Brent’s uptrend persists. The overview also delves into the movements of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

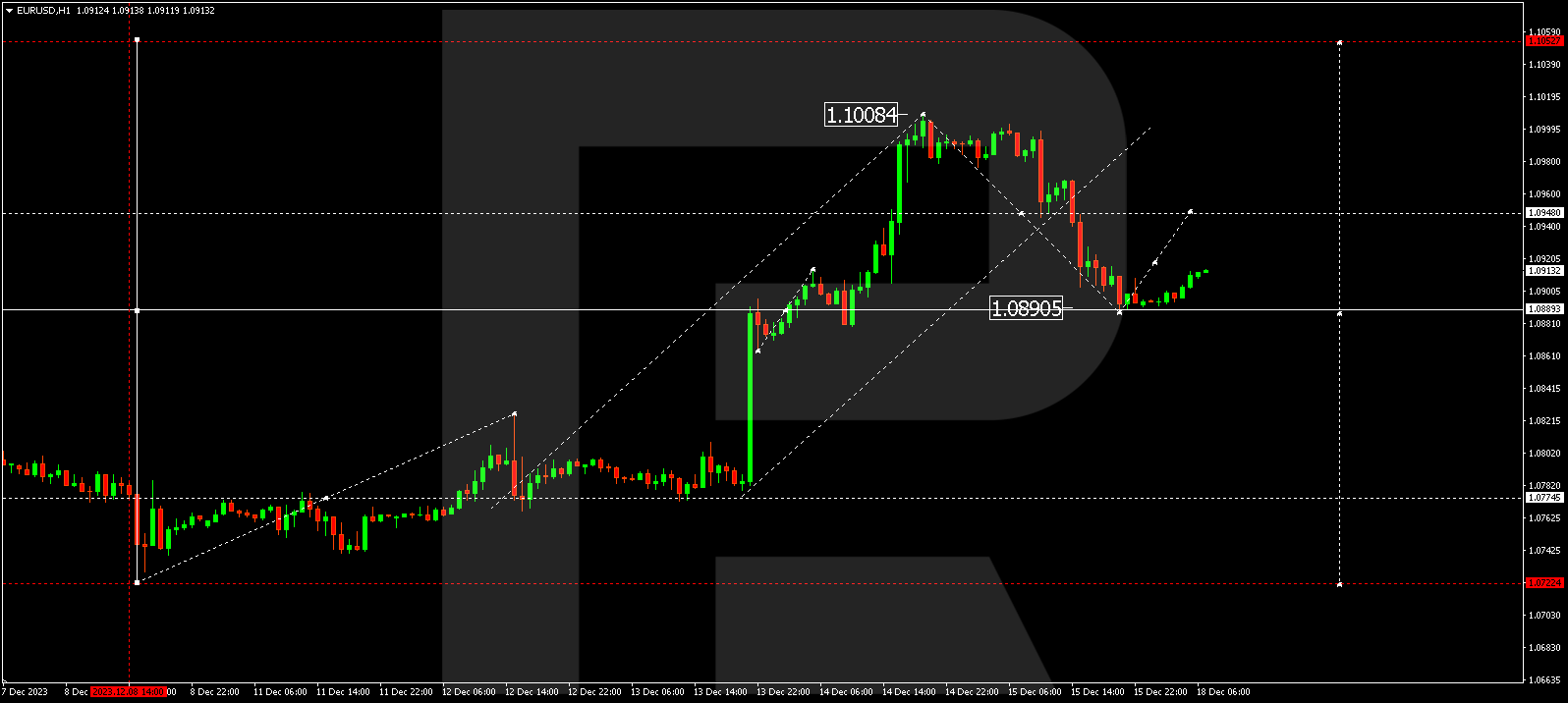

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded its correction at 1.0889. A climb to 1.0949 is anticipated today. A consolidation range is practically forming around 1.0950. A breakout upwards could propel the quotes to 1.1050. Conversely, a downward escape might open the door to a decline to 1.0770.

