Brent Sustains Growth, Plus Dynamics of EUR, GBP, JPY, CHF, AUD, Gold, and S&P 500

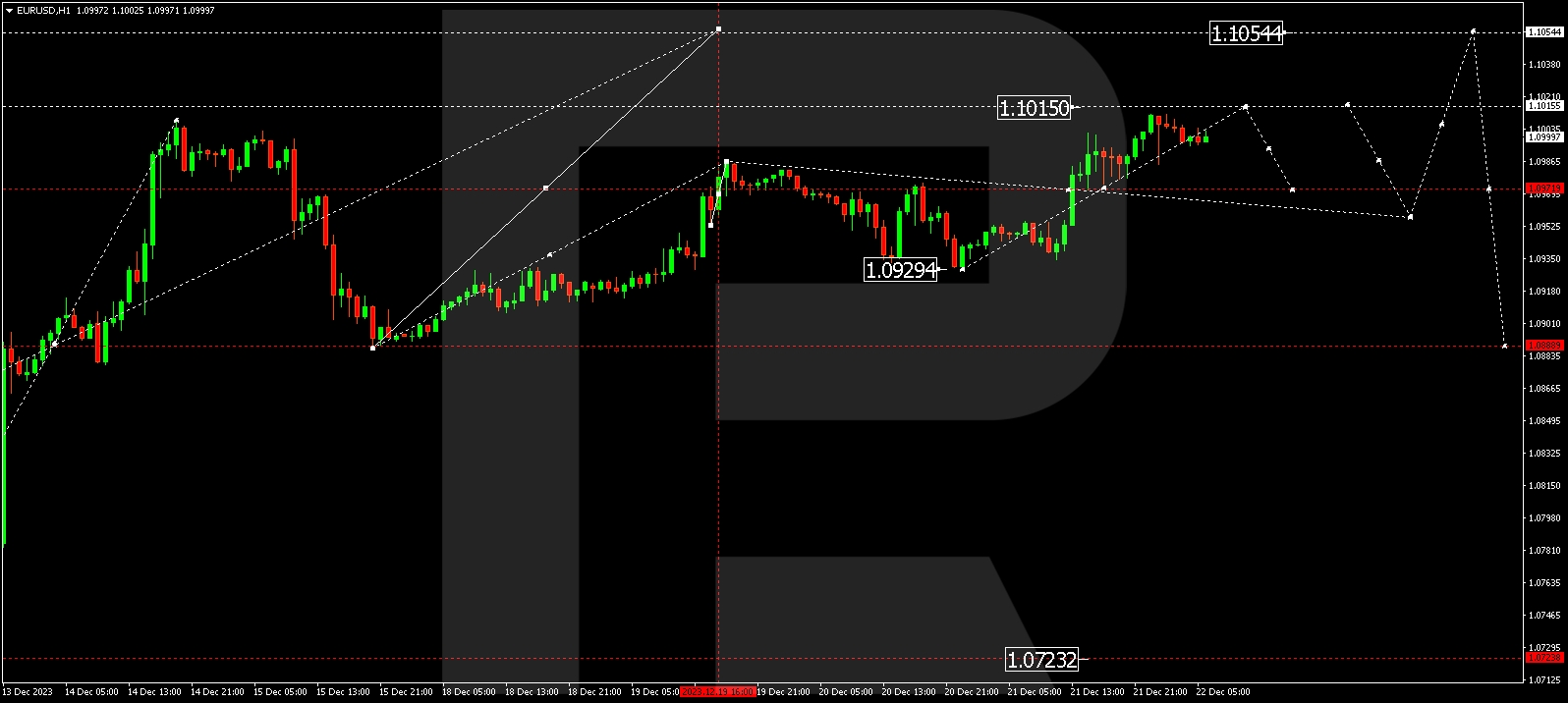

EUR/USD (Euro vs US Dollar)

EUR/USD concluded a growth phase at 1.1011. Today, an expected consolidation range around 1.1000 might form, with a potential extension to 1.1015. Following this, a decline to 1.0972 could emerge (a test from below), succeeded by a rise to 1.1054. At this level, the growth wave’s potential may be exhausted.

