EUR poised for further decline. This overview also encompasses the dynamics of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

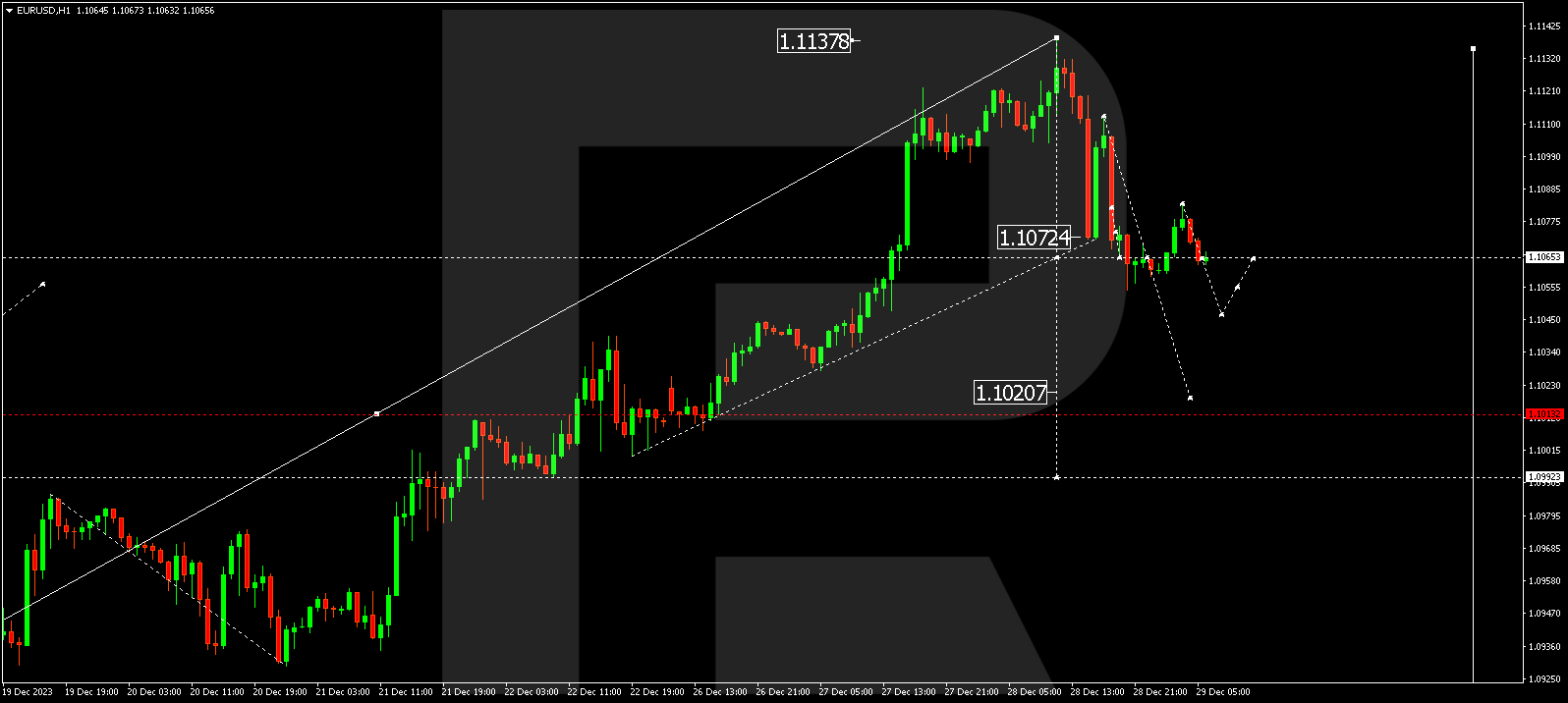

EUR/USD (Euro vs US Dollar)

EUR/USD has concluded the initial downward impulse at 1.1073, followed by a correction to 1.1112. The structure of a new decline wave to 1.1055 has commenced. Notably, the low of the first decrease wave has been breached. Today, a consolidation range around 1.1055 is expected. If the range breaks downward, the decline wave may extend to 1.1020. This is considered a local target.