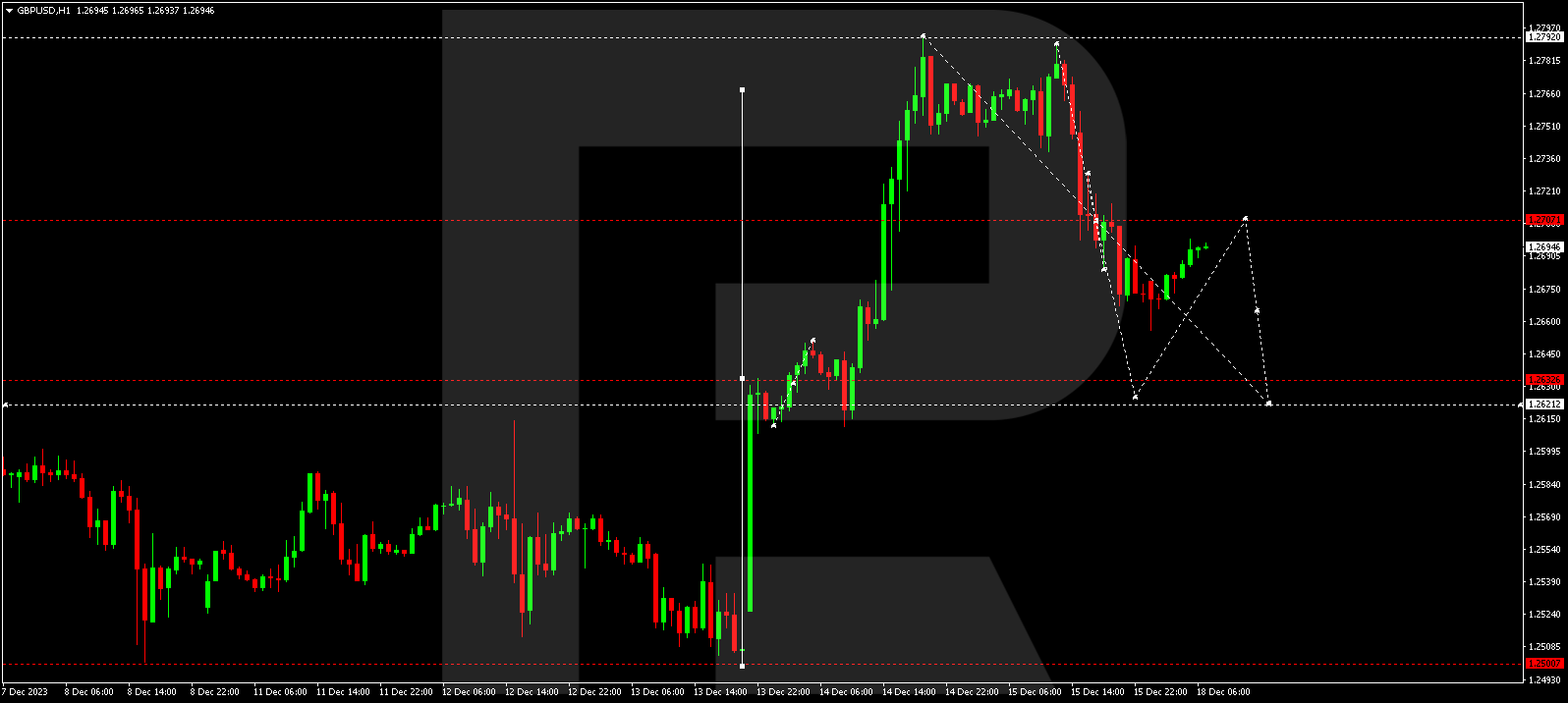

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has wrapped up a corrective wave at 1.2656. A rise to 1.2707 is on the horizon today, followed by a dip to 1.2622. Once this level is reached, the pair could embark on an upward trajectory to 1.2707. A broad consolidation range could materialize around this level. If a downward breakout occurs, it might pave the way for a decline to 1.2500.

