Today we will explain how to test a trading strategy. We will begin by explaining what a trading strategy is, why it needs to be tested, and how to do this. We will also give you some important recommendations.

What is a trading strategy?

A trading strategy is a trader’s main tool that gives them an advantage in the market. In other words, it is a set of trading rules that have been tested in practice. The strategy can be considered successful if the total result of all deals made by using it within a specific period (month, quarter, year) is positive, i.e., profitable.

A trader’s failure to have a clear, understandable, and practically proven system when trading can lead to a loss of funds. Making profit from random unsystematic trades is possible, but it will mostly depend on luck rather than experience and knowledge. You can only be successful in the long run if you use a proven trading strategy.

Why test a trading strategy?

Backtesting is the process of assessing how well a trading strategy can perform under past conditions. It is a key component in developing an effective system. There are various possibilities to change strategy parameters, and the adjustments made can have a significant impact on the results. Such testing shows the overall performance of an idea and checks whether some trading parameters will work better than others.

Testing the chosen trading approach on past data allows you to assess its effectiveness without any real monetary investment. The basic logic behind such testing is the assumption that a system that has worked well in the past is likely to also be effective now. Correct backtesting on historical data and obtaining positive results increases the trader’s confidence that the idea will work. If the backtest shows negative results, the parameters should be changed or the chosen strategy should be abandoned.

Ways to test a trading strategy

You can test your trading approach on historical data or real trading conditions, either manually or by using special programmes.

Manual backtesting

Manual testing with historical data is a rather time-consuming process. This method is used when automated testing cannot be used for one reason or another.

Manual test scheme:

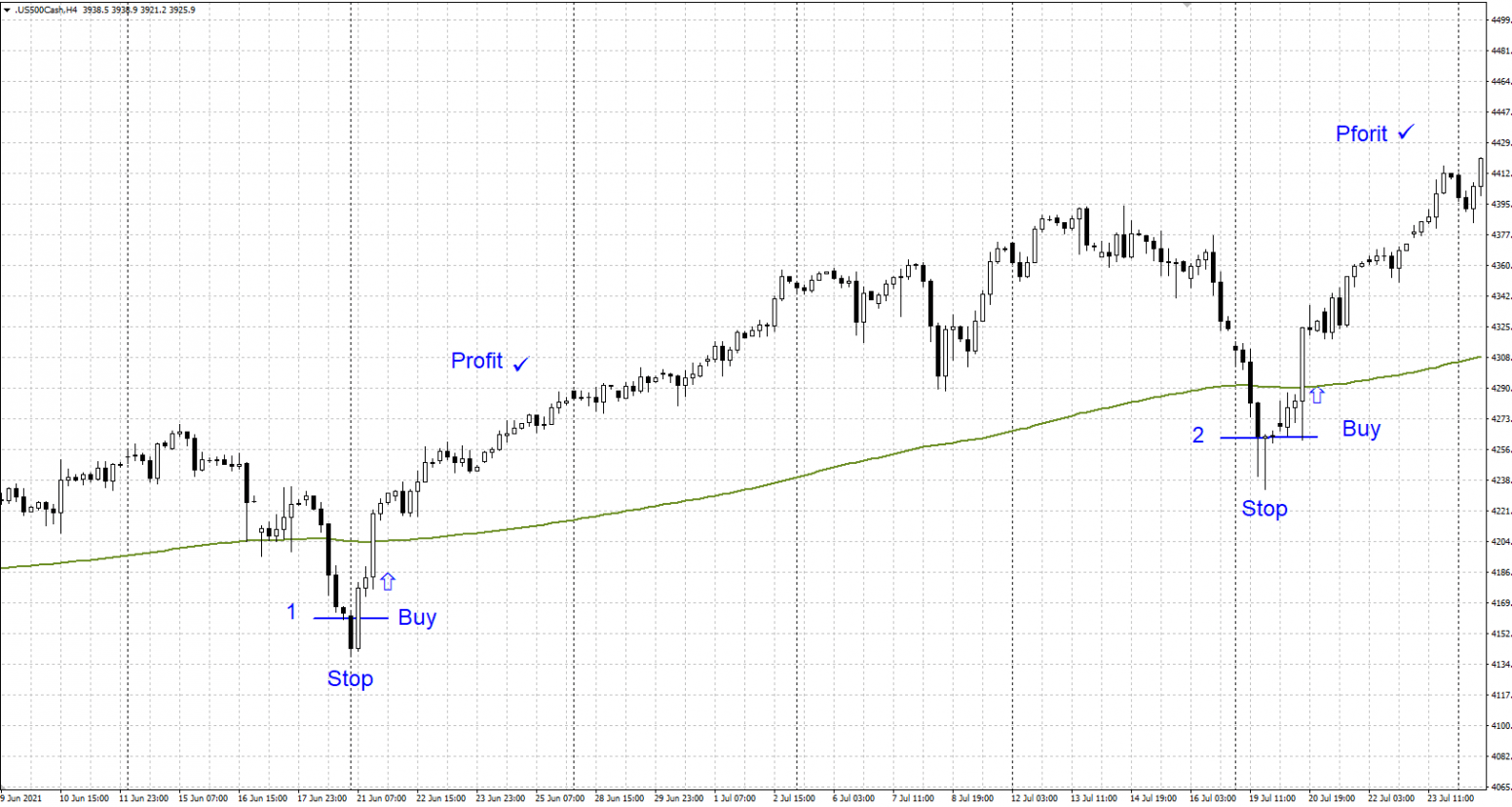

- A chart of the financial instrument is opened. All necessary indicators and tools for trading according to the strategy are installed. The desired timeframe and the period of interest in the quotes history are selected.

- The strategy then searches the chart for setups (conditions) for trades.

- When a strategy is detected, the trader records all parameters of the potential trade: date, entry point, direction, Stop Loss, Take Profit, trade result, and any other useful information.

- After a careful examination of all the potential trades found, their individual results and the total are analysed. A conclusion is made as to whether trading on this system will bring profit or loss.

If the strategy works at a loss, it is abandoned, or adjustments are made to improve its effectiveness. After the changes have been made, the strategy is checked again, and the process is repeated until it achieves an acceptable result. Manual testing of a trading strategy on historical data takes time and discipline. Correctly performed testing creates the conditions for a more accurate understanding of the level of success of the chosen approach and allows you to improve the practical skills of identifying setups for trading.

