GBP Expected to Decline; Overview of EUR, JPY, CHF, AUD, Brent, Gold, and S&P 500 Index

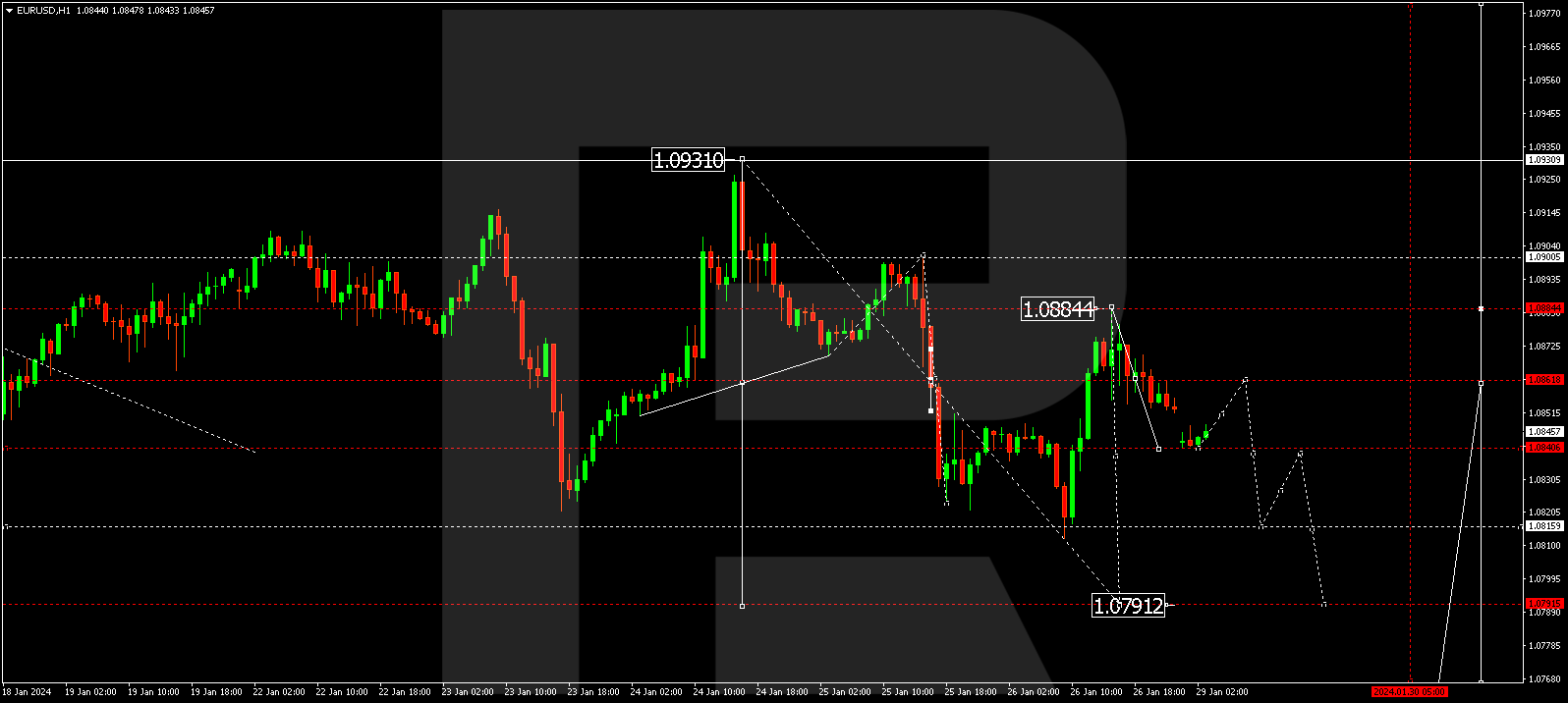

EUR/USD (Euro vs US Dollar)

EUR/USD has completed a corrective wave at 1.0884. Today, the market is showing a potential decline wave to 1.0839. Once this level is reached, a narrow consolidation range is anticipated, with a possible upward breakout towards 1.0860 or a downward shift setting the stage for a decline wave to 1.0817, and further down to 1.0791 as a local target.

