In the stock market, there are companies that have been paying dividends for decades. Is this good or bad for an investor? Let us try to find out.

Imagine we have found a company that pays 1 USD per share of dividends, which is 2% yield a year. With the current 6% inflation, this investment looks losing, the only hope being that the shares will grow. And if so, how do we get higher dividend yield, provided that the company is not planning to increase the sum of them?

In fact, things are simple: you need to catch the moment when the share price is falling, while dividend yield will be growing.

Here is an example. The shares of the company we are interested in cost 100 USD. Yearly dividends are 5 USD per share, which makes profitability of 5% a year. The share price keeps moving constantly, growing or falling depending on the overall market situation and things in the company itself.

Imagine the issuer has published a quarterly report that turned out inferior to the forecasts of experts (which is a thing that often happens). The shares fell abruptly o 80 USD. And if you buy them at this price and receive 5 USD dividends, your yield will be 6.25%.

Are there such shares in the market? Indeed, there is a company I would like to drive your attention to.

This company is AT&T Inc. (NYSE: T).

History of AT&T dividend payments

AT&T has been paying dividends since 1989, constantly increasing the sum. While in 1898 they paid 13 cents per share, now the payment size has reached 2.02 USD. With the share price of 23 USD, the yield reaches 9% a year.

For such a large and reliable company, this is impressive yield. For comparison, an AT&T rival Verizon Communications Inc. (NYSE: VZ), having a capitalization of 40 billion USD larger than AT&T, pays 2.56 USD dividends a year, which makes 5.1% yield annually. Moreover, T-Mobile US, Inc. (NASDAQ: TMUS) with a smaller capitalization does not pay dividends at all.

Why has dividend yield of AT&T become so high?

Since 2009, average dividend yield had been around 5.5% (with the inflation level being under 2%). Meanwhile, the share price had tripled over a decade.

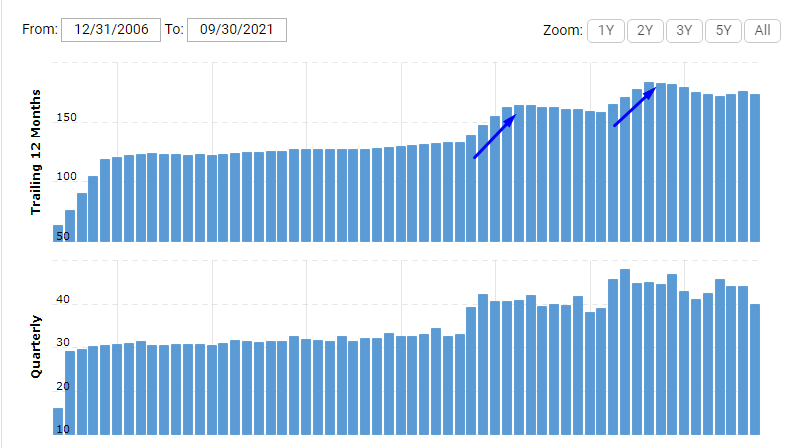

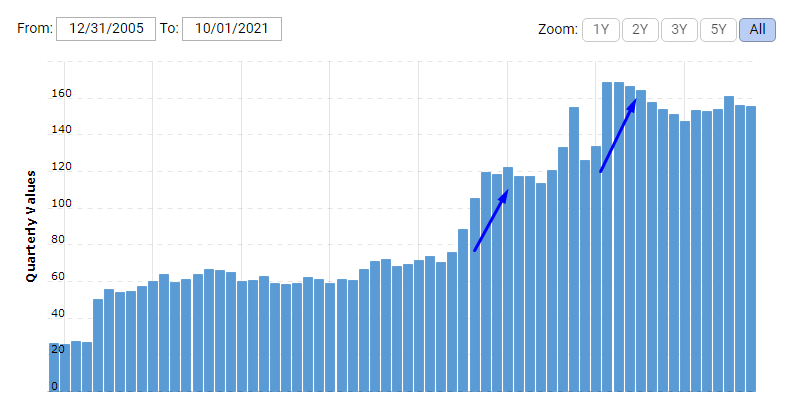

Since 2020, the profitability has been growing noticeably, finally reaching the current 9%. To keep dividend yield at this level, the company needs to make money. Look at the revenue chart of AT&T to make sure that the company is doing well:

The most noticeable growth started in 2015. At that time, AT&T bought DirecTV for 49 billion USD. The next wave of the growth of revenue happened in 2018, when the company bought Time Warner for 85 billion USD.

Those two mergers played a nasty joke with AT&T. At a certain point, the revenue increased, and the company started advancement to the streaming market. However, simultaneously, the main business of the company, which is telecom, suffered, though AT&T is mostly associated with that.

All in all, the company entered a new market but got loaded with the debts of the company it had merged with. This is also quite visible on the chart: in 2015, the long-term debt of the company grew by 60% and in 2018 – by 30% more.

