AUD May Initiate a Decline Wave. Discover insights into the dynamics of EUR, GBP, JPY, CHF, Brent, Gold, and the S&P 500 index in the overview.

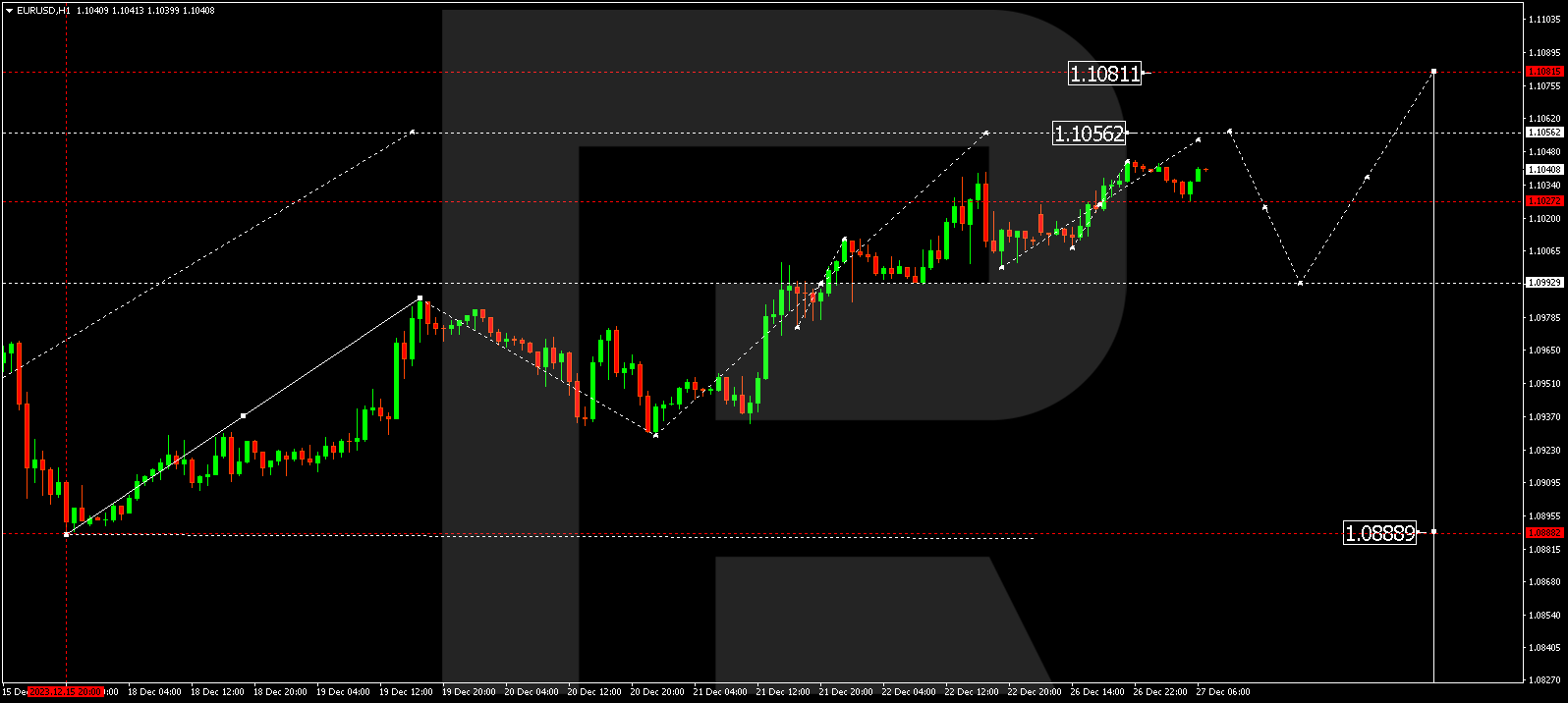

EUR/USD (Euro vs US Dollar)

EUR/USD concluded a growth phase reaching 1.1044. A potential correction to 1.1025 might unfold today, followed by an extension of the growth wave to 1.1056. After reaching this level, a correction to 1.0993 could commence, succeeded by an upward move to 1.1088.

