GBP Wraps Up Correction: Analyzing EUR, JPY, CHF, AUD, Brent, Gold, and S&P 500

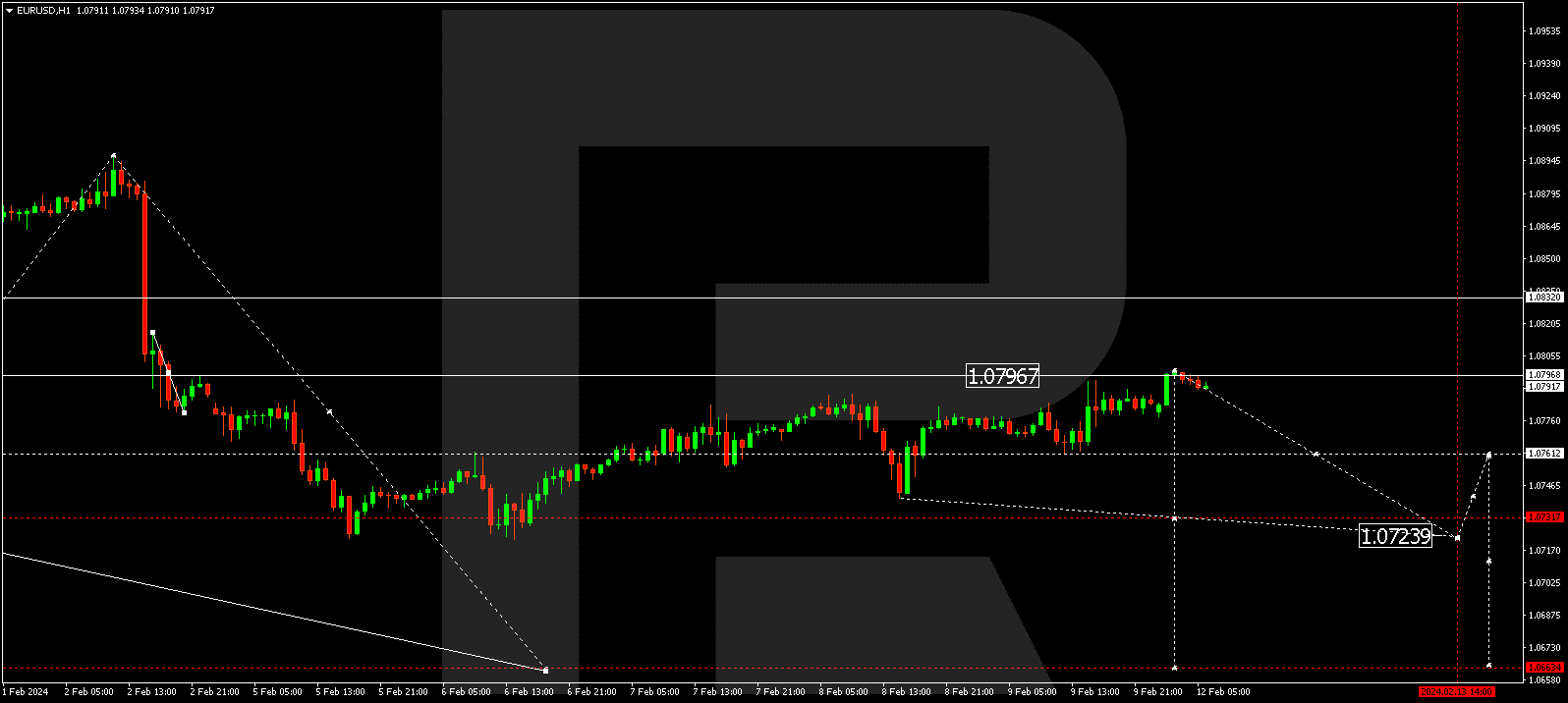

EUR/USD (Euro vs US Dollar)

EUR/USD has undergone a corrective phase, reaching 1.0799. The market currently consolidates in a narrow range below this level. There’s a possibility of extending the range to 1.0805 today. Following this, a decline to 1.0730 is anticipated, paving the way for the trend to extend to 1.0666. This marks a local target.

