USD/CAD – US dollar vs Canadian dollar – is a major currency pair, popular in the Forex market. Let us see, what influences its quotations and what the main trading methods are.

Some history

Canada is a country with the largest territory in North America. The name of the country stands for “kanata”, which means “settlement, land” in the language of local Indian people. The history of Canada started in 1534 when a French seafarer Jacques Cartier explored the country. One of the first French colonies was founded on the territory of modern Quebec, initially populated by indigenous people.

Canada is a federative country that consists of ten provinces and three territories. As early as the 1850s, the country gave up the colonial Canadian pound and switched to the Canadian dollar. Traders also use a slang name “loony”, from “loon”, the name of the bird on the 1 dollar coin. This bird is a mascot o Canada. Since 1970, the CAD has been a free tradable currency; the monetary policy is regulated by the Bank of Canada, the Central Bank of the country.

The CAD is a popular currency that takes part in 3% of all trading operations of international trade. Many leading countries keep a part of their gold reserves in the CAD. Thanks to free conversion and good volatility, the CAD is one of the seven Forex majors.

Trading characteristics of USD/CAD

USD/CAD demonstrates the relation of the US dollar to the Canadian dollar. The quotation demonstrates how many Canadian dollars you will need to buy one Us dollar. The growth of USD/CAD means that the USD becomes stronger on the expense of the CAD. And when the USD/CAD falls, the CAD becomes stronger against the USD.

Here are several trading characteristics of the USD/CAD:

- Trading time: the pair trades 24/7 except weekends and holidays. Its trading volumes and volatility reach their peaks during the American trading session when important economic statistics from the USA and Canada is published, influencing the quotations of the pair.

- Volatility: USD/CAD is a quite volatile pair. Its average daily movements are about 80-100 points. Strong surges bring the volatility to 200-300 points a day for a short while.

- Spread: this pair is a major, popular and liquid enough for the spread to be small. On popular ECN accounts in normal market conditions it amounts to 1-1.5 points.

Which factors influence USD/CAD quotations?

USD/CAD dynamics is one of the indicators reflecting the economic situation in the USA and Canada. Here are the main factors that influence the dynamics of the pair.

Monetary policies of the BoC and Fed

The interest rate policy of the CBs of Canada and the USA influences the quotations of the pair quite a bit. If the Federal Reserve System initiates a cycle of increases in the interest rate while the Bank of Canada changes nothing, USD/CAD gets support to grow. And vice versa, if the BoC raises the rate and the policy of the Fed remains neutral, the Canadian dollar will be growing, and the USD/CAD quotations will be falling.

Global oil prices

The rate of “loony” depends heavily on commodity prices, crude oil prices in the first place. Canada is a major exporter of nature resources, especially oil, and the USA is the main sales market. So, oil prices have a serious influence on the exchange rate, and the Canadian dollar belongs to the commodity group of currencies.

Such currencies tend to decline when the investment climate worsens, and the demand for commodities fall. An increase in oil prices, on the contrary, supports the CAD.

When oil prices grow, the USD/CAD quotations fall (the Canadian currency grows). And when oil prices drop, the USD/CAD heads upwards (the Canadian currency declines).

Economic indicators of Canada and USA

Statistical offices of the USA and Canada regularly publish various economic indicators that characterize the current economic situation in the countries. The following statistics can have a strong influence on the USD/CAD quotations:

- Statements and comments of CB heads and major politicians of the USA and Canada

- Unemployment Rate

- Non-farm Payrolls

- GDP

- CPI and PPI

- Industrial Production

- Trade Balance

See more about economic indicators in our article devoted to fundamental analysis in the Blog:

Trading USD/CAD

To trade the pair, you can use fundamental analysis, tech analysis, and indicators.

Fundamental analysis

This approach analyzes various fundamental factors: economic statistics, expectations of changes in the interest rate, or the current trend in global currency and commodity markets.

