To choose promising stocks, investors study reports of the company closely. To decide whether companies are attractive for investments, various multipliers are used, including PEG. This article is devoted to this multiplier and how to use it.

What is PEG?

PEG demonstrates to investors relations of three values:

- Current stock price

- Return on stock

- Future growth of profit

In essence, PEG is a derivative from P/E multiplier already described in one of our articles. Its task is to assess the issuer not from the point of past results but from the perspective of future growing profits.

How is PEG calculated?

PEG is calculated by the following formula:

PEG = (P/E) / EPS Growth

Where:

- P (Price) is the capitalization of the company, i.e. the general market price of the company. The price is calculated by multiplying the price of one share for the number of all shares in turnover.

- E (Earnings) is the net profit of the company over the reporting period. Most often, the data for the last calendar year is used.

- EPS (Earnings Per Share) Growth is the forecast growth of the return on stock, expressed in percent. As a rule, for such calculations average results of 3-5 years are used.

The P/E multiplier is a coefficient that compares the share price of the company to its return on stock. One of its drawbacks is the fact that it neglects the growth of the company. However, PEG accounts for future profits of the company, trying to cover up for this drawback.

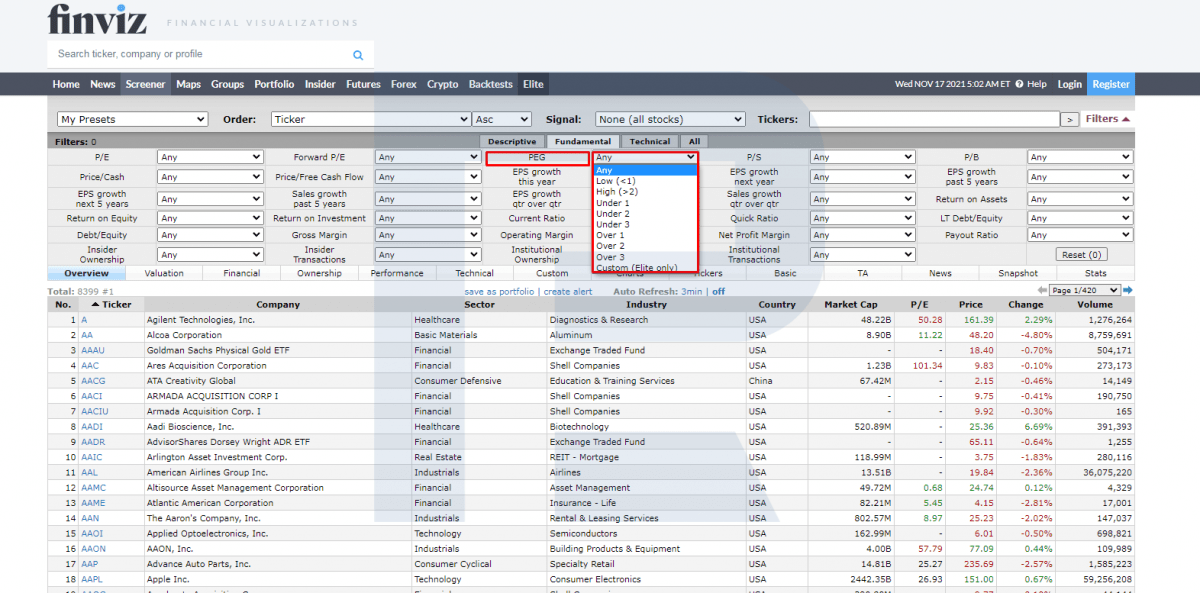

You can calculate PEG yourself by the formula, find it in analytical reports, or use special websites. Many foreign resources provide its values for key issuers. For example you can find PEG for American companies on Funviz.com:

How to use PEG?

PEG is useful for assessing developing companies and other businesses that are growing actively, including startups. Most often, the shares of such companies look extremely overbought by P/E. This is mostly because they spend most of the revenue on innovations and do not present it as net profit.

As a rule, PEG = 1 is considered fair assessment of the company. If PEG is below 1, the shares of the company are undervalued, and investors can make a profit on buying it at a moderate price. And on the contrary, if PEG is above 1,the share is considered overvalued. In the US stock market, a good investment situation is PEG = 0.5.

Example of using PEG for assessing companies from one sphere

- Company A: P/E = 30, expected speed of growth of the profit = 20%, PEG = 1.5.

- Company B: P/E = 20, expected speed of growth = 30%, PEG = 0.8.

- Company C: P/E = 10, growth of profit = 10%, PEG = 1.

According to the calculations, Company B looks most attractive for investments as it has the lowest PEG (0.8). Its shares can be bought with a discount, as long as its growth is so prominent. Company A has high PEG = 1.5, which suggests that its shares are currently somewhat overvalued. As for Company C, its PEG is 1. Though its P/E is the lowest of the three, its expected growth is also the slowest, and its market price is now fair.

As long as PEG is based on the profit, trustworthy forecasts if its growth are extremely important for calculating the multiplier. Some companies can keep their forecast speed of growth secret, in which case PEG might prove inefficient. PEG is a useful multiplier but not a universal one, recommended for use alongside other multipliers.

Advantages and drawbacks of PEG

Advantages of PEG would be:

- As well as P/E, it helps to find undervalued companies, promising investment options, but with expected growth of the profit.

- It is suitable for assessing the attractiveness of fast-growing companies that already have increased P/E, thus smoothing out the low base effect.

The drawbacks would be:

- PEG, as well as P/E, cannot be used for assessing losing companies. For this, P/S (Price/Sales ratio) is normally used.

- PEG for one company can vary depending on which period of expected growth is used in calculations. For example, yearly and five-year assessments can be different.

- Forecast profit is always assessed subjectively. Basing the forecast on past results, we risk missing the moment when a fast-developing company becomes stable or even stagnates. If so, growth of profit will be slower than expected.

Bottom line

PEG is a derivative the famous P/E. It can smooth out the drawbacks of P/E because it forecasts future profits. PEG multiplier gives an idea of which stocks will provide for the best return on investment.

However, do not rely solely on PEG when making investment decisions. It has certain drawbacks, and investors need other multipliers at hand.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.25. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex.com and open a trading account.

The post PEG Multiplier: How to Calculate and Use for Assessing Stocks appeared first at R Blog – RoboForex.