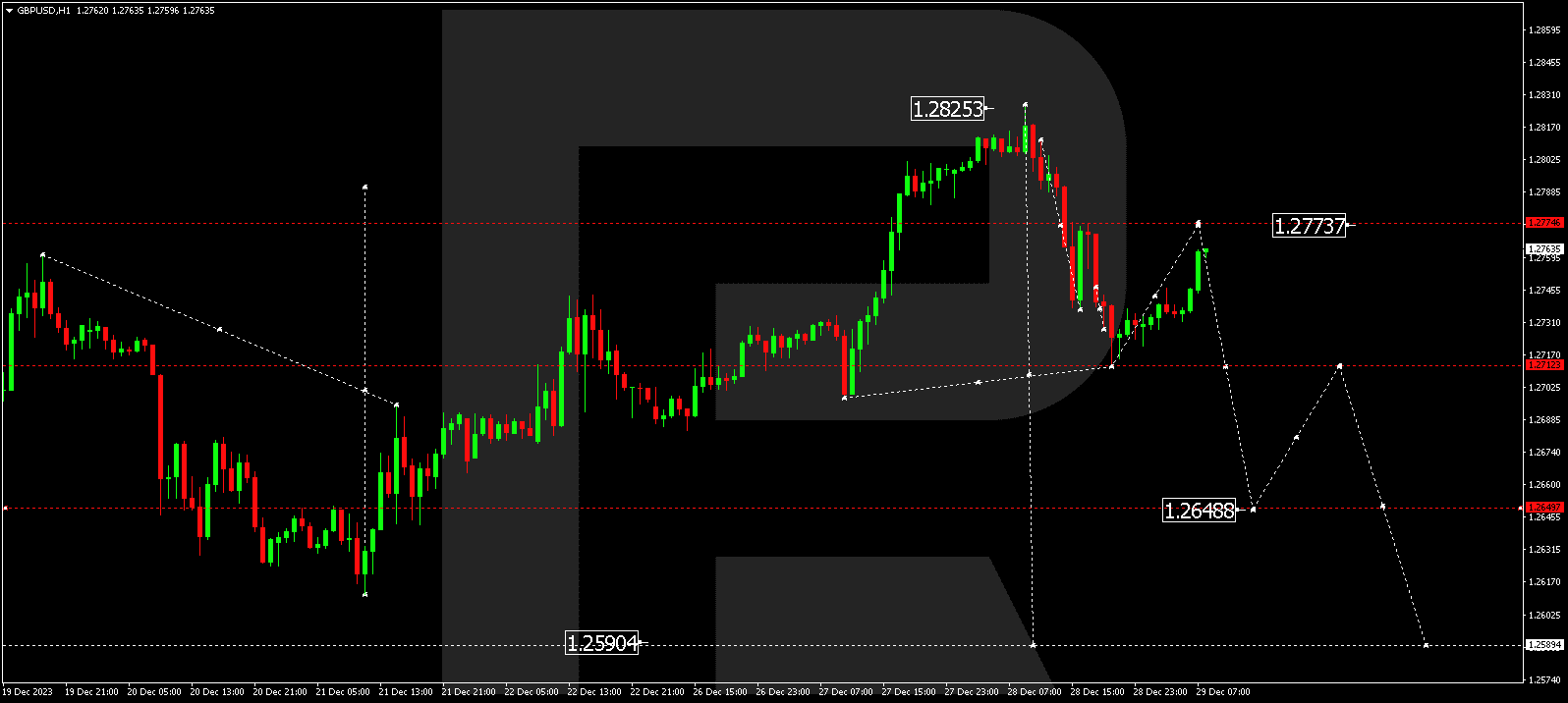

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has wrapped up a decline wave at 1.2712, with a correction to 1.2773 expected today. Once the correction concludes, a decline to 1.2710 is anticipated. Breaking this level could open the potential for a decline to 1.2648, marking a local target.

