Gold‘s upward trajectory may persist. This overview also delves into the dynamics of EUR, GBP, JPY, CHF, AUD, Brent, and the S&P 500 index.

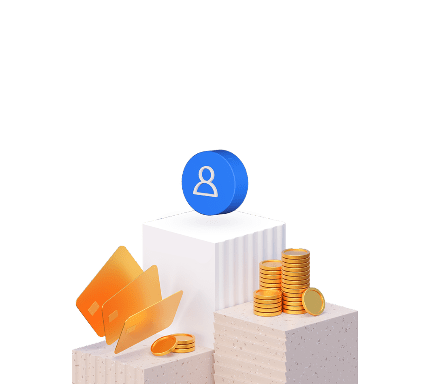

EUR/USD (Euro vs US Dollar)

EUR/USD completed a growth wave, reaching 1.0986. Currently, a consolidation range is shaping below this level. A potential downward breakout could lead to a correction to 1.0936. Following the correction, there’s a possibility of a new growth wave targeting 1.1011. This is considered a local target.

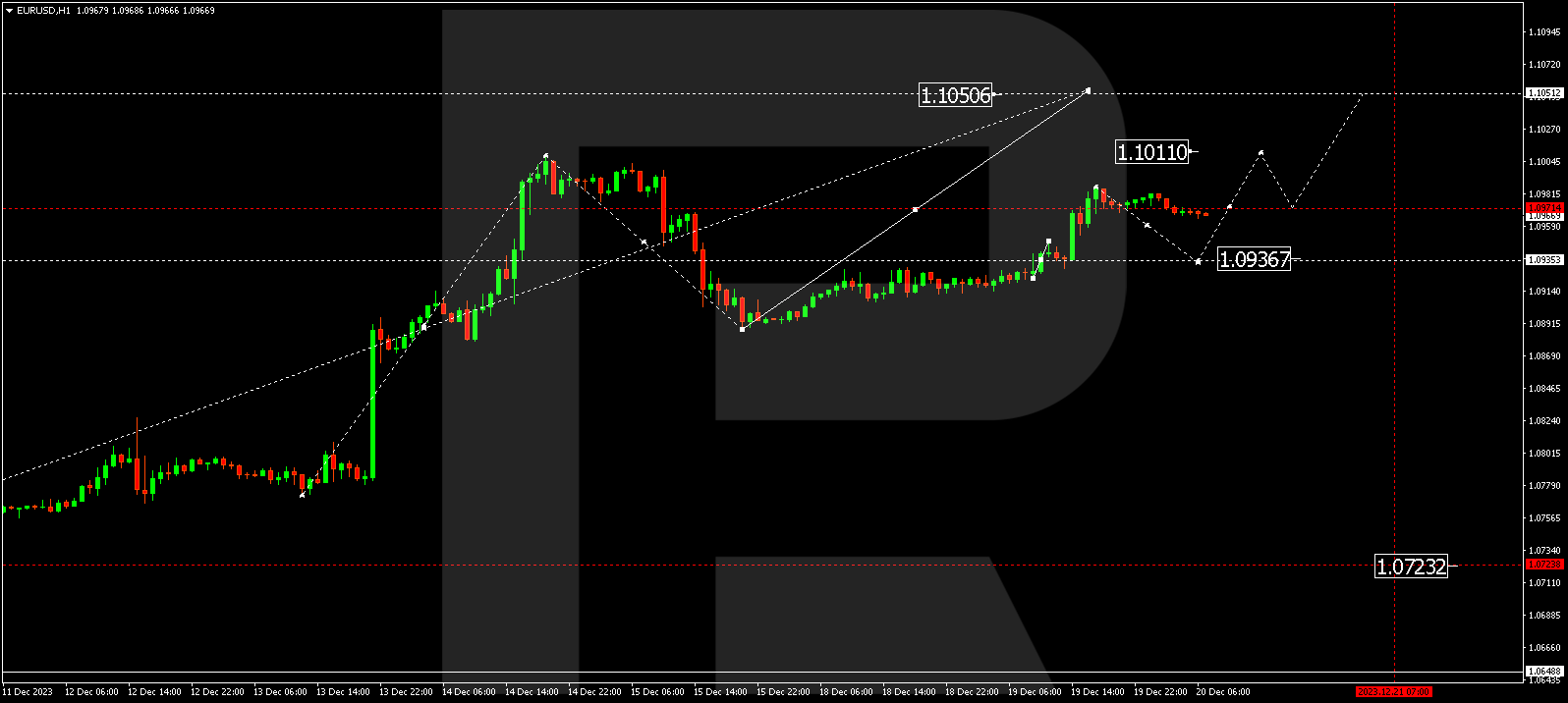

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD concluded a growth wave at 1.2760. The market is undergoing correction to 1.2720 today. Following the correction, a new upward link to 1.2777 might form, succeeded by a decline to 1.2700.

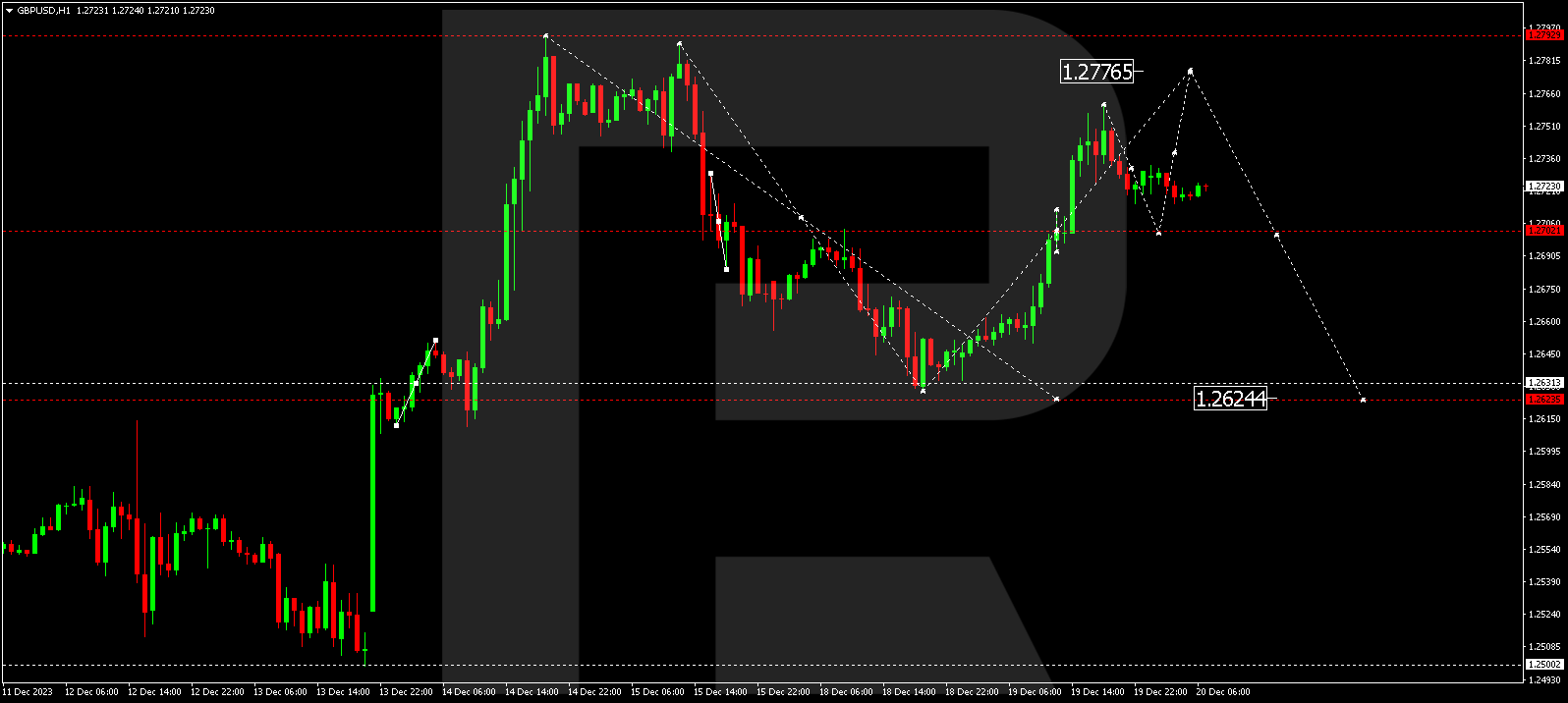

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is in the midst of an extending corrective wave to 143.07. After the correction, there’s potential for a rise to 145.88, marking a local target.