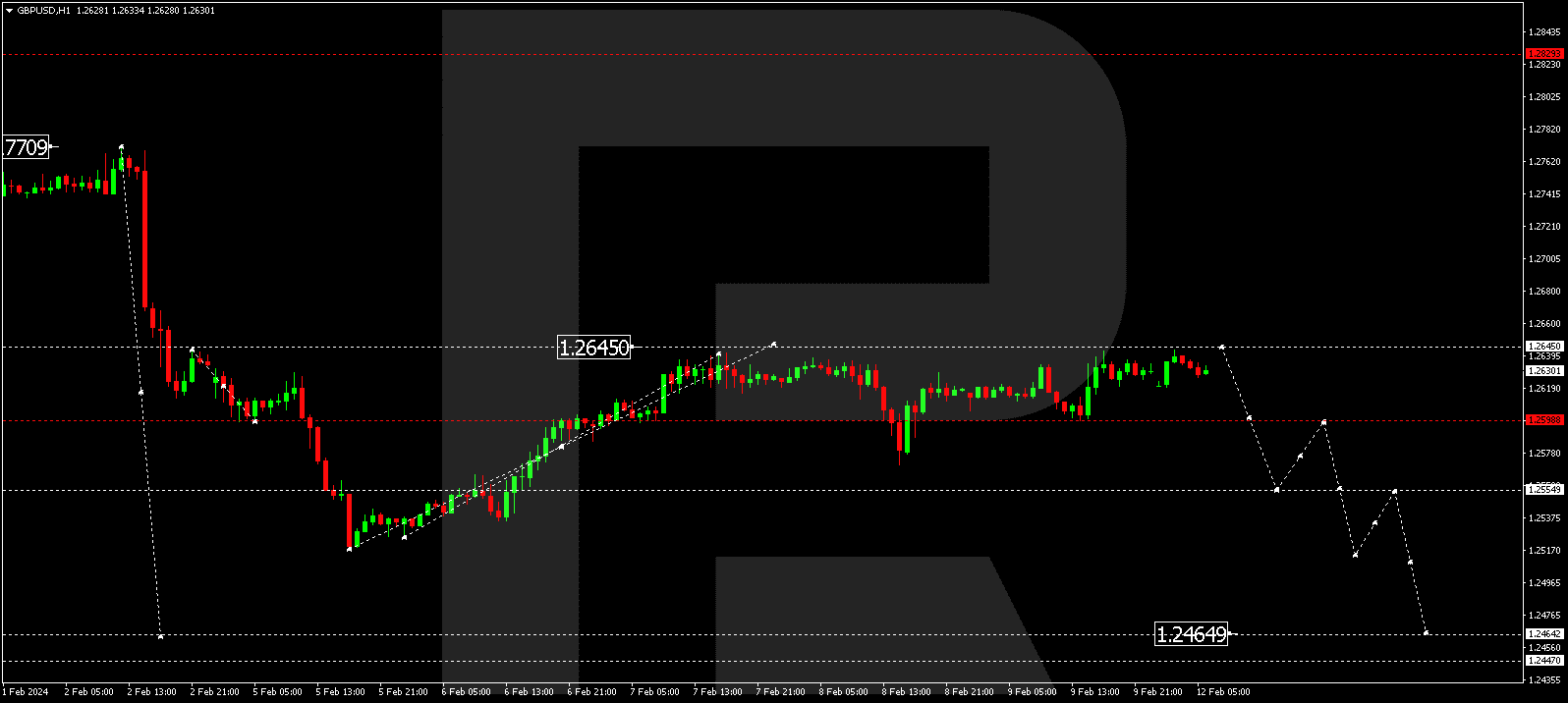

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD successfully concluded a correction to 1.2642. Expect a consolidation range around this level today. An upward move to 1.2650 is plausible, followed by a decline to 1.2598. A break below this level may open the potential for a decline wave to 1.2464.