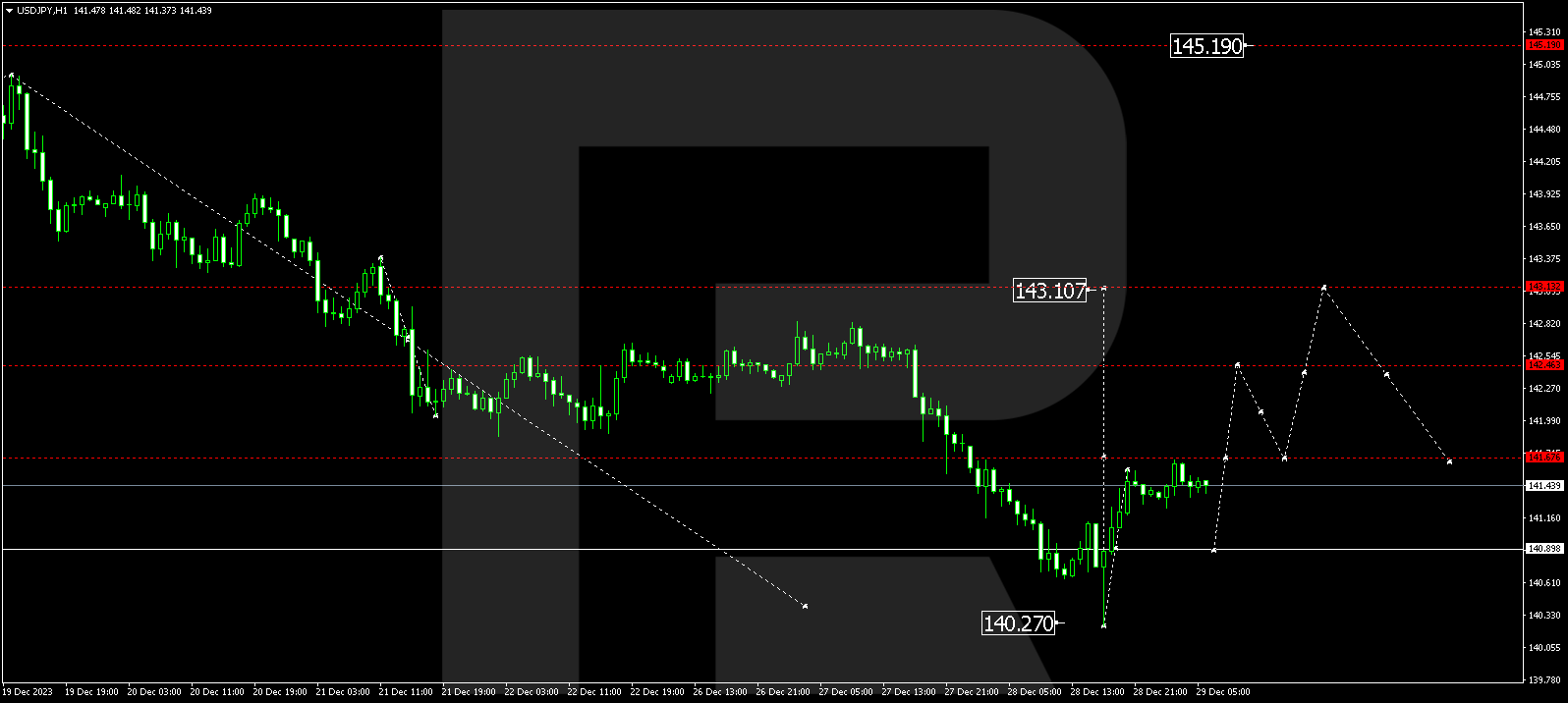

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has completed a growth impulse to 141.66, with a correction to 140.90 expected today. After the correction, a new decline wave to 142.45 might commence, representing a local target.