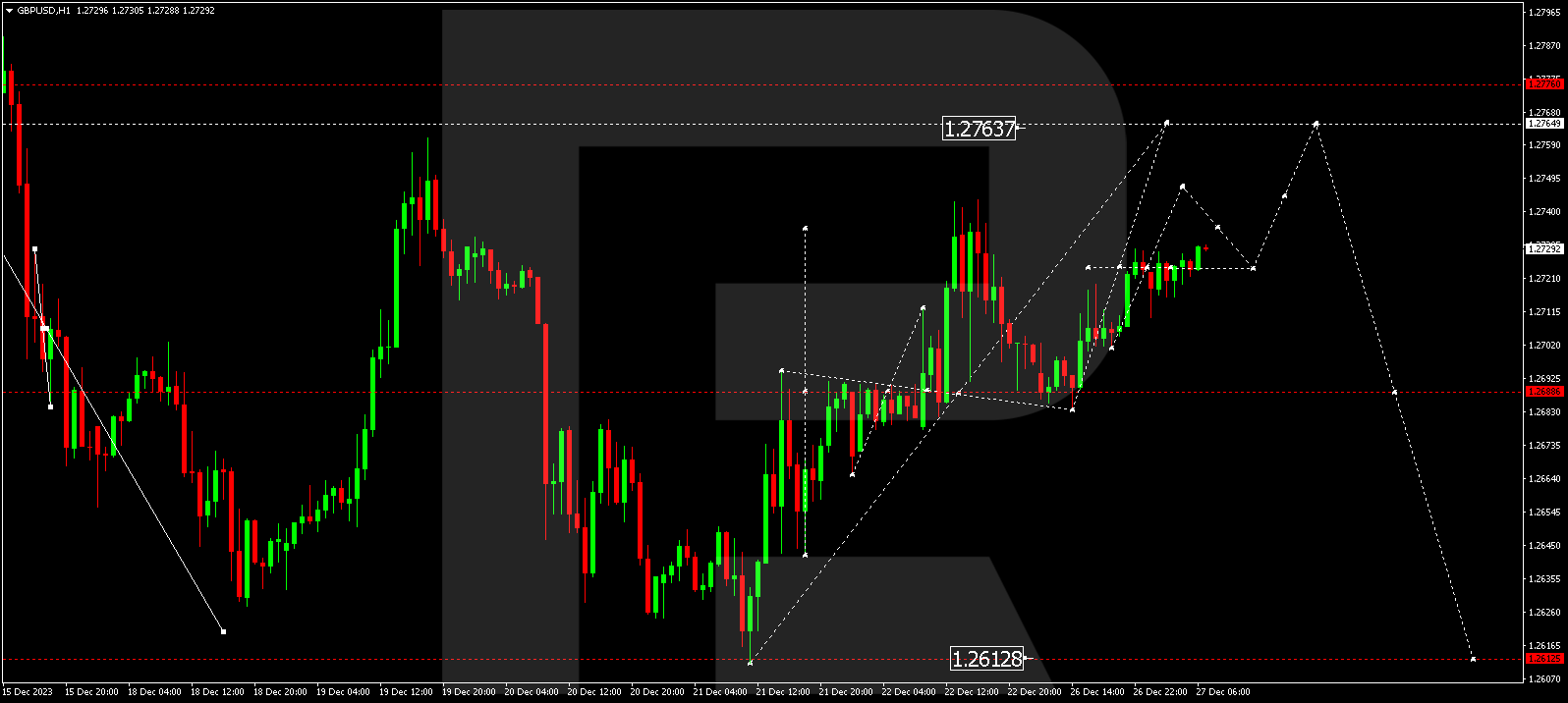

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is shaping a consolidation range around 1.2720. A plausible upward movement to 1.2747 is on the horizon. Once attained, a correction to 1.2720 is anticipated, followed by a subsequent ascent to 1.2765.

