The European Union is reviving coal power plants. Military operations in Ukraine, sanctions against Russia, and aggressive efforts to switch to “green energy” – all these factors have made many countries revive their coal production facilities, which were closed in the past.

For stock market investors, it means that demand for coal in the European Union will be high, and since Europe is absolutely dependent on coal imports, it might have a huge influence on global prices. As a result, the companies that are involved in mining and selling coal might seriously benefit from the existing situation and make a lot of money.

High demand for coal can be spotted all over the world, not just in Europe. In the last two years, the price leaped up by over 700%. Coal mining companies that didn’t scale down their activities earlier are already making good profits, which has resulted in their shares gaining tens of percent.

The European energy crisis tells us that these stocks have a great potential for further growth. that’s why today’s article will be dedicated to coal mining companies and possible risks that may prevent their revenues from rising.

What caused the coal deficit?

High coal prices imply supply shortages in the market. Where did it come from? Almost all commodities are carrying a price hike. The first reason for that was the coronavirus pandemic, which broke existing logistics chains. Then there were military operations in Ukraine and sanctions against Russia. Because of this, logistics problems escalated and commodity supply dropped again.

Logistics have a direct impact on the final product price for consumers, and, to a lesser degree, influence coal mining. If it were all about product delivery, no one would really worry, because it’s not a problem to find transport companies that can deliver goods according to new routes – such firms have always existed and nowadays are no exception. Then there might be fierce competition between these companies, and transportation prices would finally reach stability at levels acceptable to everyone.

Supply shortages are a more serious problem, which appeared as a result of aggressive efforts to switch to “green” energy sources. Due to this, the amount of investments in the coal sector reduced, companies stopped exploring new coal deposits and started cutting down expenses. Investing in coal stocks became old-fashioned and a new trend appeared, ESG investments.