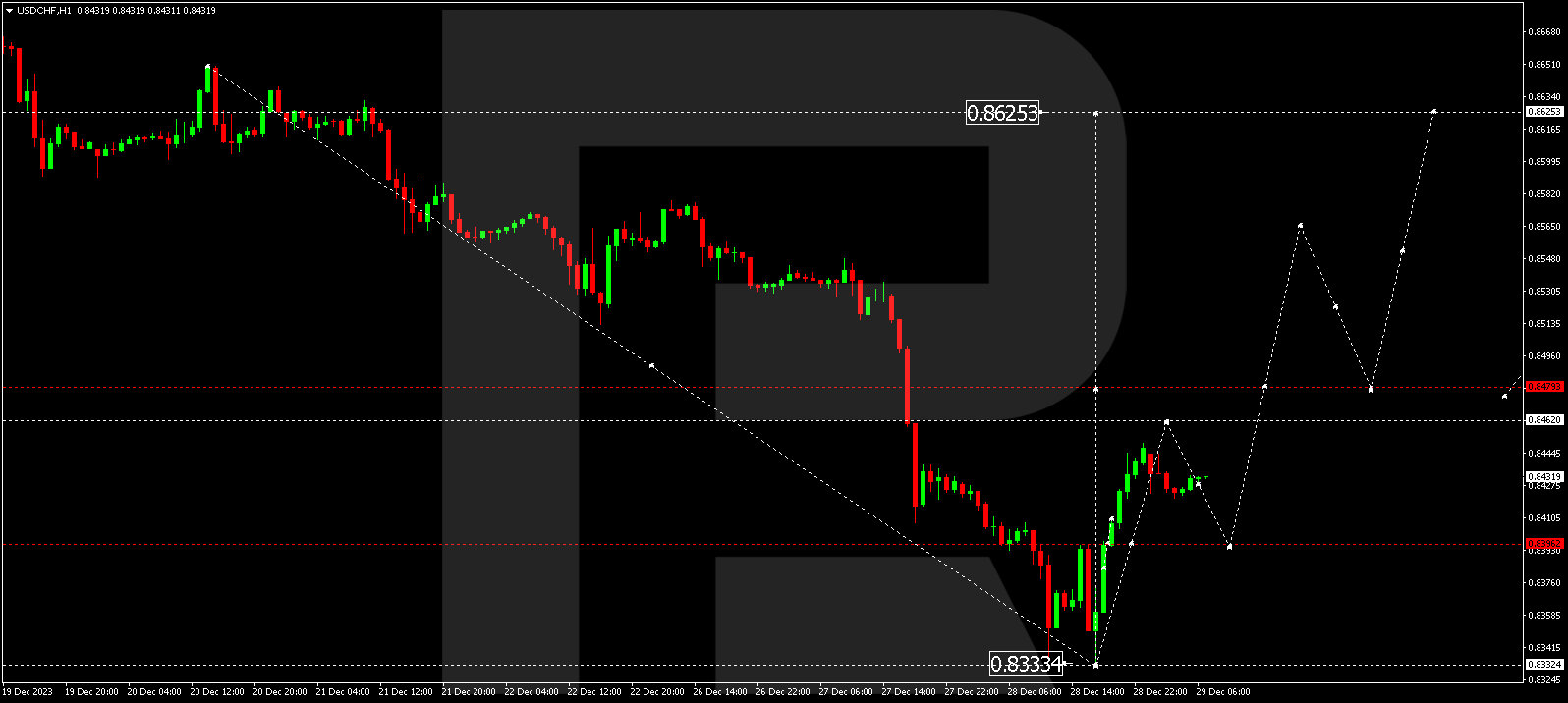

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is structuring a growth wave to 0.8462. Upon reaching this level, a correction to 0.8396 could follow, succeeded by a rise to 0.8480. A breakthrough at this level might signal a continuation of the trend to 0.8565, marking a local target.