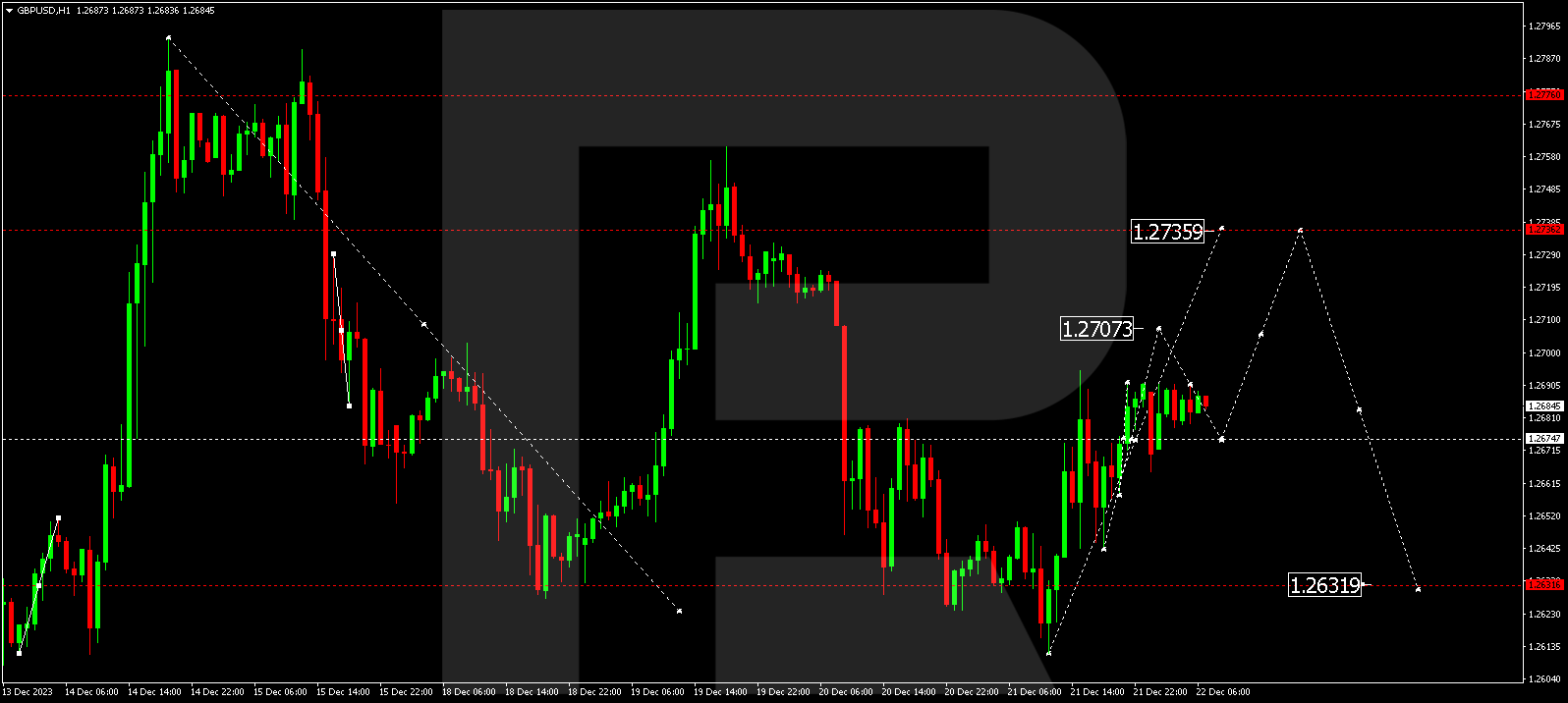

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is currently shaping a consolidation range near 1.2675. There is a possibility of extension to 1.2707 today, followed by a decline to 1.2675. Upon reaching this level, a rise to 1.2735 might unfold.