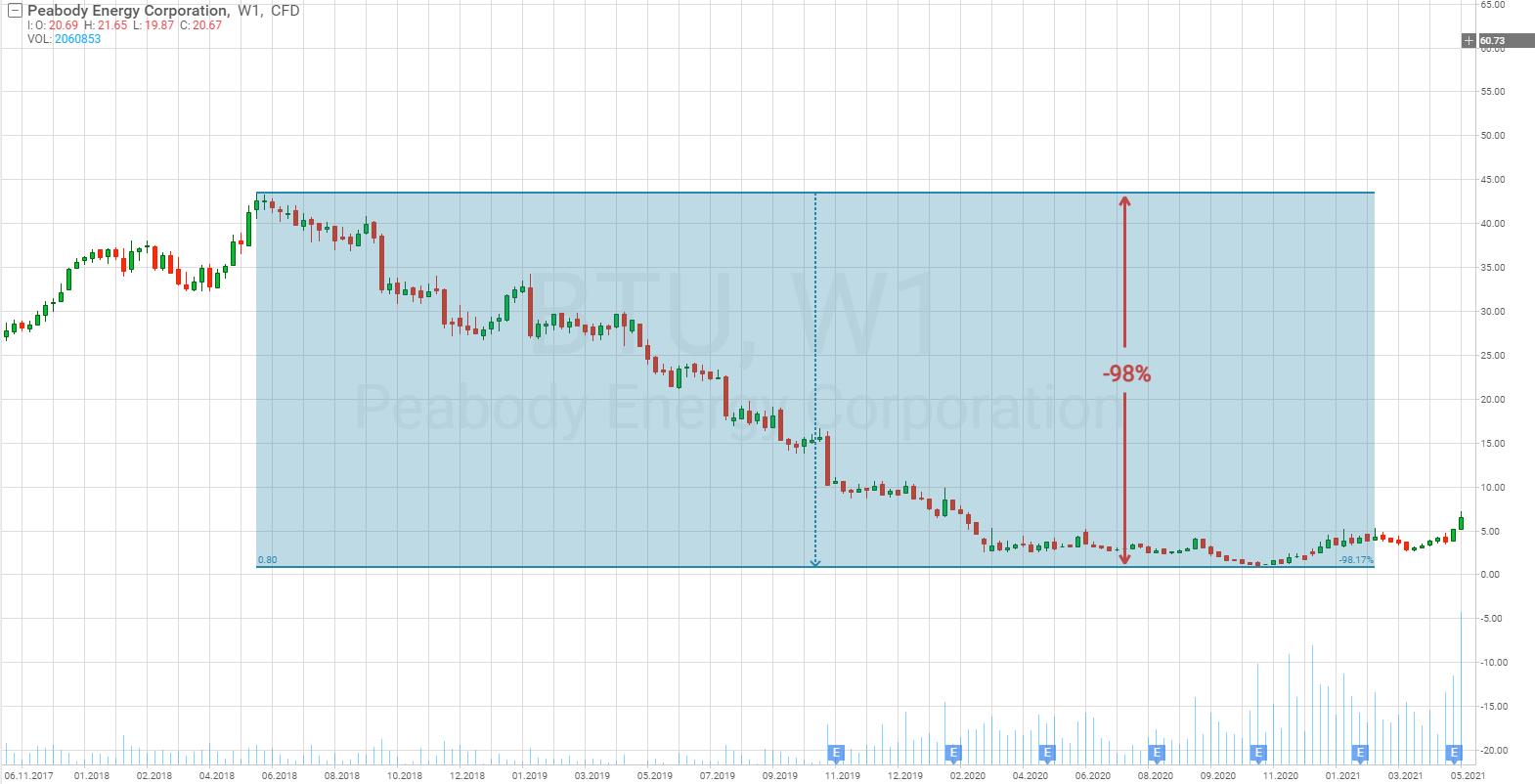

The exodus of investors from the coal industry can be easily seen in the dynamics of stock prices. For example, shares of the largest American coal mining company, Peabody Energy Corporation, started falling early in 2018 and had lost 98% by the end of 2020.

What did they plan to replace coal with?

If you elect not to use conventional energy sources, then you have to replace them with alternative ones, because the demand for energy remains the same. Coal was planned to be replaced with natural gas and atomic energetics. We’ve already discussed atomic energetics in “How to Profit from Growing Uranium Prices?”. As for natural gas, we remind you that the leading supplier of this commodity to the European Union is Russia.

Russia limits gas supplies to the EU

“Nord Stream 2”, which could have solved the issue of gas supplies expansion to European countries, hasn’t been launched. The US took advantage of the situation and started supplying their liquefied gas to Europe and captured a huge market. Russia, saying that “Nord Stream-1” required maintenance that could not be performed under sanctions, limited gas supplies through this pipeline.

Explosion at the export facility in the US

The demand for American gas, which was already pretty high since April, became much higher after limitations were imposed on “Nord Stream-1”. And if demand is high, the price goes up.

Consequently, the valuation of gas in the US started rising and boosted inflation. Consumers negatively reacted to fuel price hikes and natural gas price growth made the situation much worse. The government had to quickly respond and undertake measures to settle the situation.

However, this problem in the US was resolved in a natural way: there was an explosion at the Freeport LNG plant in Texas. 68% of shipments from this export facility are intended for European consumers. The official estimate is that the facility might get back to its normal operation not earlier than next year.

As a result, the gas that was initially exported remained in the domestic market, causing a supply growth and a 25% drop in prices. Under current conditions, the US can’t export natural gas in full due to technical reasons, but it can offer coal in any quantities.

Europe depends on coal imports

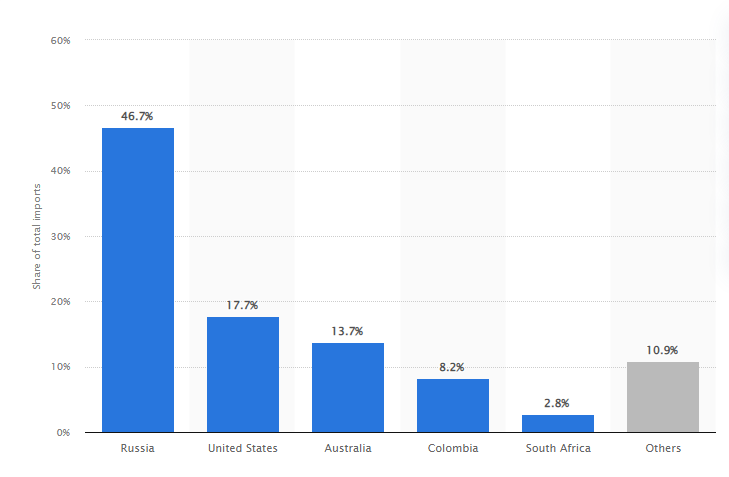

Complications with gas supplies push the European Union for unpopular measures: Europe might get back to using coal and re-launch nuclear power stations. When it comes to coal, the situation is much more complicated – in addition to gas, Europe is very dependent on coal imports as well. The 2020 data shows that the EU imports 46%, 17.7%, and 13.7% of coal from Russia, the US, and Australia, respectively.

