The potential for EUR growth persists. Explore the insights into the dynamics of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

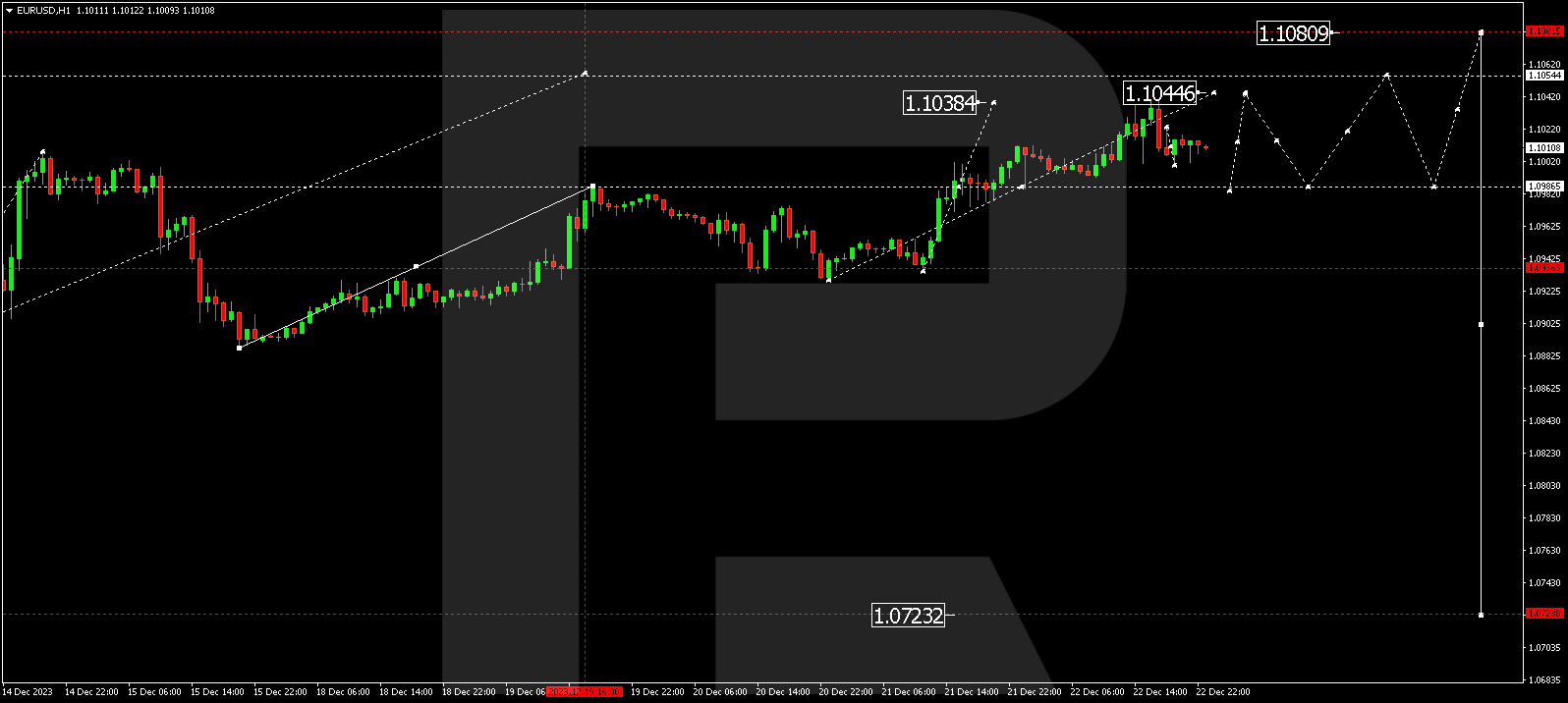

EUR/USD (Euro vs US Dollar)

EUR/USD has successfully completed a growth wave, reaching 1.1039. Today, an anticipated correction down to 1.0986 is expected. Following the correction, a new growth phase to 1.1080 might unfold, subsequently followed by a decline to 1.0940.