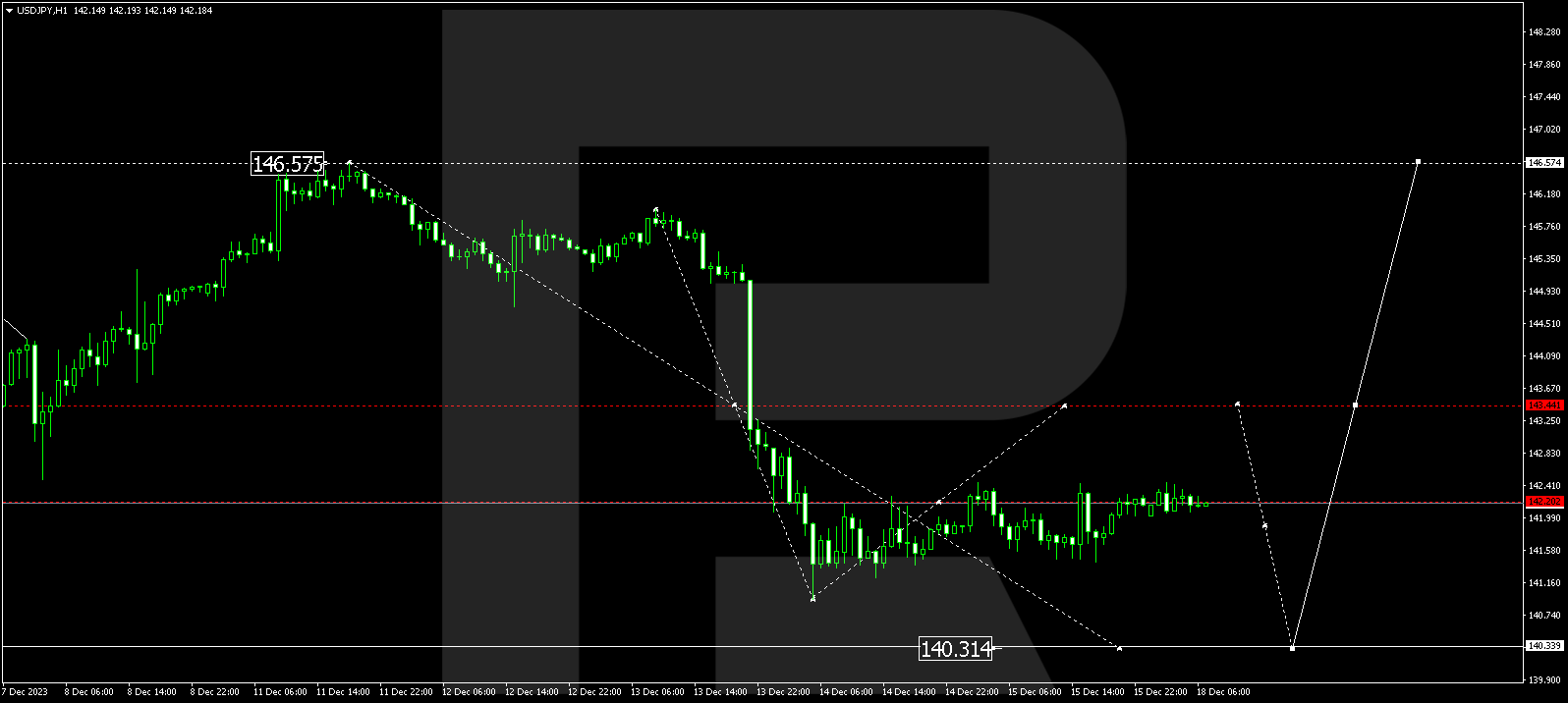

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is in the midst of forming a consolidation range around 142.22 without a clear trend. A breakout upwards could trigger a correction to 143.44, followed by a descent to 140.33. Next, an ascent to 143.43 is expected, setting the stage for a potential continuation to 146.55. This marks the first target.

