Brent‘s upward momentum may persist. This overview also delves into the movements of EUR, GBP, JPY, CHF, AUD, Gold, and the S&P 500 index.

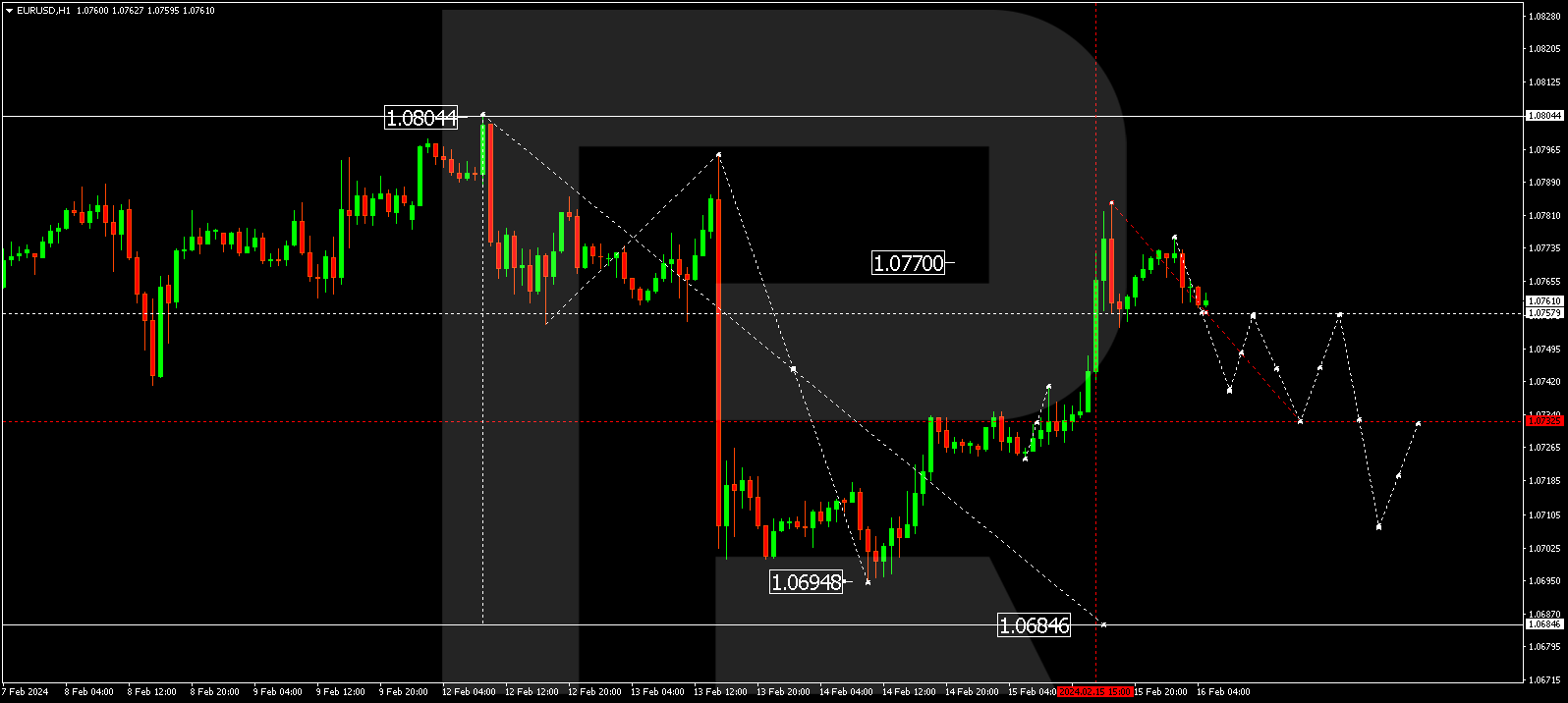

EUR/USD (Euro vs US Dollar)

EUR/USD broke out of a consolidation range, pushing the correction wave to 1.0784. Currently, the market has established a consolidation range below this level. Today, prices might break out of the range to the downside, reaching the 1.0732 level. This marks the initial target for a new downward wave.