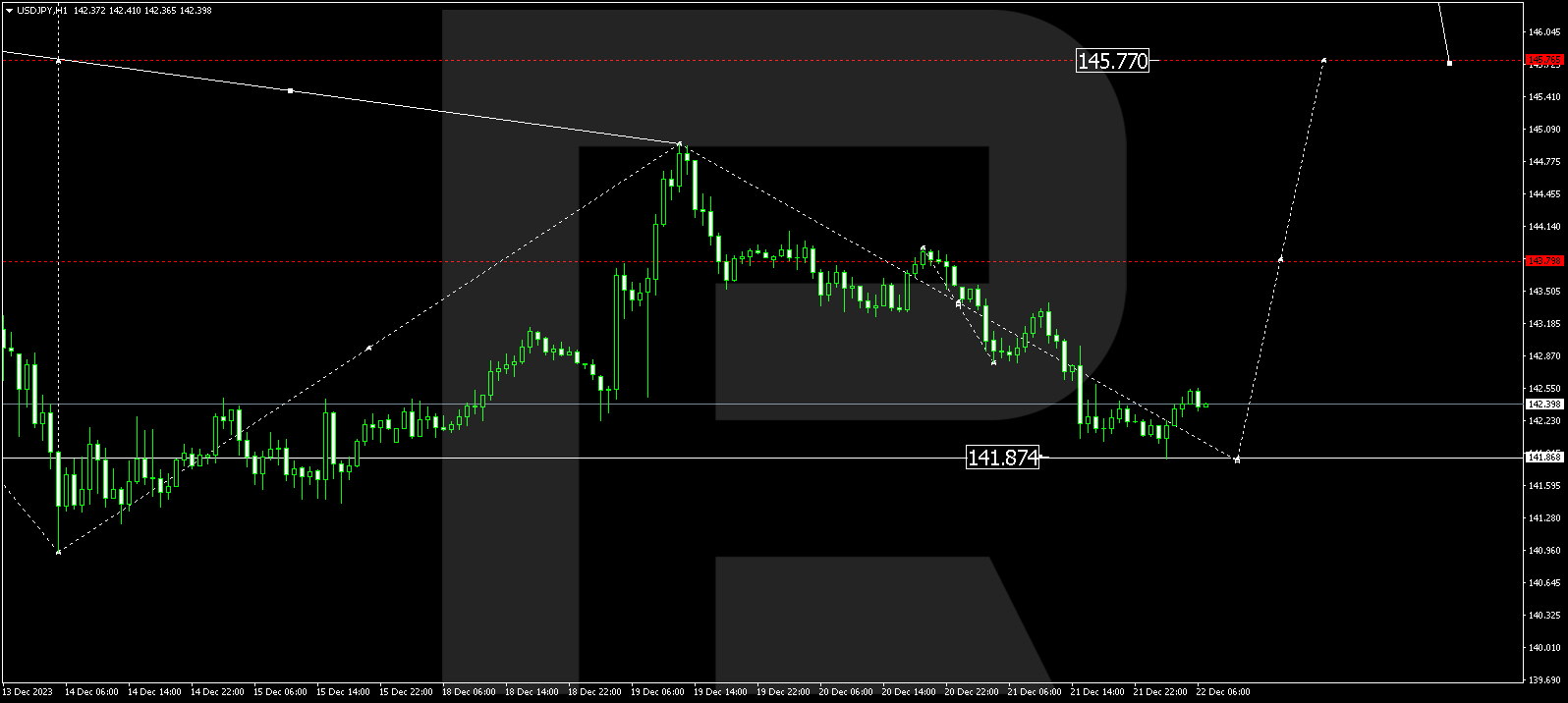

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has corrected to 141.86. Anticipate a growth link to 143.80 today. If this level breaks upwards, the potential for a wave to 145.75 could emerge.

