EUR Anticipates an Upward Move. The analysis also encompasses the movements of GBP, JPY, CHF, AUD, Brent, Gold, and the S&P 500 index.

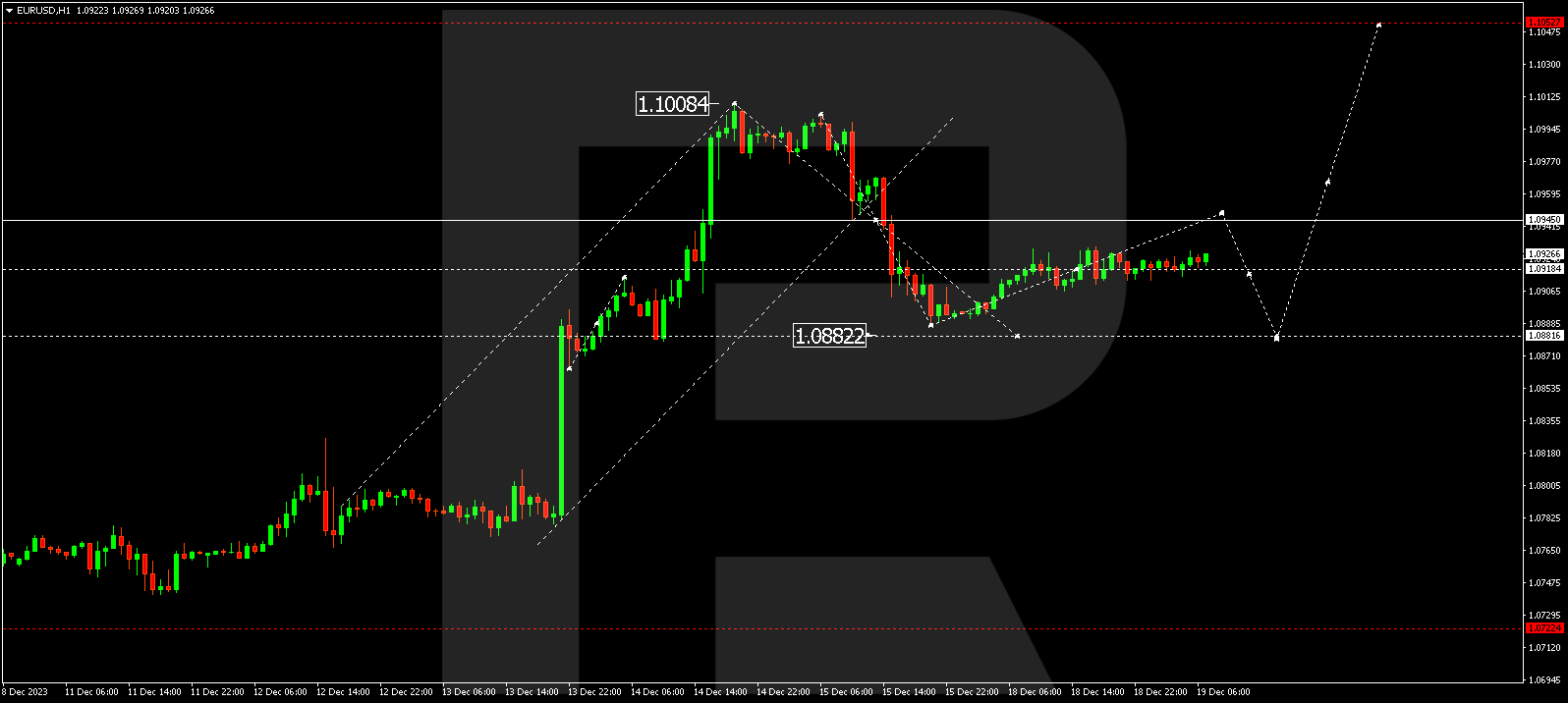

EUR/USD (Euro vs US Dollar)

EUR/USD continues its consolidation around 1.0919. A breakout upward might signal a growth wave to 1.0945, with the potential for an extension to 1.1050. Conversely, an escape downward could trigger a correction to 1.0882, followed by a rise to 1.0960.

