CHF is in the midst of a downward trend. This analysis also covers the movements of EUR, GBP, JPY, AUD, Brent, Gold, and the S&P 500 index.

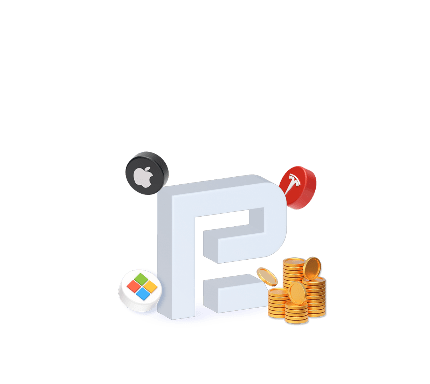

EUR/USD (Euro vs US Dollar)

EUR/USD has found a supportive base at the 1.0600 level and is in the process of a growth phase towards 1.0670. Following this rise, a potential dip to 1.0600 may occur (with a test from above), succeeded by an anticipated increase to 1.0706.

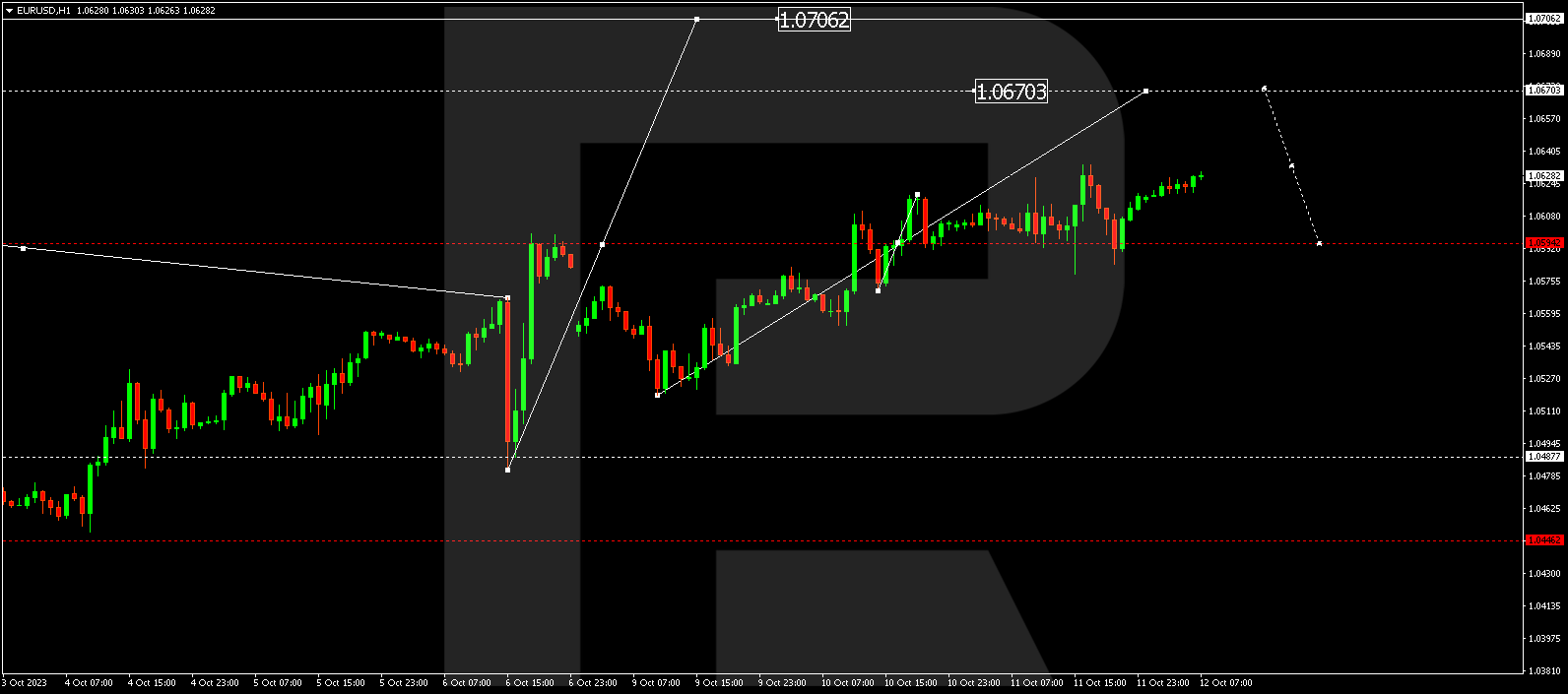

GBP/USD (Great Britain Pound vs US Dollar)

GBP/USD is extending its upward momentum to 1.2378. Once this target is achieved, a retest of 1.2242 might ensue (with a test from above). Subsequently, a new upward surge to 1.2447 may be anticipated, eventually followed by a decline to 1.2242.

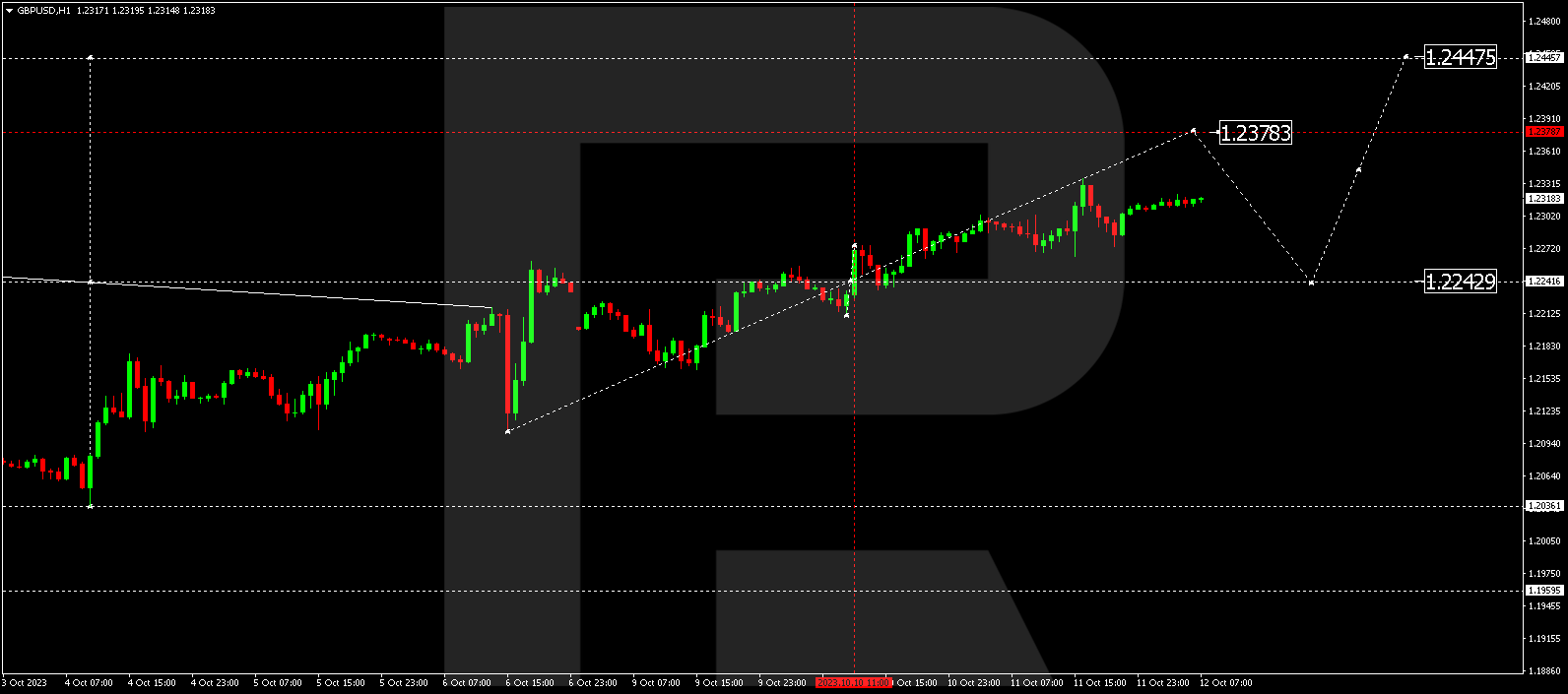

USD/JPY (US Dollar vs Japanese Yen)

