This article is devoted to the notion of the bill market: what it is, what peculiarities it has, and how to use it for trading.

What is the bull market

Bull market is a situation in a financial market when market prices are growing stably and investors are very optimistic. This term is more frequently used for the stock market yet it would be equally valid in the case of bonds, real estate, currencies, goods, and other financial spheres.

The term “bull market” describes lengthy time frames when most stocks grow stably and stock indices confidently renew highs. In other words, there is a long-term uptrend in the market: new highs and lows higher than the previous ones are set regularly. Normally, bull markets last from several months to several years.

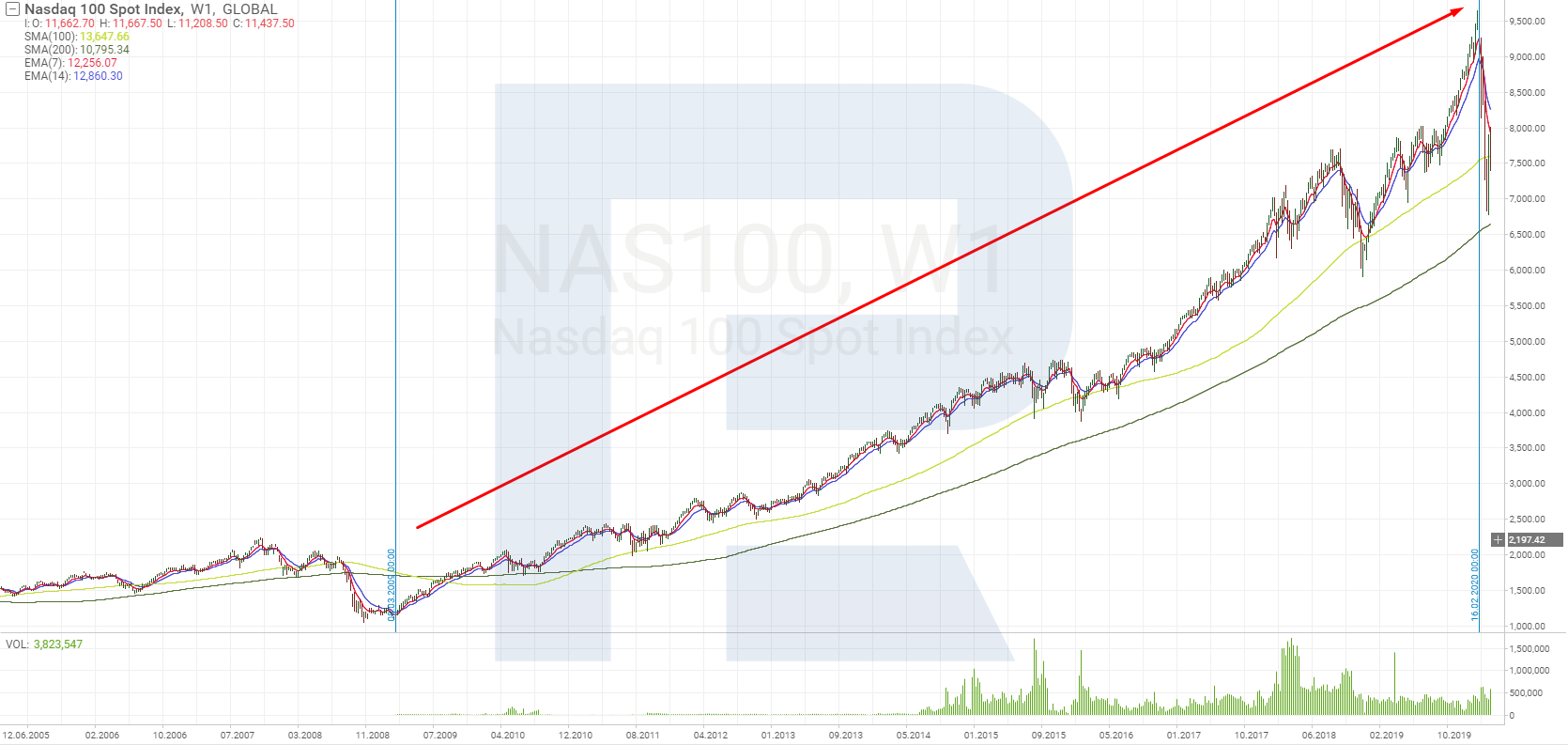

Over history, the global stock market has passed through several such times. The longest of all started right after the mortgage crisis of 2008 in the US and ended with the COVID-19 pandemic in 2019. Over these years, the Nasdaq 100 stock index grew by more than 800%, while some popular share — by more than 1,000%.