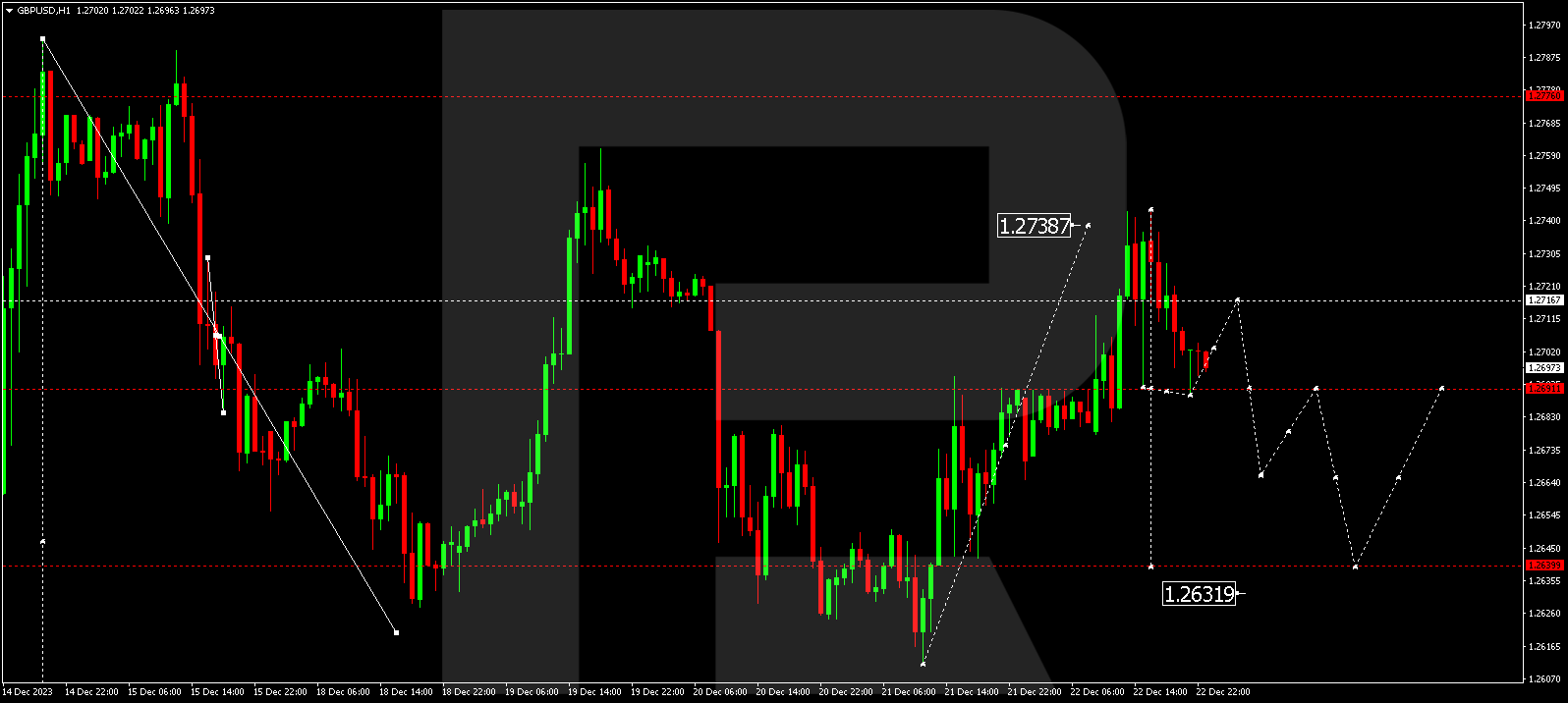

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD concluded a growth wave at 1.2743, followed by a correction to 1.2691. Currently, a consolidation range may emerge around this level. In case of an upward breakout from this range, a new growth phase to 1.2770 cannot be ruled out. Conversely, a downward breakout may open the potential for a decline wave to 1.2633.