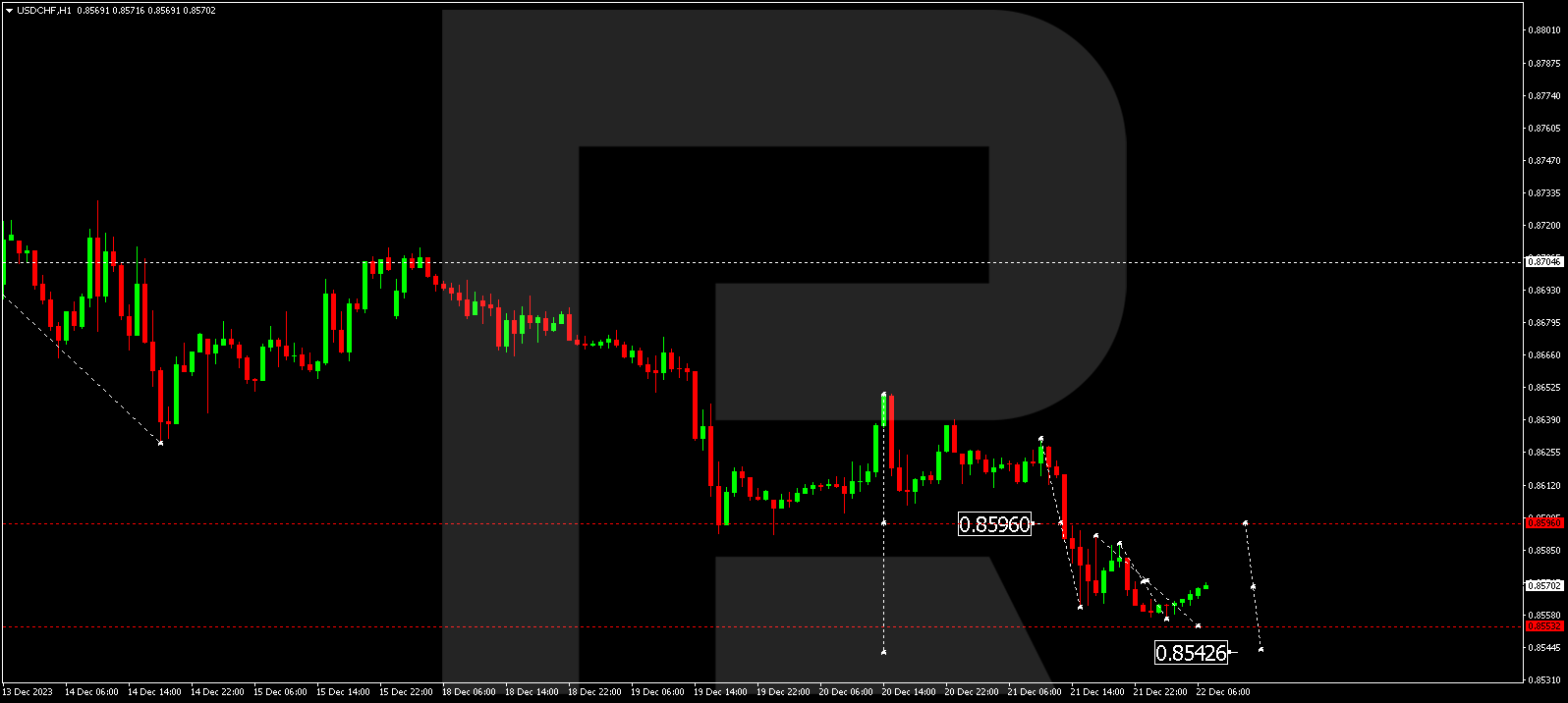

USD/CHF (US Dollar vs Swiss Franc)

USDHCF is in the process of a decline wave to 0.8555. After reaching this level, a potential rise to 0.8595 might happen, followed by a decline to 0.8543. Subsequently, a rise to 0.8700 is expected.