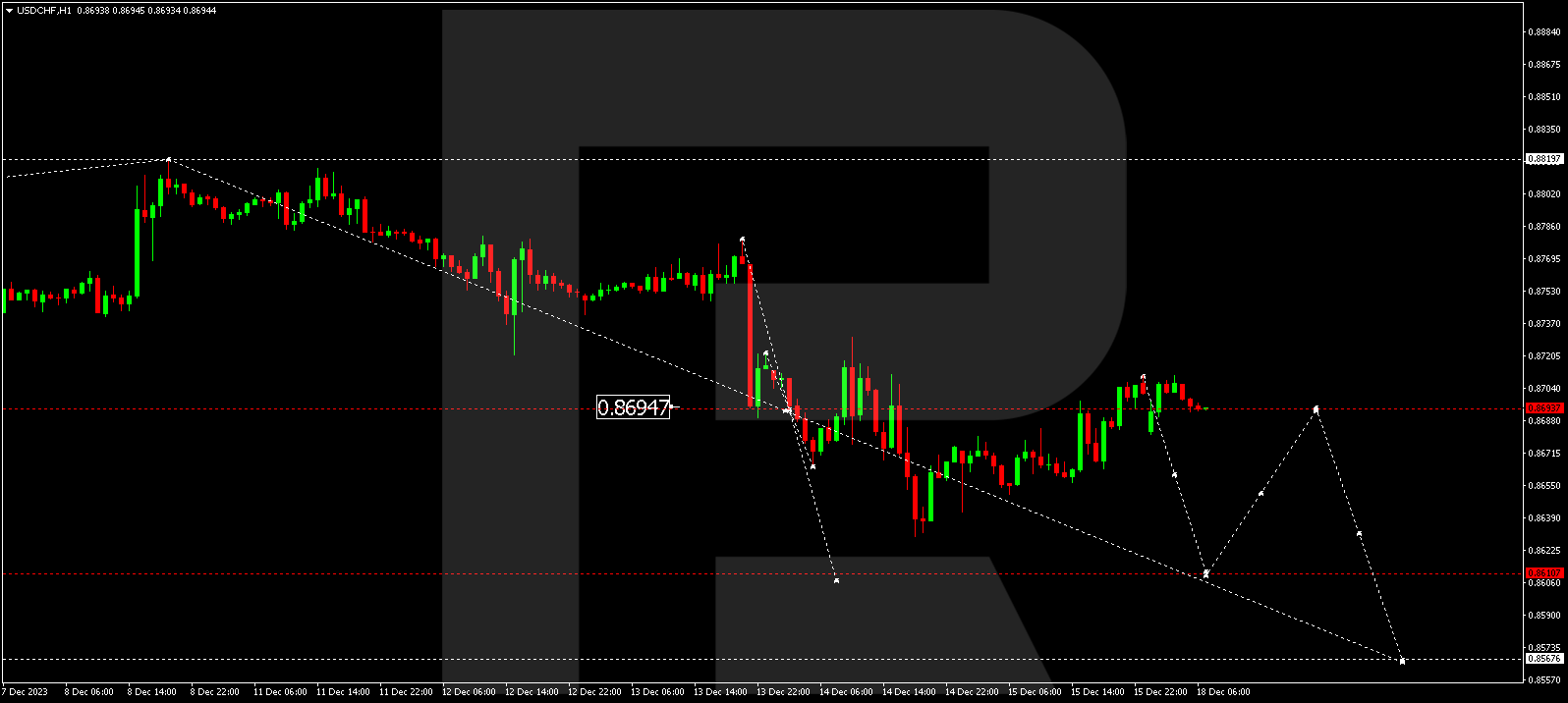

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is persistently shaping a consolidation range around 0.8694. A drop to 0.8610 is in the cards today, followed by an ascent to 0.8694 (a test from below). Subsequently, a decline to 0.8566 might unfold. After reaching this level, a growth wave to 0.8800 could take off.