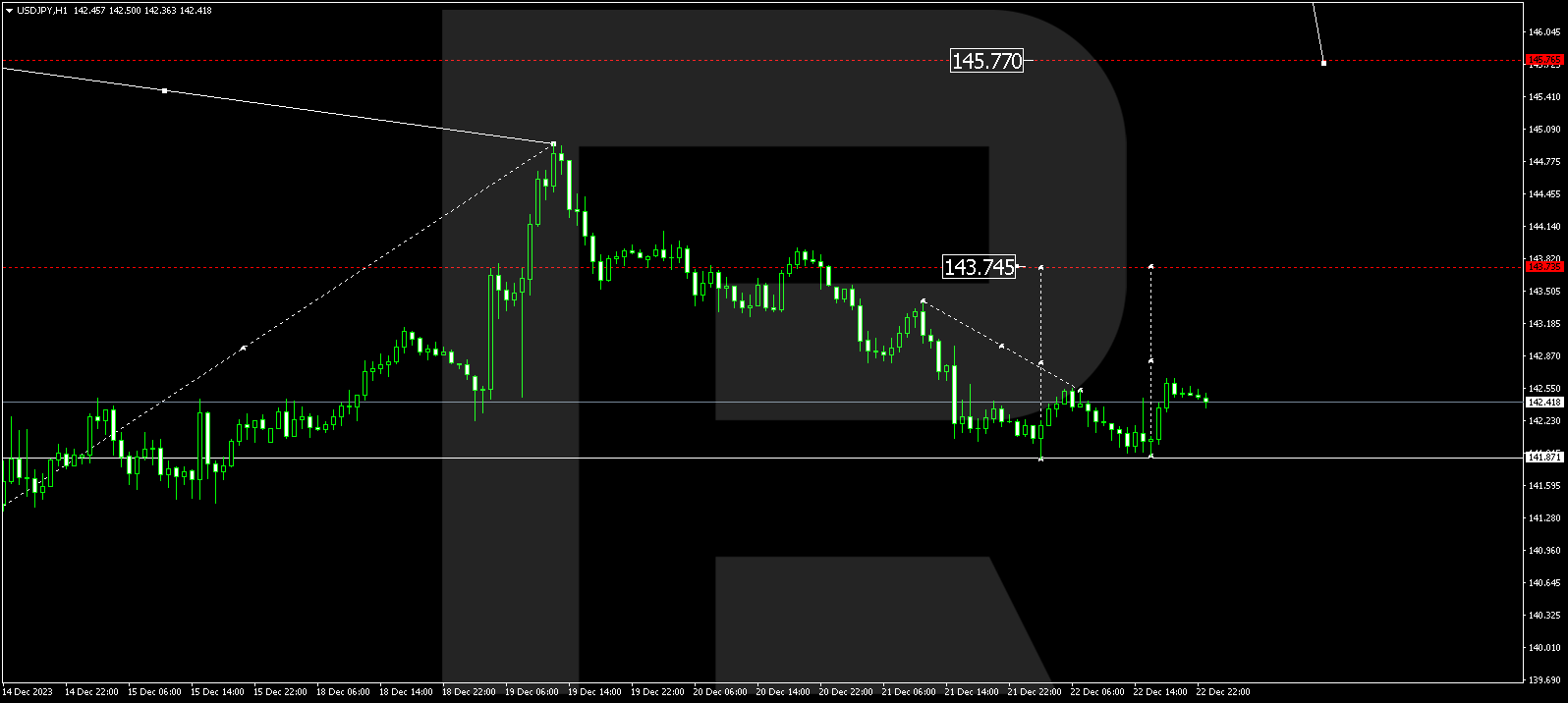

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has established a consolidation range above 141.88. An upward breakout could pave the way for a growth wave to 144.17, representing the initial target.