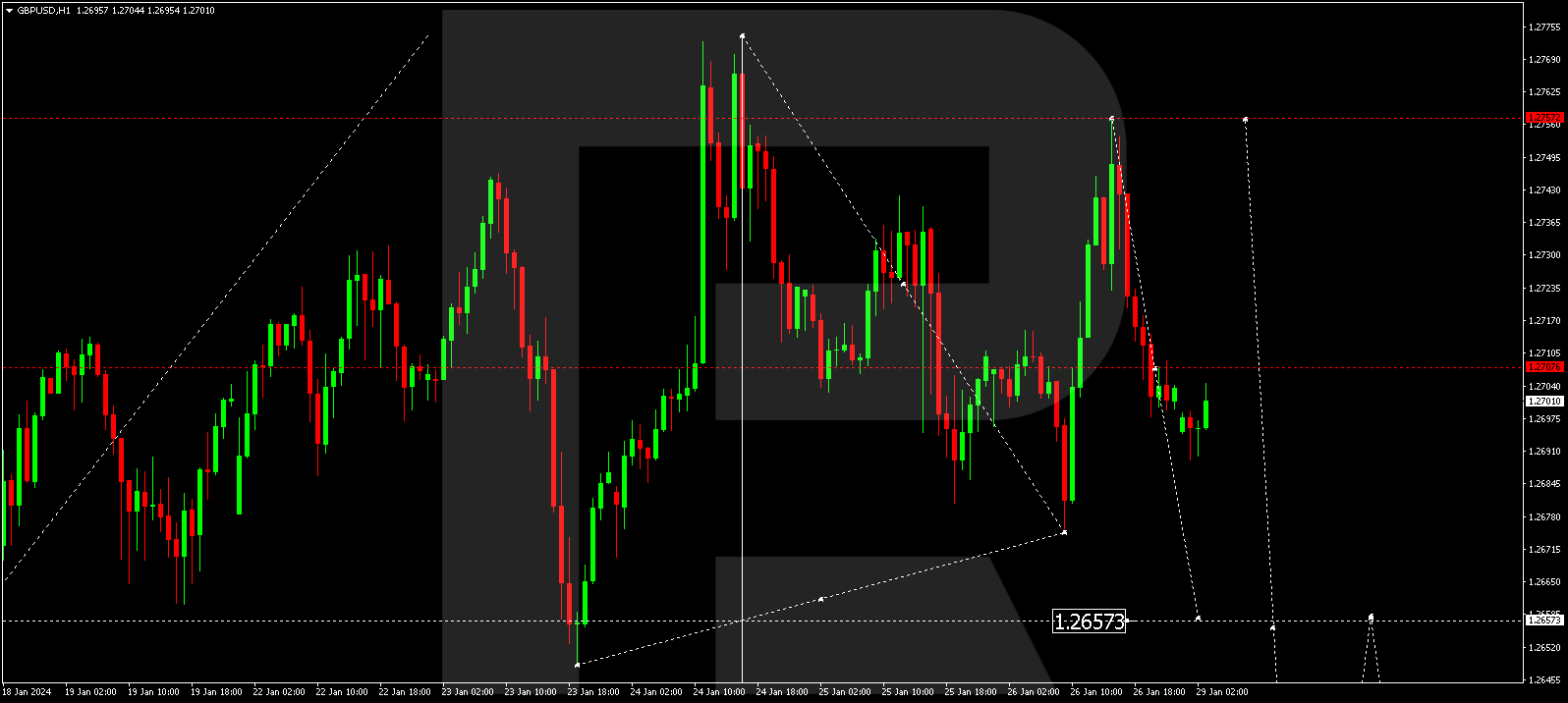

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD has concluded a corrective wave at 1.2757. Currently, a decline wave to 1.2690 has been observed, with a consolidation range forming above this level. A correction to 1.2707 is possible, followed by a decline wave to 1.2655. Breaking this level could open the potential for a move to 1.2590 as a local target.