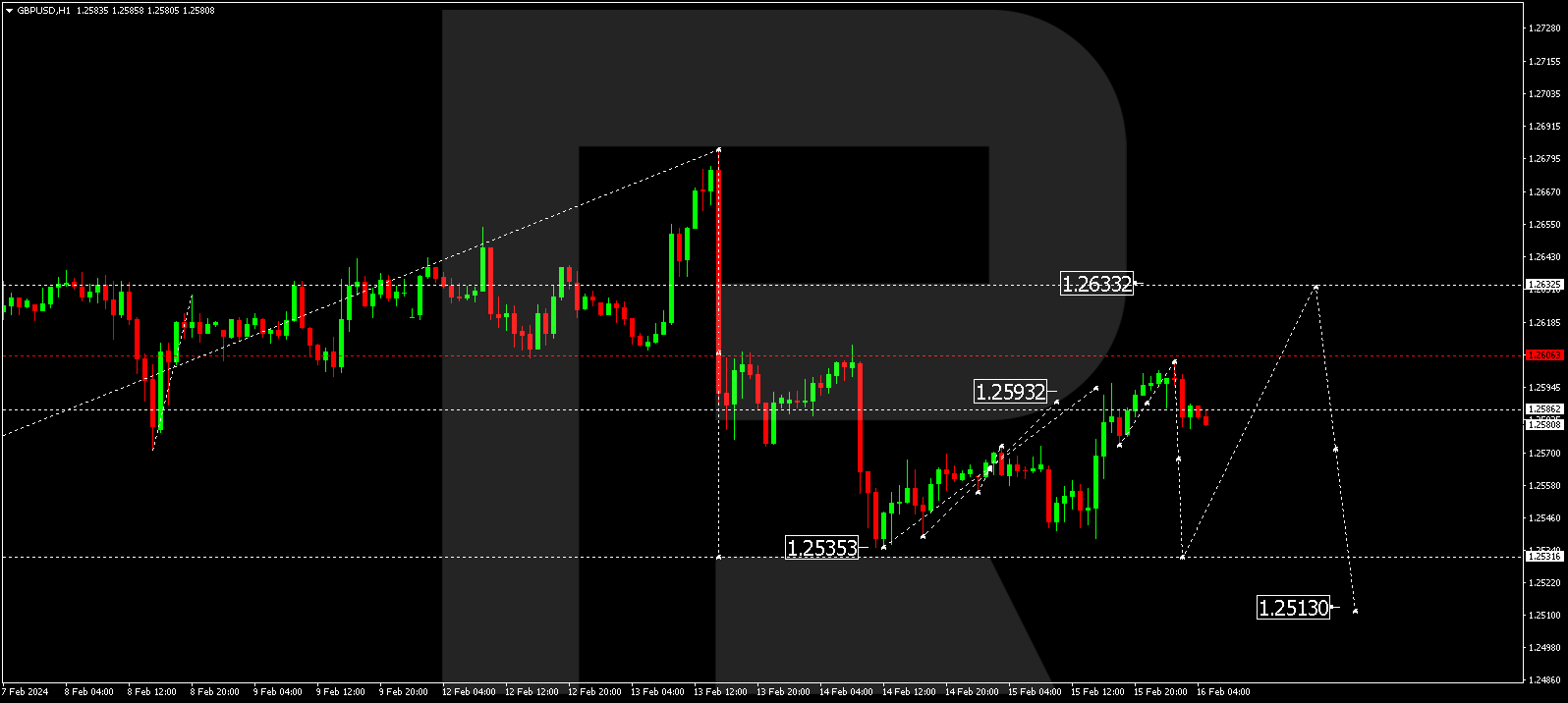

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has completed a corrective wave targeting 1.2604. A consolidation range might shape up under this level today. If there’s a downward breakout from this range, the decline wave could proceed to 1.2533, representing the primary target for a new downward wave.