Under conditions of a sanctions war with Russia, the US and Australia might have a great chance to become a major importer of coal to the European Union. However, considering that these countries can’t just cover the entire volume earlier imported from Russia, the demand for coal in Europe will remain high. It means that the chances that the price goes down are low.

What companies can benefit from high coal prices

Our choice turned to such companies as BHP Group Limited, Teck Resources Ltd, and Peabody Energy Corporation. Let’s take a closer look at each of them.

BHP Group

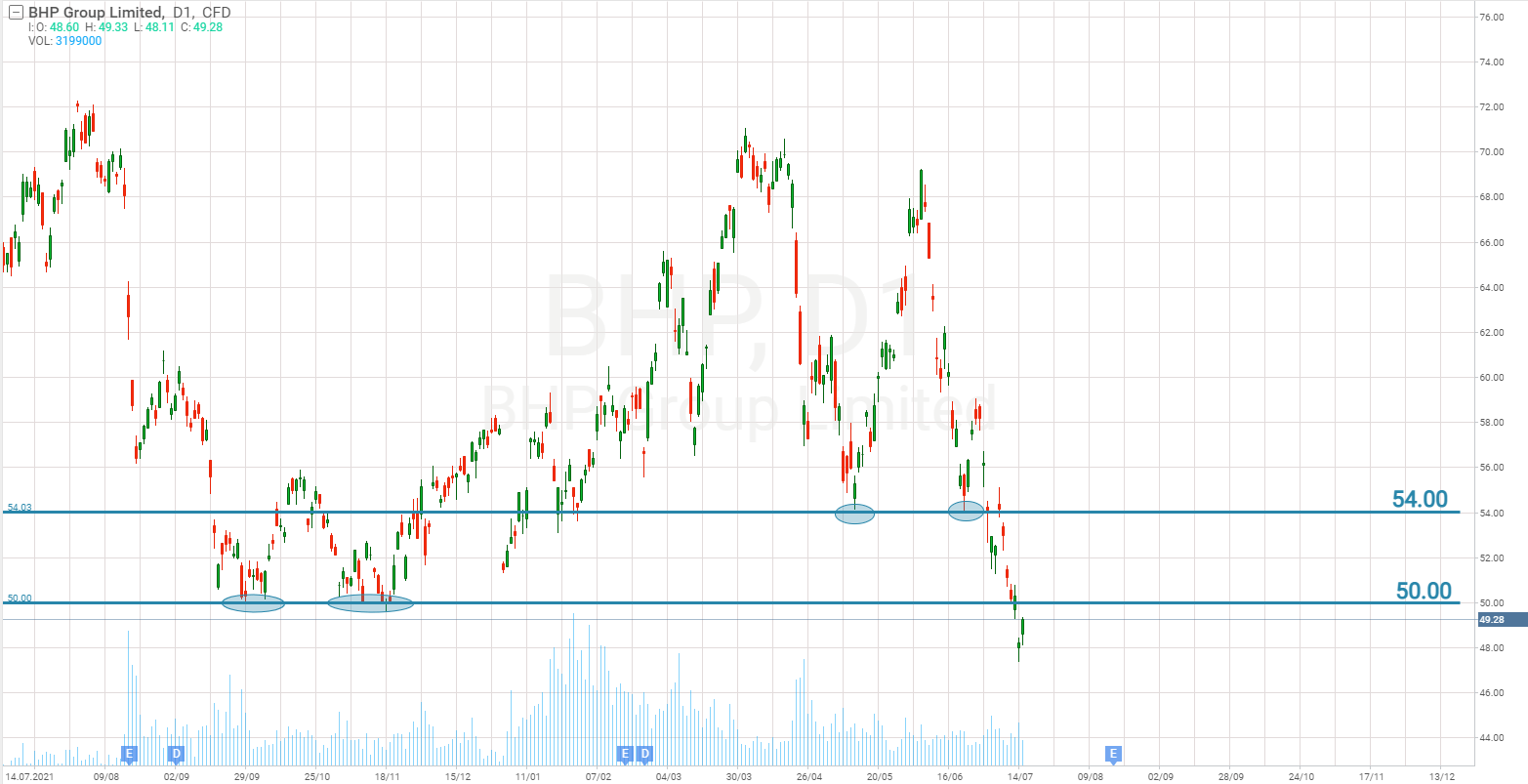

BHP Group Limited (NYSE: BHP) is the world’s largest mining company in terms of capitalisation. It operates in six segments, such as coal, copper, oil, iron ore, gas, and mineral fertilizers.

