GBP Extends Decline: Market Overview Covering EUR, JPY, CHF, AUD, Brent, Gold, and S&P 500 Index.

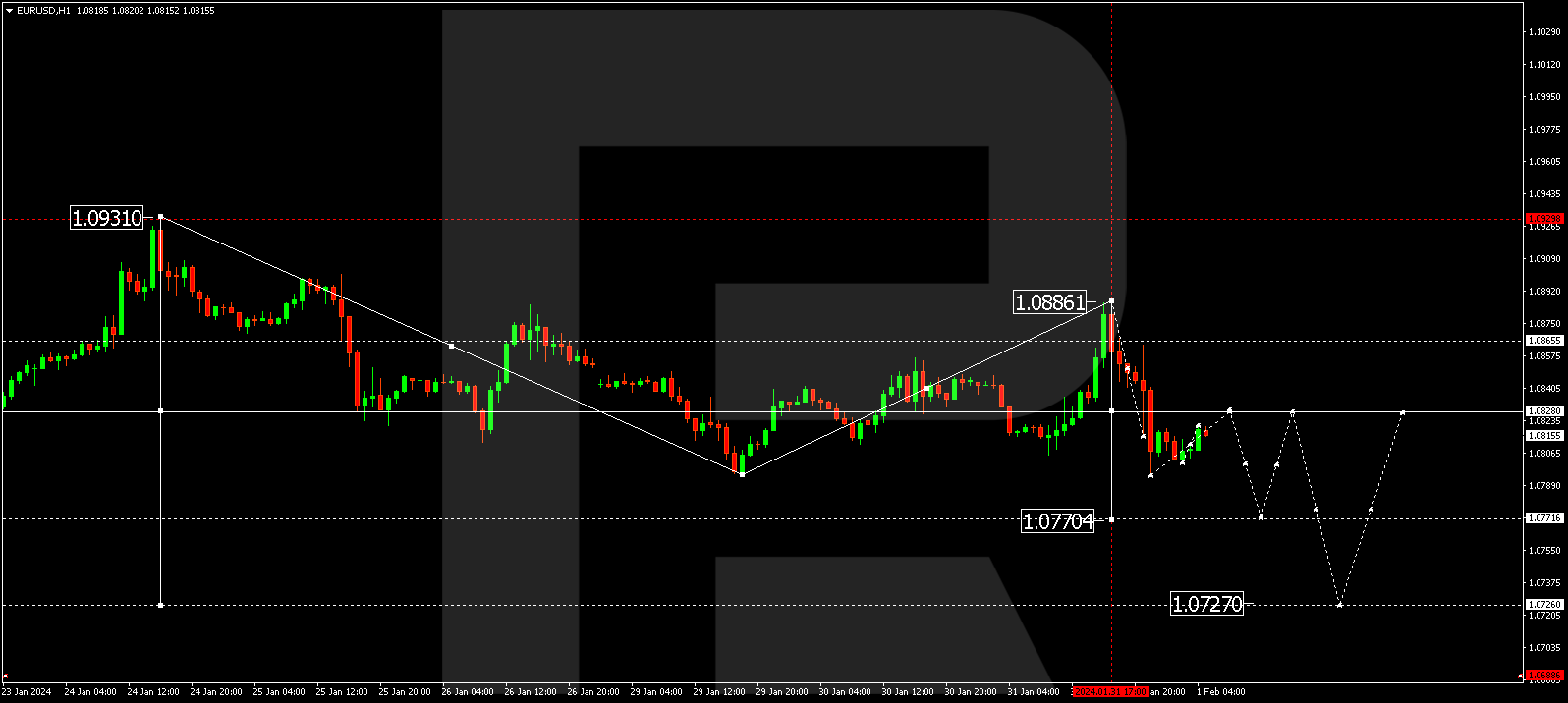

EUR/USD (Euro vs US Dollar)

The EUR/USD pair has concluded a correction wave reaching 1.0886. The news triggered a decline to the 1.0816 level, followed by a correction to 1.0860. Today, the market has executed a decline wave structure to 1.0794. Subsequently, a correction to 1.0828 is anticipated. After the correction, the decline wave might extend to 1.0770—a local target.

