This article will explore current trends and prospects for the gaming industry. We will look into the main areas of this rapidly growing industry, get to know the leading companies in the market and analyse opportunities to invest in their stocks.

Introduction

The video gaming industry originated in the mid-1970s, starting with a small group of enthusiastic scientists aiming to demonstrate computer capabilities beyond heavy computing. Over a few decades, this industry grew from a small market into a multi-billion dollar economic sector: according to Newzoo, total revenues of the gaming industry reached 184.4 billion USD in 2022.

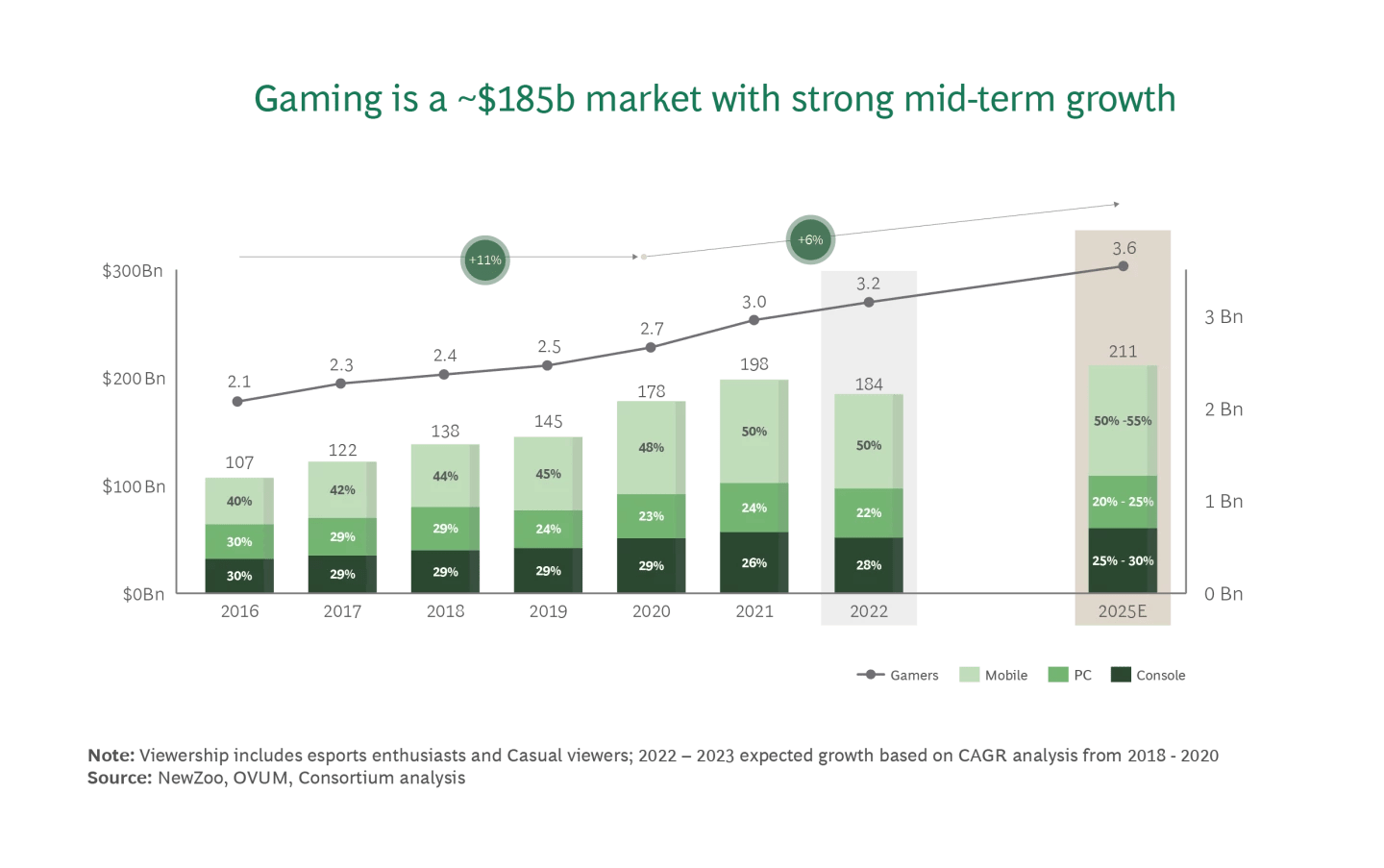

Nowadays, the video gaming market encompasses the entire industry involved in creating, developing, publishing, distributing, and monetising video games. It covers a wide range of products, including consoles, PCs, mobile games, and online games. This includes equipment and accessories such as game consoles, controllers, and virtual reality headsets. The gaming market is a rapidly growing industry, with the number of video gamers increasing from 1.5 billion to 3 billion from 2016 to 2021 inclusive.

