Airbnb and Uber published their quarterly reports for July-September, 2021 on November 4th. Performance of both companies last quarter was above expectations of analysts. I’ll share with you the most interesting facts provided by the corporations and a fresh tech analysis of their stocks.

Airbnb report for Q3, 2021: all-time high revenue and profit

An American company Airbnb, owning a dwelling rental service with the same name, reported that bookings remain abundant. In July-September, people booked dwellings and entertainment options 79.7 million times. This is 29% more than in Q3, 2020.

Also note that the number of rentals for 7 and more nights keeps growing. Over the previous quarter, this parameter has grown by 45%. In North America and Europe, the increase in the number of bookings was the most prominent.

After the Q3 report was published, Airbnb shares grew by almost 13%

The recovery of the tourist industry let the corporation reach all-time high quarterly revenue and profit. On November 5th, with such great statistics, the shares of Airbnb (NASDAQ: ABNB) grew by 12.98% to $201.62. As you remember, since January, the share price has increased by 37.3%.

The company is optimistic about the tourist industry, hoping that the vaccination campaign will drive it to the pre-crisis level. This allows making quite bold guesses about the revenue in Q4: in October-December, the revenue is to reach $1.39-1.48 billion. Analysts on average suggest $1.44 billion.

Important report details

- Revenue – $2.2 billion, +69.2%, forecast – $2.05 billion.

- Return on stock – $1.22, forecast – $0.75.

- Net profit – $834 million, +280.8%.

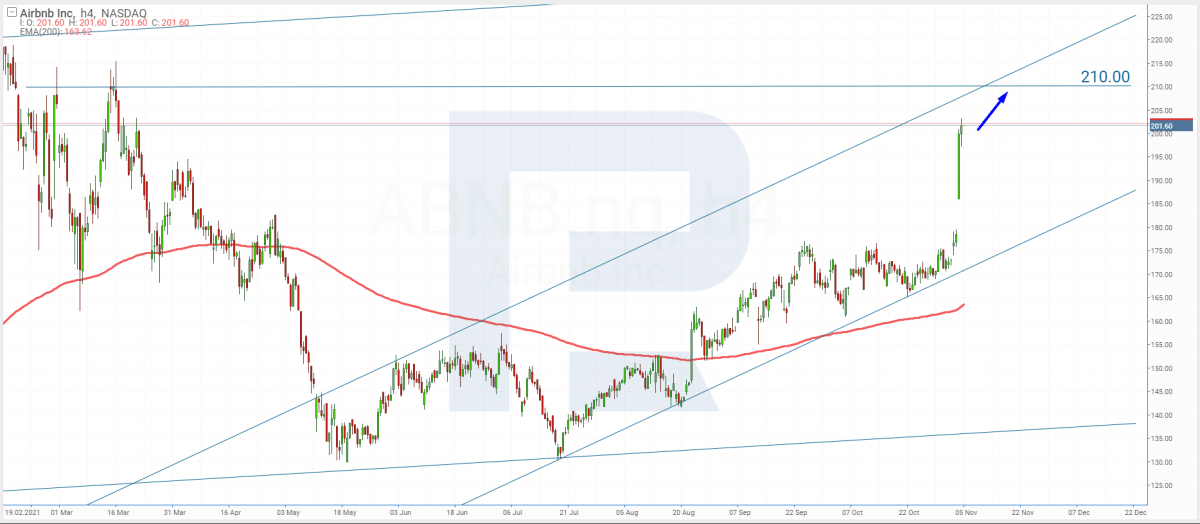

Tech analysis of Airbnb shares by Maksim Artyomov

Investors and traders are optimistic and keep pushing Airbnb shares to $210. Now the quotations keep growing after the report for Q3, 2021 was published. As long as the 200-days Moving Average is also ascending, I guess that the price will not stop there.

The nearest goal for growth is $210. If the situation with COVID-19 gets better, the company has all the chances to renew all-time highs and go on growing.

Uber report for Q3, 2021: losses grow two times

Over July-September, all segments of business of Uber Technologies demonstrated growth. Revenue from food delivery grew by 92% to $2.24 billion, from taxi – by 59% to $2.2 billion, from cargo delivery – by 40% to $402 million.