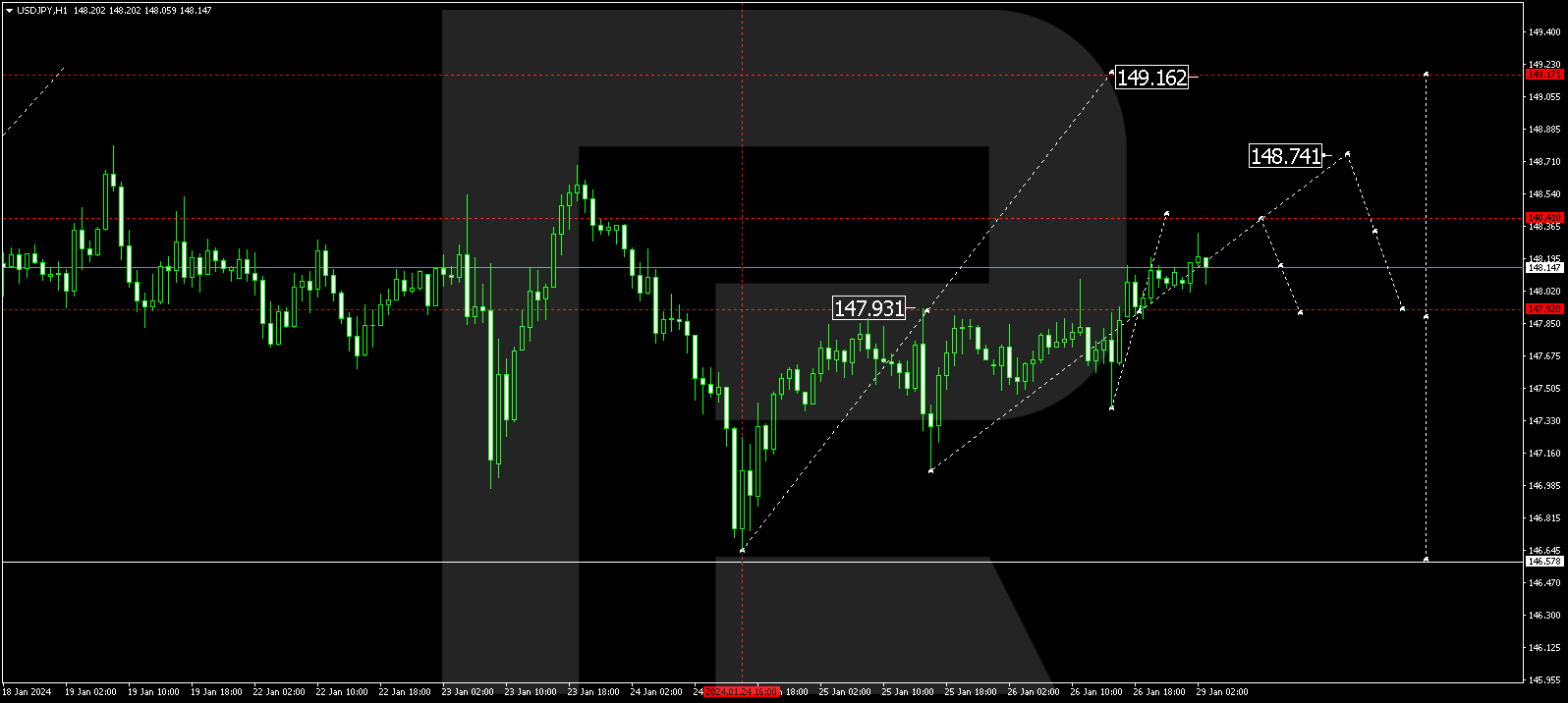

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY has broken upwards to 148.48, with a potential continuation to 149.16 as a local target.