Overview of the Gaming Market

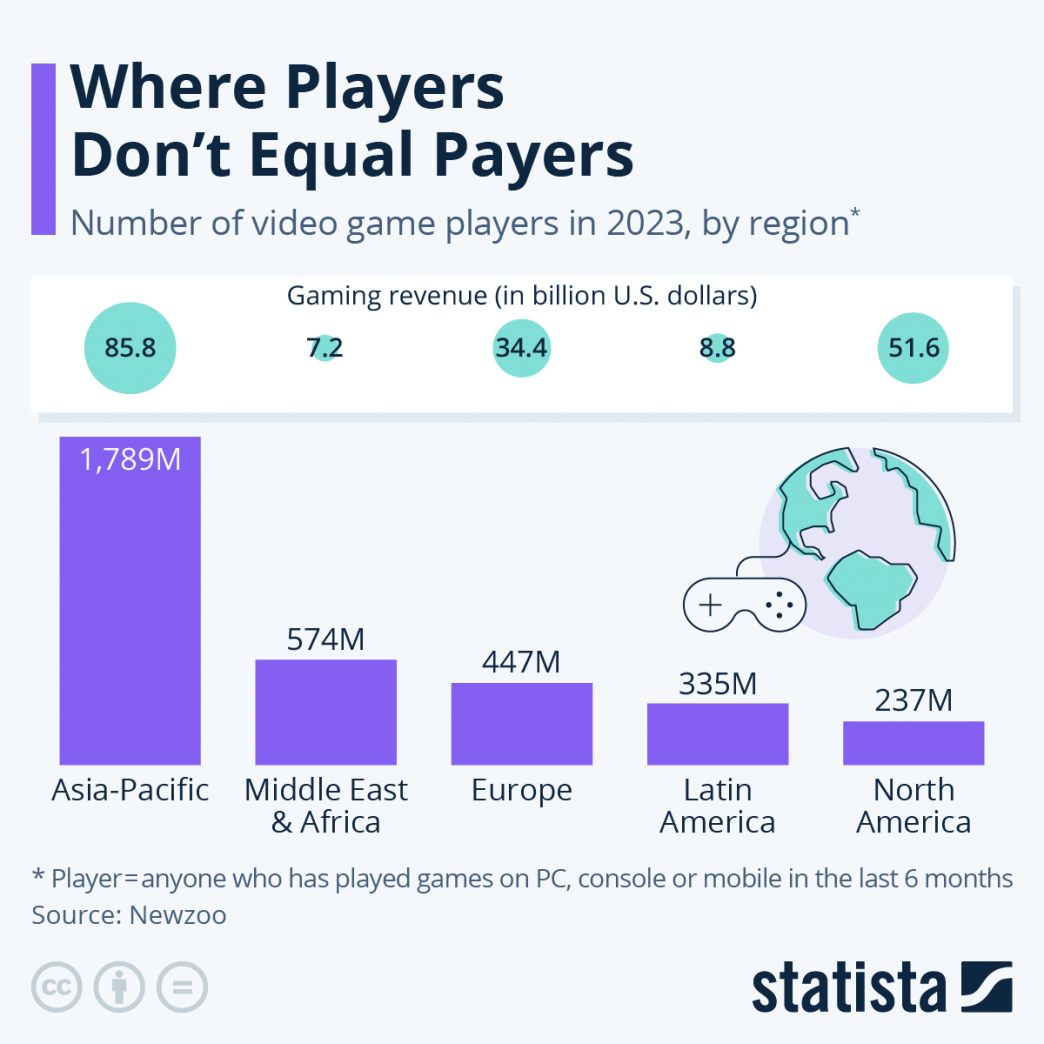

According to Newzoo, the global number of video game players reached approximately 3.38 billion in July 2023. By region, this is distributed as follows:

- The Asia and Pacific region – 1.79 billion

- The Middle East and Africa – 0.57 billion

- Europe – 0.45 billion

- Latin America – 0.34 billion

- North America – 0.24 billion

Newzoo estimates overall revenues of gaming companies in 2023 at 187.7 billion USD, which are distributed by region as follows:

- The Asia and Pacific region – 85.8 billion USD

- The Middle East and Africa – 7.2 billion USD

- Europe – 34.4 billion USD

- Latin America – 8.8 billion USD

- North America – 51.6 billion USD

