The quarterly reporting season started in October with the US banks among the first to publish their results. The statistics were much higher than predicted.

This was not a complete surprise, because it seems logical for banks to increase their earnings in the face of rising interest rates. Stocks of Bank of America Corporation (NYSE: BAC), JPMorgan Chase & Co (NYSE: JPM), and Citigroup Inc. (NYSE: C) started to appreciate noticeably amid the strong financial statistics.

The Federal Reserve System (the Fed) is not giving any signals yet about easing its monetary policy, which means the high-interest rates will remain for some time. Although this is not good news for businesses, it is to the advantage of the banking sector.

In this article, we’ll draw your attention to the impact of the interest rate hike on the earnings of America’s largest banks and their stock prices. But first, let’s look at previous periods of monetary policy tightening.

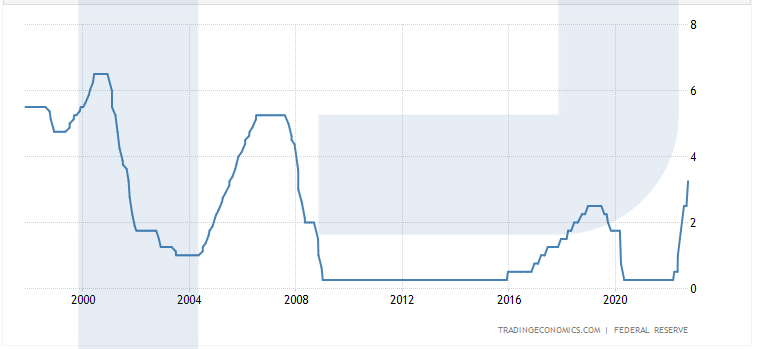

When the monetary policy was tightened in the US

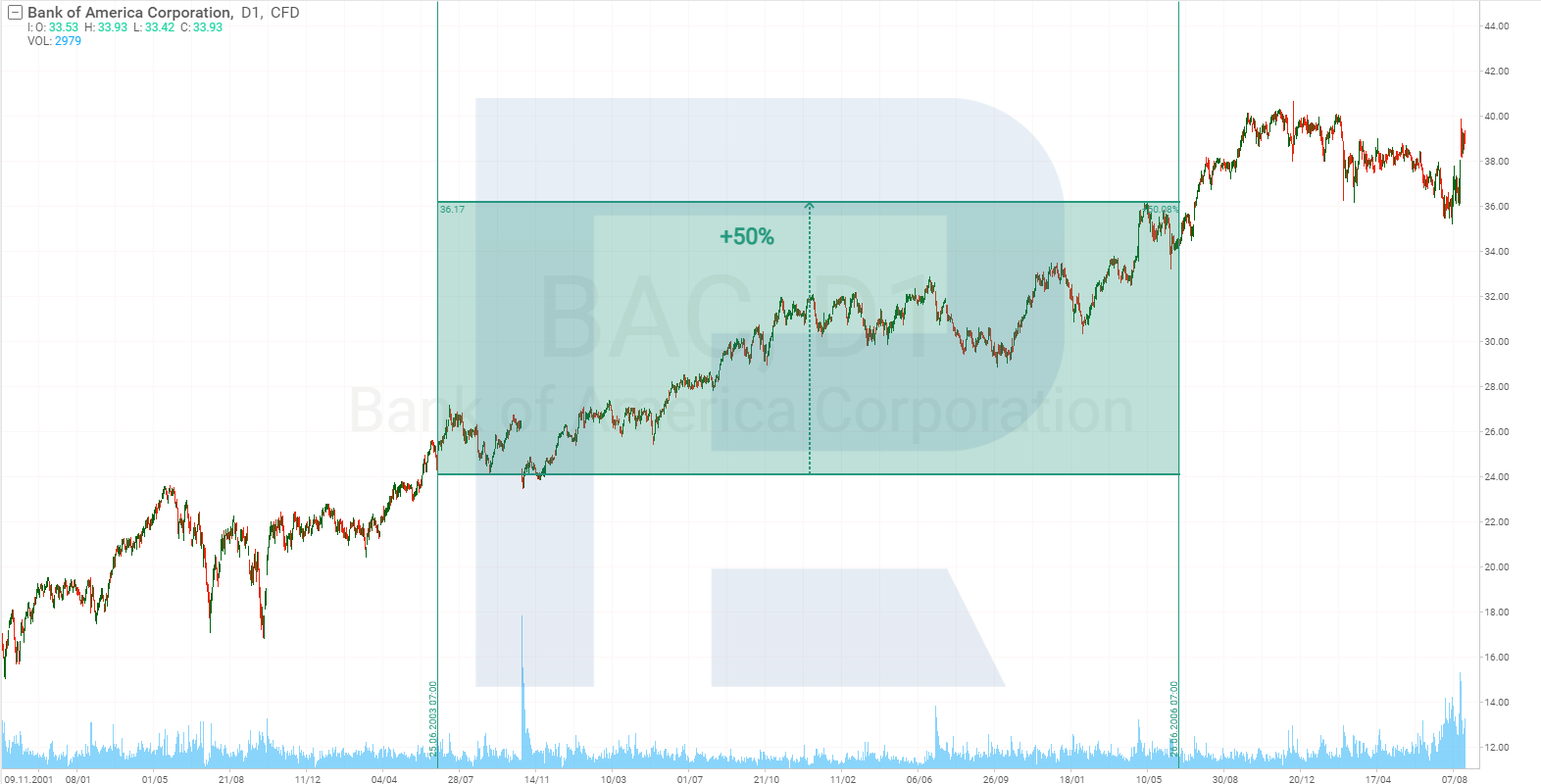

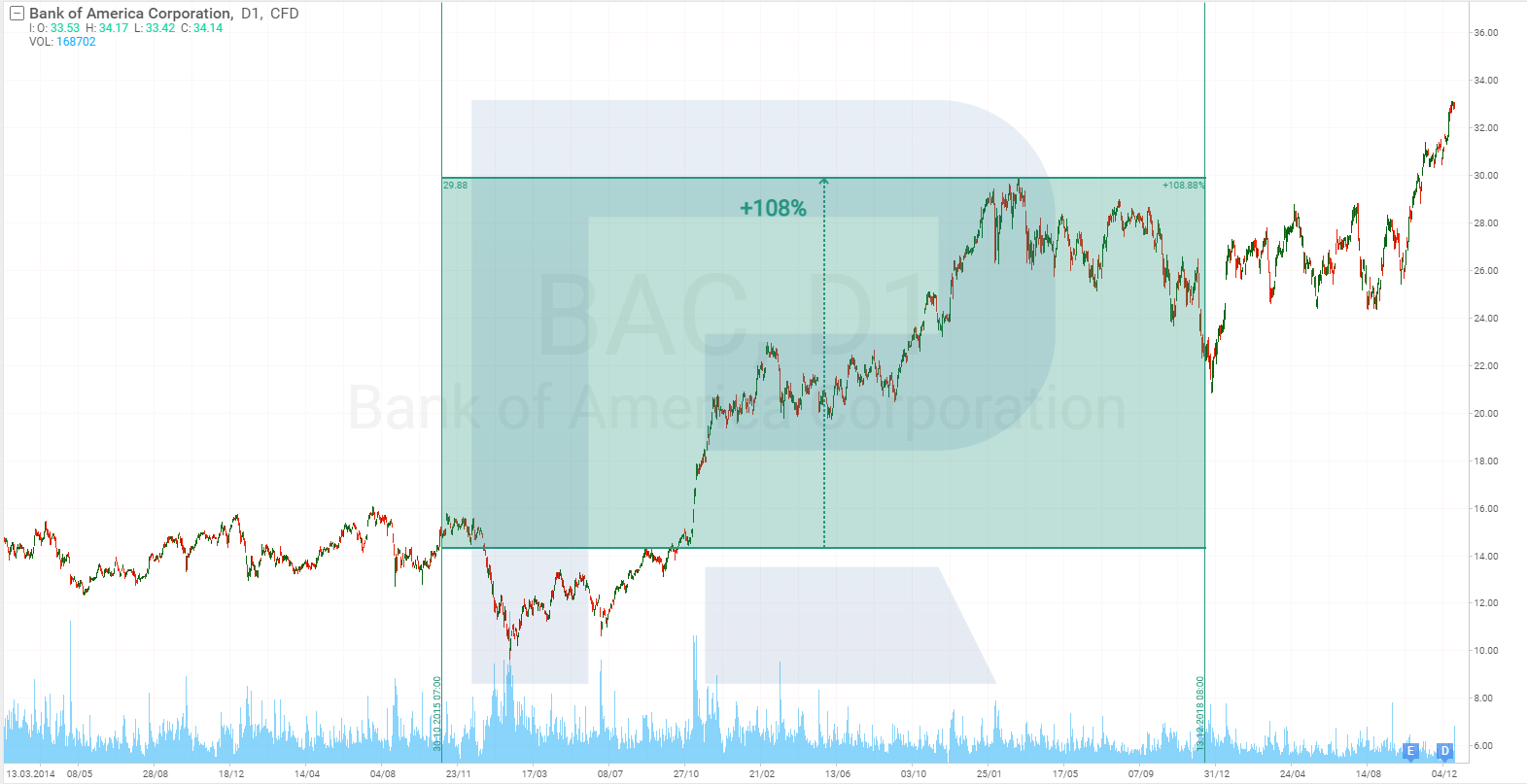

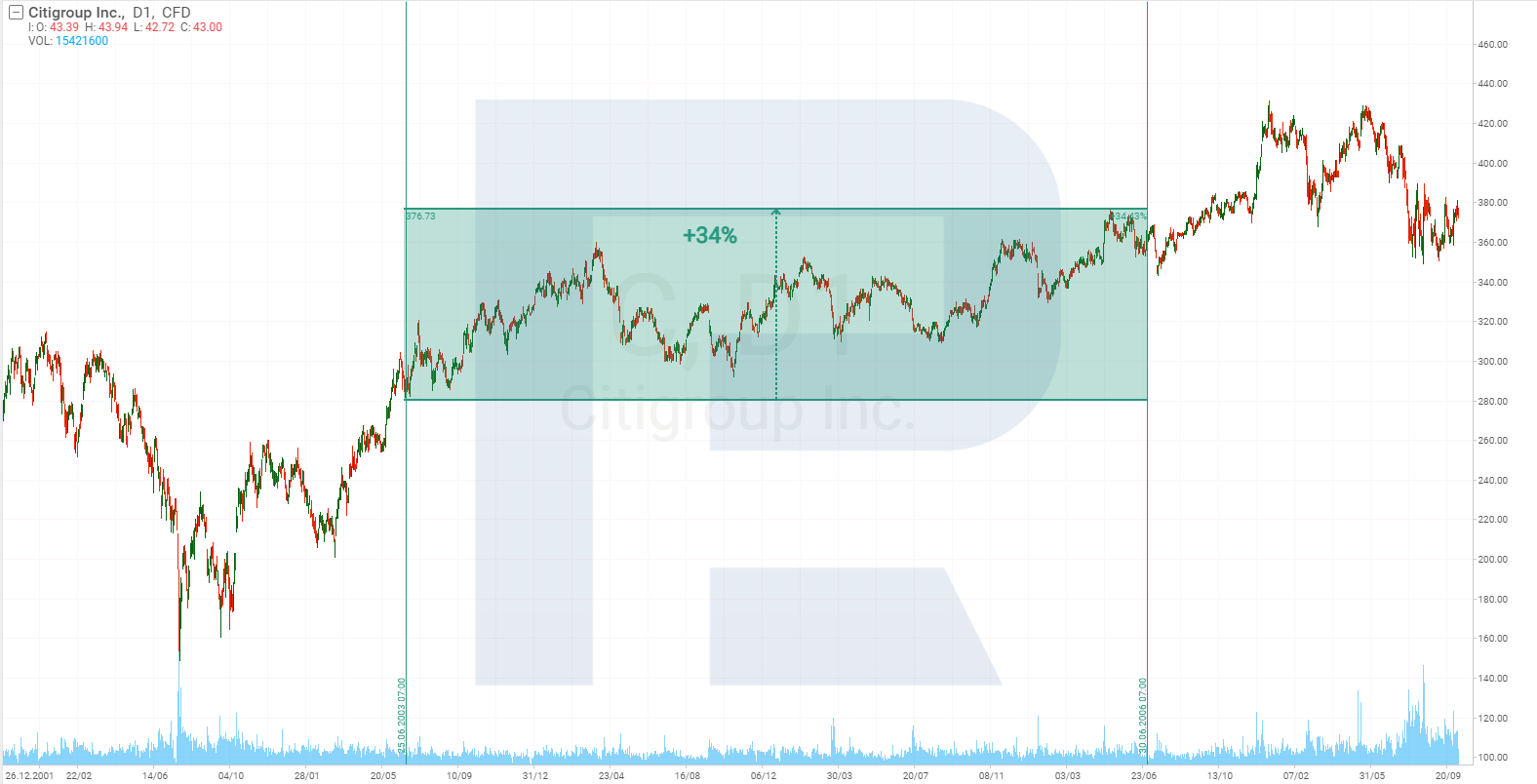

Since 2002, there were two periods when the Federal Reserve raised the interest rate. During the first cycle, which began in 2003 and ended in 2006, the rate was raised from 1% to 5.25%. The second period lasted from 2015 to 2019, during which time the rate rose from 0.25% to 2.5%.