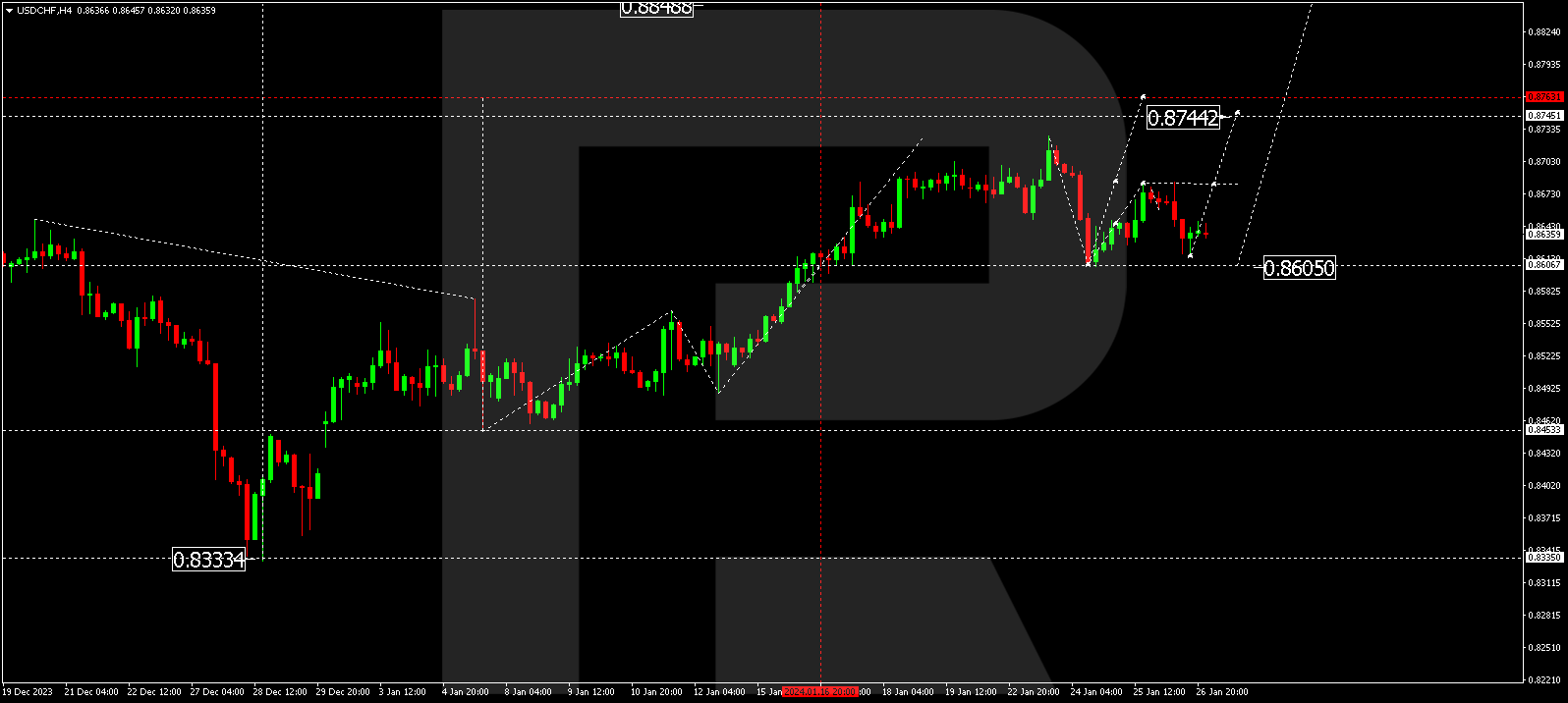

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF has completed a growth wave at 0.8684 and could see a corrective move to 0.8605 before resuming an upward wave to 0.8744, then to 0.8766.

