In the modern world of marketing, online advertising plays a very important role. Promotional campaigns are run on social networks, messengers, and different online services. In the era of business digitalisation, there is a dire need for management, analysis, and optimisation of advertising traffic.

Basis Global Technologies – the company that developed a SaaS platform for algorithmic media purchase – is planning to go public by listing on the NASDAQ under the “BASI” ticker symbol. The exact date of the IPO hasn’t been announced yet.

The business of Basis Global Technologies

Basis Global Technologies Inc. was registered in 2001 with headquarters in Chicago, Illinois. The company’s founder and CEO is Shawn Riegsecker. The company currently employs over 800 people.

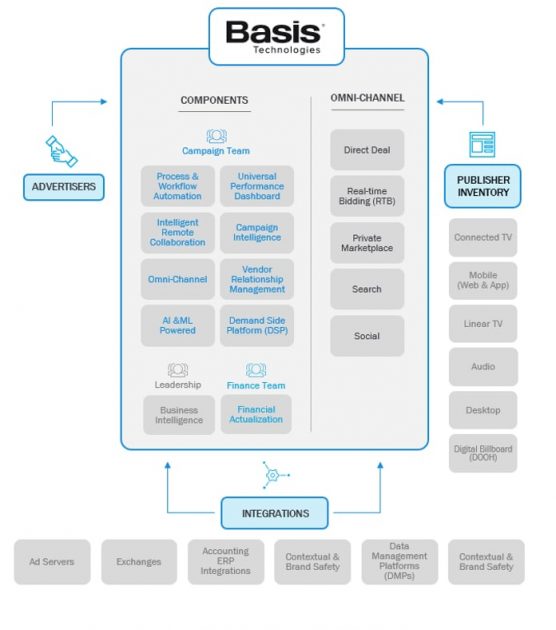

Initially, the key investors were FTV Ventures and NB Holdings. The company developed a SaaS platform that consists of several applications. The platform automates daily routine operations and unifies business processes. The platform’s key goal is to improve online advertising cost-effectiveness.

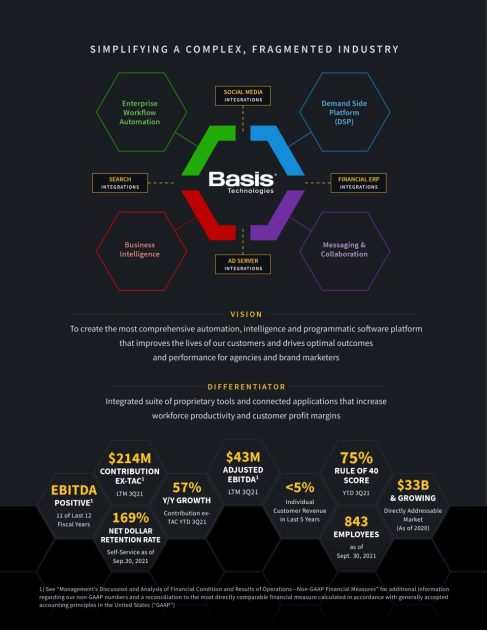

Key features of the Basis Global Technologies product:

- Work process automation

- Search of clients for buying/selling media

- Managing buying/selling media

- Marketing audit and optimisation

The issuer’s clients are small and medium enterprises and also transnational corporations from the Fortune 500 list. As a result, Basis Global Technologies covers a wide target market. Moreover, its customer base is well diversified: none of the company’s clients contributes more than 5% of its revenue.

The market and competitors of Basis Global Technologies

According to Industry Research, the global online advertising market on SaaS platforms was estimated at $18 billion in 2019. By 2025, it is expected to reach $80 billion. As a result, the average annual growth rate from 2020 to 2025 could be 28.2%.