JPMorgan Chase

JPMorgan Chase & Co is the largest bank in the US. Its total assets are USD 3.95 trillion. On 14 October, the bank published its report for the third quarter of this year. Earnings per stock amounted to 3.12 USD, which is 6.4% higher than expected. Revenue reached 32.7 billion USD, which is 1.8% higher than analysts’ expectations and 17% higher than the statistics for the same period last year.

The bank’s interest income rose by 34% to USD 17.6 billion due to an increase in the interest rate. JPMorgan Chase & Co stocks started growing sharply the day before the report release, and after the data continued to move, the stocks gained 17% in four days.

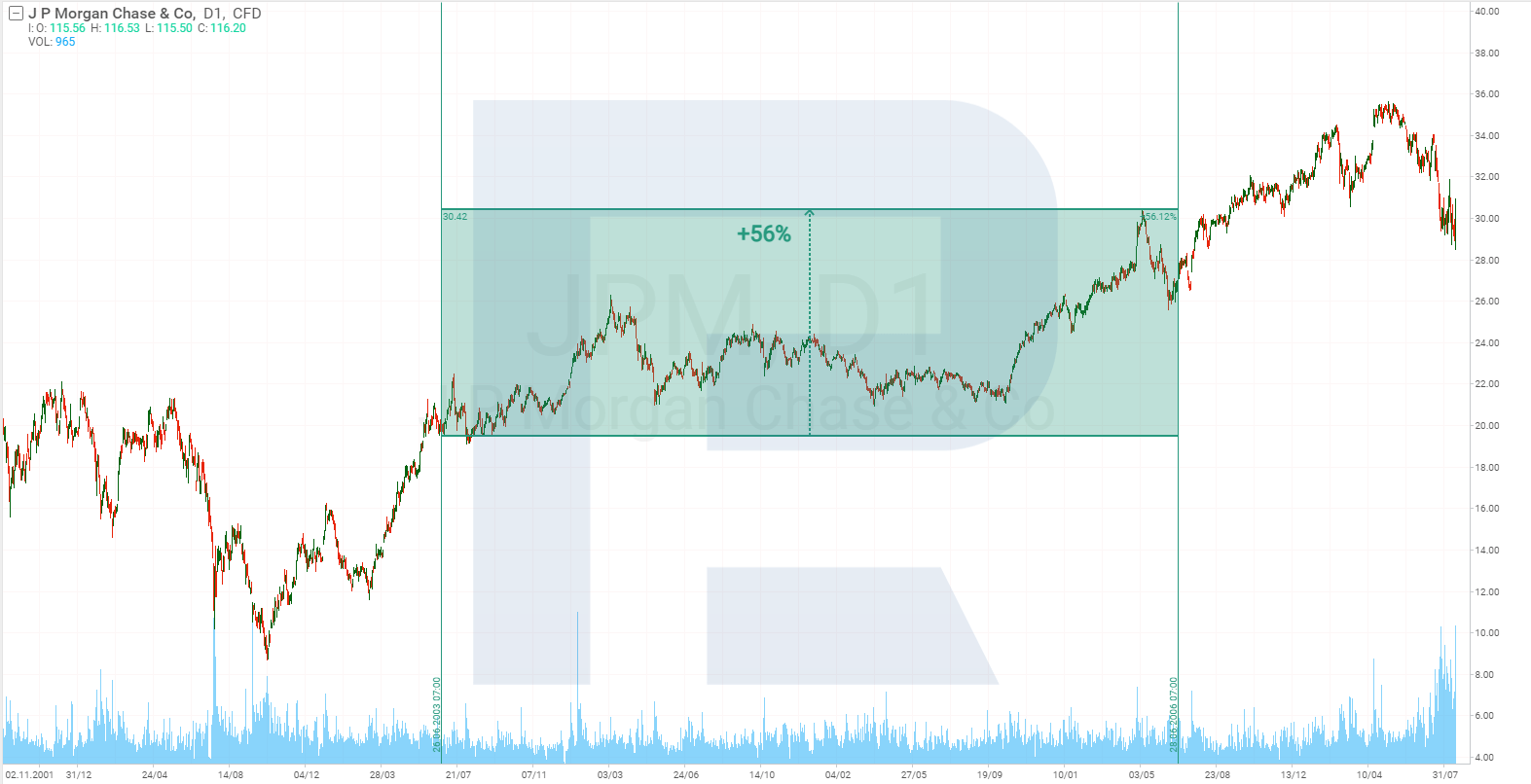

Let’s find out how the company’s stock behaved during previous cycles of rate hikes. Over 2003-2006, JPMorgan Chase & Co stocks gained 56%. By comparison, the S&P 500 Index (US500) gained 37% during the same time.

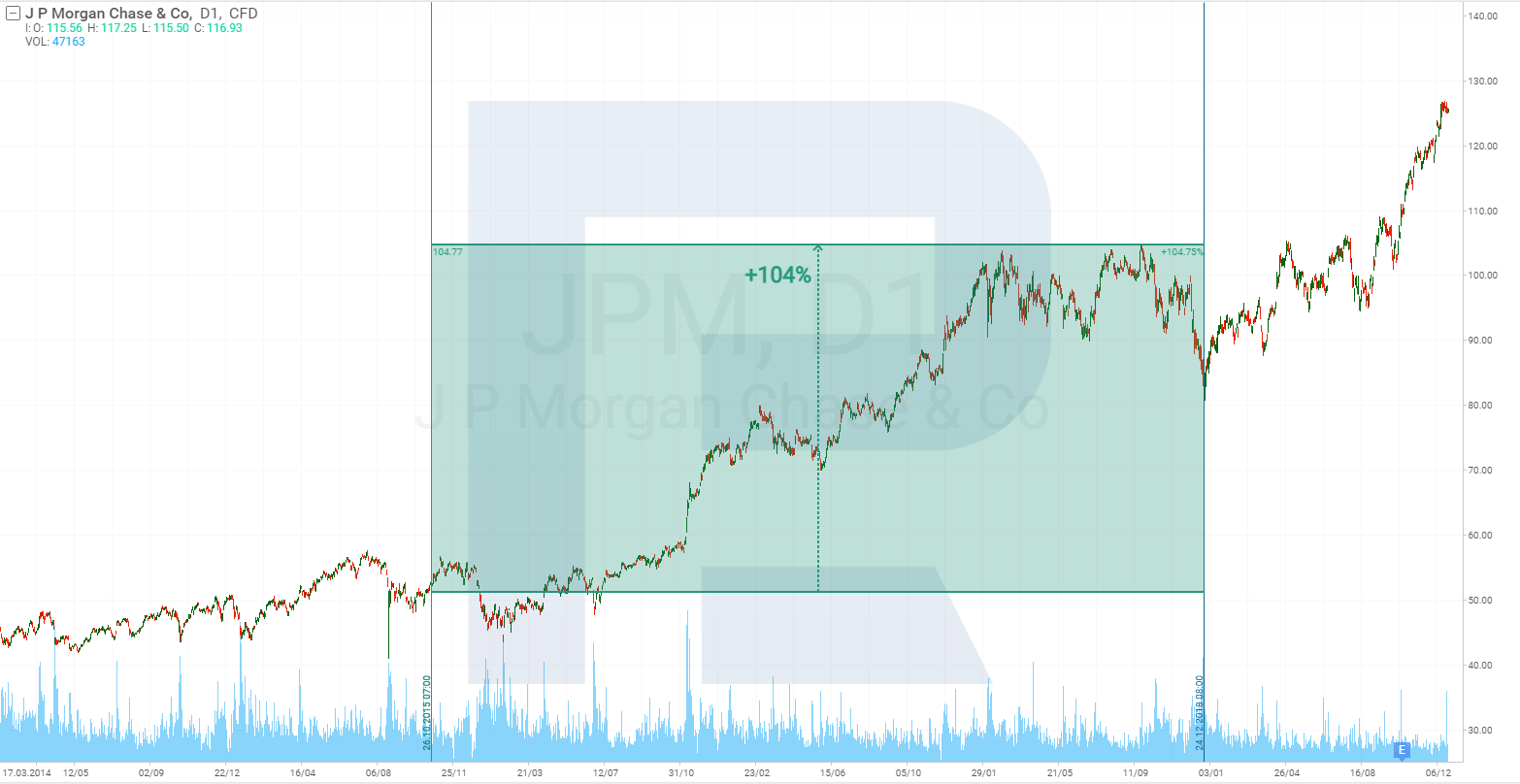

Over 2015-2019, the stock value rocketed 104%, while the S&P 500 only rose 43%.

