Brent remains in a consolidation phase at the lower levels of the declining wave. This analysis also encompasses the movements of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

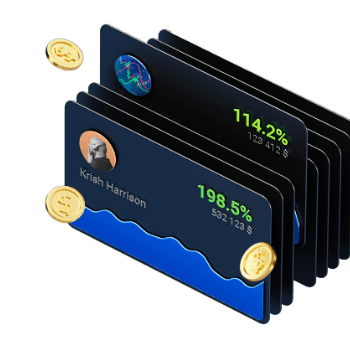

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded a downward wave, reaching 1.0940. Currently, the market has established a consolidation range around this level. Breaking out of this range to the downside, it achieved the local target of 1.0878. Today, a correction to 1.0940 might unfold (testing from below). Following this correction, a new descending structure to 1.0860 is anticipated. This marks the initial target.

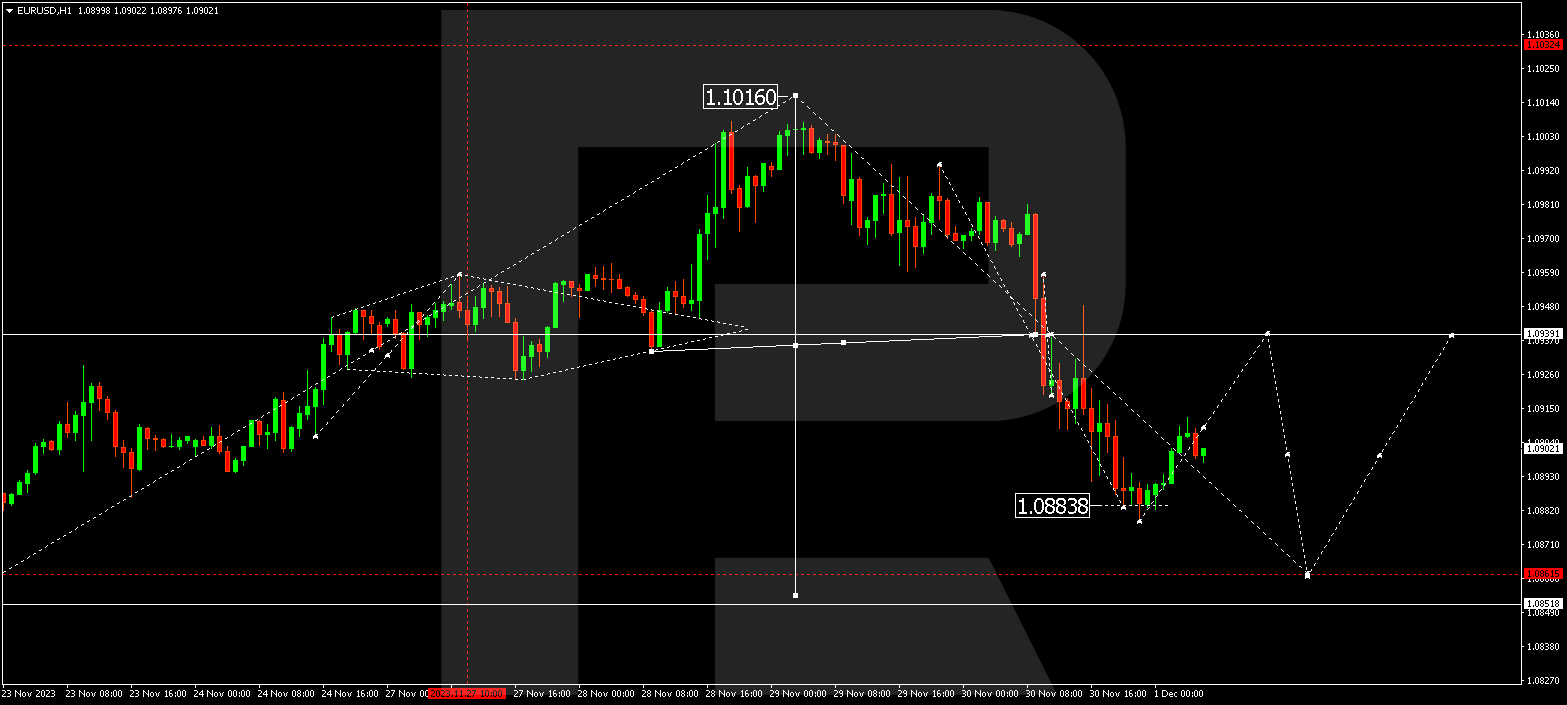