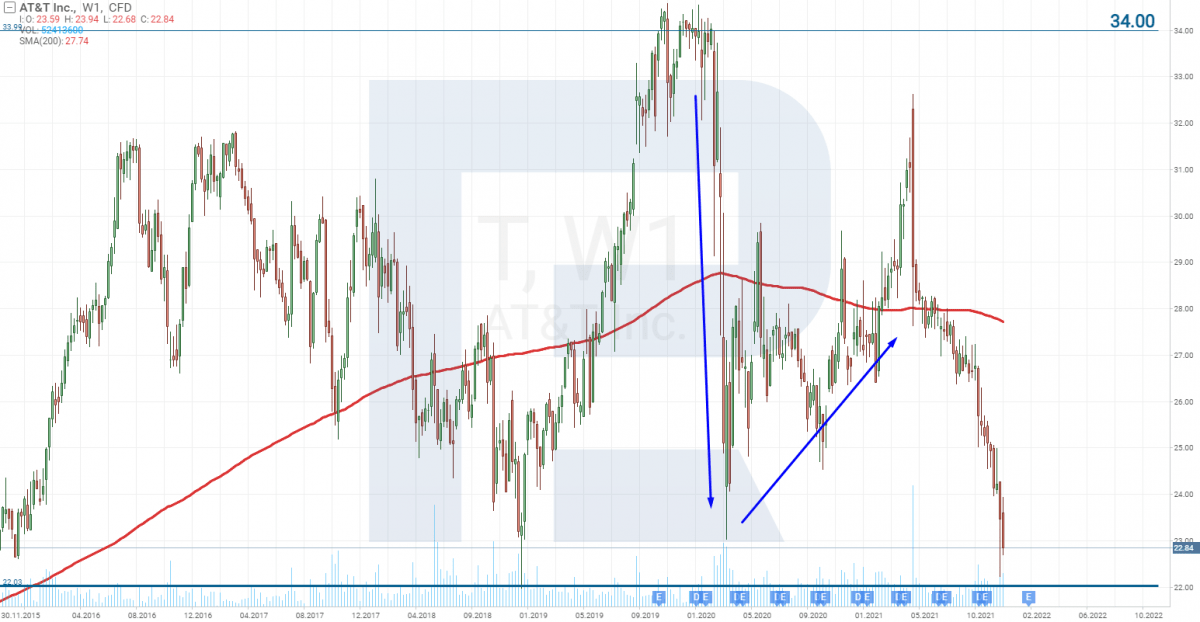

When the COVID-19 crisis broke out, the share price of the company dropped from 34 to 24 USD, then a slow recovery followed. However, with the debt being rather large, investors were not as active buying the shares as before. As a result, the shares never reached their pre-crisis levels.

The shares might have tested 34 USD several months later, yet something happened that prevented this from becoming real.

In May 2021, we heard that Warner Media (a multimedia department of AT&T) was becoming a separate business later merging with Discovery. AT&T started selling its assets.

The shares reacted by an abrupt decline. They lost 15% over two days and went on falling. As a result, the share price shrunk but dividend yield (for those who bought the shares at the lower price) increased.

How deep can the shares of AT&T fall?

In 2015, before AT&T bought DirecTV, you could by AT&T shares for about 22 USD. After Time Warner was bought, the share price grew to 34 USD. Hence, if AT&T is leaving the media market, the share price must return to those previous levels.

However, creating a subsidiary, AT&T receivers 70% of the new joint company, i.e. it will still be receiving some income, only in the form of dividends. Hence, if the shares cost 22 USD, they will be oversold.

Looking at the chart, you will see that the quotations are now at the level of 2015. Hence, the current price is optimum for investments in AT&T. Buying the shares at these levels, we will get 9% yield, even above inflation.

Risks of investing in AT&T

Leaving the media market, the company loses a part of its income; hence, it might decrease dividends as well. However, keep in mind that the spending of the company will also decrease. The merger of Warner Media and Discovery will bring AT&T a profit of 43 billion USD, which it plans to allocate for pying off the debt.

However, market players always try to include the expected events in the price, and one such event these days is the revenue of AT&T falling. So, it is hard t imagine until when the shares of the company will be falling. All the risks might be already inside the price, yet further falling cannot be excluded totally.

Good news for the company

AT&T has acknowledged its mistakes and is getting actively rid of its assets that have no connection to its main business. In particular, it is cutting off Warner Media, and a bit earlier it sold a Latin American satellite company Vrio, the developer of Playdemic games, TMZ website, and the Crunchyroll animation platform. Simultaneously, the company got rid of a part of its real estate – all this was done to optimize the business, focus on the development of 5G, and telecom services.

These measures together will decrease the long-term debt significantly and create some free cash that will be spent for the development of the main business.

Global companies optimize their business

Here, you can compare the situation with that at General Motors Company (NYSE: GM). In 2019, it started shutting down plants actively worldwide, spending all the effort on manufacturing electric cars, after which the shares started growing actively. In other words, the company optimized its business, and AT&T is doing the same.

Many other large companies have got rid of non-core assets.

General Electric Company (NYSE: GE) announced it would get rid of its medical business and airline, concentrating on energy projects.

Johnson & Johnson (NYSE: JNJ) claimed it would stop making consumer goods and focus on pharma business.

So, the actions of AT&T look reasonable, and the company has chances to catch up in the telecom market.

Closing thoughts

Dividend shares are interesting to funds because they manage billions of dollars and 9% dividend yield is quite a serious sum. AT&T is also popular among private investors, yet its share price grows so slowly, compared to, say, Apple (NASDAQ: AAPL), which means investors look for dividend payments. If the share price increases, this will be just a nice bonus.

To confirm what I have said above, I will show you the trades of hedge funds in Q3, 2021. According to the reports, 13F, фонды BlackRock Inc., MILLENNIUM MANAGEMENT LLC, and STATE STREET CORP together bought 31 million AT&T shares, and 200 more funds joined them.

The conclusion is: if you are interested in a long-term investment in a reliable company with dividends, AT&T is the issuer to give some room in your portfolio.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex.com and open a trading account.

The post AT&T: Reliable Company for Long-Term Investments appeared first at R Blog – RoboForex.