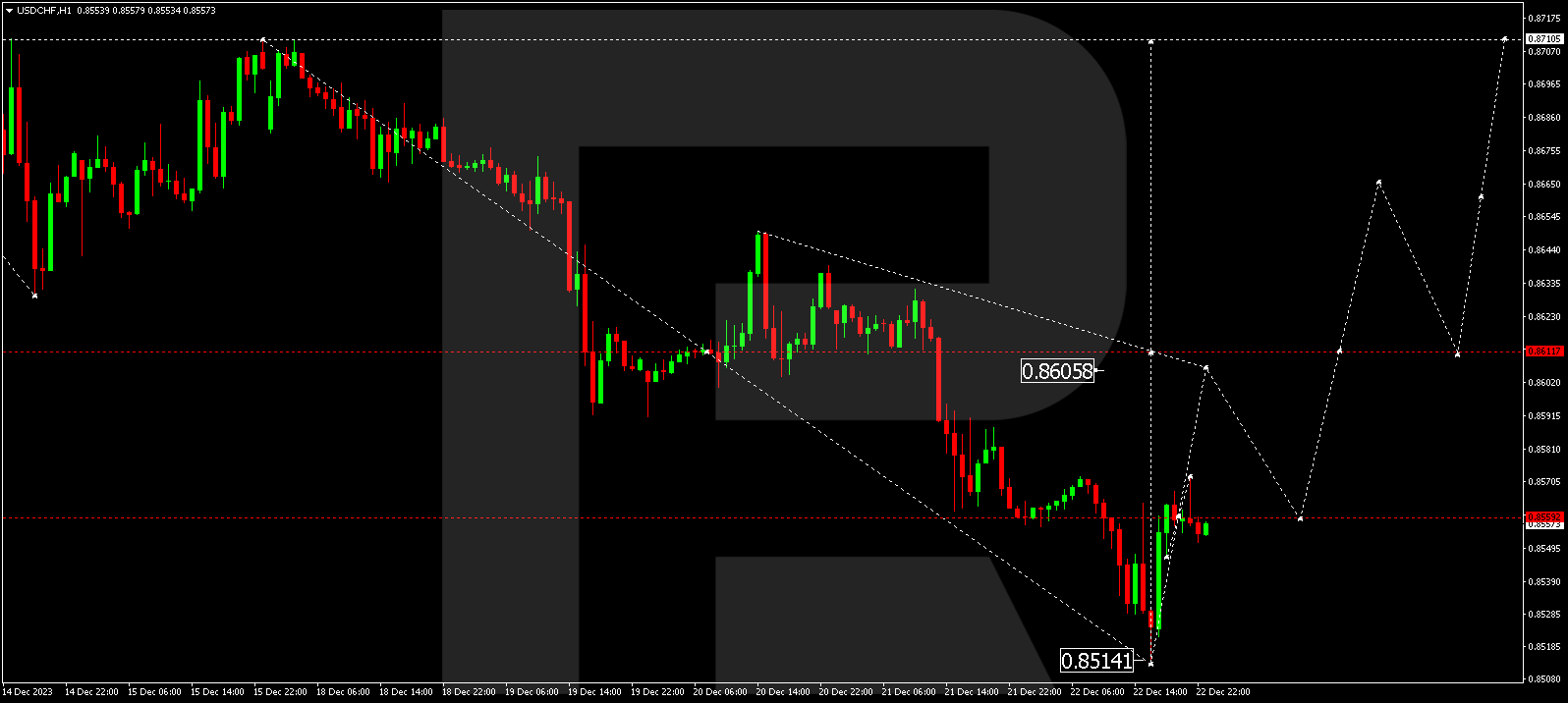

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF successfully completed a decline wave, reaching 0.8514. A subsequent growth impulse to 0.8560 followed. Today, a consolidation range might take shape around this level. An upward breakout from this range could lead to a correction to 0.8611, marking the initial target.