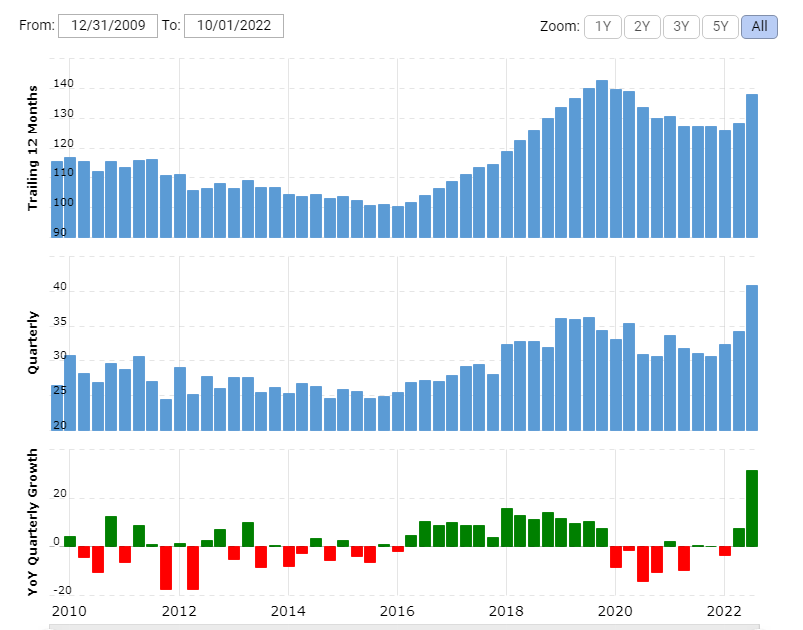

We can look at the impact of the interest rate on the bank’s revenue from 2015 to 2019.

In the chart, we can see that JPMorgan Chase’s revenue started to grow in 2016, and surpassed record levels by 2019.

Bank of America

Bank of America Corporation is the second largest bank in the US. Its assets amount to USD 3.11 trillion. The last quarterly report was published on 17 October 2022. The bank’s revenue amounted to 24.5 billion USD, which is almost 1 billion more than the consensus forecast. Earnings per stock also exceeded experts’ expectations and reached 0.81 USD. Interest income, which depends on the Fed funds rate, increased by 24% to USD 13.77 billion.

The Bank of America Corporation stock, influenced by the strong statement of JPMorgan Chase & Co, which was provided three days earlier, started rising even before the release of the company’s quarterly results and gained 15% by 17 October. After the release of statistics, this indicator grew by 4%.

Now, let’s pay attention to the movement of Bank of America Corporation stock during the previous hikes in the interest rate. Over 2003-2006, the stock prices skyrocketed 150%.

Over 2015-2019, stocks rose 108% in value.

