EUR Set for Potential Correction – Overview of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 Index

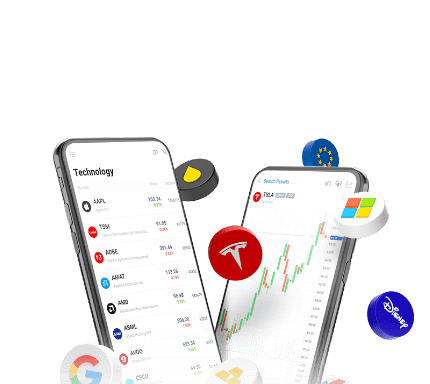

EUR/USD (Euro vs US Dollar)

The EUR/USD pair has reached the anticipated target of a decline wave at 1.0700. The structure of the last decline suggests a potential correction link to 1.0734 that might materialize today. There is a possibility of a consolidation range forming between these two levels. An escape from the range downward could lead to a decline link to 1.0680, while an upward escape might extend the correction to 1.0777.

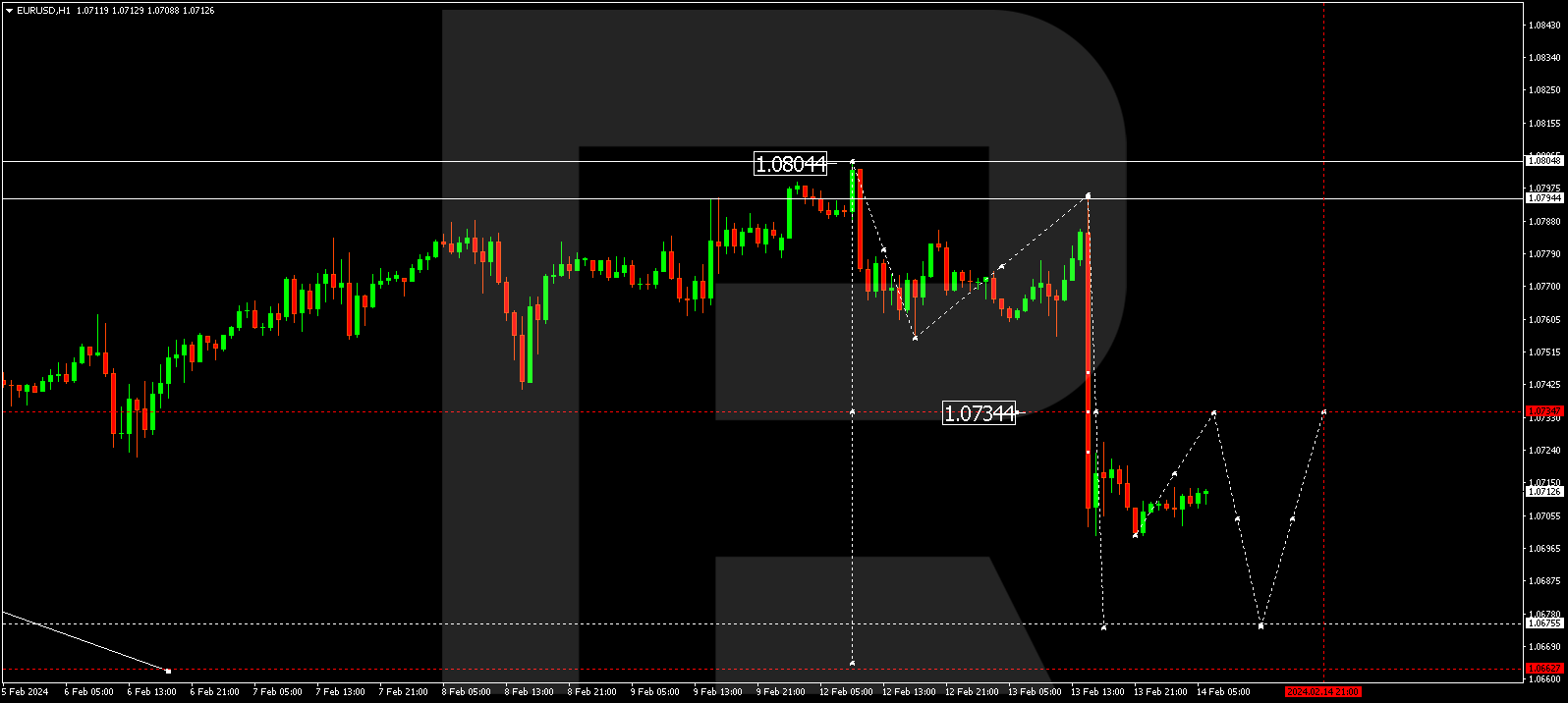

GBP/USD (Great Britain Pound vs US Dollar)

The GBP/USD pair has completed a decline wave to 1.2573. Today, it could experience a correction to 1.2607. Once the correction concludes, the quotes might drop to 1.2533, representing a local target.

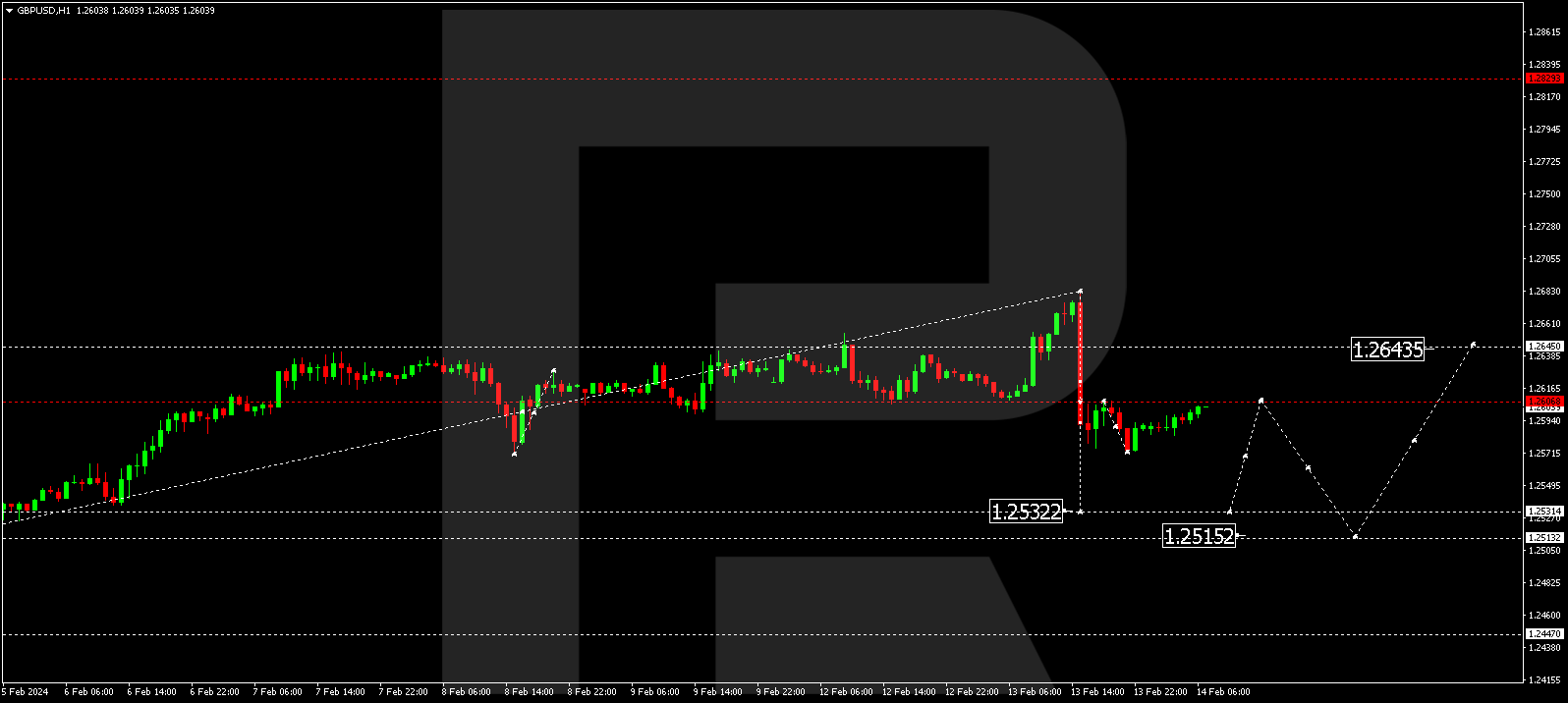

USD/JPY (US Dollar vs Japanese Yen)