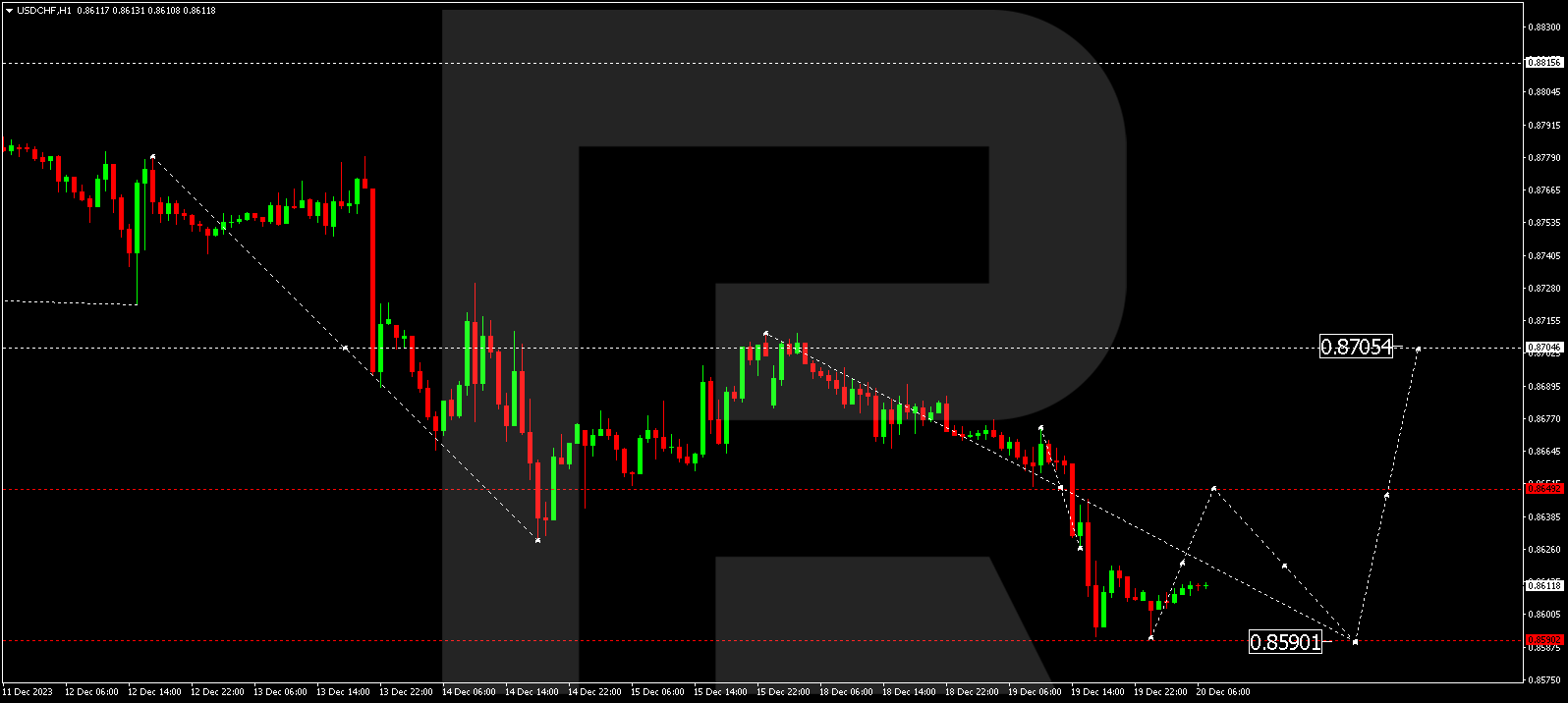

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF completed a decline wave to 0.8592. A consolidation range is emerging above this level. An upward breakout might trigger a growth wave to 0.8650. Upon reaching this level, a decline structure to 0.8590 could unfold.

