This article is devoted to a multiplier called P/CF, frequently used by traders and analysts for stock analysis. I will show you examples of how the multiplier can help to choose investment instruments and how to use it in comparative analysis.

P/CF calculations

P/CF stands for Price/Cash Flow and, obviously, demonstrates the ratio of the market price of the company and the cash flow generated by its business. To find the P/CF value, divide the market price of the company by the cash flow from market operations.

Where:

- Price is the capitalization of the company found as the price of one share multiplied by the number of shares in turnover. The capitalization of the company can be found in financial reports or on the Internet. The digits of the capitalization normally get rounded because of the quotations changing constantly. For a more precise calculation, perform it yourself using the current share price.

- Cash Flow is the cash that the company gets “on hand” after all the expenses paid. In essence, this is money that can be used for paying dividends to shareholders or be withdrawn painlessly.

Example calculation of P/CF:

The current share price of AMD (when this article was being prepared) is 109.15 USD. There are 1,212,965,282 shares in turnover. Multiplying these, we find out that AMD costs 132,395,160,530.3 USD.

Though cash flow and net profit are quite similar to one the other, the former has certain differences from the latter:

- Cash flow demonstrates the current money volume.

- Cash flow accounts for the overall income and payments.

- Cash flow accounts for the expenses of the next period.

This means cash flow shows the financial situation in the company more objectively than net profit.

P/CF values

Conditionally, P/CF values are calculated in the following range:

- P/CF above 20 means that the company is not doing well.

- P/CF between 15 and 20 is acceptable

- P/CF below 15 means that the company is doing well and has bright perspectives. Such companies are considered underpriced.

These values are, of course, conditional and may differ depending on the sector of economy in which the company works or the stage of development at which the company is now. Young and quickly developing companies may demonstrate negative P/CF, perplexing investors, but this does not mean that the company is doing bad. P/CF values will become correct as soon as the company stands firmly on both feet.

Using P/CF

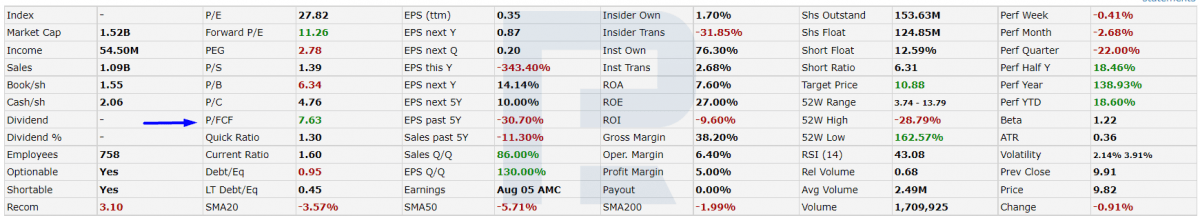

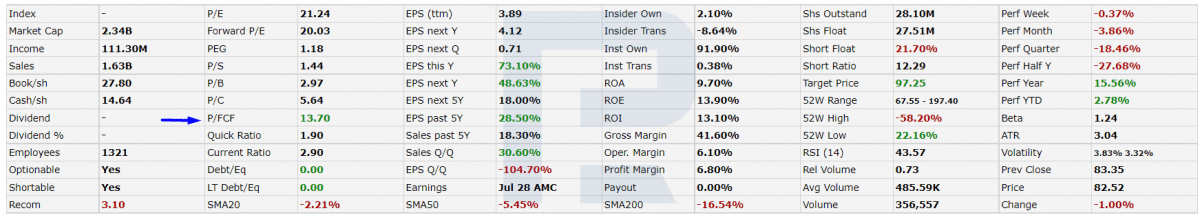

Let us see how the multiplier can be used in practice and help with investment decisions. As an example, I chose two companies working in one field: GoPro, Inc and iRobot Corporation (tech sector, appliances). With all the modern technology, there is little use calculating P/CF manually because it can be found easily on the Internet. Let us compare the values for the two companies.