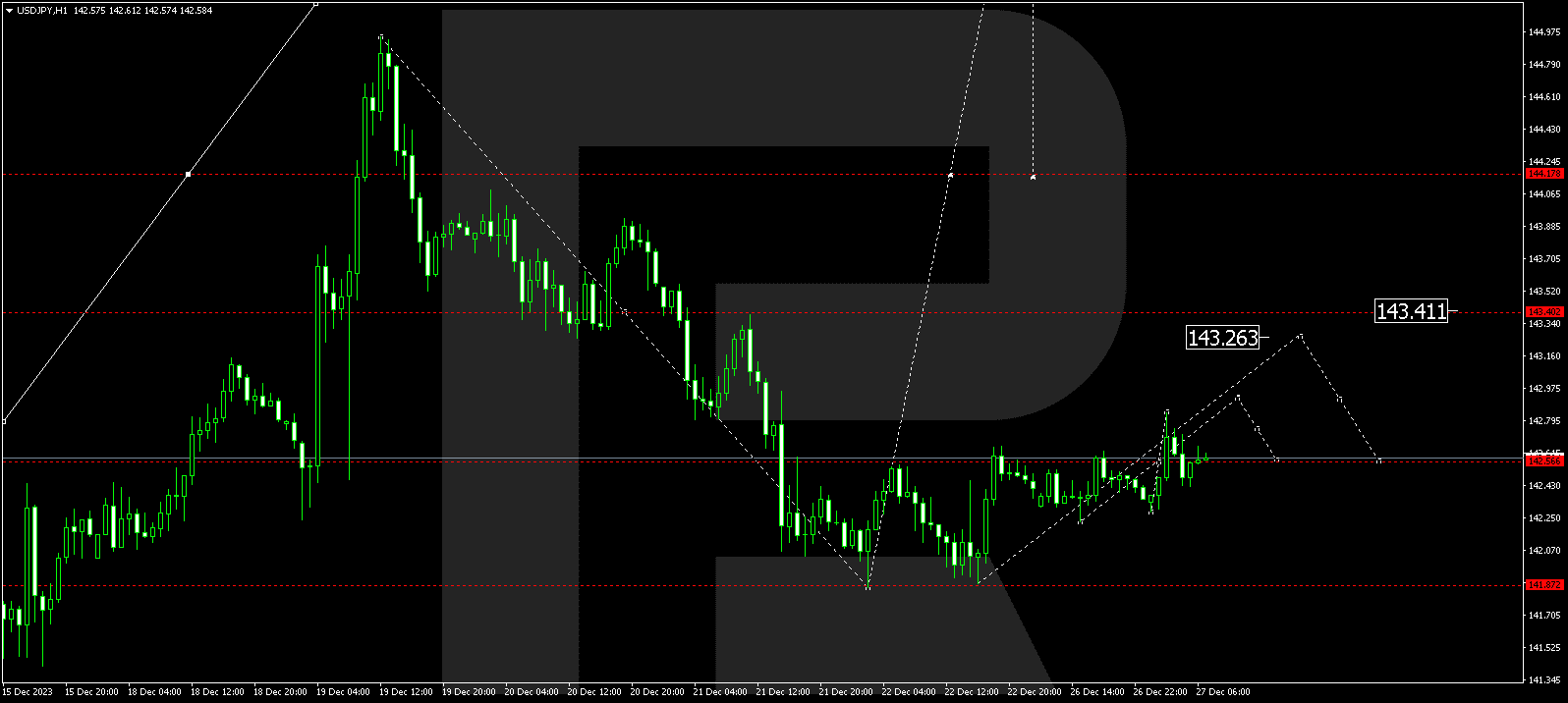

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is navigating a consolidation range around 142.50, lacking a distinct trend. A breakout upwards could trigger a correction to 143.43. Conversely, a downward breakout presents the potential for a decline to 140.00, marking a local target.