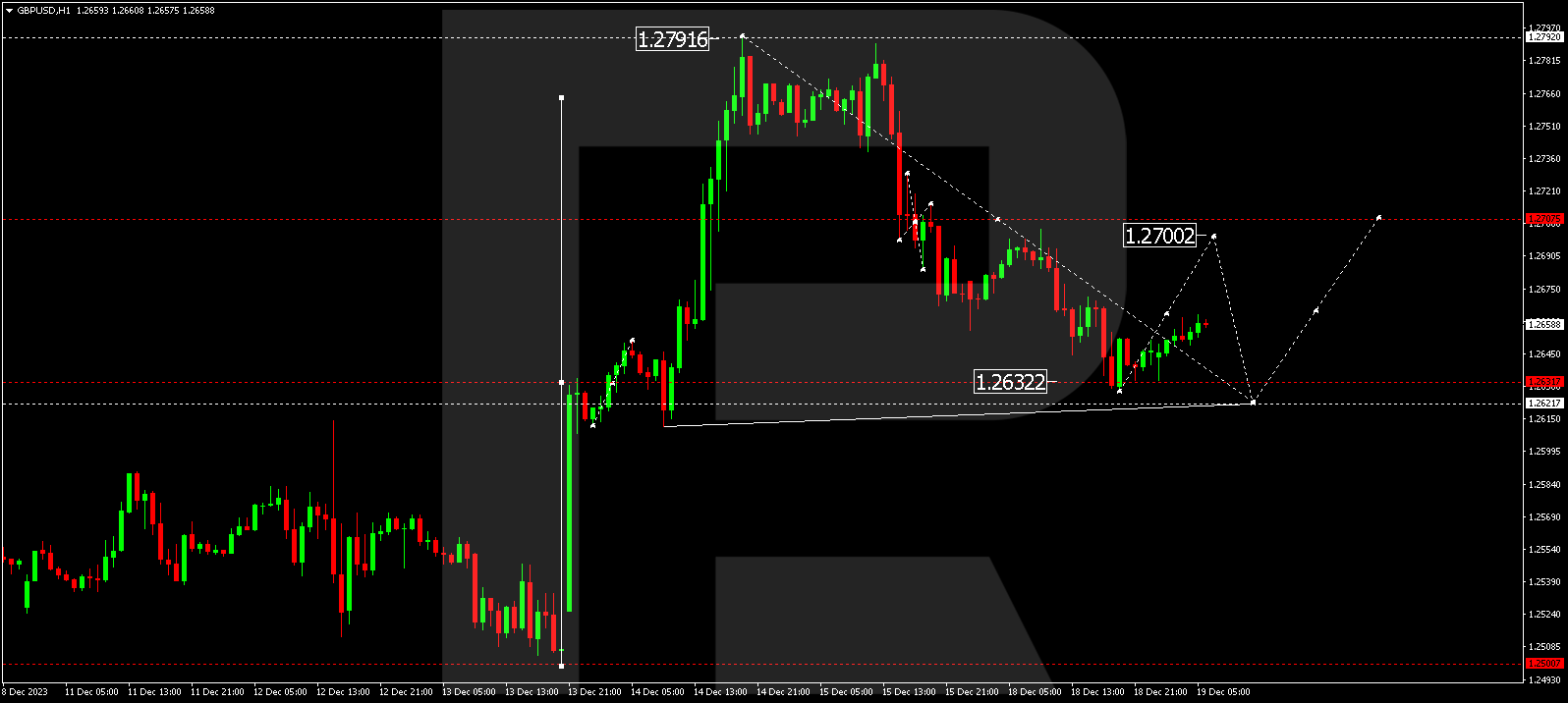

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD completed a corrective wave at 1.2627. A rise to 1.2700 is expected, followed by a potential decline to 1.2666. After reaching this level, a growth structure to 1.2707 might initiate. A wide consolidation range is forming around this level, with a downward breakout potentially leading to a decline wave to 1.2500, while an upward breakout might spur a growth wave to 1.2790.