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has achieved the local target of the downward wave at 1.2603. A corrective phase to 1.2663 could materialize today. Subsequently, a downward wave to 1.2588 is expected. This represents the first target. Following this, a corrective wave to 1.2663 is anticipated.

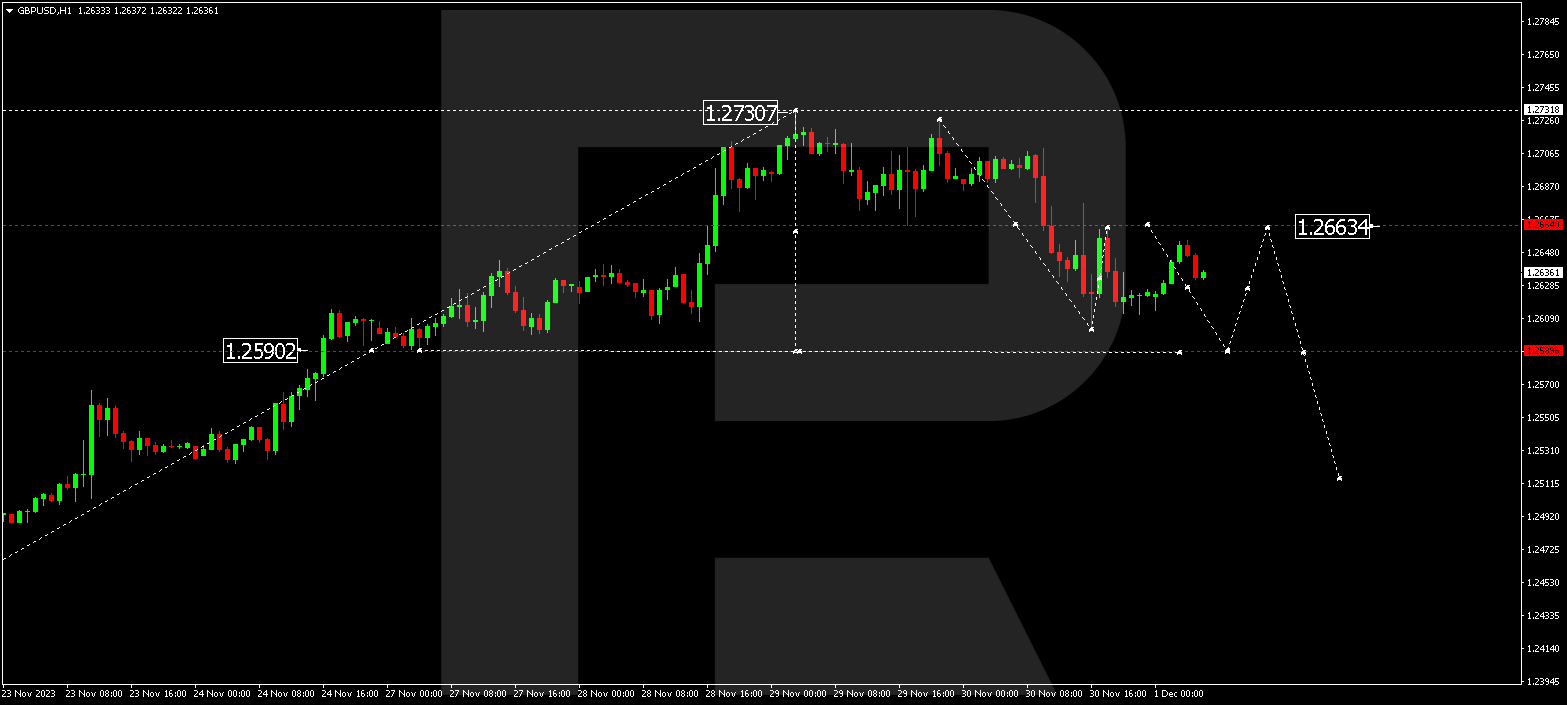

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed an upward structure to 148.50. Today, a corrective structure to 147.35 is in progress. After the correction concludes, a new upward wave to 148.71 might initiate. Breaking out of this level could reveal potential for a wave to 150.00. This serves as a local target.