The Middle East is currently considered one of the most promising markets for the gaming industry. Governments of the Persian Gulf countries invest heavily in developing this sector and actively implement strategies to attract gaming companies.

PC vs Mobile Gaming

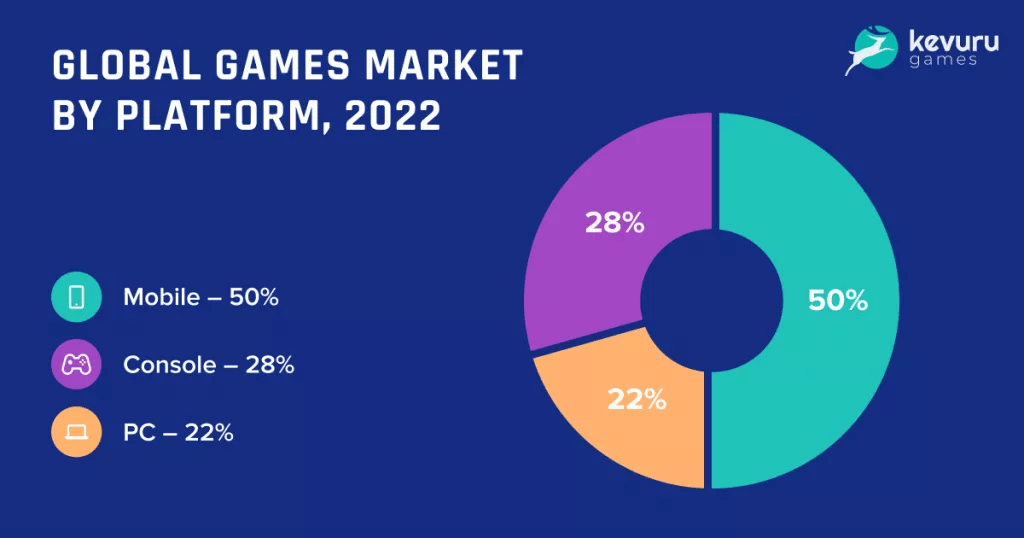

Mobile devices have been the main driver of growth in the gaming market over the last years, with their share of the overall industry revenue rising from 40% in 2016 to 50% in 2022, according to the BCG survey. However, this does not mean interest in PCs and consoles has declined: experienced gamers still prefer these devices thanks to more engaging and sophisticated gameplay. Furthermore, the PC and console market is growing, driven by the rapid development of game streaming as separate content, which is attractive to both professional players and common users.