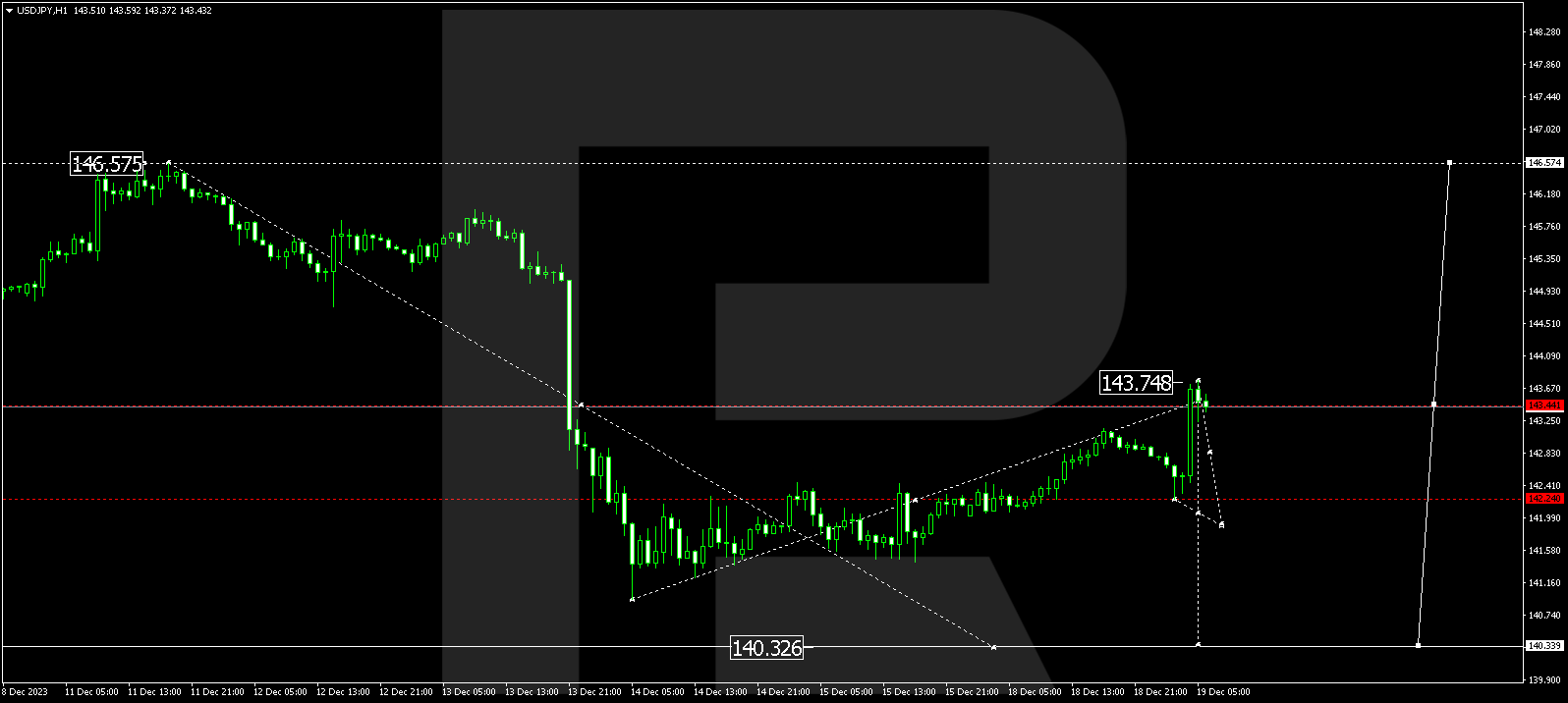

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY concluded a growth wave at 143.73. Today, a decline to 141.90 might follow. If this level is breached, the wave could continue to 140.33, marking the first target.