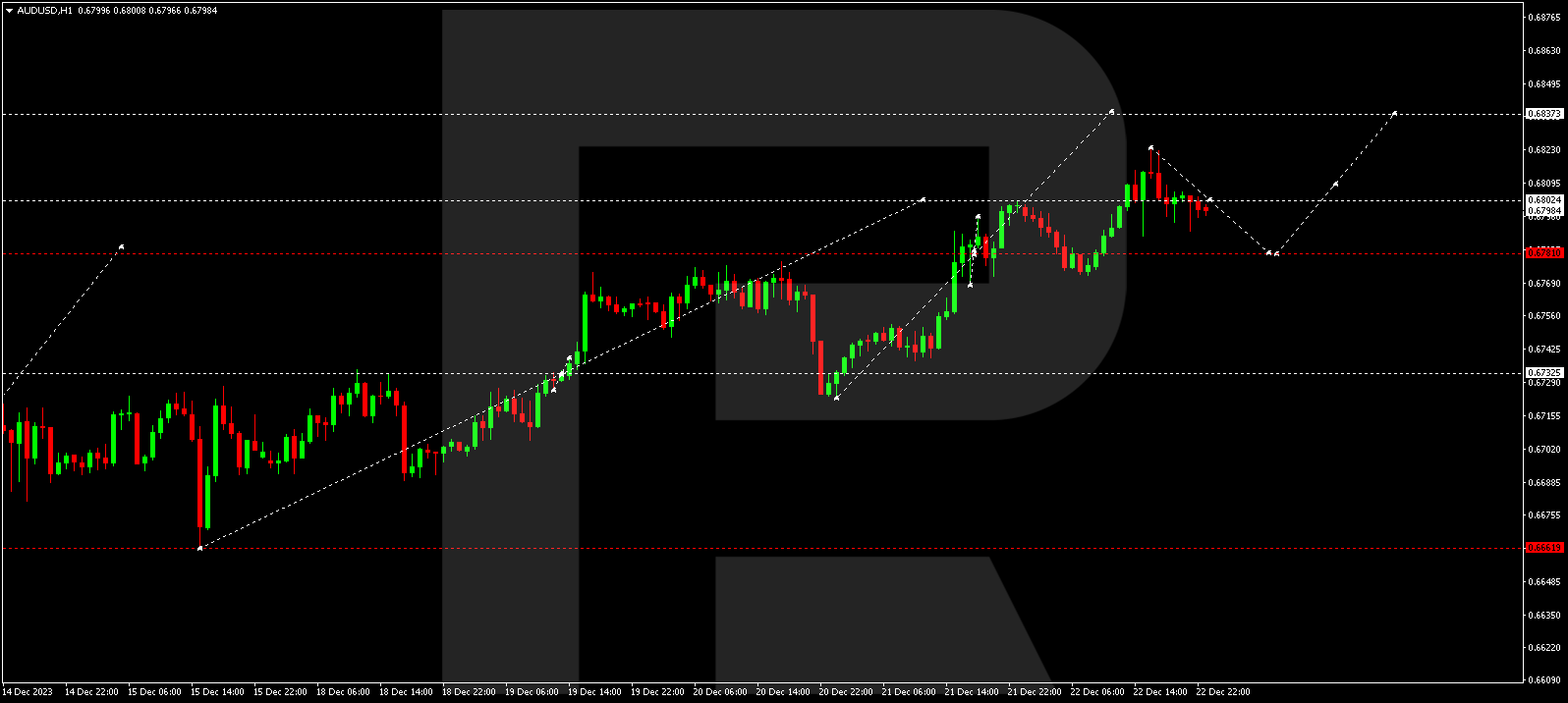

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD wrapped up a growth wave at 0.6823. A correction down to 0.6781 is likely today. After the correction, a new wave to 0.6837 might unfold as a local target.