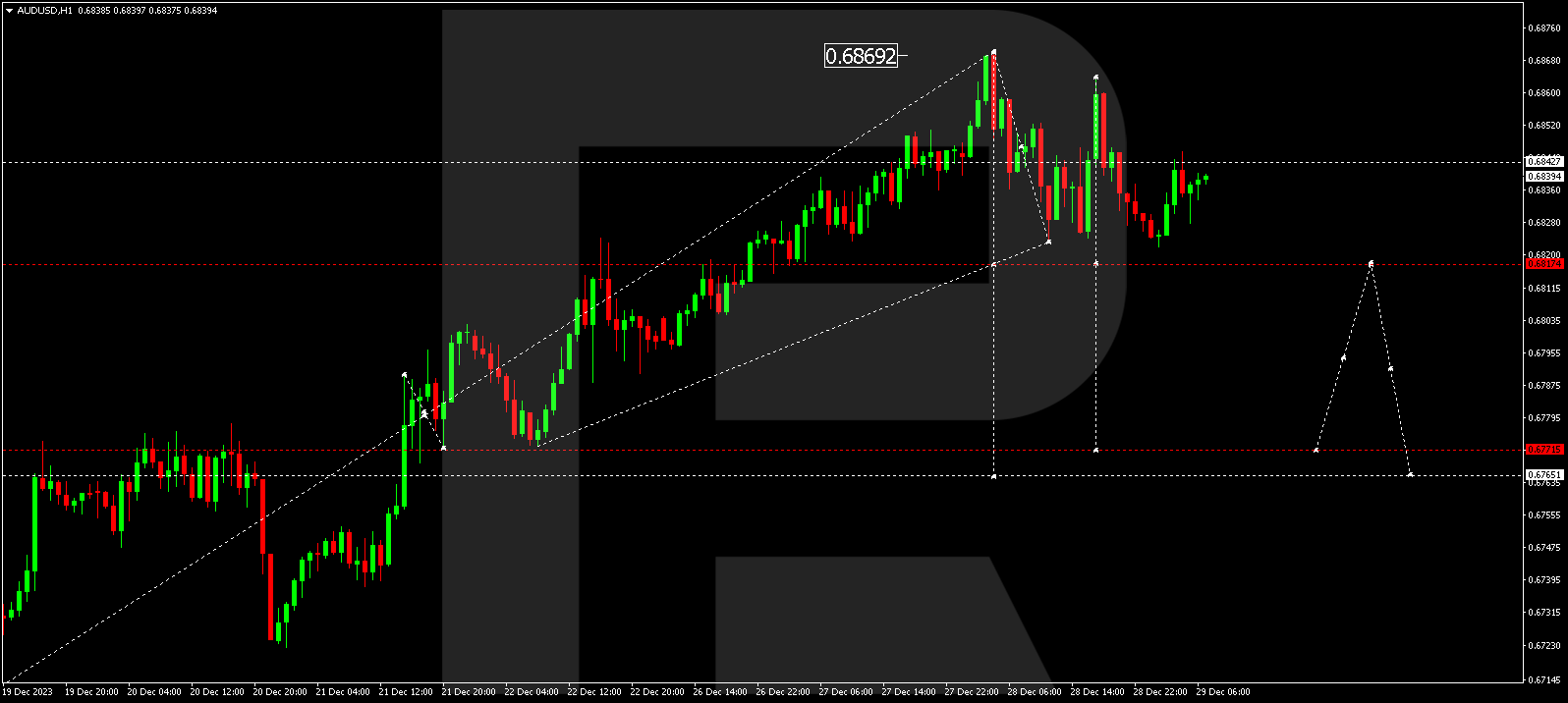

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has wrapped up a growth wave at 0.6824, with a correction to 0.6863. An anticipated decline wave to 0.6817 is expected today. If this level breaks, the wave might extend to 0.6777, representing a local target.

