Today the article is devoted to the Standard Deviation indicator. It helps evaluate the dynamics of volatility of a financial instrument and find promising entry points.

What the indicator shows

Standard Deviation (STDev) is a trading instrument that shows how far the price of a financial instrument deviates from standard values of a certain period. It shows the deviation from a Simple Moving Average and thus helps to assess the change in the price volatility.

The indicator conditionally belongs to trend ones: when it grows, this might mean the beginning of a new market trend. The higher the volatility and the more the price fluctuates from the average over the chosen period, the higher STDev values will be. And vice versa: if the quotes are stable, trading in a narrow price range, indicator values will fall to the lows.

STDev can be used for trading on its own and alongside other indicators. Also, it is used inside more complicated indicators. For example, it can be found in a famous channel indicator Bollinger Bands: STDev helps to calculate the borders of the price range for the quotes.

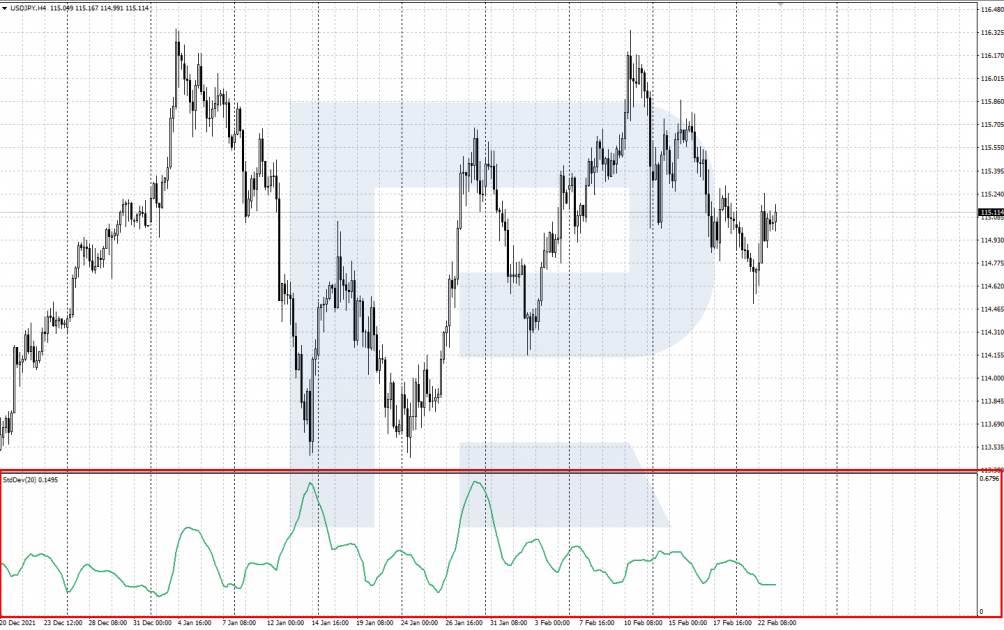

Standard Deviation appears in a separate window under the chart and has just one main line. Its values start with 0 and always remain positive, i.e. never drop under 0.

The indicator does not show trend direction. The line will grow alongside the growth of volatility regardless of the market direction, equally when the quotes are growing and falling.

How to install Standard Deviation

Standard Deviation is built in the majority of popular trading platforms. To install it on the chosen price chart on the MetaTrader 4 and MetaTrader 5 platforms, go to the Main Menu. Your algorithm is: Main Menu – Insert – Indicators – Trend – Standard Deviation.

You can customize the following settings:

• Period is the period for which the indicator will be calculated. By default, it is 20.

• Apply to: choose the price that calculations will be based on. By default, it is Close.

• MA method is the calculation method for the MA. By default, it is Simple.

• Style sets the appearance of the line. You can change its color, width, and representation method.

Calculating Standard Deviation

To calculate the indicator, use the following formula of statistic average square deviation:

Standard Deviation = Sqrt (SUM ((CLOSE – SMA (CLOSE, N)) ^ 2, N) /N)

Where:

• Sqrt is the square root

• N is the calculation period

• SUM (…, N) is the value of the SMA(N)

• CLOSE is the closing price.

Calculating STDev:

• Calculate SMA(N)

• Subtract the SMA value from the Close price of the current TF

• Square the result and add it up.

