The falling of the shares of Advanced Micro Devices Inc. (NASDAQ: AMD) has stopped, so now they are recovering gradually. It might seem that the driver of the growth was the news about buying Xilinx, but in fact, there were other reasons as well. They are what we are going to speak about today.

AMD quarterly report

On February 1st, the report for Q4, 2021 was presented. It showed that, compared to the same quarter of 2020, the revenue had grown by 49% to 4.83 billion USD. Experts had forecast 4.53 billion USD, hence the actual result became a nice surprise for investors.

The EPS grew by 77%, reaching 0.92 USD, net profit — by 76% to 1.1 billion USD. Note that the net profit has been growing for 4 quarters in a row.

Moreover, the publication of the report attracted attention by a good forecast for 2022, voiced by the company management. They expect sales to reach 21.5 billion USD — 31% more than in 2021.

After the report saw light, AMD shares leaped up by 11%. This info was enough to think about investing in Advanced Micro Devices in 2022, and yet there are more reasons for optimism.

China allows AMD to buy Xilinx

Advanced Micro Devices has long been craving for Xilinx. For the first time they spoke about a merger in October 2020. However, the process took longer than expected, and the reason was China. Mergers of large tech companies the products of which are used all over the world must be approved of by the regulators of Great Britain, Europe, the USA, and China.

China took its time giving the permission, yet on 14 February we heard that the permission had been granted — on certain conditions, of course. Joint products of AMD and Xilinx must be available in the Chinese domestic market, and their CPUs and graphic processors must be compatible with Chinese hardware.

Regulators augment rivalry

This year, a large contract between NVIDIA Corporation (NASDAQ: NVDA) and ARM Limited has never been signed. AMD is not as large as NVIDIA or Intel Corporation (NASDAQ: INTC), so its merger has not been checked so thoroughly.

This creates an idea that regulators are trying to increase competition in semiconductor markets this way, supporting AMD. Hence, Intel investors need to be extra careful.

In 2015, Intel bought Altera. At that time, it was the number two (after Xilinx) manufacturer of programmed logistic integral schemes. However, this investment never helped Intel. If AMD accounts for Intel mistakes, the merger with Xilinx can take the company to the new highs in the semiconductor industry.

AMD captures its part of the semiconductor market

Financial reports for previous quarters show that sales in AMD grow faster than at Intel. Initially, Intel management tried to explain weak statistics by the shortage of semiconductors and issues with the supply chain.

However, the publication of the AMD quarterly report that demonstrated no significant influence of the factors named above made Intel investors think otherwise. As a result, Intel is losing its positions in the semiconductor market.

Changes in the sector are confirmed by the Mercury Research that shows: the share of AMD in the processing unit market has reached 25.6%, while the share of Intel over the last two years has dropped from 78.3% to 74.4%. AMD is also nagging on NVIDIA in the graphic processor market: there the company now takes up 18%, which is also its all-time high.

Demand for semiconductors remains high

The pandemic turned out to be the best time for semiconductor companies. At that time, lots of people started learning and working from home, which augmented the demand for computers.

When the quarantine was over, the demand for goods grew unexpectedly — the price for almost everything was growing. Simultaneously, the trend for green energy got stronger, supporting the demand for electric cars. This led to a sharp shortage of semiconductors in the car industry, so that car makers had to put plants to a halt.

Add here the agitation around the 5G technology. As a result, semiconductor companies started investing actively in expanding production powers.

The pandemic is gradually becoming shadowed out, but the shortage of semiconductors remains. Companies do not insist on employees returning to offices anymore. Healthcare, agriculture, retail sales, and other sectors of economy have sped up the process of digital transformation.

Electric cars are becoming common; add here artificial intelligence, data processing centres, and the metaverse. All in all, the demand for semiconductors is only growing, and there is no clue to when it will stabilize.

Reason for shortage of semiconductors

One could figure out that the shortage of semiconductors originates in the lack of workforce or supply problems. However, the real reason was, in fact, the increased demand. Data shows that global sales of semiconductors in 2021 grew by 26% to 555 billion USD, while the number of supplied product units was over 1.1 trillion pieces.

The shortage was mostly created by the car industry. To solve the problem semiconductor companies increased production to a level never seen before, yet it was not enough because other branches of economy started creating demand.

This means that the more and deeper our life will be digitalizes, the higher will be the demand for semiconductors. Hence, this sector has potential for further growth.

Why AMD is interesting

Firstly, by attaching Xilinx, Advanced Micro Devices expands its target market by 38% from 80 billion to 110 billion USD.

Secondly, the Moody’s agency has raised the rating of AMD to A3 with a forecast “stable”. In the report, the agency states that the revenue and net profit of the company will keep growing, and one of the main parts will be played by Xilinx. The company will let AMD go far beyond the market of PCs, servers, and games. The growth of the rating to A3 is also meaningful for the shares of the company because they become available to large conservative hedge funds.