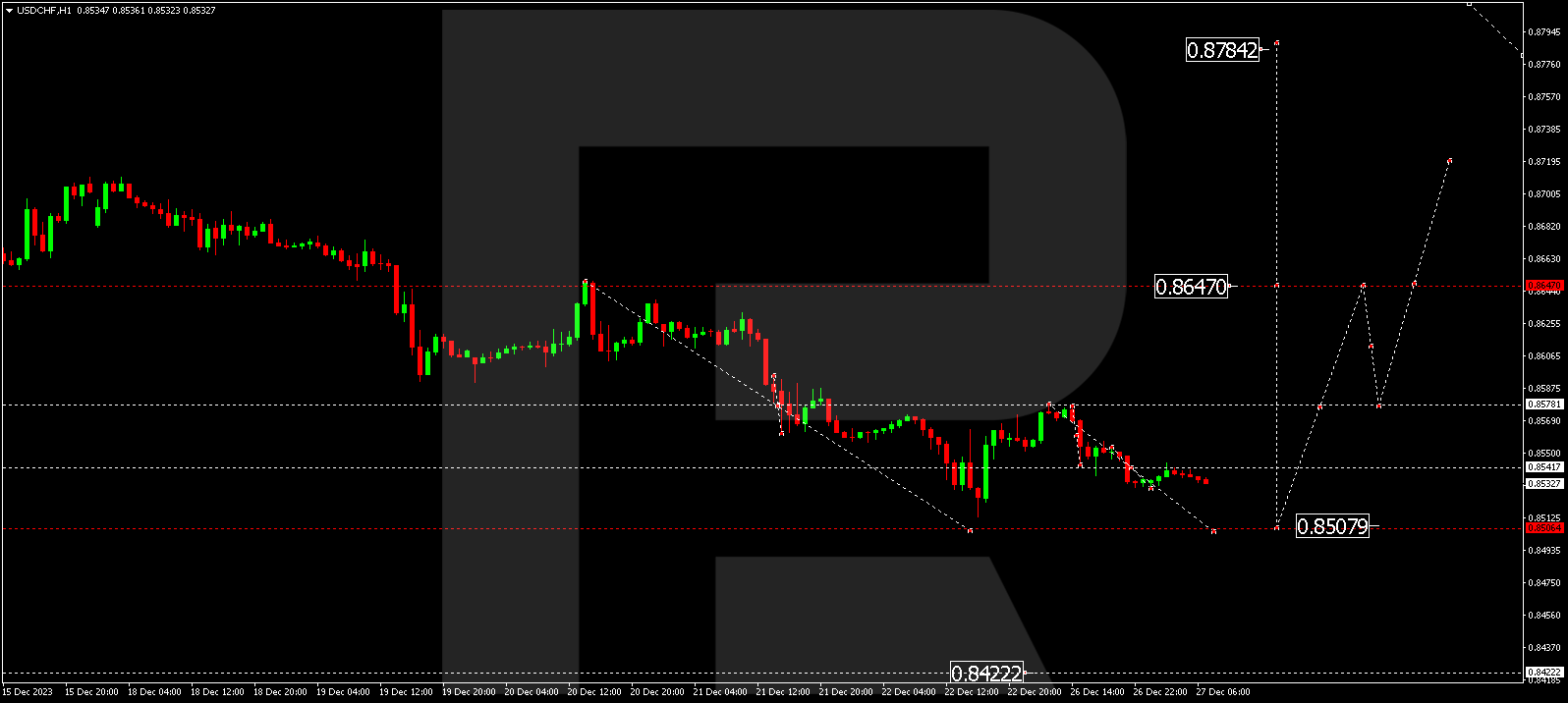

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has concluded a decline wave at 0.8537, fostering a consolidation range around this level. A potential downward breakout could lead to a decline to 0.8508. Upon reaching this level, a new upward wave to 0.8647 might commence, possibly extending to 0.8784.

