On 1 February, Alphabet Inc. (NASDAQ: GOOGL) announced a stock split at 20 to 1. The split is due on 15 July. The news made the share price grow abruptly, by 11% over 2 days. However, several days later, the quotes returned to the starting levels. If the company had planned the split in 2021 like Tesla (NASDAQ: TSLA), the result could have been different.

Is the split of Alphabet stocks an interesting event? Should we focus on it at all? To answer these questions, we need to address history and analyse the behaviour of stocks of large companies after splits.

Goal of stock splits

Why do companies carry out stock splits? The main goal of a split is making the stocks cheaper, which, in turn, makes the stocks available to a wider range of investors.

How shares behave after news about upcoming split

One of the most usual behaviour options is the share price growth that lasts until the split actually happens. The reason is the increased interest of short-term investors for the shares. However, the market still can behave differently. The time of the split has a lot of importance. If it happens when the credit and monetary policy is soft, and the QE policy is carried out, chances for stock price growth increase. See some examples below.

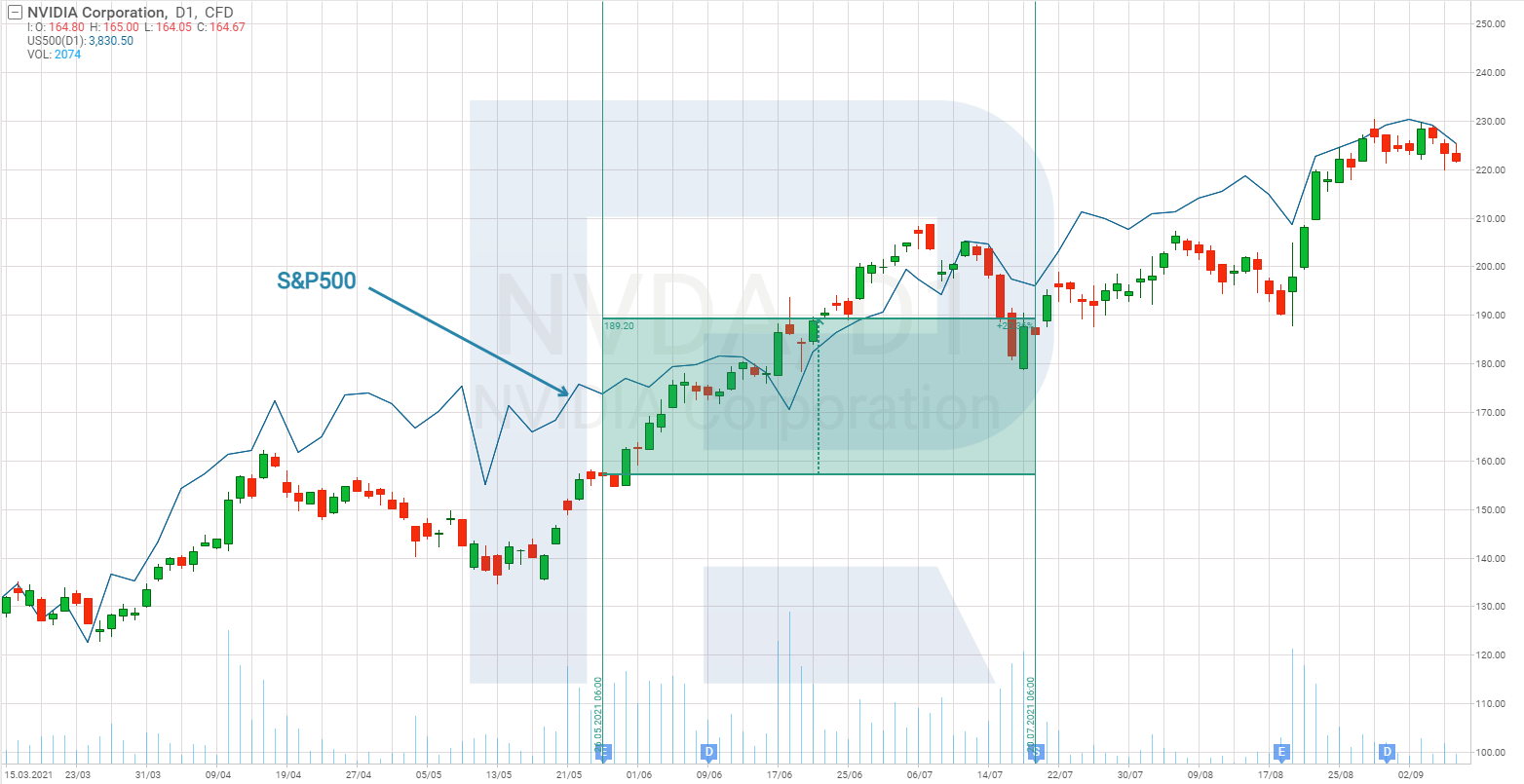

NVIDIA Corporation stock split

A good example is the stock split of NVIDIA Corporation (NASDAQ: NVDA). The information appeared on 26 May 2021, and the split actually happened on 20 July 2021. Over these months, the share price increased by 20%. Moreover, in 2021 the Fed was carrying out the QE policy, which facilitated the growth of the stock market on the whole.

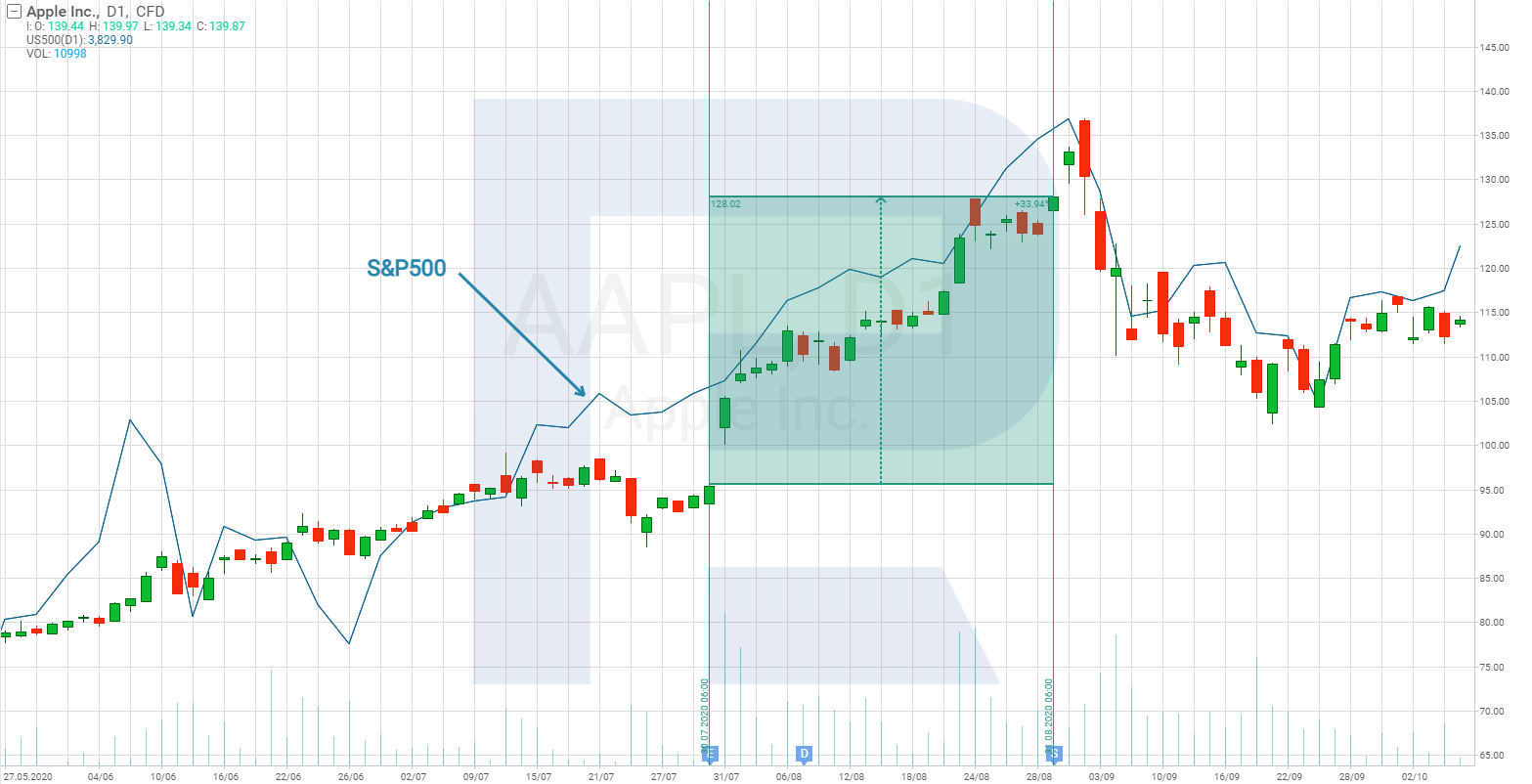

Apple stock split

A year before, Apple (NASDAQ: AAPL) also carried out a stock split. The split was announced on 31 July 2020 and carried out on 31 August. Over the month, the share price grew by 34%. Mind that the S&P 500 was also growing, and the Fed had launched the QE programme to support the economy.