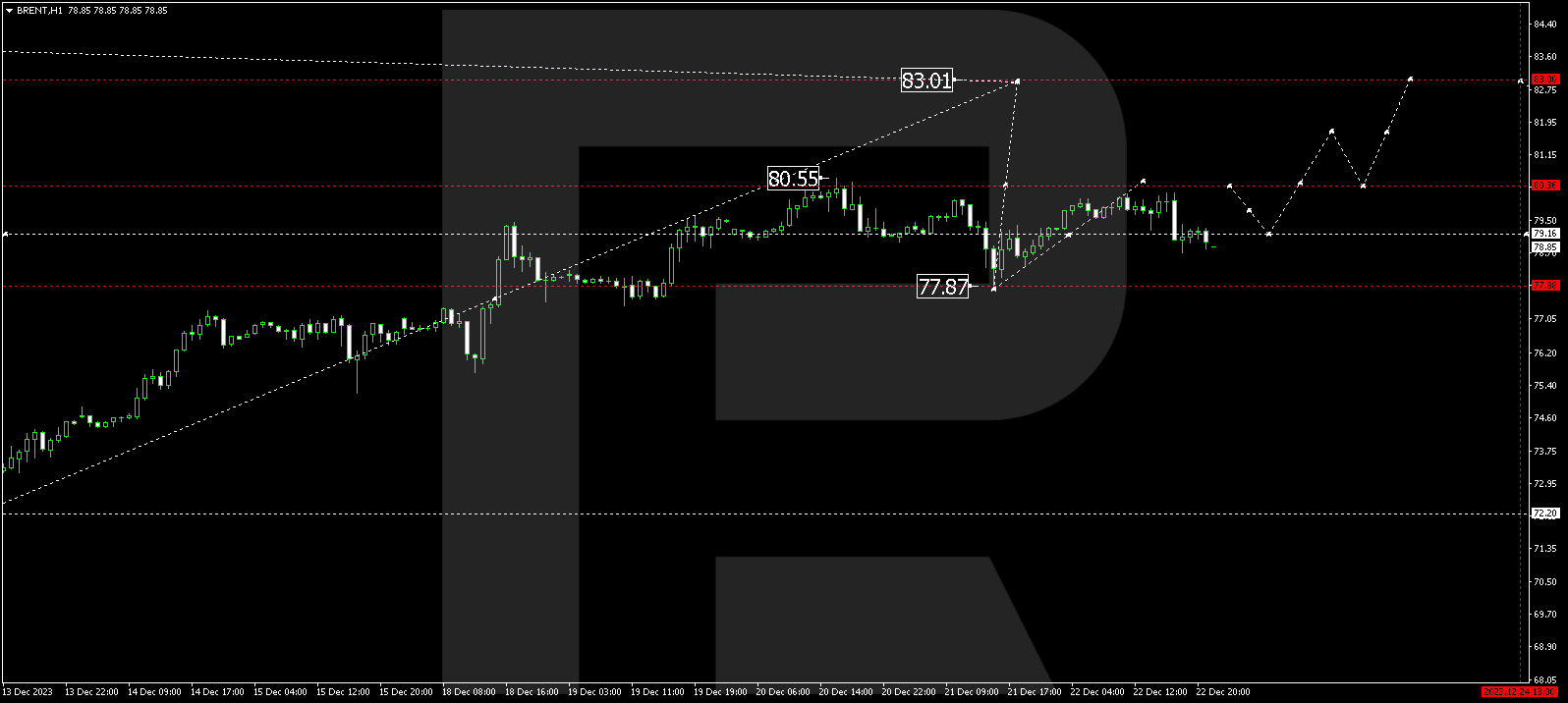

BRENT

Brent is currently developing a consolidation range around 79.20. An upward breakout from this range could set the stage for a growth structure to 83.00, representing the first target. Following this achievement, a correction to 77.80 might ensue (a test from above).