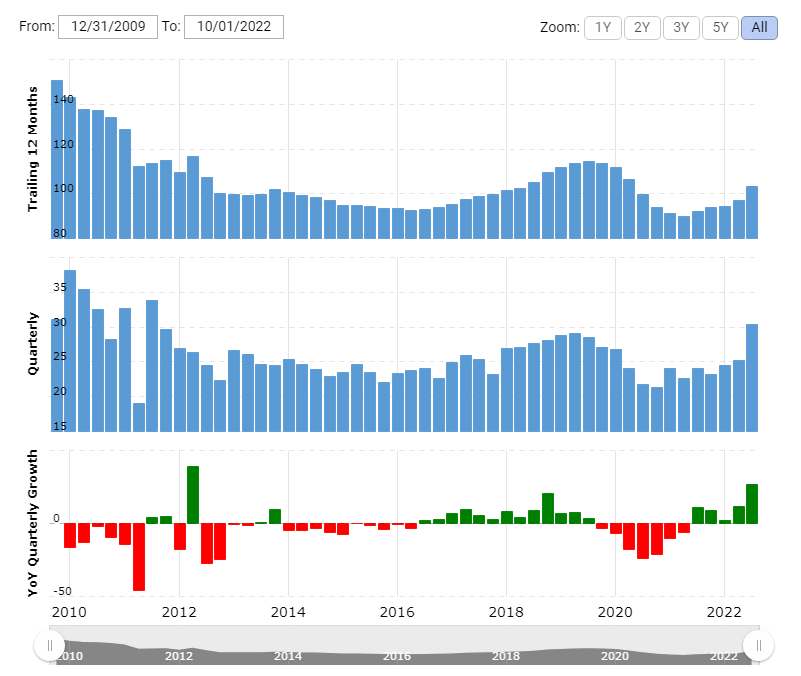

Take a look at Bank of America Corporation’s revenue graph from 2010 to 2022.

As we can see, the bank’s earnings started to increase in 2015, but have not exceeded record levels. Nevertheless, the correlation with the Fed rate is noticeable.

It is important to note another observation: from 2009 to 2015, the rate was at its lowest level and Bank of America Corporation’s revenue gradually declined during this period. This, too, confirms the dependence of the company’s financial results on the Fed’s interest rate.

Citigroup

The third largest bank in the US is Citigroup Inc. Its assets reach USD 2.26 trillion. The third quarter report was released on 14 October, and the results pleased investors.

Revenue amounted to 18.5 billion USD, which is 150 million USD more than forecasted. Earnings per stock also exceeded experts’ expectations, having reached the level of 1.50 USD. In the report, the bank stressed that the revenue was positively affected by the sale of consumer business in the Philippines. Without this transaction, the results would have been markedly more modest.

Interest income, which is influenced by the Fed’s interest rate, rose by 18%, although it would not have reached this level without the sale of the business.

The bank plans to leave the markets in Russia, Bahrain, Malaysia, and Thailand in the future; and preparations have already started to wind down the UK business. Against this backdrop, Citigroup’s earnings could rise in the near term as the sale of the business will be factored into the revenue. What impact the asset sale will have on the bank in the medium term is difficult to say. Assuming that Citigroup Inc. is likely to get rid of assets that are not profitable, such action will have a positive impact on the company.