According to Kevuru Games, total video gaming market revenues of 184.4 billion USD in 2022 were distributed by segment as follows:

- Mobile games – 50%, 92.2 billion USD

- Consoles – 28%, 51.8 billion USD

- PCs – 22%, 40.5 billion USD

Factors that have driven growth in the mobile game sector

- Accessibility: a smartphone is always on hand

- Enhanced performance: mobile devices have greater processor power and operating memory

- Adaptation of popular games by developers to mobile devices

Factors driving demand for PCs and consoles

- Big monitors, three-dimensional sound, and convenience in operation

- Excellent high-resolution graphics

- Multiplayer games

- Esports tournaments

The Future of the Gaming Industry

Let us explore four trends that might have the most significant impact on the development of the gaming sector in the future:

- Audience growth and demographic shifts

- M&A activity

- New technologies

- New market players

Audience Growth and Demographic Shifts

The gaming industry continues to develop, drawing strong interest from various social groups. Mobile games are now popular among people of all ages, especially in Western European and North American countries. According to BCG’s data, the average player is 31 years old.

While children and the youth still account for a large part of new players, Generation Z becomes the first group to allocate as much time to gaming as watching videos. The audience expands as the number of children joining the gaming world constantly increases.

According to data from the Playtoday portal for 2022, gamers in the US were allocated by age group as follows:

- Below 18 years old – 24%

- 18-34 years old – 36%

- 35-44 years old – 13%

- 45-54 years old – 12%

- 55-64 years old – 9%

- 65+ years old – 6%

M&A Activity in Gaming

The video game industry has already undergone a significant consolidation. This trend is projected to persist in the near term since large publishers, media companies, and tech giants are actively buying gaming studios and other assets in the global market. According to BCG, more than 650 gaming mergers and acquisitions were announced or closed in the first six months of 2022.

New Technologies

- Cloud-gaming. Popular video games may drive a wider use of cloud-based technologies among consumers. This trend appears to have long-term prospects but requires significant investments in infrastructure like 5G networks and edge data centres

- Metaverse. The Metaverse concept is a virtual world with a unique economy based on virtual reality, augmented reality, and NFT. Games have already considerably impacted the Metaverse’s formation and development. For example, Second Life and World of Warcraft created exciting virtual spaces for gamers to spend time and trade various digital assets. This trend is likely to strengthen in the years to come

- Play-to-Earn Gaming (NFTs/Blockchain). In 2017, CryptoKitties introduced an innovative game model that uses NFTs. For example, Web3 games such as CryptoKitties and NFL Rivals are based on the blockchain and decentralisation principles but face challenges relating to speed and user-friendliness. Play-to-earn crypto games give the impression of quite a promising trend

New Market Players Entering the Gaming Sector

- Investment funds consider an opportunity to diversify their portfolios with gaming stocks

- Media companies may capitalise on gaming intellectual property and more large-scale gaming concepts

- Intellectual property owners may benefit from collaboration with gaming companies and use intellectual property to create a potentially diversified income flow

- Tech companies may find a synergy between their own assets and the gaming industry by creating highly demanded products in the infrastructure

- Communications service providers may team with the leading gaming companies to provide clients with access to exclusive game publications and introduce in-game advertising of their products