The USD/JPY pair formed a consolidation range around 149.30 and concluded a growth wave to 150.85, breaking out of the range upward. Today, the quotes might correct to 149.30 (a test from above). Following the correction, a rise to 151.00 is expected.

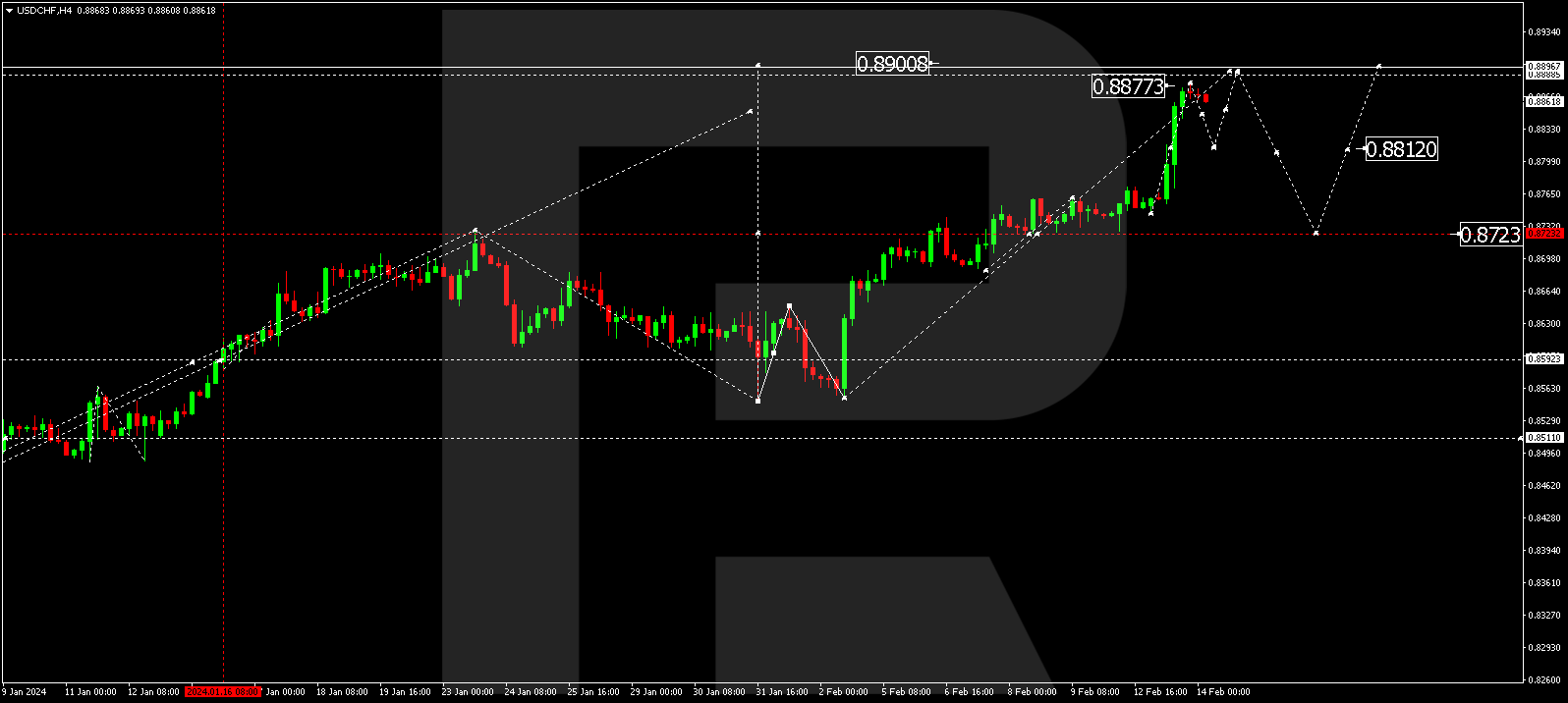

USD/CHF (US Dollar vs Swiss Franc)

The USD/CHF pair has completed a growth wave to 0.8877. Today, the quotes could correct to 0.8815. Following the correction, a growth wave to 0.8888 might develop, representing a local target.