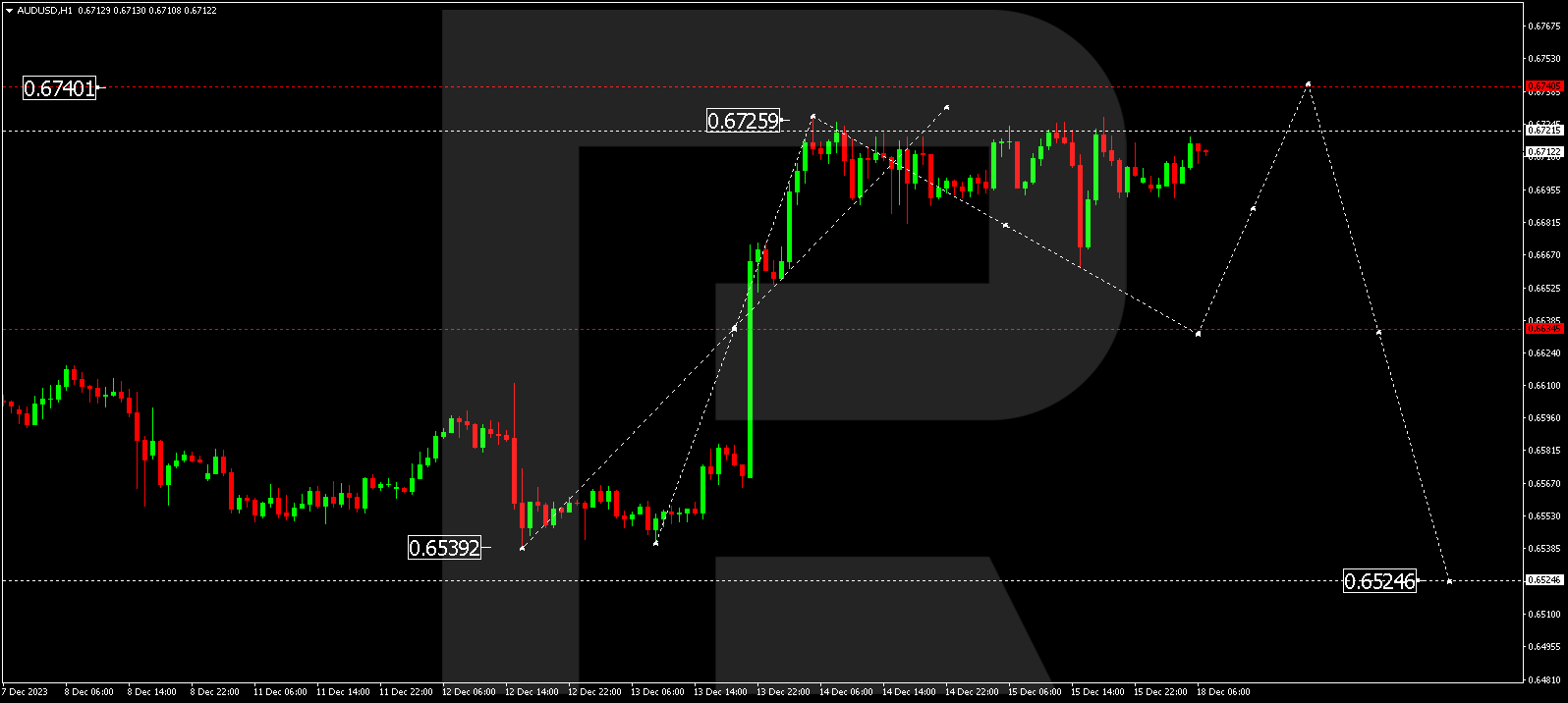

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is currently constructing a consolidation range below 0.6700. A breakout downward might usher in a correction to 0.6633, followed by an upswing to 0.6740. Upon reaching this level, the price might initiate a decline wave to 0.6525.