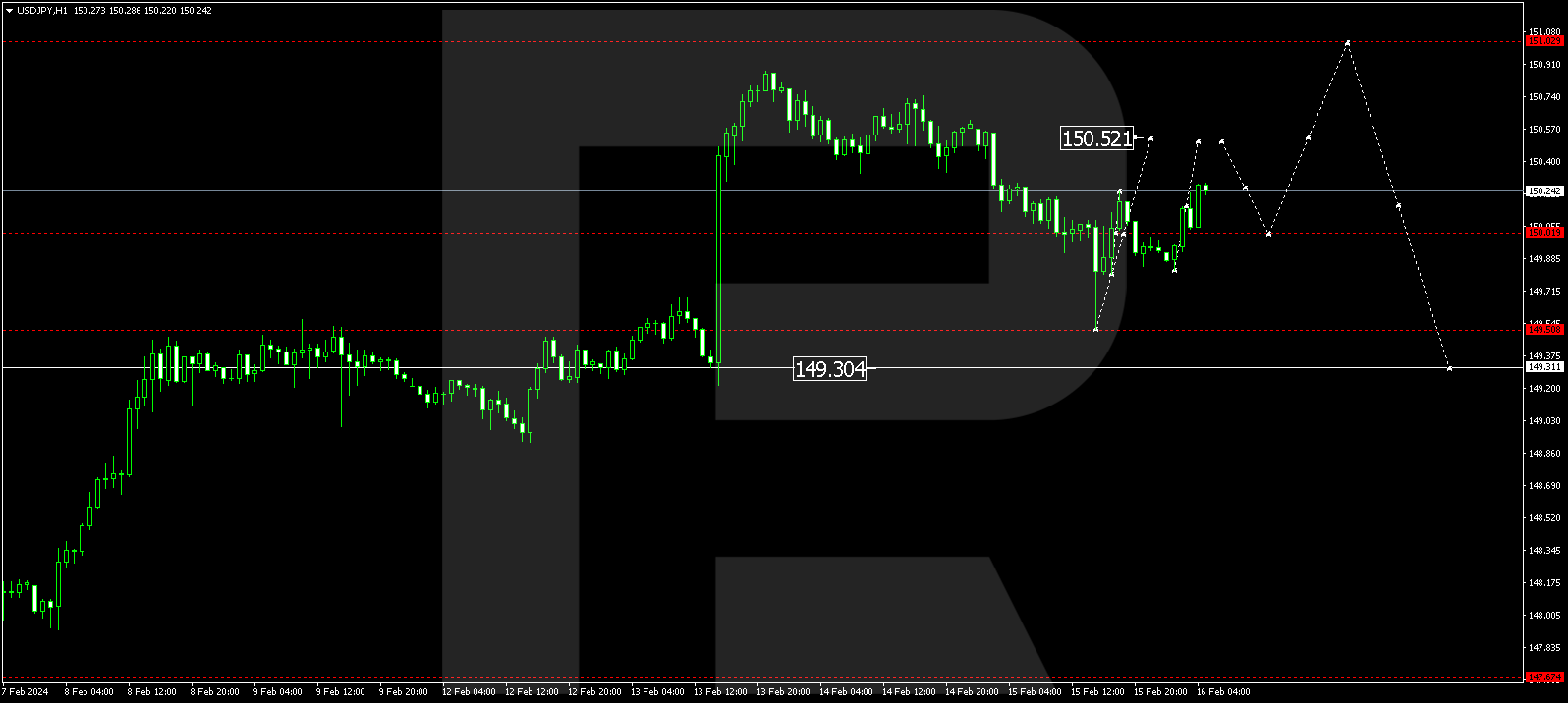

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY continues to unfold an upward wave towards 150.52. Once this level is attained, there might be a correction to 150.00, followed by a potential extension of the growth wave to 151.03.