Basis Global Technologies’ key competitors are:

- Trade Desk

- Microsoft

- Amazon

Financial performance

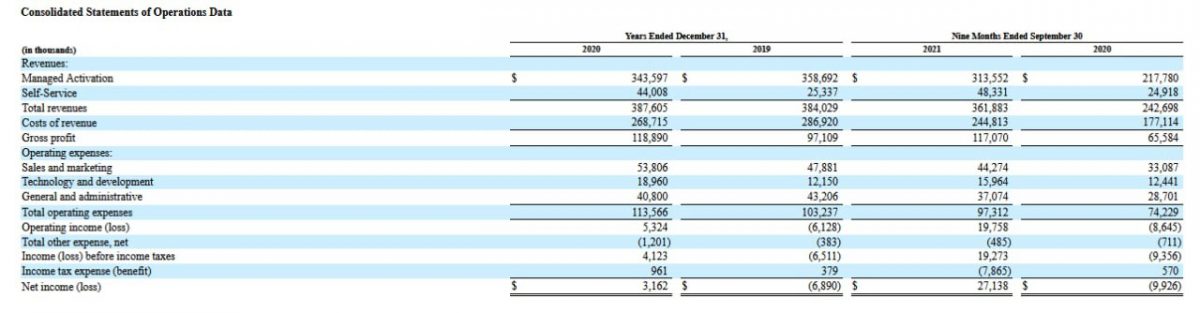

According to the provided report, sales in 2020 were $387.61 million, this is a 0.93% increase in comparison with 2019.

In the first 9 months of 2021, the company’s sales were $361.88 million – this is a 49.11% increase in comparison with the same period of 2020. As a result, the revenue over the last 12 months was $506.8 million. The reasons for such a high growth were the global lifting of severe quarantine restrictions and the revival of the digital advertising market.

The company’s net profit in 2020 was $3.16 million. A year before, the issuer had a $6.89 million loss. In the first 9 months of 2021, the net profit increased to $27.3 million. As we can see, the business is starting to generate net profit, while operating expenses are reducing.

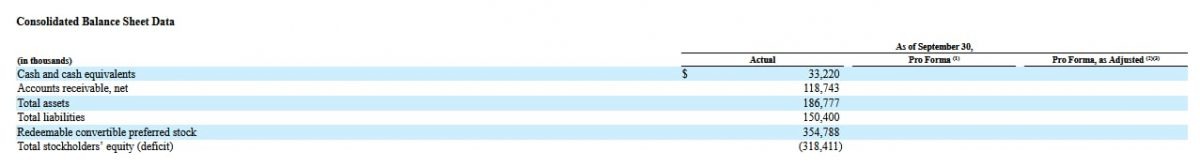

The company’s total liabilities are $186.78 million, and the cash equivalents on its balance sheet are $33.22 million – this implies a negative cash position; however, the company is in the black, and this fact compensates it.

Strengths and weaknesses of Basis Global Technologies

The advantages of investing in Basis Global Technologies are justified by the following:

- Recovering of the revenue growth rate after stagnancy in 2020

- Gross profit growth

- Net profit growth

- Sound management

- High predicted growth rate of the target market

Risk factors of investing in these shares are the following:

- Unstable cash flow

- Strong competition

- Business depends on the product’s popularity

IPO details, and estimation of Basis Global Technologies’ market capitalisation

The underwriters of the IPO are Samuel A. Ramirez & Company, Inc., C.L. King & Associates, Inc., Academy Securities, Inc., Loop Capital Markets LLC, Needham & Company, LLC, Stifel, Nicolaus & Company, Incorporated, BMO Capital Markets Corp., Siebert Williams Shank & Co., LLC, RBC Capital Markets, LLC, BofA Securities, Inc, and Goldman Sachs & Co. LLC.

The number of shares to be sold hasn’t been announced yet. The IPO volume is a standard $100 million with an estimated market capitalisation of $1 billion. In the case of favourable market conditions, Basis Global Technologies may yet increase the IPO volume and raise capitalisation.

To assess loss-making companies, we use a multiplier – the Price-to-Sales ratio (P/S ratio). A P/S value for the technological sector with such a rapidly-growing target market could be 15.0-20.0 during the lock-up period. The issuer’s P/S is unknown yet.

This investment might well be of a venture nature if the actual P/S is over 20. The stock could be interesting to investors who are ready to take risks.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post IPO of Basis Global Technologies: Business Analytics of Online Advertising appeared first at R Blog – RoboForex.