Characteristics of bull market

Such a state of things in the financial market quite often accompanies a growth cycle in the global economy. This is the most promising time for investors because companies and enterprises normally make a stable profit, and the unemployment rate remains low. In such times, people are ready to spend and invest more, and earnings in the stock market go up.

Main characteristics of the bull market:

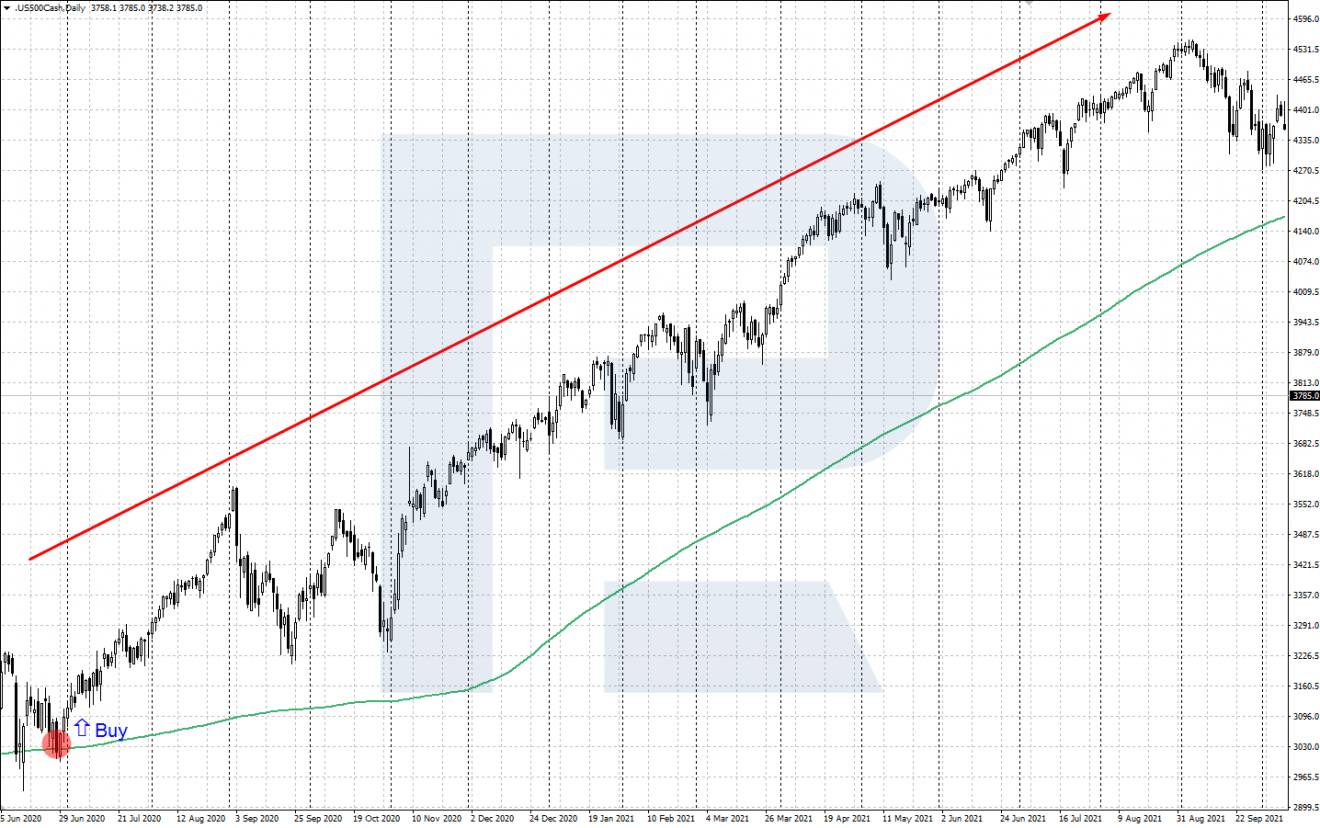

- Sustainable growth of asset prices. In the stock market context this means growth of market indices and stock prices. After minor corrections the quotes of securities and indices aim upwards again and regularly renew their highs.

- Positive economic reports. Bull markets normally happen when the economy either starts growing after a crisis or is already strong. Interest rates are rather low, the GDP is growing, the unemployment rate falls, and companies report increased profits.

- Demand exceeds supply. When economies are growing and the unemployment rate is low, investors try to buy and hold securities, hoping that their price will grow. A market appears that has more buyers who want to buy stocks than sellers.