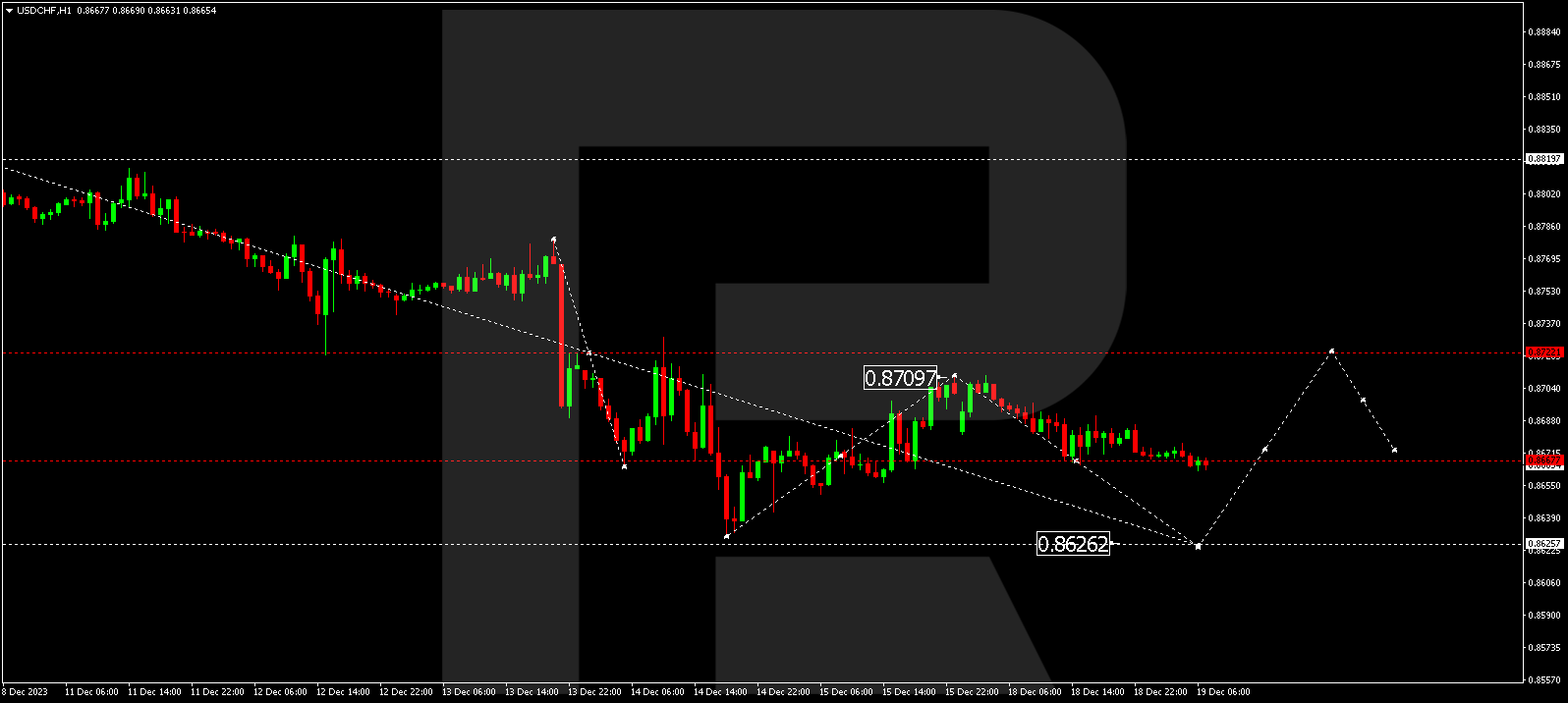

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF completed a decline wave to 0.8666. A consolidation range is forming around this level. A downward breakout might extend the decline wave to 0.8626, followed by an expected rise to 0.8722 as the first target.