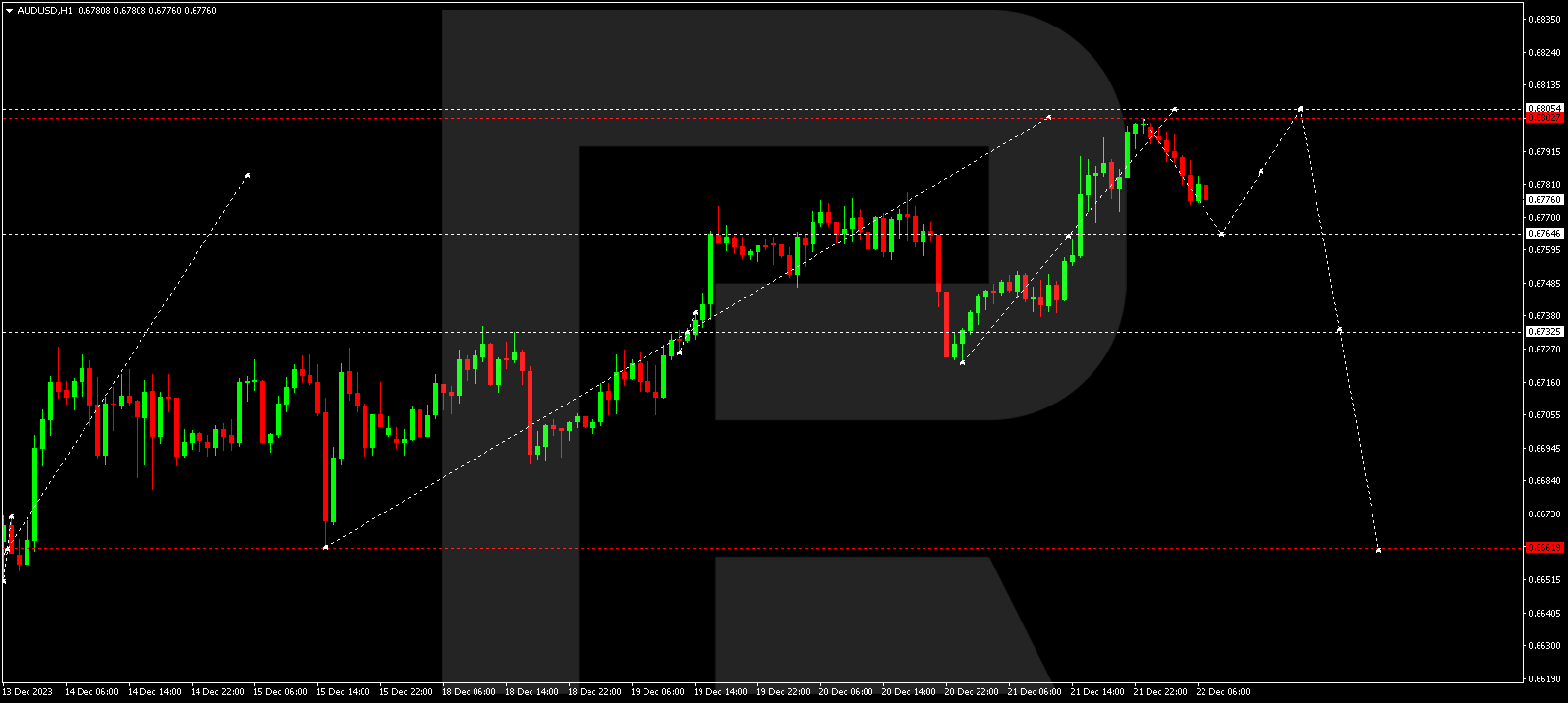

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a growth wave to 0.6800. Today, the pair might correct to 0.6765. After this correction, a new growth wave to 0.6805 could develop.