USD/JPY is prolonging its upward trajectory to 149.81. This could be followed by a decline to 149.00, after which a fresh upward wave towards 150.75 might materialize. After reaching this level, a subsequent downturn to 147.94 is projected.

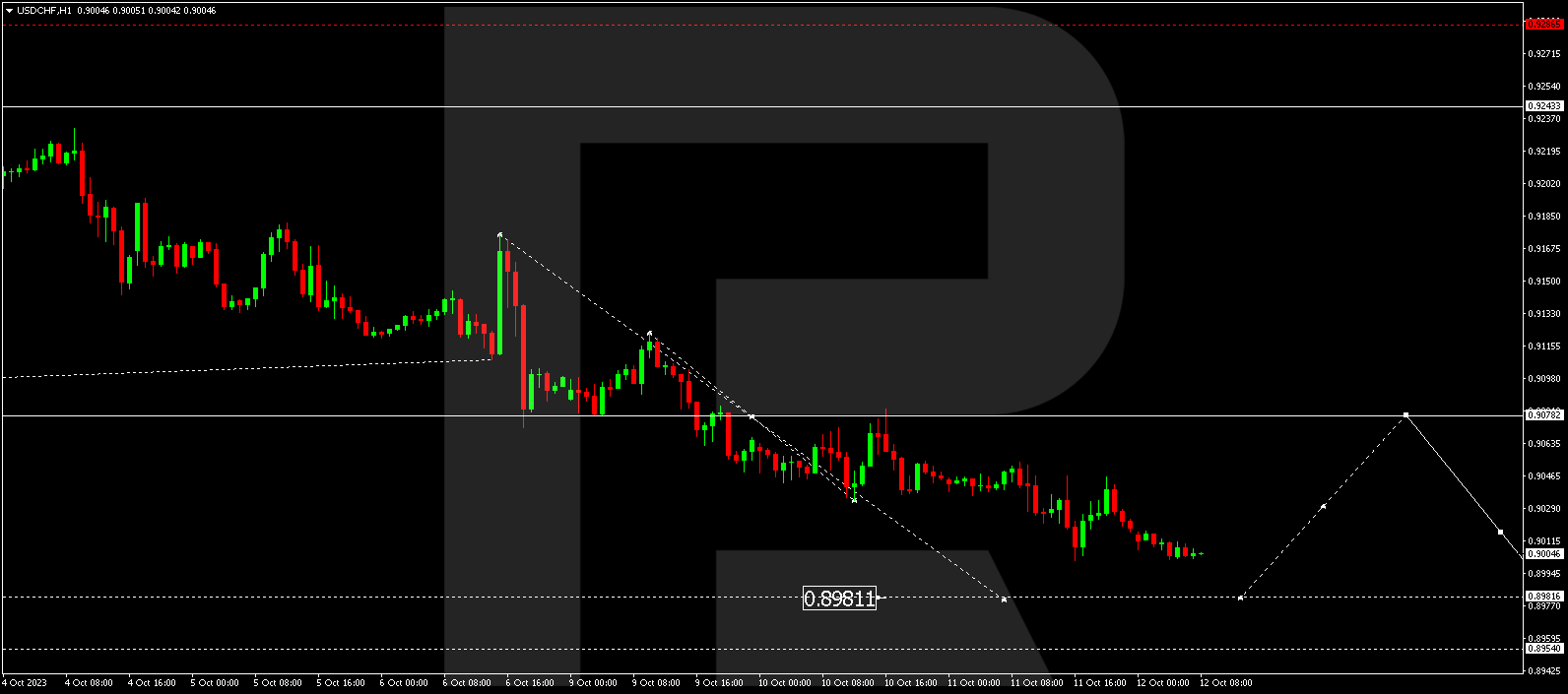

USD/CHF (US Dollar vs Swiss Franc)

USD/CHF is persisting in a descending wave towards 0.8982. Following the achievement of this level, an upswing to 0.9078 could follow, eventually paving the way for a downturn to 0.8955.