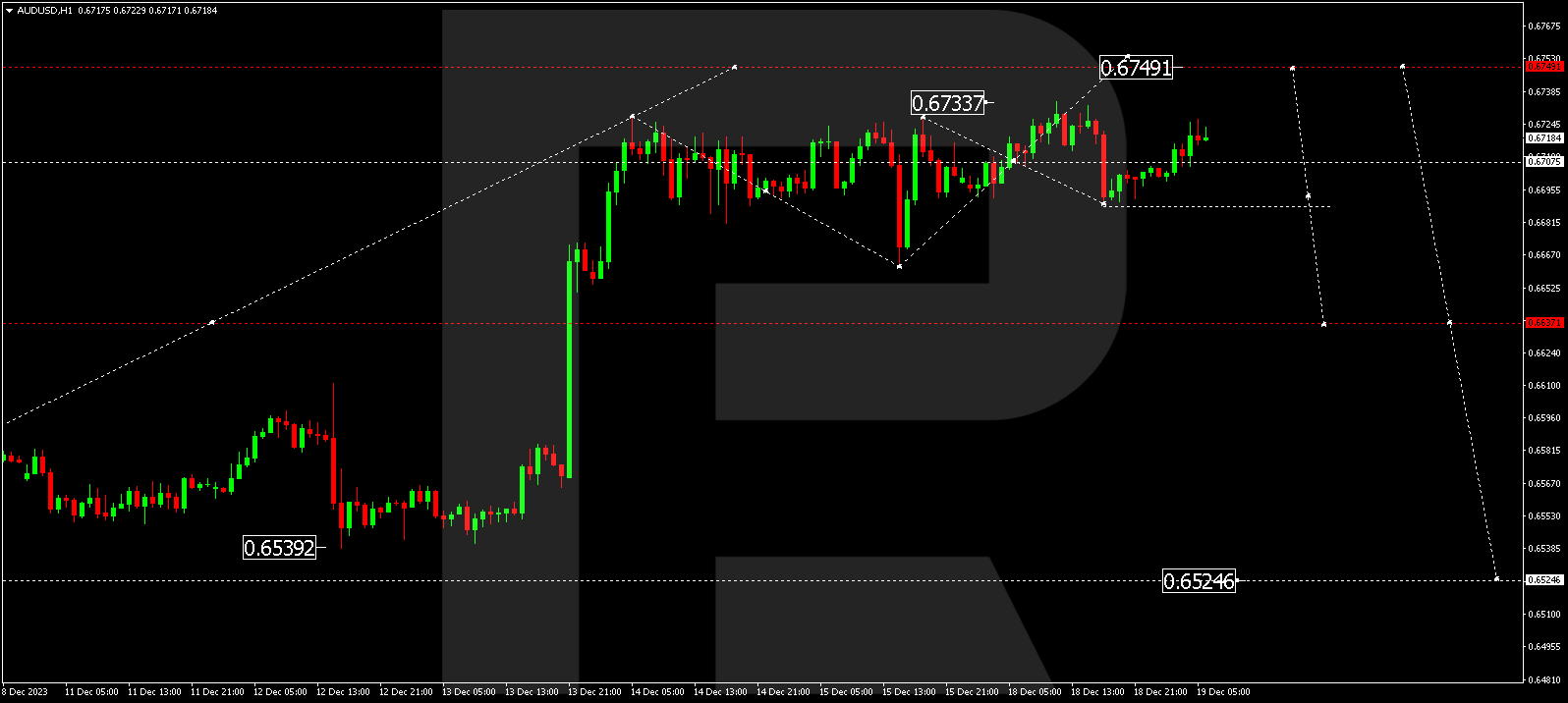

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is within a consolidation range under 0.6700. An exit downward could prompt a correction to 0.6633, followed by an expected rise to 0.6740. After reaching this level, the quotes might initiate a decline wave to 0.6525.