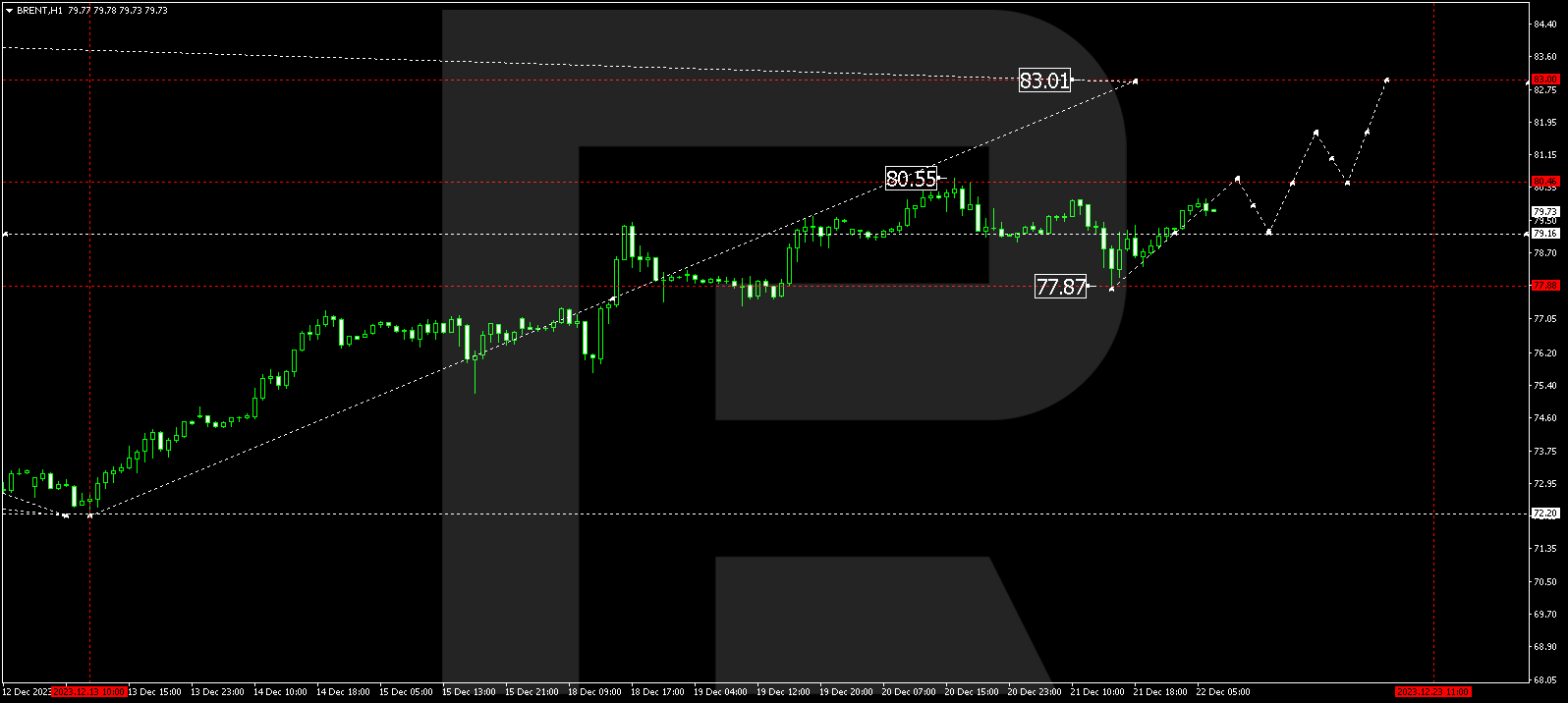

BRENT

Brent broke the 79.33 level upwards and continues the growth wave to 80.45. Next, a potential correction to 79.20 (a test from above) might occur, followed by a growth link to 83.00. This is the initial target.