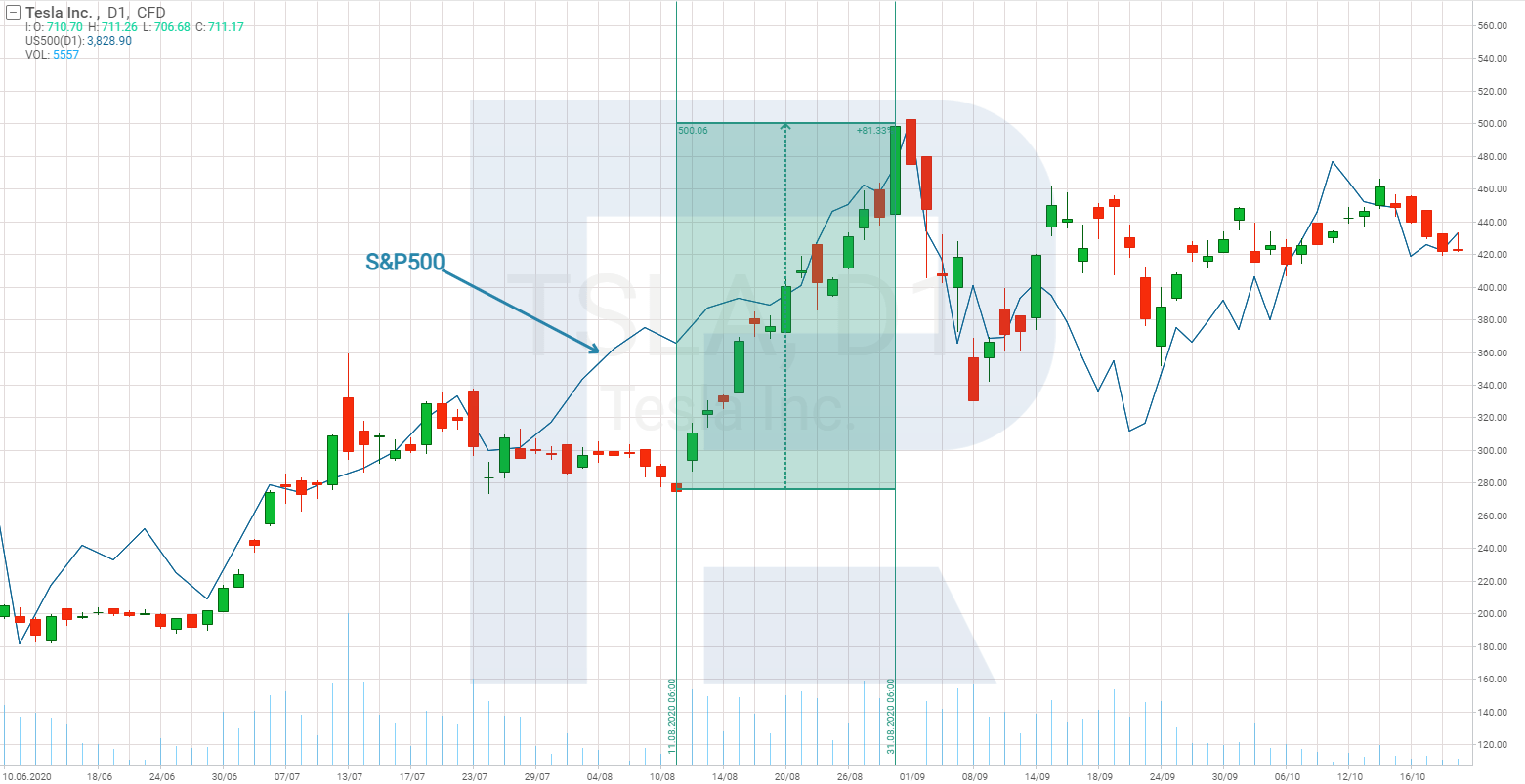

Tesla stock split

Another good example is the split of Tesla shares. When the quotes reached over 1,000 USD, the company began talking about the split, which is another confirmation of the theory that companies come to the idea of stock splits when their share price rises high enough. The measure was officially announced on 11 August 2020. Shares started trading at the new price on 31 August. Over the waiting time, the share price grew by 80%. Here, credits should be given to the head of the company Elon Musk, thanks to him the company used to be at the top of headlines in the media at that time. Otherwise, the growth could have been more modest.