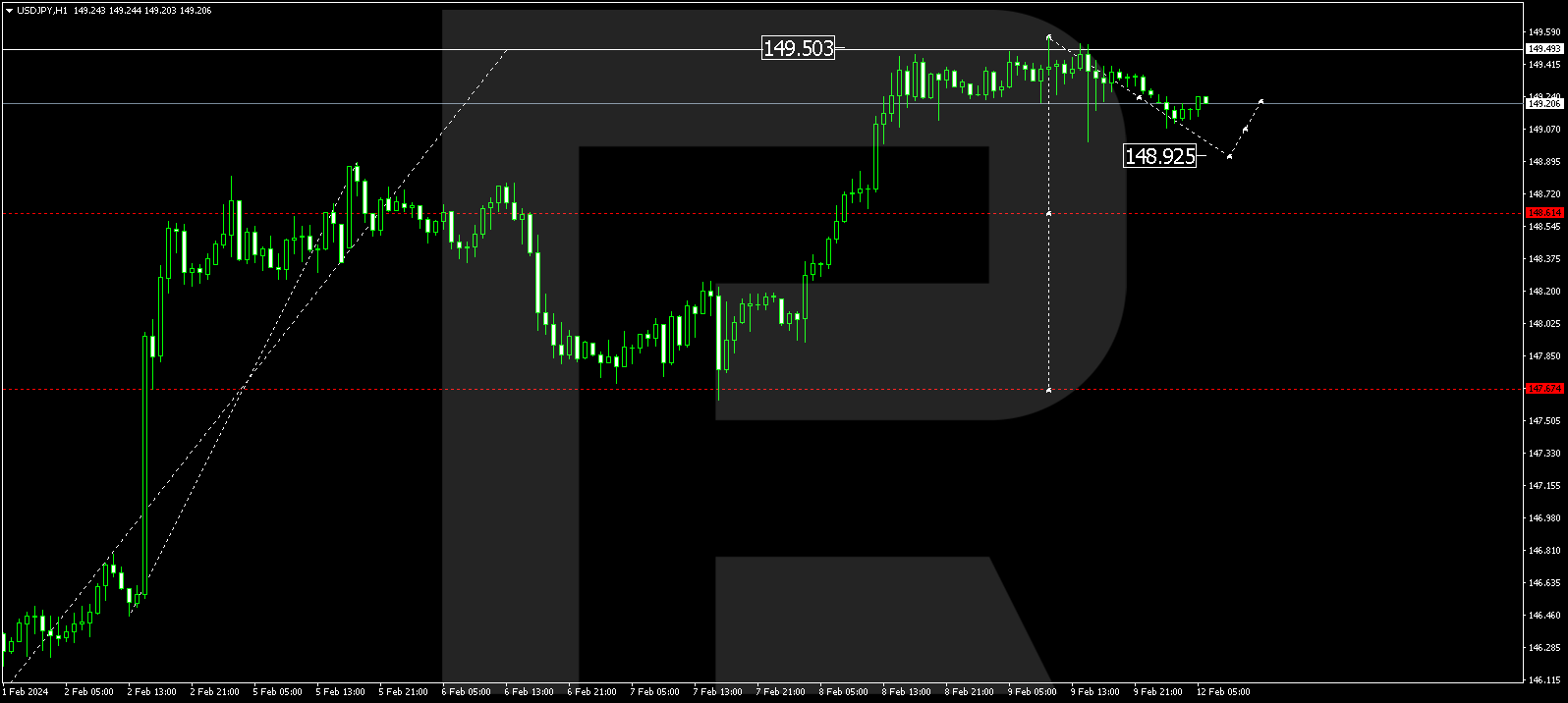

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is in the process of forming a decline wave structure targeting 148.92. After reaching this level, a correction to 149.20 may occur. Currently, a consolidation range is shaping up at these levels. A downward breakout from the range could signal a new decline wave to 147.66, representing the initial target.