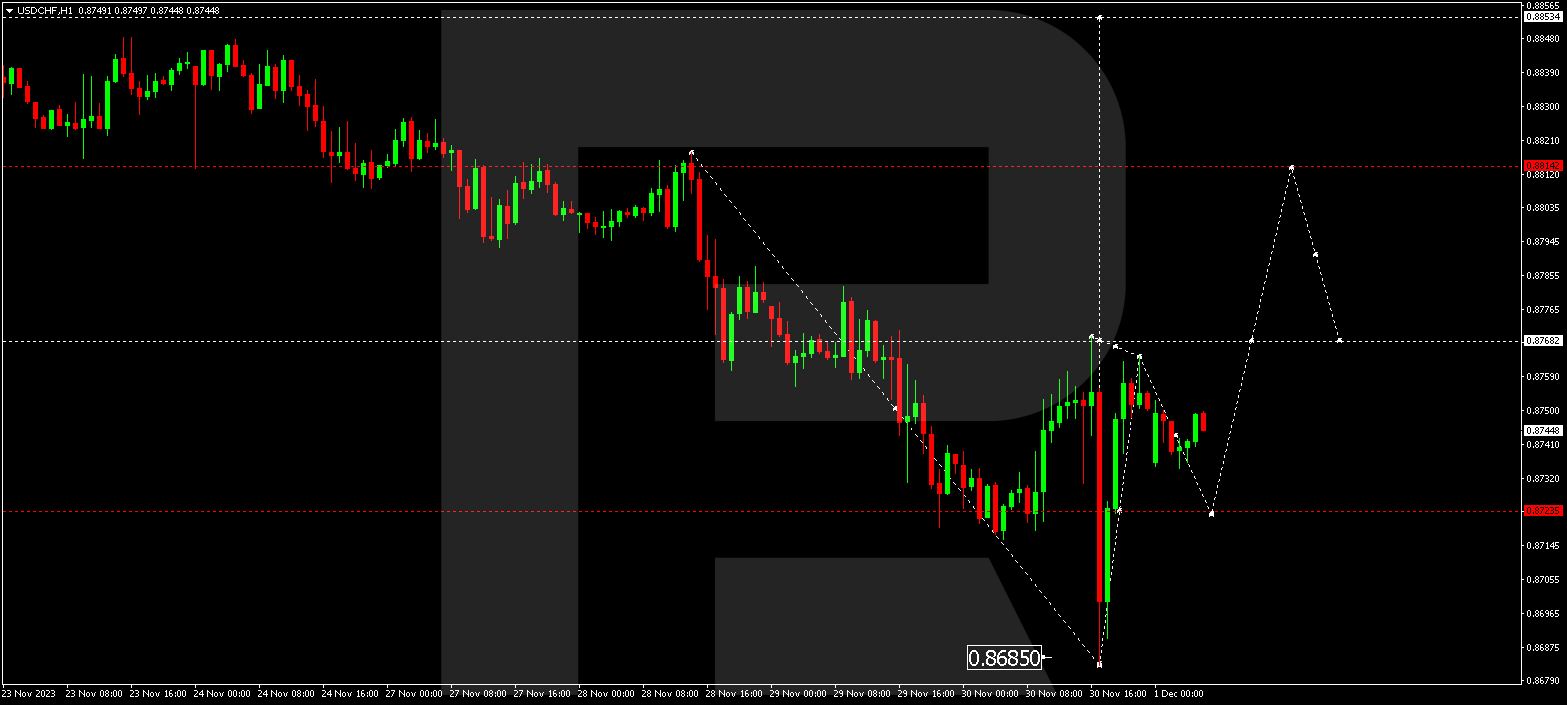

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has executed an upward impulse to 0.8764. Today, quotes might correct to 0.8723. Following the correction, a new upward wave to 0.8760 could commence. If there’s a breakout above this level, the potential for further development of the wave to 0.8814 could unfold. This is the local target.