- Optimistic market players. When the stock market and economic indices grow, investors become more confident. They are more optimistic and interpret even bad news as temporary moves that can provide a better price for buying on corrections.

How to trade in bull markets

When the prices of most assets grow, it is easier to make a profit than when the market is uncertain. So here are some popular strategies for trading in a bull market.

Buy and hold

This is the most popular way to invest in a bull market: investors buy assets and hold them for as long as possible, until some evidence of the end of the uptrend appear. By this strategies, positions are held for really long — from several months to years. The longer the market grows, the more profit investors can make on their assets.

In case the investor buys stocks, they make money on their price growth and dividends from the issuer as well. Hence, securities with large dividend payments are most attractive to buyers.

The strategy also uses popular stock indices: they help diversify investments because they consist of many shares of various companies.

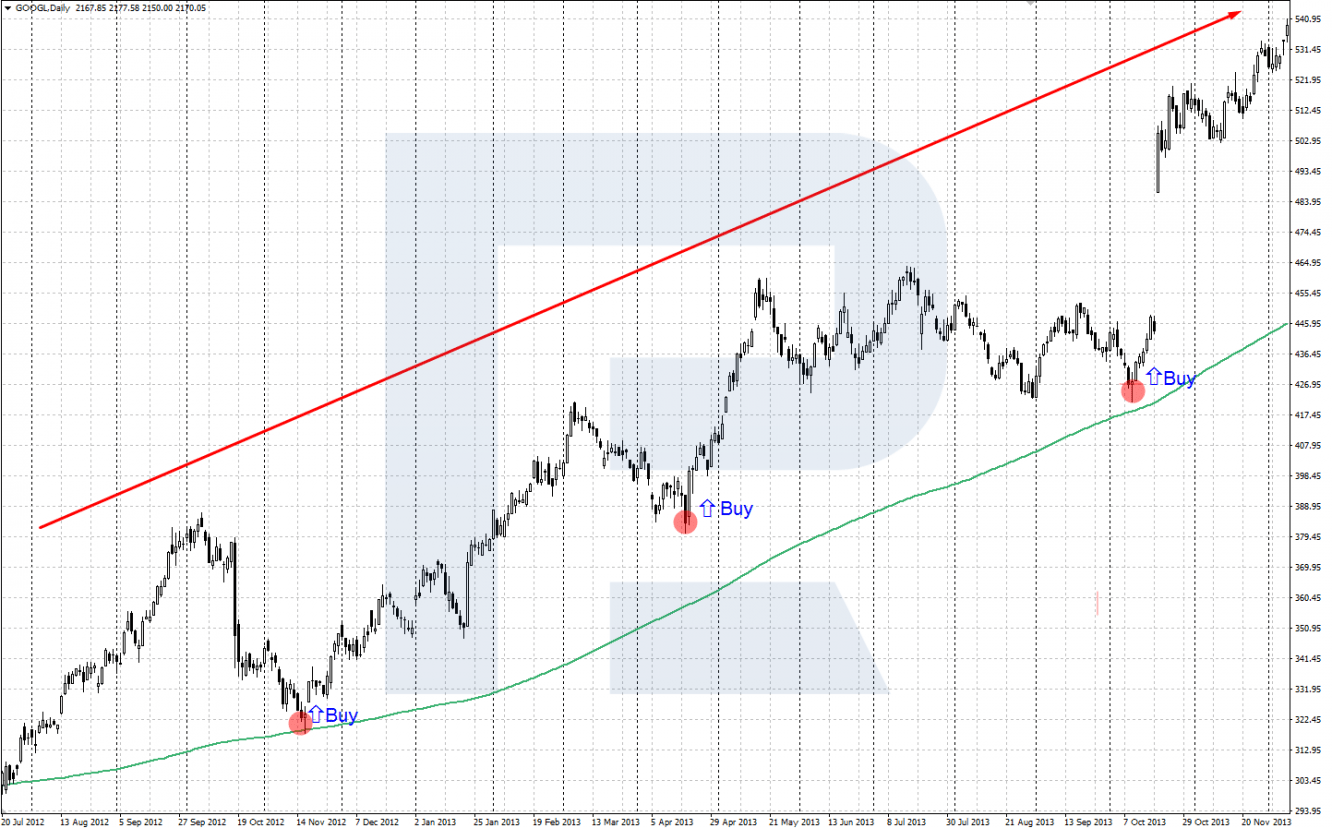

Buying on corrections

Correction is a short timeframe in which the global trend reverses. Even in the bull market price assets cannot only grow: periodically, downward corrections appear, after which the global uptrend resumes.