However, the size of losses also grew, reaching $2.4 billion. As you know, a year ago they amounted to $1.09 billion. The company explains the difference by the falling of the price of its share in Didi corporation. However, the share in other companies – Joby, Aurora, and Zomato – have grown, decreasing the overall loss size.

The loss in Uber Technologies amounts to $2.4 billion

Note that in the last quarter Uber reached positive EBITDA – profit of $8 million. Nonetheless, a quarter ago it reported a loss sized $509 million. In the company, they expect the revenue reach $25-26 billion in October-December and EBITDA profit – $25-75 million.

On November 5th, on the next day after the quarterly report was published, the share price of Uber Technologies (NYSE: UBER) grew by 4.24%, reaching $47.19 per share. Since the beginning of the year, the shares of the company dropped by 7.5%.

Important report detail

- Revenue – $4.8 billion, +72%, forecast – $4.42 billion.

- Loss per stock – $1.28, +106.5%, forecast – $0.34.

- Net loss – $2.4 billion, +120%.

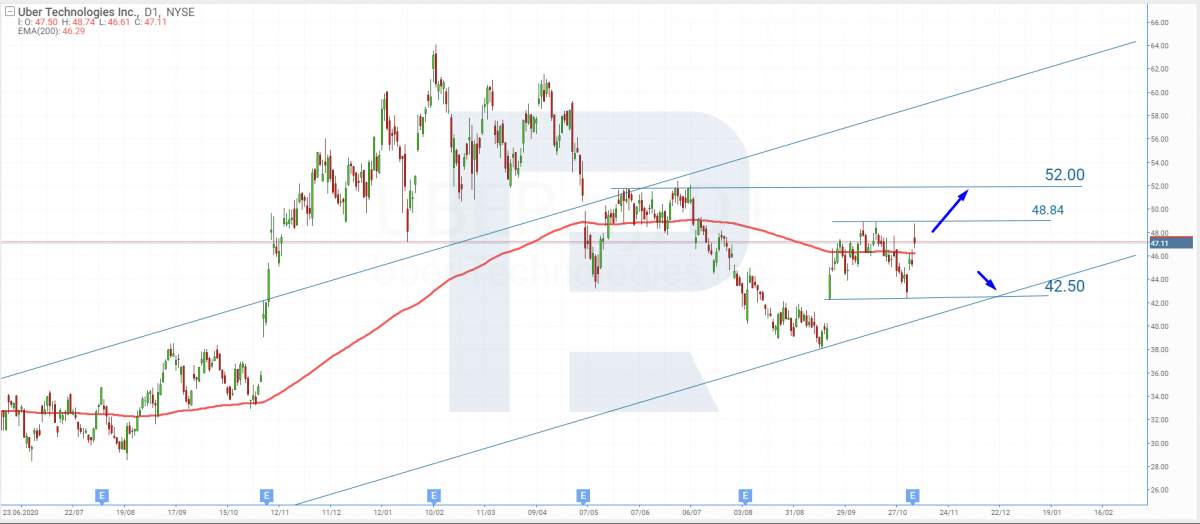

Tech analysis of Uber shares by Maksim Artyomov

Opening the trading session with a gap, Uber quotations fell down and almost covered the gap. The resistance level at $48.84 became the stumbling stone that the price failed to come over. As long as the quotations broke through the 200-days MA, I’d say that in the nearest future investor will get back their trust alongside the position of the shares.

A signal fir further growth will be a breakaway of the resistance level at $48.84, while the next goal should be $52. However, if the losses of the company keep growing, the share price might head down. In this case, the goal will be the support level of $42.3.

Summing up

On November 4th, Airbnb and Uber published their quarterly reports for July-September, 2021. The first one reported all-time high revenue and profit, while the second one – a doubled loss. Meanwhile, the shares of both corporations grew – by 12.98% and 4.24%, respectively.

More quarterly reports on R Blog

The post Airbnb and Uber Shares Are Growing After Reports for Q3, 2021 appeared first at R Blog – RoboForex.