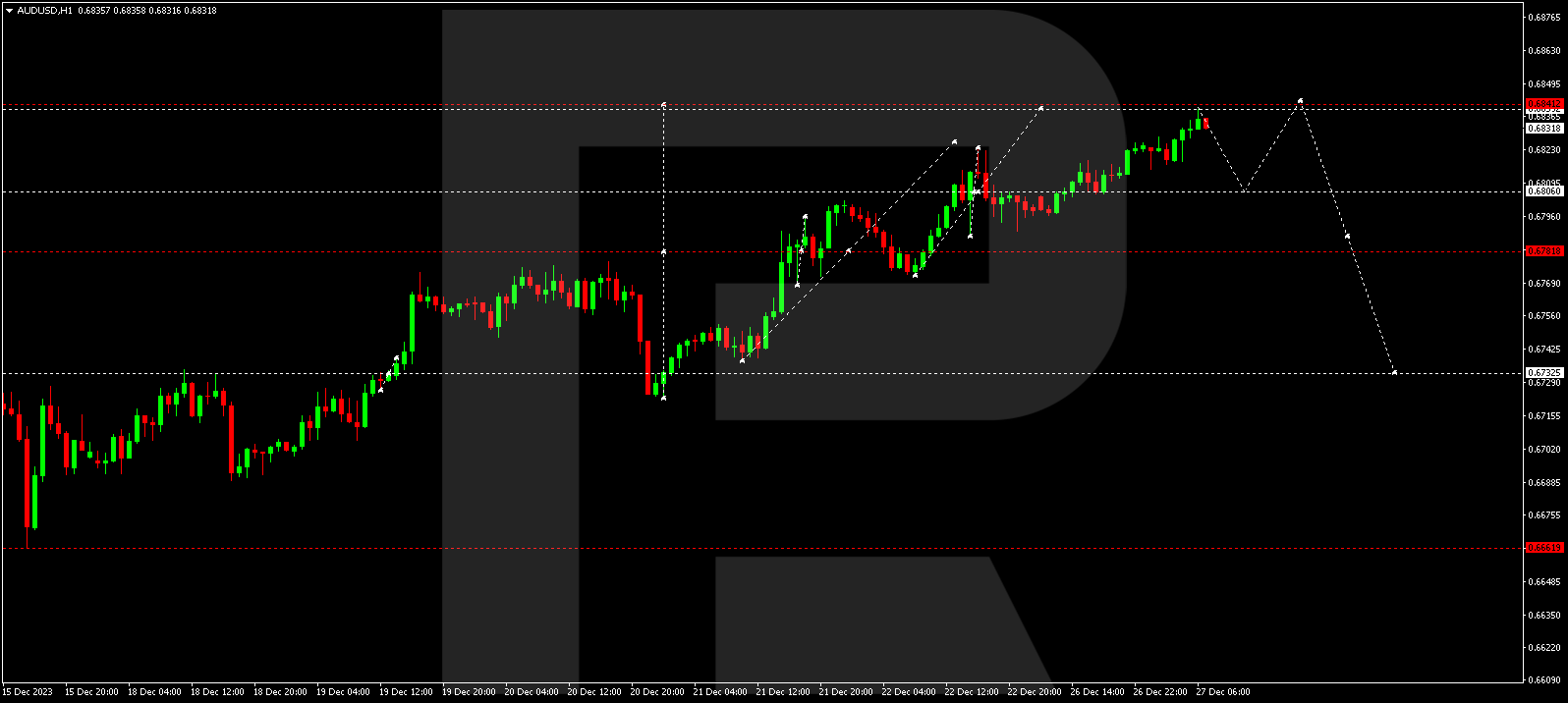

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD completed a growth wave to 0.6840. A decline phase to 0.6800 might initiate today. A breakout at this level could lead to a decline wave to 0.6733, marking the initial target.