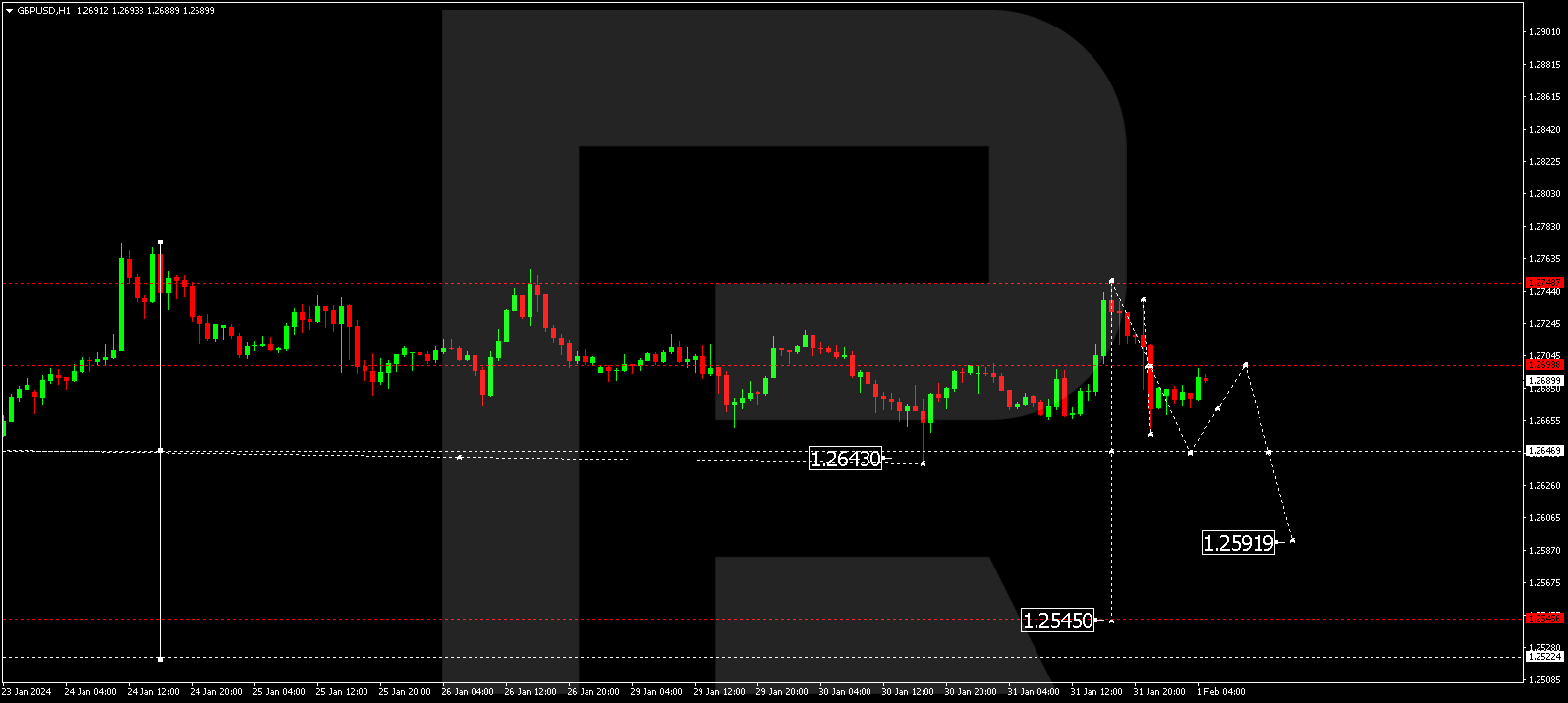

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a corrective wave to 1.2748. A decline wave to 1.2646 may take shape today, representing the first target. Once this level is reached, a correction to 1.2698 might follow, with an expected decline to 1.2592—a local target.

