A ban on legally buying some goods and services that are still in demand creates perfect conditions for the development of a grey market. Though illegally, it satisfies the demand for the banned goods and services. Meanwhile, the government makes no profit on this commercial activity.

If the harm made by the use of these goods and services is less than the harm from the ban, the government gradually takes it off. The issue of harm is quite often philosophical while the issue of legalisation is always about finance.

When the grey market reaches an impressive scale of billions of dollars, the government cannot resist the temptation to count possible profits from taxation if the said sphere is legalised.

Compare legalisation of marijuana and online sports betting

In October 2018, Canada legalised use of marijuana. After that companies in connection with this product carried out IPOs, and their stock prices sky-rocketed by thousands of percent.

There is another sector that has much less obstacles for growth than the cannabis sector, and this is online betting. In the same 2018, the US Supreme Court lifted the ban off betting activity, which means each state may now regulate this business on its own.

With legalising marijuana, the situation in the US is the opposite: certain states allow using it but on the federal level the ban has not yet been lifted. This state of business substantially hinders investments in this sector.

Assessment of online sports betting market

The federal ban has been taken off online betting, now it is time for separate states to legalise the business. Now these activities have been approved of in 17 states which are home for 36% of the population of the country. Other states are in the midst of discussion, ready to make some decision in the nearest future.

To draft the scale, several digits will be enough. According to the American Gaming Association (AGA), in 2018 there were bets made for 150 billion USD in the US grey online betting market. In 2022, the market volume is expected to reach 500 billion USD.

In the end of 2019, one of the largest companies in the market of online sports games, betting, and gambling DraftKings Inc. (NASDAQ: DKNG) carried out an IPO by a merger with Diamond Eagle Acquisition Corp.

Its quotes started going up slowly, and just 3 months later the share price doubled. However, they started falling again and soon returned to former levels.

What we know about DraftKings

DraftKings was founded in 2012 and initially offered virtual baseball games to clients. As long as online betting was still illegal, the company started organizing online tournaments.

Users form a fantasy team and play with each other. To participate in the games, users have to pay a fee in real money. The winner, in turn, gets a real reward comprised of the fees. The company charges 10% of each fee.

In 2013, DraftKings paid 50 million USD of rewards. Over a year, it added football, hockey, and baseball to the list of games. In 2014, DraftKings became the second-largest company offering online sports games. In the same year, it bought a rival DraftStreet, increasing the client base by 50%.

DraftKings enters the EU market

In 2015, the company entered the British market, getting licensed for betting activities. A year later, it got licenses all over the EU.

The company decided to capture the whole of the market and decided to merger with FanDuel, the second-largest company in the segment. However, the US Federal Trade Commission blocked the trade. In 2018, DraftKings became the first American company offering legal online sports betting.

Why DraftKings shares grew by 600%

In March 2020, when the stock indices headed downwards, DraftKings shares started growing. As you remember, at that time the COVID-19 pandemic started. During the pandemic, investors noticed various companies providing online services. This interest made DraftKings shares grow by 600%.

When quarantine measures became less tough, investors hurried to get rid of these shares. No one tried to check whether the company had any potential for further growth and whether they depended that much on the pandemic. In 2022, the trend got stronger,, so now DraftKings shares cost like 2 years ago.

DraftKings partners

In 2020, DraftKings announced partnership with Entertainment and Sports Programming Network (ESPN). This is an international sports channel owned by Walt Disney Company (NYSE: DIS). By the agreement, DraftKings integrates in studio shows of the channel.

In March 2021, the company signed one more agreement – with Dish Network, an American television provider. By the agreement, DraftKings Sportsbook and Daily Fantasy apps will be integrated in the DISH TV Hopper platform.

These agreements, alongside further legalisation of the betting business in different states has let the company improve its financial situation noticeably. The report for Q4, 2022 demonstrate that the revenue of the company grew by 190% to 473 million USD over 2 years.

Lockdowns are mostly over but the revenue of the company keeps growing. Hence, the fears of investors that after the pandemic the company will be unable to keep growing did not come true.

DraftKings CEO Jason Robins publicly announced that investors that are now selling the shares of his company would later be sorry for all their lives. However, Robins has never bought the shares of his company – insider shares show this quite unequivocally.

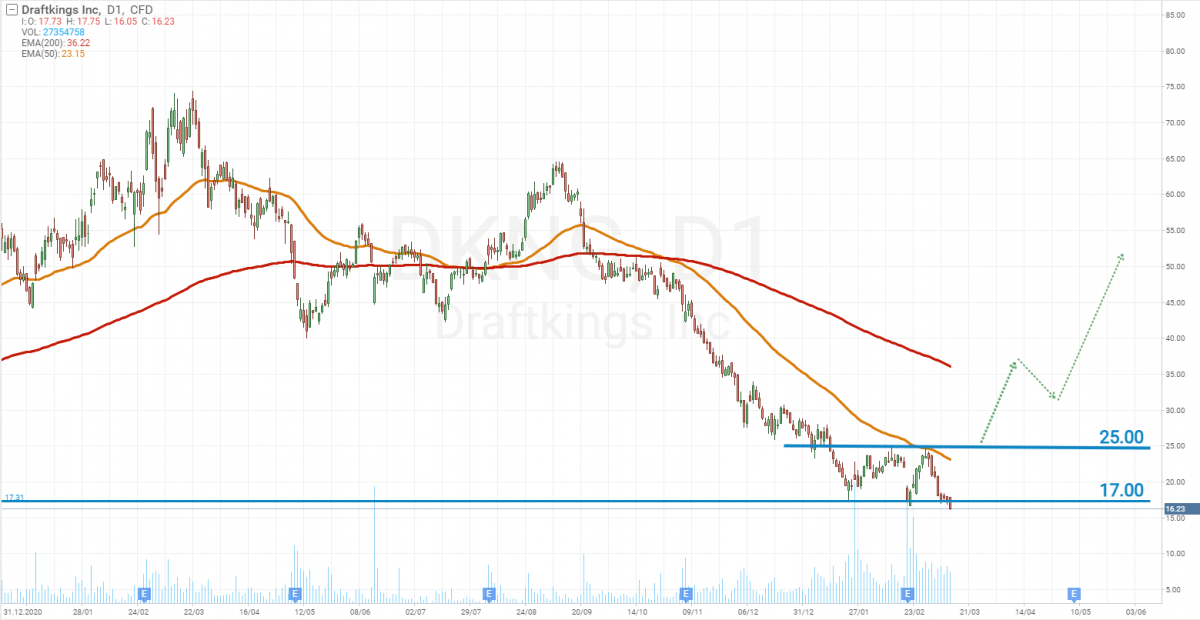

Tech analysis of DraftKings shares

DraftKings shares are trading under the 200-days Moving Average, which indicates a downtrend. The 50-days Moving Average is also above the price, with no evidence o a reversal. Moreover, on 11 March the quotes broke through the support level at 17 USD downwards, which means the possibility of further decline.

The first sign of an upward reversal will become a breakaway of the 50-days MA and of the resistance at 25 USD.

Closing thoughts

Full legalisation of online sports betting in the USA will definitely make DraftKings revenue grow. As long as this market is growing fast, the company does not even need to extend its presence in the market: share price charts will go on going up.

In these circumstances, the forecast of the management saying that in the long run the yearly income of the company can reach 6-9 billion USD does not look that unrealistic.

However, before deciding to invest in DraftKings, it would be better to wait for the chart to demonstrate evidence of growth, rising over the 50-days MA and the resistance level of 25 USD.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.