Investors who have enough capital, keep an eye on pullbacks and buy at good prices. This strategy is based on the idea that most probably, the bull market will continue, and more buys will bring more profit.

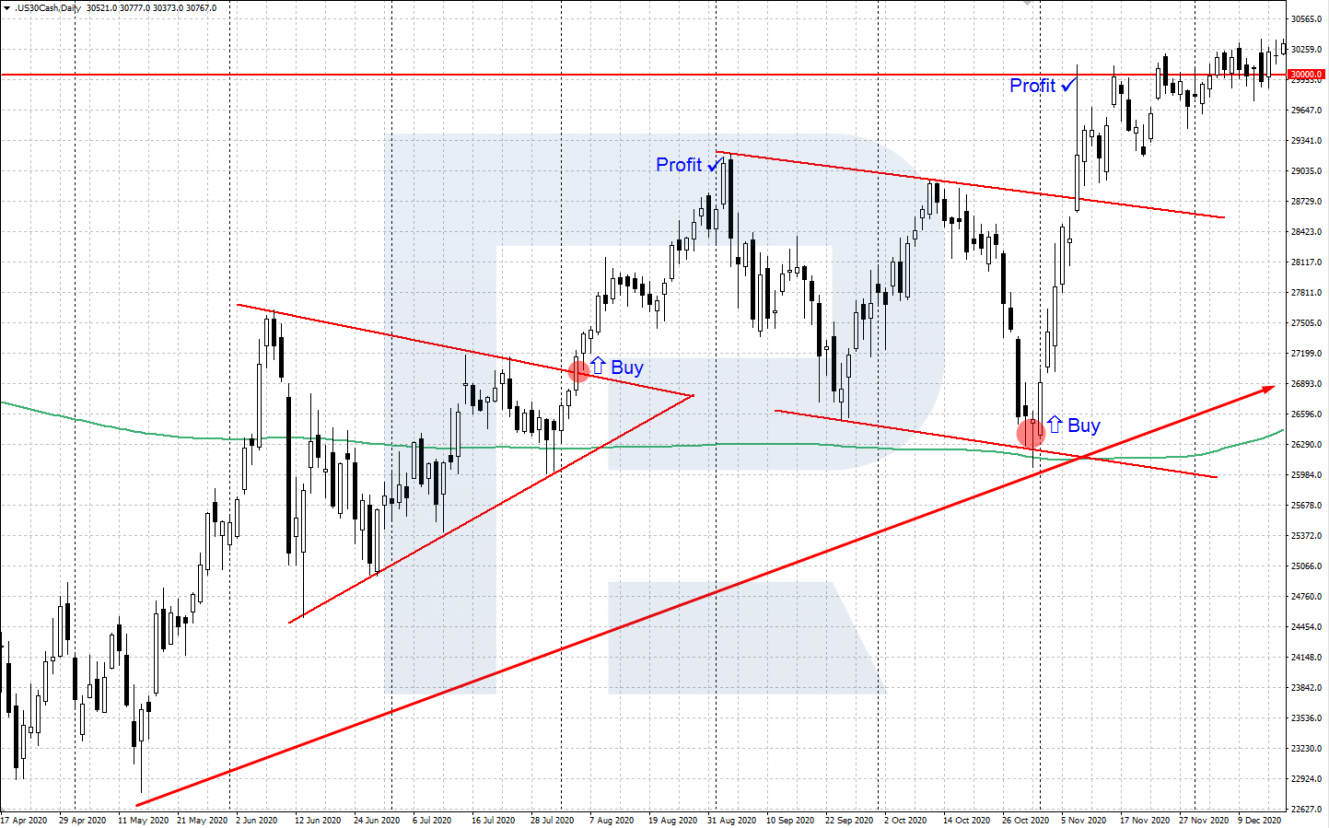

Swing trading

Swing trading is a short-term trading method by which the trader makes buys or sells, holding positions open for several days or weeks. As a rule, trading is based on tech analysis and indicators. In the bull market, the goal of swing trading is normally catching a growing wave and take the profit in time, as soon as a downward correction starts.

Bottom line

The bull market is the gold age for investors: asset prices grow steadily, and all market players are optimistic. One can make a good profit, buying assets and holding them until they grow.

However, it should be realised that a reversal and the end to the bull market is hard to predict, so the rules of risk management are to be followed immaculately.

The post Bull Market: Characteristic and Trading Principles appeared first at R Blog – RoboForex.