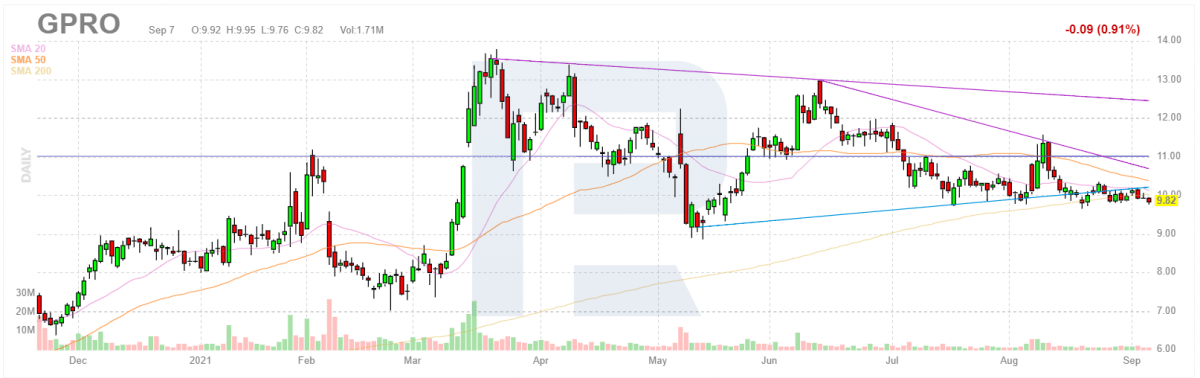

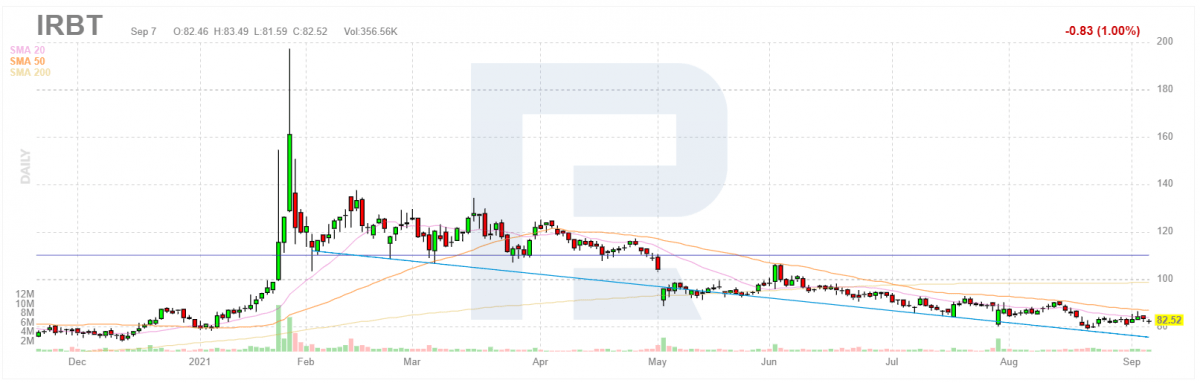

The P/CF values of GoPro Inc is 7.63. For iRobot Corporation it is 13.70. Both companies are in the positive area of the multiplier, which means they look attractive to investors and have good perspectives of development. They are both underpriced by the market and have room for growth. GoPro Inc, still, looks more appealing yet it would be incorrect to call this advantage a serious one. Both companies are at the same level of development.

The conclusions based on the P/CF values are confirmed by D1 charts of the shares of the companies. The quotations of both are in a flat, promising growth.