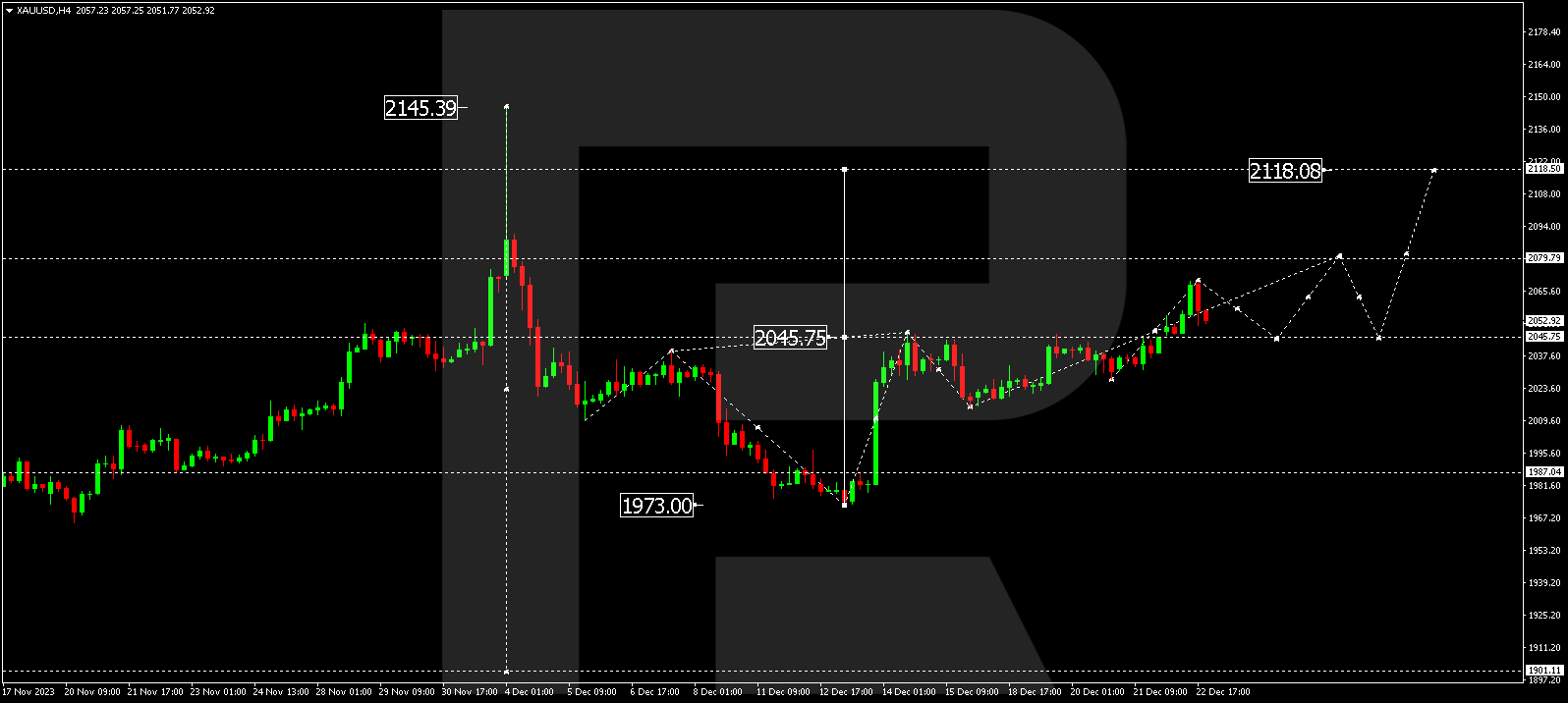

XAU/USD (Gold vs US Dollar)

Gold is continuing its growth wave to 2079.80. After reaching this level, a correction to 2045.75 may transpire, followed by a rise to 2118.00.