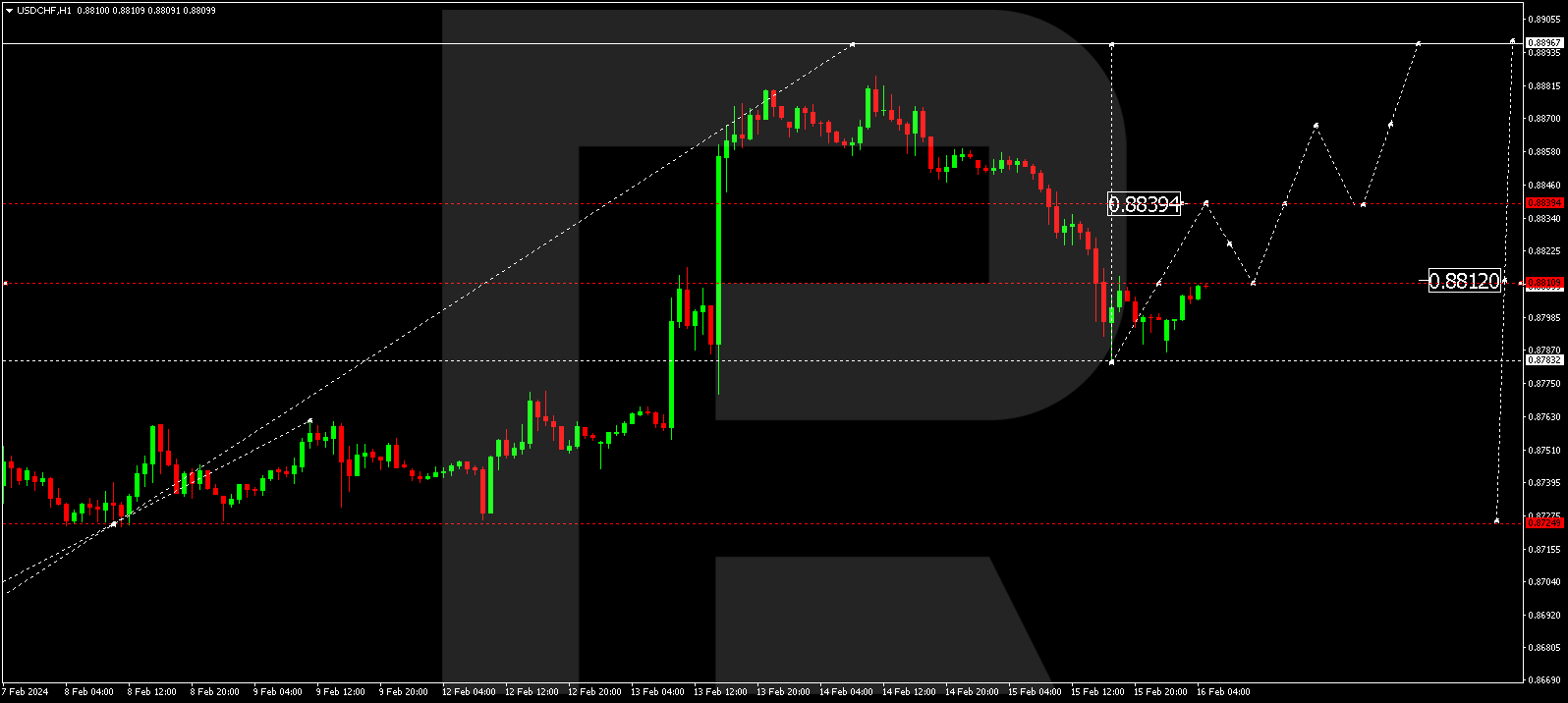

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has finished a corrective wave at 0.8787. Currently, a consolidation range has taken shape above this level. Today, prices might break out of this range to the upside, reaching 0.8840. After reaching this level, a correction to 0.8812 is plausible, succeeded by a climb to 0.8870.