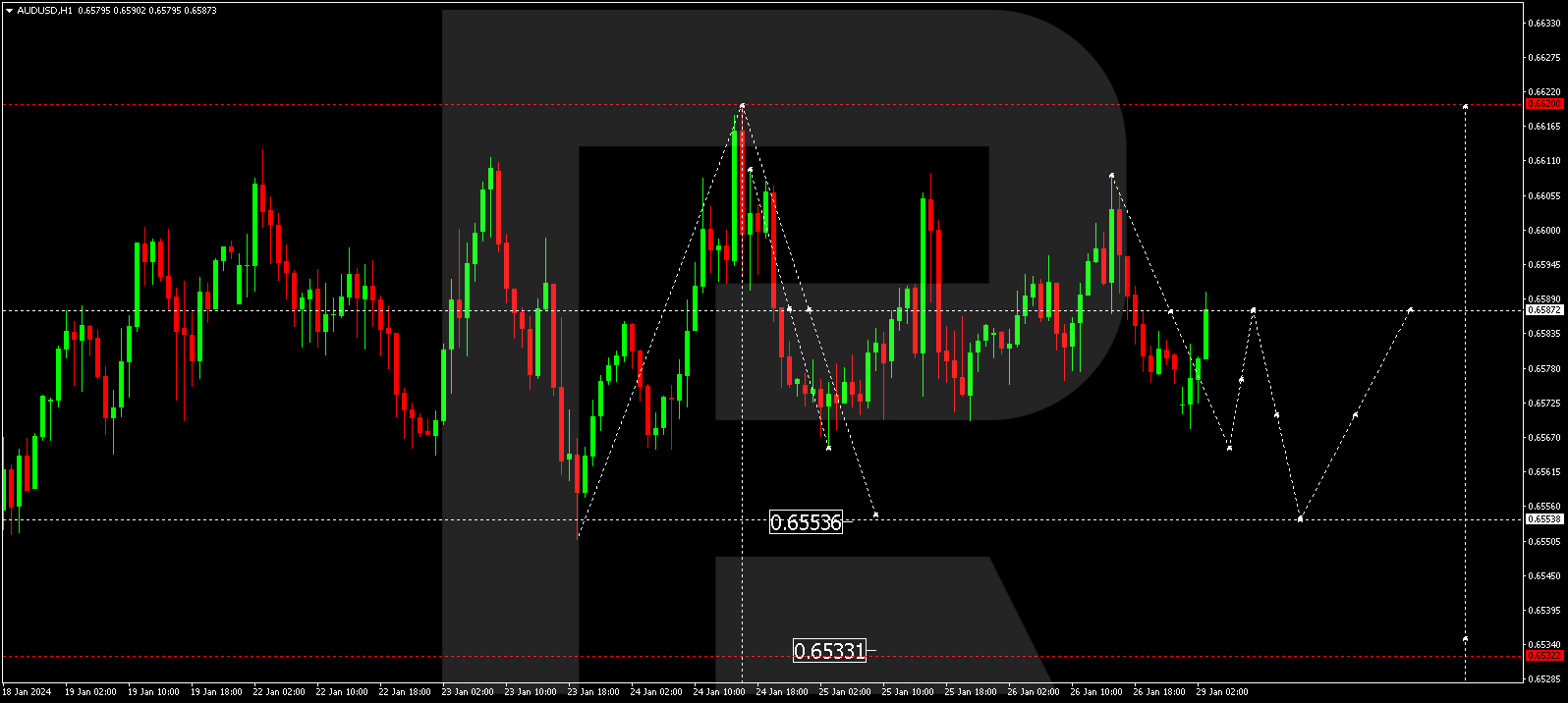

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD is in a consolidation range around 0.6585 with a potential rise to 0.6598, followed by a decline wave to 0.6550 as a local target.