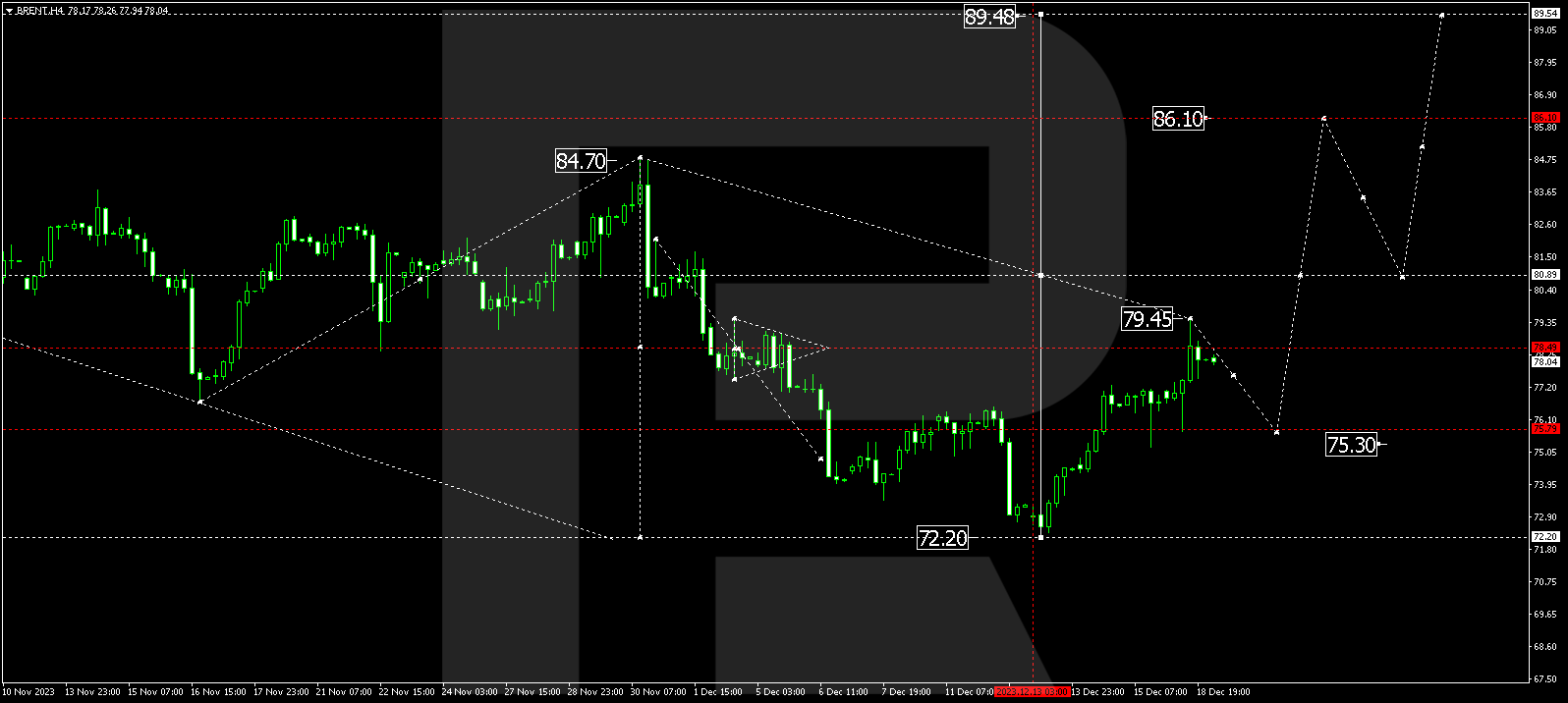

BRENT

Brent completed a growth impulse to 79.45. A correction to 75.80 might follow (a test from above), with the next potential move being a growth wave to 86.10, representing a local target.