Example:

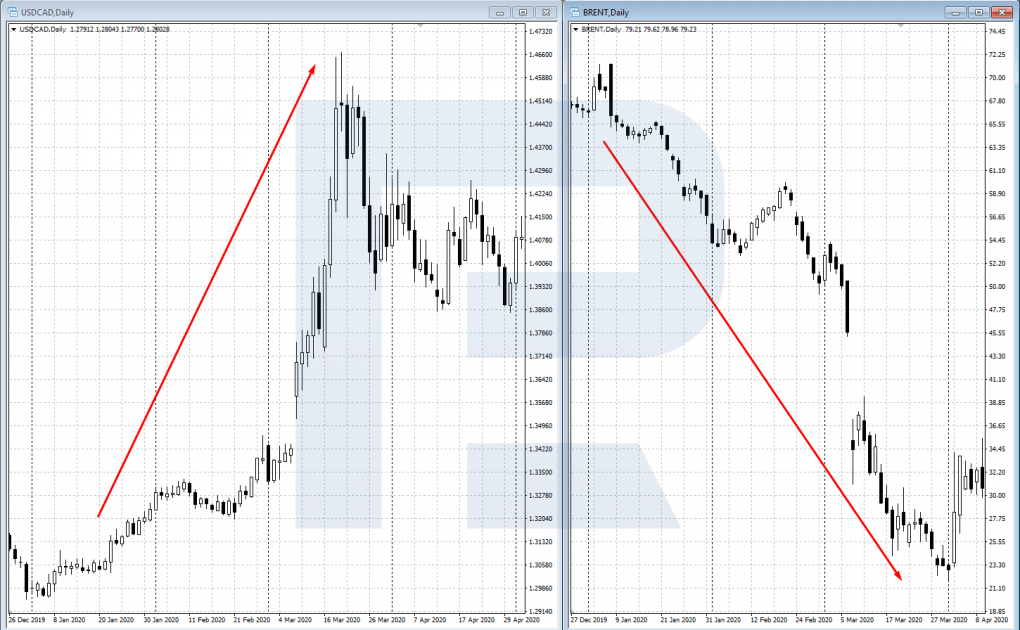

In 2020, when the stock market collapsed due to the pandemic, global oil prices were falling fast. At that time, two negative factors at once influenced the CAD: the US dollar was growing because investors were fleeting from risks, and oil prices were falling. As a result, the USD/CAD pair was growing fast; one could buy it and hold until its growth stopped with the end of the acute phase of the crisis and the beginning of economic recovery.

Tech analysis

This method is based on accurate analysis of the chart of the currency pair. Here, we use tech analysis, original methods, candlestick combinations, Price Action patterns, etc.

Example:

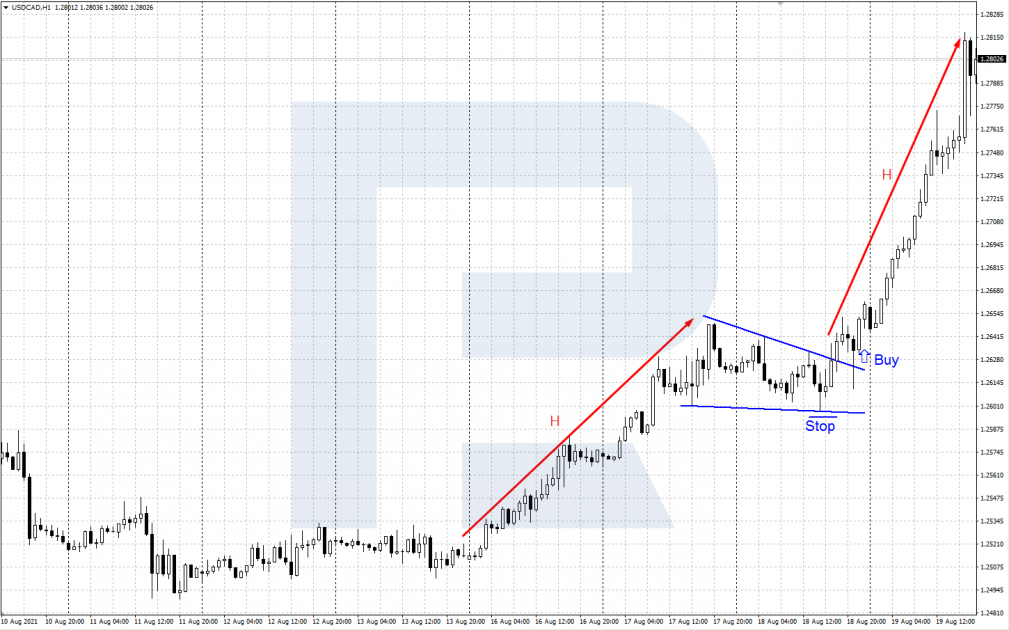

- On H1 of USD/CAD in an uptrend a trend continuation pattern called Flag formed.

- Open a buying position after the price breaks through the upper border of the pattern.

- Place a Stop Loss behind the lower line of the pattern, and the Take Profit – at the distance of the previous movement in points (H).

Trading by indicators

This trading method includes using indicators. Those can be complex indicators or a set of simpler ones. Indicator signals can be used for automating your work by expert advisors.

Example:

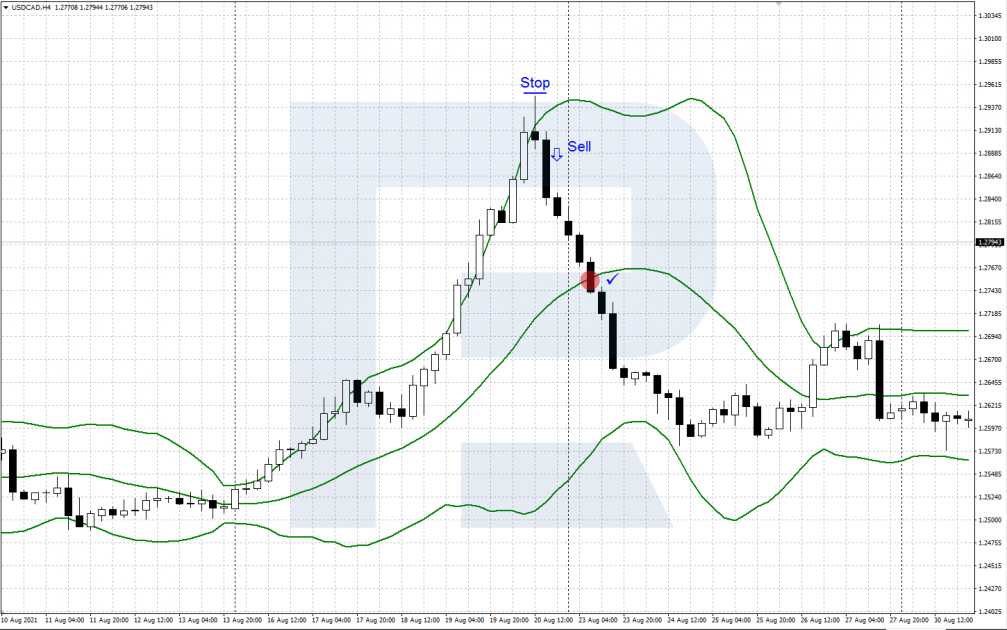

Take a simple indicator strategy Return to Average, once described in our Blog.

- A signal to sell appears when the price bounces off the upper border of the Bollinger Bands channel, while a Shooting Star reversal pattern has formed.

- Upon opening a position, place your SL behind the local high on the price chart.

- Take the profit when middle line of the indicator channel is reached.

Closing thoughts

Thanks to good liquidity, volatility, and a small spread, USD/CAD is actively used by Forex traders. Trading decisions are based on various methods, including analysis of economic statistics, price charts, and indicator signals.

To get started, use a demo account so you could practice and only then switch to a real account with minimal risks.

The post How to Trade USD/CAD Currency Pair? appeared first at R Blog – RoboForex.