In this review we will get acquainted with the popular harmonic pattern “Bat”. We will learn how to find it on the price chart and what trading signals it gives. We will consider the rules and examples of its formation.

Description of the “Bat” pattern

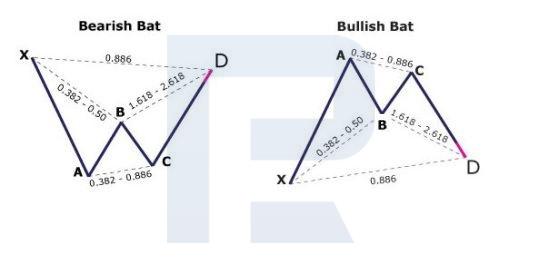

The harmonic Bat pattern is a 5-point graphical pattern formed by taking into account certain Fibonacci ratios. It was introduced by Scott Carney in 2001. The figure has a similar structure to the Gartley’s Butterfly, but they differ in Fibonacci ratios.

It has five points (X, A, B, C and D) and four price swings (XA, AB, BC and CD). The last point in the pattern is D, which is a potential reversal zone. Its appearance is seen as a signal to open buy or sell positions.

This chart pattern is formed on a variety of timeframes. Often it represents a correction area, after the end of which the preceding trend is likely to continue. For more reliable signals, this pattern can be used in conjunction with classic means of technical analysis – trend lines, support and resistance levels.

Rules for shaping the “Bat” pattern

Like many other harmonic patterns, the Bat is defined by Fibonacci ratios. There are automated ways to find this pattern on the chart – special indicators. But you can also determine it yourself, knowing the rules of formation:

- XA is the first impulse of the price movement on the chart.

- AB – correction from the first XA movement, ranging from 38.2% to 50%.

- BC – can range from 38.2% to 88.6% of the wavelength of AB.

- CD, the final wave, is an extension of 161.8% to 261.8% of the BC section and ends at about the 88.6% correction level of the XA wave.

- The emergence of the D-point is the final stage of formation.

How a bullish Bat pattern is formed

- Wave XA is formed as a result of an upward price impulse.

- The price then reverses in AB and corrects from 38.2% to 50% of the XA segment.

- On the BC section, price reverses again and rises to 38.2-88.6% of the AB wave.

- In the final CD phase, the price reverses downwards and reaches approximately 88.6% of the first XA impulse.

- After the formation of the pattern, quotes are expected to rise from point D.