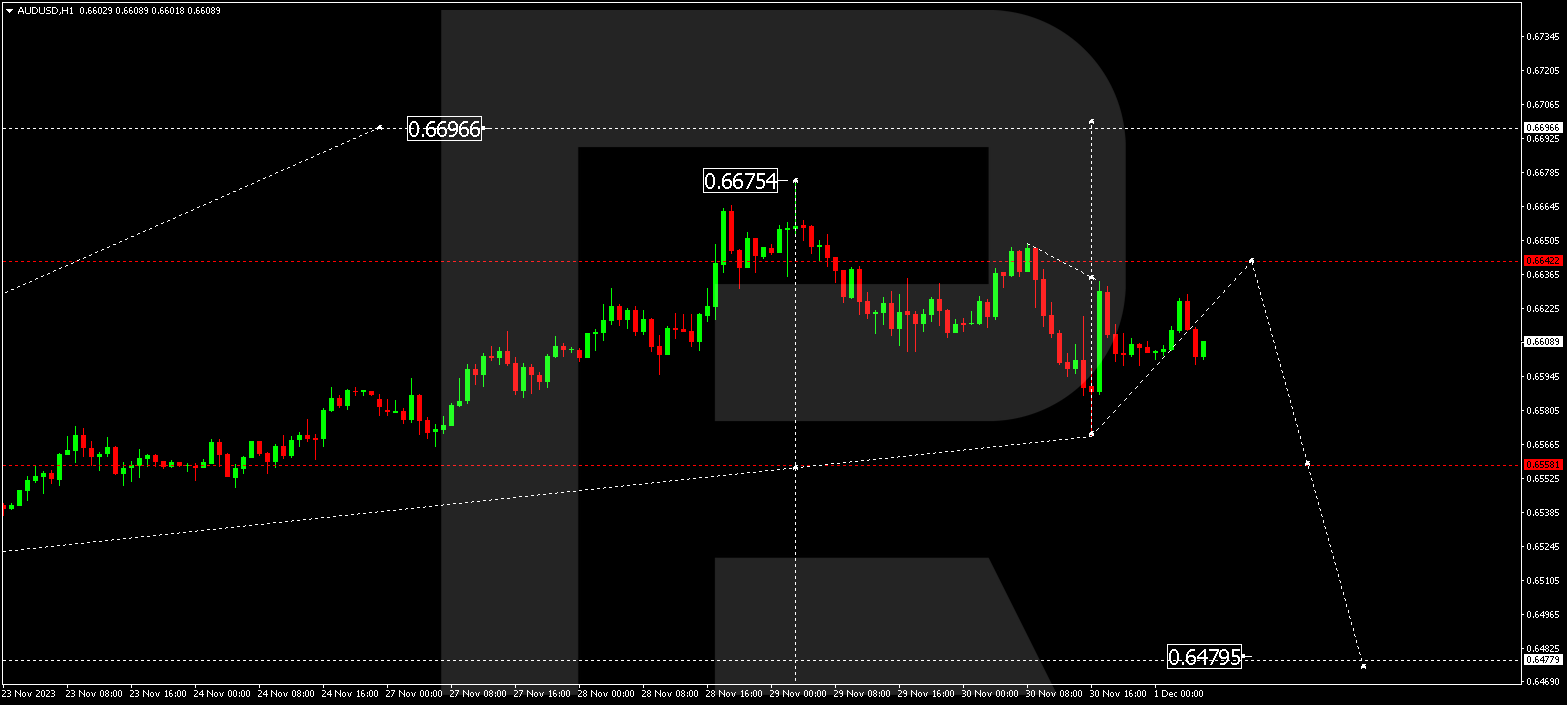

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has finalized a downward wave to 0.6570. A corrective link to 0.6642 is conceivable today. Following the correction, a new wave to 0.6555 could begin. Breaking out of this level could open the potential for further development of the wave to 0.6480. This serves as a local target.