• Divide the result by N.

• Take the square root.

How to trade by STDev

Standard Deviation is often used alongside other indicators and tech analysis instruments, but equally it can be used on its own. It will help detect the beginning of a correction and its end. Here are two main trading signals of the indicator — a reversal on extremes and an escape from the range.

Reversal on extremes

The signal appears when the Standard Deviation line demonstrates highs that can be visually detected in the indicator window. This indicates quite a strong movement that provoked a surge in volatility.

The quotes have deviated from the average quite a bit, and the market is oversold/overbought. A correction or reversal can start at any moment.

If the signal is against the current trend, this is a reason to close profitable positions because a reversal is very probable. To open new ones, extreme growth of the indicator in a correction should be used.

In other words, if during a correction there is a noticeable surge in the indicator values and then the price reverses towards the current trend, this is a good signal to open a position by the trend.

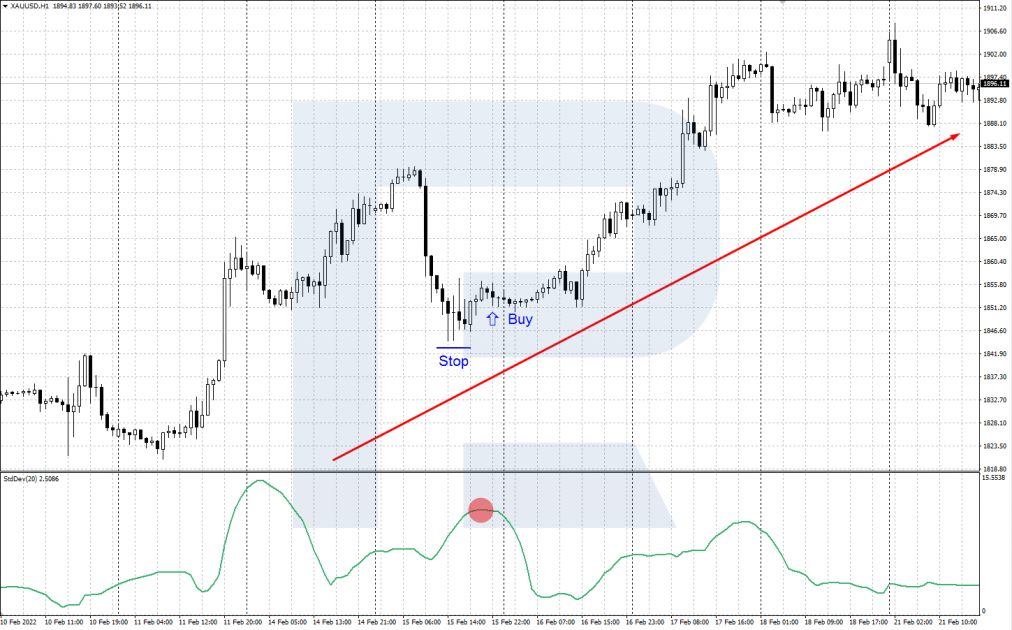

Example of a reversal on extremes

• On H1 of XAU/USD a descending correction happened in an uptrend.

• Upon reaching the high on STDev, the price reversed upwards, confirming the end of the correction. A buying position by the trend can be opened.

• Stop Loss is placed behind the low of the correction. Profit can be taken as soon as the price reaches a strong resistance level or after signals of a reversal downwards appear.