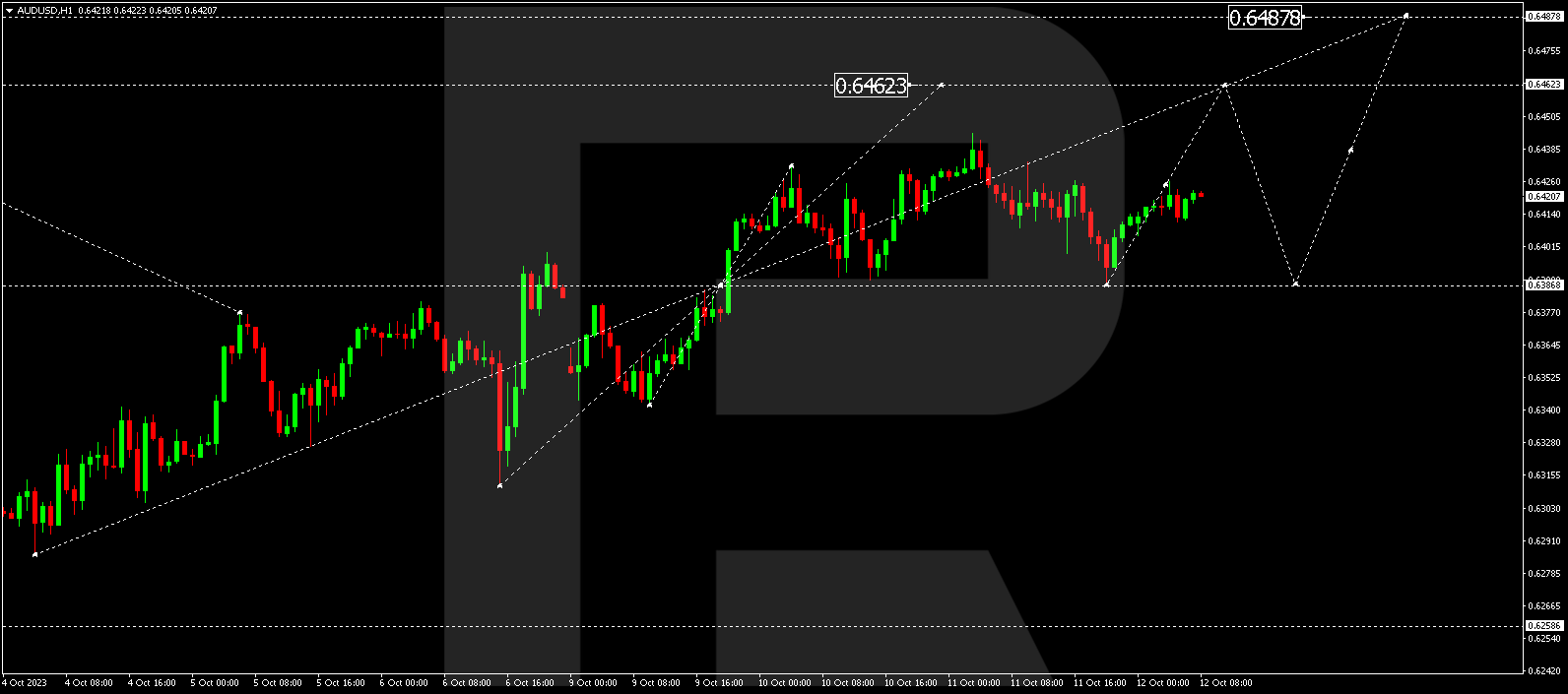

AUD/USD (Australian Dollar vs US Dollar)

AUD/USD has completed a downward phase reaching 0.6388 (with a test from above). Today, we could witness an upward move targeting 0.6460. This marks a local objective. Next, a decline to 0.6388 and a subsequent rise to 0.6488 might be in the cards.