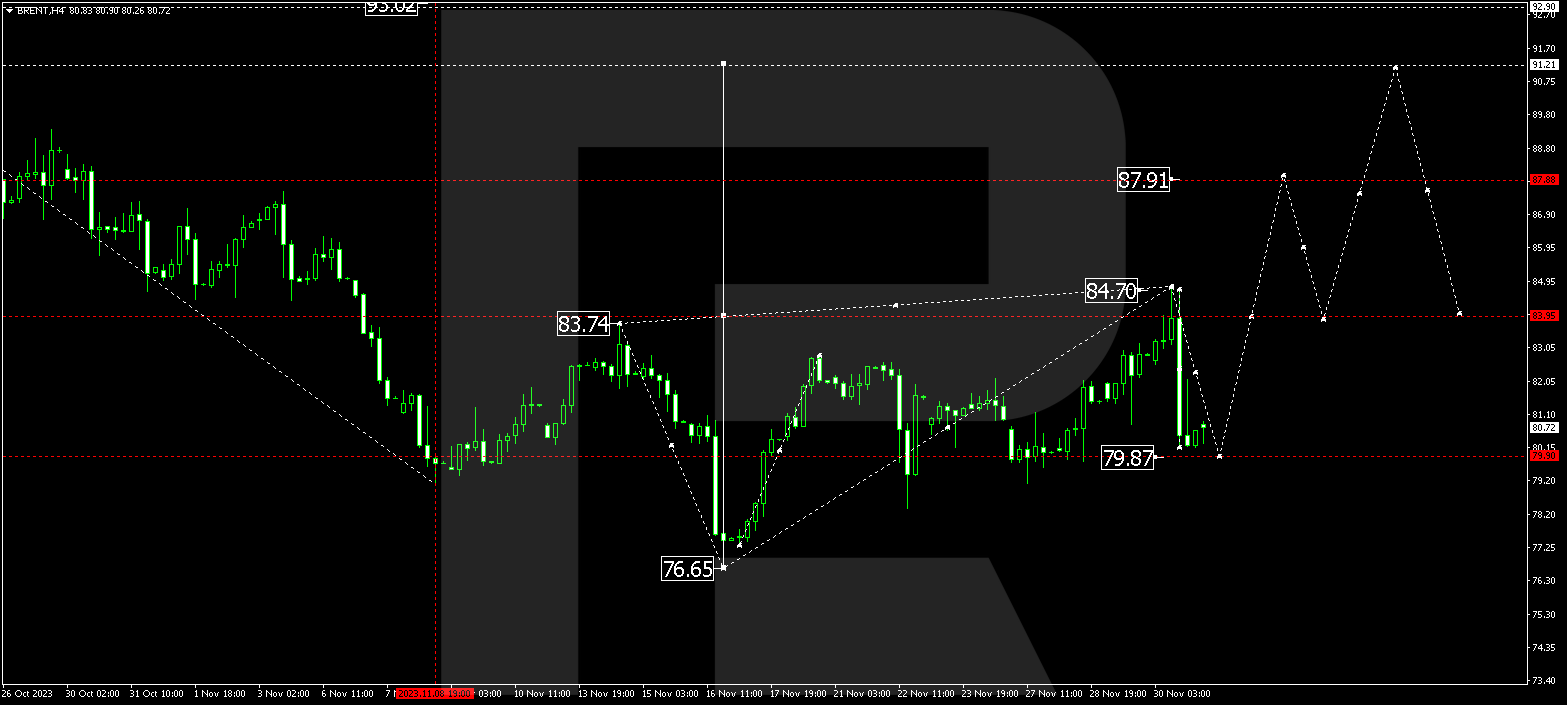

BRENT

Brent has concluded an upward wave to 84.70. Today, the market is undergoing a correction to 79.90. Essentially, a consolidation range persists around 80.00. Breaking out of the range to the upside could lead to a growth phase to 88.00. This is a local target.