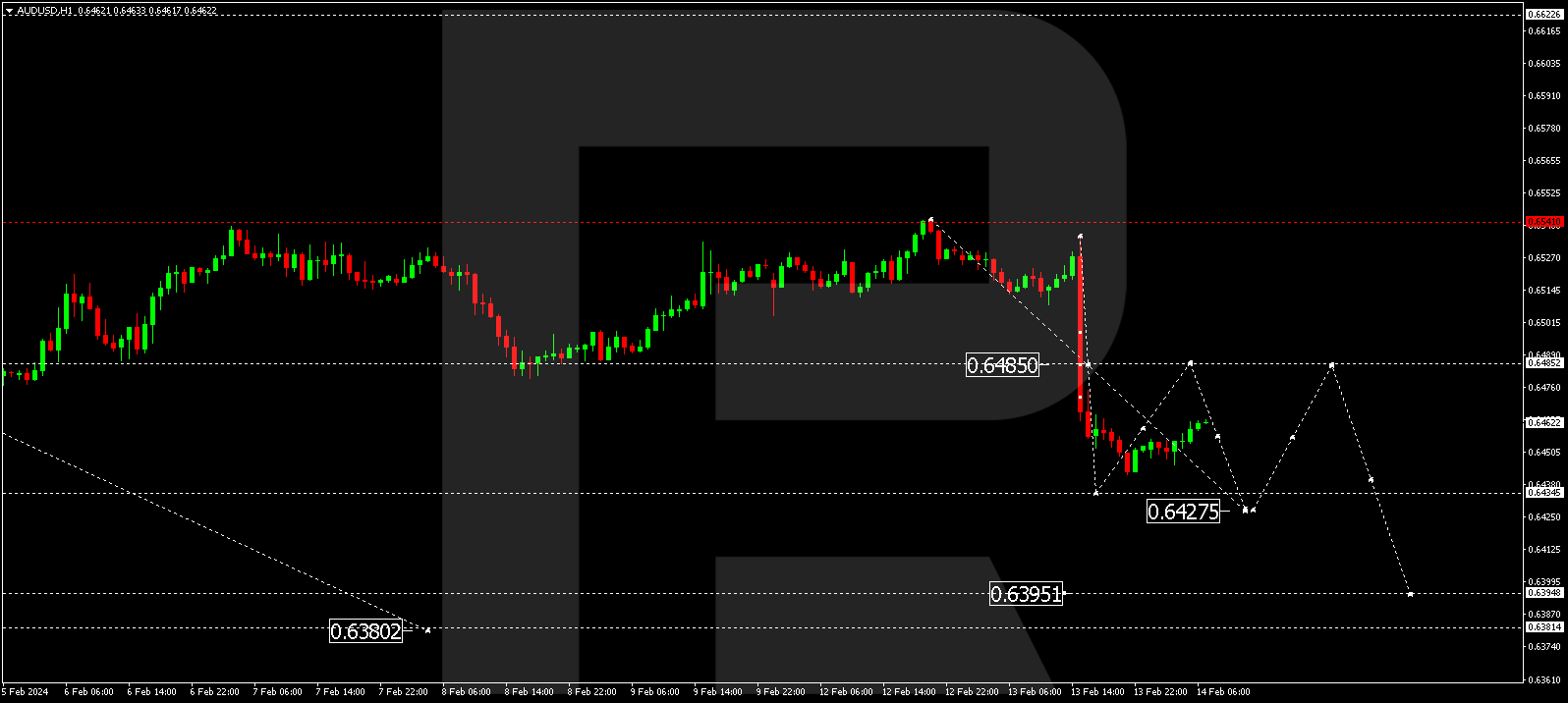

AUD/USD (Australian Dollar vs US Dollar)

The AUD/USD pair has concluded a decline wave to 0.6444. A correction link to 0.6484 is expected today (a test from below). After the correction, a decline wave to 0.6427 might follow, marking a local target.