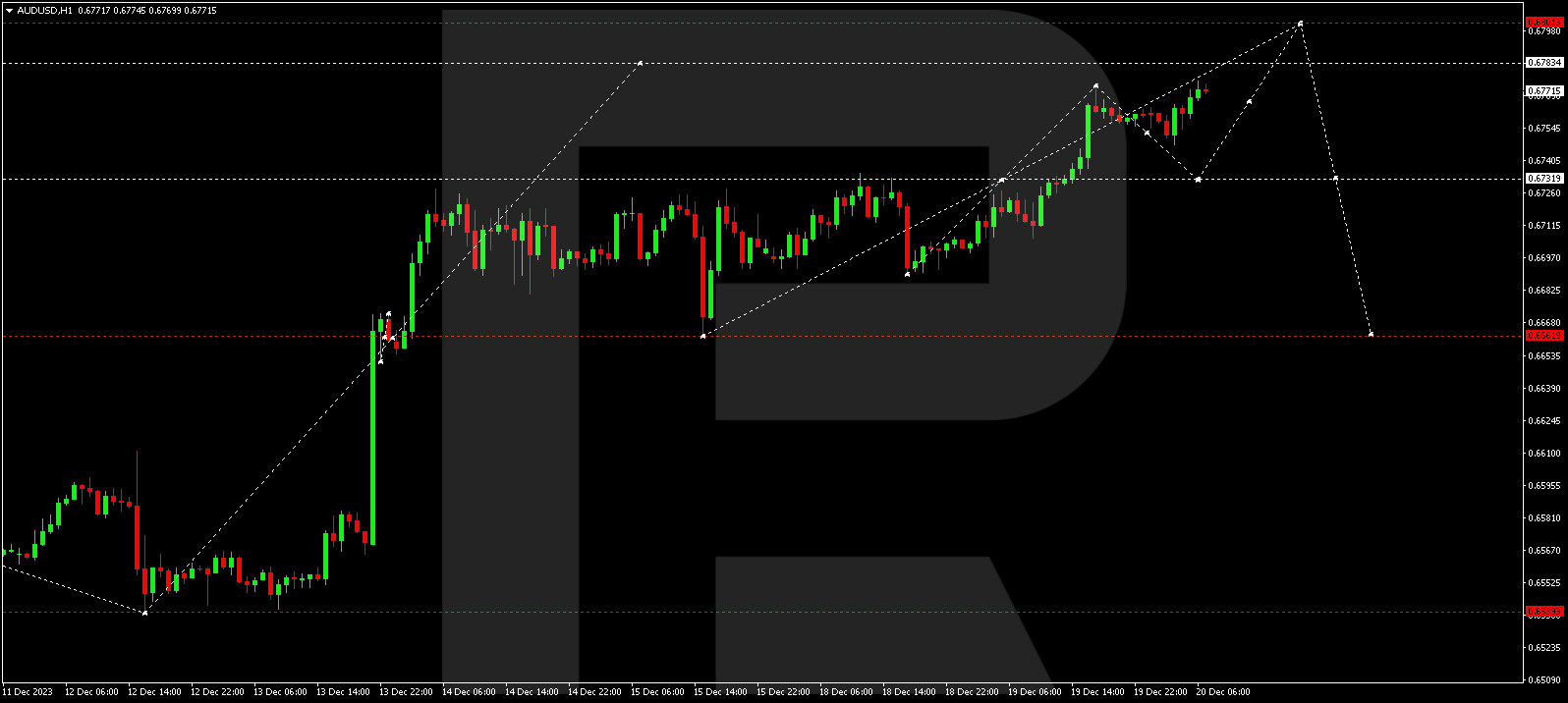

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD continues evolving in a growth wave to 0.6783, and there’s potential for an extension to 0.6800. Following this level, a new decline wave to 0.6730 might initiate, paving the way for a continuation to 0.6666.