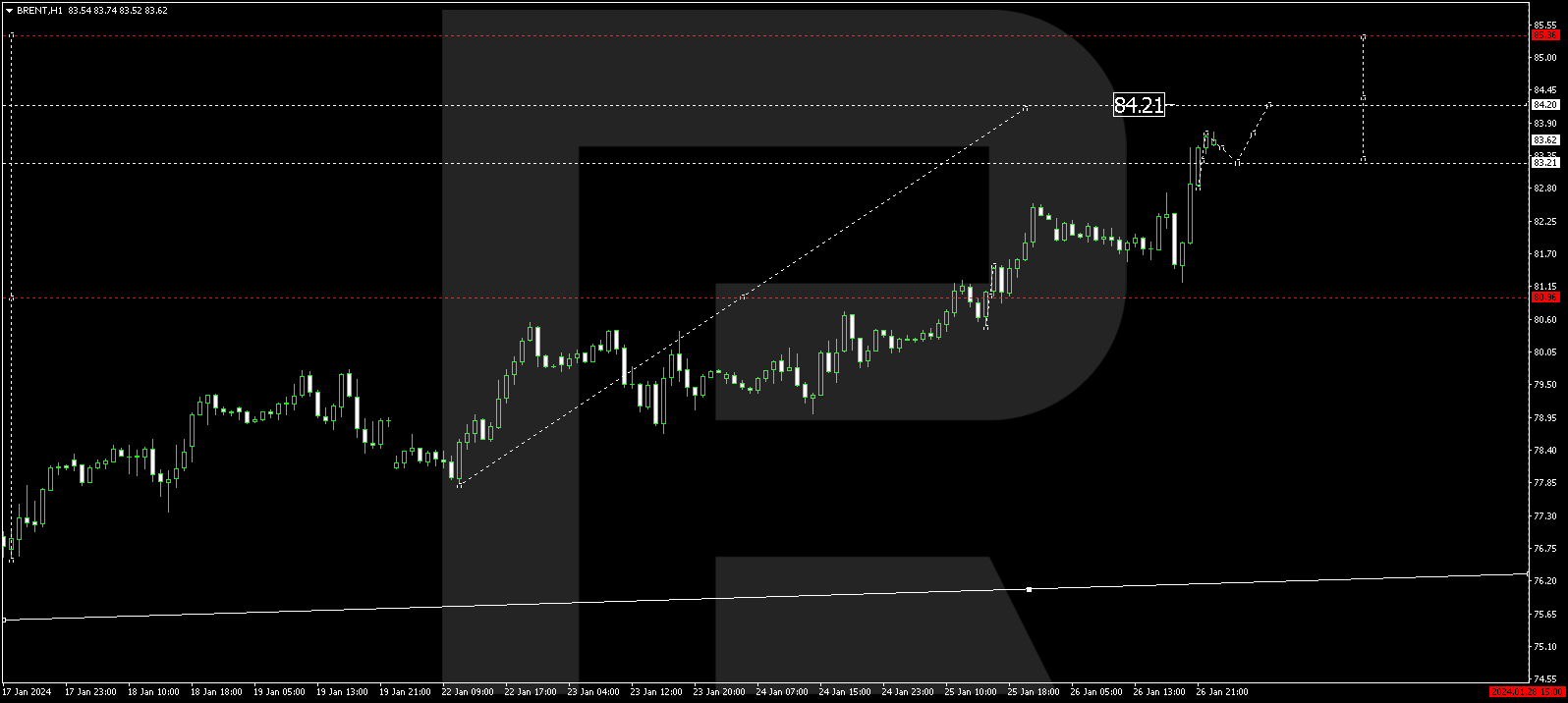

BRENT

Brent has formed a consolidation range around 83.40 and could extend the growth wave to 84.22. Following this, a correction to 83.40 is possible, with a potential continuation to 85.55 as a local target.