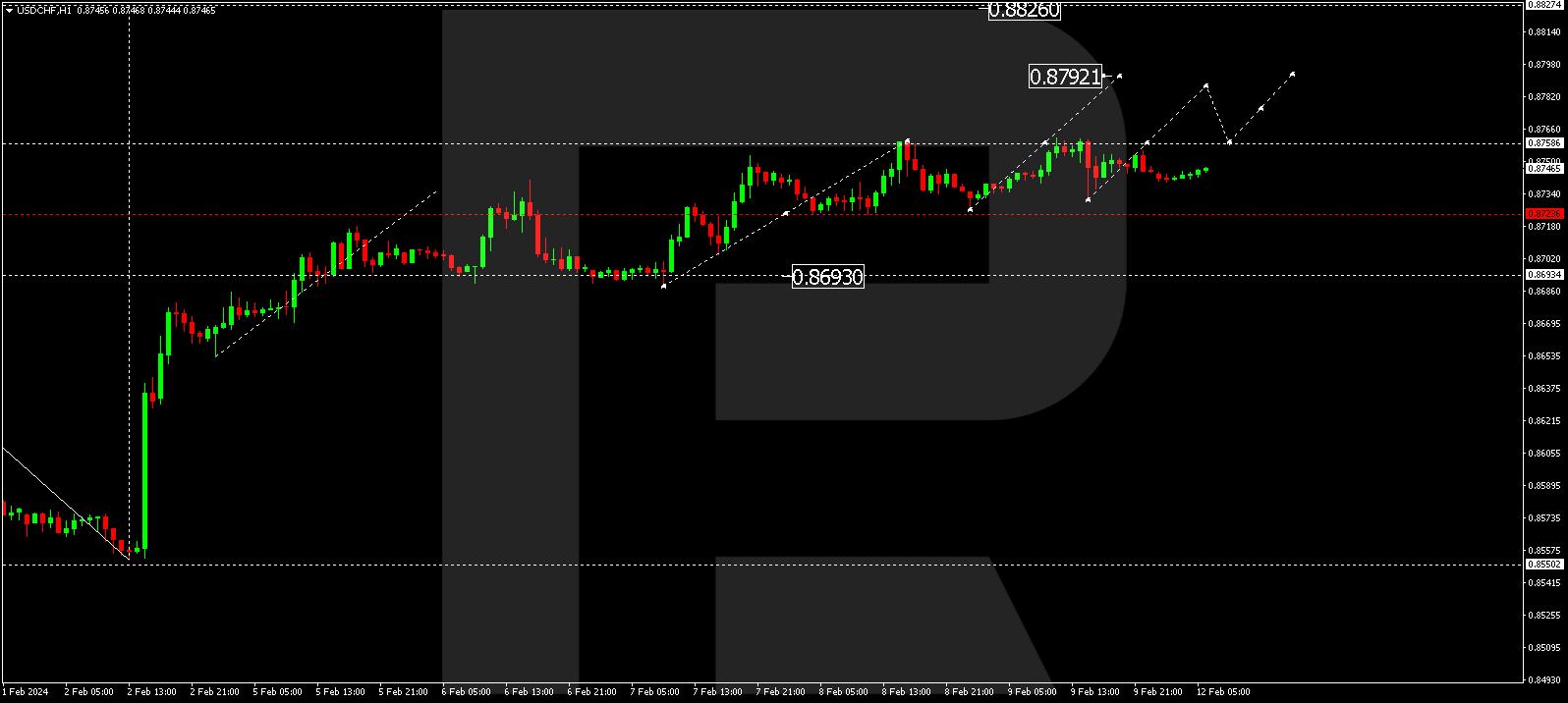

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF executed a growth wave reaching 0.8757. A consolidation range is anticipated below this level. In case of a downward breakout, a correction to 0.8725 is possible. On the flip side, an upward breakout could extend the growth wave to 0.8792, potentially leading to further upward movement to 0.8828.