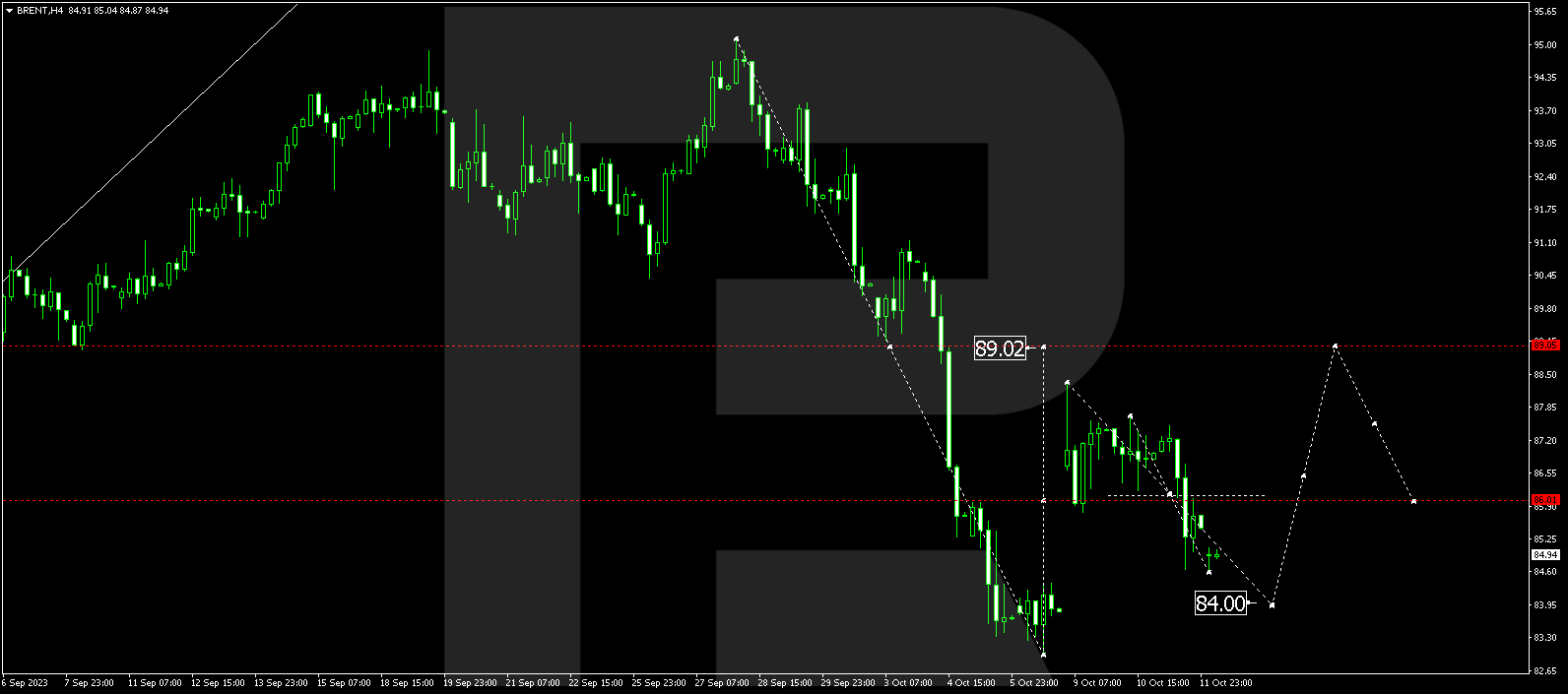

BRENT

Brent is ongoing in a descending wave towards 84.00. It’s anticipated to consolidate above this level. An upward breakout from this range might indicate the potential for an upward wave to 89.00. This represents the initial target.