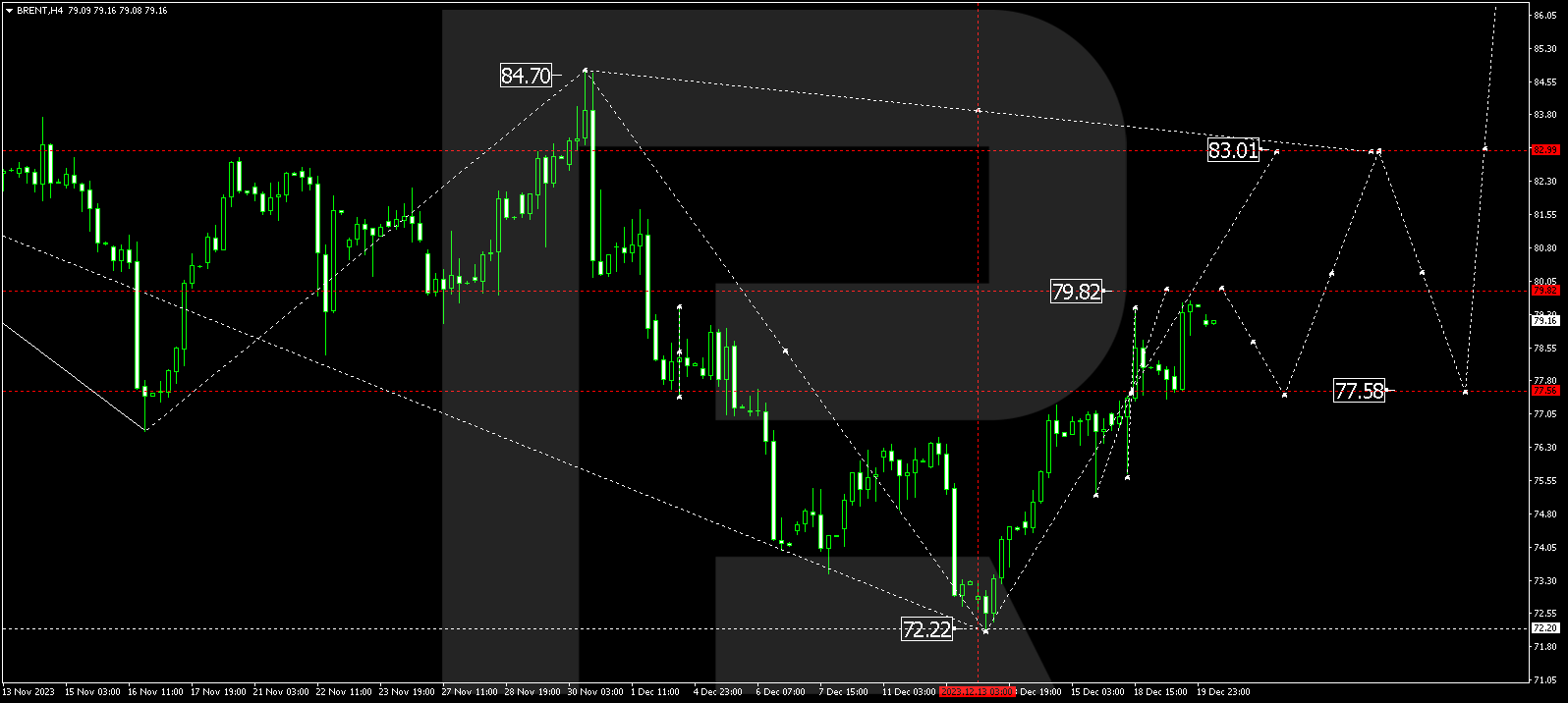

BRENT

Brent is progressing in a growth wave to 79.82. After reaching this level, a corrective link to 77.60 is plausible. Once the correction concludes, the trend may resume towards 83.00. This is considered the first target.