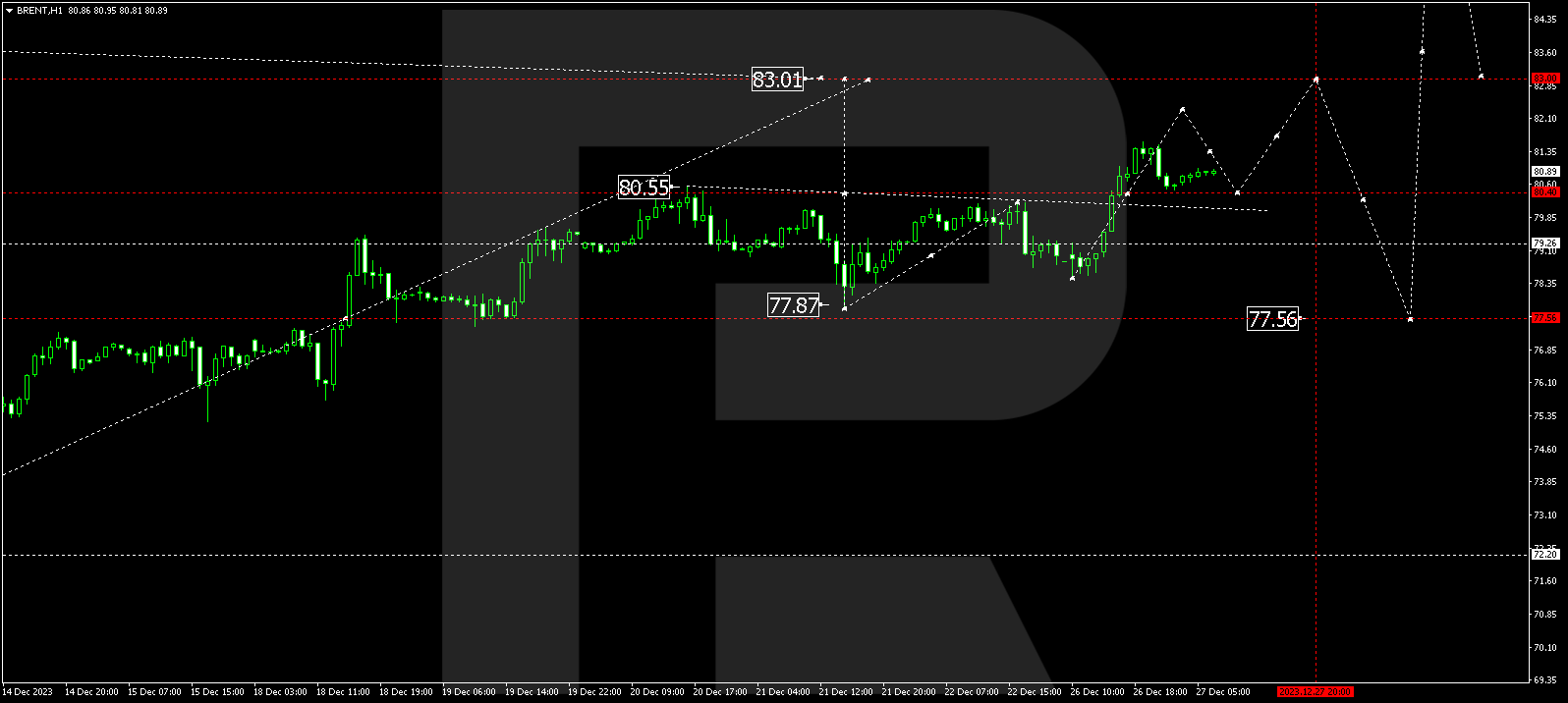

BRENT

Brent has surpassed the 80.55 level, completing a growth structure to 81.56. A possible correction to 80.55 (a test from above) is anticipated, followed by a rise to 83.00. This marks the initial target.