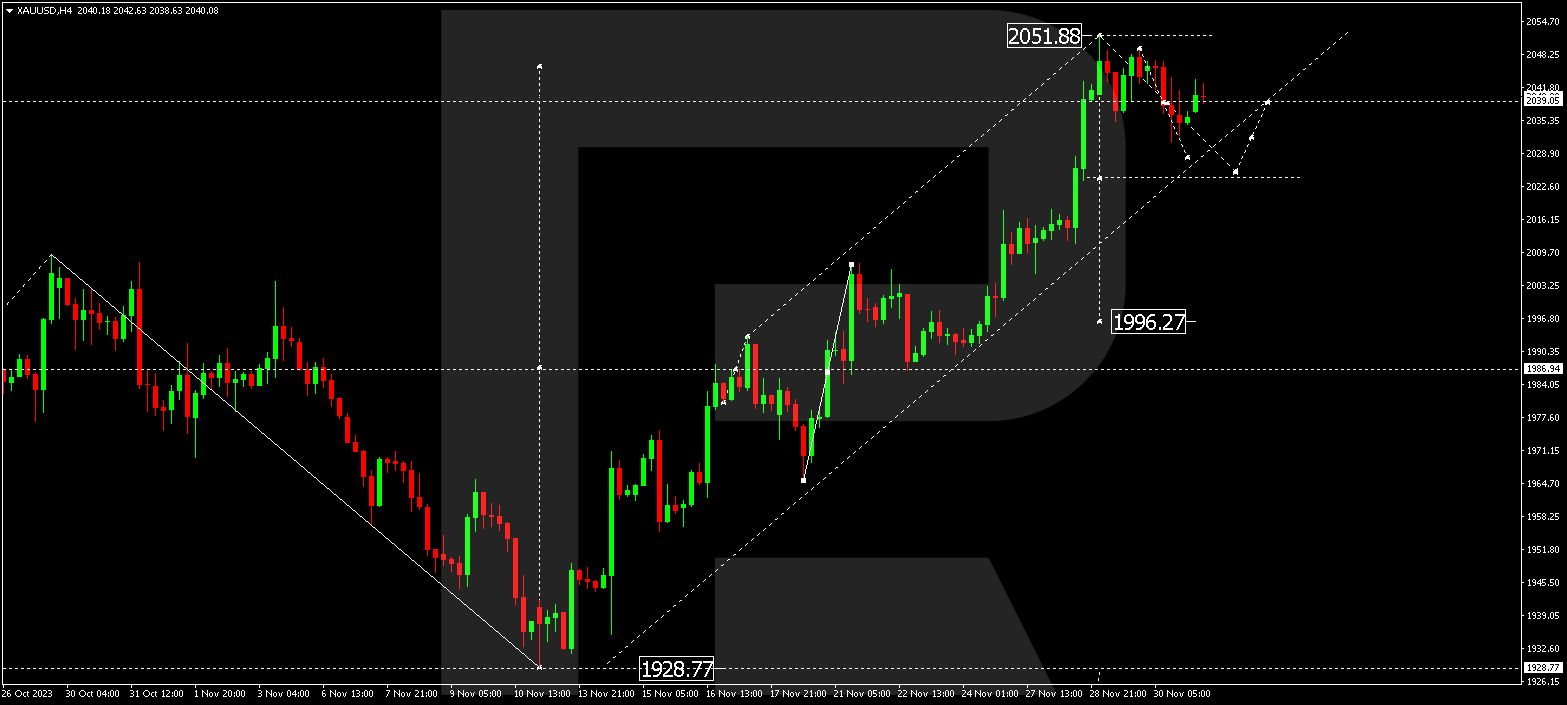

XAU/USD (Gold vs US Dollar)

Gold is still forming a consolidation range at the peak of the growth wave around 2040.00. Today, a downward link to 2025.25 is expected. Subsequently, a growth link to 2040.00 could follow. Afterward, the price might decline to 1986.00. This represents the initial target.

