This overview is devoted to two reversal candlestick patterns: Morning Star and Evening Star.

These two are definitely rare visitors to charts, yet they remain quite popular. Like other reversal patterns, the Morning and Evening Stars form at the highs and lows of the price and contain three candlesticks each.

How does a Morning Star form?

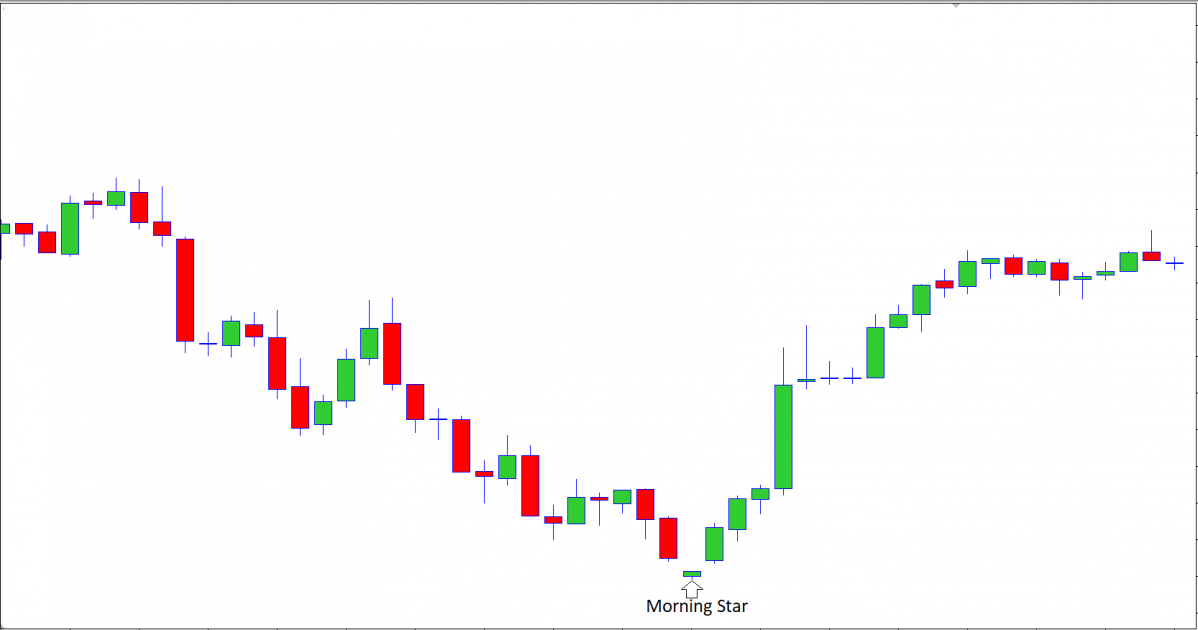

This pattern forms at the lows of the price chart. When a descending impulse is going to subside, the price makes a minor surge upwards, so that the candlestick opens and closes with a gap.

Conditions required for the pattern to appear:

- A support or resistance level;

- The first candlestick has a long body of the same color that the current trend is – and small shadows.

- The second candlestick opens with a gap, has a small body and short shadows. It may be of the opposite color that the current trend is; in most cases, it has little significance anyway.

- The third candlestick opens with a gap and closes above the opening price. It must be of different color than the first candlestick.

Open a position after the third candlestick closes. Place a Stop Loss at the low of the pattern. If you are trading an instrument with a large spread and on a small timeframe, you may add the average spread to the low to compensate for the error.

You may place a Take Profit at the nearest resistance level or as 1:4 to the SL.

A Morning Star looks as follows:

How does an Evening Star form?