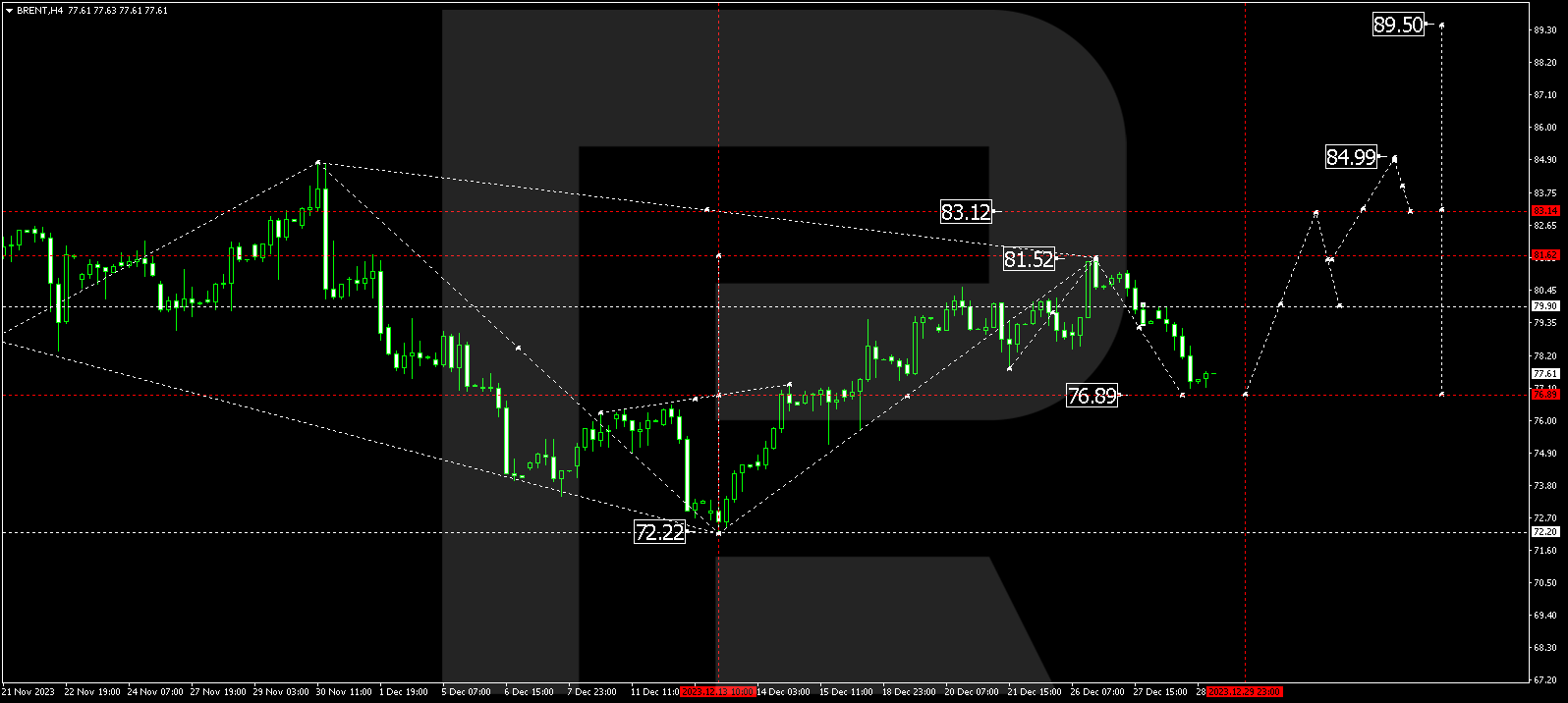

BRENT

Brent continues forming a correction to 76.90. After its completion, a rise to 83.15 might follow. Breaking this level could open the potential for a growth wave to 89.50, considered a local target.