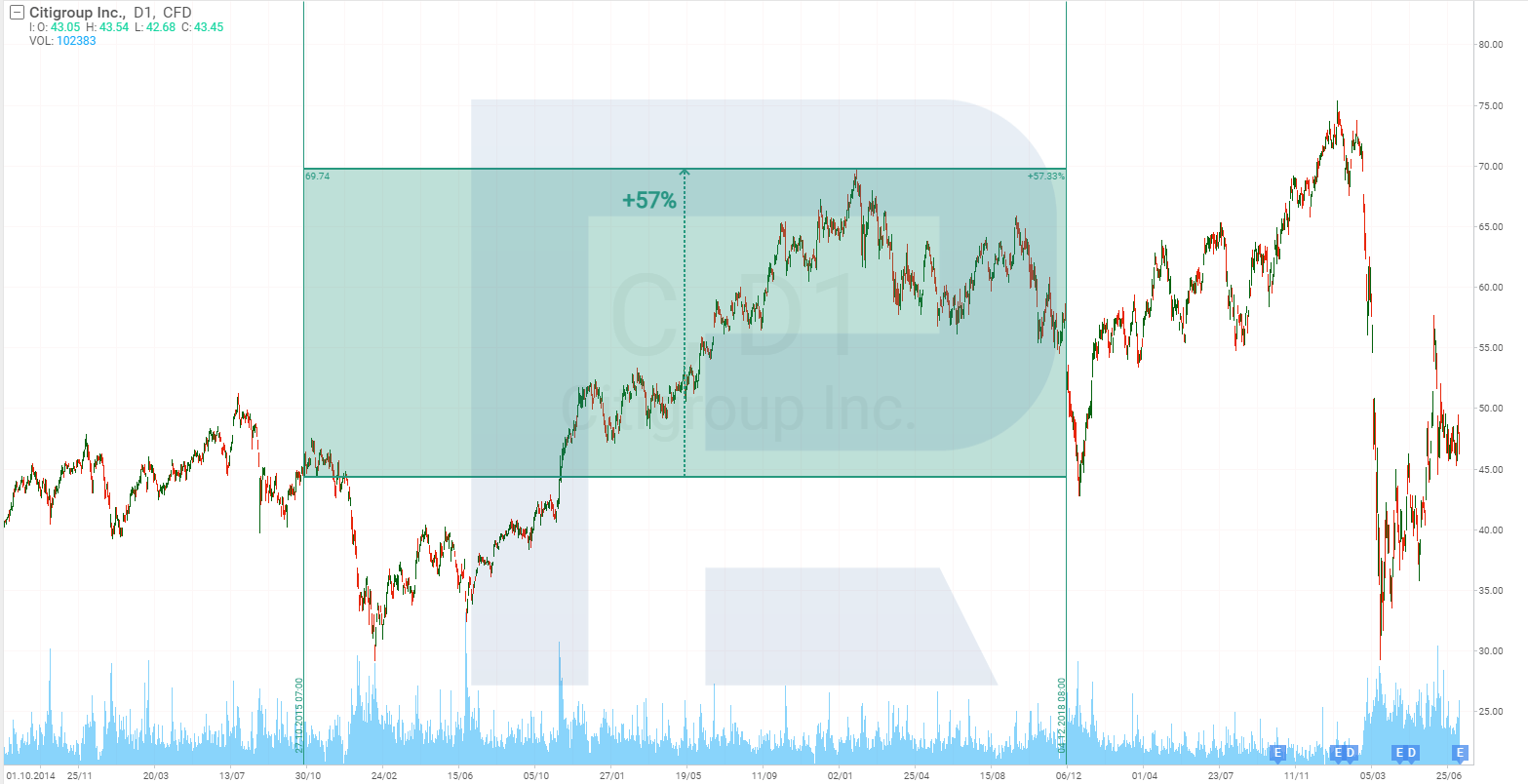

Now let’s turn our attention to the relationship between the interest rate and the company’s stock price. From 2003 to 2006, Citigroup’s stock gained 34%.

During the next rate hike cycle, the stock price increased by 57%.

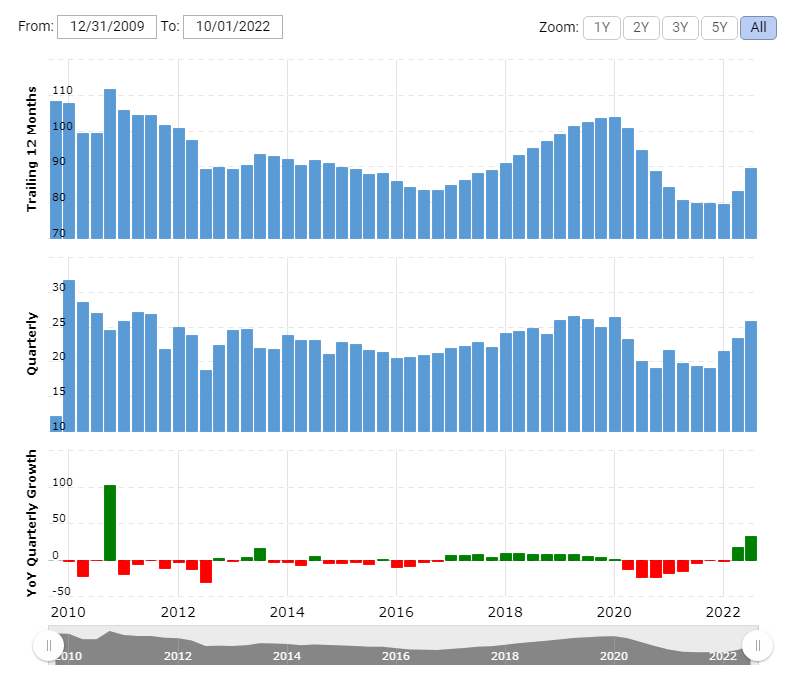

Let’s take a look at Citigroup’s earnings: since 2016, they have increased gradually.

Conclusion

Rising interest rates make loans more expensive, which is good for banks’ revenues, but could potentially reduce their customer base. At the same time, the attractiveness of bank deposits is increasing.

In such an environment, financial institutions are able to channel public money into business loans or, even more profitably, into buying bonds. The return on a bond is higher than the interest paid to the depositor.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post How the Fed’s Interest Rate Affects Profits of Large Banks appeared first at R Blog – RoboForex.