Five of these six segments, coal, copper, oil, mineral fertilizers, and gas, are currently considered bottleneck commodities. The company’s profits are diversified and its products are now more popular than ever before.

The company is headquartered in Melbourne, Australia. Its mines are located in Algeria, Australia, Brazil, Canada, Chile, Columbia, Mexico, Trinidad and Tobago, Peru, and the US. Major consumers of BHP Group Limited products are the US, Europe, and Asia.

The BHP Group Limited stock broke the support at $50 and is currently trading below it. If the price breaks this level upwards, it may resume growing to reach the closest resistance at $54.

Teck Resources

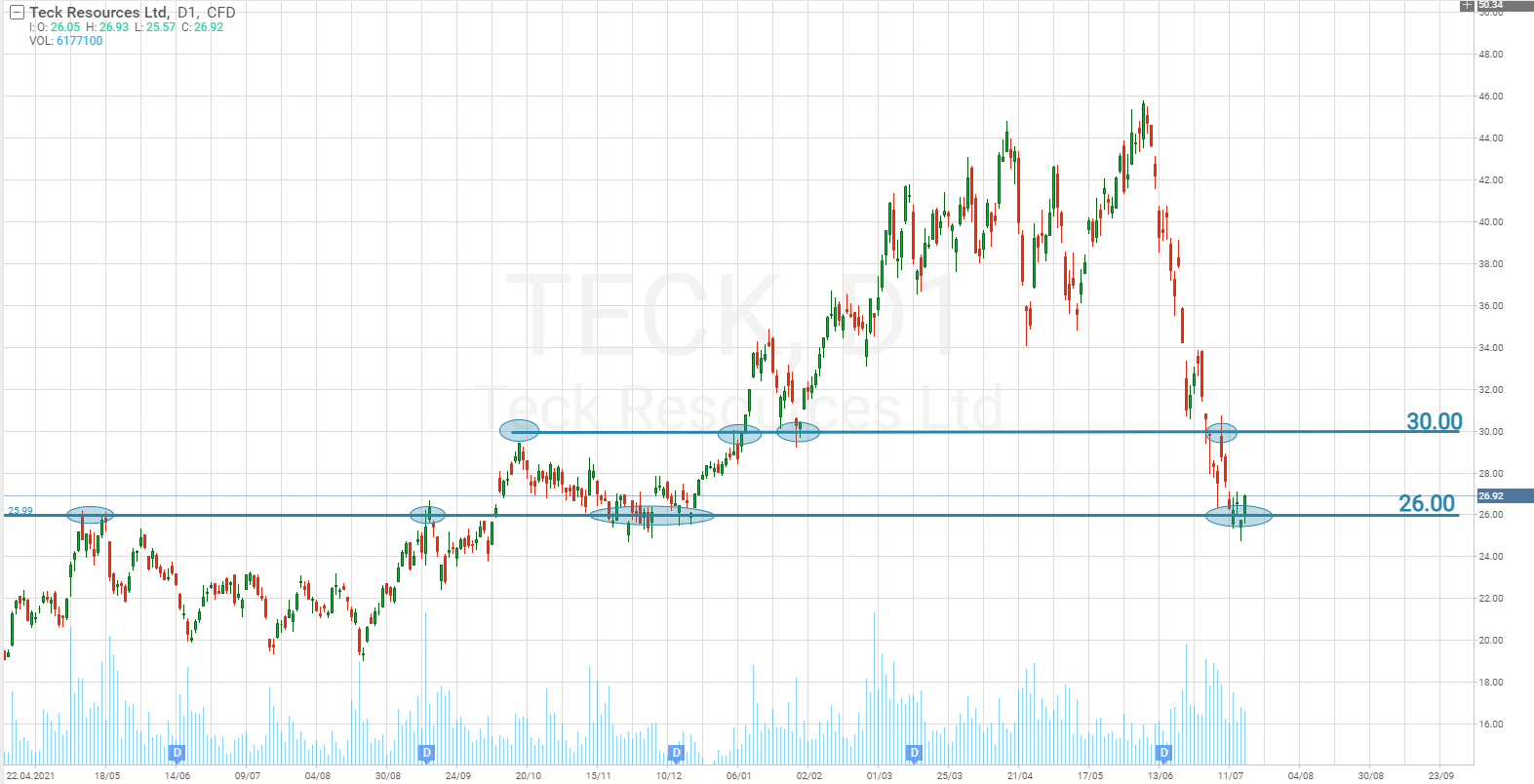

Teck Resources Ltd (NYSE: TECK) is a Canadian mining company, which is engaged in the exploration, extraction, and distribution of mineral resources, including coal. In 2021, 55% of the company’s gross profit came from coal. Teck Resources mines coal in Peru, the US, Canada, and Chile.

In its latest report on sales and coal prices, the company announced a 164% annual growth in sales of coal. Such a high volume was reached at a time when the Canadian Pacific Railway was shut down due to a strike, which broke logistics in this region. If the price remains high, Teck Resources might exceed this number in the future when rail communication is restored.

Railway lines are used by mining companies to deliver mineral resources to harbours where they are loaded on board and then sent to consumers. The railway strike had a negative influence on Teck Resources shares: they dropped to the support at $26. Right now, the bulls are trying to hold this level. The closest resistance is at $30.

Peabody Energy

Unlike the companies mentioned above, Peabody Energy Corporation (NYSE: BTU) has no income diversification to show for. Its activities and operations are focused only on mining coal, most of which is delivered to energy producers.

Coal is mined in the US, Japan, Taiwan, Australia, Indian, Indonesia, China, Vietnam, and South Korea. In addition, Peabody Energy holds majority shares of 23 American and Australian mining companies, which are leading suppliers of coal to the European Union.

In 2010, Peabody Energy undertook a study and came to the conclusion that the world was at the early stage of a 30-year super cycle in the coal market. Major consumers would be China, India, and the US. 12 years later, it’s safe to say that this forecast stands a good chance of coming true because coal prices are now close to their all-time highs and it’s difficult to assume when demand will go down. The company predicted an increasing demand for coal but couldn’t keep afloat and initiated bankruptcy procedures in 2016. It helped avoid environmental pollution claims and restore its business health. In 2017, the company emerged from bankruptcy and went public. In about a year, Peabody Energy shares leaped up 70% of the IPO price.