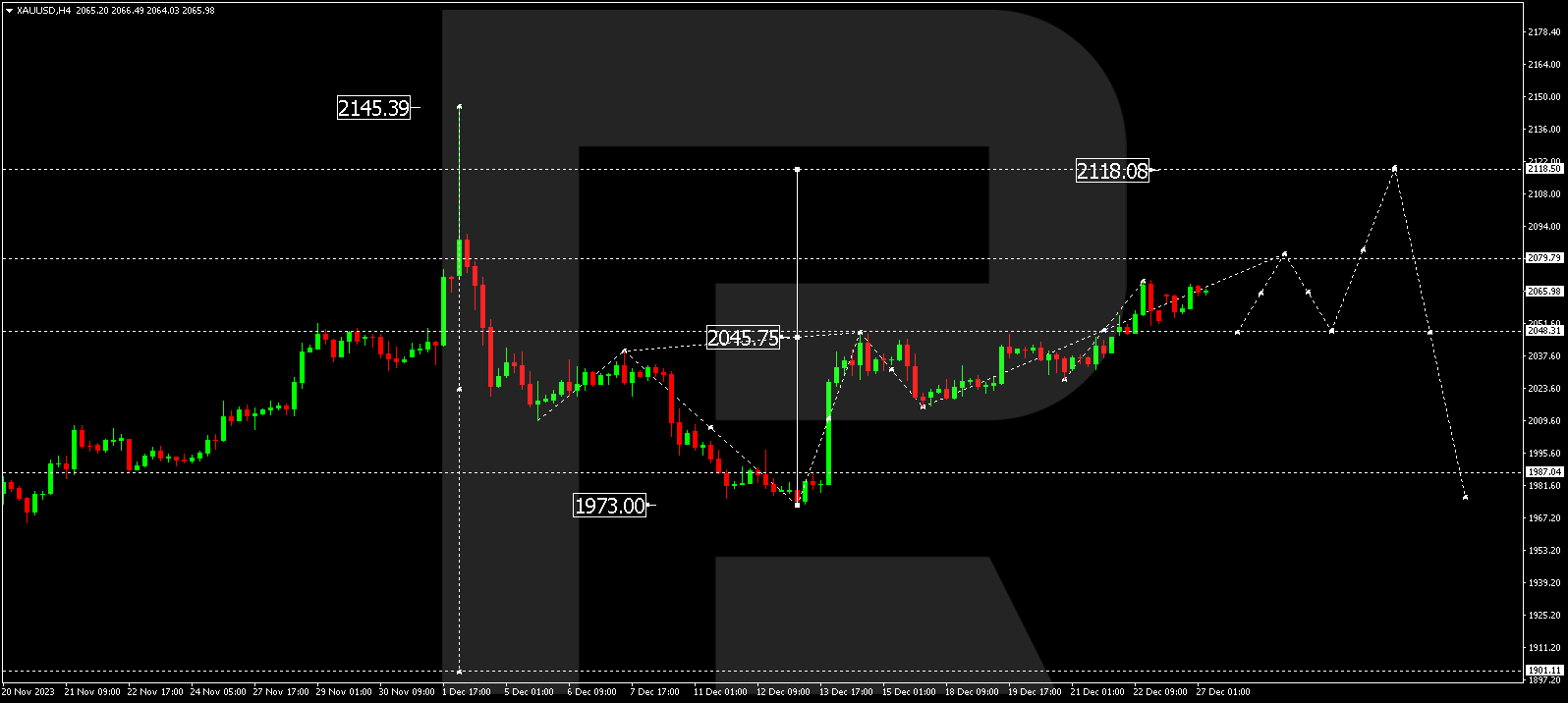

XAU/USD (Gold vs US Dollar)

Gold is continuing a growth wave to 2079.80. After reaching this level, a correction to 2045.76 could transpire (a test from above). Subsequently, a growth phase to 2118.00 is projected.

