In advanced economies, the healthcare sector is a pretty profitable business, which is not prone to cyclic crises. In western Europe and the US, this business has multi-billion volumes and requires financial management optimization. This is the reason why a lot of technology startups are currently engaged in developing such platforms.

Ensemble Health Partners is the leading provider of RCM solutions for both physicians in private practice and hospitals. The company is planning to have an IPO at the NASDAQ; the ticker symbol is “ENBS”. The IPO date was postponed by underwriters and is still unknown.

In this article, we’ll discuss the attraction of these shares for investments.

Business of Ensemble Health Partners

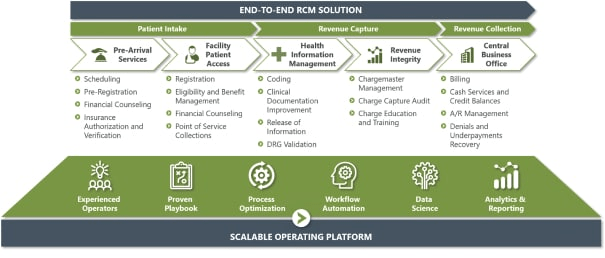

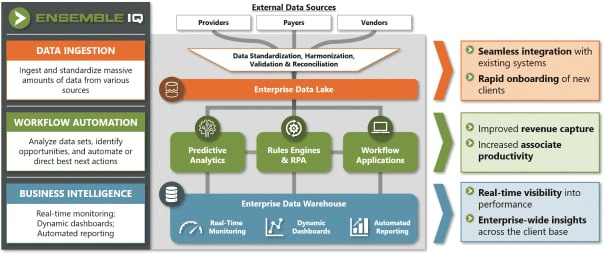

The company was established in 2014 with its headquarters in Cincinnati, Ohio. As of now, it employs over 1,000 people. The company’s key product is a technological revenue cycle management platform for hospitals, their doctors, and physicians in private practice.

As a result, Ensemble Health has a pretty big and diversified customer base. As of the IPO application filing date, the company’s platform processed transactions for over $20 billion. The RCM platform allows to improve the revenue management procedure and focus on providing more quality healthcare services. Usually, the company lands long-term contracts with its clients, for 10-15 years with automatic renewal.

Ensemble Health received several awards in the public healthcare sector. According to KLAS Research, the company was named the “Best in KLAS” in all five categories: services, operations, loyalty, value, and relations. Ensemble Health Partners won this award twice in a row, in 2020 and 2021, based on objective data received from healthcare services providers.

In addition to that, Ensemble Health Partners was recognised as the best employer several times by Beckers 150 Top Places to Work and Cincinnati Enquirer. The awards help the company to attract more qualified and professional staff and increase the quality of the services offered to its customers. The company operates in a rapidly-growing RCM (revenue cycle management) market. We’ll talk about it below.

The market and competitors of Ensemble Health Partners

According to Global Market Insights, the US revenue cycle management market in 2020 was estimated at $98 billion. Forecasts say that by 2027 the market may reach $230 billion, with an average annual growth rate of 12.9%. The key factors for this growth will be the technological advance and the need for financial management optimization in the healthcare industry.

In 2020, the global healthcare market was estimated at $1 trillion. Ensemble Health believes that the target market at the time of the IPO is about $50 billion.

The company’s key competitors are:

- Candela Medical

- Oscar Health

Financial performance

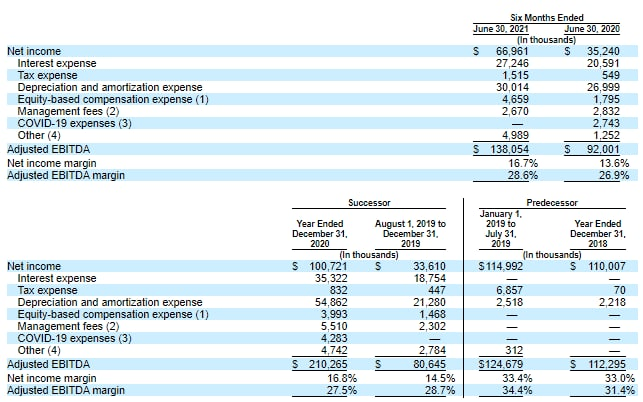

Ensemble Health Partners is filing for the IPO being profitable, which is rather unusual for technological companies. That’s why we’ll start analysing its financial performance with net profit.

The company’s net profit in 2020 was $100.72 million, a 32.22% decrease relative to 2019. According to the S-1 report, in the first 6 months of 2021, the company’s net profit was $66.96 million, a 90.01% increase if compared with the same period of 2020. As we can see, the net profit growth rate is recovering.

Over the last 12 calendar months, the net profit was $176.78 million. At the year-end of 2021, this sum may reach $231.72 million.

The company’s sales in 2020 were $600.02 million, a 4.07% increase relative to 2019. According to the S-1 report, In the first 6 months of 2021, the company’s revenue was $400.08 million, a 55.01% increase if compared with the same period of 2020. Over the last 12 calendar months, the revenue was $742.26 million.

Cash and cash equivalents on the company’s balance sheet are $76.05 million, while its total liabilities are $1.49 billion, including two long-term loans worth $1.4 billion. Ensemble Health Partners generates a positive cash flow with growing revenue.

Strong and weak sides of Ensemble Health Partners

It’s time to highlight the risks and advantages of Ensemble Health. I believe the company’s strong sides are:

- The net profit growth rate of above 90%.

- Low debt load.

- Awards for the best employer and quality of services.

- Promising target market.

- Sound management.

Among investments risk, I would name:

- Low revenue growth rate.

- Unstable net profit.

- The company doesn’t pay dividends.

IPO details and estimation of Ensemble Health Partners capitalization

At first, the company’s management was planning to go public in late October, but later decided to postpone the IPO. The underwriters of the IPO are Robert W. Baird & Co. Incorporated, William Blair & Company, L.L.C., Academy Securities, Inc., Loop Capital Markets LLC, Guggenheim Securities, LLC, Credit Suisse Securities (USA) LLC, Evercore Group L.L.C., Wells Fargo Securities, LLC, SVB Leerink LLC, Deutsche Bank Securities Inc., BofA Securities, Inc., and Goldman Sachs & Co. LLC.

During the IPO, the company is planning to sell 29.5 million common shares at the price of $19-22 per share. The IPO volume is expected to be $605 million with a capitalization of up to $3.62 billion.

As a rule, to assess the capitalization of a company from the technological sector we use a multiplier, the Price-to-Sales ratio (P/S ratio). At the time of the IPO, the company’s P/S value is 4.88. For companies from this sector, P/S may be up to 10, that’s why the upside for Ensemble Health shares may be up to 108.33%.

With all that said, I would recommend this company for mid/short-term investments.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex.com and open a trading account.

The post IPO Of Ensemble Health Partners: An RCM Platform or Public Health Services appeared first at R Blog – RoboForex.