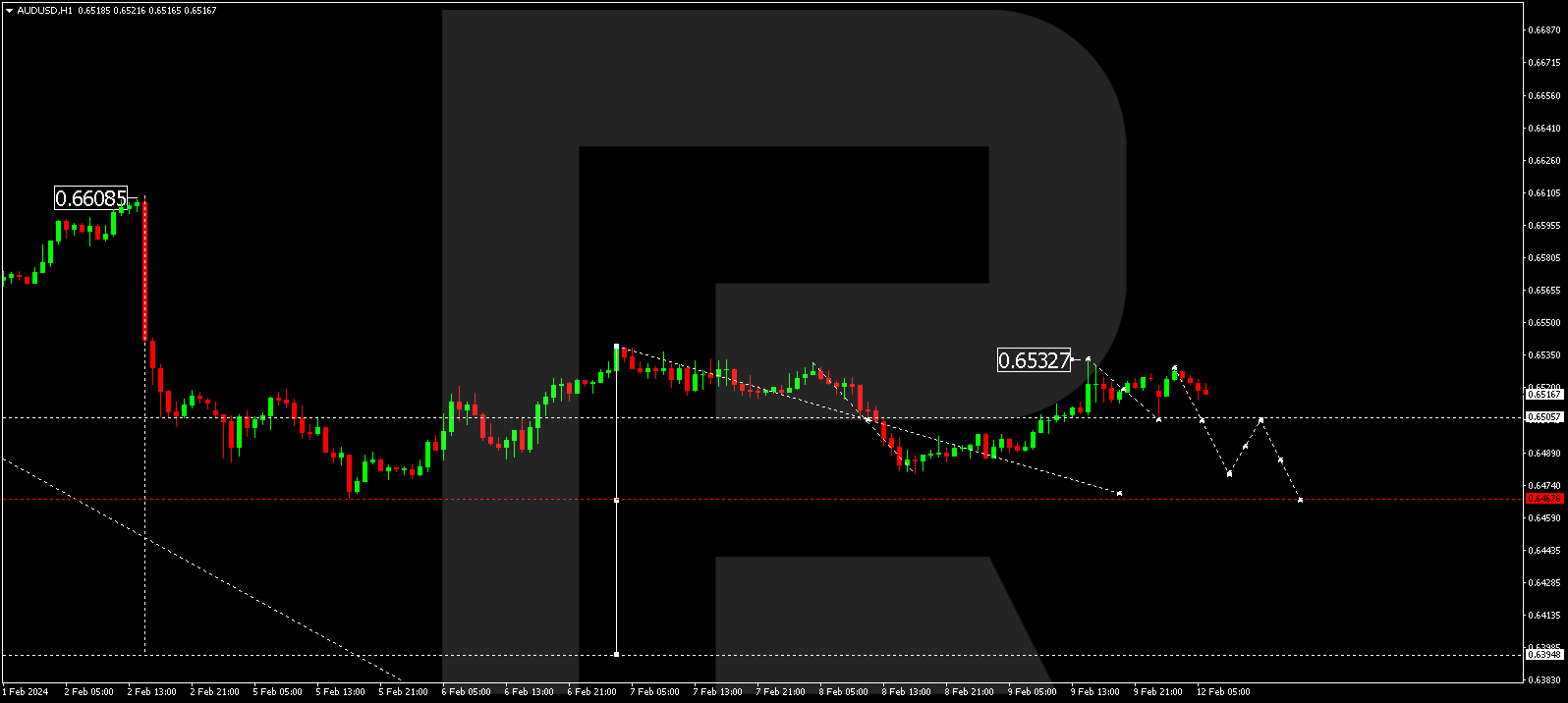

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is currently evolving within a consolidation range around 0.6505. An anticipated downward breakout from the range to 0.6467 might occur today. Subsequently, a correction to 0.6505 is probable, followed by a decline to 0.6450, initiating a potential move to 0.6400. This sets the initial target within the downtrend structure.