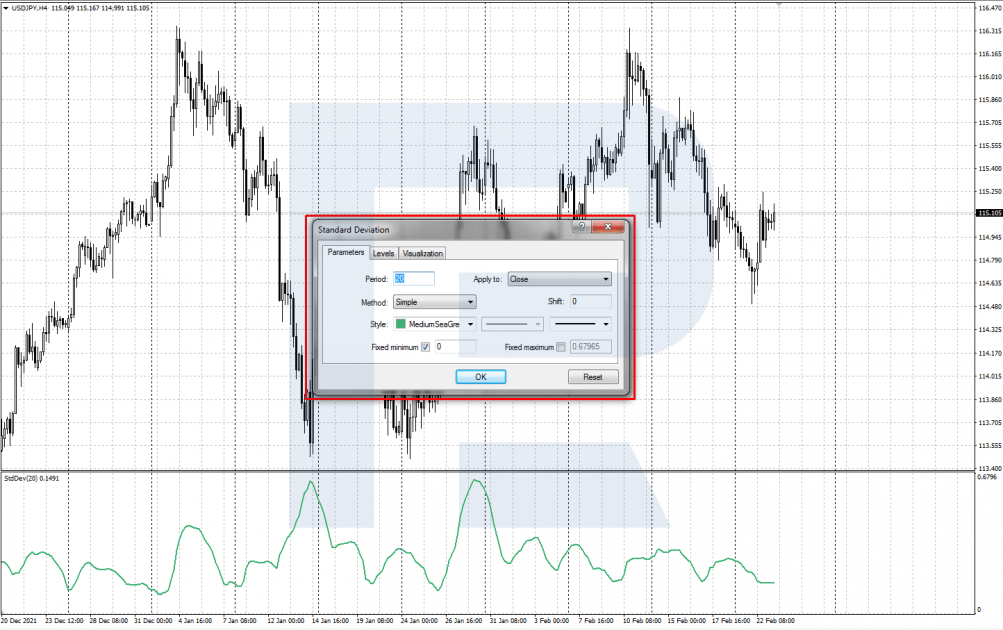

Escape from the range

This signal appears after the quotes escape from a range — a correction area before the beginning of a new movement. Before the price escapes the range, the indicator line must be at its lows, and in the window a horizontal level through its nearest highs can be drawn. When the price escapes the range, STDev line also breaks through its level upwards, confirming the entry signal.

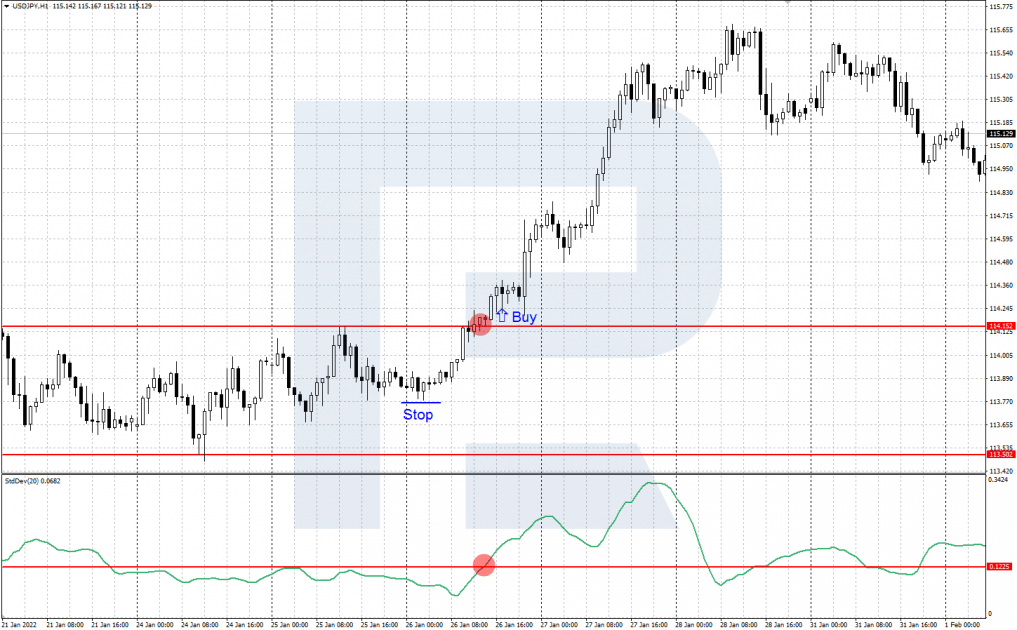

Example of an escape from the range

• On the H1 chart of USD/JPY the price comes out of a flat upwards.

• The indicator line confirms the signal rising above the level drawn through its nearest highs. A buying position can be opened.

• Stop Loss is placed behind the local low. Profit can be taken when the price reaches an important resistance level or after some evidence of a reversal appear.

Bottom line

Standard Deviation demonstrates the deviation of quotes from average values and thus helps the trader assess the current volatility levels.

In trading, the instrument is most often used alongside other indicators and means of tech analysis. Before using for real, the indicator should be tested on a demo account.