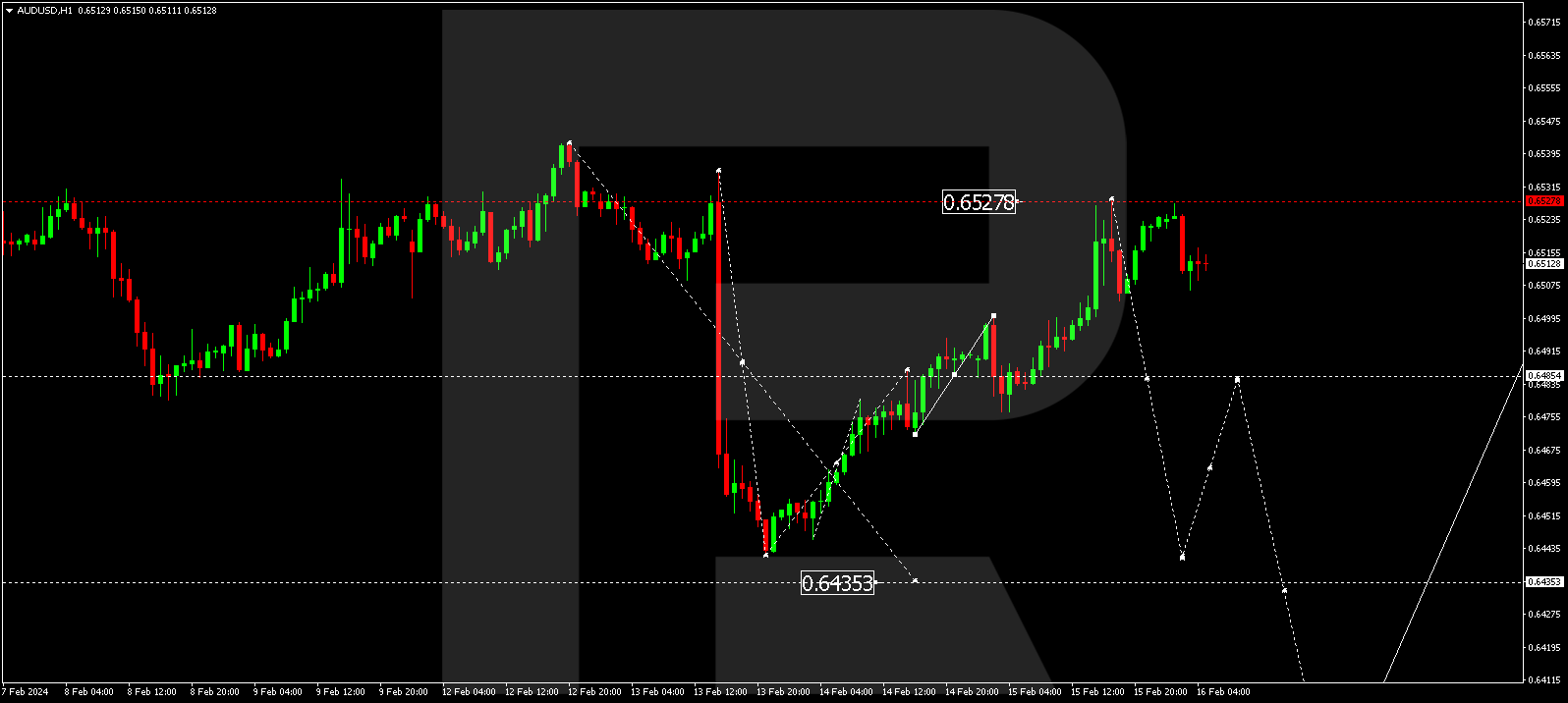

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has wrapped up a correction wave at 0.6525. A consolidation range has formed below this level. Today, the price may break out of the range to the downside, reaching 0.6485. This represents the initial target in a new downward wave.