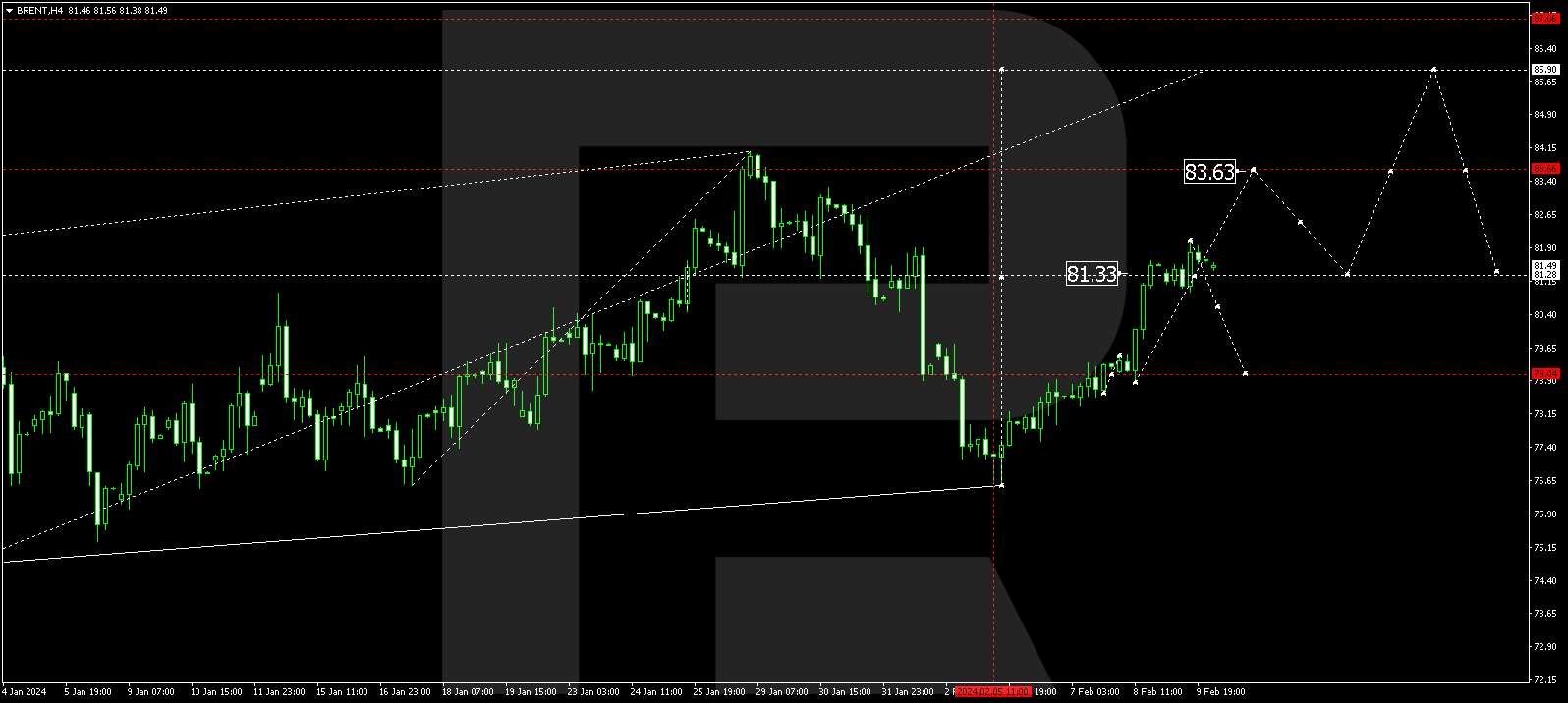

BRENT

Brent is in the process of forming a consolidation range under 82.12. A potential downward breakout could trigger a correction to 79.10. Conversely, an upward breakout holds the potential for a growth wave to 83.63, marking a local target. Once achieved, a correction to 81.30 could ensue, followed by a rise to 85.90, representing the first target.