What unites these companies

All the mentioned companies announced the split, and their shares started growing before the split actually happened. Yet the most important detail is that the Fed was carrying out the QE programme at that time, thanks to which the stock market was generally optimistic, and stock indices demonstrated positive dynamics. The conclusion is as follows: when the stock market is favourable, the shares of companies that have announced a stock split have good chances for growth.

But what happens to the share price when the Fed’s policy is the opposite, i.e. when they speak about toughening the monetary policy and winding up the QE programme? Let ‘s look at the examples:

Amazon stock split

Let us take a look at Amazon.com (NASDAQ: AMZN). There the split happened on 3 June. We got to know about these plans on 9 March, and the news made the price grow by 22% over the first fortnight. However, the quotes then returned to the initial levels, and when the split happened, the shares were trading 10% lower than in March.

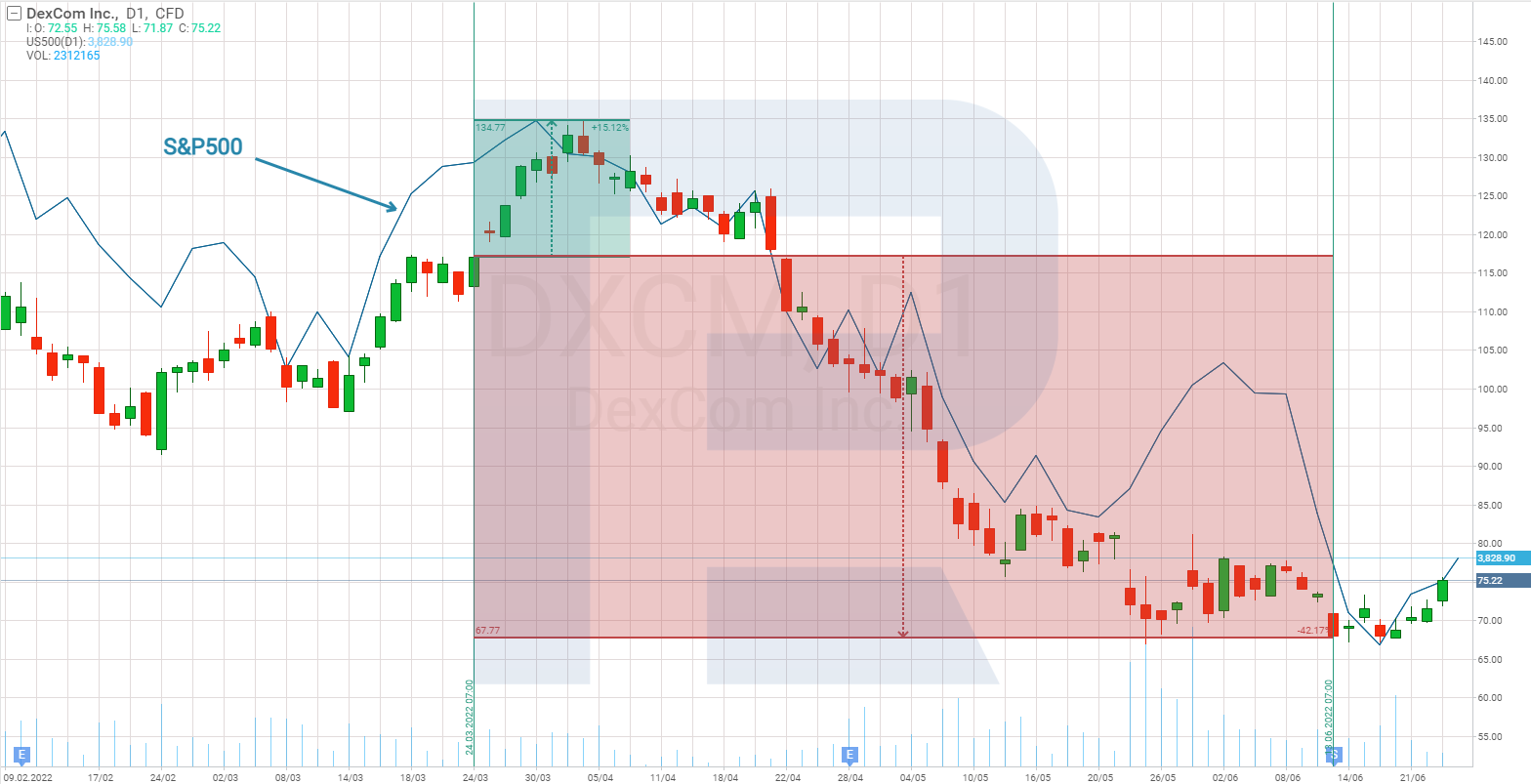

DexCom stock split

The second example is DexCom Inc. (NASDAQ: DXCM). The company produces equipment for treating diabetes. Like Amazon.com, it announced the split in March. In the short run, the shares grew by 14% after the news, but at the moment of the split (13 June), they were trading 40% below the March levels.

In this case, we can note a direct correlation between the Fed’s credit and monetary policy and the share prices of companies that have announced splits. Moreover, if you check the charts, you will see their correlation with the S&P 500.

What happens to shares after split

Here, each company has a different story. Since the IPO, Apple has carried out stock splits 5 times, and only once the share price dropped after the event – this happened during the dotcom crisis. It took the shares 4 years to return to initial levels. In all other cases, the stock price kept growing after the split.

Since 1999, NVIDIA has also carried out 5 splits, and 3 of them asked for patience from investors because it took the share price long to recover after them. The first case was also during the dotcom crisis. Investors did not have to wait long, and after 6 months the shares got their lost positions back. However, 5 months later the management decided on another split. This time, investors had to wait for 4 years. It was the hardest for those who bought the shares after the split in 2007, before the mortgage crisis. At that time, the shares lost 80% of the price and only recovered 9 years later.

In Alphabet history, this is the second stock split. The first one happened in 2014, and after it the shares grew by 323%.

Analysing the shares of three tech giants, we come to a conclusion that the times of the split has a lot of importance for the share price behaviour. If it happens before a crisis, there are high chances for the falling of the stock price. In different time, shares will most likely be growing for at least 2 years.

Why attention should be paid to companies that plan split