TOP-10 Publishers in the Gaming Industry

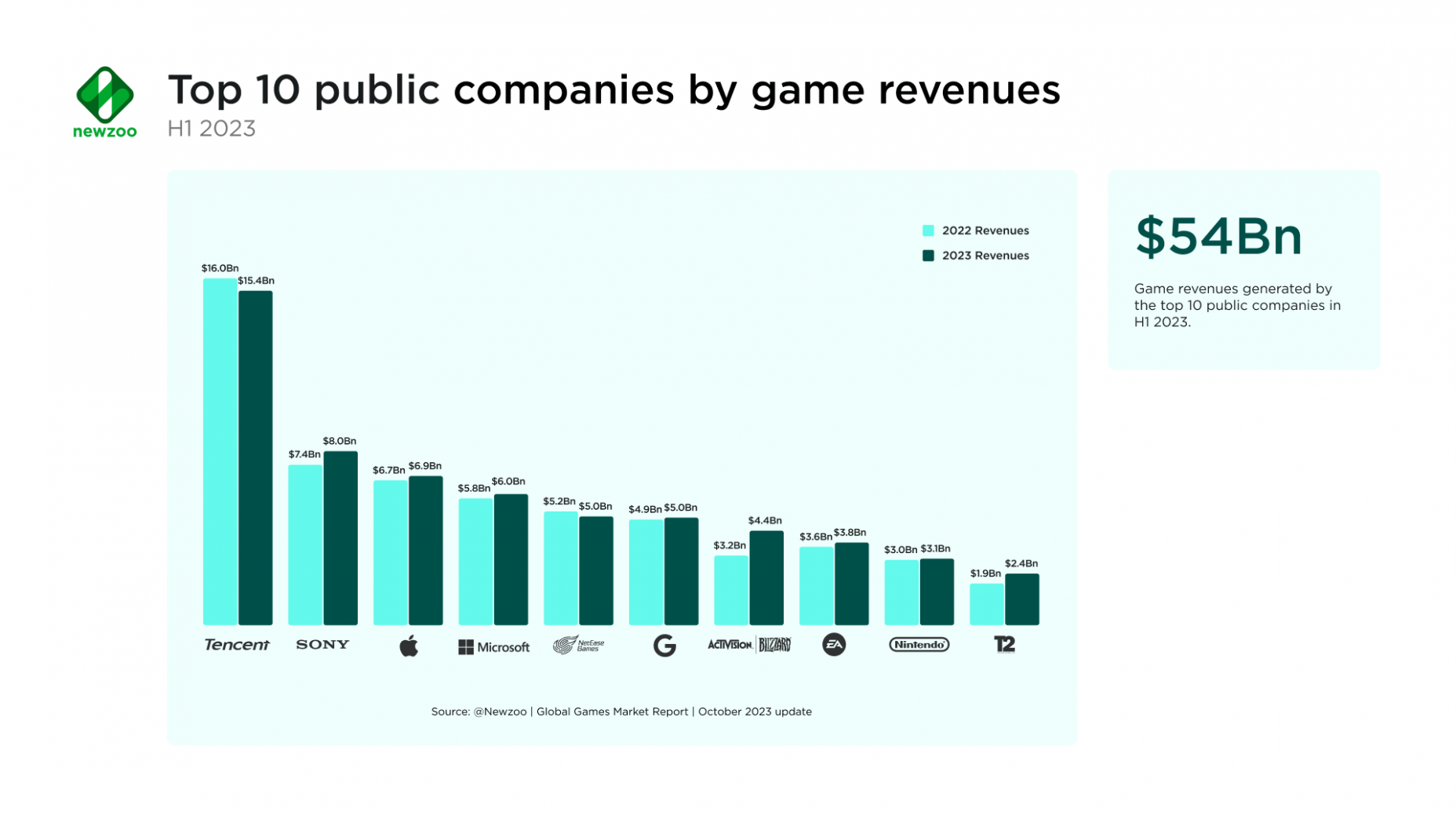

Based on the Newzoo survey, the total revenues of the gaming industry in 2022 reached 184.4 billion USD, with the following companies having the most considerable revenue in the industry:

- Tencent Holdings Limited (HK: 0700) – 16.0 billion USD

- Sony Group Corporation (NYSE: SONY) – 7.4 billion USD

- Apple Inc. (NASDAQ: AAPL) – 6.7 billion USD

- Microsoft Corporation (NASDAQ: MSFT) – 5.8 billion USD

- NetEase Inc. (NASDAQ: NTES) – 5.2 billion USD

- Alphabet Inc. (NASDAQ: GOOGL) – 4.9 billion USD

- Electronic Arts Inc. (NASDAQ: EA) – 3.6 billion USD

- Activision Blizzard Inc. – 3.2 billion USD

- Nintendo Co Ltd (TYO: 7974) – 3.0 billion USD

- Take-Two Interactive Software Inc. (NASDAQ: TTWO) – 1.9 billion USD

It is worth noting that the top ten companies remained the same in 2023. It is fair to presume that a small number of companies controlling such a significant market share reflects the industry’s ongoing consolidation. The acquisition of Activision Blizzard Inc. by Microsoft Corporation in 2023 continues this trend.