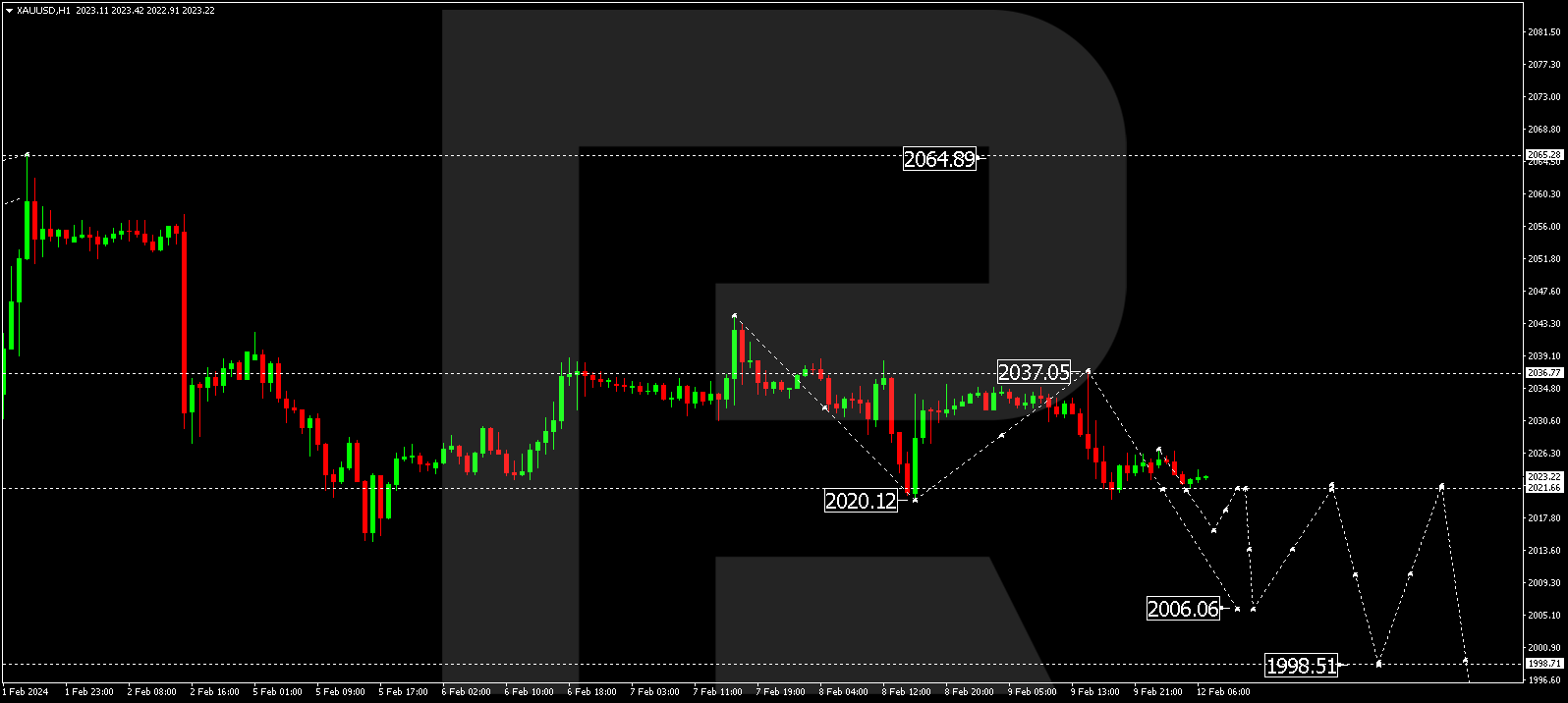

XAU/USD (Gold vs US Dollar)

Gold completed a correction wave to 2036.77 and subsequently executed a decline wave to 2020.25. Currently, a consolidation range is forming above this level. An expected downward breakout from the range may continue the decline wave to 2006.06. Following this, a correction to 2020.25 is projected (a test from below), eventually leading to a decline to 1998.50.