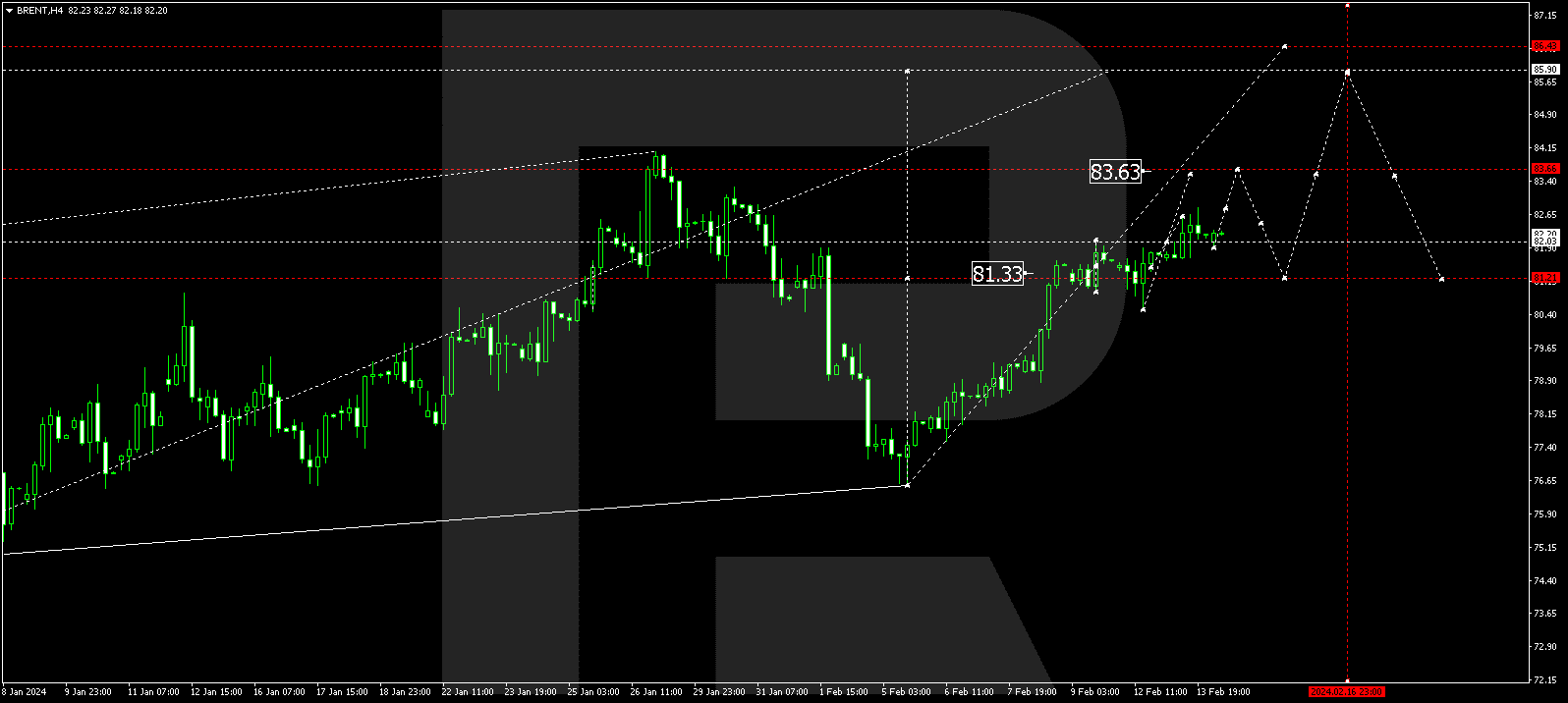

BRENT

Brent has extended the consolidation range to 82.80. Today, the quotes might correct to 82.00. Following the correction, a growth link to 83.63 is expected, from where the trend could continue to 85.80, representing a local target.