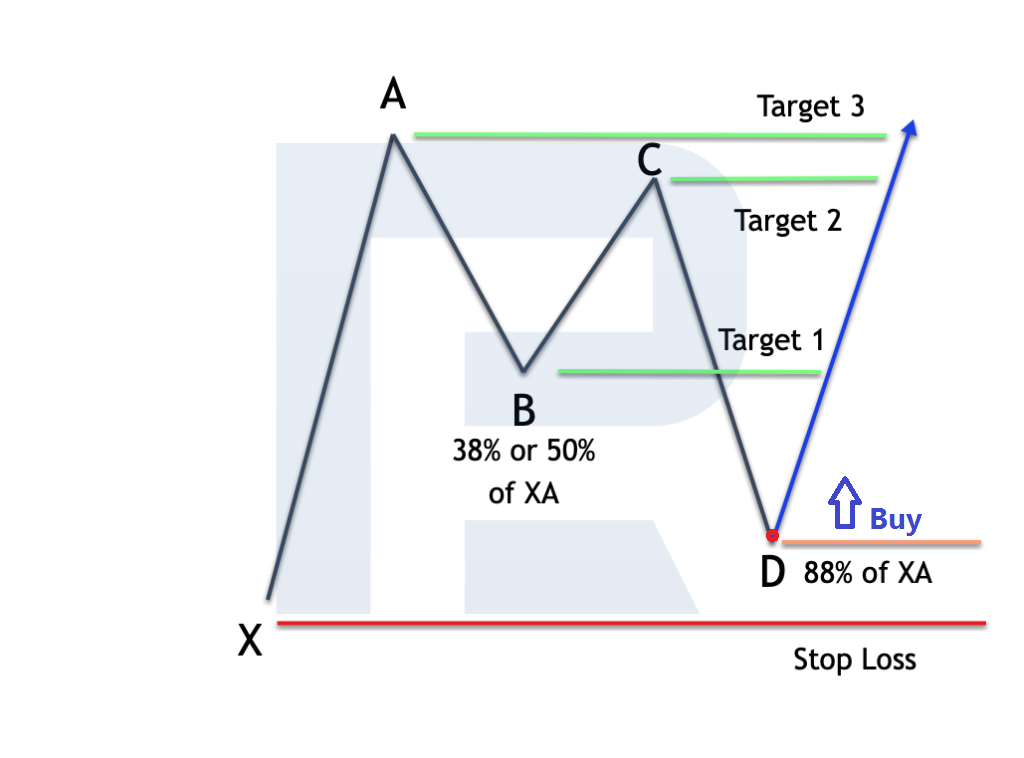

Rules for trading the bullish Bat pattern

- A buy position can be opened once the D-point has been formed and quotations have started to reverse upwards.

- The Stop Loss should be placed just below the pattern low at point X.

- The Take Profit can be based on the B point, the C point or the maximum value of the pattern at the A point.