ESG investing was growing in popularity quickly and market players started refusing to invest money in coal mining companies. As a result, Peabody Energy got under pressure and plummeted 98%. Under the circumstances, one might expect another bankruptcy, but the company managed to survive the pandemic and is currently on to a good thing. After rebounding from local lows, the stock skyrocketed and has leaped up 2,500% in comparison to the lows of 2020.

Risks of investing in coal mining companies

In attempts to fight inflation, the US Fed is raising the benchmark interest rate, thus slowing economic growth down. Other central banks are doing exactly the same. There are a lot of talks and rumours about a recession and stagflation, which are marked by a falling demand and the reduction in prices.

A falling consumer demand might lead to the decline of production and, as a result, the demand for energies from enterprises will also drop. It means that supply and demand for coal might find some kind of a balance. In addition, if Europe finally solves its gas issues, coal prices might go down.

Summary

Sri Lanka has found itself in an interesting situation: the government took extreme measures to please “green activists” and elected to use natural fertilisers, such as manure, instead of chemical fertilisers used in the past. However, a bit later it emerged that there weren’t enough natural fertilisers in the country to meet farmers’ needs. Eventually, instead of exporting rice, Sri Lanka found itself being an importer. Then there was a crisis with all the consequences that came with it.

Some parts of the global community did exactly the same, trying to switch to “green” energy. However, they didn’t think that the amount of alternative energy might not be enough to meet all needs. That’s why we are now witnessing a return to conventional energy sources.

No one really knows how long this tendency will last, but it’s already quite clear that there is no quick solution. In the next several years, coal will stand a good chance of being a very popular source of energy. If Peabody Energy’s study about a 30-year super cycle turns out to be correct, we’re probably in the middle of it right now.

The post Coal: Demand Exceeds Supply. What Companies Are Worth Paying Attention To? appeared first at R Blog – RoboForex.