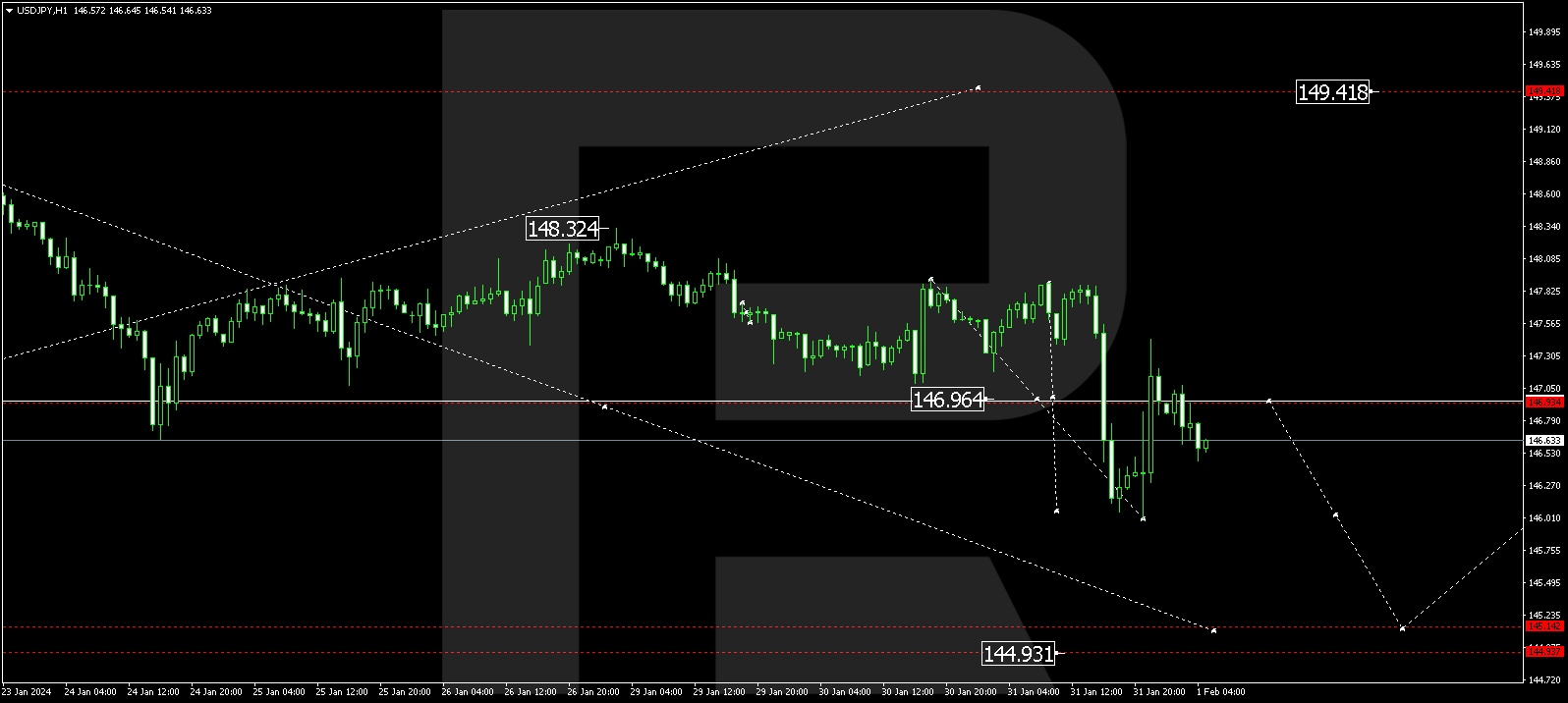

USD/JPY (US Dollar vs Japanese Yen)

The USD/JPY pair continues to develop a consolidation range around 146.93, extending to 146.00. After reaching this level, a technical return to 147.00 occurred (a test from below). A new decline wave to 145.15 might develop today.