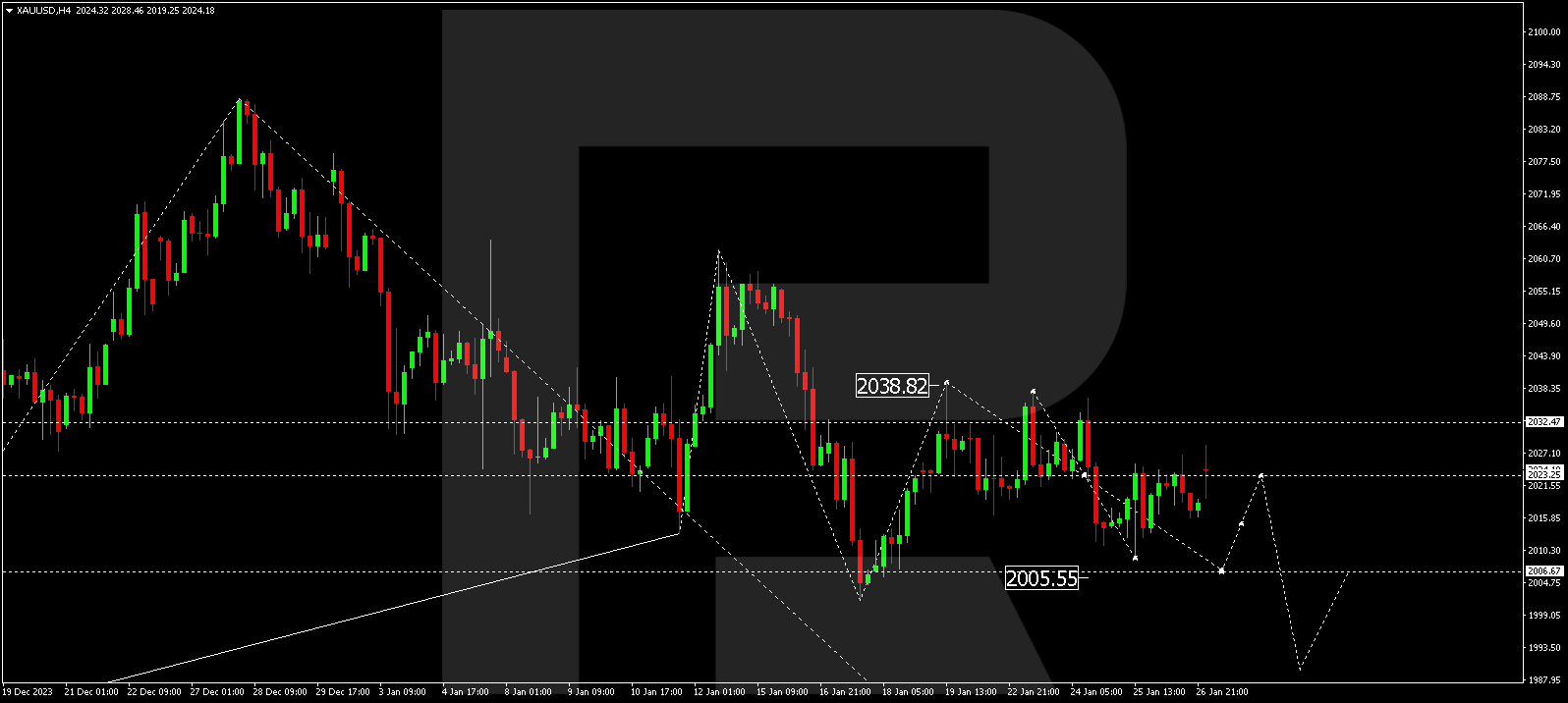

XAU/USD (Gold vs US Dollar)

Gold is developing a consolidation range around 2023.23, with a growth to 2030.00 expected, followed by a decline to 2005.55. A further decline to 1991.10 is possible, with a potential continuation to 1976.50.

