In this article, we’ll discuss the rules and methods of trading the “Tasuki Gap” pattern. You won’t find it very often, but it’s a quite strong pattern of trend continuation from the candlestick analysis.

How the “Tasuki Gap” pattern is formed

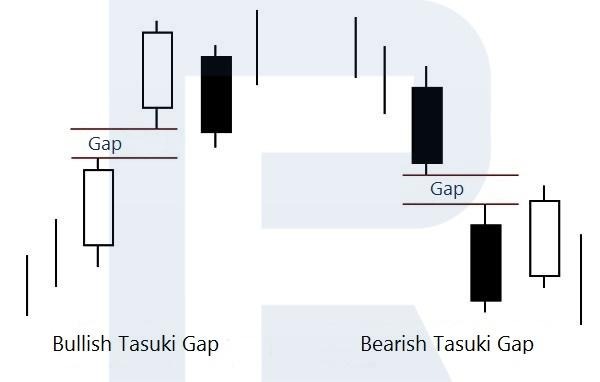

The “Tasuki Gap” candlestick pattern is formed during an ascending or descending tendency and predicts its further development. The pattern consists of three candlesticks: the first two have the same body colour with a price gap between them; the third candlestick has an opposite body colour and returns the price into the gap (between the first two candlesticks).

The first two candlesticks of the pattern show the trend direction and confirm its strength – the gap between them is evidence of that. The third candlestick, which is closed in the opposite direction, is a correction towards the previous movement. This candlestick shouldn’t eliminate the gap with its closing price – if it happens, trading the pattern is not recommended.

Types of the “Tasuki Gap” pattern

Depending on the location, the pattern can be of two types: “Bullish Tasuki Gap” (or “Upside Tasuki Gap”) and “Bearish Tasuki Gap” (or “Downside Tasuki Gap”).

Bullish Tasuki Gap

“Upside Tasuki Gap” is formed during an ascending tendency: bulls control the market and expect the growth to continue. The first white bullish candlestick with a big body appears on the chart. Later, with the market sentiment being positive, the next trading session is opened with a gap to the upside and closed with a strong white candlestick.

After that, the price is forming a descending correction, during which a black bearish candlestick appears and makes the price return to the gap. This gap is now a support level and if bears couldn’t break it with closing prices, then bulls are very likely to attack and resume the uptrend.

Bearish Tasuki Gap

“Upside Tasuki Gap” is formed during a descending tendency: bears dominate the market and believe that the decline will continue. The black bearish candlestick appears on the chart. Later, under the influence of active sales on the market, the next candlestick is opened with a gap to the downside and closed with a black body candlestick.

After that, the price is forming an ascending correction, during which a white bullish candlestick appears and makes the price return to the gap. This gap is now a resistance level. Here, bears start selling again and if bulls couldn’t close the session above the gap, then bears are very likely to resume the downtrend and update the local low.

Trading the “Tasuki Gap” pattern

Here are the methods of trading both types of the “Tasuki Gap” pattern.

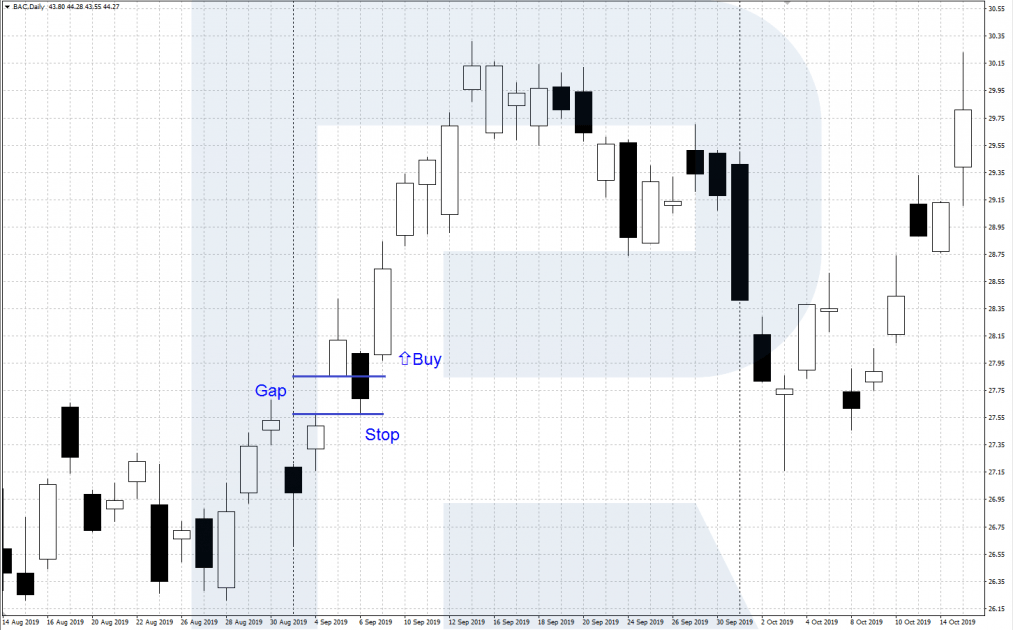

Bullish Tasuki Gap: buying

The method of trading the bullish pattern is as follows:

- A “Bullish Tasuki Gap” pattern is formed on the price chart during an ascending tendency.