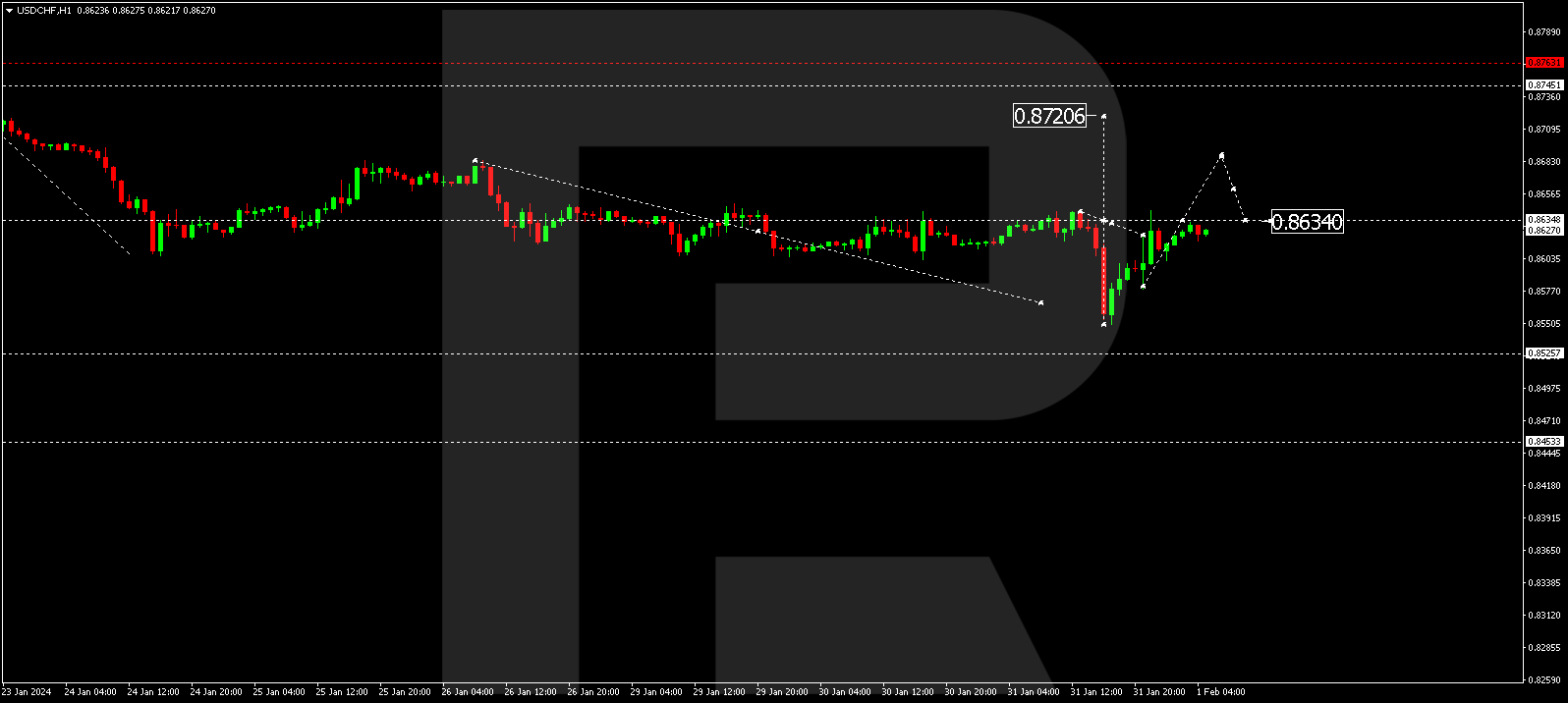

USD/CHF (US Dollar vs Swiss Franc)

The USD/CHF pair has corrected to 0.8555. Today, the market is forming a growth wave to 0.8634. Once this level is reached, a consolidation range could form around it. With an upward escape, a growth wave could develop towards 0.8686, from where the trend might extend to 0.8720—the first target.