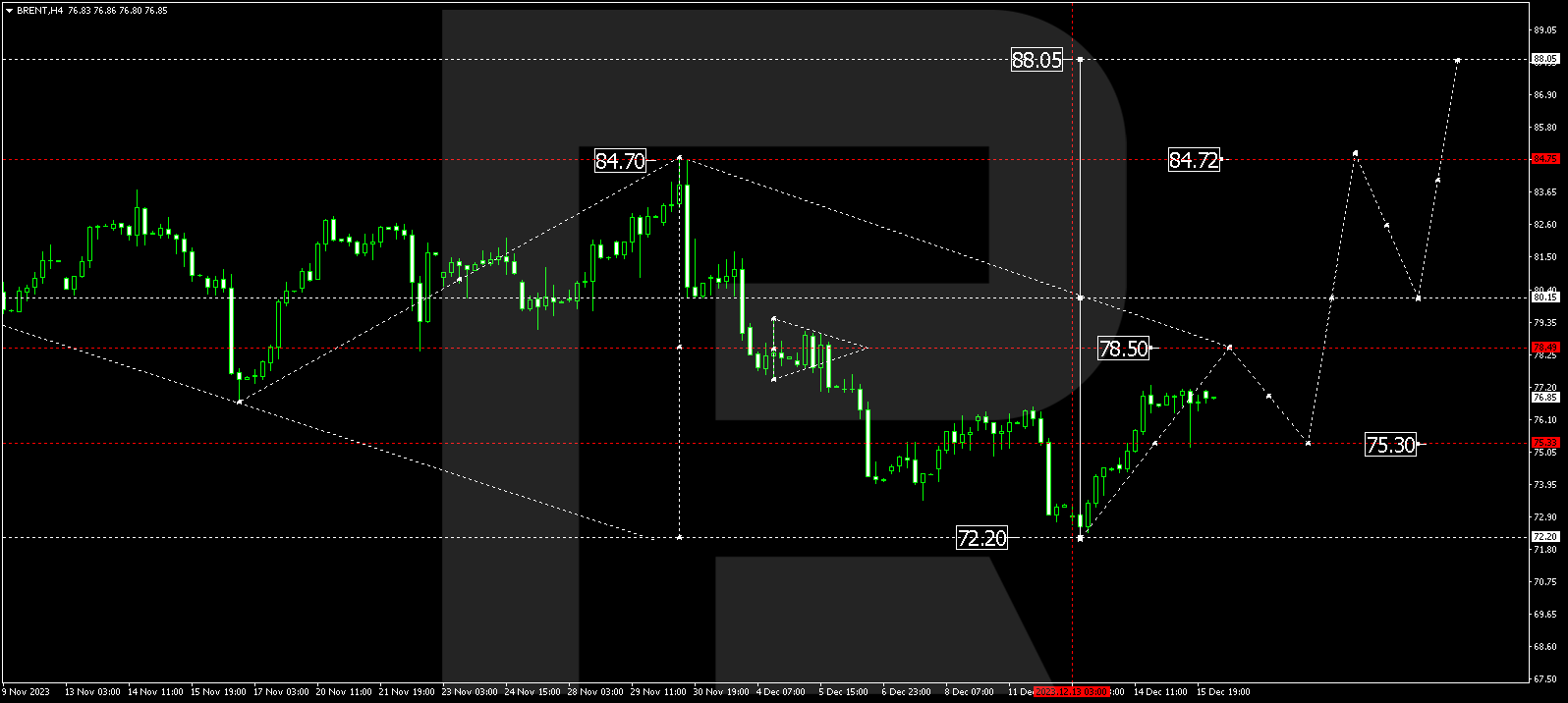

BRENT

Brent is continuing its upward trajectory towards 78.50. Following this peak, a corrective decline to 75.30 might follow. Subsequently, a rise to 80.15 is expected, where the trend could extend to 84.72. This represents a local target.