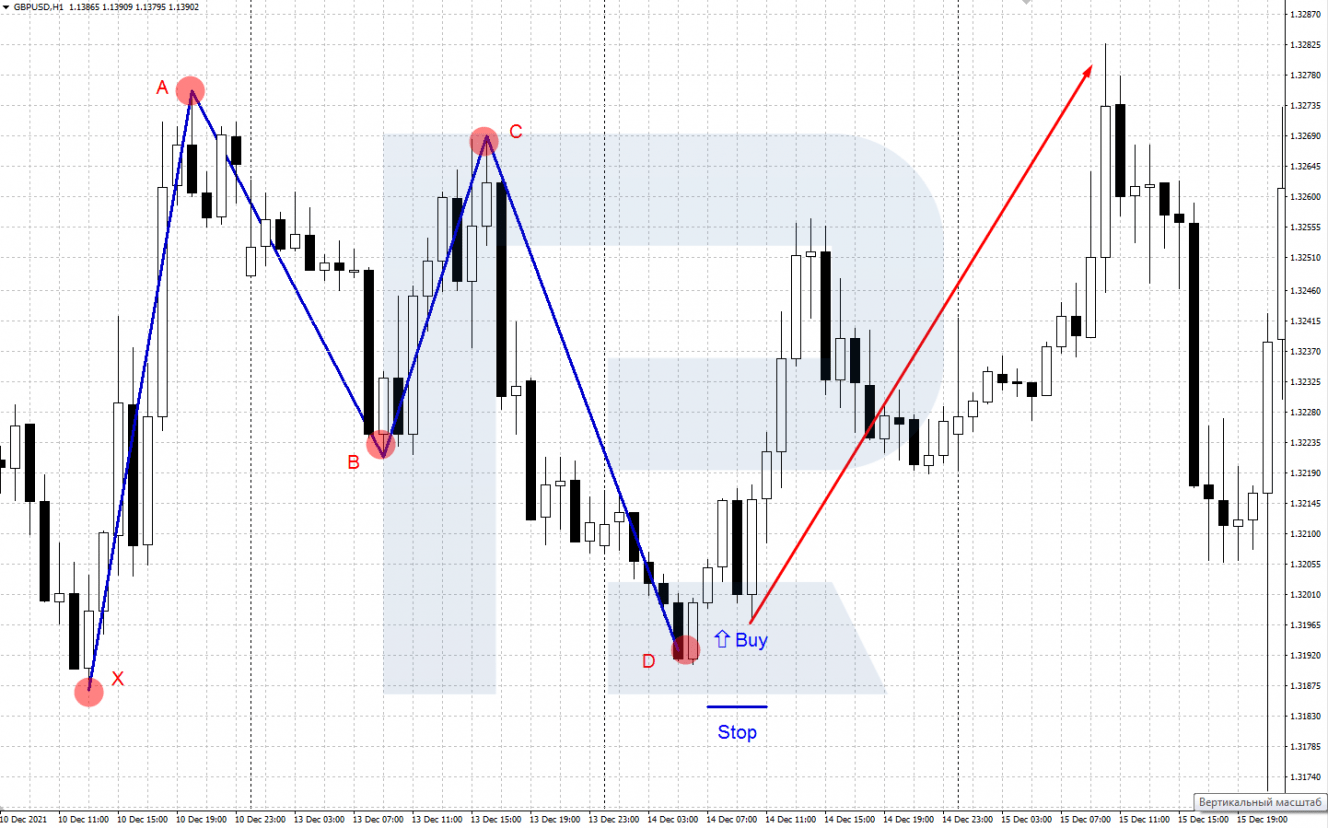

Example of bullish trading in the Bat pattern

A pattern has formed on the H1 chart of the GBP/USD currency pair. After the start of the upward movement from point D, a buy position can be opened. Stop Loss is placed just below point X, profit taking targets are points A, B, C and higher if there is a strong upward movement.

How a bearish Bat pattern is formed

- The first momentum of the XA price movement is downward.

- The price then reverses upwards in AB and corrects from 38.2% to 50% of the XA momentum.

- On the BC section, price reverses again and descends by 38.2-88.6% of the AB wave.

- On the last CD move, the price rushes upwards and reaches approximately 88.6% of the XA momentum.

- After the formation of the pattern, a reversal downwards at D is expected and further price declines.

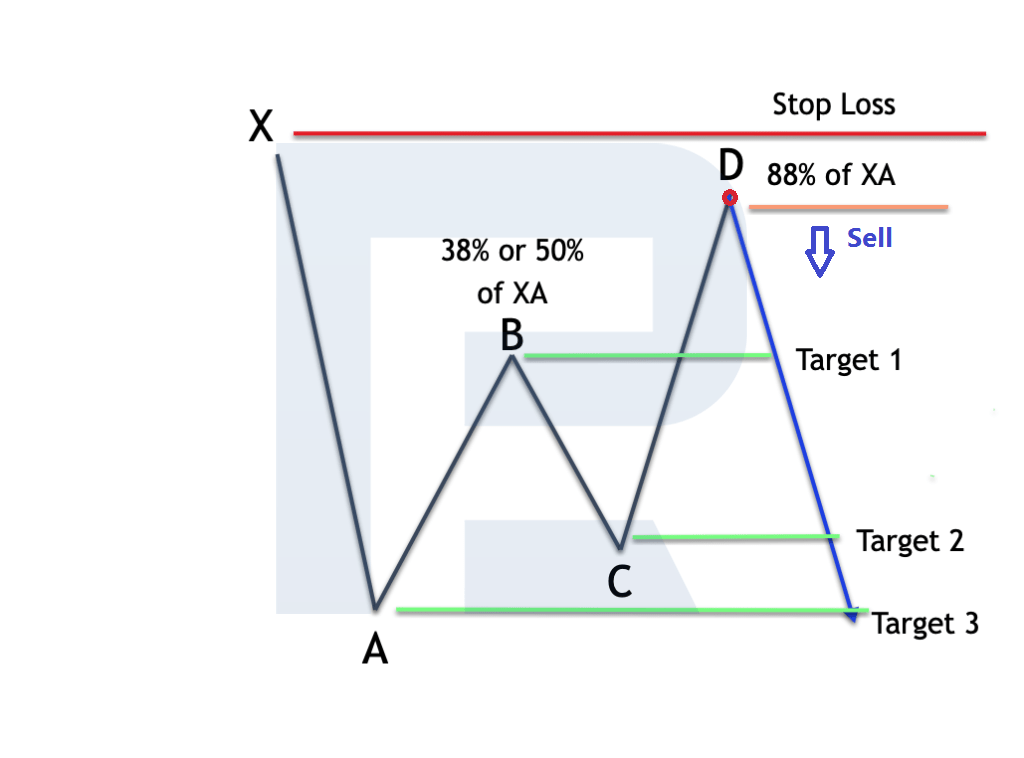

Rules for trading the bearish Bat pattern

- A sell position can be opened once the D-point has been formed and the price of the financial instrument has reversed downwards.

- The Stop Loss should be placed just above the high of the model at point X.

- Take Profit can be based on the B point, the C point or the minimum value of the pattern at the A point.