Gaming Stock Picks

Let us look at the stocks of the three most prominent players in the industry, specifically Microsoft Corporation, Electronic Arts Inc., and Take-Two Interactive Software Inc.

Financial Analysis of Microsoft

Microsoft Corporation, a key player in the gaming industry, showcases significant financial strength:

- Diverse Gaming Portfolio: Microsoft’s gaming division, which includes Xbox and the recent acquisition of Bethesda, contributes to a varied and robust gaming portfolio

- Consistent Financial Growth: the company has seen steady growth in its gaming segment, supported by its console sales, game titles, and services like Xbox Game Pass

- Strategic Acquisitions: on 18 January 2022, Microsoft announced its intent to acquire Activision Blizzard for 68.7 billion USD. The deal was finalised on 13 October 2023. Under the terms of the agreement, Microsoft integrated Activision Blizzard into its Microsoft Gaming business unit as a sibling division to Xbox Game Studios and ZeniMax Media. With this acquisition, Microsoft gained ownership of several franchises under Activision, Blizzard Entertainment, and King, including Call of Duty, Crash Bandicoot, Spyro, Warcraft, StarCraft, Diablo, Overwatch, and Candy Crush. As of 2023, the acquisition is the largest video game acquisition by transaction value in history

- Investment Potential: Microsoft’s overall financial health, combined with its strong position in the gaming industry, makes it a compelling choice for investors interested in gaming stocks

Microsoft Corporation’s total share capital amounts to 220.7 billion USD, and its total debt is 71.5 billion USD, resulting in a debt-to-equity ratio of 32.4%. The total assets and liabilities are 445.8 billion USD and 225.1 billion USD, respectively. The company pays dividends with a current yield of 0.79%. According to the Simply Wall St portal, earnings per share are expected to grow 12.4% annually, and the return on equity is projected to be 30.2% in the next three years.

Microsoft Corporation’s stock experienced a downward correction in 2022. Since the beginning of 2023, the weekly chart has shown a consistent upward trajectory, supported by the Alligator and SMA (200) trend indicators. Quotes are rising, regularly setting new historical highs. In this scenario, an effective investment strategy might be assumed to involve buying shares after local downward corrections, with the next growth target set at 400.0 USD.

Technical analysis of stocks Microsoft Corporation*

Financial Analysis of Electronic Arts

Electronic Arts Inc. (EA) is another major player in the gaming industry, known for its strong portfolio:

- Diverse Revenue Sources: EA’s revenue is bolstered by its wide range of popular sports titles like “FIFA” and “Madden NFL”, as well as other franchises like “The Sims”

- Consistent Growth: the company has demonstrated consistent financial growth, buoyed by its strong brand and loyal customer base

- Innovation and Expansion: EA’s ongoing innovation and expansion into new gaming formats and markets indicate potential for future growth

- Investment Potential: Given its market position and financial stability, EA is a solid investment choice in the gaming stock sector

Electronic Arts Inc. has a total share capital of 7.6 billion USD and a total debt of 1.9 billion USD, which makes a 24.8% debt-to-equity ratio. Total assets and liabilities amount to 13.1 billion USD and 5.6 billion USD, respectively. The company pays dividends at the current rate of 0.56%. According to Simply Wall St, earnings per share are expected to rise by 12.2% annually, while the return on equity is forecasted to reach 25.6% in three years.