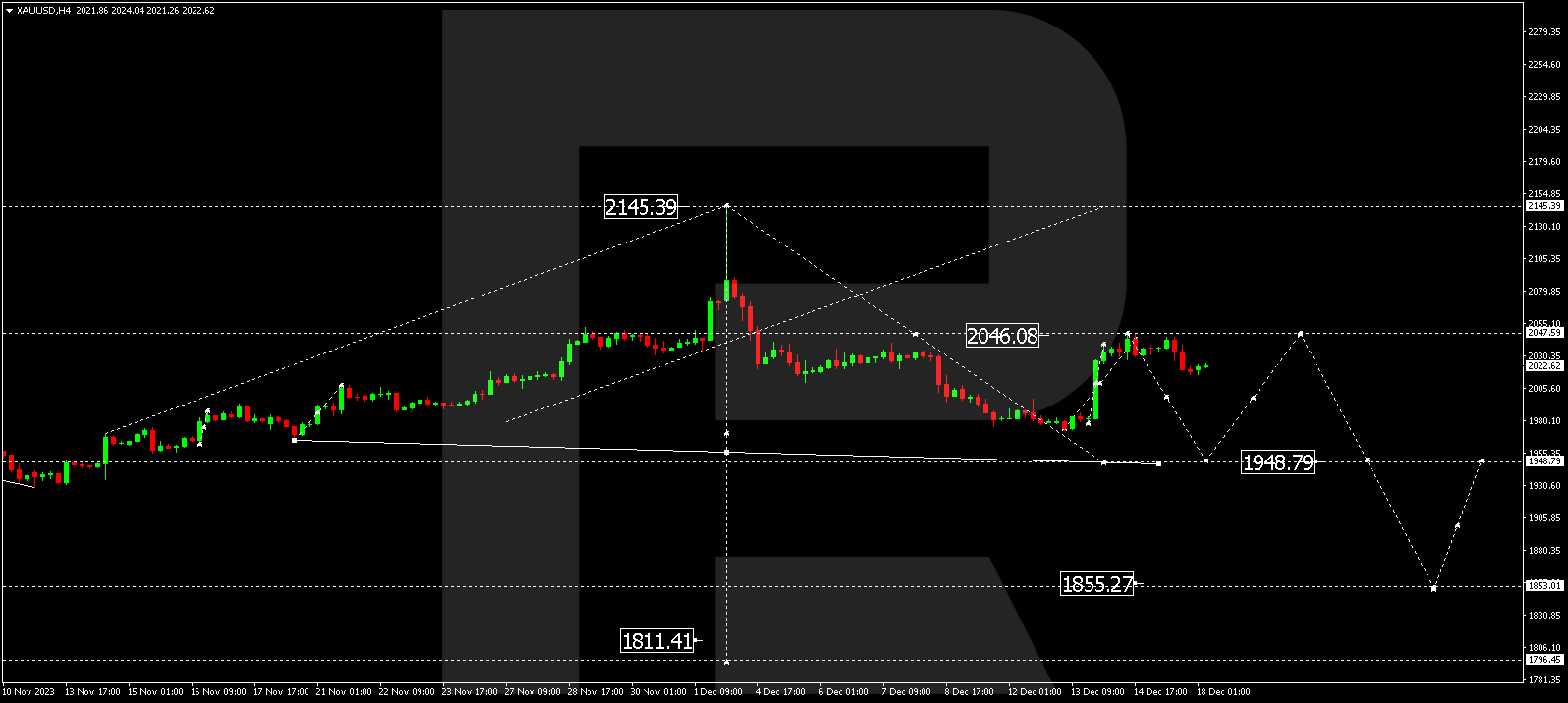

XAU/USD (Gold vs US Dollar)

Gold has wrapped up a correction at 2047.55. Next, a decline wave to 1948.80 might materialize, succeeded by an upswing to 2047.50. Following that, the price could plummet to 1940.00, from where the wave might continue to 1855.00.