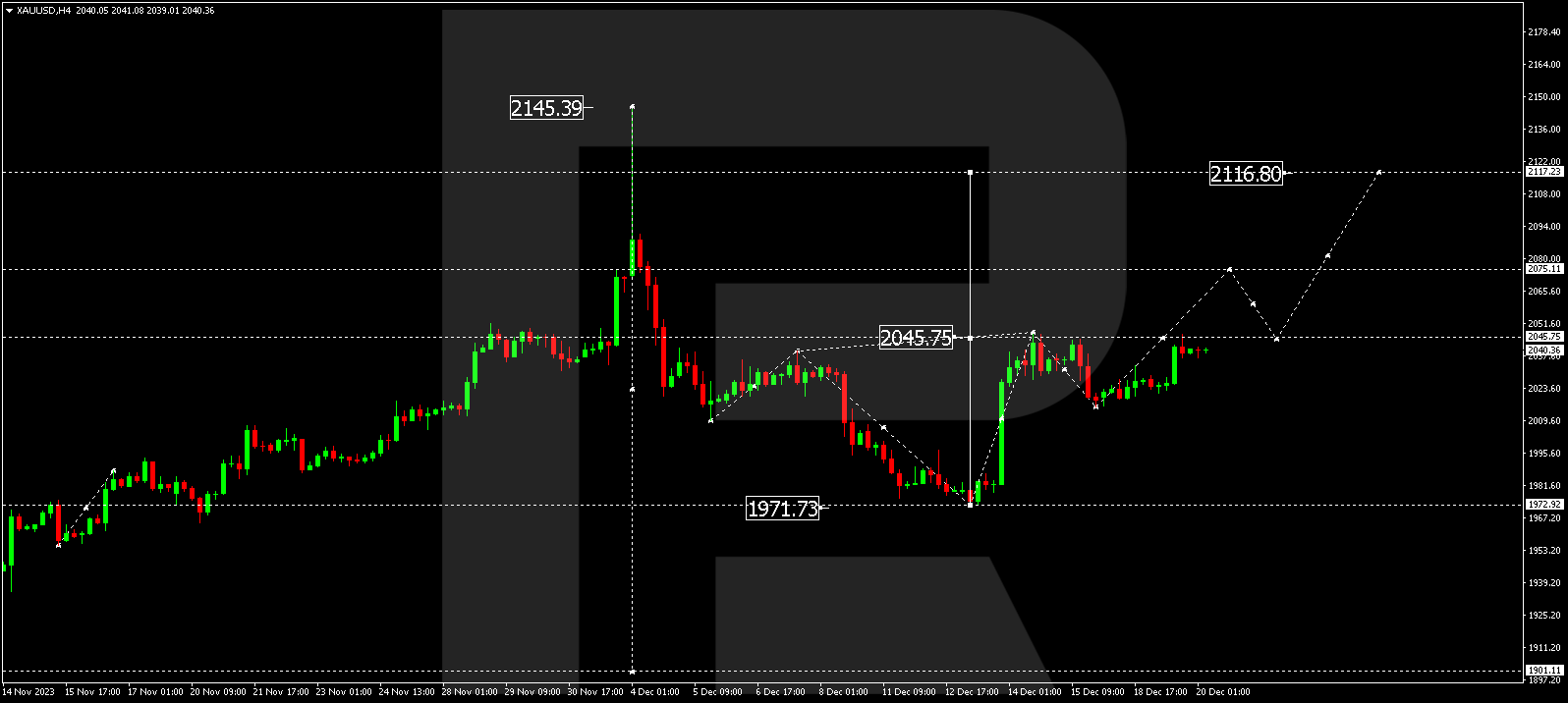

XAU/USD (Gold vs US Dollar)

Gold has established a fresh growth structure to 2046.00. A consolidation range is anticipated around this level. An upward breakout could signal a potential growth wave to 2075.00. This is a local target. Subsequently, a decline to 2046.00 might follow (a test from above), and the price could then rise to 2118.00.