The first reason for the issuer to start thinking about the stock split is the high stock price. High prices have directly to do with a high demand for them because this is what pushes the price upwards. The demand can be created by the company itself via the Buyback programme – and also by investors.

Reasons for investors to buy shares

They can consider the company promising and having a potential for growth and think its produce or services popular in the market. For example, Tesla used to be losing until 2019 but its shares kept growing since the IPO because the demand for its produce exceeded supply. Elon Musk invested actively in expanding production powers, allowing market players assess future scale of the company and its earnings.

Those who prefer scrupulous analysis of reports often choose companies with a stable and predictable source of income, high profitability, low debts, and enough free cash. This group of investors creates its part of demand for the shares.

Financially stable companies normally tend to support their investors and start paying dividends or announce Buybacks. This attracts one more group of market participants who buy shares not only counting on the future price growth but also on dividend payments.

Summing up all the said above, we can say that stock splits are usually carried out by financially stable or promising companies whose shares enjoy increased demand. Hence, information about an upcoming split tells us that the company is either promising or financially stable or both, and we should take a look at it and carry out our own analysis.

Alphabet stock split

The company is one of the Top 3 global leaders in terms of capitalisation among public companies. It owns Google.com and YouTube.com, which are the largest websites in the world. They help the ads business of the company generate substantial earnings that Alphabet can use for developing other branches. The profitability of the business is 27.6%. The free cash flow is 133 billion USD, which is 30 billion USD higher than all the company’s debts. Alphabet does not pay dividends but carries out Buyback. In April 2022 we got to know that it would spend 70 billion USD on it.

Since the beginning of 2022, the shares of the company have lost 26%. The decline stopped at 2,100 USD and started growing gradually. Currently, they cost 2,230 USD. The nearest resistance level is 2,400 USD.

Closing thoughts

A stock split is not a signal to buy and does not guarantee that the share price will grow in the future. Practically, this is just an increase in the number of shares traded in the market, so that their price corrects. However, voicing of these plans helps find long-term investment options. Judging by history, Alphabet chose the time for the first split wisely. Time will show whether its second split will be a success.

Invest in American stocks with RoboForex on favorable terms! Real shares can be traded on the R StocksTrader platform from $ 0.0045 per share, with a minimum trading fee of $ 0.5. You can also try your trading skills in the R StocksTrader platform on a demo account, just register on RoboForex and open a trading account.

The post Split of Alphabet Shares: What Happens to Share Price After Split? appeared first at R Blog – RoboForex.