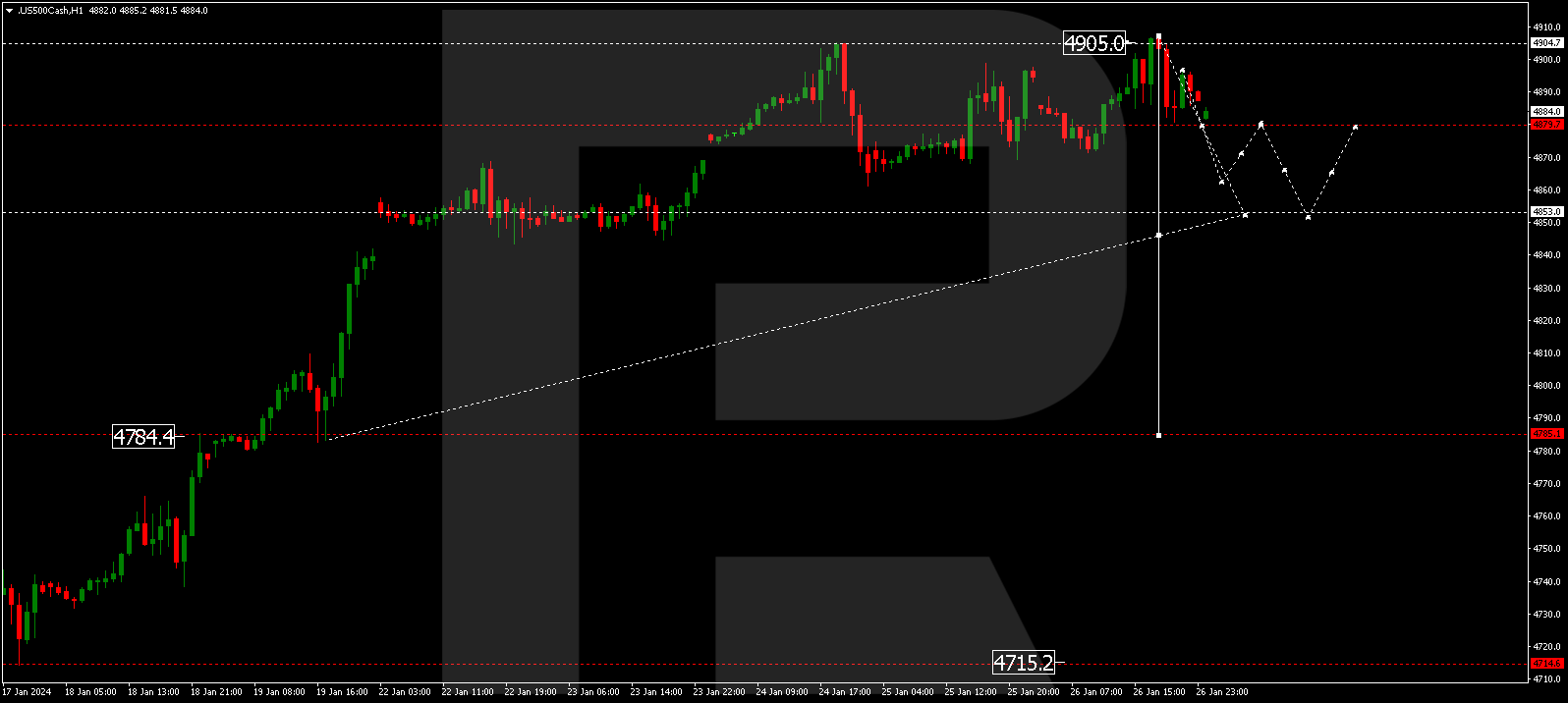

S&P 500

The stock index is in a consolidation range around 4880.0. A potential downward move to 4853.0 is expected, with a further decline to 4785.0 as the first target.

The post Technical Analysis & Forecast for January 29, 2024 appeared first at R Blog – RoboForex.