On the weekly chart, the company’s shares demonstrate upward momentum, as confirmed by the Alligator and SMA (200) indicators. Yet the quotes remain within a long-term descending price channel. The crucial mark is the resistance level of 140.0 USD. By rising above this level and consolidating there, the potential could open for the price to grow further to the all-time high area of 151.26 USD.

Technical analysis of stocks Electronic Arts Inc.*

Financial Analysis of Take-Two Interactive

Take-Two Interactive Software Inc., renowned for blockbuster titles, stands out in the gaming market for:

- High-Performing Titles: with franchises like “Grand Theft Auto” and “NBA 2K”, Take-Two has high-earning, popular games in its portfolio

- Revenue Growth: the company has seen significant revenue growth, driven by the strong performance of its key titles and expansions into new gaming experiences

- Strategic Acquisitions: Take-Two uses its financial strength to acquire mobile and social game-maker Zynga (NASDAQ: ZNGA) in a 12.7 billion USD deal. Bringing Zynga under its umbrella will add a slate of popular mobile franchises to its portfolio and allow the company to leverage Zynga’s expertise in free-to-play games

- Market Positioning: Take-Two’s strategic market positioning, focusing on high-quality, immersive gaming experiences, offers a strong investment case

- Future Prospects: With a pipeline of new titles and potential expansions, Take-Two is well-positioned for continued financial success, making it an attractive option for investors in the gaming sector

Take-Two Interactive Software Inc. has a total share capital of 8.4 billion USD and a total debt of 3.1 billion USD, which makes a 36.5% debt-to-equity ratio. Total assets and liabilities amount to 15.2 billion USD and 6.8 billion USD, respectively. The company is not paying dividends yet. According to the Simply Wall St portal, earnings per share are expected to rise by 94% annually, while the return on equity is projected to be 15.2% in three years.

From a technical analysis perspective, Take-Two Interactive Software Inc. shares demonstrate ascending price momentum. After skyrocketing in 2021 and setting an all-time high of 215.0 USD, the stock started a lengthy correction within a descending price channel. In November 2023, the quotes managed to consolidate above the upper channel boundary and the resistance level of 155.84 USD, which might signal a possible trend change from descending to ascending. A trend continuation pattern called Flag has formed, and the Alligator and SMA (200) indicators confirm the uptrend. The stock appears promising, with a target growth set at 215.0 USD.

Technical analysis of stocks Take-Two Interactive Software Inc.*

Gaming Market Predictions

- According to research by Fortune Business Insights, the global gaming market volume will reach 665.77 billion USD by 2030 at the projected compound annual growth rate of 13.1%. One of the key factors supporting the development of this market is the interest taken by youngsters in video games

- According to a GlobalData report, in 2030, mobile games will be generating more than half of the income of the whole gaming industry. Cloud games will become a fast-growing segment: from 2021 to 2030, their revenue will augment from about 2 billion USD to over 30 billion USD

- The Newzoo portal forecasts that in 2026, the global gaming market will generate an annual revenue of 212.4 billion USD, and the number of gamers will reach 3.79 billion.

Conclusion

The gaming industry is a large and fast-growing sector of the economy that might have serious potential for growth in the long run. In 2022, the global game market was valued at 184.4 billion USD; by 2026, it could reach 212.4 billion USD, by the most modest calculations.

The leading companies in the industry, such as Microsoft Corporation, Electronic Arts Inc., and Take-Two Interactive Software Inc., capitalised on the expanding demand for their products during the COVID-19 pandemic. The industry is now on the rise, and with that, the revenue of its prominent representatives is expected to increase substantially in 2024-2030. This, in turn, could positively affect their stock quotes.

* – The interactive charts in this article are provided by the TradingView platform, which offers a wide range of tools for analysing the financial markets. It is a convenient, high-tech online market data charting service that allows users to perform technical analysis, research financial data, and communicate with other traders and investors.

The post Gaming Industry Analysis: Will Gaming Stocks Rise in 2024? appeared first at R Blog – RoboForex.