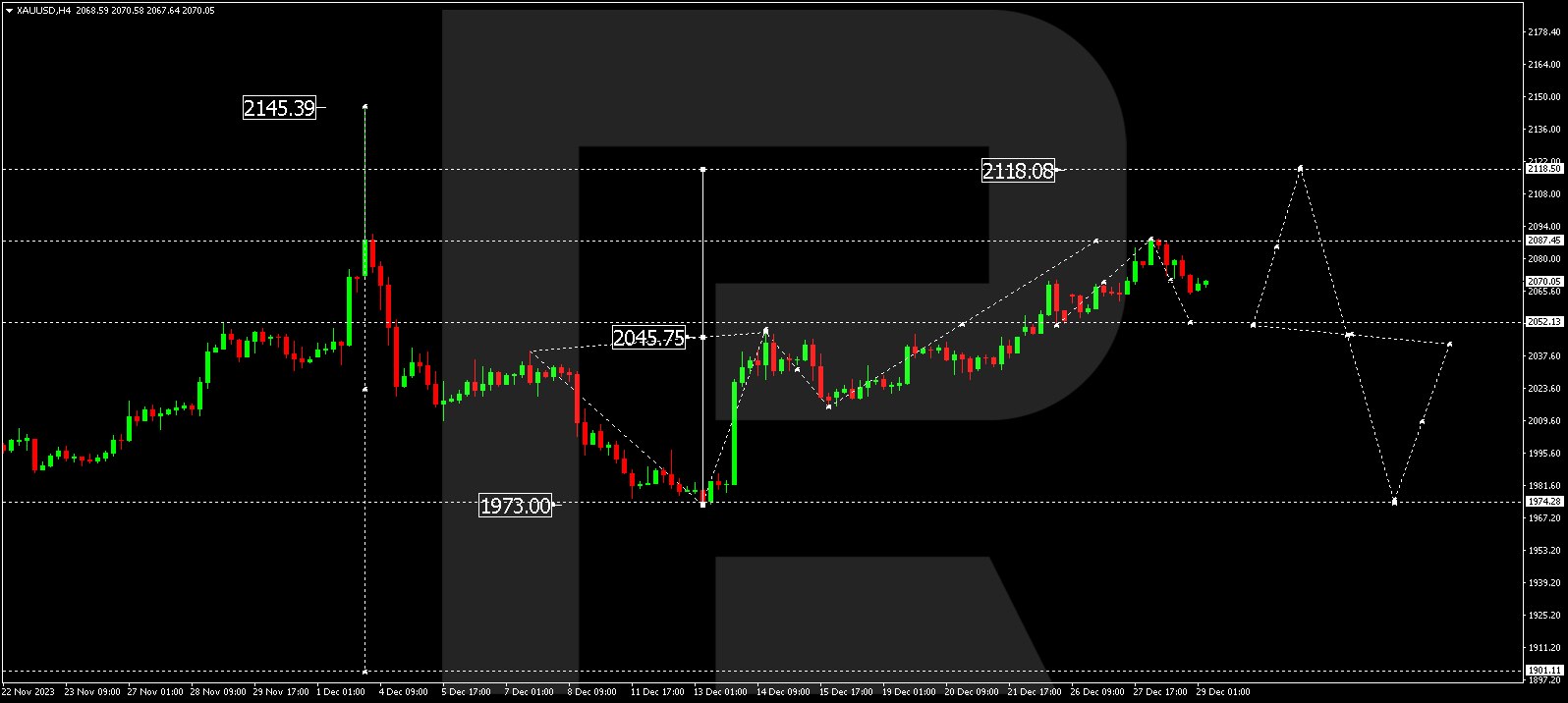

XAU/USD (Gold vs US Dollar)

Gold is structuring a correction to 2052.10. After the correction concludes, a growth link to 2118.50 is anticipated. Subsequently, a new decline wave to 1974.30 might begin, serving as a local target.