Thirdly, the popularity of Advanced Micro Devices among population and businesses grows stably. The corporation has been included in the rating of the most responsible US companies, becoming number 8 out of 500 companies in the ecologic category. The evaluation was carried out by the key indications of efficacy based on reports and independent polls.

At the first glance, joining the rating has little to no correlation with the share price. However, this is quite wrong. The poll demonstrates that the population knows the company and trusts it. This means that as long as business is facing people, there is a direct connection between the popularity of the brand and the demand for its products. In other words, the more popular the company is, the more probable it is that users will order components from it.

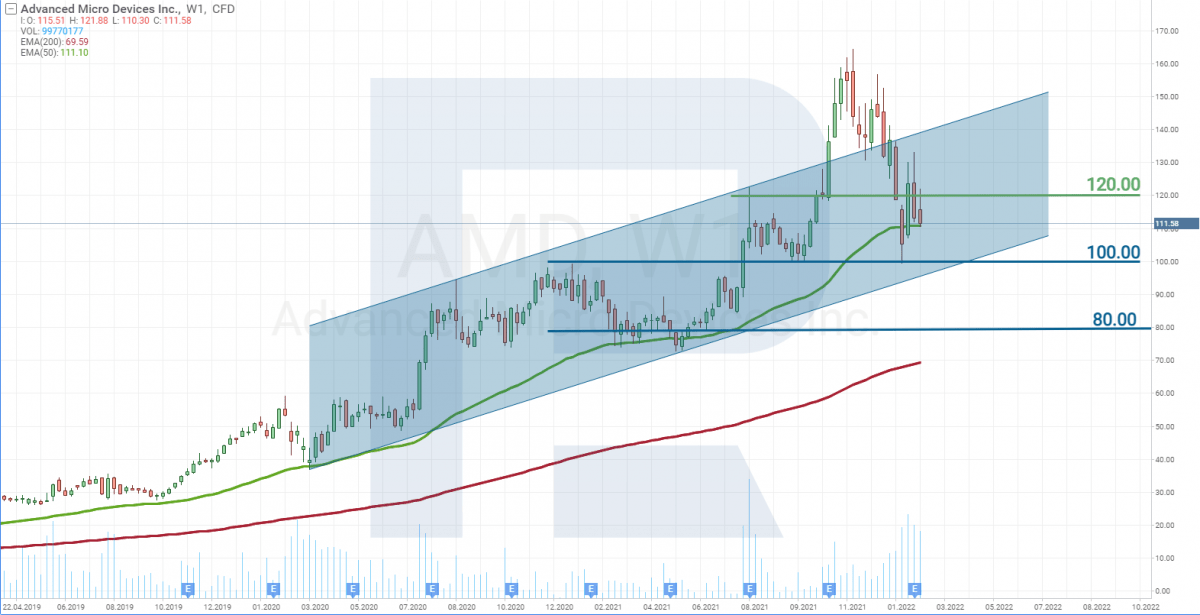

Tech analysis of AMD shares

Since 2016, the shares of AMD have grown by 6,500%. This is a crazy number, and the reason is the increased demand for its products from crypto miners.

This growth was expected to be temporary, and then analysts thought AMD shares will head down. However, miners remained interested, the car industry, data processing centres, AI, metaverse and others joined them.

In the end, in 2021 AMD shares reached their high of 160 USD and only then started correcting. Over the last 3 months the shares lost 30%, yet remain in an uptrend. The nearest support line is at 100 USD, and this is the level the shares are likely to decline to.

Why do we expect the price to fall? Since January 2022, there has been a strong correlation between S&P 500 and AMD shares. Market participants are afraid of a recession provoked by high inflation and switch to less risky assets, such as bonds. In these circumstances, the S&P 500 is falling, and it drags AMD shares after itself.

If the price breaks off the mentioned support level, it will mean the first signal for gradual growth. Otherwise the quotes might drop to 80 USD, where the 200-days Moving Average goes. This is a stronger support level, and by then the market should have included in the price all the inflation risks.

The most optimistic scenario is a breakaway of the resistance level of 120 USD. This will indicate that market players trust the company and it’s potential to reach the goals placed for 2022.

Closing thoughts

Since the beginning of the year, the tech sector turned out to be among the outsiders, hence, now shares for investments are to be looked for there. Numbers show us that Advanced Micro Devices bite by bite captures its part of the market.

Moreover, buying Filing, the company will secure it’s position and expand its target market. Do not forget: experts forecast that extremely high demand for semiconductors will remain there.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post AMD Shares: Interesting Investment but not at Current Prices appeared first at R Blog – RoboForex.