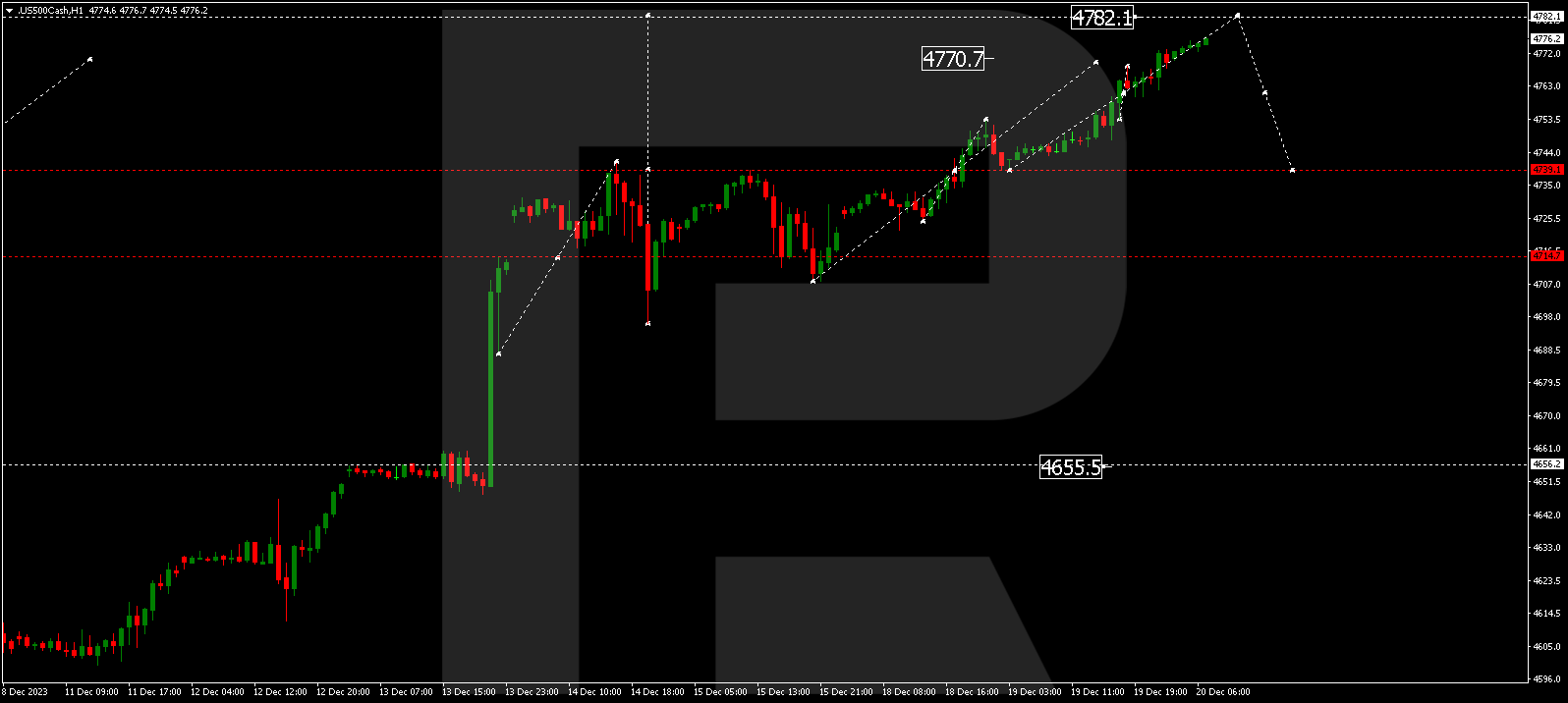

S&P 500

The stock index is advancing in a growth wave to 4782.0. Upon reaching this level, a correction to 4739.0 might unfold. A wide consolidation range is practically forming around this level. If there’s a downward breakout, a decline wave to 4666.0 could follow.

The post Technical Analysis & Forecast December 20, 2023 appeared first at R Blog – RoboForex.