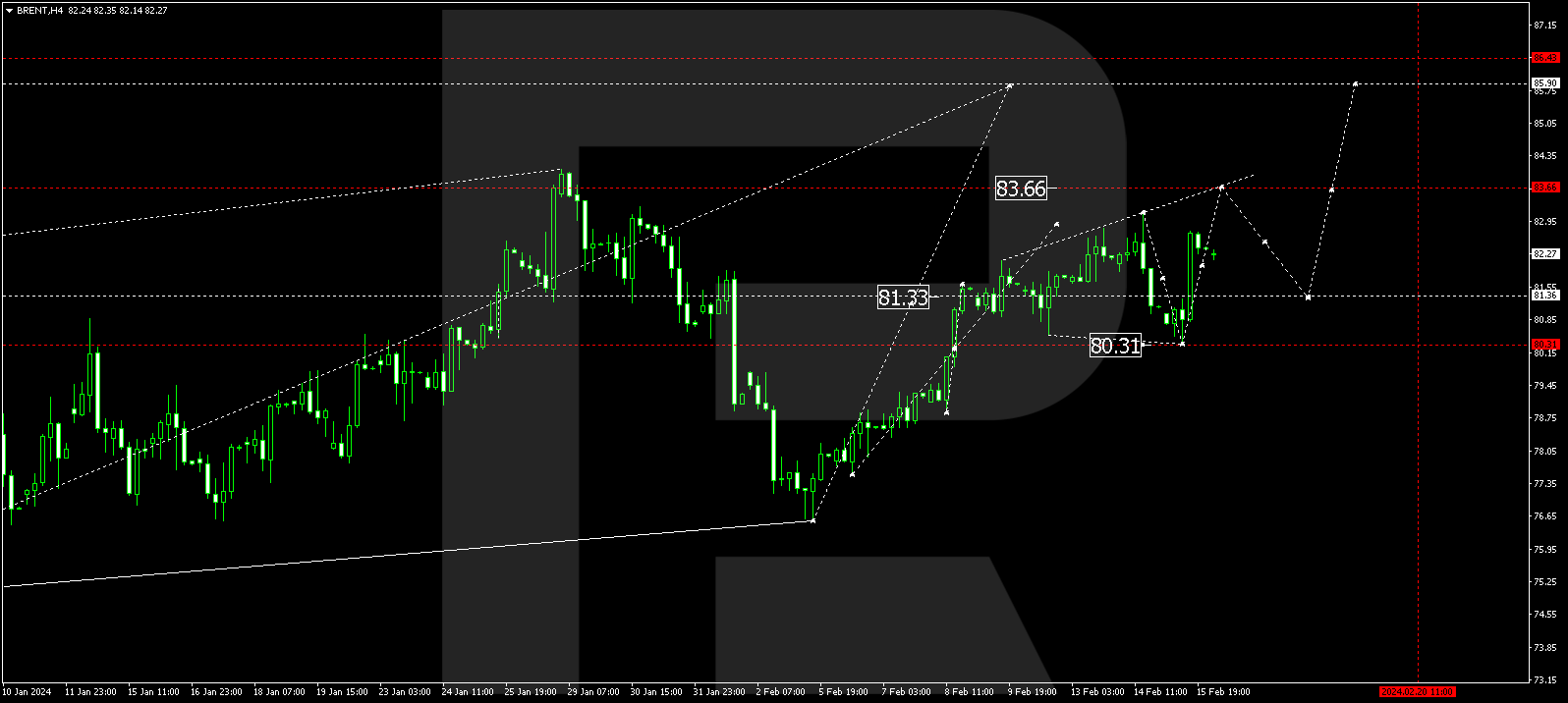

BRENT

Brent has completed a correction wave at 80.32. Currently, the market has undergone a growth wave to 82.75. A consolidation range is anticipated under this level. An upward breakout from the range and an extension of the wave to 83.66 are expected. This is considered a local target.