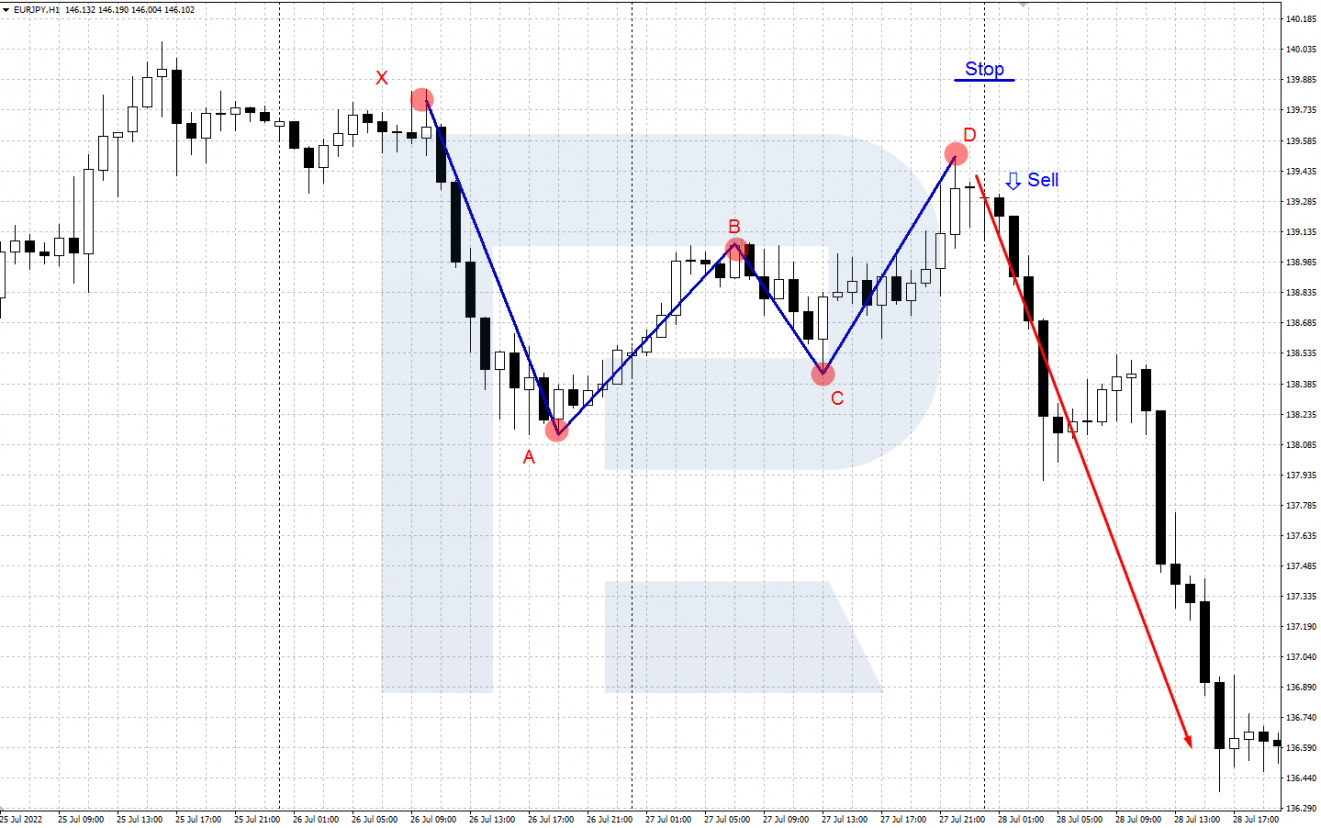

Example of trading a bearish Bat pattern

A pattern has formed on the H1 chart of the EUR/JPY currency pair. After the price reverses down from point D, a sell position can be opened. Stop Loss is set just above point X, Take Profit is set at points A, B, C and below if there is a strong downtrend.

Conclusion

The Bat pattern is a popular harmonic pattern based on Fibonacci levels. It is characterized by a good ratio of Stop Loss and Take Profit: as a rule from 1:2 and higher. This pattern may be combined with technical analysis to provide more reliable trading signals.

The Bat trade will be relevant in Forex as well as other financial markets. Before using it in real trading, you should test finding and working out the pattern on a demo account.

The post How to Trade the Bat Pattern appeared first at R Blog – RoboForex.