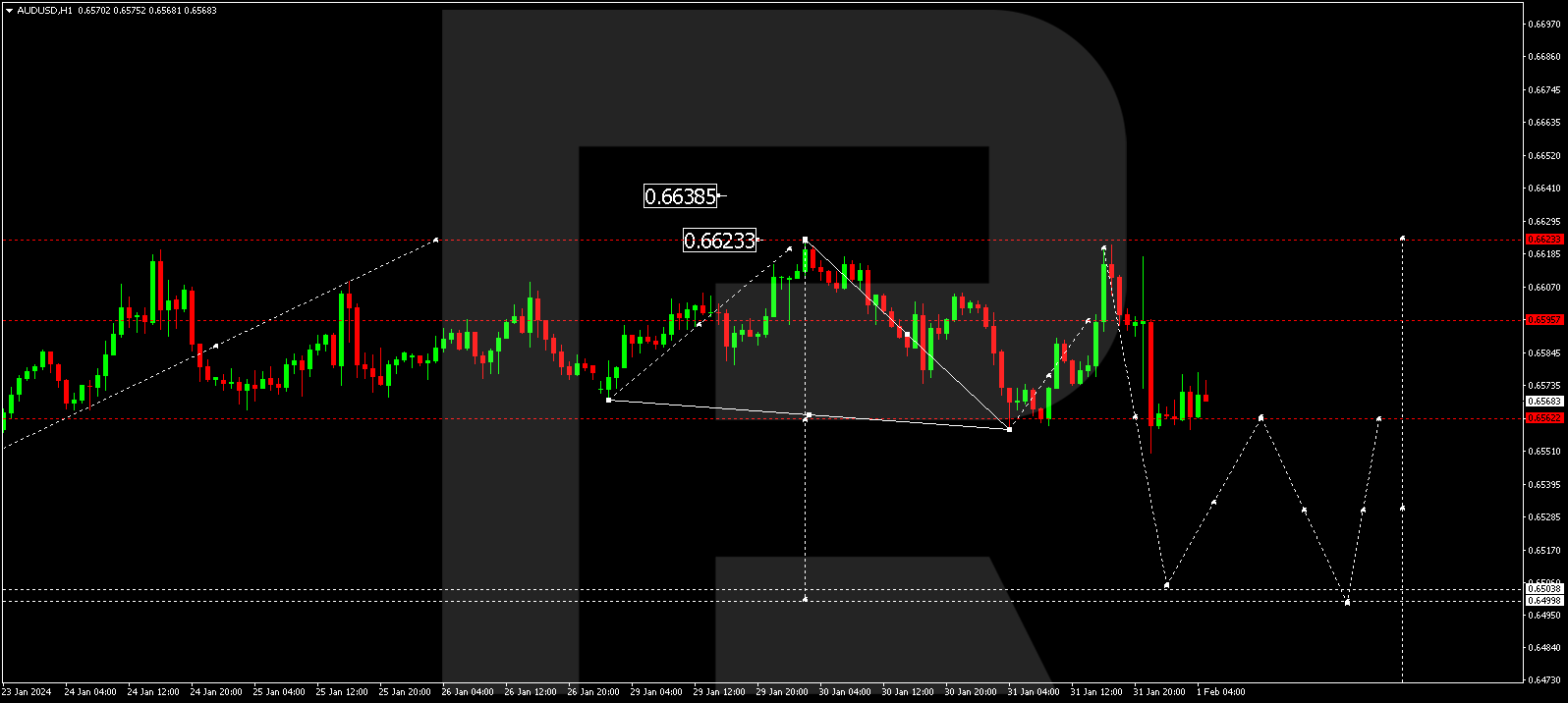

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has completed a decline wave to 1.6562. A consolidation range is forming above this level. With a downward escape from this range, the decline wave could extend to 0.6504—a local target. Once this level is reached, a correction to 0.6560 is not excluded, followed by a decline to 0.6500.