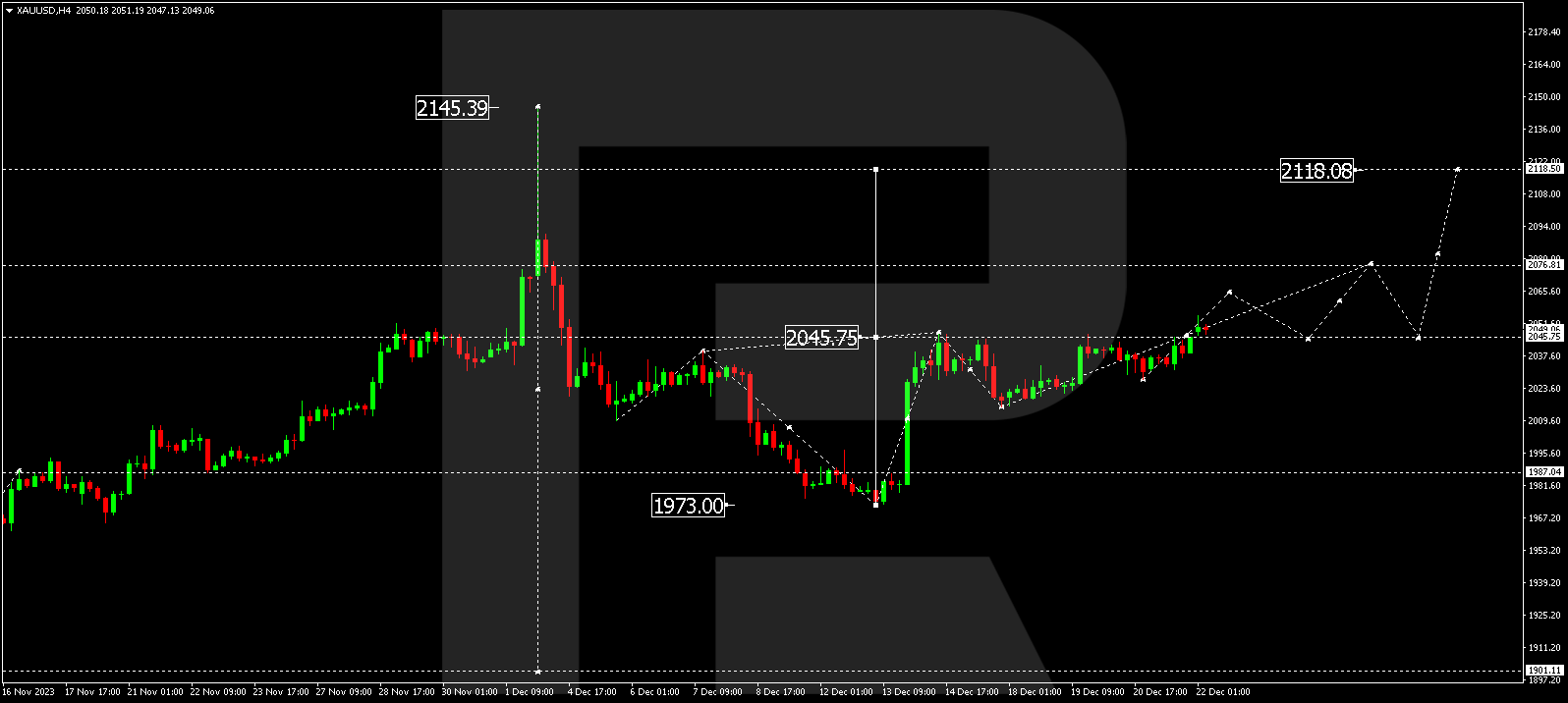

XAU/USD (Gold vs US Dollar)

Gold is in the process of developing a consolidation range around 2045.75. With a downward escape, there is a possibility of a decline link to 1990.00. Conversely, with an upward escape, the potential for a growth link to 2076.80 could open, from where the trend might extend to 2118.00.