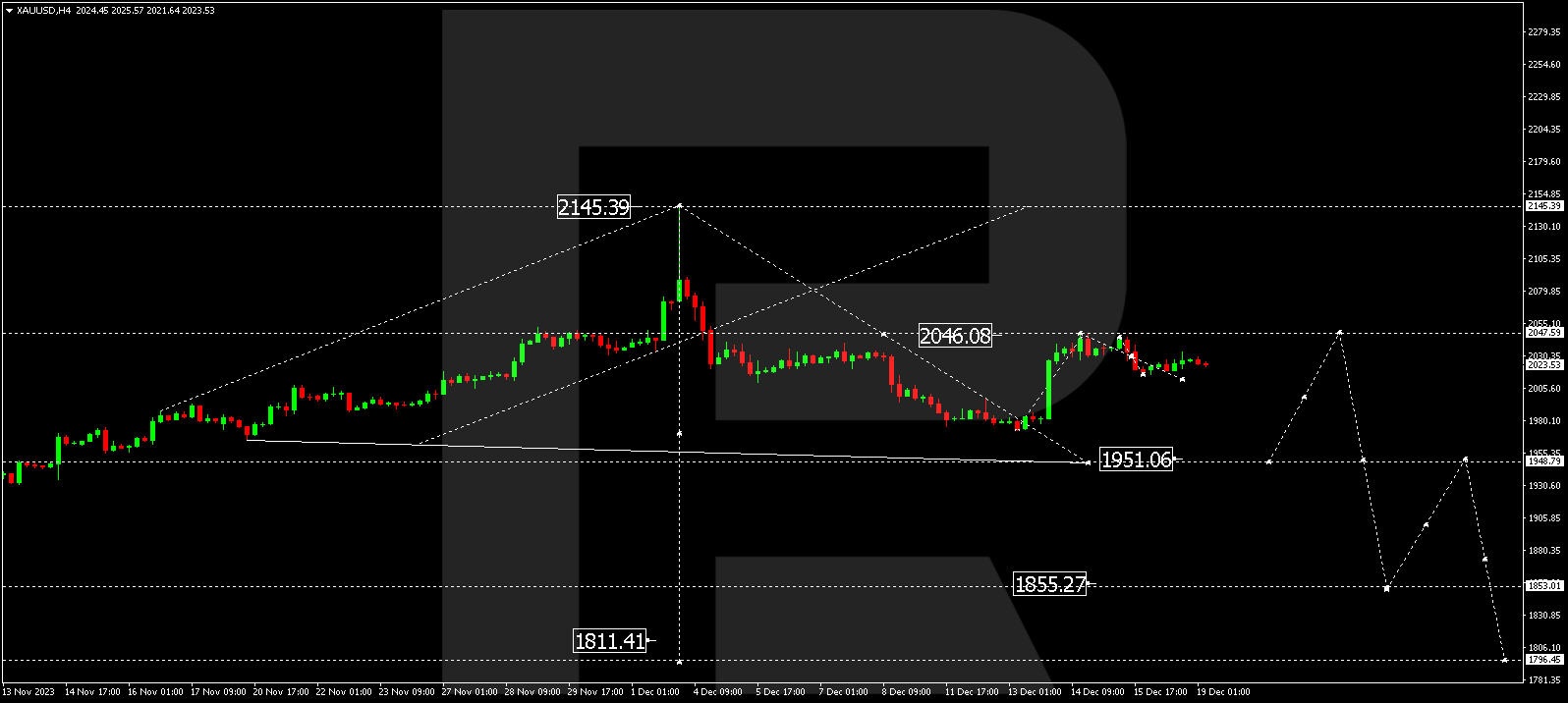

XAU/USD (Gold vs US Dollar)

Gold is forming a decline structure to 2010.00. A breakout below this level might open the potential for a decline wave to 1950.00. Following this, a correction to 2047.00 is expected (a test from below), followed by a decline to 1855.00.