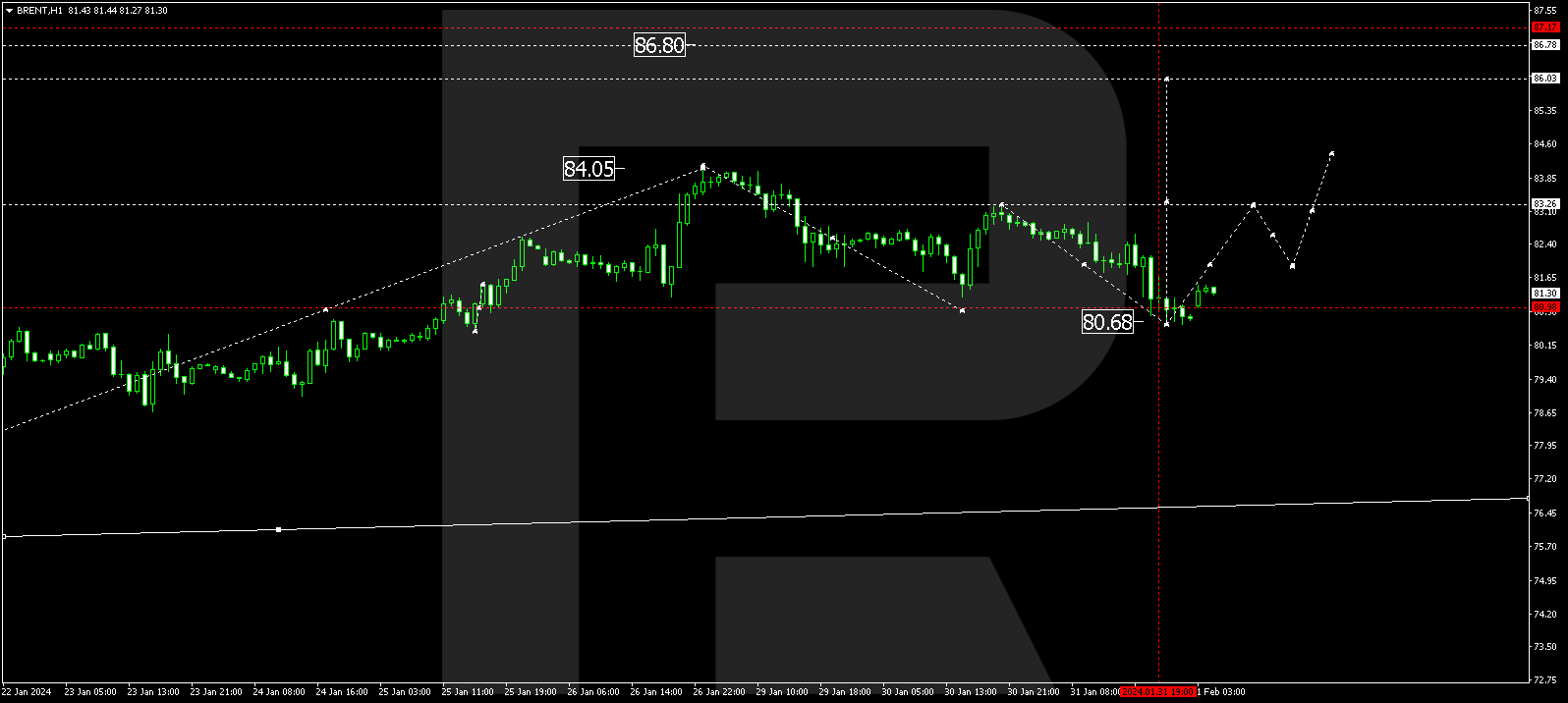

BRENT

Brent has executed a correction link to 80.70. Currently, the market is forming a consolidation range above this level. With an upward escape from the range, the potential for a growth wave to 83.26 could open. If this level is breached upwards, the potential for a growth wave to 86.03 might open—a local target.

