shares are trading below Moving Average, that’s why we should wait for the descending tendency to be over and a breakout of the 50-day Moving Average.

Closing thoughts

A buyback is not a “magic pill” on the stock market but one of the ways to find a company to invest in. When we know the direction where major market players are trading, our job gets much easier. However, regardless of this, we have to learn more information about the company, shares of which we’re planning to buy.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex.com and open a trading account.

The post What Is A Share Buyback and When Should One Buy? appeared first at R Blog – RoboForex.