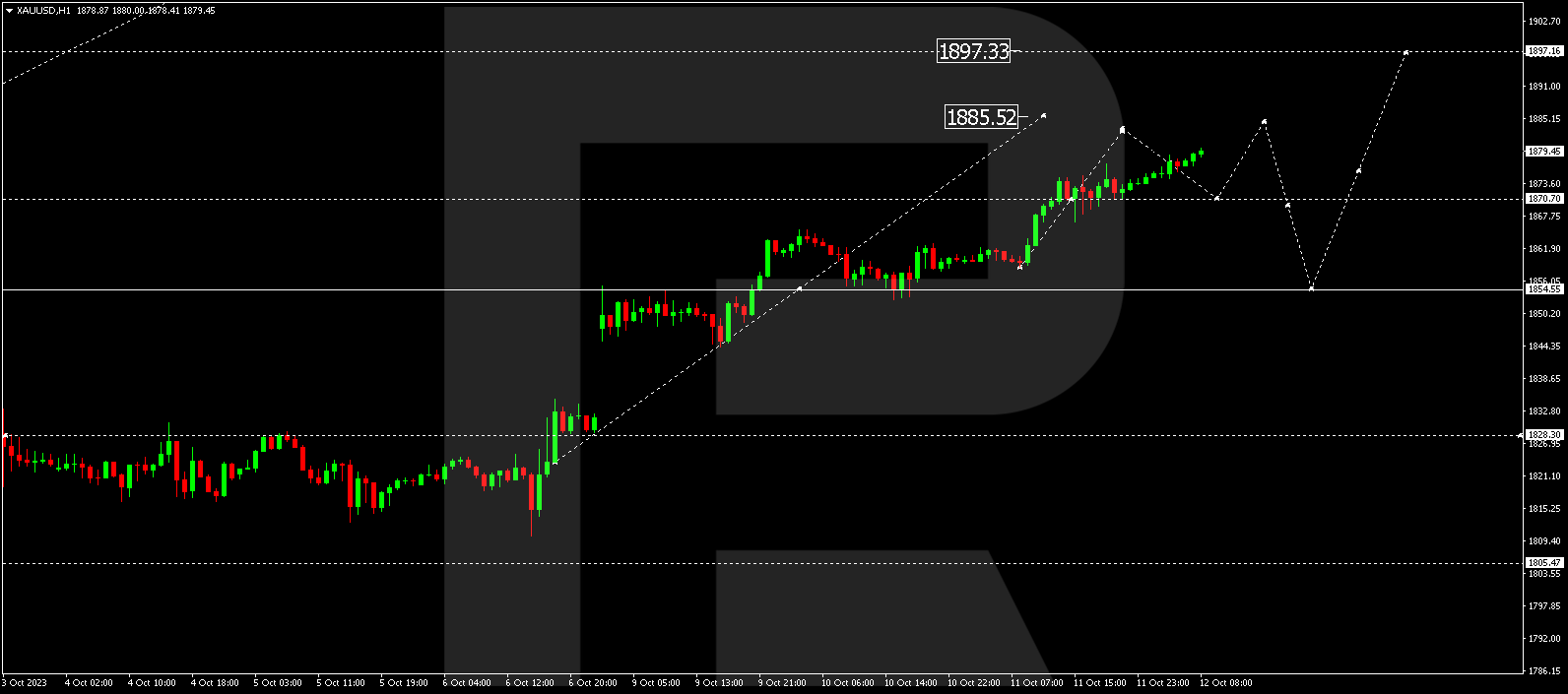

XAU/USD (Gold vs US Dollar)

Gold is currently experiencing an upward wave to 1885.55. Following this, a downturn to 1855.55 is plausible. The next movement is forecasted to be an upward surge to 1897.33.