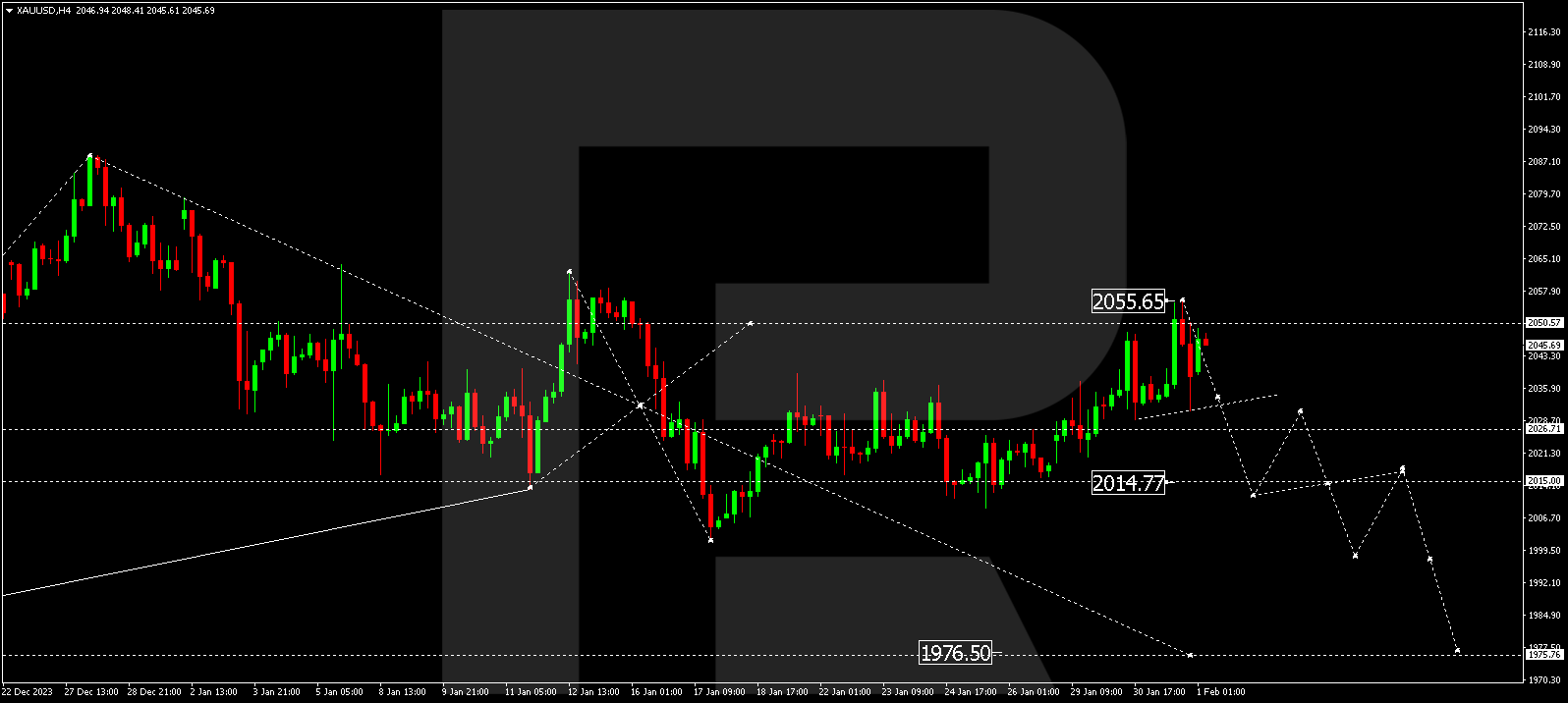

XAU/USD (Gold vs US Dollar)

Gold has corrected to 2055.65. Today, the market has completed a decline wave to 2030.81, followed by a correction to 2049.39. A decline structure to 2014.77 is expected. Subsequently, a consolidation range might appear around this level. With a downward escape from the range, the trend could continue to 1976.50.