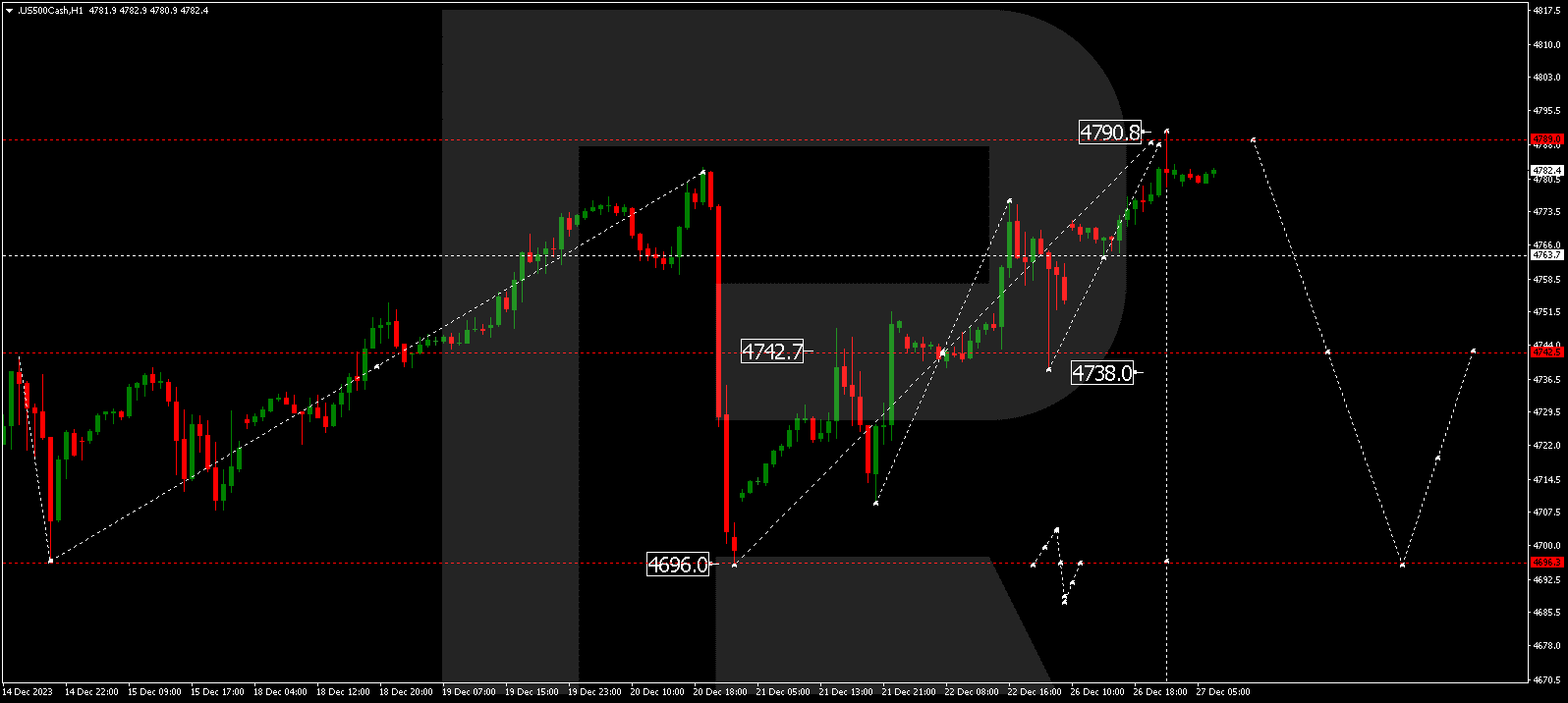

S&P 500

The stock index has wrapped up a growth wave at 4790.0. A consolidation range beneath this level is expected. A downward breakout could initiate a new decline wave to 4742.5, signifying the initial target.

The post Technical Analysis & Forecast December 27, 2023 appeared first at R Blog – RoboForex.