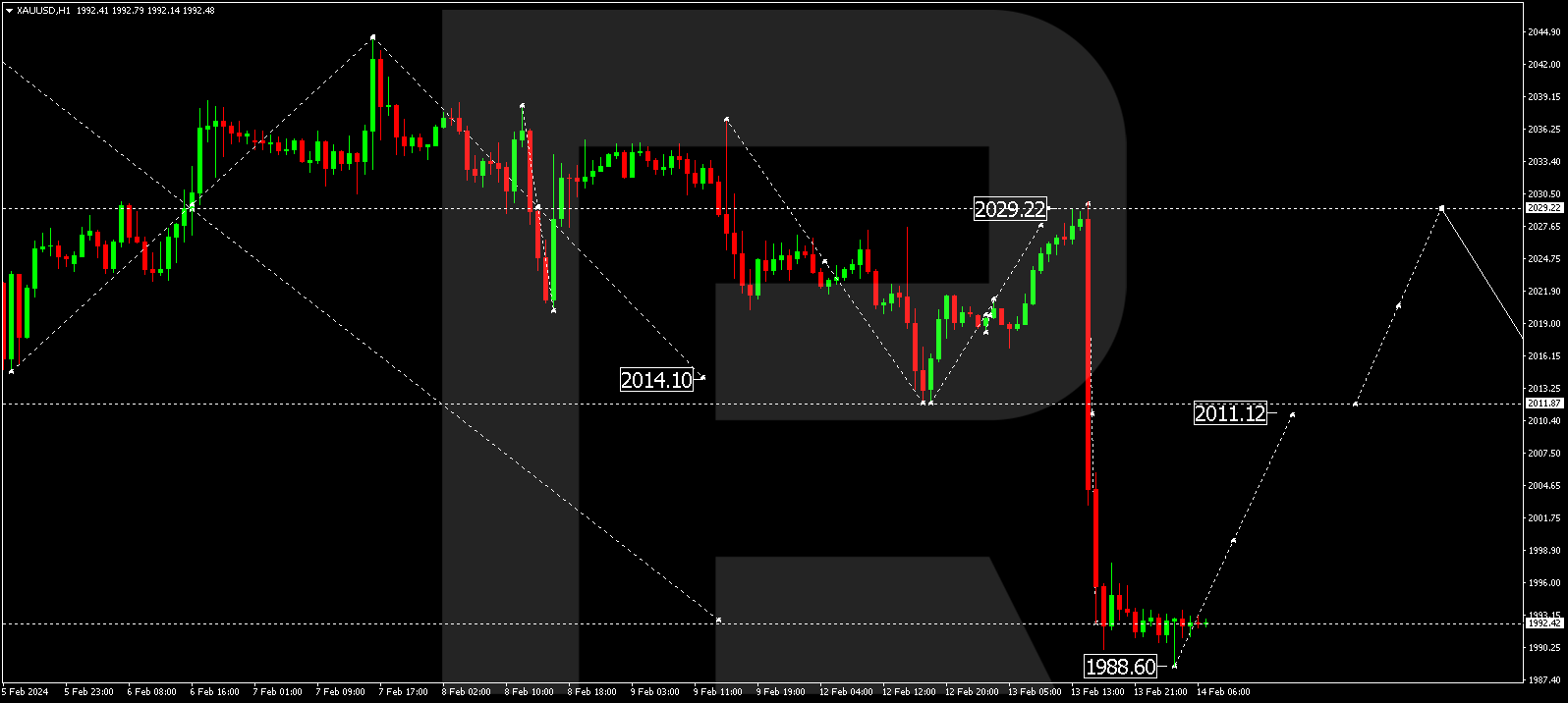

XAU/USD (Gold vs US Dollar)

Gold has concluded a decline wave to 1988.60. Currently, the instrument is forming a consolidation range above this level. An escape from the range upwards could open the potential for a correction to 2011.11, while a downward escape might lead to a decline link to 1970.30.