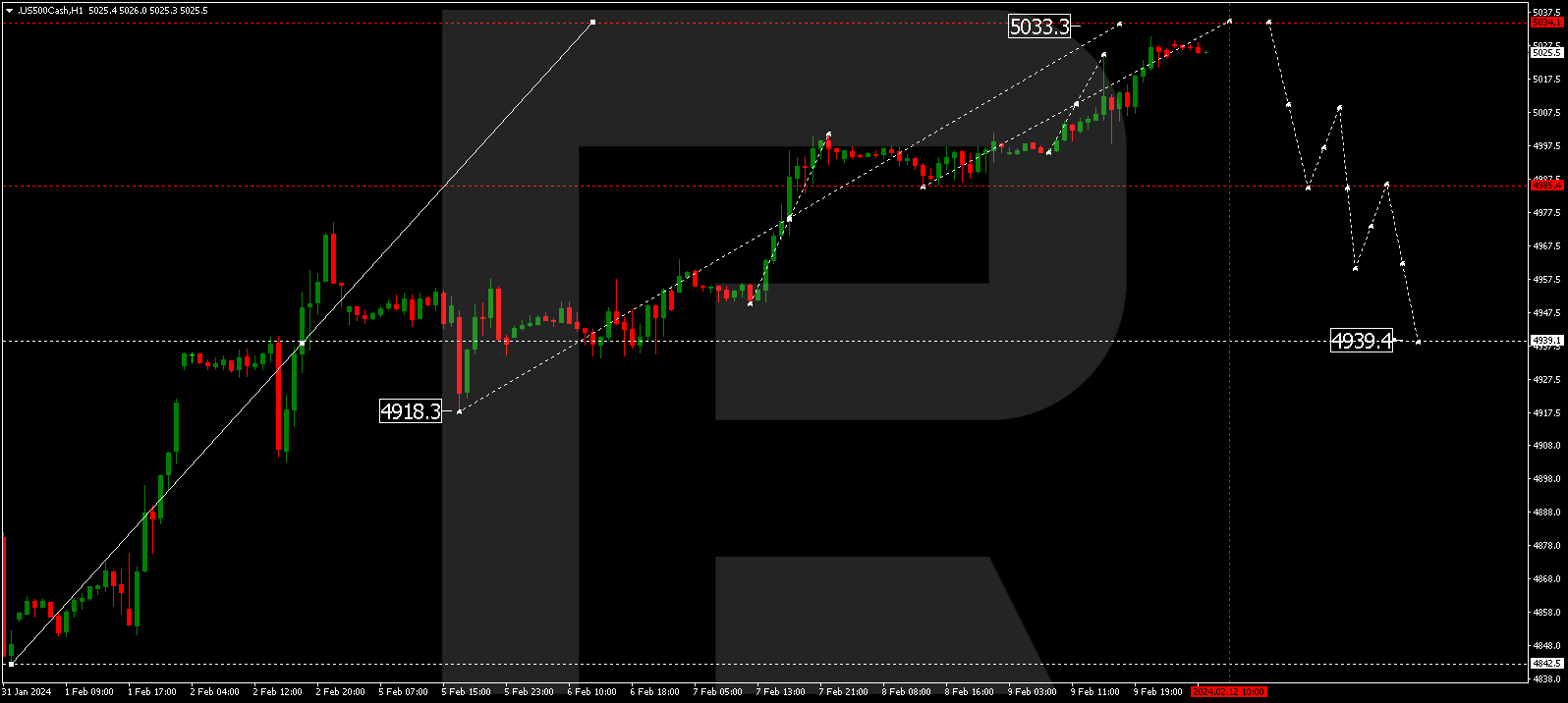

S&P 500

The stock index wrapped up a growth wave at 5030.0. Presently, a narrow consolidation range forms below this level. There’s a possibility of an upward move to 5034.0. Subsequently, a decline wave to 4995.0 may unfold, representing the initial target.

The post Technical Analysis & Forecast February 09, 2024 appeared first at R Blog – RoboForex.