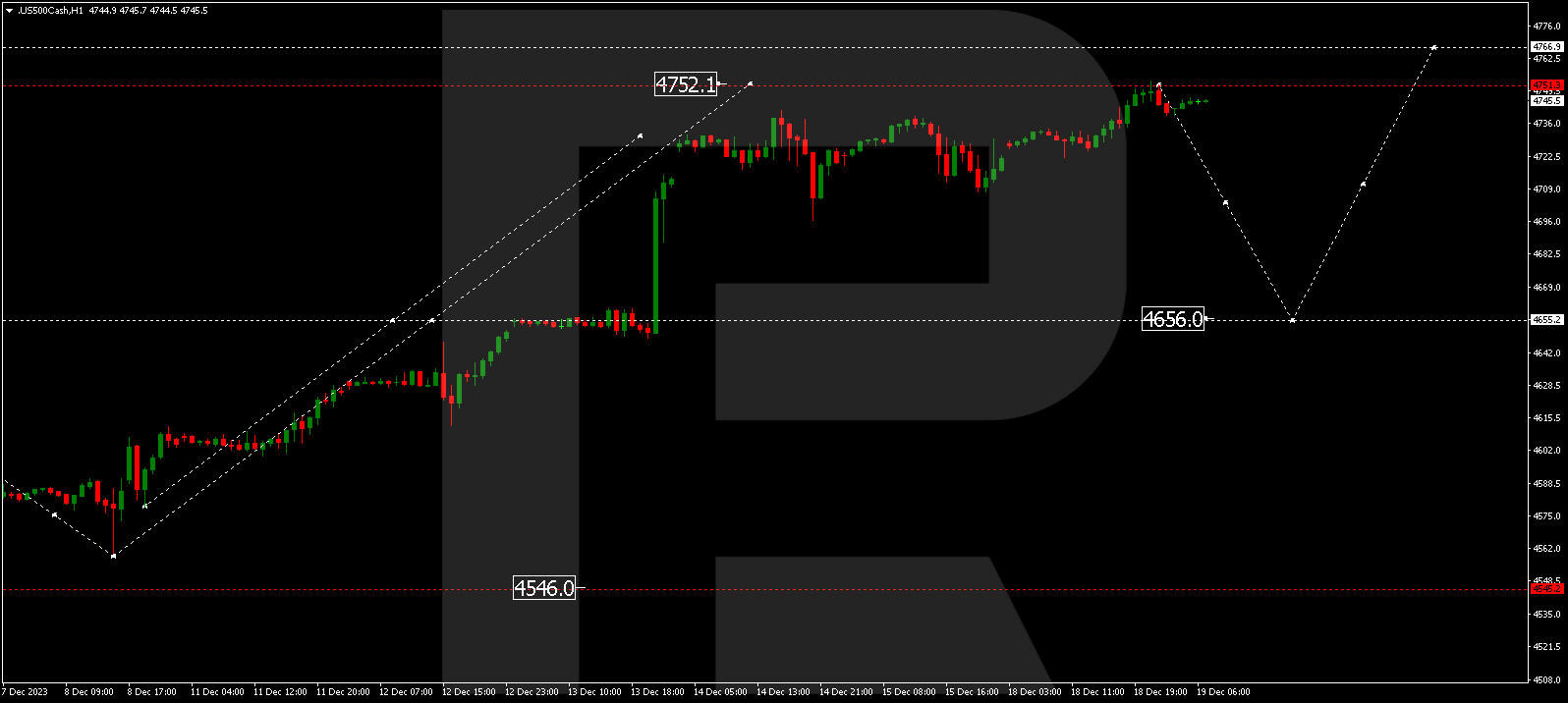

S&P 500

The stock index reached a local target with a growth wave at 4752.0. A decline wave to 4656.0 might initiate today. After the correction, a rise to 4767.0 could materialize.

The post Technical Analysis & Forecast for December 19, 2023 appeared first at R Blog – RoboForex.