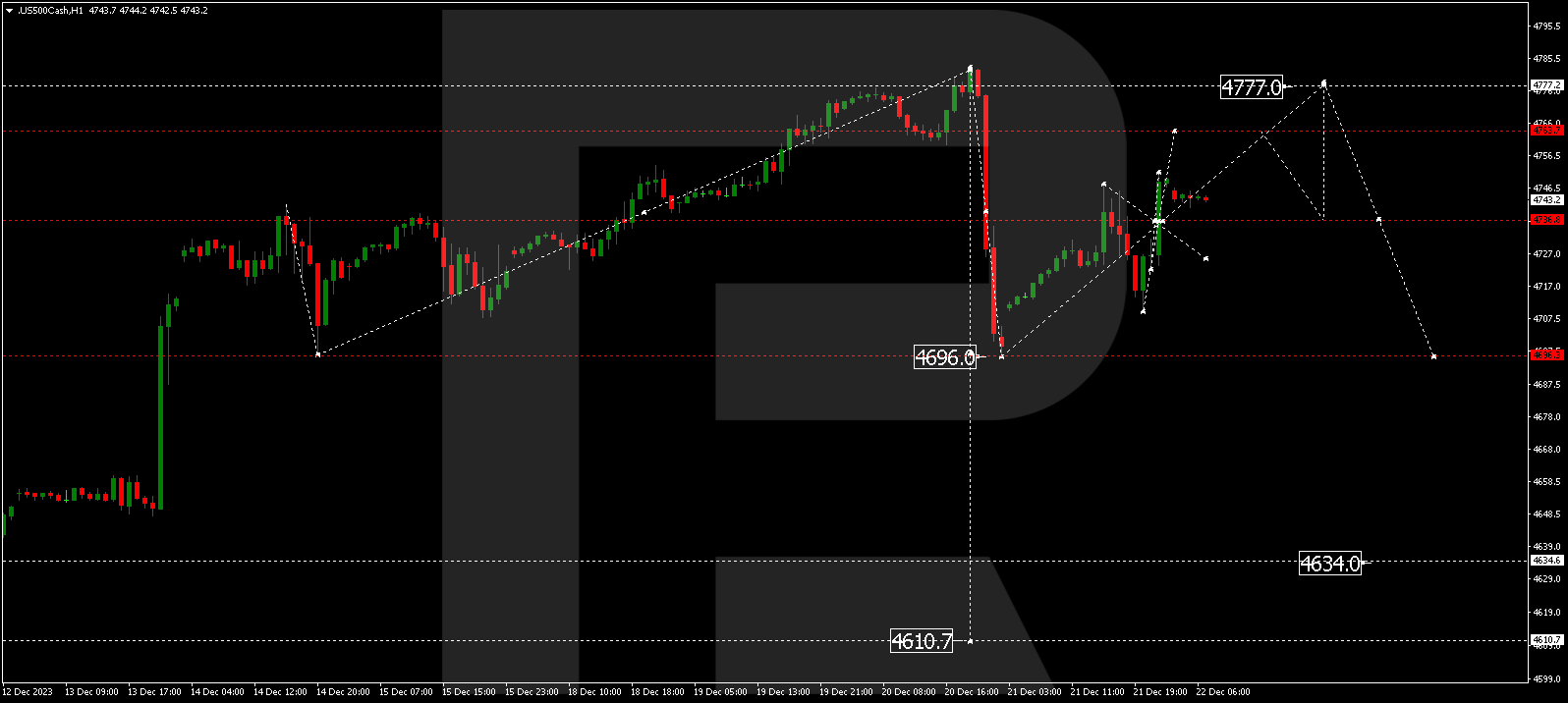

S&P 500

The stock index is establishing a consolidation range around 4736.6. An upward escape could lead to an extension of the correction to 4763.6. Conversely, a downward escape might continue the decline to 4700.0, from where the trend could extend to 4610.0.

The post Technical Analysis & Forecast December 22, 2023 appeared first at R Blog – RoboForex.