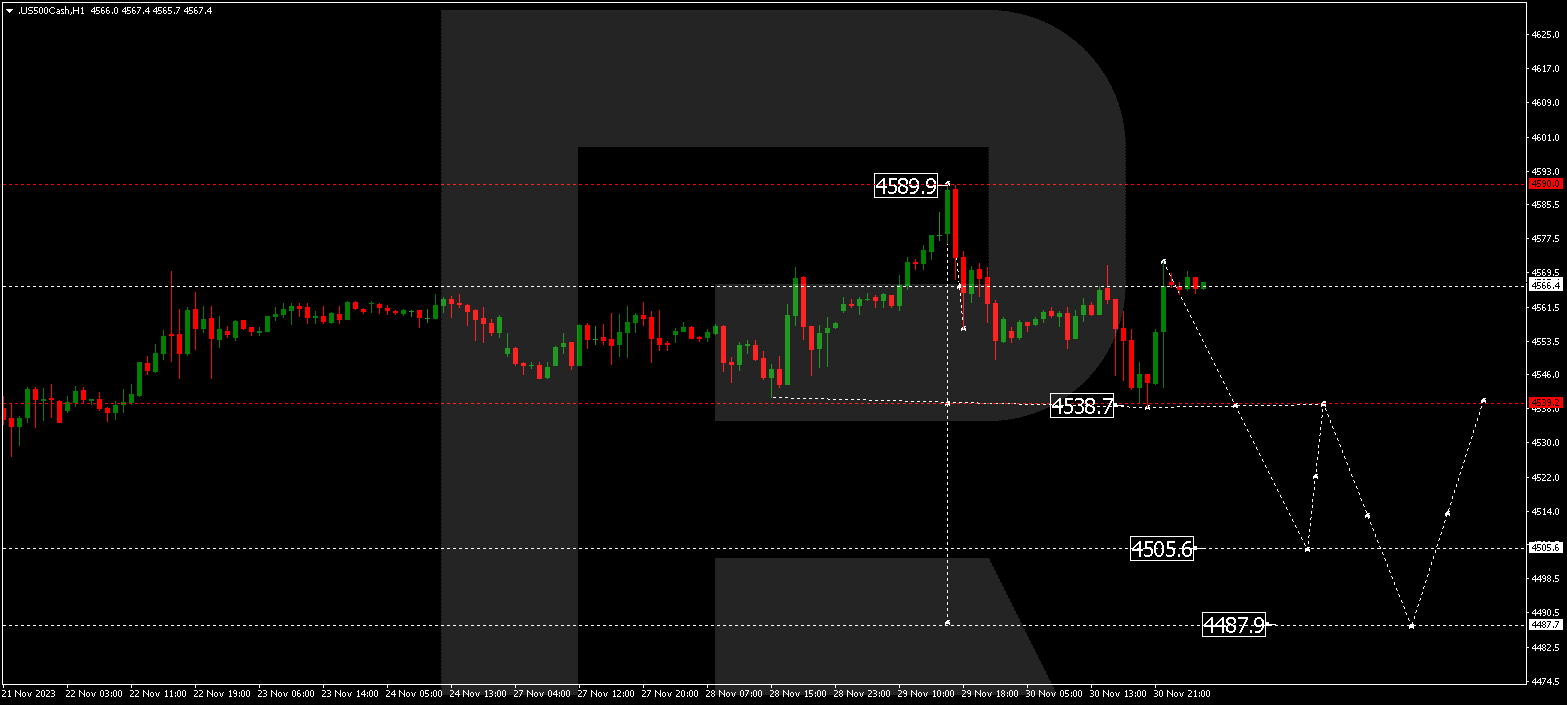

S&P 500

The stock index has completed a downward impulse to 4540.0. Currently, it has corrected to 4566.6. A downward link to 4540.0 might manifest today. Breaking out of this level to the downside could reveal the potential for further development of the wave to 4505.5. This is a local target.

The post Technical Analysis & Forecast December 01, 2023 appeared first at R Blog – RoboForex.