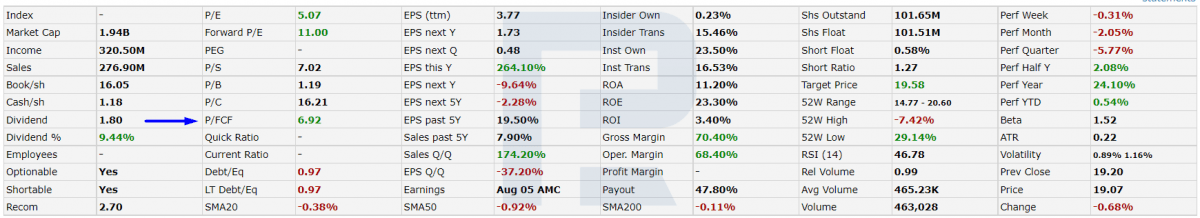

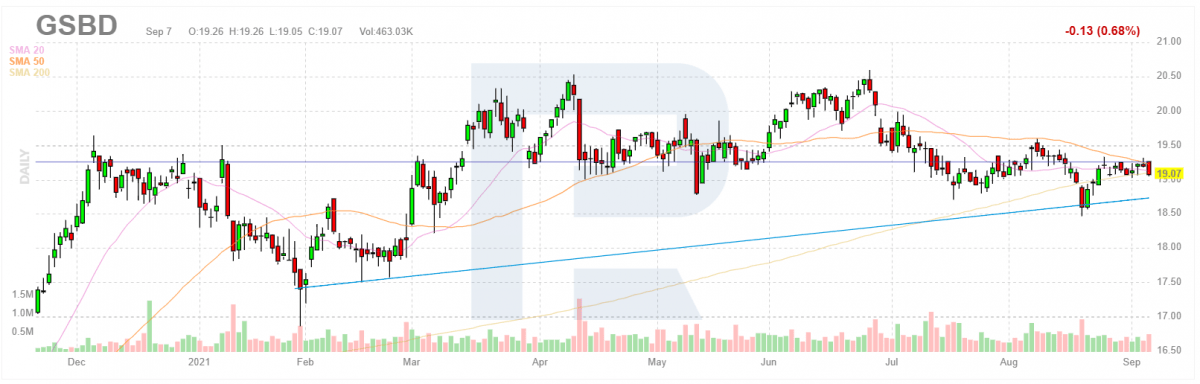

As the next example, let us take companies from the same sector but a big difference in the P/CF value: Goldman Sachs BSC, Inc. and Mastercard Incorporated. As you can figure out from the tables of financial indices, the P/CF value of Goldman Sachs BDC, Inc is 6.92, which means the company is underpriced and has bright perspectives for growth.

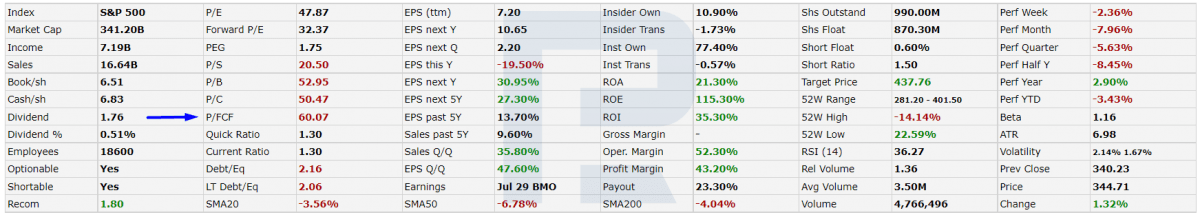

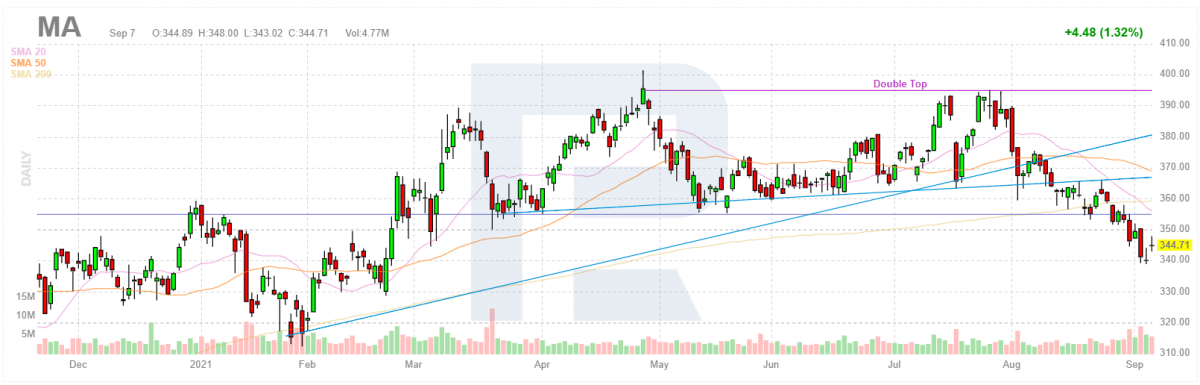

The P/CF value of Mastercard Incorporated is above all limits, reaching 60.07, which means the company is overpricer, and in the future investors might go on getting rid of the shares.

On D1 charts of Goldman Sachs BDC, Inc and Mastercard Incorporated the quotations of the former go on in a flat while an uptrend is developing, which also supports growth in the nearest future.

As for the latter quotations, they continue a downtrend, breaking through the support levels. At the current stage, they are unlikely to recover, and the price will most probably be going down, while the capitalization will follow it.

Comparing the two companies, we come to a conclusion that Goldman Sachs BDC, Inc have a brighter future. However, do not neglect the stock price of the companies: the share price of Goldman Sachs BDC, Inc is 19.07 USD, and of Mastercard Incorporated 344.71 USD. This becomes an investment threshold for investors with a small capital.

Closing thoughts

As well as other multipliers, P/CD has certain peculiarities and allows to compare companies working in one sector and forming financial reports by the same criteria. An optimum option will be using P/CF alongside other indicators.

The post Multipliers for Stock Analysis: How to Work with P/CF appeared first at R Blog – RoboForex.