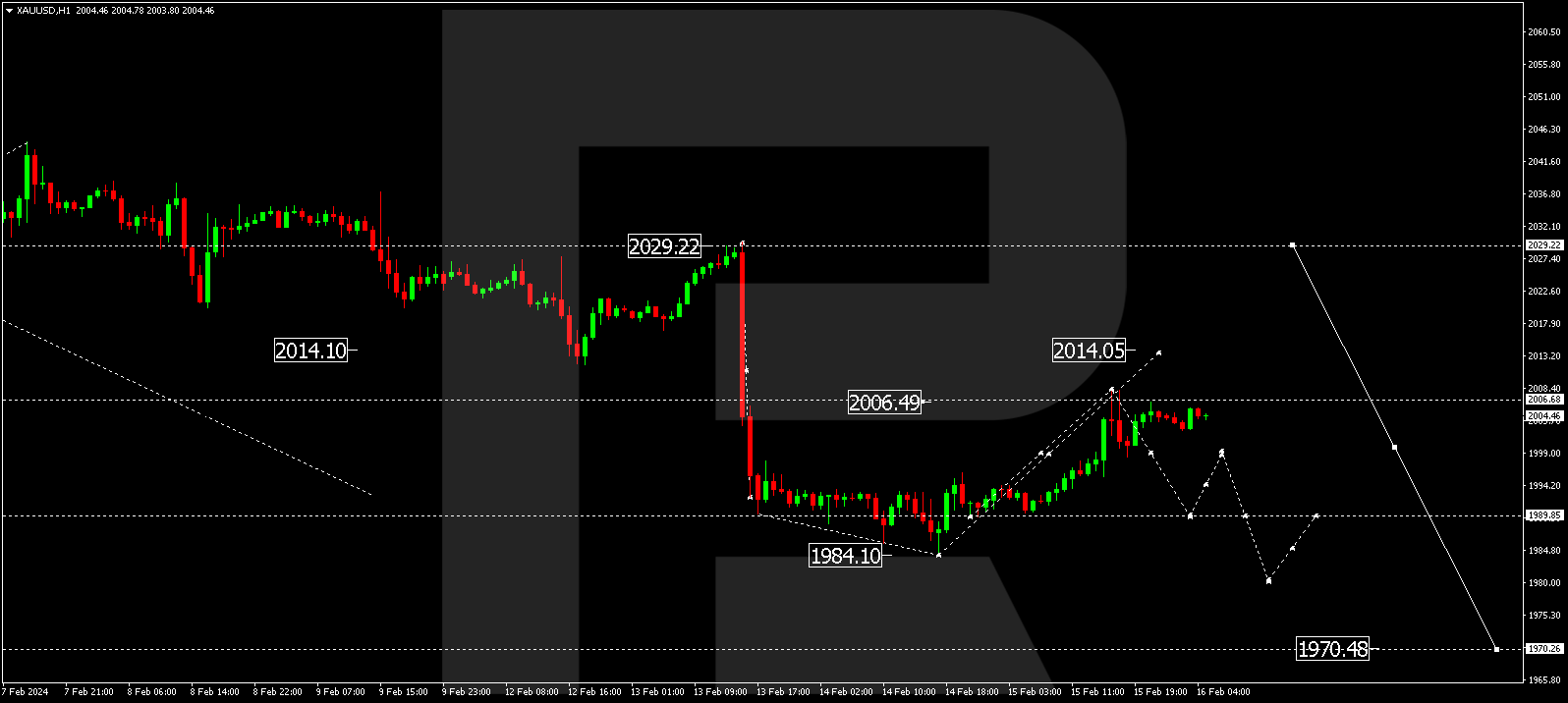

XAU/USD (Gold vs US Dollar)

Gold has finished a correction wave at 2008.00. A consolidation range might emerge below this level today. A breakout to the upside could lead to a growth phase to 2014.00. Conversely, a downward breakout might sustain the decline wave to 1990.00, setting the stage for a continuation to 1970.50.