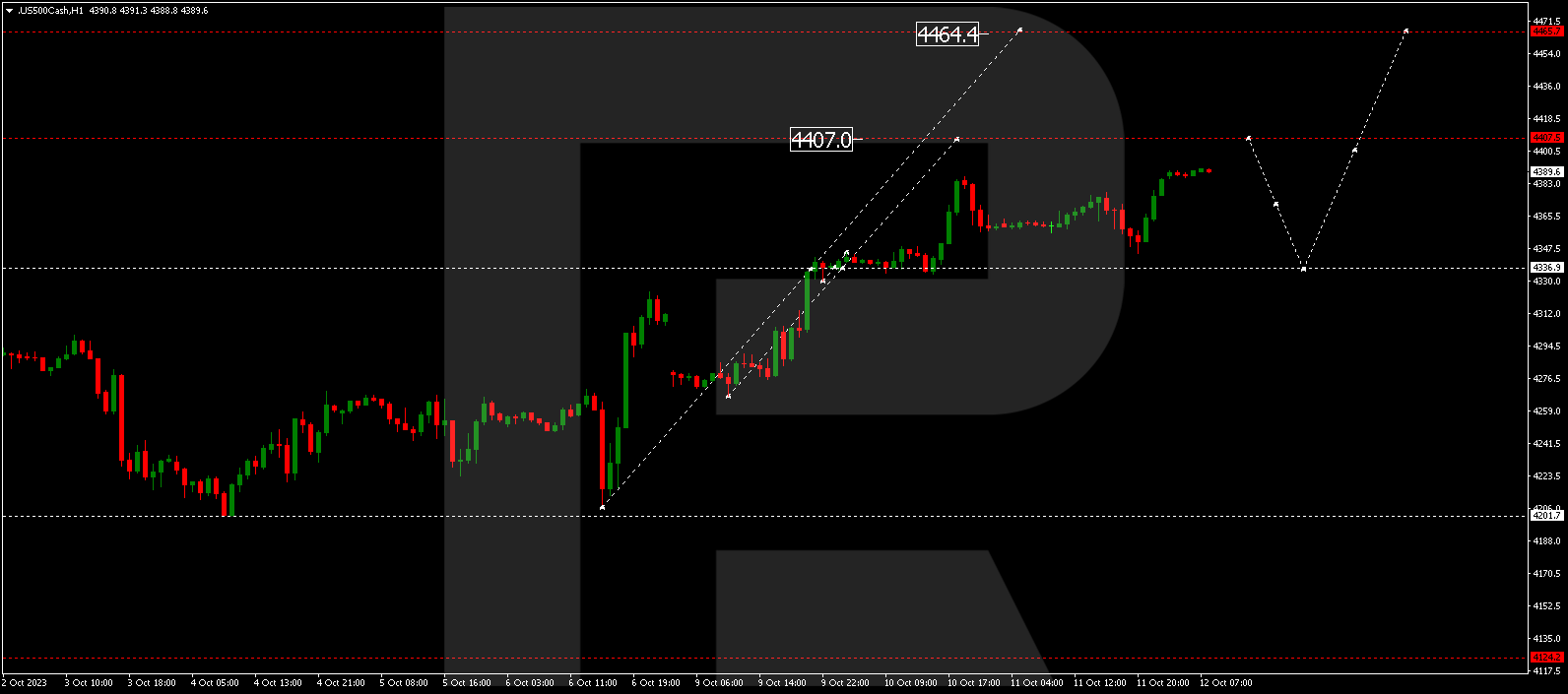

S&P 500

The stock index is still advancing in an upward wave towards 4407.5. Upon reaching this level, a potential dip to 4337.0 may arise (with a test from above). Subsequently, an upswing to 4464.4 is expected, followed by a trend-driven decline to 4200.0.

The post Technical Analysis & Forecast for October 12, 2023 appeared first at R Blog – RoboForex.