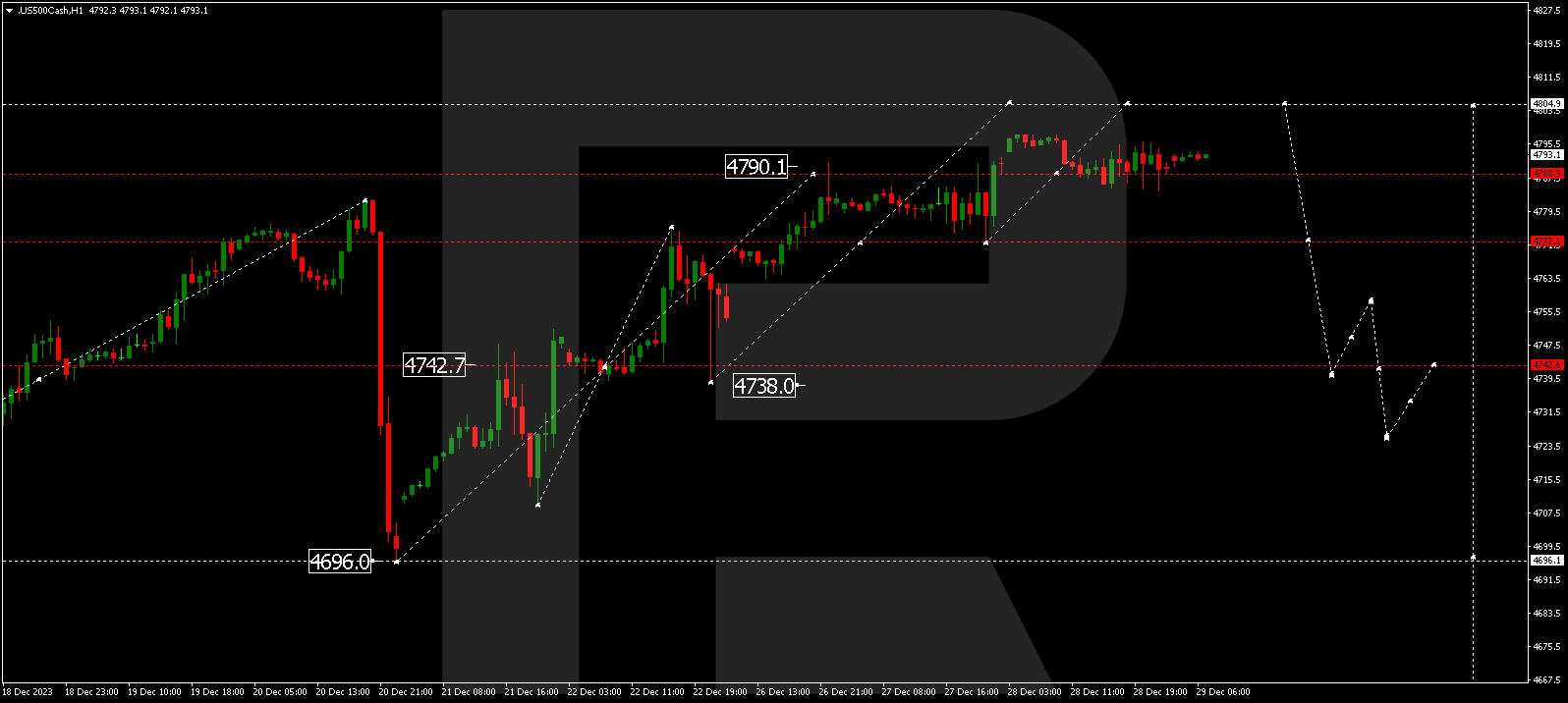

S&P 500

The stock index continues structuring a consolidation range around 4788.0 without a clear trend. Today, the range might extend to 4805.0, followed by a decline wave to 4772.0. Breaking this level could open the potential for a wave to 4696.0, considered the first target.

Our analytics team will be back on 9 January 2024 with the latest overviews and forecasts. Happy Holidays!

The post Technical Analysis & Forecast December 29, 2023 appeared first at R Blog – RoboForex.