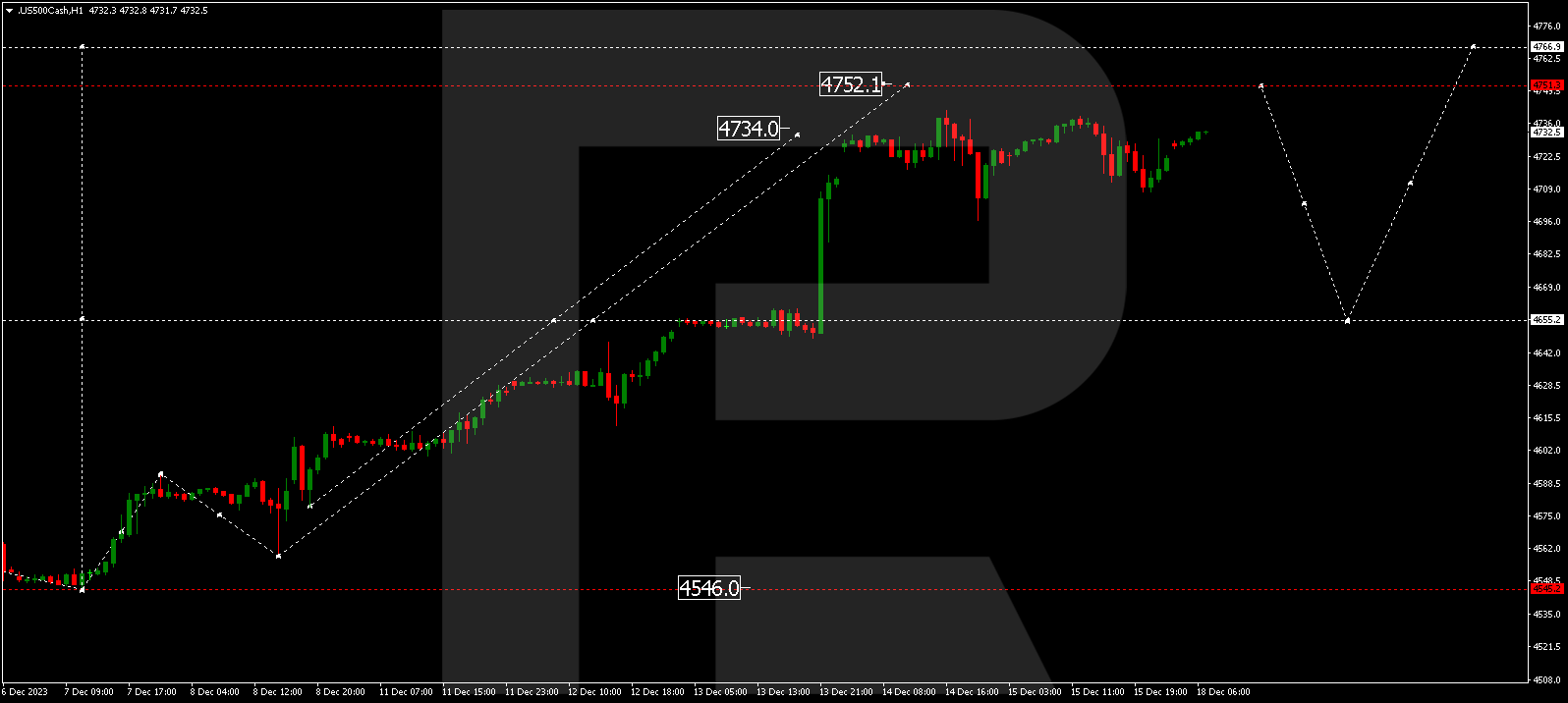

S&P 500

The stock index is currently entrenched in a consolidation range around 4722.0 without a clear trend. An upward breakout could expand the range to 4751.0. Subsequently, a corrective decline to 4655.5 might take place, followed by a rise to 4767.0.

The post Technical Analysis & Forecast December 18, 2023 appeared first at R Blog – RoboForex.