Automated backtesting

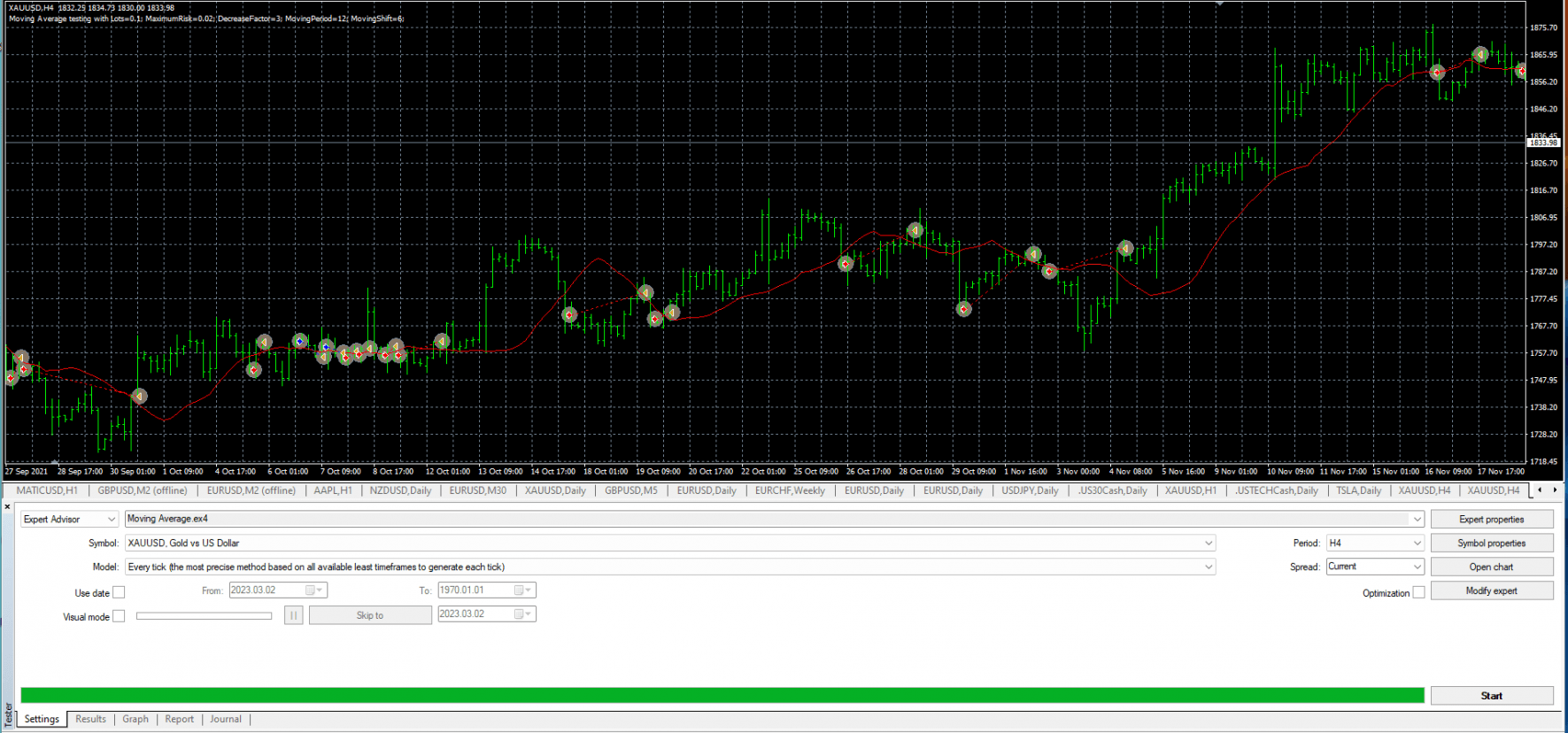

Special software is used that finds trades that meet the strategy’s criteria. It summarises profitable and losing trades to show whether the strategy has been effective over a certain period of time. There are many trading platforms that provide such testers nowadays.

The basic algorithm for automatic testing is as follows:

- A financial instrument and time frame for testing are selected.

- All the necessary parameters of the trading strategy are indicated, on the basis of which the trades are made: timeframe, risk level, profit target, signals for entering and exiting the position, etc.

- Testing starts.

- The result is examined.

- The basic parameters are changed to obtain the optimum result.

The use of special software makes it much easier and faster to check the performance of a trading strategy on historical data. Additionally, it allows you to select the most suitable trading parameters, e.g., the value of Stop Loss or Take Profit. But it requires skills and experience in programming and testing automated trading systems.

Forward testing

Backtesting requires finding trades based on historical data, while forward testing is the process of trading a strategy in real time under current market conditions. The trader will need to observe the market, find sets and execute trades. You can use a demo account or a small real deposit to trade with minimal volumes.

Testing on historical data allows a trader to find out whether a strategy has the potential to profit, while forward testing helps to confirm or refute this assumption in real-time.

Recommendations for testing strategies

- Be objective and don’t attempt to distort the results

- Estimate the result with a large number of transactions in mind. The minimum benchmark is 300-500 deals. The more trades, the more objective the statistics

- Consider different market conditions. Be sure to test your strategy during periods of high and low volatility, as well as during periods of an active trend and when quotations are trading in a limited range

- Assess slippages and commissions, as they can reduce expected profits

- Complete the validation with a forward test. Successful strategy performance on historical data does not guarantee that the idea will be effective in current market conditions. Trading in real conditions for at least 30 days will show the system’s performance level

Conclusion

Strategy testing is a very important and useful stage of a trader’s work and development: skills are improved, and experience is increased while the effectiveness of the chosen trading approach is tested. There is no risk of losing real money. Testing can be done using historical data and current market conditions, as well as manually or with special programmes. It is important to follow the guidelines listed above to improve the result.

The post How to Test a Trading Strategy appeared first at R Blog – RoboForex.