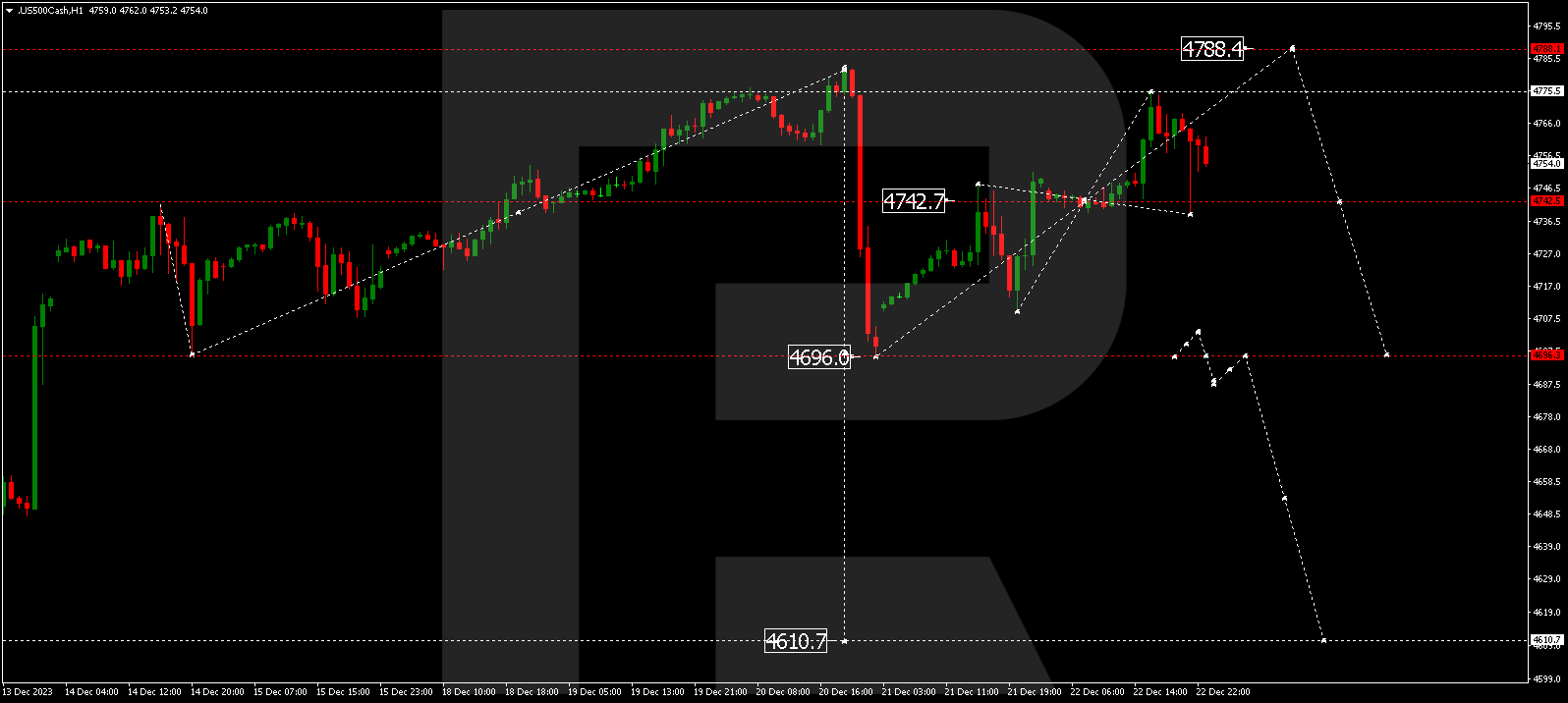

S&P 500

The stock index has concluded a growth wave at 4775.5, followed by a correction to 4742.5. Today, a new growth structure to 4788.5 could manifest. Once this level is attained, a decline wave to 4696.0 might commence, representing the initial target.

The post Technical Analysis & Forecast December 25, 2023 appeared first at R Blog – RoboForex.