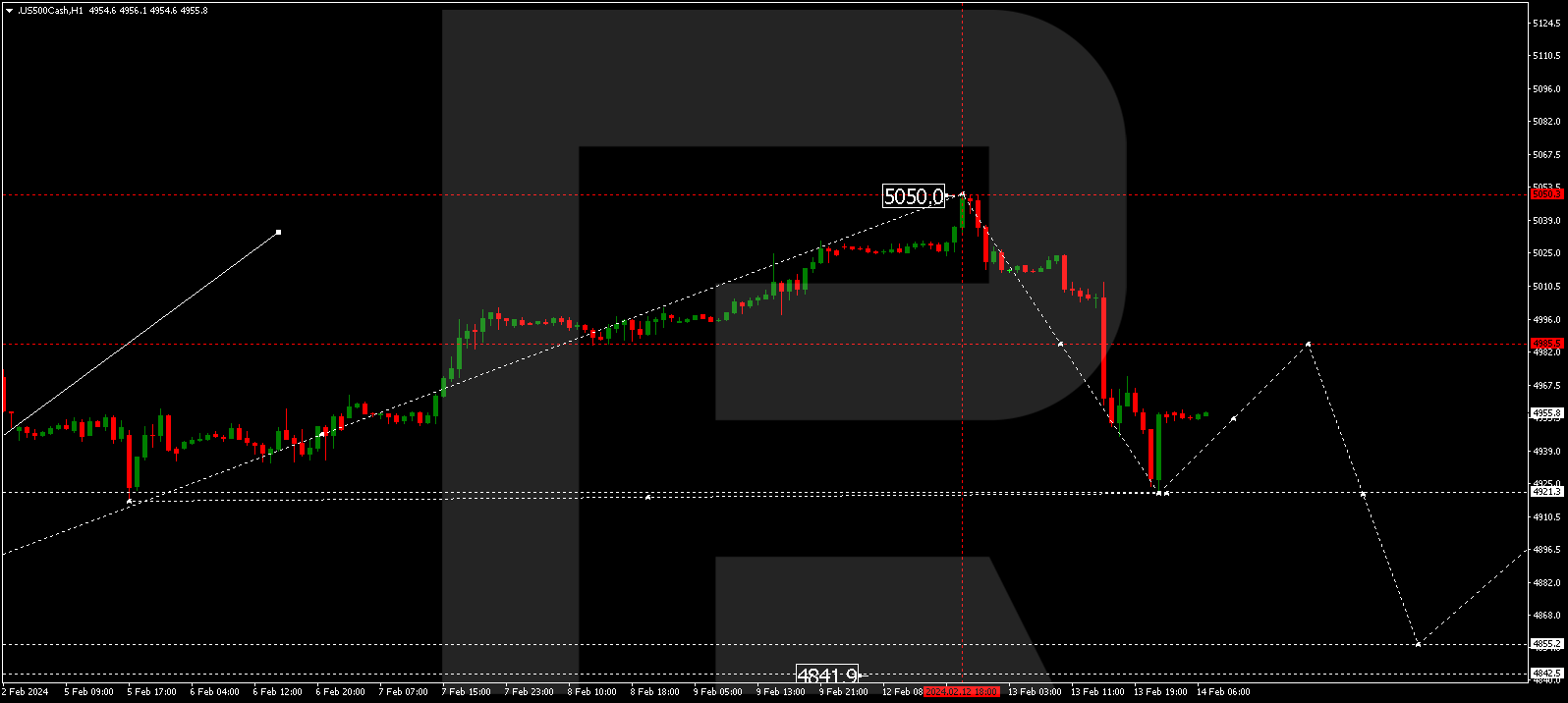

S&P 500

The stock index has undergone a decline impulse to 4920.0. Today, the quotes could correct to 4985.5. Following the correction, a decline link to 4855.0 is expected, marking a local target. Subsequently, a correction to 4920.0 is not excluded (a test from below). After that, a decline to 4790.0 might follow, representing the first target.

The post Technical Analysis & Forecast February 14, 2024 appeared first at R Blog – RoboForex.