- One can aggressively buy right after the formation of the third (black) candlestick with a Stop Loss order beyond the gap’s downside border. In this case, the pattern materialization probability is lower but the SL/TP ratio is more profitable.

- One can buy conservatively after the price passes the high of the second (white) candlestick with a Stop Loss order beyond the gap’s downside border. In this case, the pattern materialization probability is higher but the SL/TP ratio is less profitable.

- One can Take Profit when the price reaches an important resistance level or when there are signs of a trend reversal to the downside.

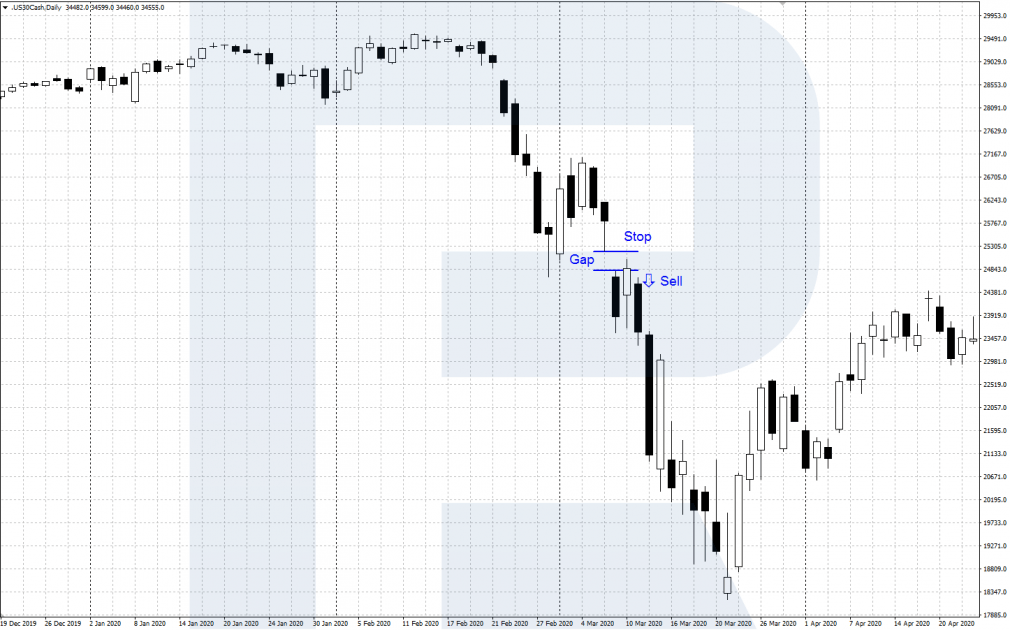

Bearish Tasuki Gap: selling

The method of trading the bearish pattern is as follows:

- A “Bearish Tasuki Gap” pattern is formed on the price chart during a descending tendency.

- One can aggressively sell right after the formation of the third (white) candlestick with a Stop Loss order beyond the gap’s upside border. In this case, the pattern materialization probability is lower but the SL/TP ratio is more profitable.

- One can sell conservatively after the price passes the low of the second (black) candlestick with a Stop Loss order beyond the gap’s upside border. In this case, the pattern materialization probability is higher but the SL/TP ratio is less profitable.

- One can Take Profit when the price reaches strong support levels or when there are signs of reversal patterns.

Recommendations for trading the “Tasuki Gap” pattern

When trading this pattern, one should pay attention to the following:

- “Tasuki Gap” must be formed within an ascending or descending tendency, it’s better not to trade it inside a sideways channel (flat).

- The pattern’s third candlestick mustn’t close the gap completely with its body. In this case, a trading signal is cancelled.

- The pattern materialization probability increases in the combination with price patterns, support and resistance levels, signals of trading indicators.

- It is recommended to use H4 of longer timeframes.

- One should always manage risks and not forget to place SL orders.

Closing thoughts

The “Tasuki Gap” candlestick pattern appears during an ascending or descending tendency (bullish or bearish respectively) and predicts its further development. Excellent addition to the pattern is technical analysis.

Before using the pattern in real trading, one should learn past statistics and historic records and practice on a demo account.

Information about other candlestick patterns can be found in this article:

The post How to Trade “Tasuki Gap” Pattern? appeared first at R Blog – RoboForex.