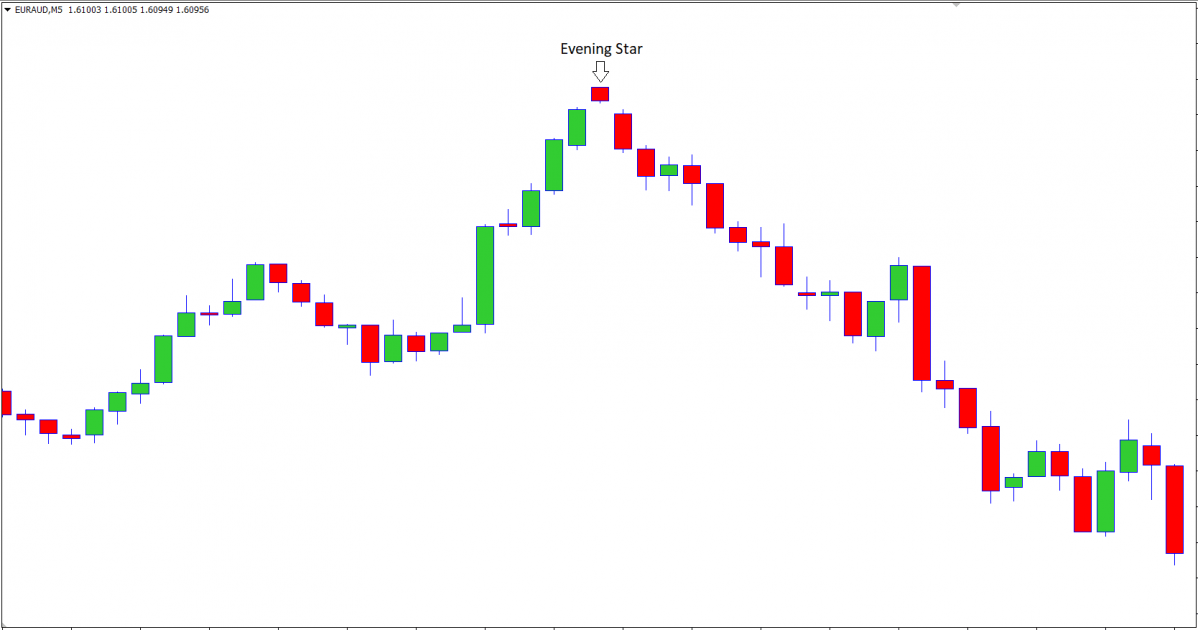

An Evening Star appears at the highs of the price chart, and its structure is totally opposite to that of the Morning Star.

Conditions required for the pattern to appear:

- A support or resistance level

- The first candlestick is ascending; it has a long body of the same color that the current trend is.

- The second candlestick has a small body and opens with a gap. The color of the candlestick is irrelevant.

- The third candlestick also opens with a gap; its color is opposite to that of the first one, and the closing price is below the opening price.

Place an SL at the high of the pattern. As with the Morning Star, you may compensate for the error by placing the SL plus the average spread. The TP belongs to the nearest support level or is at 1:4 ratio with the SL.

An Evening Star looks as follows:

When trading both candlestick combinations, you may use Trailing Stop to build up profit in the position.

Trading the Morning and Evening Star

Having decided upon the timeframe and position size, start looking for the pattern you need. After you find a combination that resembles any of the Stars, wait for it to complete. If you open your position too early, you might encounter excessive risks; hence try to never run ahead of the pattern, hoping for it to form as needed.

Morning Star: buying

After the third candlestick of the pattern forms (closes), open a buying position. Ideally, open your position at the opening price of the candlestick that follows the third one.

Place an SL behind the low: this will insure you from a false signal. If you are trading on M1, M5, or M15, and your SL is close to the opening price of the position, you can move it lower, by the size of the average spread of the instrument.

Then place a TP at the nearest resistance level or as 1:4 to the SL. Next, as soon as the quotations start going towards the open position, you may move the SL to the entry price of the position.

Evening Star: selling

As long as the Evening Star forms at the high of an uptrend and forecasts an upcoming reversal, you open a selling position.

After the third candlestick of the pattern closes, open a selling position at the opening price of the next candlestick. Place your SL at the high (or shift it upwards by the average spread of the instrument). Place a TP at the nearest support level; you may later move it in the positive direction, checking with the technical levels.

As in the previous example, when the quotations start going in the direction of the position, you may place the SL at the entry price of the position.

Those who do not like tech analysis or do not know how to draw support/resistance levels may use an EMA(50) as an additional filter.

Morning and Evening Stars do not give many trading signals over a session; hence, they are better to be used alongside other candlestick patterns. This way you can increase the number of trades significantly.

Extra thoughts

The choice of a timeframe depends on the trader’s ambitions and the deposit size. On D1, SLs and TPs are much larger than on the minute one, and this is to be accounted for. Moreover, on small timeframes trades take little time to complete. On minute charts, try to trade the trend that you detect on larger TFs. In this case, signals will form on corrections.

The Stars can be used not only in the currency market but also for other trading instruments: stocks, indices, futures, and commodities.

The post How to Trade Morning Star and Evening Star? appeared first at R Blog – RoboForex.