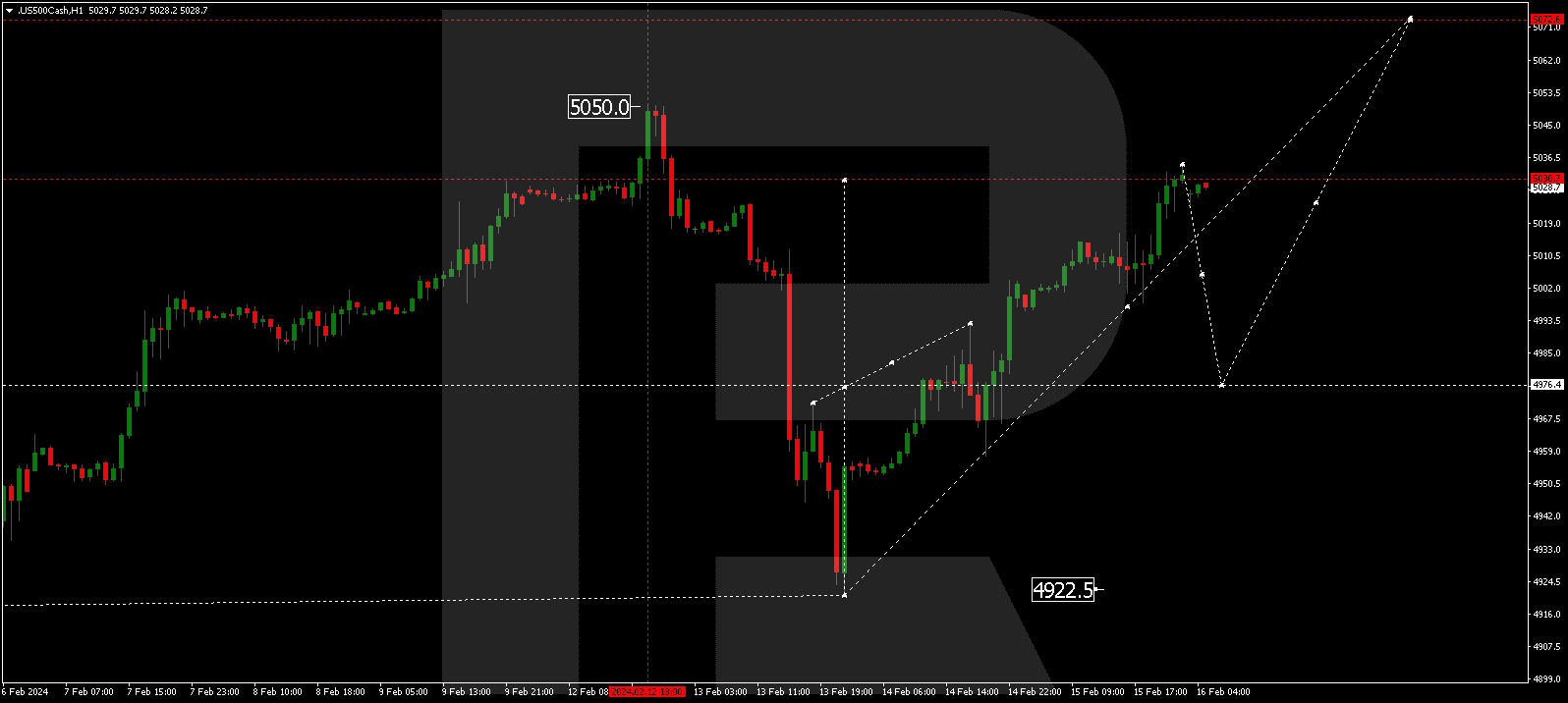

S&P 500

The stock index has wrapped up a correction phase at 5030.0. Currently, a consolidation range is shaping up around this level. Today, it might expand to 4977.0. An upward breakout could lead to a wave reaching 5070.0, followed by a decline to 5000.0. This marks the primary target.

The post Technical Analysis & Forecast February 16, 2024 appeared first at R Blog – RoboForex.