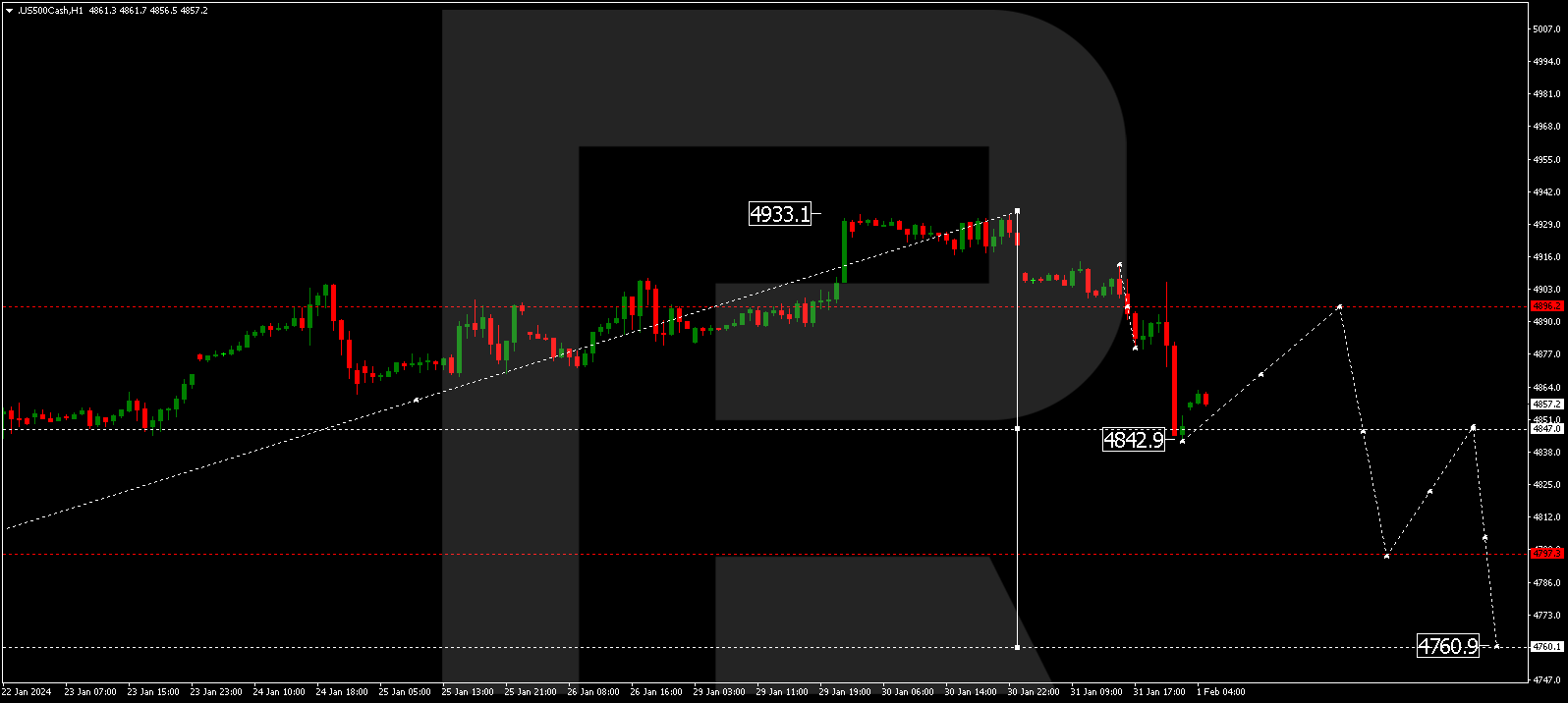

S&P 500

The stock index has concluded a decline wave to 4843.0. Today, a correction to 4896.0 might form. After the correction, a decline wave to 4797.0 could follow—a local target. Next, a growth link to 4847.0 and a decline to 4760.0 are anticipated.

The post Technical Analysis & Forecast February 01, 2024 appeared first at R Blog – RoboForex.